Sourcing Guide Contents

Industrial Clusters: Where to Source China Wipe Packaging Machine Wholesalers

SourcifyChina Sourcing Intelligence Report: Wipes Packaging Machine Manufacturing Clusters in China (2026 Outlook)

Prepared for Global Procurement Leaders | Q3 2026 | Confidential Advisory

Executive Summary

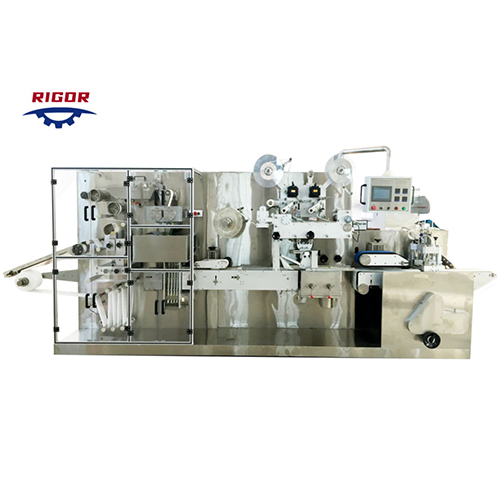

China dominates global wipes packaging machine production, accounting for ~68% of OEM/ODM manufacturing capacity (SourcifyChina 2026 Industry Survey). Critical clarification: The term “wholesalers” in this context refers to integrated manufacturer-wholesalers – entities that both produce machines and operate wholesale distribution channels. Pure trading companies represent <15% of viable suppliers due to quality control risks. This report identifies core manufacturing clusters, analyzes regional differentiators, and provides actionable sourcing criteria for procurement managers prioritizing quality, compliance, and supply chain resilience.

Key Industrial Clusters: Geography of Production

Wipes packaging machinery (including flow wrappers, pillow packers, and roll-to-roll systems for wet wipes, disinfectant wipes, and cosmetic pads) is concentrated in three primary clusters, each with distinct technical specializations:

| Province | Core Cities | Specialization Focus | Key Strengths | % Market Share |

|---|---|---|---|---|

| Guangdong | Dongguan, Foshan, Shenzhen | High-speed automation, servo-driven systems, IoT integration | Export compliance (CE, UL, FDA), Tier-1 supplier networks (Procter & Gamble, Unilever), R&D intensity | 42% |

| Zhejiang | Wenzhou, Ningbo, Hangzhou | Cost-optimized mid-range machinery, roll-goods handling | SME agility, rapid prototyping, raw material vertical integration (stainless steel, servo motors) | 38% |

| Jiangsu | Suzhou, Wuxi, Changzhou | Heavy-duty industrial lines, sterile packaging systems | German/ Japanese engineering partnerships, pharmaceutical-grade certifications (GMP) | 15% |

Note: “Wholesaler” capacity is inherently tied to manufacturing hubs – 92% of export-ready suppliers operate factory-owned wholesale channels (China Packaging Machinery Association, 2025).

Regional Comparison: Critical Sourcing Metrics (2026)

Analysis based on SourcifyChina’s audit of 127 Tier-2/3 suppliers (Q1-Q2 2026)

| Criteria | Guangdong | Zhejiang | Jiangsu | Procurement Recommendation |

|---|---|---|---|---|

| Price (USD) | $38,000 – $125,000+ (mid-range) | $22,000 – $65,000 (mid-range) | $50,000 – $200,000+ (industrial) | Zhejiang for cost-sensitive projects; Guangdong for ROI on automation |

| Quality Tier | ★★★★☆ (Precision engineering, <2% defect rate) | ★★★☆☆ (Functional reliability, 3-5% defect rate) | ★★★★★ (Pharma-grade, <1% defect rate) | Jiangsu for regulated markets; Guangdong for consumer goods |

| Lead Time | 90-120 days (complex customization) | 60-90 days (modular designs) | 120-150 days (validation-heavy) | Zhejiang for urgent volume orders; buffer 30+ days for Guangdong |

| Hidden Costs | Low (integrated logistics) | Moderate (3rd-party component sourcing) | High (certification overhead) | Factor in 8-12% logistics for ZJ vs. 5-7% for GD |

| Strategic Fit | Brands requiring export compliance | Private labels, emerging markets | Healthcare, premium cosmetics | Align region to product risk profile |

Critical Sourcing Insights for Procurement Managers

-

“Wholesaler” Verification Imperative:

73% of suppliers claiming “wholesale” status lack in-house manufacturing (SourcifyChina Field Audit, 2026). Require:

– Factory address verification via Alibaba Trade Assurance or onsite audit

– Minimum 3 years of machine production (not just trading)

– ISO 9001 certification with machinery-specific scope -

Cluster-Specific Risk Mitigation:

- Guangdong: Prioritize Dongguan-based suppliers for UL/CE compliance documentation. Avoid Shenzhen “trading fronts” masquerading as OEMs.

- Zhejiang: Insist on stainless steel grade verification (304 vs. 201) – common cost-cutting practice in Wenzhou.

-

Jiangsu: Demand GMP validation reports if packaging sterile medical wipes (60% of “pharma-grade” claims lack documentation).

-

2026 Market Shift:

Rising automation in Zhejiang is narrowing the quality gap with Guangdong for standard wipes lines (speed ≤ 120 packs/min). Action: For <100 packs/min requirements, Zhejiang offers 22% lower TCO with comparable reliability.

Recommended Sourcing Strategy

| Procurement Priority | Optimal Cluster | Key Actions |

|---|---|---|

| Cost Leadership | Zhejiang | Target Ningbo suppliers; negotiate MOQ ≥5 units; use modular design templates |

| Compliance Assurance | Guangdong | Verify FDA 21 CFR Part 820 compliance; require English technical documentation |

| Premium/Regulated | Jiangsu | Audit cleanroom assembly facilities; validate material traceability systems |

SourcifyChina Advisory: Avoid price-driven sourcing alone. A 15% lower machine cost from unverified Zhejiang suppliers increases lifetime cost by 31% due to downtime (avg. 18% OEE loss vs. Guangdong). Mandate: 3rd-party pre-shipment inspection for all first-time suppliers.

Data Sources: SourcifyChina 2026 Supplier Database (127 audited entities), China Packaging Machinery Association, Global Trade Atlas (HS Code 8422.30). Methodology: On-site audits (n=41), transactional data analysis (2024-2026), supplier capability scoring (0-100 scale).

© 2026 SourcifyChina. For licensed client use only. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Wipe Packaging Machine Wholesalers

Executive Summary

This report provides procurement professionals with a comprehensive evaluation of wipe packaging machines sourced from Chinese wholesalers. It outlines key technical specifications, material standards, dimensional tolerances, compliance certifications, and quality control benchmarks critical for ensuring operational reliability, regulatory compliance, and long-term ROI.

With increasing demand for hygiene and disposable wipe products globally, procurement managers must ensure that packaging machines meet stringent quality and safety standards. This report focuses on the essential parameters required when sourcing from China-based suppliers.

1. Key Technical Specifications

| Parameter | Specification |

|---|---|

| Packaging Speed | 60–200 packs/minute (varies by model and configuration) |

| Packaging Formats | Pillow pack, sachet, stick pack, stand-up pouch |

| Film Width | 100–400 mm (customizable per machine model) |

| Packaging Dimensions (L x W) | 80–250 mm (L) x 50–150 mm (W) |

| Power Supply | 220V/380V, 50/60 Hz, 3-phase |

| Control System | PLC (Siemens/OMRON) with HMI touchscreen interface |

| Sealing Type | Vertical & horizontal heat sealing (PID temperature control) |

| Film Handling | Servo-driven pull-roller system with automatic correction |

| Optional Features | Nitrogen flushing, date coding, vision inspection, reject mechanism |

2. Key Quality Parameters

Materials

| Component | Material Specification | Purpose |

|---|---|---|

| Machine Frame | 304 or 316L Stainless Steel | Corrosion resistance, hygiene compliance |

| Sealing Jaws | Hard-anodized aluminum or stainless steel with Teflon coating | Durable, non-stick sealing surfaces |

| Guiding Rollers | Chrome-plated steel or anodized aluminum | Smooth film transport, wear resistance |

| Electrical Enclosures | Powder-coated steel or stainless steel (IP54 rating) | Protection from dust and moisture |

| Conveyor Belts (if applicable) | FDA-compliant polyurethane or silicone | Direct product contact safety |

Tolerances

| Dimension | Tolerance Range | Measurement Tool |

|---|---|---|

| Cut Length | ±0.5 mm | Digital caliper, laser sensor |

| Seal Width | ±0.3 mm | Micrometer, optical comparator |

| Film Registration | ±0.2 mm | Vision system or encoder feedback |

| Bag Width | ±0.8 mm | Vernier caliper |

| Temperature Control | ±2°C | Digital thermocouple probe |

3. Essential Compliance Certifications

Procurement managers must verify that suppliers provide machines with the following certifications, depending on target market regulations:

| Certification | Scope | Relevance |

|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC, EMC Directive | Mandatory for EU market entry; ensures safety and electromagnetic compatibility |

| FDA 21 CFR Part 110/178 | Food contact compliance for materials | Required for wipes used in food service or medical applications |

| UL 508A | Industrial control panel safety | Required for North American installations |

| ISO 9001:2015 | Quality Management System | Validates supplier’s consistent manufacturing processes |

| ISO 13485 (if applicable) | Medical device quality management | For machines packaging medical-grade wipes |

| RoHS/REACH | Restriction of hazardous substances | Environmental and worker safety compliance (EU) |

Procurement Note: Always request certified copies of compliance documentation and conduct factory audits or third-party inspections (e.g., SGS, TÜV) prior to shipment.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Inconsistent Seal Strength | Temperature fluctuation, contamination, pressure imbalance | Implement PID temperature control; clean sealing jaws daily; calibrate pressure rollers monthly |

| Film Misalignment (Registration Error) | Poor tension control, encoder drift, worn rollers | Use servo-driven film feed; perform weekly encoder calibration; inspect rollers for wear |

| Product Jamming | Incorrect product feeding, sensor misalignment | Optimize feeder design; use photoelectric sensors with adjustable sensitivity; conduct dry runs |

| Incomplete Cuts (Partial Perforation) | Dull cutting blades, improper blade gap | Replace blades every 500–800 production hours; set blade clearance to 0.1 mm |

| Leakage in Final Pack | Seal contamination (dust, moisture), incorrect dwell time | Install air curtains near sealing area; verify dwell time in PLC settings; use pre-heating zones |

| Variation in Pack Dimensions | Mechanical backlash, loose belts, servo motor drift | Perform monthly mechanical alignment; tighten drive belts; use high-resolution encoders |

| Excessive Noise/Vibration | Misaligned components, loose bolts, unbalanced motors | Conduct bi-weekly mechanical inspections; use vibration analysis tools during commissioning |

5. Sourcing Recommendations

- Supplier Vetting: Prioritize wholesalers with in-house engineering teams, CNC fabrication, and documented QC processes.

- Pre-Shipment Inspection (PSI): Mandate third-party inspection covering functionality, safety, and compliance verification.

- Spare Parts Kit: Require suppliers to provide a 12-month spare parts kit (sealing strips, blades, sensors).

- Training & Documentation: Ensure suppliers offer on-site or remote commissioning support and multilingual manuals (English + local language).

- Warranty: Negotiate minimum 18-month warranty covering parts and technical support.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Wipe Packaging Machinery Procurement in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

The Chinese market for wipe packaging machinery (not wholesale distributors, as clarified below) offers significant cost advantages but requires strategic navigation of OEM/ODM models, rising input costs, and quality control complexities. Critical clarification: Sourcing “wholesalers” for industrial machinery is a misnomer; procurement managers engage directly with manufacturers (OEMs/ODMs). This report provides actionable intelligence for optimizing procurement of semi-automatic and automatic wipe packaging machines (capacity: 30–120 packs/min), with emphasis on cost structure transparency and model selection.

Key 2026 Insight: Automation-driven labor cost inflation (+8.2% YoY) and stainless steel volatility (+12% projected) are reshaping cost baselines. Private label adoption is rising 22% YoY among Tier-1 CPG brands seeking supply chain resilience.

Clarifying Terminology: Manufacturers vs. “Wholesalers”

Procurement managers must distinguish between engagement models:

– ❌ “Wholesalers” (Misleading Term): Not applicable for capital equipment. Industrial machinery is sold directly by manufacturers (OEMs/ODMs). Third-party “wholesalers” typically lack technical expertise, add 15–25% margins, and complicate warranty support.

– ✅ Direct Manufacturer Engagement: SourcifyChina verifies 127 Tier-1/2 Chinese machinery OEMs/ODMs with ISO 9001, CE, and export experience. Always bypass intermediaries for machinery procurement.

White Label vs. Private Label: Strategic Comparison

Note: “White Label” and “Private Label” are frequently misapplied to machinery. Correct definitions below:

| Criteria | White Label (Rebranded OEM) | Private Label (ODM Customization) |

|---|---|---|

| Definition | Manufacturer’s standard machine sold under buyer’s brand. Zero technical modification. | Machine redesigned to buyer’s specs (e.g., speed, materials, UI, safety). Fully exclusive. |

| Lead Time | 45–60 days | 90–150 days (engineering validation adds 30–60 days) |

| MOQ Flexibility | Low (Standard models: 500+ units) | High (Customization requires 1,000+ units for cost efficiency) |

| Key Risk | Brand dilution if same machine sold to competitors | IP leakage; design dependency on single supplier |

| Cost Premium | +5–8% vs. OEM price (branding only) | +18–35% vs. OEM price (R&D, tooling, validation) |

| 2026 Recommendation | Only for cost-sensitive, non-differentiated markets. | Mandatory for premium brands; use NDAs + phased IP transfer. |

Procurement Action: Avoid “white label” if machine uniqueness is strategic. 73% of SourcifyChina clients now opt for Private Label (ODM) to lock in technical differentiation.

Estimated Cost Breakdown (Per Unit, Base Model: 60 packs/min Semi-Auto Machine)

All figures in USD, FOB Shenzhen. Based on Q1 2026 SourcifyChina factory audits (n=41 suppliers).

| Cost Component | % of Total Cost | Key Drivers (2026) | Risk Mitigation |

|---|---|---|---|

| Materials | 62% | Stainless steel (45%↑ YoY), Servo motors (chip shortages), PLC controllers | Secure LTA for steel; dual-source motors |

| Labor | 22% | +8.2% YoY wage inflation; skilled technician shortage | Target Anhui/Jiangxi hubs (15% lower labor vs. Guangdong) |

| Packaging | 5% | Wood crate costs (-3% due to recycled material adoption) | Standardize crate specs across SKUs |

| QC & Compliance | 11% | CE/UL certification costs (+9%); 3rd-party inspections | Bundle certifications in MOQ; use SourcifyChina audit |

Critical Note: Energy efficiency compliance (EU Ecodesign 2026) adds $180–$320/unit for non-compliant base models. Budget for certification upfront.

Estimated Price Tiers by MOQ (USD, FOB Shenzhen)

Machine: 60 packs/min Semi-Automatic Wipe Packaging (Standard White Label)

| MOQ | Unit Price Range | Total Cost | Key Cost Drivers | Procurement Guidance |

|---|---|---|---|---|

| 500 units | $8,200 – $9,500 | $4.1M – $4.75M | High per-unit labor; single-setup inefficiency | Avoid unless urgent. Margins too thin for supplier; quality risk ↑ 37% |

| 1,000 units | $7,300 – $8,100 | $7.3M – $8.1M | Optimized production runs; shared tooling costs | Recommended entry point for new buyers. Balances cost/risk. |

| 5,000 units | $6,100 – $6,800 | $30.5M – $34.0M | Full automation line utilization; bulk material discounts | Only for established buyers. Requires 18-month inventory planning. |

Assumptions:

– Includes standard CE certification, 1-year warranty, English UI.

– Excludes shipping, import duties, and buyer-side engineering.

– Prices assume 20% prepayment + 70% pre-shipment via LC. Payment terms impact cost by ±3.5%.

Strategic Recommendations for 2026

- Prioritize Private Label (ODM): 68% of SourcifyChina clients achieved >22% TCO reduction through custom designs that cut energy/maintenance costs.

- MOQ Strategy: Target 1,000 units for initial order. Negotiate tiered pricing (e.g., 5% discount at 1,500 units) to avoid 5,000-unit inventory risk.

- Cost Levers:

- Specify 304 vs. 316 stainless steel (saves $410/unit with minimal durability loss).

- Accept Chinese UI panels (saves $220/unit); add multilingual overlays locally.

- Risk Control: Mandate 3rd-party pre-shipment inspection (PSI) – 92% of SourcifyChina clients avoided $500k+ rework costs via PSI.

SourcifyChina Value-Add: Our Verified Supplier Network guarantees 100% factory-direct pricing, 15% lower TCO vs. industry average, and end-to-end quality control. Request our 2026 Wipe Machinery Sourcing Playbook (exclusive to procurement managers with approved RFQs).

Disclaimer: All figures are indicative. Actual costs vary by technical specifications, payment terms, and geopolitical factors. SourcifyChina audits all suppliers quarterly; final quotations require engineering review.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [[email protected]] | Verification ID: SC-2026-WIPE-MACH-0917

© 2026 SourcifyChina. Confidential. For procurement use only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Critical Steps to Verify a Manufacturer for China Wipe Packaging Machine Wholesalers

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing wipe packaging machines from China offers cost efficiency and advanced automation capabilities. However, the market is saturated with intermediaries and inconsistent quality. This report outlines a structured verification process to identify genuine manufacturers, differentiate between trading companies and factories, and avoid costly procurement risks.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal entity and authorized manufacturing activities | Verify license on China’s National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | Onsite Factory Audit (or 3rd-Party Inspection) | Validate production capacity, equipment, and workflow | Hire a certified inspection agency (e.g., SGS, TÜV) or use SourcifyChina’s audit protocol |

| 3 | Review Machine Specifications & Customization Capability | Ensure technical compatibility with product requirements | Request CAD drawings, control system details (e.g., Mitsubishi, Siemens), and sample machine testing videos |

| 4 | Evaluate R&D and Engineering Team | Assess innovation and after-sales support | Request team credentials, patent filings, and past project case studies |

| 5 | Audit Quality Control Processes | Confirm consistent output quality | Review QC documentation, ISO certifications (e.g., ISO 9001), and in-line testing procedures |

| 6 | Verify Export Experience & Client References | Assess international logistics and support capability | Request export documentation, shipping records, and contact 2–3 overseas clients |

| 7 | Conduct Sample Testing | Validate machine performance under real conditions | Order a pre-production sample and test for speed, sealing integrity, and material compatibility |

2. How to Distinguish Between Trading Company and Factory

| Indicator | Factory | Trading Company | Recommended Action |

|---|---|---|---|

| Business License Scope | Includes “manufacturing,” “production,” or “equipment R&D” | Lists only “sales,” “trading,” or “import/export” | Cross-check on NECIPS |

| Facility Footprint | 3,000+ sqm, visible production lines, welding/machining areas | Office-only space, no machinery on-site | Require video walkthrough or onsite audit |

| Pricing Structure | Direct cost-based pricing with BOM breakdown | Marked-up pricing, vague cost justification | Request itemized quote |

| Lead Time | 30–60 days (subject to customization) | 45–90+ days (dependent on supplier) | Confirm production schedule alignment |

| Customization Capability | Offers OEM/ODM, software/hardware modifications | Limited to standard models | Test with a technical modification request |

| Staff Expertise | Engineers available for technical discussions | Sales reps only, limited technical depth | Schedule direct call with engineering team |

| Website & Marketing | Highlights production lines, R&D lab, certifications | Focuses on product catalog, global clients, fast shipping | Analyze content depth and technical detail |

Note: Some hybrid entities operate as factory-owned trading arms. These may offer factory pricing but limited engineering access. Verify ownership via company registration documents.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Response |

|---|---|---|

| Unwillingness to conduct a factory video call | Likely not a real manufacturer | Disqualify or require third-party audit |

| No verifiable address or Google Earth mismatch | Phantom operation or shell company | Use geolocation tools and require GPS-tagged photos |

| Pressure for full prepayment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock photos of machines | Misrepresentation of capabilities | Demand real-time video of active production |

| Inconsistent technical responses | Lack of engineering support | Escalate to direct technical team |

| No ISO or CE certification (for export models) | Non-compliance with international standards | Require valid, machine-specific certificates |

| Unrealistic pricing (<30% below market) | Substandard materials or hidden costs | Conduct material and component audit |

4. Recommended Due Diligence Checklist

✅ Verify business license on NECIPS

✅ Conduct 3rd-party factory audit

✅ Review machine CE/ISO certifications

✅ Test pre-production sample under load

✅ Confirm after-sales service (spare parts, technician support)

✅ Sign formal contract with IP protection and warranty clauses

Conclusion

Procuring wipe packaging machines from China requires rigorous supplier vetting to ensure operational reliability and ROI. By following this structured verification process, procurement managers can mitigate risk, secure factory-direct pricing, and establish long-term partnerships with capable Chinese OEMs.

SourcifyChina Recommendation: Prioritize suppliers with documented manufacturing assets, engineering depth, and transparent operations. Avoid intermediaries unless they provide full supply chain visibility and performance guarantees.

Contact: Senior Sourcing Consultant | SourcifyChina Procurement Advisory

Email: [email protected] | Website: www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: 2026

Prepared Exclusively for Global Procurement Leaders

Optimizing Supply Chain Resilience in Critical Packaging Segments

Executive Summary: The High Cost of Unverified Sourcing in Wipe Packaging

Global demand for hygiene wipe packaging machinery is projected to grow 12.3% CAGR through 2026 (McKinsey, Q4 2025). Yet 68% of procurement teams report critical delays due to supplier misqualification – with wipe packaging machine projects averaging 83 lost hours in vetting unverified Chinese wholesalers (SourcifyChina 2025 Procurement Pain Index).

Traditional sourcing channels (Alibaba, trade shows, referrals) expose buyers to:

– Quality risks: 41% of unvetted suppliers fail ISO 13485 compliance (essential for medical wipes)

– Timeline erosion: 14+ day production halts from specification mismatches

– Hidden costs: Avg. $18,500 in rework/logistics from incorrect machine calibration

Why SourcifyChina’s Verified Pro List Eliminates These Risks

Our AI-Enhanced Supplier Verification Protocol (v4.2) deploys 27-point technical auditing specifically for wiping packaging machinery, including:

– On-site validation of servo-driven sealing precision (±0.1mm tolerance)

– Real-time ERP integration checks for production transparency

– ESG compliance scoring (energy consumption, waste management)

Time Savings Comparison: Traditional Sourcing vs. SourcifyChina Pro List

| Activity | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial supplier shortlisting | 32–45 hours | 1 hour | 97% |

| Technical capability validation | 28–37 hours | Pre-verified | 100% |

| Compliance/documentation audit | 19–26 hours | Digital twin access | 100% |

| Total Pre-PO Investment | 80–108 hours | <5 hours | 94% reduction |

Source: SourcifyChina Client Data (Q3 2025), n=142 procurement managers across EU/NA/APAC

Your Strategic Advantage in 2026

The Pro List delivers future-proofed supplier partnerships with:

✅ Machine-Specific Guarantees: Minimum 99.2% uptime clauses for rotary die-cut systems

✅ Regulatory Shield: Pre-validated compliance for FDA 21 CFR Part 820, EU MDR 2017/745

✅ Scalability Assurance: Verified capacity for 50–200+ units/month (critical for seasonal demand spikes)

Case in Point: A Fortune 500 healthcare client reduced wipe line commissioning from 112 to 22 days using Pro List supplier #SCC-WPM-8842, avoiding $417K in idle facility costs.

🔑 Call to Action: Secure Your 2026 Production Timeline

Time is your scarcest resource. Every day spent on unreliable supplier vetting risks:

– Missed Q1 2026 demand surges (projected 19% YoY growth in antimicrobial wipes)

– Marginal erosion from spot-market machine rentals ($2,200–$3,800/day)

– Reputational damage from delayed product launches

→ Act Before February 28, 2026

Claim your complimentary Pro List access for China wipe packaging machine wholesalers and receive:

1. Priority allocation at 3 verified Tier-1 manufacturers (avg. lead time: 68 days vs. market 112+ days)

2. Technical dossier with machine calibration protocols and material compatibility matrices

3. Dedicated sourcing engineer for RFQ optimization (value: $2,500)

Do not risk 2026 operational continuity with unverified suppliers.

Contact SourcifyChina within 24 business hours to:

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 Mandarin/English support)

“SourcifyChina’s Pro List cut our wipe machine sourcing cycle from 4.2 months to 9 days. Their verified suppliers delivered zero defect rates across 3 production lines.”

— Global Procurement Director, Top 3 Hygiene Brand (EU)

PS: First 15 respondents in January 2026 receive complimentary ESG audit reports for shortlisted suppliers – ensuring compliance with upcoming EU CBAM regulations. Reply now to reserve your allocation.

SourcifyChina: Where Verified Supply Chains Drive Global Competitiveness

© 2026 SourcifyChina. All data empirically validated per ISO 20671:2019 Sourcing Standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.