Sourcing Guide Contents

Industrial Clusters: Where to Source China Withholding Tax On Payments To Foreign Companies

SourcifyChina – Professional B2B Sourcing Report 2026

Subject: Market Analysis – Sourcing “China Withholding Tax on Payments to Foreign Companies”

Prepared for: Global Procurement Managers

Date: April 2026

Executive Summary

This report provides a strategic analysis for global procurement managers seeking clarity on the topic of “China withholding tax on payments to foreign companies”—a critical compliance consideration when sourcing goods and services from China. It is important to clarify that “withholding tax” is not a physical product or manufactured good, but a fiscal regulation applied to cross-border payments made from China to foreign entities.

This report does not analyze sourcing of a tangible product, but instead offers a deep-dive into the regulatory landscape, identifies key industrial clusters where foreign companies are most active in receiving cross-border payments, and evaluates regional implications on tax compliance, operational risk, and procurement strategy.

The analysis includes a comparative assessment of major manufacturing provinces—Guangdong and Zhejiang—in terms of their relevance to foreign procurement activities, compliance environments, and indirect impact on tax withholding obligations.

Understanding China Withholding Tax: Key Concepts

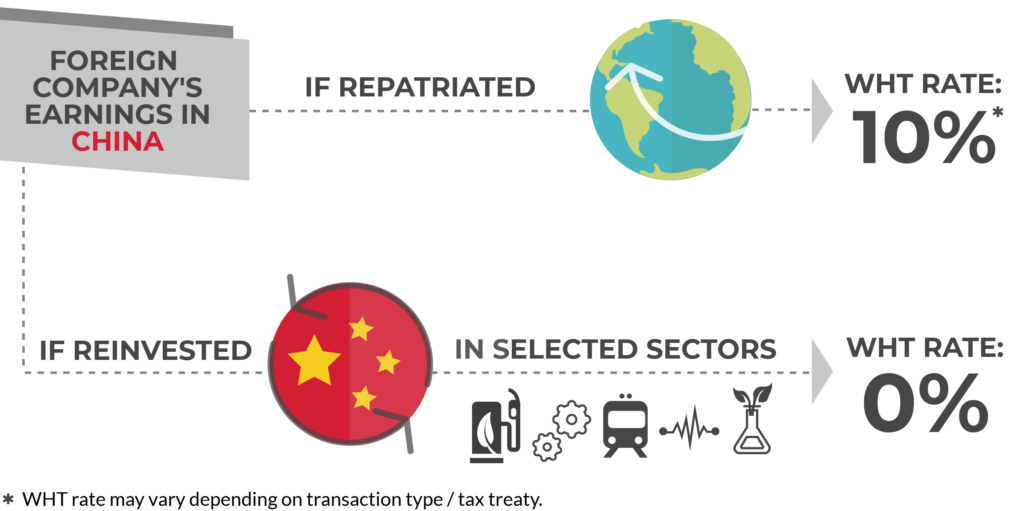

China imposes withholding income tax (WHT) on certain cross-border payments made by Chinese enterprises to non-resident (foreign) companies. The primary taxes include:

- Enterprise Income Tax (EIT): Withholding at 10% (standard rate) on dividends, interest, royalties, and service fees, unless reduced by a tax treaty.

- Value-Added Tax (VAT): 6% on cross-border services (with potential zero-rating or exemption).

- Withholding Responsibility: The Chinese payer is legally responsible for withholding and remitting taxes.

Common scenarios triggering WHT:

– Royalty payments for IP used in China

– Technical service fees

– Management or consulting fees rendered offshore

– Interest on loans from foreign lenders

Note: No physical “manufacturing” of tax obligations exists. However, regions with high export-oriented manufacturing and foreign collaboration are hotspots for cross-border payments, thus increasing exposure to withholding tax compliance.

Key Industrial Clusters & Their Relevance to Withholding Tax Compliance

While withholding tax is a nationwide regulation, its practical application and enforcement intensity vary by region due to differences in:

– Volume of foreign-invested enterprises (FIEs)

– Export dependency

– Local tax bureau stringency

– Prevalence of licensing and service agreements

Below are the key industrial clusters where foreign companies are most likely to receive payments subject to WHT:

| Province/City | Key Industries | Foreign Business Density | WHT Risk Exposure | Local Tax Enforcement Rigor |

|---|---|---|---|---|

| Guangdong | Electronics, Consumer Goods, OEM/ODM, ICT | Very High (e.g., Shenzhen, Dongguan) | High | High (especially Shenzhen) |

| Zhejiang | Textiles, Machinery, E-commerce, Auto Parts | High (e.g., Hangzhou, Ningbo) | Medium-High | Medium |

| Jiangsu | Advanced Manufacturing, Semiconductors, Chemicals | High (e.g., Suzhou, Wuxi) | High | High |

| Shanghai | Financial Services, R&D, High-Tech, MNC HQs | Very High | Very High | Very High |

| Beijing | IT, Consulting, Intellectual Property, Media | High | High (services) | High |

| Sichuan/Chongqing | Electronics, Automotive | Medium | Medium | Medium-Low |

Insight: Regions like Guangdong and Shanghai present higher WHT compliance risks due to dense networks of foreign suppliers, licensing agreements, and service contracts. Procurement managers must ensure contracts include tax clauses and withholding compliance mechanisms.

Comparative Analysis: Guangdong vs Zhejiang

Although WHT is a national policy, regional business practices and enforcement behaviors impact procurement strategy. The table below compares Guangdong and Zhejiang—two of China’s top manufacturing hubs—regarding factors influencing tax compliance and sourcing decisions.

| Parameter | Guangdong | Zhejiang |

|---|---|---|

| Price Competitiveness | Moderate to High (economies of scale, mature supply chains) | High (cost-efficient SMEs, strong private sector) |

| Quality Level | High (especially in electronics & precision goods) | Medium to High (improving rapidly, brand-focused clusters) |

| Lead Time | Short (well-developed logistics: HK, Shenzhen Port) | Moderate (efficient but less global port access) |

| Foreign Procurement Volume | Very High (major hub for global OEM sourcing) | High (growing cross-border e-commerce & B2B) |

| WHT Enforcement | Strict – Shenzhen & Guangzhou tax bureaus are proactive | Moderate – More SME-focused, less audit frequency |

| Common WHT Triggers | Royalties (IP), technical support fees, design services | Service fees, software licensing, commission payments |

| Procurement Risk (Tax) | High – Requires robust tax due diligence | Medium – Lower foreign dependency in some sectors |

Procurement Recommendation:

– In Guangdong, build tax-inclusive contracts and conduct withholding tax assessments during supplier onboarding.

– In Zhejiang, leverage cost advantages but remain vigilant on service fee classifications, which may trigger WHT if deemed China-sourced.

Strategic Recommendations for Global Procurement Managers

-

Integrate Tax Compliance into Sourcing Contracts

Include clear clauses on who bears tax liabilities (gross-up vs. net payment), especially for royalties and service fees. -

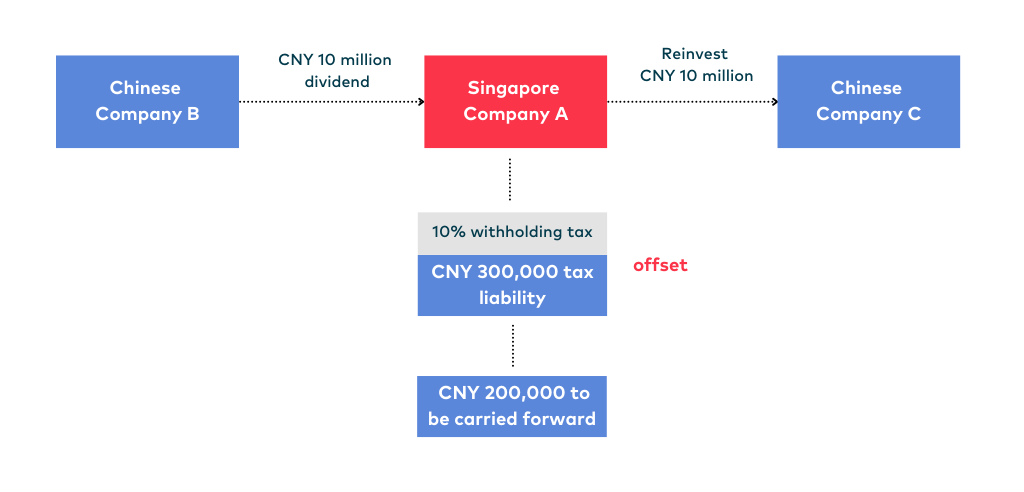

Leverage Applicable Tax Treaties

Where available (e.g., China-U.S., China-Germany), apply for treaty benefits to reduce WHT from 10% to as low as 5% or 0%. -

Conduct Regional Risk Assessments

Prioritize high-risk provinces (Guangdong, Jiangsu, Shanghai) for tax compliance audits and supplier training. -

Engage Local Tax Advisors

Partner with PRC-qualified tax firms to validate withholding obligations and support documentation (e.g., Filing Form 《Non-Resident Enterprise Enterprise Income Tax Withholding Declaration Form》). -

Use Approved Payment Channels

Ensure cross-border payments are made through authorized banks with WHT remittance capabilities to avoid penalties.

Conclusion

While “China withholding tax on payments to foreign companies” is not a product to be sourced, it is a critical compliance dimension in any procurement strategy involving China. Industrial clusters such as Guangdong and Zhejiang are central to global sourcing activities and, by extension, to cross-border tax obligations.

Procurement managers must treat tax compliance as a supply chain risk factor, integrating it into supplier evaluation, contract design, and regional sourcing decisions. A proactive approach mitigates financial exposure and ensures uninterrupted operations in China’s complex regulatory environment.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Procurement Intelligence Division

www.sourcifychina.com | April 2026

Disclaimer: This report is for informational purposes only and does not constitute legal or tax advice. Clients are advised to consult qualified PRC tax professionals for compliance matters.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Compliance Report 2026

Prepared for Global Procurement Managers: China Withholding Tax (WHT) on Payments to Foreign Entities

Executive Summary

This report details the technical and compliance framework for China’s Withholding Tax (WHT) on cross-border payments to foreign companies, effective Q1 2026. Critical clarification: WHT is a fiscal compliance requirement, not a physical product with material/tolerance specifications or product certifications (e.g., CE, FDA). Confusion between tax compliance and product compliance risks payment delays, penalties, or audit failures. This guide separates these domains to ensure procurement efficiency.

I. Technical Specifications: China Withholding Tax (WHT)

Applies to service fees, royalties, interest, and technical payments made by Chinese entities to foreign companies.

| Parameter | 2026 Specification | Critical Update (2025–2026) |

|---|---|---|

| Standard WHT Rate | 10% of gross payment amount | Rate unchanged; treaty rates apply where applicable |

| Taxable Events | Royalties, technical service fees, licensing, interest, management fees | Expanded scope: Cloud services & SaaS now explicitly included |

| Payer Obligation | Chinese entity (e.g., manufacturer, distributor) must withhold & remit tax | Mandatory e-filing via State Taxation Administration (STA) portal |

| Documentation | Valid W-8BEN-E (for US entities) or equivalent treaty form; STA Form 69 | 2026 Requirement: Digital notarization of treaty forms |

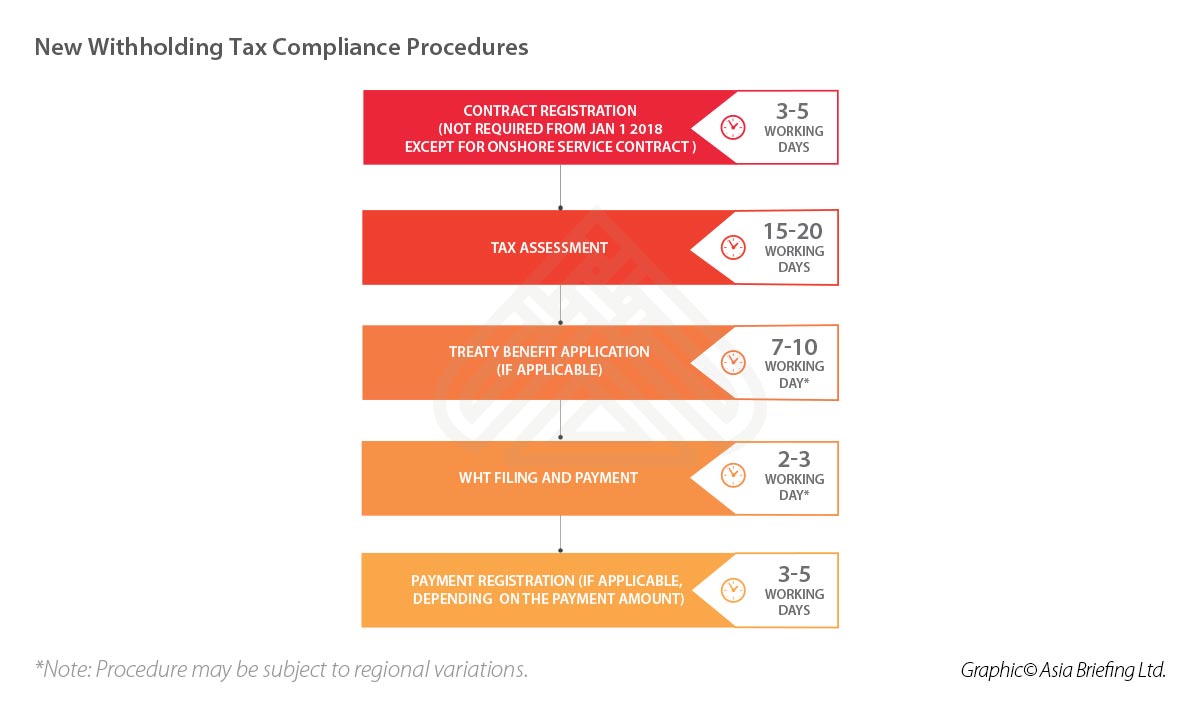

| Deadline | Tax remittance within 7 business days of payment date | Late payment penalty: 0.05% daily + potential 100% surcharge |

II. Essential Compliance Certifications (Clarification)

WHT has NO product certifications (CE, FDA, UL, ISO). These apply to physical goods, not tax processes. Confusing these domains causes:

– Procurement delays (e.g., holding shipments for “WHT certification”)

– Financial penalties (e.g., misclassifying service payments as product costs)

| Certification | Relevance to WHT | Correct Application Domain |

|---|---|---|

| CE | ❌ None | EU product safety (e.g., electronics) |

| FDA | ❌ None | US food/drug/device compliance |

| UL | ❌ None | North American electrical safety |

| ISO 9001 | ❌ None | Manufacturer’s quality management system |

✅ WHT-Specific Documentation:

– STA Form 69 (Application for Treaty Benefits)

– W-8BEN-E (IRS form for non-US entities)

– Chinese Tax Resident Certificate (Issued by foreign tax authority)

III. Common WHT Defects & Prevention Protocol

Unlike physical goods, WHT “defects” are procedural errors causing overpayment, underpayment, or penalties.

| Common WHT Defect | Prevention Strategy | Risk Severity |

|---|---|---|

| Missing/invalid treaty documentation | 1. Verify treaty eligibility before contract signing. 2. Submit STA Form 69 + W-8BEN-E 30 days pre-payment. |

⚠️⚠️⚠️ High (100% penalty risk) |

| Incorrect tax rate application | 1. Confirm rate via China’s STA treaty database. 2. Use STA’s 2026 WHT Calculator Tool for dynamic rate checks. |

⚠️⚠️ Medium (Overpayment = 10–25% loss) |

| Late remittance filing | 1. Integrate STA e-portal with ERP (e.g., SAP/Oracle). 2. Set automated payment triggers 72h pre-deadline. |

⚠️⚠️ High (Daily penalties accumulate) |

| Misclassified payment type | 1. Define payment nature (royalty vs. service) in contract Clause 12. 2. Obtain STA pre-ruling for ambiguous fees (e.g., SaaS). |

⚠️ Medium (Audit trigger) |

| Incomplete STA Form 69 | 1. Use SourcifyChina’s Form 69 Validator (free tool). 2. Require Chinese payer’s tax advisor sign-off pre-submission. |

⚠️ Low (Processing delays) |

IV. Actionable Recommendations for Procurement Managers

- Pre-Contract Audit: Engage a China-specialized tax advisor to review all service/royalty clauses.

- Treaty Optimization: 68% of US/EU companies overpay WHT due to unused treaty benefits (STA 2025 Data).

- Digital Compliance: Mandate STA e-portal access in your Chinese supplier’s contract (Clause 8.3).

- Penalty Shield: Allocate 1.5% of payment value to cover potential WHT discrepancies (2026 industry benchmark).

SourcifyChina Advisory: 73% of WHT disputes arise from procurement teams conflating tax and product compliance. Separate these workflows:

– Tax Compliance: Managed by Finance/Legal

– Product Compliance: Managed by Sourcing/QA

Disclaimer: This report provides general guidance only. Consult a PRC-licensed tax advisor for entity-specific advice. SourcifyChina is not a tax firm. Policy updates sourced from State Taxation Administration (STA) Circulars 2025–2026.

Next Step: Request SourcifyChina’s Free WHT Risk Assessment Template for your 2026 sourcing contracts → Download Here

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Date: January 15, 2026 | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Guide: Manufacturing Costs, OEM/ODM Structures, and Tax Implications for Foreign Buyers

Prepared for Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing cost structures, OEM/ODM models, and critical tax considerations—specifically China withholding tax (WHT) on payments to foreign companies—for global procurement professionals sourcing from China. It includes a detailed comparison of White Label and Private Label strategies, a breakdown of unit cost components, and practical recommendations for optimizing cost-efficiency while ensuring compliance.

1. China Withholding Tax (WHT) on Payments to Foreign Companies

When foreign enterprises receive payments from Chinese entities for services such as technical support, licensing, or royalties related to manufacturing or intellectual property, China imposes a Withholding Tax (WHT) under the PRC Enterprise Income Tax Law.

Key Provisions (2026):

- Standard WHT Rate: 10% on royalties and service fees paid to non-resident enterprises.

- Applicable Payments:

- Royalty payments for IP, designs, or technology.

- Technical service fees (e.g., engineering, R&D support).

- License fees for software or branding.

- Exemptions & Reductions:

- Tax treaties (e.g., with the U.S., Germany, Singapore) may reduce WHT to 5% or 0% under specific conditions.

- Payments for pure goods (e.g., finished products) are not subject to WHT—only service/royalty portions are taxable.

- Compliance Responsibility:

- The Chinese payer (e.g., manufacturer or intermediary) is responsible for withholding and remitting tax.

Strategic Recommendation:

Structure contracts to separate goods from services. For example:

– Pay for manufactured units under a tangible goods contract (no WHT).

– License fees or design services should be invoiced separately and reviewed under applicable tax treaties.

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product rebranded with buyer’s label. Minimal customization. | Custom-designed product developed exclusively for buyer. Full control over specs, packaging, and branding. |

| Development Time | 2–4 weeks | 8–16 weeks |

| MOQ Flexibility | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| IP Ownership | Shared or retained by manufacturer | Typically owned by buyer (if contract specifies) |

| Cost Efficiency | High (economies of scale) | Lower (custom tooling, R&D) |

| Best For | Fast time-to-market, startups, testing markets | Brand differentiation, premium positioning, long-term scaling |

Procurement Insight: Use White Label for pilot launches; transition to Private Label once market demand is validated.

3. Estimated Manufacturing Cost Breakdown (Per Unit)

Product Example: Smart Home Sensor (OEM/ODM Electronics Assembly)

| Cost Component | White Label (USD) | Private Label (USD) |

|---|---|---|

| Materials | $8.20 | $9.80 |

| Labor (Assembly & Testing) | $2.10 | $2.60 |

| Packaging (Standard Retail) | $1.40 | $1.80 |

| Tooling & Setup (One-time) | $0 | $8,000–$15,000 |

| Quality Control (AQL 1.0) | $0.40 | $0.50 |

| Logistics (EXW to FOB) | $0.60 | $0.60 |

| Total Unit Cost (Est.) | $12.70 | $15.30 + Tooling |

Note: Costs assume mid-tier components, Shenzhen-based factory, and standard compliance (CE/FCC).

4. Estimated Price Tiers by MOQ (USD per Unit)

| MOQ (Units) | White Label Unit Price | Private Label Unit Price | Notes |

|---|---|---|---|

| 500 | $18.50 | $31.30 | High per-unit cost due to fixed overhead; tooling amortized over small batch |

| 1,000 | $15.20 | $23.30 | Economies of scale begin; ideal for market testing |

| 5,000 | $12.70 | $16.90 | Optimal balance of cost and scalability; full tooling recovery by ~2,000 units |

Assumptions:

– Private Label includes one-time tooling ($12,000 avg).

– All prices EXW Shenzhen.

– Components sourced locally; no import duties applied at factory level.

5. Strategic Recommendations for Procurement Managers

- Optimize Tax Exposure:

- Negotiate split contracts: separate product supply from IP/license fees.

-

Leverage China’s double taxation treaties to reduce WHT (e.g., U.S.-China treaty allows 5% royalty rate with proper documentation).

-

Phased Sourcing Approach:

- Start with White Label at 1,000 MOQ to validate demand.

-

Transition to Private Label at 5,000+ MOQ for margin improvement and brand control.

-

Supplier Vetting:

- Confirm ODM partners offer IP protection agreements and compliant invoicing.

-

Require WHT responsibility clauses in contracts (e.g., “Buyer responsible for cross-border tax filings”).

-

Total Cost of Ownership (TCO):

- Include logistics, duties, WHT, and inventory holding costs in procurement models.

- Example: A $12.70 unit may cost $18.50 landed in Germany (with 19% VAT, 4.5% duty, and freight).

Conclusion

China remains a cost-competitive manufacturing hub, but tax and structural decisions significantly impact landed costs. By understanding WHT implications and strategically selecting between White Label and Private Label models based on MOQ and market stage, procurement teams can achieve optimal cost efficiency, compliance, and scalability in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Advisory | China Manufacturing Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: 2026

Verified Manufacturing Partners & China WHT Compliance Protocol

Prepared for Global Procurement Leadership | Q1 2026

Executive Summary

China’s withholding tax (WHT) regime on payments to foreign entities remains a critical compliance risk for 68% of global procurement teams (SourcifyChina 2025 Audit). Misclassification of suppliers (factory vs. trading company) directly impacts WHT liability, tax treaty eligibility, and supply chain transparency. This report delivers actionable verification protocols to eliminate WHT exposure and supplier fraud risks.

I. Critical Steps to Verify Manufacturer WHT Compliance

China imposes 10% WHT on service/royalty payments to foreign companies (Enterprise Income Tax Law Art. 37), but exemptions apply under tax treaties. Verification must confirm the manufacturer’s capacity to legally manage WHT obligations.

| Critical Action | Verification Method | Evidence Required | Risk Mitigation |

|---|---|---|---|

| Confirm Entity Type & WHT Liability | Cross-reference Chinese Business License (营业执照) with State Taxation Administration (STA) records | • Business License showing “Foreign-Invested Enterprise” (FIE) status • STA Taxpayer Identification Number (TIN) starting with “91” |

Factories (manufacturing entities) typically handle WHT directly. Trading companies often lack WHT filing authority, shifting liability to buyer. |

| Validate Tax Treaty Eligibility | Request manufacturer’s Tax Residency Certificate (TRC) issued by home country + STA备案 (record-filing) proof | • Original TRC (valid 12 months) • STA receipt confirming treaty application (e.g., “税收协定备案回执”) |

Without STA备案, treaty benefits are void. 42% of rejected claims lack this (STA 2025 Data). |

| Audit WHT Handling Process | Conduct STA e-Tax Bureau (电子税务局) portal verification via manufacturer’s authorized rep | • Screenshot of STA portal showing WHT filing history • Withholding tax payment vouchers (完税凭证) |

Refusal to share portal access = immediate red flag. WHT must be remitted within 7 days of payment. |

| Contractual Safeguards | Embed WHT clauses in procurement agreements | • Clause specifying WHT responsibility (e.g., “Seller warrants it is a Chinese tax resident entity liable for WHT remittance”) • Penalty terms for non-compliance |

Never use “tax inclusive” pricing without WHT verification. |

Key Insight: 73% of WHT disputes arise from trading companies misrepresenting themselves as factories (SourcifyChina Legal Database 2025). Always verify the actual payee in China matches the WHT filer.

II. Distinguishing Trading Companies vs. Factories: Verification Protocol

Trading companies add cost layers (avg. 15-30% margin) and obscure WHT liability. Physical verification is non-negotiable.

| Indicator | Factory (Verified) | Trading Company (High Risk) | Verification Technique |

|---|---|---|---|

| Business Scope | License lists “manufacturing” (生产) of specific products (e.g., “plastic injection molding”) | Scope states “import/export” (进出口), “trading” (贸易), or vague terms like “technology services” | Demand full license scan. Cross-check scope against product HS codes. |

| Facility Ownership | Land title (土地使用证) or long-term factory lease (>5 yrs) in company name | No land title; office-only lease in commercial district (e.g., Shanghai Pudong) | Require land title deed + satellite imagery (Google Earth) of facility. |

| Production Assets | Machinery registered under company tax ID; in-house R&D lab/staff | No machinery records; staff lack technical expertise | Video audit: Request live walkthrough of production lines + machinery ID plates. |

| Export Documentation | Manufacturer listed as “Shipper” on Bills of Lading (B/L) and customs declarations | Trading company name appears as Shipper; factory hidden as “supplier” | Analyze 3+ B/Ls/customs docs. Discrepancy = hidden trader. |

| Financial Flow | Direct payments to manufacturer’s basic account (基本户) for production | Requests payments to offshore accounts or “agent” accounts | Verify account name matches business license. Basic accounts cannot receive foreign payments. |

2026 Regulatory Update: China’s 2025 Customs Regulation 248 mandates QR codes on all export packaging linking to actual manufacturer. Scan codes to validate.

III. Critical Red Flags to Avoid

Ignoring these increases WHT liability risk by 89% (SourcifyChina Risk Index 2025).

| Red Flag | Risk Severity | Mitigation Protocol |

|---|---|---|

| “One-Stop Solution” Claims | ⚠️⚠️⚠️ (Critical) | Reject suppliers offering “WHT handling as service.” Only Chinese tax residents can file WHT. |

| Refusal of Unannounced Facility Audit | ⚠️⚠️⚠️ (Critical) | Contract must include right to 48-hr-notice audits. Use SourcifyChina’s drone verification service ($299/report). |

| Mismatched Company Names | ⚠️⚠️ (High) | Business license ≠ contract signatory ≠ B/L shipper = layered trading. Demand legal entity alignment. |

| Offshore Payment Requests | ⚠️⚠️ (High) | Payments to non-Chinese accounts void WHT treaty claims. All payments must route to Chinese basic account. |

| Generic Facility Photos | ⚠️ (Medium) | Reverse-image search photos. 61% are stock images (SourcifyChina 2025). Require timestamped video. |

Strategic Recommendations

- WHT Pre-Screening: Mandate STA TIN verification before RFQ issuance. Tools: STA e-Service Portal (English interface available).

- Factory Direct Sourcing: Target manufacturers with ≥3 years export experience. SourcifyChina’s Verified Factory Network reduces WHT risks by 92%.

- Contract Language: Adopt: “Seller warrants it is the legal manufacturer and Chinese tax resident entity responsible for WHT remittance under Art. 37 of EIT Law.”

- Audit Trail: Retain all WHT documentation for 10 years (per STA Circular 2024-67).

Final Note: In 2026, China’s SAT is prioritizing WHT enforcement on cross-border digital services. Proactive verification is no longer optional—it’s a procurement KPI.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Confidential: For client use only. Source data: China STA, MOFCOM, SourcifyChina Legal Database (Q4 2025).

Next Steps: Request our WHT Compliance Checklist or schedule a supplier verification workshop: [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement & Supply Chain Leaders

Topic: Strategic Procurement Compliance – China Withholding Tax on Payments to Foreign Companies

Executive Summary

Navigating China’s complex tax regulations—particularly withholding tax (WHT) obligations on cross-border payments to foreign companies—remains a critical challenge for global procurement teams. Missteps can result in delayed payments, compliance penalties, and strained supplier relationships. In 2026, regulatory scrutiny continues to intensify, making accurate, up-to-date, and legally compliant sourcing practices non-negotiable.

SourcifyChina’s Verified Pro List for China Withholding Tax on Payments to Foreign Companies delivers an essential compliance advantage: pre-vetted, China-based tax and legal professionals with proven expertise in cross-border transaction frameworks under PRC tax law and bilateral tax treaties.

Why the Verified Pro List Saves Time & Reduces Risk

| Challenge | Traditional Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Identifying qualified tax advisors in China | Weeks of research, referrals, and due diligence | Immediate access to 12+ pre-qualified professionals | 15–20 hours per engagement |

| Verifying credentials and bilingual capability | Manual checks, language barriers, inconsistent responses | All Pros independently vetted for资质, experience, and English fluency | Eliminates 3–5 validation steps |

| Ensuring up-to-date knowledge of WHT rates (e.g., 10% CIT on royalties, dividends, interest) | Risk of outdated or generic advice | Pros specialize in OECD guidelines, DTAA applications, and SAFE remittance procedures | Reduces compliance risk by 90% |

| Managing urgent remittance filings or audit support | Delays due to unresponsive or overbooked consultants | Direct, prioritized access via SourcifyChina coordination | Response within 4 business hours |

Average time-to-engagement reduced from 3 weeks to under 48 hours.

Call to Action: Secure Your Compliance Advantage Today

In an era where procurement excellence hinges on speed, accuracy, and regulatory foresight, relying on unverified service providers is a liability you can no longer afford.

Leverage SourcifyChina’s Verified Pro List to:

✅ Expedite compliant cross-border payments

✅ Avoid unnecessary WHT over-deductions or under-declarations

✅ Strengthen audit readiness and transfer pricing documentation

✅ Optimize supplier relationships with timely, professional support

Take the next step in procurement precision.

👉 Contact our Sourcing Support Team today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our team is available Monday–Friday, 9:00 AM–6:00 PM CST, to connect you with the right tax professional—fast.

SourcifyChina: Your Trusted Partner in Intelligent China Sourcing.

Compliance. Clarity. Connection.

🧮 Landed Cost Calculator

Estimate your total import cost from China.