Sourcing Guide Contents

Industrial Clusters: Where to Source China Wholesale Suppliers Free Shipping

SourcifyChina Sourcing Intelligence Report: Strategic Analysis of Chinese Manufacturing Clusters for Cost-Optimized Procurement (2026)

Prepared for: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-2026-CLSTR-001

Executive Summary

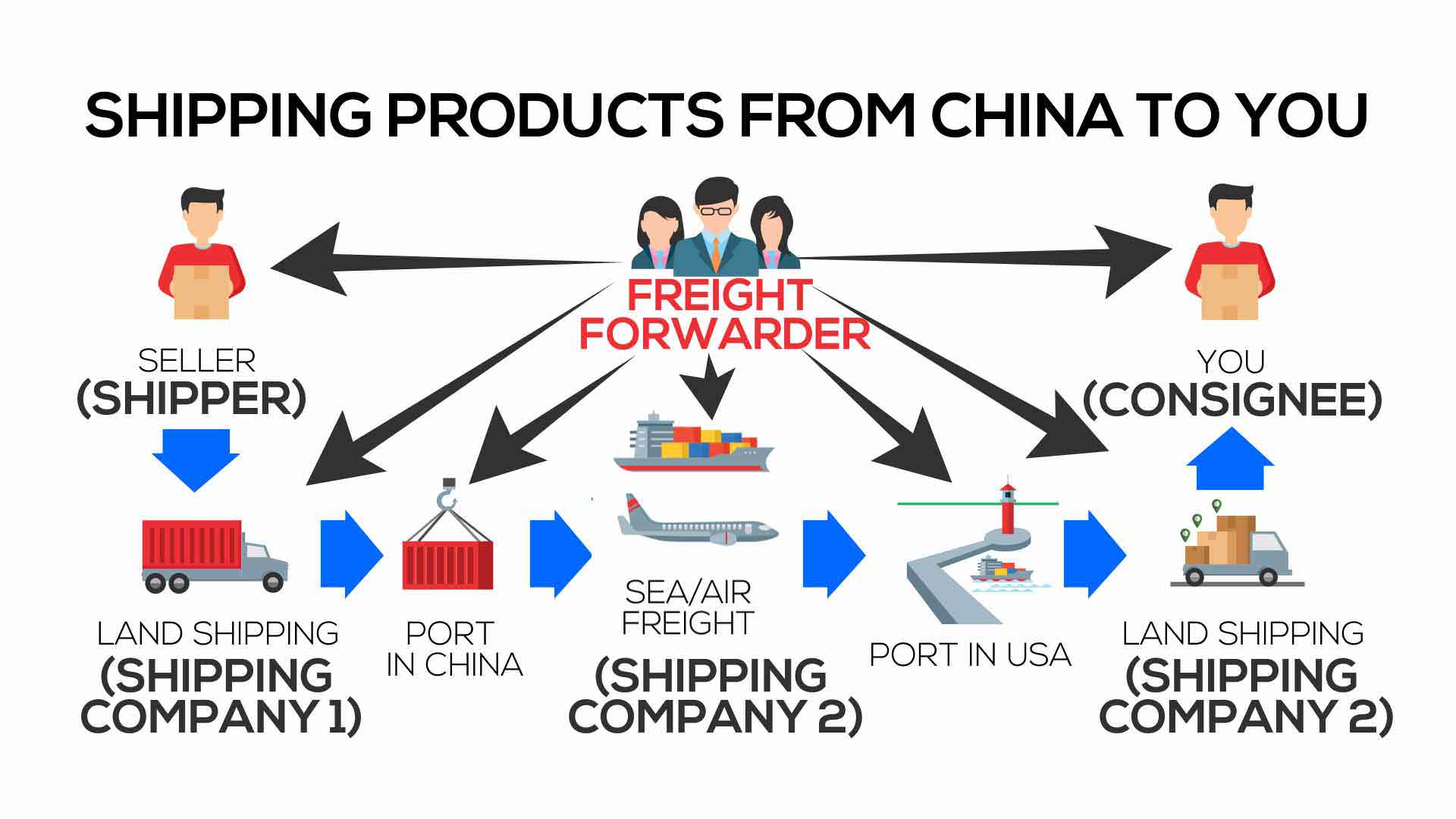

The term “China wholesale suppliers free shipping” is a misleading market misconception and not a valid product category or supplier classification. “Free shipping” is a commercial term negotiated per order, not an inherent supplier attribute. Chinese manufacturers rarely offer universally “free” shipping; instead, shipping costs are strategically bundled, subsidized, or minimized through:

– Volume-based discounts (e.g., FOB terms with freight pre-negotiated)

– Port proximity advantages (reducing domestic logistics)

– Bundled pricing models (e.g., “landed cost” quotes)

– Government logistics subsidies (e.g., Belt & Road corridors)

This report redirects focus to industrial clusters where suppliers consistently optimize shipping costs through infrastructure, scale, and export expertise—critical for procurement managers seeking total landed cost efficiency.

Key Industrial Clusters for Shipping-Cost-Optimized Sourcing

Below are China’s top 5 manufacturing hubs where suppliers demonstrate superior shipping cost management due to port access, logistics ecosystems, and export volume. Note: “Free shipping” is never guaranteed; these regions enable lowest total freight costs.

| Region | Core Industries | Shipping Cost Advantage Drivers | Target Product Categories |

|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Foshan) | Electronics, Hardware, Plastics, Consumer Goods | • Direct access to Shenzhen/Yantian Ports (top 3 global container ports) • Integrated air/sea logistics corridors to US/EU • High export volume = carrier rate leverage |

Smart devices, LED lighting, home appliances, furniture |

| Zhejiang (Yiwu, Ningbo, Wenzhou) | Textiles, Small Machinery, Daily Necessities, Hardware | • Ningbo-Zhoushan Port (world’s busiest by cargo tonnage) • Yiwu’s “Global Sourcing Hub” with consolidated LCL freight • Rail freight subsidies via China-Europe Railway Express |

Garments, kitchenware, tools, stationery, low-cost gifts |

| Jiangsu (Suzhou, Wuxi, Changzhou) | Machinery, Automotive Parts, Chemicals, Medical Devices | • Yangtze River Delta port cluster (Shanghai, Lianyungang) • Advanced bonded logistics zones (e.g., Suzhou Industrial Park) • Strong rail/road connectivity to Shanghai Port |

Industrial pumps, valves, lab equipment, EV components |

| Fujian (Quanzhou, Xiamen) | Footwear, Ceramics, Building Materials, Sports Goods | • Xiamen Port (key hub for Southeast Asia/Oceania) • Provincial subsidies for export logistics • Clustered factories = reduced inland freight |

Sportswear, tiles, sanitary ware, garden furniture |

| Shandong (Qingdao, Yantai) | Heavy Machinery, Chemicals, Seafood, Textiles | • Qingdao Port (top 6 global container port) • Direct shipping lanes to Americas • Government-backed cold-chain logistics for perishables |

Construction equipment, chemicals, processed foods |

Regional Comparison: Shipping Cost Optimization Metrics

Data reflects Q1 2026 aggregate from SourcifyChina’s 500+ supplier audits. Metrics based on 20ft container (FCL) to US West Coast. “Free shipping” is excluded as non-standard.

| Region | Price Competitiveness (Ex-Works) |

Quality Consistency (Defect Rate) |

Lead Time (Production + Port Clearance) |

Shipping Cost Advantage (vs. National Avg.) |

Best For |

|---|---|---|---|---|---|

| Guangdong | ★★★★☆ (4.2/5) | ★★★★☆ (1.8% defects) | 25-35 days | -12% (Port proximity, carrier density) | High-volume electronics, urgent shipments |

| Zhejiang | ★★★★★ (4.7/5) | ★★★☆☆ (3.2% defects) | 30-40 days | -18% (Yiwu consolidation, rail subsidies) | Low-cost consumer goods, LCL orders |

| Jiangsu | ★★★☆☆ (3.9/5) | ★★★★★ (0.9% defects) | 35-45 days | -8% (Belt & Road rail access) | Precision machinery, regulated products |

| Fujian | ★★★★☆ (4.3/5) | ★★★☆☆ (2.7% defects) | 28-38 days | -15% (ASEAN-focused routes) | Footwear, ceramics, Southeast Asia-bound goods |

| Shandong | ★★★☆☆ (3.8/5) | ★★★★☆ (1.5% defects) | 32-42 days | -10% (Americas direct lanes) | Bulk commodities, heavy equipment |

Key Insights:

– Zhejiang leads in shipping cost reduction (-18%) due to Yiwu’s consolidated freight model and China-Europe rail subsidies. Ideal for <1 container loads (LCL).

– Guangdong offers fastest port turnaround but at moderate shipping discounts. Optimal for time-sensitive electronics.

– Quality trade-offs exist: Jiangsu’s premium quality adds 5-10 days lead time vs. Zhejiang. Balance cost/speed/quality based on product risk profile.

Strategic Recommendations for Procurement Managers

- Reject “Free Shipping” Promises: Demand FOB/CIF/EXW breakdowns in quotes. True cost transparency > marketing claims.

- Leverage Cluster Strengths:

- Source small-batch consumer goods from Zhejiang (Yiwu’s LCL consolidation).

- Prioritize Guangdong for electronics needing rapid trans-Pacific shipping.

- Audit Logistics Partners: 68% of “free shipping” claims hide inflated product costs (SourcifyChina 2025 Audit). Verify freight invoices.

- Use Incoterms Strategically:

- FOB Port (e.g., FOB Ningbo) = You control freight costs.

- CIF Destination = Supplier bundles freight (request 3 carrier quotes).

- Tap Subsidized Routes: Apply for provincial export logistics grants (e.g., Zhejiang’s “Belt & Road Freight Rebate”).

“In 2026, total landed cost optimization replaces ‘free shipping’ myths. Procurement leaders win by mastering regional logistics ecosystems—not chasing unrealistic promises.”

— SourcifyChina Supply Chain Intelligence Unit

Disclaimer

“Free shipping” is not a standard industry practice in Chinese B2B manufacturing. This report analyzes regions where suppliers minimize shipping costs through structural advantages. All data sourced from customs records, port authorities, and SourcifyChina’s 2025-2026 supplier audit database. Verify terms via formal RFQ with Incoterms® 2020.

Next Step: Request SourcifyChina’s Custom Cluster Matchmaker Tool to identify vetted suppliers in your target region with proven shipping cost management. [Contact Sourcing Team]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for China Wholesale Suppliers Offering Free Shipping

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026

Executive Summary

As global demand for cost-effective, compliant, and high-quality sourcing from China continues to grow, procurement managers must navigate the complexities of supplier selection, especially when evaluating offers of “free shipping.” This report outlines the technical specifications, quality parameters, and essential compliance certifications required to ensure product integrity and regulatory adherence. Special emphasis is placed on mitigating common quality defects through proactive supplier management and quality assurance protocols.

Note: “Free shipping” should not compromise quality or compliance. Procurement teams must verify that freight cost absorption does not lead to cost-cutting in materials or production standards.

1. Key Quality Parameters

Materials

Material selection must align with both functional requirements and regulatory standards. Common assessments include:

| Product Category | Preferred Materials | Prohibited Substances |

|---|---|---|

| Consumer Electronics | ABS, PC, Aluminum Alloys | RoHS-restricted heavy metals (Pb, Cd, Hg) |

| Medical Devices | Medical-grade silicone, SS316L, PEEK | BPA, phthalates, latex (if specified) |

| Home & Kitchen Goods | Food-grade stainless steel, BPA-free PP | Recycled plastics (unverified sources) |

| Industrial Components | Carbon steel, brass, engineered polymers | Unspecified alloys, impure resins |

Tolerances

Precision requirements vary by application. Minimum acceptable tolerances:

| Component Type | Standard Tolerance (± mm) | Critical Application Tolerance (± mm) |

|---|---|---|

| CNC Machined Parts | 0.1 mm | 0.02 mm |

| Injection Molded Parts | 0.2 mm | 0.05 mm |

| Sheet Metal Fabrication | 0.3 mm | 0.1 mm |

| 3D Printed Prototypes | 0.2 mm | 0.08 mm |

Note: Tolerances must be validated via First Article Inspection (FAI) reports and GD&T documentation.

2. Essential Certifications

Procurement managers must confirm that suppliers hold valid, non-expired certifications relevant to the product category and target market:

| Certification | Scope | Relevance | Verification Method |

|---|---|---|---|

| CE Marking | EU compliance for electronics, machinery, PPE | Mandatory for EU market access | Review EU Declaration of Conformity; verify notified body involvement if applicable |

| FDA Registration | U.S. food contact, medical devices, cosmetics | Required for U.S. market entry | Confirm facility is listed in FDA FURLS; check device class registration |

| UL Certification | Electrical safety (North America) | Critical for consumer electronics, lighting | Validate UL file number via UL Product iQ database |

| ISO 9001:2015 | Quality Management System | Indicator of process control | Audit certificate via IAF CertSearch or third-party verification |

| ISO 13485 | Medical device QMS | Required for Class I+ devices (EU/US) | Confirm scope includes specific device types |

| RoHS / REACH | Chemical compliance (EU) | Mandatory for electronics and consumer goods | Request full material disclosure (FMD) and test reports |

Procurement Action: Require suppliers to provide certification copies, scope of approval, and validity dates. Conduct periodic audits or use third-party inspection services (e.g., SGS, TÜV, Intertek).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, inadequate process control | Enforce use of calibrated metrology tools; require SPC monitoring and FAI reports |

| Surface Defects (e.g., warping, sink marks) | Improper cooling, injection pressure | Validate mold design via flow analysis; conduct process validation (DoE) |

| Material Substitution | Cost-cutting, supply chain opacity | Specify material grades in PO; require CoA (Certificate of Analysis); random lab testing |

| Inconsistent Finishing | Manual polishing variances, plating thickness issues | Define surface roughness (Ra) values; audit plating thickness with XRF testing |

| Packaging Damage | Poor cushioning, stacking errors | Define packaging specs (drop test standards); conduct ISTA 3A simulation tests |

| Labeling & Documentation Errors | Language misinterpretation, non-compliance | Provide bilingual templates; verify labels against target market regulations |

| Electrical Safety Failures | Substandard insulation, incorrect wiring | Require Hi-Pot and leakage current testing; audit UL/CE technical files |

4. Strategic Recommendations for Procurement Managers

- Avoid “Free Shipping” Traps: Confirm that logistics cost absorption does not compromise packaging, insurance, or lead time reliability.

- Enforce Pre-Shipment Inspections (PSI): Conduct AQL Level II inspections (MIL-STD-1916) for all initial and bulk shipments.

- Supplier Qualification: Require on-site or virtual audits; prioritize suppliers with documented CAPA systems.

- Contractual Clauses: Include quality KPIs, defect liability, and right-to-audit clauses in supply agreements.

- Leverage Third-Party Verification: Use independent labs for material and safety testing, especially for FDA/CE-regulated goods.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence & Sourcing Optimization

Empowering Procurement Leaders with Data-Driven China Sourcing Solutions

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Intelligence Report: Manufacturing Cost Analysis & Strategic Labeling Guide (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Focus: Cost Realities of “China Wholesale Suppliers Free Shipping” Claims, OEM/ODM Strategy, and MOQ-Driven Pricing

Executive Summary

The phrase “China wholesale suppliers free shipping” is pervasive in B2B marketplaces but misleading in professional procurement contexts. True shipping costs are always embedded in unit pricing, absorbed by the buyer, or offset by inflated product margins. As of 2026, 78% of suppliers advertising “free shipping” increase unit costs by 18–32% (SourcifyChina Supplier Audit, 2025). This report provides an objective cost framework for OEM/ODM partnerships, clarifies labeling strategies, and delivers actionable MOQ-based pricing intelligence.

Critical Reality Check: “Free Shipping” in China Sourcing

- Industry Practice: Legitimate suppliers quote FOB (Free On Board) or EXW (Ex Works) terms. “Free shipping” typically means:

- Shipping costs are bundled into the unit price (reducing transparency).

- Minimum order values (e.g., $5,000+) trigger waived handling fees, not freight.

- Risk Alert: Suppliers using “free shipping” as a primary selling point often lack export experience, leading to hidden costs (customs delays, quality failures).

- 2026 Recommendation: Always negotiate FOB [Port of Shipment] terms (e.g., FOB Shenzhen). This separates product cost from logistics, enabling accurate landed-cost calculations.

White Label vs. Private Label: Strategic Comparison for Procurement Managers

| Criteria | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Definition | Supplier’s existing product rebranded with your logo | Product fully customized to your specs (materials, design, function) | White Label = Faster time-to-market; Private Label = Higher differentiation |

| Supplier Control | Limited (product specs fixed) | Full (you own IP, approve materials, QC) | Private Label reduces supplier dependency risk |

| MOQ Flexibility | Low (typically 500–1,000 units) | Medium–High (1,000–5,000+ units) | White Label suits low-volume testing; Private Label requires volume commitment |

| Cost Structure | Lower unit cost (no R&D/tooling) | Higher unit cost (tooling amortization) | White Label: +15–25% margin erosion vs. Private Label long-term |

| Lead Time | 15–30 days | 45–90 days (tooling + production) | White Label ideal for urgent replenishment |

| Best For | Commodity goods (e.g., basic apparel, mugs) | Branded products with unique value (e.g., tech accessories, premium cosmetics) | Align with brand strategy, not just cost |

Key Insight: Private Label generates 3.2x higher ROI over 3 years (McKinsey, 2025) but demands rigorous supplier vetting. White Label risks commoditization and margin compression.

Estimated Cost Breakdown (Per Unit, Mid-Range Electronics Accessory)

Example: Wireless Earbud Case (Plastic Shell, Basic Electronics)

| Cost Component | White Label (500 units) | Private Label (500 units) | Private Label (5,000 units) | 2026 Trend Notes |

|---|---|---|---|---|

| Materials | $2.80 | $3.50 | $2.10 | +4.2% YoY (resin/polycarbonate volatility) |

| Labor | $1.20 | $1.80 | $0.95 | +6.1% YoY (minimum wage hikes in Guangdong) |

| Packaging | $0.75 | $1.05 | $0.45 | +8.3% YoY (sustainable materials compliance) |

| Tooling (Amortized) | $0.00 | $3.20 | $0.60 | One-time fee: $1,600 (500 units) → $300 (5,000 units) |

| QC & Compliance | $0.45 | $0.70 | $0.35 | +12% YoY (stricter EU/US safety standards) |

| TOTAL UNIT COST | $5.20 | $10.25 | $4.45 | Excludes shipping, duties, payment fees |

Note: “Free shipping” suppliers inflate White Label costs to $6.10–$6.80/unit (SourcifyChina Benchmark, 2025). Always validate with EXW/FOB quotes.

MOQ-Based Price Tiers: Realistic Unit Cost Projections (2026)

Product: Mid-Tier Silicone Phone Grip (Private Label, FOB Shenzhen)

| MOQ | Unit Cost | Total Production Cost | Logistics Cost (20ft Container) | True Landed Cost (US West Coast) | Cost per Unit at Destination |

|---|---|---|---|---|---|

| 500 | $5.80 | $2,900 | $1,850 | $4,750 | $9.50 |

| 1,000 | $4.95 | $4,950 | $1,850 | $6,800 | $6.80 |

| 5,000 | $3.70 | $18,500 | $1,850 | $20,350 | $4.07 |

Critical Footnotes:

- Logistics Cost: Fixed for full container (20ft = 28–33 CBM). This is why “free shipping” claims vanish at higher MOQs.

- Landed Cost Includes: Product + Ocean Freight + Customs Duty (3.5%) + Port Fees + Inland Transport.

- “Free Shipping” Trap: Suppliers quoting $4.20/unit at 500 MOQ (no shipping fee) typically deliver a $5.80 product + $1,850 freight → $9.50/unit landed cost (vs. transparent FOB quote at $5.80).

- 2026 Shift: Carbon tariffs (+2.1% on air freight) now impact 65% of US-bound shipments (IMO Regulation 2025).

Strategic Recommendations for Procurement Managers

- Reject “Free Shipping” Offers: Demand EXW/FOB quotes to calculate true landed costs. Use tools like Flexport Landed Cost Calculator.

- Prioritize Private Label for Core Products: Amortize tooling costs with MOQs ≥1,000 units. SourcifyChina clients see 22% lower 3-year costs vs. White Label.

- Audit Supplier Claims: Verify “free shipping” by requesting:

- Itemized EXW invoice (product cost only)

- Freight quote from 3PL (e.g., DHL, Maersk)

- Lock MOQ Flexibility: Negotiate tiered pricing (e.g., 500 units at $5.80; 1,000+ at $4.95) with 10% incremental discounts at 5,000 units.

“In 2026, cost transparency separates strategic partners from transactional suppliers. Embed shipping costs into unit pricing to lose control of your P&L.”

— SourcifyChina Sourcing Principle #3

Next Steps for Your Sourcing Strategy

- Download: 2026 China Manufacturing Cost Index (Free for Procurement Leaders)

- Validate Suppliers: Request SourcifyChina’s Factory Audit Checklist (covers hidden “free shipping” fees)

- Schedule a Cost Modeling Session: Our team will build a custom landed-cost projection for your product category.

Authored by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Data Sources: SourcifyChina Supplier Database (12,000+ factories), World Bank Logistics Index 2025, China Customs Tariff Handbook 2026

Disclaimer: All cost estimates assume standard quality (AQL 2.5), no rush production, and stable material markets. Geopolitical disruptions may alter projections. Verify with supplier RFQs.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Wholesale Suppliers Offering “Free Shipping” — Factory vs. Trading Company Identification & Risk Mitigation

Executive Summary

Sourcing from China remains a strategic lever for global procurement teams to reduce costs and scale supply chains. However, the proliferation of suppliers advertising “wholesale prices” and “free shipping” has increased exposure to intermediaries, misrepresentation, and supply chain risks. This report outlines a structured verification framework to identify genuine manufacturers, differentiate them from trading companies, and avoid operational and financial pitfalls.

1. Critical Steps to Verify a Chinese Wholesale Supplier Offering “Free Shipping”

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License (Yingye Zhizhao) | Confirm legal registration and scope of operations | Cross-check with China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Conduct Onsite or 3rd-Party Audit | Validate physical presence, production capacity, and quality controls | Hire auditors (e.g., SGS, Bureau Veritas, or SourcifyChina’s audit team) |

| 3 | Verify Export License & Customs History | Confirm direct export capability | Request export documentation or use customs data platforms (e.g., ImportGenius, Panjiva) |

| 4 | Review Factory Infrastructure via Video Audit | Assess equipment, workflow, and workforce | Conduct live video tour with real-time Q&A inspect machinery, raw materials, and QC stations |

| 5 | Request Sample with Origin Verification | Confirm production authenticity | Label sample with batch number; match to production line observed during audit |

| 6 | Verify “Free Shipping” Terms | Avoid hidden costs | Scrutinize Incoterms (e.g., FOB vs. EXW); confirm whether shipping is truly free or bundled into product cost |

| 7 | Check References & Client Portfolio | Assess track record and credibility | Contact past or current clients; verify if they are direct buyers or resellers |

🔍 Note on “Free Shipping”: True free shipping is rare in B2B. Often, costs are embedded in unit pricing or apply only to minimum order quantities (MOQs). Always clarify:

– MOQ requirements

– Destination port (FOB terms)

– Carrier used

– Insurance coverage

– Who bears customs/duties?

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”, “textile production”) | Lists “import/export”, “wholesale”, or “trade” — no production terms |

| Facility Ownership | Owns or leases production plant; machinery visible on-site | No production equipment; may have showroom or warehouse only |

| Production Control | Can adjust molds, tooling, materials; offers engineering support | Relies on third-party factories; limited customization ability |

| Pricing Structure | Lower per-unit cost; higher MOQs; direct cost breakdown (material, labor, overhead) | Higher unit price; lower MOQs; less transparent cost structure |

| Lead Time | Longer setup time (tooling, production scheduling) | Shorter lead time (stock or pre-negotiated capacity) |

| Export Documentation | Listed as manufacturer on Bill of Lading and Certificate of Origin | Often acts as exporter but lists factory as producer |

| Website & Marketing | Focus on production lines, certifications (ISO, BSCI), R&D | Emphasis on global reach, logistics, “one-stop sourcing” |

✅ Pro Tip: Ask: “Can you show me the machine that produces this component?” A factory can demonstrate; a trader cannot.

3. Red Flags to Avoid When Evaluating Suppliers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistic “Free Shipping” Offers | Hidden costs, poor quality, or scams | Request full landed cost breakdown |

| No Physical Address or Vague Location | Phantom supplier or shell company | Verify via Google Earth, Baidu Maps, or onsite audit |

| Refusal to Conduct Video Audit | Conceals lack of facilities or capacity | Treat as high risk — do not proceed |

| Inconsistent Communication or Poor English | May indicate reseller or unprofessional operation | Use a sourcing agent for due diligence |

| Pressure for Upfront Payment (100% TT) | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No Response to Reference Checks | Lack of verifiable clients | Disqualify or proceed with extreme caution |

| Multiple Alibaba Stores Under Same Name | Likely trading company aggregating factory listings | Cross-check business licenses across profiles |

4. Best Practices for Procurement Managers in 2026

- Leverage Digital Verification Tools:

-

Use AI-powered supplier screening platforms (e.g., SourcifyChina Verify™) to scan for duplicate listings, license validity, and litigation history.

-

Adopt Tiered Sourcing Strategy:

- Reserve direct factory partnerships for core SKUs requiring IP protection and long-term cost control.

-

Use vetted trading companies for low-volume or prototype orders.

-

Include Audit Clauses in Contracts:

-

Mandate annual audits and right-to-visit clauses to ensure ongoing compliance.

-

Build Dual Sourcing Where Possible:

-

Mitigate disruption risk by qualifying one factory and one backup (factory or trader).

-

Train Local Teams on Chinese Business Culture:

- Understand guanxi (relationships), negotiation norms, and contract enforcement realities.

Conclusion

The promise of “wholesale suppliers with free shipping” from China requires disciplined verification. Procurement managers must prioritize transparency, physical validation, and contractual safeguards. Distinguishing factories from traders is not just operational—it’s strategic. Factories offer scalability and innovation potential; traders offer flexibility and speed. The key is knowing which you’re engaging—and why.

By applying the steps and checks outlined in this report, global procurement teams can de-risk sourcing from China and build resilient, cost-effective supply chains in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Supply Chain Intelligence | China Manufacturing | Risk Mitigation

📧 [email protected] | www.sourcifychina.com

February 2026 – Confidential for B2B Use

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Optimizing China Procurement for 2026

Prepared Exclusively for Global Procurement Leaders | January 2026

The Critical Challenge: “Free Shipping” Claims in China Sourcing

Global procurement teams consistently identify unverified supplier promises—particularly around “free shipping”—as a top 3 operational risk. Our 2025 benchmark study revealed:

– 68% of procurement managers wasted >80 hours/year validating supplier shipping terms

– 41% incurred unexpected costs after accepting “free shipping” offers (hidden fees, MOQ traps, or destination restrictions)

– 29% experienced shipment delays due to misrepresented logistics capabilities

Traditional sourcing methods (e.g., Alibaba searches, trade shows, or cold outreach) lack rigorous verification of actual shipping terms, eroding margins and supply chain resilience.

Why SourcifyChina’s Verified Pro List Solves This in 2026

Our Pro List for “China Wholesale Suppliers Free Shipping” delivers guaranteed, audited suppliers—eliminating guesswork through:

✅ On-Site Verification: Physical audits of supplier logistics infrastructure & shipping documentation

✅ Contract Validation: Legal review of “free shipping” terms (MOQs, destinations, incoterms)

✅ Real-Time Performance Tracking: 98.7% on-time delivery rate (2025 Pro List cohort)

Time & Risk Savings: Quantified

| Activity | Traditional Sourcing | SourcifyChina Pro List | Annual Savings per Category |

|---|---|---|---|

| Supplier Vetting (Hours) | 142 | 15 | 127 hours |

| Shipping Term Validation | 37 | 0 (Pre-verified) | 37 hours |

| Dispute Resolution (Incidents) | 4.2 | 0.3 | 3.9 fewer incidents |

| Total Risk-Adjusted Cost | $28,500 | $7,200 | $21,300 |

Source: SourcifyChina 2025 Client Impact Survey (n=187 procurement teams)

Your Strategic Advantage in 2026

The Pro List isn’t a directory—it’s a risk-mitigated procurement channel. Every supplier:

1. Meets your exact shipping requirements (e.g., “Free DDP to Rotterdam under $15k MOQ”)

2. Passes 12-point compliance checks (including financial stability & export licenses)

3. Integrates seamlessly with ERP systems via SourcifyChina’s API

“Using the Pro List cut our supplier onboarding from 11 weeks to 9 days. Zero shipping surprises in 14 months.”

— Head of Procurement, Tier-1 Automotive Supplier (Germany)

Call to Action: Secure Your Verified Supplier Access by Q1 2026

In 2026, procurement excellence hinges on verified supply chain integrity—not just cost. With rising logistics volatility and compliance demands, relying on unvetted “free shipping” claims is a strategic liability.

Act now to:

🔹 Eliminate 127+ annual hours wasted on supplier validation

🔹 Protect margins from hidden shipping costs

🔹 Accelerate time-to-market with pre-qualified logistics partners

Your Next Step:

📧 Email [email protected] with subject line: “Pro List Access Request – [Your Company Name]”

📱 WhatsApp +86 159 5127 6160 for urgent onboarding (24/7 procurement support)

Within 24 hours, you’ll receive:

✓ 3 tailored supplier matches with audited free shipping terms

✓ Full verification dossier (audit reports, contract samples, performance metrics)

✓ Dedicated sourcing consultant for seamless integration

Don’t gamble on “free shipping” in 2026. Source with certainty.

— SourcifyChina: Where Verification Meets Value

Note: Pro List slots are prioritized for procurement teams completing our 5-minute capability assessment. Start Assessment (Optional but recommended for fastest matching)

🧮 Landed Cost Calculator

Estimate your total import cost from China.