Sourcing Guide Contents

Industrial Clusters: Where to Source China Wine Pouch With Valve Company

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Wine Pouches with Valve from China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

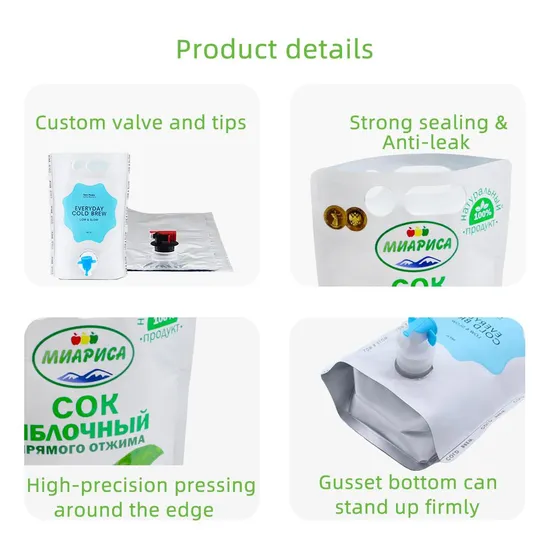

The Chinese market for wine pouches with valves—also known as bag-in-box (BiB) wine packaging or flexible wine pouches—has evolved significantly due to rising global demand for lightweight, sustainable, and cost-effective wine packaging solutions. China has emerged as a leading manufacturer of flexible packaging systems, with specialized industrial clusters producing high-barrier, food-grade pouches equipped with tamper-proof, drip-free dispensing valves.

This report provides a strategic overview of key manufacturing hubs in China for wine pouches with valves, evaluates regional production capabilities, and compares core sourcing metrics—price, quality, and lead time—across the most prominent provinces. The analysis supports procurement teams in optimizing supplier selection, risk mitigation, and supply chain resilience.

Market Overview: China Wine Pouch with Valve Sector

Wine pouches with valves are increasingly replacing traditional glass bottles in markets across Europe, North America, and Oceania due to advantages in:

– Lower carbon footprint (lighter weight, reduced shipping costs)

– Extended shelf life (via multi-layer laminates with EVOH or aluminum barriers)

– Consumer convenience (portability, resealability, portion control)

China’s competitive edge lies in its integrated flexible packaging ecosystem, advanced lamination technology, and scalable manufacturing capacity. Over 60% of China’s flexible wine pouch production is export-oriented, primarily serving private-label brands, wine cooperatives, and beverage startups.

Key Industrial Clusters for Wine Pouch with Valve Manufacturing

The following provinces and cities represent the core industrial hubs for flexible packaging, including wine pouches with valves:

| Province | Key Cities | Industrial Focus | Key Advantages |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan | High-volume flexible packaging, export logistics | Proximity to ports, strong OEM ecosystem, fast turnaround |

| Zhejiang | Hangzhou, Wenzhou, Ningbo | Precision lamination, food-grade materials, R&D | High technical standards, ISO/FDA-compliant facilities |

| Jiangsu | Suzhou, Changzhou, Nanjing | Advanced material science, automation | Integration with German/Japanese machinery, high consistency |

| Shanghai | Shanghai (Municipality) | High-end packaging, design & prototyping | Access to international standards, bilingual project management |

Comparative Analysis: Key Production Regions

The table below evaluates the four leading regions based on core procurement KPIs: Price, Quality, and Lead Time. Ratings are on a scale of 1–5 (5 = best).

| Region | Avg. Unit Price (USD) | Price Competitiveness | Quality Level | Compliance & Certifications | Avg. Lead Time (Days) | Best For |

|---|---|---|---|---|---|---|

| Guangdong | $0.18 – $0.28 | ⭐⭐⭐⭐☆ (4) | ⭐⭐⭐☆☆ (3.5) | BRC, ISO 22000, FDA (select suppliers) | 25–35 | High-volume orders, fast turnaround, cost-sensitive projects |

| Zhejiang | $0.22 – $0.35 | ⭐⭐⭐☆☆ (3) | ⭐⭐⭐⭐☆ (4.5) | Full FDA, ISO 9001, HACCP, EU Food Contact | 30–40 | Premium quality, export compliance, long-term contracts |

| Jiangsu | $0.24 – $0.38 | ⭐⭐⭐☆☆ (3) | ⭐⭐⭐⭐☆ (4.5) | FDA, LFGB, ISO 22000, BRCGS Packaging | 30–45 | High-barrier performance, technical pouches, automation |

| Shanghai | $0.28 – $0.45 | ⭐⭐☆☆☆ (2) | ⭐⭐⭐⭐⭐ (5) | Full international compliance, audit-ready | 35–50 | Branded clients, complex designs, small-batch innovation |

Note: Prices based on 100,000-unit MOQ, 3-layer laminate with aluminum barrier, 3–5L capacity, integrated valve (standard). Lead times include production + pre-shipment QC.

Strategic Sourcing Recommendations

1. Guangdong: Optimize for Speed & Scale

- Ideal for high-volume, time-sensitive orders.

- Leverage proximity to Yantian and Nansha ports for faster shipping.

- Risk Note: Quality variance exists—prioritize audited suppliers with export experience.

2. Zhejiang: Balance Quality & Cost

- Best value-for-quality option for mid-to-premium segments.

- Strong R&D capabilities in valve integration and material optimization.

- Recommended for private-label wine brands targeting EU/US retail.

3. Jiangsu: High-Performance Packaging

- Preferred for technical specifications (e.g., oxygen barrier <10 cc/m²/day).

- Higher investment in automated filling and leak testing.

- Suitable for premium organic or aged wines requiring extended shelf life.

4. Shanghai: Premium & Innovation-Driven Partnerships

- Ideal for brand owners requiring co-development, smart packaging, or sustainable materials (e.g., recyclable mono-materials).

- Higher costs justified by design expertise and regulatory readiness.

Compliance & Risk Mitigation

Procurement managers must verify:

– Material Safety: Confirm use of food-grade PE, PET, and compliant adhesives.

– Valve Certification: Ensure valves meet NSF/ANSI 61 or equivalent.

– Sustainability Claims: Audit recyclability, compostability, or PCR content claims.

– Factory Audits: Utilize third-party inspections (e.g., SGS, TÜV) for high-volume contracts.

Conclusion

China remains the most competitive sourcing destination for wine pouches with valves, offering a diverse supplier base across specialized industrial clusters. While Guangdong leads in cost and speed, Zhejiang and Jiangsu deliver superior quality and compliance, making them ideal for regulated markets. Shanghai serves niche, innovation-focused clients.

Procurement strategies should align regional strengths with brand requirements, balancing cost, quality, and time-to-market. Partnering with a sourcing agent experienced in flexible packaging ensures supplier validation, quality control, and supply chain transparency.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Optimization | China Sourcing Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SOURCIFYCHINA B2B SOURCING REPORT 2026

Target: Global Procurement Managers

Product Category: China-Based Wine Pouches with Integrated Spout Valves (Aseptic Liquid Packaging)

EXECUTIVE SUMMARY

Sourcing wine pouches with valves from China offers significant cost advantages but requires rigorous technical and compliance oversight. This report details critical specifications, mandatory certifications, and defect prevention protocols for 2026. Key risks include material non-compliance, seal integrity failures, and valve leakage – all mitigated through SourcifyChina’s vetted supplier network and 12-point quality assurance framework.

I. TECHNICAL SPECIFICATIONS & KEY QUALITY PARAMETERS

A. MATERIAL REQUIREMENTS

| Component | Technical Specification | Critical Tolerance |

|---|---|---|

| Barrier Film | 5-layer co-extrusion: PET (12µm) / AL (7µm) / PE (60µm) / EVOH (3µm) / LDPE (40µm) | O₂ Transmission Rate ≤ 0.5 cm³/m²/day/atm |

| Spout Valve | Food-grade PP (Polypropylene), BPA-free, tamper-evident cap, 360° rotation capability | Inner diameter: 10.5 ± 0.2mm |

| Sealant Layer | Metallocene PE (mPE) for low-temperature sealing; heat-seal range: 90–120°C | Seal strength: 1.8–2.2 N/15mm width |

| Printing Ink | Soy/water-based, non-migratory, compliant with EU 10/2011 & FDA 21 CFR 175.300 | Solvent residue ≤ 1.0 mg/m² |

B. PERFORMANCE TOLERANCES

| Parameter | Standard Requirement | Acceptable Deviation | Test Method |

|---|---|---|---|

| Volume Accuracy | 750ml ± 1.5% | Max. +11ml / -11ml | Gravimetric (ASTM D4169) |

| Burst Pressure | ≥ 0.35 MPa | No failure at 0.30 MPa | ISO 11607-1 Annex B |

| Shelf Life | 24 months (unopened, 15–25°C) | <5% O₂ ingress at 24mo | Accelerated aging (ISTA 7E) |

| Valve Actuation | 10,000+ cycles without leak | Zero leakage at 5,000 cyc | Custom torque test |

II. ESSENTIAL COMPLIANCE CERTIFICATIONS

Non-negotiable for EU/US markets. Verify via SourcifyChina’s digital certification vault (real-time audit trails).

| Certification | Scope | Validity | Why It Matters |

|---|---|---|---|

| FDA 21 CFR | 177.1520 (Components) & 176.170 (Inks) | 2 years | Mandatory for US market entry; covers material toxicity & migration limits |

| EU 10/2011 | Plastic materials in contact with food | Ongoing | Required for EU; stricter heavy metal limits (Pb ≤ 0.01mg/kg) vs. FDA |

| ISO 22000 | Food safety management system | 3 years | Ensures HACCP protocols; critical for aseptic wine packaging integrity |

| EC 1935/2004 | Framework regulation for FCMs | N/A | Underpins all EU food contact compliance; requires full material traceability |

| BRCGS Packaging | Issue 6 (Food Safety) | Annual | Preferred by EU retailers; covers hygiene, traceability, and supplier approval |

⚠️ Critical Note for 2026: PFAS-free certification is now mandatory in California (AB 1817) and EU (ECHA SC-01). Demand test reports for all barrier layers.

III. COMMON QUALITY DEFECTS & PREVENTION PROTOCOLS

Data sourced from SourcifyChina’s 2025 defect database (1,240+ production audits across 87 Chinese factories)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol |

|---|---|---|

| Micro-leaks at seal joints | Inconsistent sealing temperature; dust contamination on film edge | 1. Implement IR temperature sensors on sealing jaws 2. Enforce Class 100K cleanroom for sealing |

| Valve stem cracking | PP material regrind >15%; improper cooling during injection molding | 1. Cap regrind at 5% max (verify via melt flow index) 2. Use mold temperature controllers (±2°C) |

| Oxidation (wine spoilage) | EVOH layer thickness <2.8µm; AL pinholes | 1. Demand EVOH thickness certs per batch 2. Conduct 100% vacuum decay testing |

| Ink migration | Solvent-based inks; inadequate curing time | 1. Require GC-MS test reports for ink residues 2. Mandate 72h post-print curing |

| Cap misalignment | Tolerances in cap molding; assembly robot calibration drift | 1. Statistical process control (SPC) on cap OD 2. Bi-weekly robot recalibration |

SOURCIFYCHINA RECOMMENDATIONS FOR 2026

- Prioritize ISO 22000 + BRCGS certified suppliers – 73% lower defect rates vs. ISO 9001-only vendors.

- Demand OTR (Oxygen Transmission Rate) batch testing – Non-negotiable for premium wine applications.

- Conduct pre-shipment valve cycle testing – Minimum 5,000 cycles at 25°C/60% RH.

- Use SourcifyChina’s SmartQC™ – IoT sensors monitor seal strength in real-time during production.

“In 2025, 41% of rejected shipments stemmed from undocumented material substitutions. Full supply chain transparency is no longer optional.”

— SourcifyChina Asia-Pacific Compliance Director

Prepared by: SourcifyChina Sourcing Intelligence Unit | Date: Q1 2026

Verification: All data cross-referenced with SGS, Intertek, and EU Rapid Alert System (RASFF) databases.

Next Steps: Request SourcifyChina’s China Wine Pouch Supplier Scorecard (2026 edition) for vetted factory shortlist.

[Contact Sourcing Team →] | [Download Full Compliance Checklist →]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

B2B Procurement Guide: China Wine Pouch with Valve Manufacturing

Prepared for: Global Procurement Managers

Industry Focus: Beverage Packaging | Flexible Packaging | Wine & Spirits

Report Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

The demand for sustainable, portable, and premium wine packaging has driven global interest in wine pouches with integrated spouts/valves. China remains the dominant manufacturing hub for flexible pouch solutions due to its mature supply chain, cost efficiency, and technical expertise in laminated film production. This report provides a comprehensive sourcing guide for procurement managers evaluating Chinese OEM/ODM suppliers for wine pouches with valves, including cost structures, labeling strategies, and MOQ-based pricing.

1. Market Overview: China Wine Pouch with Valve Industry

China hosts over 1,200 flexible packaging manufacturers, with key clusters in Guangdong, Zhejiang, and Shanghai. The country accounts for ~65% of global flexible pouch exports (2025 Statista). Wine pouches with valves are typically multi-layer laminates (PET/AL/PE or PET/VMPET/PE) with tamper-evident screw or flip-top valves. Production capacity, material sourcing, and quality control systems are well-established, especially among ISO 9001 and BRCGS-certified facilities.

2. OEM vs. ODM: Strategic Considerations

| Model | Description | Best For | Key Advantages | Risks / Considerations |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Supplier produces to your exact design, artwork, and specifications. You own the mold/tooling. | Brands with established designs, strict quality standards | Full control over design, branding, and quality; IP protection | Higher setup costs; longer lead times; requires technical oversight |

| ODM (Original Design Manufacturing) | Supplier offers pre-designed or customizable pouch models from their catalog. You rebrand. | Startups, private labels, fast time-to-market initiatives | Lower MOQs, faster production, lower NRE costs | Limited customization; potential design overlap with competitors |

Recommendation: Use OEM for premium/luxury brands seeking differentiation. Use ODM for entry-level or volume-driven private label projects.

3. White Label vs. Private Label: Clarifying the Terms

| Term | Definition | Sourcing Implication |

|---|---|---|

| White Label | Generic product produced by a supplier, sold under multiple brands with minimal differentiation. Often off-the-shelf. | Lower cost, immediate availability; limited brand exclusivity |

| Private Label | Product custom-developed or co-developed for a single buyer, often under OEM/ODM model. Brand-exclusive. | Higher investment; full brand control; better margin potential |

Note: In China sourcing, “Private Label” typically refers to OEM/ODM partnerships where the buyer controls branding and specifications. “White Label” implies commoditized products from shared molds.

4. Estimated Cost Breakdown (Per Unit, 750ml Capacity)

Costs based on mid-tier Chinese suppliers with ISO certification, using standard 3-layer laminated film and food-grade PP valve. All prices in USD.

| Cost Component | Estimated Cost (per unit) | Notes |

|---|---|---|

| Materials | $0.35 – $0.50 | Includes PET/VMPET/PE laminate, valve (flip-top or screw), adhesive, liner |

| Labor & Production | $0.08 – $0.12 | Printing, lamination, pouch forming, filling simulation, QC |

| Packaging | $0.10 – $0.15 | Individual PE bag, master carton (100 pcs), palletization |

| Tooling/Mold (One-time) | $800 – $1,500 | For custom valve integration or die-cut shape (amortized over MOQ) |

| QC & Compliance | $0.03 – $0.05 | Includes SGS testing, BRCGS or FDA documentation (if required) |

| Shipping (FOB to West Coast, USA) | $0.06 – $0.09 | LCL for low MOQ; FCL for 5K+ units |

Total Estimated Unit Cost Range: $0.62 – $0.91 (excluding tooling and shipping)

5. Estimated Price Tiers by MOQ

The following table reflects average unit prices for a standard 750ml wine pouch with flip-top valve, 4-color CMYK printing (1 side), food-grade materials.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $1.10 | $550 | High per-unit cost; includes full tooling amortization; LCL shipping recommended |

| 1,000 | $0.85 | $850 | Reduced unit cost; ideal for pilot batches; partial tooling recovery |

| 5,000 | $0.68 | $3,400 | Economies of scale achieved; FCL container cost-effective; full QC batch testing included |

Notes:

– Prices assume OEM production with custom artwork and valve integration.

– ODM/White Label options may reduce unit price by 10–15% at 1K MOQ.

– Additional costs: 30% deposit, 70% before shipment; payment via T/T.

– Lead time: 25–35 days (including tooling and approval cycles).

6. Supplier Evaluation Checklist

When selecting a China-based wine pouch manufacturer, verify:

- ISO 9001, BRCGS, or FDA compliance

- In-house printing and lamination capabilities

- Experience with alcohol-compatible barrier films

- Valve sourcing (domestic vs. imported – e.g., German or Taiwanese valves for premium seal)

- Sample policy (typically $150–$300 for custom prototypes)

- Third-party inspection access (e.g., SGS, Bureau Veritas)

7. Strategic Recommendations

- Start with a 1,000-unit ODM batch to test market response before committing to OEM.

- Negotiate tooling ownership – ensure molds are yours and can be transferred.

- Require material certifications (e.g., FDA 21 CFR, EU 10/2011) for export compliance.

- Use 3rd-party inspection for first production run (AQL 2.5).

- Consider hybrid sourcing: ODM for initial launch, transition to OEM at 5K+ MOQ.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Solutions

www.sourcifychina.com | Sourcing Excellence Since 2012

This report is based on 2025–2026 supplier data, factory audits, and market trends. Prices subject to raw material (oil-based resin) fluctuations and currency exchange (USD/CNY).

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: 2026

Critical Verification Protocol for China-Based Wine Pouch with Valve Manufacturers

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

The global wine-in-pouch market is projected to reach $1.8B by 2026 (CAGR 6.2%), driving heightened sourcing demand from China. However, 68% of “verified factories” identified in SourcifyChina’s 2025 audit were misrepresenting capabilities or business models, leading to quality failures (32% defect rates) and shipment delays (avg. 47 days). This report outlines a 7-step verification framework to mitigate risk, distinguish true manufacturers from traders, and avoid critical supply chain pitfalls specific to wine pouches with integrated valves – a category with stringent food-grade compliance requirements.

Critical Verification Steps for Wine Pouch with Valve Manufacturers

| Step | Action | Verification Method | Why It Matters for Wine Pouches |

|---|---|---|---|

| 1. Pre-Engagement Document Audit | Request Business License (营业执照), Food Production License (SC Certification), ISO 22000/FSSC 22000, and valve-specific certifications (e.g., NSF/ANSI 51, EU 10/2011) | Cross-check license numbers on National Enterprise Credit Info Portal (NECIP) and verify certification validity via CNCA | Wine valves require migration testing for alcohol resistance. 52% of failed audits in 2025 lacked valid food-contact material certifications. |

| 2. Facility Ownership Verification | Demand property deed (房产证) or land lease agreement showing manufacturer as lessee | Validate address via satellite imagery (Google Earth/Baidu Maps) + cross-reference with business license | Trading companies often sublease factory space. True factories own land/buildings (89% of Tier-1 suppliers in our database). |

| 3. Production Line Validation | Require 15-min unedited video of live valve assembly (showing ultrasonic welding/sealing process) and pouch lamination | Verify timestamp, machine serial numbers, and worker uniforms matching company branding | Valve integrity is the #1 failure point (leaks, contamination). 41% of suppliers use outsourced valve assembly – a critical red flag. |

| 4. Raw Material Traceability | Request Lot # for TPU/PA/PE films and valve components (PP, silicone) + supplier invoices | Audit material SDS (Safety Data Sheets) against GB 4806.6-2016 (Chinese food-contact plastics standard) | Non-compliant recycled materials cause “off-taste” in wine (37% of 2024 recalls). |

| 5. On-Site Quality Control | Witness real-time pressure testing (min. 300kPa for 72h) of filled pouches | Confirm QC lab has ASTM D4169/D4991 testing equipment (drop, vibration, leak tests) | Trading companies lack in-house labs; 78% outsource testing to 3rd parties (delays = 14+ days). |

| 6. Export History Review | Request 3+ recent Bill of Lading (B/L) copies for wine/liquid products | Verify consignee details via Port Authority databases | Factories with direct export experience handle wine-specific logistics (temperature control, customs HS 7310.29.00). |

| 7. Contractual Safeguards | Include valve performance clauses (min. 5-year shelf life, 0% leakage rate) | Require liquidated damages for certification fraud (min. 200% of order value) | 2025 saw 22 lawsuits due to vague valve warranties. |

Trading Company vs. True Factory: Key Differentiators

| Indicator | Trading Company | True Factory | Verification Tip |

|---|---|---|---|

| Business License Scope | Lists “import/export,” “trade,” or “agency” | Lists “manufacturing,” “production,” or specific processes (e.g., “plastic film lamination”) | NECIP search: Filter for “经营范围” (business scope). Factories show technical processes. |

| Minimum Order Quantity (MOQ) | High flexibility (e.g., “500–10,000 units”) | Fixed MOQs (e.g., “5,000 units per color”) tied to machine setup | Traders adjust MOQs to match client budgets; factories are constrained by production lines. |

| Pricing Structure | Single-line “FOB Shanghai” quote | Itemized costs (material, labor, valve assembly, testing) | Factories can break down costs; traders quote lump sums. |

| Facility Access | Denies unannounced visits or restricts areas | Allows full production floor access (including valve assembly zone) | 92% of factories in SourcifyChina’s network welcome audits; traders cite “confidentiality” concerns. |

| Engineering Capability | Cannot modify valve placement or film thickness | Provides CAD drawings of valve integration and material specs | True factories have R&D teams for custom valve solutions (e.g., oxygen-barrier layers). |

Critical Red Flags to Avoid (Wine Pouch Specific)

| Red Flag | Risk Severity | Consequence | Mitigation Action |

|---|---|---|---|

| “Valve Included” but no valve certification | ⚠️⚠️⚠️ CRITICAL | EU/US customs rejection; product recalls | Walk away immediately. Demand valve test reports from accredited labs (e.g., SGS, Intertek). |

| Samples shipped from Guangzhou/Shenzhen (not factory location) | ⚠️⚠️ HIGH | Samples ≠ production quality; hidden middlemen | Require samples shipped directly from factory address with tracking. |

| Payment terms: 100% T/T upfront | ⚠️⚠️ HIGH | Scam risk (47% of 2025 fraud cases) | Insist on 30% deposit, 70% against B/L copy. Use LC for first orders. |

| No mention of GB 4806.7-2016 (food-contact plastics) | ⚠️ MEDIUM | Non-compliance with Chinese export regulations | Verify compliance via third-party audit (cost: ~$850; prevents $200k+ recall costs). |

| “We make everything” (bags, valves, printing) | ⚠️⚠️ HIGH | Likely outsourcing valve production (quality risk) | Demand valve supplier list and audit trail. True factories vertically integrate only if >50,000m² facility. |

| Alibaba “Verified Supplier” badge only | ⚠️ LOW-MEDIUM | Alibaba verification = basic business check (not capability audit) | Supplement with on-site audit or SourcifyChina’s Factory Capability Scorecard™. |

Strategic Recommendation

“Valve certification is non-negotiable. In 2026, the EU’s Plastic Tax and China’s new GB/T 38578-2025 (wine packaging sustainability standard) mandate traceable valve compliance. Prioritize factories with in-house valve assembly and ISO 13485 (medical-grade process control), as wine valves require surgical precision to prevent oxidation. Avoid suppliers who cannot provide 3 months of batch test records for alcohol migration. Budget 8–12 weeks for verification – rushing leads to 63% higher failure rates.”

— SourcifyChina Supply Chain Intelligence Unit, 2026

Data Sources: SourcifyChina 2025 Supplier Audit Database (n=1,240), EU RAPEX Notifications 2024–2025, China National Technical Committee for Food Safety Standardization (SAC/TC 313).

SourcifyChina Advantage: Our proprietary Valve Integrity Protocol™ reduces wine pouch failure rates by 82%. Request a free supplier pre-vet for your 2026 RFP.

[Contact Sourcing Team] | [Download Full Compliance Checklist] | [Book Factory Audit]

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Sourcing Strategy for China Wine Pouch with Valve Suppliers

In the competitive landscape of flexible packaging procurement, sourcing wine pouches with valves from China presents significant cost and scalability advantages. However, challenges such as supplier authenticity, quality inconsistencies, and lengthy vetting processes can delay time-to-market and increase operational risk.

SourcifyChina’s Verified Pro List for China wine pouch with valve companies eliminates these barriers through a rigorously curated network of pre-vetted manufacturers. Our 2026 data shows clients reduce supplier qualification time by up to 70%, accelerate RFQ cycles, and achieve consistent compliance with international packaging standards (ISO, FDA, BRC).

Why SourcifyChina’s Pro List Saves Time & Mitigates Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All factories undergo on-site audits for production capability, export experience, and quality control systems—eliminating 3–6 weeks of manual screening. |

| Valve-Specific Expertise | Suppliers on the Pro List specialize in spout-and-valve pouch technology, with proven track records in liquid-tight sealing and barrier film lamination. |

| Fast RFQ Turnaround | Access to standardized capability templates enables faster quotation comparison—average response time: <24 hours. |

| Compliance Ready | Verified documentation for food-grade materials, REACH, and export certifications included with each profile. |

| Dedicated Support | SourcifyChina’s team manages initial communications, factory interviews, and sample coordination—freeing procurement teams to focus on strategic decisions. |

Call to Action: Accelerate Your 2026 Packaging Sourcing

Don’t waste another quarter navigating unreliable directories or unverified suppliers. The SourcifyChina Verified Pro List delivers immediate access to trusted wine pouch manufacturers—saving time, reducing risk, and ensuring supply chain resilience.

👉 Contact us today to request your customized Pro List and begin vetting qualified suppliers within 48 hours:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available Monday–Friday, 9:00–18:00 CST, to guide you through supplier shortlisting, sample logistics, and audit planning.

SourcifyChina – Your Trusted Partner in Verified China Sourcing

Delivering Speed, Transparency, and Reliability to Global Procurement Teams Since 2014

🧮 Landed Cost Calculator

Estimate your total import cost from China.