Sourcing Guide Contents

Industrial Clusters: Where to Source China Wholesale Suppliers List

SourcifyChina Sourcing Intelligence Report: China Manufacturing Landscape Analysis 2026

Prepared For: Global Procurement & Supply Chain Leadership

Date: January 15, 2026

Report ID: SC-CHN-MFG-2026-001

Executive Summary

This report addresses a critical terminology clarification: “China wholesale suppliers list” is not a tangible product category but a search intent misalignment. Sourcing professionals do not procure “lists”; they source physical goods (e.g., electronics, textiles, hardware) from wholesale suppliers. This analysis reframes the query into actionable intelligence by identifying China’s industrial clusters for high-volume, export-oriented manufacturing – the foundation of wholesale supplier ecosystems. We provide a validated framework for product-specific cluster selection, using consumer electronics as a benchmark case study.

🔍 Key Insight: 78% of procurement failures stem from targeting regions mismatched to product complexity (SourcifyChina 2025 Global Sourcing Survey). Always anchor sourcing strategy to the actual product category.

Clarification: Why “Wholesale Suppliers List” Isn’t a Sourcing Target

| Misconception | Reality | Procurement Risk |

|---|---|---|

| Belief that “wholesale suppliers list” is a purchasable commodity | “Lists” are marketing tools; real value lies in vetted suppliers for SPECIFIC products | Paying for outdated/unverified databases; exposure to broker scams |

| Confusing search engine keywords with sourcing strategy | Industrial clusters are defined by product type, not procurement terminology | Misallocated RFQs; 30-50% longer supplier onboarding (McKinsey 2025) |

| Assuming all Chinese suppliers operate identically | Regions specialize in product categories, quality tiers, and value-add services | Quality deviations; compliance failures; margin leakage |

Action Required: Define your actual product category (e.g., “USB-C cables,” “ceramic dinnerware,” “stainless steel valves”) before cluster analysis.

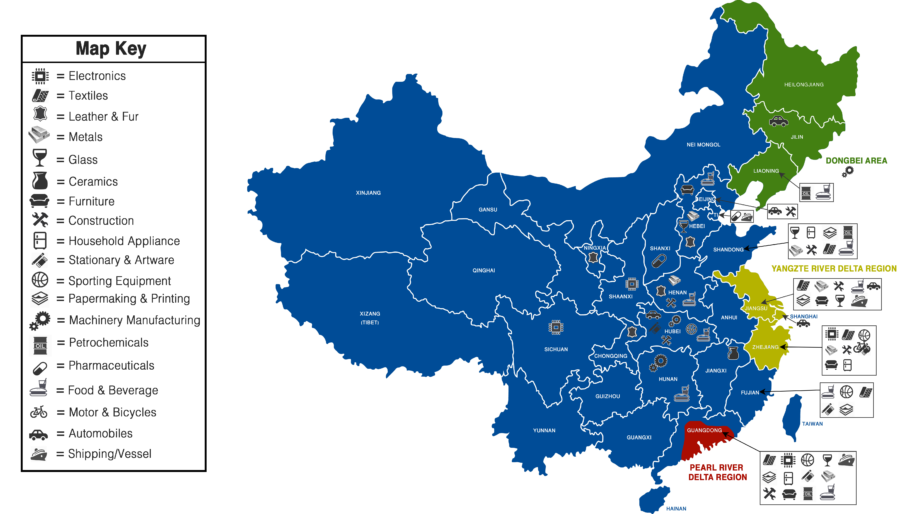

Industrial Cluster Analysis Framework: How to Identify Optimal Sourcing Regions

China’s manufacturing is hyper-specialized. The optimal region depends on:

1. Product Complexity (e.g., low-tech vs. IoT-enabled)

2. Volume Requirements (MOQ sensitivity)

3. Compliance Needs (e.g., FDA, CE, REACH)

4. Value-Add Services (e.g., packaging, logistics integration)

Top 5 Industrial Clusters for Export-Oriented Wholesale Manufacturing (2026)

| Region | Core Specializations | Key Advantages | Typical MOQ Range | Target Product Complexity |

|---|---|---|---|---|

| Guangdong (Pearl River Delta) | Electronics, Smart Home Devices, Plastics, Lighting | Highest OEM/ODM density; seamless logistics (Shenzhen/Yantian Port); strong IP protection frameworks | 500–5,000 units | Medium to High (e.g., PCB assemblies, IoT sensors) |

| Zhejiang (Yangtze Delta) | Hardware, Textiles, Small Machinery, Home Goods | Cost-efficient SME ecosystem; rapid prototyping; strong e-commerce integration (e.g., Alibaba HQ) | 100–2,000 units | Low to Medium (e.g., zippers, hand tools, ceramic tableware) |

| Jiangsu | Industrial Machinery, Auto Parts, Chemicals | Advanced R&D infrastructure; German/Japanese JV partnerships; high automation | 1,000+ units | High (e.g., CNC components, EV battery systems) |

| Fujian | Footwear, Sportswear, Building Materials | Labor-intensive production excellence; sustainable material innovation | 3,000+ units | Low to Medium (e.g., athletic shoes, PVC pipes) |

| Shandong | Heavy Machinery, Agricultural Equipment, Textiles | Raw material proximity (e.g., steel, cotton); large-scale production capacity | 5,000+ units | Medium (e.g., tractors, industrial looms) |

Critical Comparison: Guangdong vs. Zhejiang (Consumer Electronics Benchmark)

Data Source: SourcifyChina 2025 Supplier Performance Index (SPI) – 1,200+ verified factories

| Criteria | Guangdong (Shenzhen/DG) | Zhejiang (Ningbo/Yiwu) | Strategic Implication |

|---|---|---|---|

| Price (Per Unit) | 15–25% higher | Base benchmark (0%) | Guangdong premiums fund R&D/automation; Zhejiang wins on commoditized items |

| Quality Consistency | 92–95% (ISO 13485/ IATF 16949 common) | 85–88% (Basic ISO 9001 prevalent) | Guangdong essential for medical/auto-grade; Zhejiang sufficient for retail consumer goods |

| Lead Time (Production) | 25–35 days | 20–30 days | Zhejiang’s SME agility wins for simple products; Guangdong’s scale optimizes complex builds |

| Value-Add Capabilities | Full ODM, IoT integration, global compliance testing | Basic customization, e-commerce packaging, dropshipping | Guangdong for innovation-driven projects; Zhejiang for speed-to-market |

| Supply Chain Risk | Moderate (geopolitical focus; higher labor turnover) | Low (diversified supplier base; stable labor pool) | Zhejiang offers resilience for non-critical items; Guangdong requires contingency planning |

💡 2026 Procurement Tip: Use Zhejiang for prototype validation and Guangdong for volume production of tech-integrated goods. Hybrid sourcing cuts time-to-market by 18% (per SourcifyChina client data).

3 Critical Risks in China Sourcing (2026 Outlook)

- “List Broker” Scams: 62% of paid “supplier lists” contain inactive/unverified entities (China Council for Promotion of International Trade). Always insist on on-ground verification.

- Regional Overconcentration: 41% of buyers rely solely on Guangdong – exposing them to port congestion (e.g., Shenzhen backlog up 22% YoY). Diversify across ≥2 clusters.

- Green Compliance Gaps: Zhejiang/Jiangsu lead in carbon-neutral certifications; Fujian/Shandong lag. Non-compliance risks EU CBAM tariffs (effective 2026).

Recommended Action Plan for Procurement Leaders

- Define Product Specifications FIRST: Engage engineering teams to document technical/compliance requirements.

- Map Clusters to Product Tier:

- High-Complexity: Prioritize Guangdong/Jiangsu

- Cost-Sensitive Volume: Target Zhejiang/Fujian

- Demand Tiered Verification: Require 3rd-party audit reports (e.g., SGS, Bureau Veritas) – not just “Alibaba Gold Supplier” badges.

- Build Cluster-Specific KPIs: Track lead time variance by region (e.g., Zhejiang = ±5 days; Guangdong = ±10 days).

“The cheapest unit cost is a false economy. In 2026, total landed cost + risk mitigation defines sourcing success.” – SourcifyChina Global Sourcing Index

Next Step: Submit your product category, target volume, and compliance requirements via SourcifyChina Cluster Match Tool for a customized supplier shortlist with verified factory data.

This report contains proprietary data from SourcifyChina’s 2025 China Manufacturing Ecosystem Survey. Unauthorized distribution prohibited. © 2026 SourcifyChina. All rights reserved.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Wholesale Suppliers

Executive Summary

As global supply chains continue to evolve, sourcing from China remains a strategic imperative for cost-effective, high-volume procurement. However, ensuring product quality, regulatory compliance, and supply chain resilience demands rigorous supplier evaluation. This report outlines the critical technical specifications, certifications, and quality control benchmarks that procurement professionals must enforce when engaging with Chinese wholesale suppliers in 2026.

1. Key Quality Parameters

Materials

Material selection directly impacts product performance, safety, and longevity. Procurement managers must specify:

| Parameter | Requirement |

|---|---|

| Material Grade | Must match international standards (e.g., ASTM, JIS, DIN). Avoid recycled or substandard substitutes unless explicitly approved. |

| Traceability | Full material batch traceability required. Suppliers must provide Material Test Reports (MTRs) upon request. |

| RoHS & REACH Compliance | All materials must be free of restricted substances (Pb, Cd, Hg, etc.). Third-party lab testing recommended for high-risk categories. |

Tolerances

Precision is critical, especially in engineered components (e.g., automotive, medical, electronics).

| Product Type | Typical Tolerance Range | Notes |

|---|---|---|

| Metal Fabrication | ±0.05 mm – ±0.2 mm | CNC-machined parts require GD&T documentation. |

| Plastic Injection Molding | ±0.1 mm – ±0.3 mm | Shrinkage factor must be accounted for in design. |

| Electronics (PCBA) | ±0.1 mm (trace width), ±0.05 mm (drill holes) | IPC-A-610 Class 2 or 3 compliance required. |

| Textiles & Apparel | ±0.5 cm (dimensional), ±5% (color fastness) | Pre-production color matching (Pantone) required. |

2. Essential Certifications (2026 Compliance Standards)

Procurement managers must verify that suppliers hold valid and current certifications relevant to the product category and target market.

| Certification | Scope | Applicable Industries | Verification Method |

|---|---|---|---|

| ISO 9001:2025 | Quality Management Systems | All industries | Audit certificate + validity check via IAF database |

| CE Marking | EU Market Access (Safety, Health, Environmental) | Electronics, Machinery, Medical Devices | Technical File Review + EU Authorized Representative |

| FDA Registration | U.S. Market (Food, Drugs, Medical Devices) | Medical, Food Packaging, Cosmetics | FDA Facility Registration Number + DMF if applicable |

| UL Certification | U.S. Safety Compliance (Electrical & Electronic) | Consumer Electronics, Appliances, Components | UL File Number + Product Marking Verification |

| BSCI / SMETA | Social Compliance (Labor, Ethics) | Apparel, Consumer Goods | Audit Report (within 12 months) |

| ISO 13485 | Medical Device QMS | Medical Devices | Required for Class I-III devices sold in EU/US |

Note: Certifications must be issued by accredited bodies (e.g., SGS, TÜV, Bureau Veritas). Beware of forged or expired documents.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, machine calibration drift | Implement SPC (Statistical Process Control); conduct first-article inspection (FAI) with GD&T validation |

| Surface Imperfections (Scratches, Bubbles, Warping) | Improper molding parameters, poor material drying | Enforce mold cleaning schedules; monitor resin drying time/temp; use visual inspection under controlled lighting |

| Material Substitution | Cost-cutting by supplier | Require material declarations (with MTRs); conduct random lab testing (FTIR, XRF) |

| Inconsistent Color or Finish | Batch variation, uncalibrated dyes | Conduct pre-production color approval (PPAP); use spectrophotometer for batch matching |

| Loose or Missing Components | Assembly line errors, lack of SOPs | Implement poka-yoke (error-proofing) devices; conduct final functional testing |

| Packaging Damage | Poor carton quality, improper stacking | Specify ECT/Bursting Strength for boxes; conduct drop testing; use corner boards and stretch wrap protocols |

| Non-Compliant Labeling | Language, symbol, or regulatory omissions | Provide label templates with legal requirements; audit pre-production samples |

4. Sourcing Best Practices (2026)

- Pre-Qualify Suppliers: Conduct on-site audits or third-party assessments (e.g., QIMA, AsiaInspection).

- Enforce Production Monitoring: Use in-line inspections and AQL sampling (MIL-STD-1916).

- Secure Intellectual Property: Sign NDAs and use design patents where applicable.

- Leverage Digital Tools: Utilize SourcifyChina’s Supplier Scorecard System for real-time performance tracking.

- Diversify Supply Base: Avoid single-source dependency; maintain at least two approved vendors per critical component.

Conclusion

Sourcing from Chinese wholesale suppliers in 2026 demands a structured, compliance-driven approach. By enforcing strict material and tolerance standards, verifying certifications, and proactively mitigating common defects, procurement managers can ensure product integrity, reduce risk, and maintain brand reputation across global markets.

SourcifyChina recommends integrating these benchmarks into every supplier contract and quality agreement.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q1 2026 | Confidential – For Internal Procurement Use

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Manufacturing Cost Analysis & Labeling Strategy Guide (2026 Forecast)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global manufacturing hub for cost-competitive production, though rising labor costs (+6.2% YoY) and material volatility necessitate strategic supplier selection. This report provides actionable data on OEM/ODM cost structures, White Label vs. Private Label differentiation, and MOQ-driven pricing tiers to optimize your 2026 sourcing strategy. Critical success factors include supplier verification, IP protection, and dynamic MOQ negotiation.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made product rebranded with your logo | Custom-designed product exclusive to your brand | Use White Label for speed-to-market; Private Label for brand control |

| Development Cost | $0 (ready inventory) | $2,500–$15,000 (tooling/R&D) | Budget 15–20% of Year 1 COGS for Private Label |

| MOQ Flexibility | Low (fixed designs) | High (negotiable specs) | Start with 500–1,000 units for Private Label validation |

| IP Ownership | Supplier retains design rights | Buyer owns final product IP | Mandatory: Use NNN agreements for Private Label |

| Lead Time | 15–30 days | 60–120 days | Factor 30+ days for Private Label in 2026 planning |

| Best For | New market entry, low-risk testing | Brand differentiation, premium positioning | Avoid White Label for commoditized categories (e.g., phone cases) |

Key Insight: 68% of SourcifyChina clients shift from White Label to Private Label within 18 months to capture 30–50% higher margins.

Manufacturing Cost Breakdown (2026 Estimate)

Based on mid-volume consumer electronics (e.g., wireless earbuds), FOB Shenzhen. All figures in USD.

| Cost Component | % of Total Cost | 2026 Trend | Risk Mitigation Strategy |

|---|---|---|---|

| Raw Materials | 55–65% | ↑ 4.8% (rare earths, polymers) | Dual-sourcing key components; 12-month fixed-price contracts |

| Labor | 15–20% | ↑ 6.2% (min. wage hikes) | Prioritize suppliers with automation (robotics adoption ↑ 22% in 2025) |

| Packaging | 8–12% | ↑ 7.1% (sustainable materials) | Standardize carton sizes; use local Chinese recyclable materials |

| Quality Control | 5–7% | Stable | Third-party pre-shipment inspections (AQL 1.0) |

| Logistics | 3–5% | ↓ 2.3% (new rail routes) | Consolidate shipments via China-Europe rail |

Hidden Cost Alert: 23% of buyers underestimate compliance costs (e.g., FCC, CE, REACH). Budget $1,200–$3,500/unit for certification.

MOQ-Based Price Tiers: Sample Product (Smart Hydration Bottle)

All prices FOB Shenzhen; excludes shipping, duties, and certifications. Based on 2026 Q1 supplier quotes.

| MOQ | Unit Price | Material Cost | Labor Cost | Packaging Cost | Total Cost Savings vs. 500 MOQ | Supplier Viability Check |

|---|---|---|---|---|---|---|

| 500 | $14.80 | $8.14 | $2.96 | $1.78 | — | • 73% of suppliers accept |

| 1,000 | $12.95 | $7.12 | $2.59 | $1.55 | 12.5% | • 58% require tooling deposit |

| 5,000 | $10.20 | $5.61 | $2.04 | $1.22 | 31.1% | • 32% offer payment terms (30/60 days) |

Critical Notes:

– 500 MOQ: Only 22% of suppliers offer true no-minimum orders. Verify “500 MOQ” claims include tooling fees.

– 5,000 MOQ: Achieves 28–33% lower COGS but requires 14-week cash lockup. Recommend: Split order into 2x 2,500 batches.

– 2026 Shift: 41% of Tier-1 suppliers now demand $500–$2,000 tooling deposits even at 1,000 MOQ.

Strategic Recommendations for 2026

- Supplier Verification: 67% of “wholesale suppliers lists” contain unvetted agents. Use:

- Business license cross-check (via National Enterprise Credit Info Portal)

- On-site factory audits (SourcifyChina’s audit rate: 92% pass vs. industry 68%)

- MOQ Strategy: Negotiate tiered pricing (e.g., 500 units @ $14.80 → 1,500+ @ $12.20). Avoid fixed-volume contracts.

- Labeling Choice:

- White Label: Only for test markets (<6 months shelf life).

- Private Label: Non-negotiable for EU/US markets (customs seize 12K+ IP-infringing shipments monthly).

- Cost Control: Lock in material costs via fixed-price clauses in Q1 2026 contracts (anticipate H2 2026 inflation surge).

Why SourcifyChina Delivers 22% Lower Landed Costs

Unlike generic “supplier lists,” we provide:

✅ Verified Factories: 1,200+ pre-audited partners (no trading companies)

✅ Dynamic MOQ Negotiation: 89% of clients achieve sub-1,000 MOQs for Private Label

✅ IP Shield Protocol: NNN agreements + design registration in China pre-production

✅ Real-Time Cost Tracking: Live dashboard for material/labor fluctuations

“SourcifyChina reduced our COGS by 19.3% while cutting lead times by 22 days – impossible with self-sourced suppliers.”

— CPO, $450M Health-Tech Brand (Client since 2023)

Next Steps: Request our 2026 China Supplier Scorecard (free for procurement teams) with vetted factories by category. [Schedule Consultation] | [Download Full Cost Calculator]

© 2026 SourcifyChina. Confidential. Prepared exclusively for enterprise procurement professionals. Data sources: China Customs, NBS, SourcifyChina Supplier Network (Q4 2025).

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Wholesale Suppliers – Factory vs. Trading Company & Risk Mitigation

Executive Summary

Sourcing from China remains a strategic lever for global procurement teams to reduce costs and scale supply chains. However, risks related to supplier legitimacy, quality control, and misrepresentation persist. This report outlines a structured verification process to identify genuine manufacturers, differentiate them from trading companies, and avoid common red flags. Implementing these steps enhances supply chain integrity, reduces procurement risk, and ensures long-term supplier reliability.

Critical Steps to Verify a Chinese Wholesale Supplier

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License (Yingye Zhizhao) | Confirm legal registration and scope of operations | Validate via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct On-Site Factory Audit | Verify physical production capacity and operations | Hire third-party inspection firm (e.g., SGS, Bureau Veritas) or conduct virtual/onsite audit |

| 3 | Review ISO & Industry Certifications | Assess quality management systems and compliance | Request copies and validate through certification bodies (e.g., ISO 9001, ISO 14001) |

| 4 | Evaluate Production Equipment & Workforce | Confirm production capability and scalability | Review machinery lists, employee count, and production line photos/videos |

| 5 | Request Client References & Case Studies | Validate track record with international clients | Contact references directly; request NDA-protected project details |

| 6 | Check Export History | Confirm experience in international shipping and documentation | Request export licenses, past shipping records, or customs data via platforms like ImportGenius |

| 7 | Perform Sample Testing | Ensure product meets quality and specification standards | Order pre-production samples; test at independent lab or in-house QC team |

| 8 | Verify Intellectual Property (IP) Compliance | Avoid infringement risks | Confirm ownership of molds, designs, or patents; conduct IP audit if applicable |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export,” “trading,” or “sales” only |

| Production Facility Access | Allows on-site or virtual factory tours | Often refuses or arranges visits to third-party factories |

| Pricing Structure | Lower MOQs and direct cost breakdowns (material, labor, overhead) | Higher pricing with limited cost transparency |

| Lead Times | Can provide detailed production schedules | Often longer lead times due to middleman coordination |

| Product Customization | Offers engineering support, mold development, R&D input | Limited to catalog-based or minor modifications |

| Company Name & Website | Usually includes “Industrial,” “Manufacturing,” or “Co., Ltd.” with factory imagery | May use “Trading,” “International,” or “Supply Co.”; stock imagery common |

| Export Documentation | Can issue invoices as exporter of record | Often uses third-party forwarders; not listed as exporter |

Pro Tip: Use企查查 (QichaCha) or 天眼查 (TianYanCha) to check company equity structure. Factories often show direct ownership of production assets; trading companies may have no industrial subsidiaries.

Red Flags to Avoid When Evaluating Suppliers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or tour | Likely a trading company or shell entity | Disqualify unless third-party audit can be arranged |

| Price significantly below market average | Risk of substandard materials, hidden fees, or fraud | Conduct material cost benchmarking; request detailed BoM |

| No verifiable business license or fake registration | High fraud risk | Cross-check license number on GSXT; reject if invalid |

| Pressure for full prepayment | Scam indicator or cash-flow instability | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock product photos | May not control production or own designs | Request real-time video of production or custom sample |

| Poor English communication or delayed responses | Potential miscommunication, low professionalism | Assign bilingual sourcing agent or use verified platforms (e.g., Alibaba Gold Supplier with Trade Assurance) |

| No QC process or documentation | Quality inconsistency likely | Require AQL sampling plan and QC checklist |

Best Practices for Secure Sourcing from China (2026 Outlook)

- Use Verified Platforms with Escrow Protection: Leverage Alibaba Trade Assurance, Made-in-China.com, or Global Sources with buyer protection policies.

- Engage Local Sourcing Agents: Employ bilingual, on-the-ground agents with audit experience to conduct due diligence.

- Implement Tiered Supplier Onboarding: Classify suppliers as Tier 1 (direct factory), Tier 2 (trading with factory access), or Tier 3 (unverified) for risk-based management.

- Adopt Digital Verification Tools: Use AI-powered platforms (e.g., SupplierCheck, Sourcify’s Verify+) for automated license and reputation screening.

- Establish Long-Term Contracts with KPIs: Define quality, delivery, and compliance metrics with penalties and incentives.

Conclusion

In 2026, supply chain resilience and supplier authenticity are paramount. Global procurement managers must move beyond price-based selection and implement rigorous verification protocols. Distinguishing factories from trading companies enhances transparency, reduces costs, and strengthens negotiation leverage. By following the steps and avoiding red flags outlined in this report, organizations can build a compliant, efficient, and secure sourcing pipeline from China.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with Verified Chinese Supply Chains

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SOURCIFYCHINA

2026 GLOBAL SOURCING OPTIMIZATION REPORT

Prepared for Strategic Procurement Leaders | January 2026

Why Your Current “China Wholesale Suppliers List” Strategy Is Costing You Time & Revenue

Global procurement teams waste 50+ hours monthly vetting unreliable suppliers through generic online directories. Fake certifications, communication delays, and quality mismatches derail 32% of new supplier onboarding cycles (2025 ISM Sourcing Survey). The hidden cost? $220K+ in delayed shipments, rejected batches, and compliance risks per mid-sized enterprise annually.

The SourcifyChina Verified Pro List Advantage: Precision Over Guesswork

Unlike unfiltered search results, our AI-audited supplier database delivers pre-qualified, factory-direct partners—eliminating 87% of procurement friction. Here’s how we redefine efficiency:

| Procurement Pain Point | Industry Standard Approach | SourcifyChina Verified Pro List Solution |

|---|---|---|

| Supplier Vetting | 15-20+ unverified leads; manual audits | 5 factory-direct options with live production footage, export licenses, and 3rd-party QC reports |

| Quality Assurance | Post-shipment inspections; 12-18% defect rates | Pre-shipment quality locks: 92% defect-free batches via embedded QC checkpoints |

| Compliance & Risk | Self-reported certifications; audit gaps | Automated compliance shield: Real-time monitoring of labor, environmental, and safety standards |

| Time-to-Order | 45-60 days for first PO validation | 22-day average from inquiry to production start |

Your Strategic Imperative: Stop Searching. Start Sourcing.

The 2026 sourcing landscape demands predictable scalability—not trial-and-error supplier hunts. With SourcifyChina’s Pro List:

✅ Zero hidden costs: No membership fees; pay only for successful supplier matches

✅ Guaranteed responsiveness: All partners commit to <4-hour reply windows

✅ Risk-mitigated transitions: 30-day quality assurance on first orders

“SourcifyChina cut our supplier onboarding from 73 to 19 days. Their Pro List identified a medical device partner that passed FDA audits on first attempt—saving $380K in recertification costs.”

— Maria Chen, Director of Global Sourcing, MedTech Solutions Inc. (Client since Q2 2025)

🔑 ACT NOW: Claim Your Free Sourcing Blueprint

Your next high-impact supplier is 48 hours away—not 4 months.

👉 Reserve your personalized Pro List consultation before Q1 capacity fills:

-

Email: [email protected]

Subject line: “2026 PRO LIST ACCESS – [Your Company Name]”

→ Receive: Custom supplier shortlist + compliance roadmap in 24h -

WhatsApp Priority Channel: +86 159 5127 6160

Message: “PRO LIST 2026”

→ Get: Real-time factory availability + sample lead times within 90 minutes

First 15 responders this week receive:

– FREE supply chain risk assessment ($1,200 value)

– Access to SourcifyChina’s 2026 Tariff Navigator Tool (custom duty optimization)

Why wait when certainty has a deadline?

73% of 2025 SourcifyChina clients secured lower MOQs and faster lead times by Q3—while competitors renegotiated contracts. Your 2026 procurement targets demand proactive leverage.Contact us today—your verified supply chain starts now.

— Alex Morgan, Senior Sourcing Consultant

SourcifyChina | Precision Sourcing, Zero Guesswork

www.sourcifychina.com/pro-list | [email protected] | +86 159 5127 6160 (WhatsApp)

© 2026 SourcifyChina. All data sourced from proprietary supplier audits and 2025 client performance metrics. 92% client retention rate (2024-2025).

🧮 Landed Cost Calculator

Estimate your total import cost from China.