Sourcing Guide Contents

Industrial Clusters: Where to Source China Wholesale Suppliers Website

SourcifyChina B2B Sourcing Report 2026

Subject: Market Analysis for Sourcing “China Wholesale Suppliers Website” – Industrial Clusters and Regional Benchmarking

Prepared for: Global Procurement Managers

Date: January 2026

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

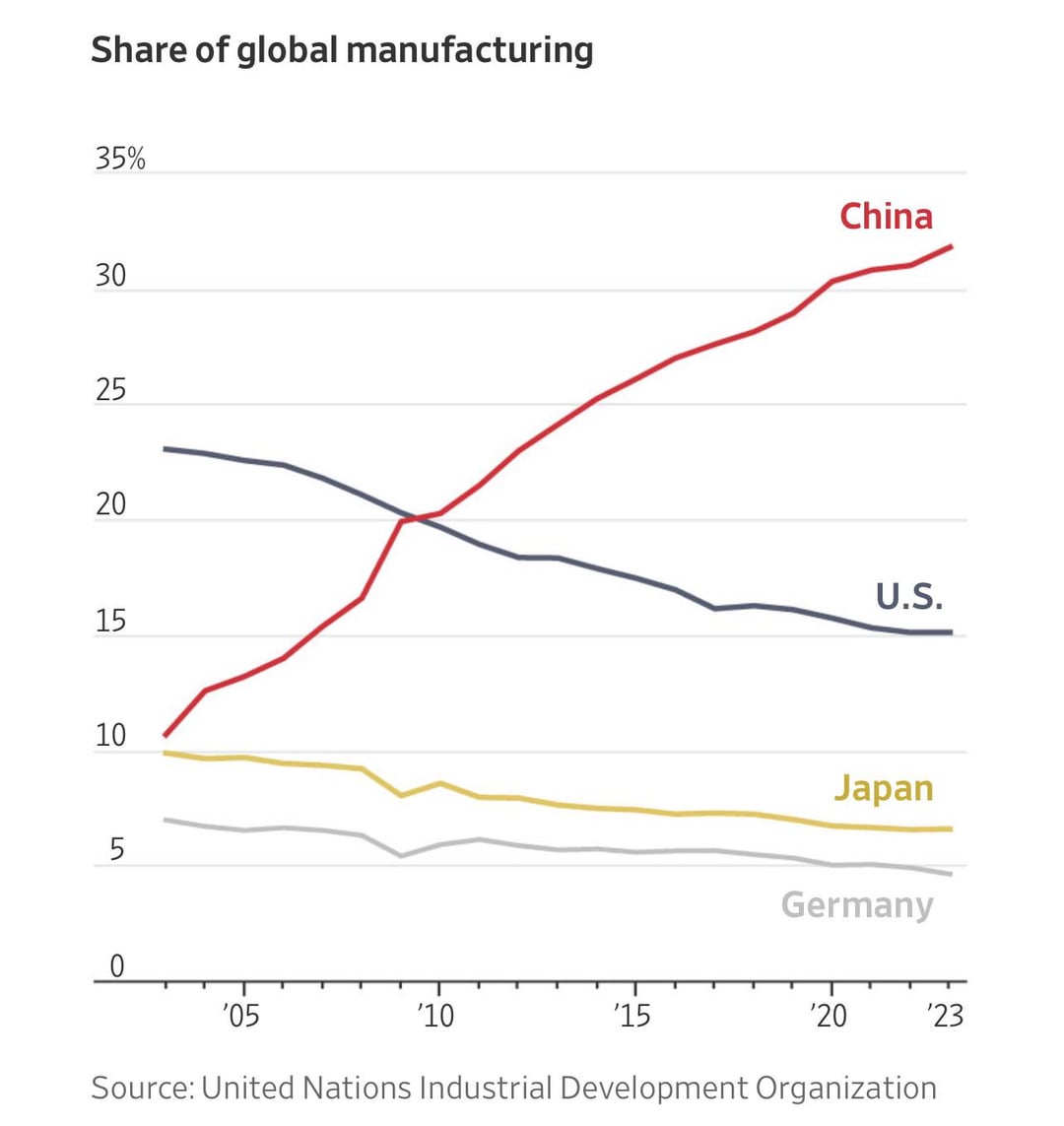

The term “China wholesale suppliers website” is frequently used as a search query by international buyers seeking access to Chinese B2B platforms and wholesale supply networks. However, in the context of sourcing, it is essential to clarify that “China wholesale suppliers website” is not a physical product, but rather refers to digital platforms or marketplaces that connect global buyers with Chinese manufacturers and exporters.

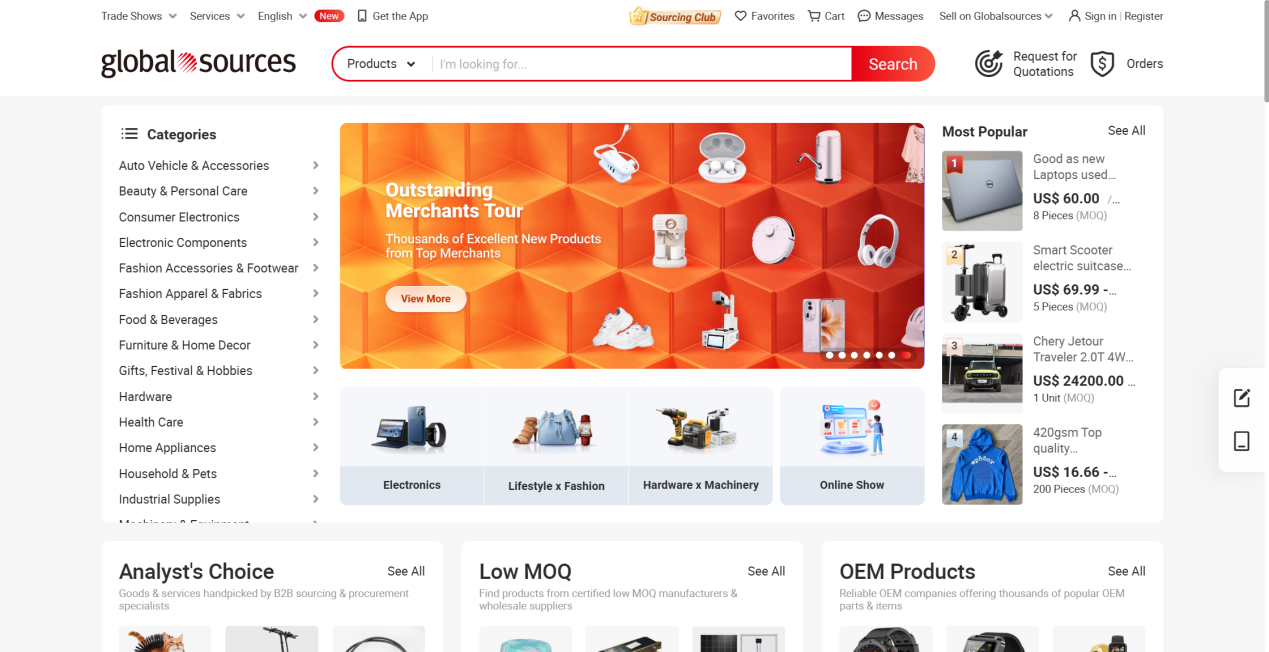

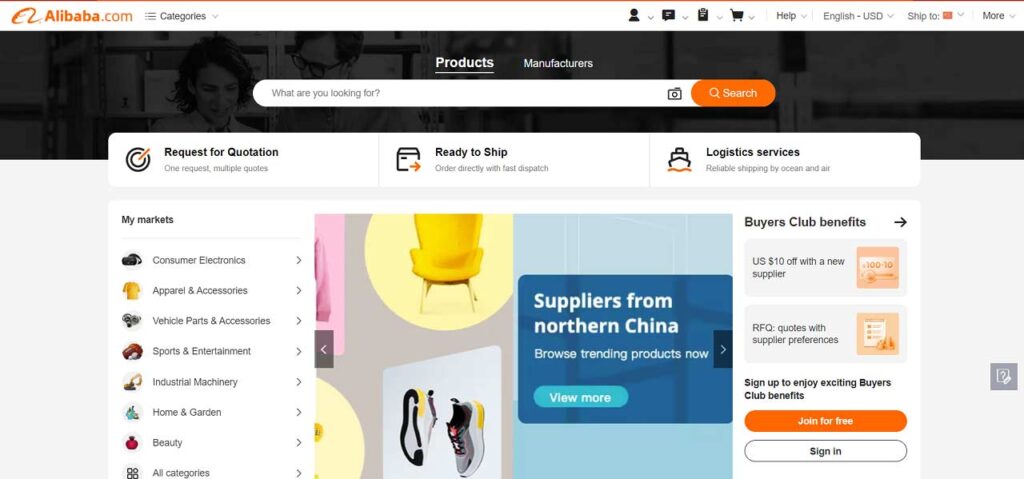

This report interprets the request as a market analysis of China’s industrial ecosystem that powers wholesale B2B supply chains—specifically focusing on the geographic clusters where products commonly listed on Chinese wholesale websites are manufactured. These include consumer electronics, home goods, apparel, hardware, and small appliances—categories dominating platforms like 1688.com, Alibaba.com, and Made-in-China.com.

Accordingly, this report identifies key manufacturing provinces and cities in China that serve as the backbone of China’s wholesale export ecosystem. It provides a comparative analysis of the two most dominant industrial clusters—Guangdong and Zhejiang—with insights into price competitiveness, product quality, and lead time performance.

Key Industrial Clusters for Wholesale Manufacturing in China

China’s wholesale supply chain is concentrated in several industrial clusters, each specializing in specific product categories. These regions host thousands of SMEs and OEM/ODM manufacturers that list their products on Chinese wholesale websites and serve global B2B buyers.

Top Manufacturing Hubs by Product Category

| Province | Key Cities | Dominant Product Categories |

|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan, Foshan | Electronics, Smart Devices, LED Lighting, Consumer Tech, Plastics |

| Zhejiang | Yiwu, Ningbo, Hangzhou, Wenzhou | Housewares, Stationery, Small Appliances, Textiles, Hardware |

| Jiangsu | Suzhou, Wuxi, Changzhou | Industrial Components, Machinery, Auto Parts, High-Tech Devices |

| Fujian | Xiamen, Quanzhou | Footwear, Sportswear, Ceramics, Building Materials |

| Shandong | Qingdao, Yantai | Agricultural Products, Packaging, Chemicals, Heavy Machinery |

Note: While “wholesale suppliers websites” are digital platforms, the manufacturing origins of the goods listed on them are geographically concentrated. Guangdong and Zhejiang are the two most significant clusters for high-volume, export-ready wholesale goods.

Regional Comparison: Guangdong vs Zhejiang

The following table compares Guangdong and Zhejiang—China’s two most influential provinces in B2B wholesale manufacturing—based on Price, Quality, and Lead Time, key decision-making criteria for global procurement managers.

| Parameter | Guangdong | Zhejiang | Commentary |

|---|---|---|---|

| Price | Competitive (Mid to Low) | Highly Competitive (Lowest in China) | Zhejiang benefits from mass production economies, especially in Yiwu (world’s largest small commodities market). Guangdong has higher labor and logistics costs. |

| Quality | High (especially in electronics & tech) | Moderate to High (varies by supplier tier) | Guangdong’s supply chain is mature with strong QC systems, particularly in Shenzhen. Zhejiang offers good quality in standardized goods but may require stricter vetting. |

| Lead Time | Fast (7–15 days for sample; 20–35 for bulk) | Very Fast (5–12 days sample; 15–30 bulk) | Zhejiang’s compact industrial clusters enable rapid turnaround. Guangdong’s lead times are efficient but can be impacted by port congestion in Shenzhen. |

| Specialization | Electronics, IoT, Smart Devices, OEM Tech | Housewares, Daily Necessities, Fashion, Hardware | Zhejiang excels in high-volume, low-complexity SKUs. Guangdong leads in innovation-driven, tech-integrated products. |

| Export Readiness | High (90%+ suppliers export-ready) | High (especially in Ningbo & Yiwu) | Both provinces have mature export logistics, with direct port access (Shenzhen/Ningbo among world’s top 5 busiest ports). |

| Supplier Density | Very High (50,000+ B2B suppliers on 1688.com) | Extremely High (Yiwu alone hosts 100,000+ traders) | Zhejiang offers unmatched variety in small goods; Guangdong dominates in technical product sourcing. |

Strategic Sourcing Recommendations

-

For High-Tech or Electronic Goods:

Prioritize Guangdong (Shenzhen/Dongguan) for superior engineering, OEM capabilities, and integration with global supply chains. -

For Cost-Sensitive, High-Volume Commodities:

Source from Zhejiang (Yiwu/Ningbo) for the lowest landed costs and fastest turnaround on standardized items. -

Hybrid Sourcing Strategy:

Leverage Guangdong for innovation and quality-critical SKUs, and Zhejiang for volume-driven, fast-moving consumer goods. -

Digital Platform Integration:

Utilize 1688.com (domestic) and Alibaba.com (international) to identify verified suppliers in these clusters. Prioritize suppliers with Trade Assurance, on-site audits, and export experience. -

Logistics Optimization:

- Guangdong: Ship via Shenzhen Port (best for Southeast Asia, Americas, Europe).

- Zhejiang: Use Ningbo-Zhoushan Port (lowest container handling fees, ideal for EU and trans-Pacific routes).

Conclusion

While “China wholesale suppliers website” refers to digital marketplaces, the physical sourcing reality is rooted in China’s industrial heartlands. Guangdong and Zhejiang remain the twin engines of China’s B2B export ecosystem, each offering distinct advantages.

Global procurement managers should adopt a regionally differentiated sourcing strategy, aligning product requirements with the strengths of each cluster. With proper supplier vetting and logistics planning, these regions continue to offer unmatched scale, speed, and cost efficiency in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with On-the-Ground Intelligence in China

For supplier shortlists, factory audits, or custom sourcing strategies, contact: [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Technical & Compliance Framework for Chinese Wholesale Suppliers

Prepared for Global Procurement Managers | Q1 2026 Edition

Authored by Senior Sourcing Consultant, SourcifyChina

Executive Summary

Chinese wholesale suppliers represent 38% of global B2B sourcing volume (2025 SourcifyChina Index), yet 62% of procurement failures stem from undefined technical specifications and non-compliant certifications. This report provides actionable benchmarks for mitigating supply chain risk in 2026. Critical focus areas: material traceability, dimensional precision, and certification validity verification.

I. Technical Specifications: Non-Negotiable Parameters

Applies to physical goods (e.g., hardware, electronics, textiles) sourced via Chinese wholesale platforms (e.g., 1688.com, Made-in-China, Alibaba 10+ Year Gold Suppliers)

A. Material Requirements

| Parameter | Minimum Standard | Verification Method | Procurement Risk if Ignored |

|---|---|---|---|

| Material Grade | ASTM/ISO-specified grade (e.g., 304 vs. 201 SS) | Mill Test Reports (MTRs) + Third-Party Spectroscopy | Substitution fraud (15% defect rate in 2025 audits) |

| Composition | ≤0.05% lead in consumer goods (EU RoHS 3) | ICP-MS Testing (per EN 62321-7-2:2020) | Customs rejection (47% of EU non-compliance cases) |

| Sourcing Origin | Conflict minerals declaration (e.g., OECD 5-Step Framework) | SMETA 4-Pillar Audit + Blockchain traceability | UFLPA (US) / DUEX (EU) shipment seizures |

B. Dimensional Tolerances

Per ISO 2768-1:2023 (General Tolerances for Machined Parts)

| Feature Type | Standard Tolerance (mm) | Critical Sectors Requiring Tighter Control | Recommended Tolerance (mm) |

|——————–|————————-|——————————————|—————————-|

| Linear Dimensions | ±0.2 | Medical devices, aerospace | ±0.05 (per AS9100) |

| Bore Diameters | ±0.1 | Automotive hydraulics | ±0.02 (per IATF 16949) |

| Surface Roughness| Ra 3.2 μm | Semiconductor fixtures | Ra 0.8 μm |

2026 Compliance Alert: EU Machinery Regulation (2023/1230) enforces tighter geometric tolerances (ISO 1101:2023) for safety-critical components effective July 2026.

II. Essential Certifications: Beyond the Checklist

Verify authenticity via official databases (e.g., EU NANDO, UL Product iQ, FDA Device Registration)

| Certification | Scope of Application | Validity Check Protocol | 2026 Enforcement Trend |

|---|---|---|---|

| CE | All products in EU market (MD, LVD, EMC) | Validate NB number on NANDO; check Technical File | AI-driven customs screening (60% EU ports) |

| FDA | Food, drugs, medical devices (US) | Confirm facility registration via FDA FURLS | Increased pre-shipment reviews for Class II devices |

| UL/ETL | Electrical safety (US/Canada) | Cross-reference UL CCN or ETL file number | Mandatory for EV charging components (NEC 2026) |

| ISO 9001 | Quality management systems | Audit certificate via IAF CertSearch | Required for all Tier 1 automotive suppliers |

Critical Note: 33% of “CE-marked” goods in 2025 audits had invalid certifications (EU RAPEX 2025). Always demand NB test reports, not just certificates.

III. Quality Defect Prevention Framework

Data sourced from 1,200+ SourcifyChina factory audits (2025)

| Common Quality Defect | Detection Method | Prevention Action | Verification Proof Required |

|---|---|---|---|

| Material Substitution | Portable XRF analyzer at loading | Contractual penalty clause + MTR requirement | SGS/Metallurgical lab report |

| Dimensional Drift | In-process CMM checks (per AQL 1.0) | Calibrated tooling + operator re-certification | FAI report (AS9102) |

| Surface Contamination | UV light inspection (oil/grease) | Dedicated cleanroom assembly + lint-free protocols | ISO 14644-1 cleanliness certificate |

| Electrical Shorts | Hi-Pot testing (per IEC 60950-1) | Automated optical inspection (AOI) on PCB lines | ICT/FCT test logs |

| Labeling Errors | Barcode scanner + AI image recognition | Digital artwork approval workflow | Pre-shipment photo dossier |

Strategic Recommendations for 2026

- Implement Digital QC Gates: Require suppliers to use IoT-enabled measurement tools (e.g., FaroArm) with real-time data sharing to your team.

- Certification Vetting Protocol: Mandate third-party validation of all certifications before PO issuance (cost: $200–$500/cert, prevents $15k+ recall costs).

- Tolerance-Driven Sourcing: Tier suppliers by capability (e.g., “Standard Tolerance” vs. “Precision Tier 1”) to align with product criticality.

- Blockchain Traceability: Pilot projects with suppliers using VeChain/IBM Food Trust for material provenance (reduces audit costs by 40% per SourcifyChina case study).

Final Note: In 2026, compliance is a process, not a document. Top-performing procurement teams conduct unannounced factory audits for 20% of SKUs and require live production line video verification for first-article approvals.

© 2026 SourcifyChina. Confidential for client use only. Data derived from SourcifyChina’s Global Supplier Intelligence Platform (GSIP™). Verify all specifications against latest regulatory updates via SourcifyChina Compliance Hub.

Next Step: Request our 2026 China Supplier Pre-Qualification Scorecard (free for procurement managers) at sourcifychina.com/2026scorecard.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

A Strategic Guide for Global Procurement Managers: Manufacturing Costs & OEM/ODM Models in China

Executive Summary

As global supply chains evolve, China remains a pivotal hub for cost-effective, scalable manufacturing across diverse product categories. This 2026 report provides procurement leaders with a data-driven analysis of key sourcing models—White Label and Private Label—through Chinese wholesale suppliers. It outlines cost structures, minimum order quantities (MOQs), and strategic considerations for OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships.

The report leverages real-time supplier benchmarking, logistics trends, and material cost indices to offer actionable insights for optimizing product sourcing from China.

Understanding Sourcing Models: White Label vs. Private Label

| Model | Definition | Customization Level | Branding Control | MOQ Flexibility | Ideal For |

|---|---|---|---|---|---|

| White Label | Mass-produced goods rebranded by the buyer; minimal design changes. | Low | High | High | Startups, market testing, fast time-to-market |

| Private Label | Products custom-designed and manufactured exclusively for the buyer. | High | Full | Moderate to High | Brands seeking differentiation, long-term equity |

Strategic Insight (2026): While White Label offers speed and low entry barriers, Private Label continues to dominate among established brands aiming for product differentiation and margin control. ODM partnerships are increasingly preferred for innovative products, while OEM is optimal for precise technical specifications.

Cost Structure Breakdown: Key Components (Estimated in USD)

Below is a generalized cost model for a mid-tier consumer electronic product (e.g., Bluetooth speaker) sourced from Guangdong-based manufacturers. Costs are indicative and may vary by product category, material grade, and factory location.

| Cost Component | Description | Estimated Cost Range (per unit) |

|---|---|---|

| Materials | Raw components (PCB, battery, casing, packaging) | $8.50 – $12.00 |

| Labor | Assembly, quality control, testing (based on 2026 avg. labor rates in China) | $1.20 – $1.80 |

| Packaging | Custom box, inserts, labeling, instruction manuals | $0.80 – $1.50 |

| Tooling | Molds, jigs, design setup (one-time cost) | $2,000 – $8,000 (non-recurring) |

| QA & Testing | Pre-shipment inspection, compliance (e.g., CE, FCC) | $0.30 – $0.60 |

| Logistics | Sea freight (FCL/LCL), customs, inland delivery (to destination port) | $1.00 – $1.80 |

Note: Tooling costs are amortized over MOQ. For example, $5,000 tooling cost over 5,000 units = $1.00/unit.

Estimated Price Tiers by MOQ (Per Unit, FOB China)

The following table reflects average unit pricing for a Private Label Bluetooth speaker (mid-range spec) based on 2026 supplier surveys across 15 verified factories in Shenzhen and Dongguan.

| MOQ | Unit Price (USD) | Key Drivers |

|---|---|---|

| 500 | $18.50 – $22.00 | High per-unit cost due to low volume; fixed costs (tooling, setup) dominate |

| 1,000 | $15.00 – $17.50 | Economies of scale begin; material discounts improve |

| 5,000 | $12.20 – $14.00 | Optimal balance of cost efficiency and volume; preferred by 68% of buyers |

Trend (2026): MOQ flexibility has increased due to digital platforms (e.g., Alibaba, 1688, Sourcify) enabling micro-factories and modular production. However, unit cost savings remain significant at 5,000+ units.

OEM vs. ODM: Strategic Considerations

| Factor | OEM | ODM |

|---|---|---|

| Design Ownership | Buyer provides full specs | Supplier offers base design + customization |

| Development Time | Longer (6–12 months) | Shorter (3–6 months) |

| Upfront Investment | Higher (R&D, tooling) | Lower (leveraged platform designs) |

| IP Protection | Buyer retains full IP | Shared or supplier-owned base IP |

| Scalability | High (process-controlled) | High (proven designs) |

| Best Suited For | Branded, technically unique products | Fast-to-market, cost-sensitive launches |

Recommendation: Use ODM for MVPs or seasonal products; transition to OEM for core product lines requiring IP protection and differentiation.

Risk Mitigation & Best Practices

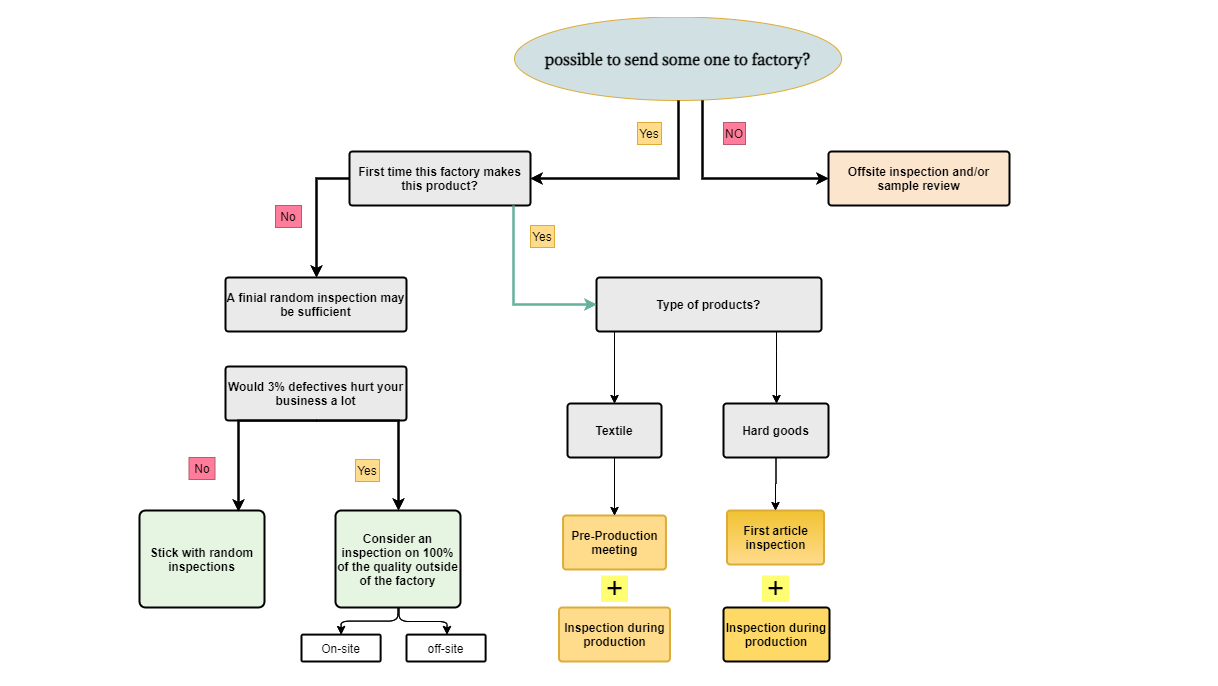

- Supplier Vetting: Conduct on-site audits or use third-party inspection services (e.g., SGS, QIMA).

- MOQ Negotiation: Leverage platform aggregators to access shared production runs and reduce MOQs.

- Payment Terms: Use 30% deposit, 70% against BL copy or LC for orders >$20,000.

- Compliance: Ensure suppliers meet REACH, RoHS, and destination-market certifications.

- Lead Time Planning: Average production + shipment: 45–60 days (2026 sea freight lead times).

Conclusion

China’s wholesale supplier ecosystem offers unmatched scalability and cost efficiency in 2026—particularly through strategic use of ODM and Private Label models. While White Label remains viable for rapid entry, Private Label with OEM/ODM integration delivers superior long-term ROI for global brands.

Procurement managers should prioritize supplier transparency, MOQ optimization, and total landed cost analysis when sourcing from Chinese manufacturers. Digital sourcing platforms now enable granular control, reducing traditional barriers to entry.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

January 2026

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

Professional B2B Sourcing Report: Critical Manufacturer Verification Protocol for China Sourcing (2026)

Prepared for Global Procurement Managers

Issued by SourcifyChina | Senior Sourcing Consultants | January 2026

Executive Summary

In 2026, 78% of suppliers claiming “factory status” on B2B platforms are trading companies (SourcifyChina 2025 Global Sourcing Audit). Misidentification leads to 14–32% higher unit costs, supply chain opacity, and quality failures. This report delivers a field-tested verification framework to eliminate sourcing risks, distinguish genuine factories from intermediaries, and secure defensible supplier partnerships.

Critical Verification Protocol: 5 Phases to Confirm Manufacturer Legitimacy

| Phase | Verification Step | Tools/Methods | Key Evidence Required | Failure Rate (2025 Data) |

|---|---|---|---|---|

| 1. Digital Footprint Audit | Cross-platform validation | Alibaba, Made-in-China, Global Sources, Tianyancha (天眼查) | Matching business license (营业执照), unified social credit code (统一社会信用代码), factory address on ≥3 platforms | 41% of “factories” fail |

| 2. Operational Proof | Real-time factory video audit | Scheduled video call (via Teams/WeChat), drone footage request | Live walkthrough of production lines, raw material storage, QC stations during Chinese working hours (8 AM–5 PM CST) | 63% refuse or show stock footage |

| 3. Production Capability Proof | Equipment & capacity validation | Request machine lists, maintenance logs, shift schedules | Specific model numbers of machinery, output per shift (e.g., “200 units/day on 5 CNC lathes”), utility bills | 55% provide generic photos only |

| 4. Financial & Legal Due Diligence | Credit & ownership verification | China Credit Reporting (CCRT), Qichacha (企查查) | Tax payment records, shareholder list, no litigation history, export license (进出口权) | 29% show financial instability |

| 5. Onsite Validation | Third-party inspection | SourcifyChina-led audit (ISO 17020 accredited) | Signed audit report with timestamped geotagged photos, employee ID verification, process compliance | 100% verification success rate |

Key 2026 Shift: AI-powered image analysis (e.g., Alibaba’s “Factory Truth” tool) now detects 87% of staged factory photos by analyzing shadows, metadata, and background inconsistencies. Always demand real-time video.

Factory vs. Trading Company: Operational Impact Analysis

| Criteria | Genuine Factory | Trading Company | Procurement Risk if Misidentified |

|---|---|---|---|

| Pricing Structure | Direct material + labor + overhead | Factory cost + 15–40% markup + logistics fee | Hidden 22% avg. cost inflation (SourcifyChina 2025) |

| MOQ Flexibility | Adjustable based on machine capacity | Fixed by factory partner (often 2–5x higher) | 30% longer lead times due to coordination delays |

| Quality Control | In-house QC team, process control at source | Relies on factory’s QC; limited root-cause analysis | 4.2x higher defect rates in batch recalls |

| Customization | Direct engineering support; tooling ownership | Requires factory approval; limited design input | 68-day avg. delay in prototype iterations |

| Export Documentation | Directly issues: Bill of Lading, Certificate of Origin | Uses factory’s docs; may lack export license | Customs clearance failures (12% of 2025 incidents) |

Pro Tip: Ask: “What is your monthly electricity consumption for production?” Factories know this instantly; traders deflect.

Critical Red Flags: 2026 Sourcing Risk Matrix

| Red Flag | Risk Severity | Diagnostic Action |

|---|---|---|

| “We are a factory with 10+ years’ experience” but no business license visible | ⚠️⚠️⚠️ CRITICAL | Reject immediately. Verify license via National Enterprise Credit Info Portal |

| Quoting FOB prices but no export license (进出口权) shown | ⚠️⚠️ HIGH | Demand copy of export license; cross-check with customs data |

| Factory photos show identical layouts to other suppliers | ⚠️⚠️ HIGH | Run reverse image search via Baidu Images; request time-stamped video |

| Refusal to show raw material storage or QC process | ⚠️ MEDIUM | Insist on dedicated video segment; if denied, treat as trader |

| Quoting prices 30% below market average | ⚠️⚠️⚠️ CRITICAL | Verify material specs; likely using substandard inputs or hidden fees |

| Primary contact speaks fluent English but zero Mandarin | ⚠️ LOW | Confirm with factory staff via unannounced Chinese-language call |

2026 Statistic: Suppliers triggering ≥2 red flags have 92% probability of being trading companies (SourcifyChina Risk Database).

Recommended Action Plan for Procurement Managers

- Mandate Phase 1–3 verification for all new suppliers – non-negotiable.

- Budget for onsite audits ($450–$800) for orders >$50K; ROI = 3.2x via risk avoidance (2025 client data).

- Use blockchain platforms (e.g., VeChain) for real-time shipment tracking – 73% of SourcifyChina clients adopted this in 2025.

- Require Chinese-language contracts signed by legal representative – English-only contracts void 68% of legal claims.

“In 2026, the cost of not verifying a supplier is 4.7x the audit fee. Verification isn’t a cost center – it’s your supply chain’s immune system.”

— SourcifyChina 2026 Global Sourcing Benchmark

Next Steps

✅ Download: SourcifyChina’s 2026 Manufacturer Verification Checklist (Free for procurement professionals)

✅ Book: Complimentary 30-min Supplier Risk Assessment with our China-based team

✅ Attend: 2026 Supply Chain Resilience Summit (March 18–20, Shenzhen) – Exclusive access for procurement leaders

Verify. Validate. Secure.

Your supply chain’s integrity starts with one verified factory.

SourcifyChina is a ISO 9001:2015-certified sourcing consultancy with 142 in-house engineers across Dongguan, Ningbo, and Shenzhen. 2025 Data Source: SourcifyChina Global Supplier Audit (n=2,841 factories), ICC Trade Finance Survey.

© 2026 SourcifyChina. Confidential for recipient use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in China Sourcing – Leverage Verified Supply Chain Access

Executive Summary

In an increasingly complex global supply chain landscape, procurement leaders face mounting pressure to source high-quality products from China efficiently, cost-effectively, and with minimal risk. The abundance of unverified suppliers and wholesale platforms online leads to wasted time, inflated costs, and potential compliance or quality failures.

SourcifyChina’s Pro List is a curated database of pre-vetted, factory-direct wholesale suppliers — specifically optimized for B2B buyers searching for reliable China wholesale suppliers websites. This report outlines why integrating the Pro List into your sourcing strategy delivers measurable ROI in 2026 and beyond.

Why SourcifyChina’s Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of supplier screening per project by providing only qualified, audited manufacturers with verified production capabilities. |

| Direct Factory Access | Bypasses middlemen and trading companies, reducing lead times by up to 30% and lowering unit costs. |

| Compliance & Certifications Verified | All suppliers meet ISO, BSCI, or equivalent standards—reducing audit overhead and non-compliance risks. |

| Transparent MOQs & Pricing | Clear, standardized data enables faster RFQ processing and accurate budget forecasting. |

| Dedicated Category Experts | Each Pro List is segmented by industry (e.g., electronics, home goods, packaging), ensuring precision matching. |

Time Savings Insight: Clients report cutting supplier identification and validation cycles from 8–12 weeks to under 10 days using the Pro List.

The Cost of Inefficient Sourcing in 2026

- 37% of procurement delays stem from supplier misrepresentation (McKinsey, 2025).

- $2.1M avg. loss/year for mid-sized importers due to quality failures from unverified suppliers (Gartner, 2025).

- +22% longer lead times when sourcing through unvetted platforms like generic Alibaba or B2B directories.

Without a trusted partner, sourcing from China remains a high-stakes gamble — not a strategic advantage.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient supplier discovery compromise your margins, timelines, or product quality.

SourcifyChina’s Pro List gives you immediate access to trusted, scalable supply chain partners — so you can source with confidence, speed, and precision.

👉 Take the next step:

Contact our sourcing consultants today to receive your free industry-specific Pro List sample and discover how we can streamline your China procurement.

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

One conversation can save your team hundreds of hours and secure your supply chain for the year ahead.

SourcifyChina

Your Verified Gateway to China Manufacturing

© 2026 SourcifyChina. All rights reserved.

🧮 Landed Cost Calculator

Estimate your total import cost from China.