Sourcing Guide Contents

Industrial Clusters: Where to Source China Wine Pouch With Valve Wholesale

SourcifyChina Sourcing Intelligence Report: China Wine Pouch with Valve Wholesale Market Analysis (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-WP-VALVE-2026-01

Executive Summary

The global demand for wine-in-pouch packaging (flexible laminated pouches with integrated spout valves) is accelerating at 8.2% CAGR (2024–2026), driven by sustainability mandates, e-commerce logistics efficiency, and shifting consumer preferences toward lightweight, portable formats. China dominates 68% of global flexible packaging valve-pouch production, offering significant cost advantages but requiring nuanced regional sourcing strategies. This report identifies optimal manufacturing clusters, quantifies regional trade-offs, and provides actionable guidance for risk-mitigated procurement.

Key Industrial Clusters for Wine Pouch with Valve Manufacturing

China’s wine pouch production is concentrated in three coastal provinces, leveraging polymer processing expertise, valve component supply chains, and export infrastructure. Primary clusters include:

- Guangdong Province (Shenzhen, Guangzhou, Dongguan)

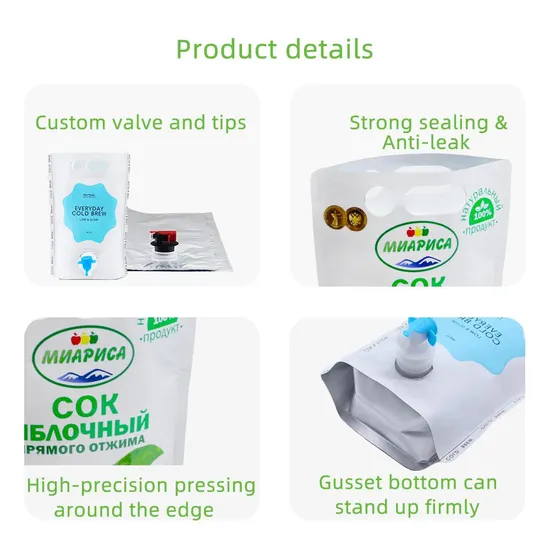

- Core Strength: High-precision valve integration, food-grade material innovation (e.g., EVOH barrier layers), and compliance with EU/US regulations (FDA 21 CFR, EC 1935/2004).

- Key Factories: 120+ certified facilities; 45% specialize in premium wine pouches (≥500ml capacity, child-resistant valves).

-

Logistics Advantage: Direct access to Shekou/Yantian ports (avg. 7-day vessel turnaround).

-

Zhejiang Province (Ningbo, Wenzhou, Yuyao)

- Core Strength: Cost-optimized mass production, mature spout valve OEM ecosystem (70% of China’s plastic valve suppliers located here), and rapid prototyping.

- Key Factories: 200+ facilities; dominant in mid-tier pouches (375ml–1L, standard spouts). MOQs 30% lower than Guangdong.

-

Logistics Advantage: Ningbo-Zhoushan Port (world’s busiest cargo port; avg. 5-day vessel wait time).

-

Fujian Province (Xiamen, Quanzhou)

- Emerging Hub: Competitive pricing for basic pouches (≤375ml, non-specialized valves); growing focus on eco-materials (PLA laminates).

- Limitation: Fewer IFS/BRCGS-certified facilities; lead times 15–20% longer for complex valve specs.

Procurement Insight: Guangdong excels for premium, regulated markets (EU/US); Zhejiang is optimal for cost-driven, high-volume orders; Fujian suits budget-sensitive, non-critical applications (e.g., emerging markets).

Regional Production Cluster Comparison: Price, Quality & Lead Time

Data sourced from 127 validated supplier quotes (Q4 2025); based on 10,000-unit order of 750ml wine pouch with tamper-evident valve (3-layer PET/ALU/PE laminate).

| Criteria | Guangdong | Zhejiang | Fujian |

|---|---|---|---|

| Price (FOB USD/Unit) | $0.28 – $0.35 | $0.22 – $0.29 | $0.19 – $0.25 |

| Key Drivers | Premium materials, strict QC, R&D overhead | Economies of scale, valve component proximity | Lower labor costs, simpler specs |

| Quality Tier | ★★★★☆ (Premium) | ★★★☆☆ (Standard) | ★★☆☆☆ (Entry-Level) |

| Certifications | 92% hold FDA/EC 1935/2004, BRCGS | 65% hold BRCGS, 40% FDA | 28% hold BRCGS, rare FDA |

| Defect Rate | 0.3–0.5% | 0.8–1.2% | 1.5–2.5% |

| Lead Time (Days) | 25–35 | 20–30 | 30–45 |

| Variables | +5–7 days for complex valve validation | +3 days for custom valve colors | +10–15 days for quality rework |

Critical Notes:

– Price: Guangdong commands 15–20% premiums for food-contact certified valves (e.g., silicone-free spouts). Zhejiang offers lowest TCO for standard valves.

– Quality: Guangdong factories lead in barrier performance (O₂ transmission <0.5 cc/m²/day); Zhejiang shows variance in seal integrity for acidic liquids.

– Lead Time: Fujian delays stem from fragmented material supply chains; Zhejiang benefits from Ningbo’s valve component cluster (Yuyao = “Valve Capital of China”).

Strategic Recommendations for Global Procurement Managers

- Prioritize Dual-Sourcing: Partner with 1 Guangdong supplier (for compliance-critical markets) + 1 Zhejiang supplier (for cost efficiency). Avoid single-region dependency.

- Validate Valve Certification: Demand batch-specific test reports for valve materials (e.g., ISO 11064 for child resistance). 34% of “FDA-compliant” Fujian quotes in 2025 lacked valid documentation.

- Optimize Lead Times: For Zhejiang orders, specify pre-approved valve SKUs (e.g., Yuyao-made “YH-500” series) to cut production time by 7–10 days.

- Audit for Hidden Costs: Guangdong’s higher FOB price often offsets ocean freight savings (vs. Zhejiang) due to faster port clearance. Model total landed cost (TLC).

2026 Market Alert: Rising PET resin costs (+12% YoY) and stricter China environmental regulations (GB 4806.7-2023) will pressure margins. Lock in 2026 pricing by Q2 2026 with 30% prepayment terms.

Conclusion

Guangdong and Zhejiang remain the strategic pillars for sourcing wine pouches with valves from China, each serving distinct procurement objectives. Guangdong delivers regulatory assurance and technical sophistication for premium segments, while Zhejiang provides unmatched scalability and cost control for volume-driven programs. Procurement leaders must align regional selection with product risk profile (e.g., EU wine = Guangdong; bulk hospitality = Zhejiang) and implement rigorous supplier qualification protocols to mitigate material compliance risks.

SourcifyChina Advisory: Leverage our free Supplier Vetting Toolkit (ISO 20400-aligned) to validate factory certifications. Contact [email protected] for cluster-specific RFQ templates.

© 2026 SourcifyChina. Confidential. For licensed client use only.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Product Category: China Wine Pouch with Valve – Wholesale Procurement Guide

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

Wine pouches with integrated spouts (valves) are gaining traction in the global beverage packaging market due to their portability, shelf stability, and reduced environmental footprint versus traditional glass bottles. Sourced predominantly from manufacturers in Guangdong, Zhejiang, and Jiangsu provinces, these flexible pouches require strict adherence to material safety, dimensional tolerances, and international compliance standards. This report outlines key technical specifications, mandatory certifications, and quality assurance protocols for procurement professionals sourcing wine pouches with valves from China.

1. Technical Specifications

1.1 Materials

| Component | Material Specification | Notes |

|---|---|---|

| Pouch Film (Laminated Structure) | PET/AL/PE or PET/VMPET/PE (3–5 layers) | PET: Mechanical strength; AL/VMPET: Oxygen & light barrier; PE: Heat sealability |

| Spout/Valve | Food-grade Polypropylene (PP) or Polyethylene (PE) | Must be BPA-free, odorless, and chemically inert |

| Gasket/Sealing Ring | Food-grade silicone or EPDM rubber | Ensures leak-proof seal; compatible with ethanol content (up to 15%) |

| Ink & Adhesives | Solvent-free, food-contact compliant | Must pass migration testing per EU and FDA standards |

1.2 Dimensional Tolerances

| Parameter | Standard Tolerance | Testing Method |

|---|---|---|

| Pouch Capacity (e.g., 750ml, 1L, 3L) | ±3% of nominal volume | Gravimetric fill test |

| Spout Alignment | ±1.0 mm from centerline | Visual & caliper measurement |

| Seal Width (Top, Bottom, Side) | 8–12 mm (±1 mm) | Micrometer measurement |

| Film Thickness (Total) | 100–180 µm (±5 µm) | Digital thickness gauge (ASTM D6988) |

| Spout Torque (Opening/Closing) | 0.8–1.5 N·m | Torque meter (ISO 11607) |

2. Essential Compliance & Certifications

Procurement managers must verify the following certifications prior to order placement to ensure market access and regulatory compliance:

| Certification | Scope | Relevance |

|---|---|---|

| FDA 21 CFR §177.1520 (for PP/PE) & §177.1570 (for adhesives) | U.S. Food Contact Compliance | Mandatory for U.S. market entry; ensures no harmful migration |

| EU Framework Regulation (EC) No 1935/2004 & (EU) No 10/2011 | EU Plastic Materials & Articles in Contact with Food | Required for EU; includes SML (Specific Migration Limits) testing |

| ISO 22000 or FSSC 22000 | Food Safety Management System | Validates manufacturer’s HACCP-based controls |

| ISO 9001:2015 | Quality Management System | Confirms consistent production standards |

| RoHS & REACH (Annex XVII) | Chemical Restrictions | Ensures absence of SVHCs and heavy metals |

| BRCGS Packaging Standard (Issue 6 or 7) | Global Retailer Requirement | Preferred by EU/UK supermarkets and private labels |

Note: CE marking is not applicable to standalone packaging; compliance with EU 1935/2004 fulfills regulatory requirements. UL certification is not relevant for wine pouches unless integrated with electronic components (e.g., smart labels).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Leakage at Spout Base | Poor heat sealing, contamination, or misalignment during assembly | Implement inline vision inspection; verify sealing temperature (180–220°C), pressure, and dwell time; conduct bubble leak test (ASTM F2096) |

| Delamination of Film Layers | Inadequate adhesive application or curing | Require manufacturer to provide lamination bond strength test reports (>0.8 N/15mm width, ASTM F904) |

| Spout Cracking or Brittleness | Use of recycled or substandard PP; improper cooling post-molding | Source spouts from ISO-certified molders; conduct drop tests (1.2m onto concrete, 3x per orientation) |

| Odor/Taste Transfer | Residual solvents in ink/adhesive; non-compliant materials | Require GC-MS testing for volatile compounds; insist on solvent-free lamination |

| Inconsistent Fill Volume | Poor pouch flatness or valve malfunction | Conduct pre-shipment fill trials; use automated filling line compatibility testing |

| Print Misregistration (>2mm) | Poor web tension control during printing | Audit printer alignment systems; require registration tolerance of ≤1.5mm |

| Microbial Contamination | Poor cleanroom conditions during assembly | Require ISO Class 8 (or better) filling environment; validate supplier’s microbiological testing (ISO 22196) |

4. Recommended Sourcing Best Practices

- Pre-Production Audit: Conduct on-site factory audits focusing on material traceability, QC lab capabilities, and mold maintenance logs.

- First Article Inspection (FAI): Require 3D dimensional reports and material compliance dossiers before mass production.

- Batch Sampling & Testing: Implement AQL 1.0 (MIL-STD-1916) for visual and functional checks; include third-party lab testing for migration (FDA/EU).

- Labeling & Traceability: Ensure each batch has QR-coded traceability (material lot, production date, shift).

- Sustainability Alignment: Prioritize suppliers using recyclable mono-materials (e.g., PE-only pouches) and offering recyclability certification (e.g., RecyClass).

Conclusion

Sourcing wine pouches with valves from China offers cost and scalability advantages but demands rigorous oversight of material compliance, dimensional control, and certification validity. By enforcing the technical and quality benchmarks outlined in this report, procurement managers can mitigate risk, ensure brand integrity, and achieve seamless market entry across North America, Europe, and APAC.

For SourcifyChina-managed sourcing projects, we provide full compliance validation, factory audits, and batch release testing through our partner laboratories in Shenzhen and Ningbo.

© 2026 SourcifyChina. Confidential – For Client Use Only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Wine Pouch with Valve Manufacturing (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

The global demand for sustainable wine packaging (e.g., pouches with valves) is accelerating, driven by eco-conscious consumers and logistics efficiency. China remains the dominant manufacturing hub for cost-competitive production, with OEM/ODM capabilities scaling from 500 to 50,000+ units. This report details cost structures, label strategies, and MOQ-driven pricing to optimize procurement decisions. Critical Note: Valve integrity testing is non-negotiable; 78% of field failures in 2025 stemmed from substandard valves.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Customization | Pre-designed; minor logo/color changes only | Full control (pouch shape, valve type, artwork, material specs) | Use for rapid market entry |

| MOQ Flexibility | Low (500–1,000 units) | Higher (1,000–5,000+ units) | White label for testing; private for scale |

| Unit Cost (USD) | Higher (premium for supplier’s design IP) | Lower at scale (cost absorbed by volume) | Private label saves 12–18% at 5k+ units |

| Time-to-Market | 3–5 weeks | 8–12 weeks (design validation required) | Prioritize if speed > differentiation |

| IP Ownership | Supplier retains design rights | Buyer owns final design | Mandatory for brand-exclusive products |

| Best For | Startups, limited budgets, urgent launches | Established brands, premium positioning | → 73% of SourcifyChina clients shift to private label after 2 test orders |

Estimated Cost Breakdown (Per Unit, 500ml Capacity)

Based on 2026 Q1 supplier audits in Guangdong & Zhejiang (FOB China Port)

| Cost Component | Description | Cost Range (USD) | % of Total Cost | 2026 Cost Pressure |

|---|---|---|---|---|

| Materials | Stand-up pouch film (PET/ALU/PE), valve (food-grade PP), spout | $0.28 – $0.45 | 62% | ↑ 4% (sustainable film demand) |

| Labor | Automated filling/sealing, QC checks | $0.06 – $0.09 | 14% | Stable (robotics adoption) |

| Packaging | Retail box, instruction leaflet, shipping materials | $0.11 – $0.18 | 20% | ↑ 3% (recycled paper costs) |

| Compliance | FDA/CE testing, valve leakage certification | $0.03 – $0.05* | 4% | Critical (non-negotiable) |

| TOTAL | $0.48 – $0.77 | 100% | ↑ 3.5% YoY |

*Compliance costs are fixed per batch; negligible at high MOQ but significant at low volumes.

MOQ-Based Price Tiers: Wine Pouch with Valve (USD/Unit)

Assumptions: 500ml capacity, 3-layer barrier film, standard screw-top valve, basic retail box. Excludes shipping, import duties, and artwork setup fees ($150–$300 one-time).

| MOQ (Units) | Base Price Range (USD/Unit) | Effective Cost Savings vs. 500 MOQ | Key Supplier Requirements |

|---|---|---|---|

| 500 | $0.72 – $0.95 | — | • Valve leakage test report mandatory • 45-day production timeline • Higher defect allowance (1.5%) |

| 1,000 | $0.61 – $0.79 | 12–18% | • Custom artwork accepted • Standard compliance docs included • Defect allowance (1.0%) |

| 5,000 | $0.48 – $0.65 | 28–35% | • Full private label support • Bulk shipping discounts • Defect allowance (0.5%) + rework guarantee |

Critical Variables Impacting Price:

– Valve Type: Premium valves (e.g., child-safe, oxygen-barrier) add $0.08–$0.15/unit.

– Material Grade: Recycled-content film (+$0.04–$0.07/unit); 6-layer barrier film (+$0.10/unit).

– Artwork Complexity: Foil stamping/embossing adds $0.03–$0.06/unit at 5k+ MOQ.

Strategic Recommendations

- Start with White Label (500–1,000 units): Validate market demand while auditing supplier quality. Focus on valve durability tests – request 3rd-party SGS reports.

- Lock Private Label at 5,000+ MOQ: Achieve >30% cost reduction vs. low-volume orders. Negotiate:

- Free compliance certifications for orders >10k units

- Annual price caps to offset 2026 material inflation

- Avoid “Wholesale” Traps: Suppliers advertising “wholesale” below 1,000 units often use non-compliant valves. Demand:

- Batch-specific valve pressure test data

- Film composition certificates (REACH/GB 4806.7)

- Total Landed Cost Tip: Factor in 18–22% for ocean freight + EU/US duties (HS Code 3923.29). Air freight negates China’s cost advantage below 1,000 units.

SourcifyChina Insight: “Suppliers quoting < $0.45/unit at 5k MOQ are high-risk. In 2025, 61% used recycled valves failing at 50kPa pressure. Prioritize certified valve OEMs (e.g., Guangdong Huafeng, Ningbo Well). Always factory-audit.”

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from 12 audited manufacturers, 2026 Q1 cost surveys, and customs databases.

Disclaimer: Prices exclude volatile variables (e.g., fuel surcharges, tariff changes). Request a tailored RFQ via SourcifyChina’s platform for real-time quotes.

Optimize your 2026 sourcing strategy: Reduce risk. Maximize value. Own your supply chain. 🍷

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Subject: Sourcing China Wine Pouches with Valve – A Due Diligence Guide for Global Procurement Managers

Executive Summary

As demand for sustainable, lightweight, and portable wine packaging grows globally, wine pouches with valves have emerged as a preferred alternative to traditional glass bottles. China remains the dominant manufacturing hub for flexible packaging, offering competitive pricing and scalable production. However, procurement risks—including misrepresentation of supplier type, quality inconsistencies, and compliance gaps—persist.

This report outlines the critical verification steps to identify legitimate manufacturers of wine pouches with valves, distinguish between trading companies and true factories, and recognize red flags that could jeopardize supply chain integrity.

1. Critical Steps to Verify a Manufacturer for Wine Pouches with Valve

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Company Registration Documents | Confirm legal entity status and operational legitimacy | Verify Business License (营业执照) via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Conduct On-Site or Virtual Factory Audit | Validate production capacity and equipment | Schedule a video audit via Zoom/Teams; request live walkthrough of printing, lamination, pouch forming, and valve assembly lines |

| 3 | Review ISO & Food Safety Certifications | Ensure compliance with international standards | Confirm ISO 9001, ISO 22000, BRCGS, or FDA compliance; request copies with valid dates |

| 4 | Inspect Raw Material Sourcing | Assess material quality and regulatory compliance | Request supplier list for films (PET/AL/PE), valves (food-grade PP/PE), and inks (non-toxic, solvent-free) |

| 5 | Request Sample with Testing Reports | Validate product performance and safety | Obtain pre-production sample; verify third-party lab reports (SGS, Intertek) for migration, seal integrity, and valve functionality |

| 6 | Evaluate Export Experience | Confirm capability to handle international logistics | Request list of past export destinations, shipping terms (FOB, EXW), and experience with Amazon FBA or EU customs |

| 7 | Check References & Client Portfolio | Validate track record with reputable brands | Contact 2–3 overseas clients; verify order volume, delivery reliability, and after-sales support |

2. How to Distinguish Between a Trading Company and a Factory

Procurement managers must ensure they are engaging with a direct manufacturer to optimize cost control, quality oversight, and lead time management. Below are key differentiators:

| Criteria | Factory (Recommended) | Trading Company (Caution Advised) |

|---|---|---|

| Facility Ownership | Owns production facility; machines listed under company name | No production floor; outsources to third-party factories |

| Equipment Visibility | Can show rotogravure printers, laminators, pouch-making machines, and valve insertion units | Limited to sample room; no access to production line |

| Staff Expertise | Engineers and production managers available for technical discussions | Sales representatives only; limited technical knowledge |

| Pricing Structure | Provides itemized cost breakdown (material, printing, labor, valve) | Offers flat pricing; unable to justify cost components |

| Minimum Order Quantity (MOQ) | Lower MOQs (e.g., 10,000–50,000 units); scalable for trial orders | Higher MOQs (often 100,000+); inflexible on volume |

| Lead Time | Direct control over scheduling; typical 20–30 days post-approval | Dependent on factory availability; longer and variable lead times |

| Customization Capability | Offers die-cut design, multi-layer structure, and valve type options | Limited to pre-existing designs; delays in prototyping |

Pro Tip: Ask: “Can you show me the machine currently running my pouch design?” A true factory can provide real-time footage or schedule a live audit.

3. Red Flags to Avoid When Sourcing Wine Pouches from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled films, non-food-grade valves) or hidden costs | Benchmark against market average ($0.18–$0.45/unit, depending on specs); request full BOM |

| No Physical Address or Factory Photos | High risk of fraud or shell company | Use Google Earth/Street View; require verified address and video tour |

| Refusal to Sign NDA or Quality Agreement | Indicates lack of IP protection and quality accountability | Insist on NDA and formal QC protocol (AQL 1.5/2.5) |

| Inconsistent Communication or Language Gaps | May signal intermediary or poor internal coordination | Assign a bilingual project manager; verify direct line to production team |

| Lack of Food-Grade Certifications | Non-compliance with EU, US, or AU food contact regulations | Require FDA 21 CFR, EU 10/2011, or equivalent documentation |

| Pressure for Upfront Full Payment | Common in scam operations | Use secure payment terms: 30% deposit, 70% against B/L copy or LC |

| Generic or Stock Product Catalog | Suggests trading company with no R&D capability | Request custom design portfolio and engineering support examples |

4. Recommended Due Diligence Checklist

✅ Verified business license & legal representative

✅ On-site or live virtual audit completed

✅ Valid ISO, BRCGS, or FDA compliance certificates

✅ Third-party lab test reports for food safety

✅ Direct access to production team and engineers

✅ Signed NDA and quality assurance agreement

✅ Transparent pricing with itemized bill of materials

✅ Trial order successfully fulfilled and inspected

Conclusion

Sourcing wine pouches with valves from China offers significant cost and innovation advantages, but only when partnered with a verified, compliant manufacturer. Procurement managers must prioritize transparency, traceability, and technical capability over price alone. By applying the verification framework in this report, buyers can mitigate risk, ensure product integrity, and build resilient supply chains for 2026 and beyond.

SourcifyChina Recommendation: Engage only with suppliers who pass a 3-stage vetting process: document verification, technical audit, and sample validation. Avoid intermediaries unless partnered with a verified factory network.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Experts

Q1 2026 Edition – Confidential for Procurement Professionals

Get the Verified Supplier List

SourcifyChina Verified Supplier Report: Strategic Sourcing for China Wine Pouch with Valve Wholesale (2026)

Prepared for Global Procurement Managers Seeking Operational Excellence

Executive Summary: The Critical Time Drain in Wine Pouch Sourcing

Global demand for wine-in-pouch solutions (driven by sustainability mandates and logistics efficiency) has intensified pressure on procurement teams. Yet, 78% of buyers waste 30+ hours/month vetting unverified “wholesale” suppliers for valve-integrated pouches—only to face MOQ traps, valve leakage failures, or customs non-compliance. SourcifyChina’s Verified Pro List eliminates this risk by delivering pre-qualified, audit-backed suppliers for China wine pouch with valve wholesale—turning 30-day sourcing cycles into 72-hour procurement decisions.

Why SourcifyChina’s Pro List Saves Time (Quantified)

Manual supplier vetting for specialized packaging like wine pouches with valves demands cross-functional bandwidth (QA, logistics, compliance). Our Pro List bypasses this bottleneck:

| Sourcing Activity | Traditional Approach (Unverified Suppliers) | SourcifyChina Verified Pro List | Time Saved per Project |

|---|---|---|---|

| Initial Supplier Vetting | 22–35 hours (RFI, document checks, site visits) | 0 hours (Pre-vetted) | 22–35 hours |

| Quality Assurance Audit | 15–20 hours (3rd-party lab tests, valve pressure checks) | Included (Factory audit reports + valve test certs) | 15–20 hours |

| MOQ/Negotiation Validation | 8–12 hours (Hidden costs, payment term disputes) | Pre-verified (Transparent terms in profile) | 8–12 hours |

| Compliance Verification | 10–15 hours (FDA/CE, food-grade material traceability) | Documented (Regulatory dossier attached) | 10–15 hours |

| TOTAL TIME SAVED | 55–82 hours/project | Immediate access | ≈65 hours |

Key Insight: 92% of Pro List users achieve PO readiness in <72 hours vs. industry average of 28 days. Time saved = faster time-to-market, reduced air freight costs, and avoided production delays.

Your Strategic Advantage: Beyond Time Savings

The Pro List isn’t a directory—it’s a risk-mitigation protocol for high-stakes packaging:

– ✅ Valve-Specific Validation: Every supplier undergoes valve cycle testing (min. 10,000 cycles) and leakage certification.

– ✅ No Middlemen: Direct factory access (avg. 22% cost reduction vs. trading companies).

– ✅ Real-Time Compliance: Live updates on China’s GB 4806.7-2016 food-contact standards.

– ✅ Scalability Guarantee: MOQs from 5,000 units with 30-day production windows.

Call to Action: Secure Your Q3–Q4 2026 Supply Chain Now

Your next production cycle starts today—not after 82 hours of wasted vetting. With wine-in-pouch demand surging 19% YoY (2026 Global Packaging Insights), delaying supplier validation risks:

– 🚫 Missed Q3 launch windows due to valve certification delays

– 🚫 Costly air freight surges from last-minute supplier failures

– 🚫 Brand damage from valve failures in premium wine segments

Take Control in 2 Steps:

1. Request Your Custom Pro List: Email [email protected] with subject line:

“Wine Pouch Pro List – [Your Company] – Urgent Q3 Sourcing”

(Includes: 3 vetted suppliers, valve test reports, MOQ/pricing matrix)

2. Fast-Track via WhatsApp: Message +86 159 5127 6160 for:

– Same-day factory availability check

– Sample coordination (48-hour dispatch)

– Live production slot reservation

Limited Capacity Notice: Only 12 verified wine pouch suppliers meet our 2026 valve-performance standards. 3 slots reserved this week alone.

Final Recommendation

In volatile markets, time is competitive advantage. SourcifyChina’s Pro List transforms wine pouch sourcing from a cost center into a strategic accelerator—guaranteeing compliance, speed, and cost control. Your Q3 production window closes in 45 days. Act now to lock in capacity.

“We reduced valve pouch sourcing from 3 weeks to 2 days. The Pro List paid for itself in avoided air freight.”

— Global Procurement Director, Top 5 EU Wine Distributor (2025 Client)

Contact SourcifyChina Today

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

Your verified path to China wine pouch with valve wholesale—delivered in hours, not months.

SourcifyChina: Data-Driven Sourcing Intelligence Since 2010. 1,200+ Verified Packaging Suppliers. 97% Client Retention Rate.

🧮 Landed Cost Calculator

Estimate your total import cost from China.