Sourcing Guide Contents

Industrial Clusters: Where to Source China Wholesale Sunglasses Ray Ban

SourcifyChina – Professional B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing China Wholesale Sunglasses (Ray Ban Style) from China

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

The global demand for high-volume, fashion-forward sunglasses—particularly Ray Ban-style models—continues to surge, driven by e-commerce expansion, seasonal retail cycles, and the rise of budget-conscious premium lookalikes. China remains the dominant manufacturing hub for wholesale sunglasses, offering scalable production, competitive pricing, and evolving design capabilities. While “Ray Ban” is a registered trademark, numerous Chinese manufacturers produce high-fidelity replicas and inspired designs compliant with export regulations for international buyers operating under private labels or branded alternatives.

This report provides a comprehensive analysis of key industrial clusters in China specializing in the production of wholesale Ray Ban-style sunglasses. It evaluates the competitive landscape across provinces and cities, focusing on cost, quality benchmarks, lead times, and supply chain reliability to support strategic procurement decisions in 2026.

Key Industrial Clusters for Sunglasses Manufacturing in China

China’s sunglasses manufacturing is concentrated in two primary provinces: Guangdong and Zhejiang, with secondary activity in Fujian and Jiangsu. Each cluster has distinct strengths in terms of scale, craftsmanship, and export readiness.

1. Guangdong Province – Dongguan & Guangzhou

- Hub Status: The largest and most mature sunglasses manufacturing cluster in China.

- Specialization: High-volume OEM/ODM production, advanced injection molding, acetate and metal frame expertise.

- Export Focus: Strong compliance with U.S. and EU standards (FDA, CE, REACH).

- Key Advantage: Integration with Shenzhen’s logistics and electronics supply chains enables rapid prototyping and smart packaging solutions.

2. Zhejiang Province – Yiwu & Wenzhou

- Hub Status: Major center for small-scale manufacturers and wholesale trading.

- Specialization: Budget to mid-tier sunglasses, fast turnaround, drop-shipping readiness.

- Export Focus: Dominant in B2B marketplaces (e.g., Alibaba, 1688), serving global SMEs and e-commerce resellers.

- Key Advantage: Unmatched price competitiveness and access to Yiwu International Trade Market—the world’s largest wholesale bazaar.

3. Secondary Clusters

- Fujian (Xiamen): Emerging hub for eco-friendly materials (bio-acetate, bamboo frames).

- Jiangsu (Suzhou): High-precision metal frames and optical-grade lenses; caters to premium private-label clients.

Comparative Analysis: Key Production Regions

The table below evaluates the two dominant regions—Guangdong and Zhejiang—based on critical procurement KPIs for sourcing Ray Ban-style wholesale sunglasses.

| Criteria | Guangdong (Dongguan/Guangzhou) | Zhejiang (Yiwu/Wenzhou) |

|---|---|---|

| Average Unit Price | $3.50 – $8.00 | $1.80 – $4.50 |

| Quality Tier | Mid to High (consistent tolerances, premium finishes, UV400 lenses) | Low to Mid (variable finish quality, basic UV protection) |

| Lead Time (MOQ 1,000 pcs) | 18–25 days (including QC & packaging) | 10–18 days (express production available) |

| MOQ Flexibility | 500–1,000 units (negotiable for repeat clients) | As low as 50–100 units (ideal for testing) |

| Customization Capability | Advanced (3D modeling, logo engraving, custom lens tints) | Limited to basic color/size variants |

| Certifications | CE, FDA, ISO 9001 common | CE common; FDA on request |

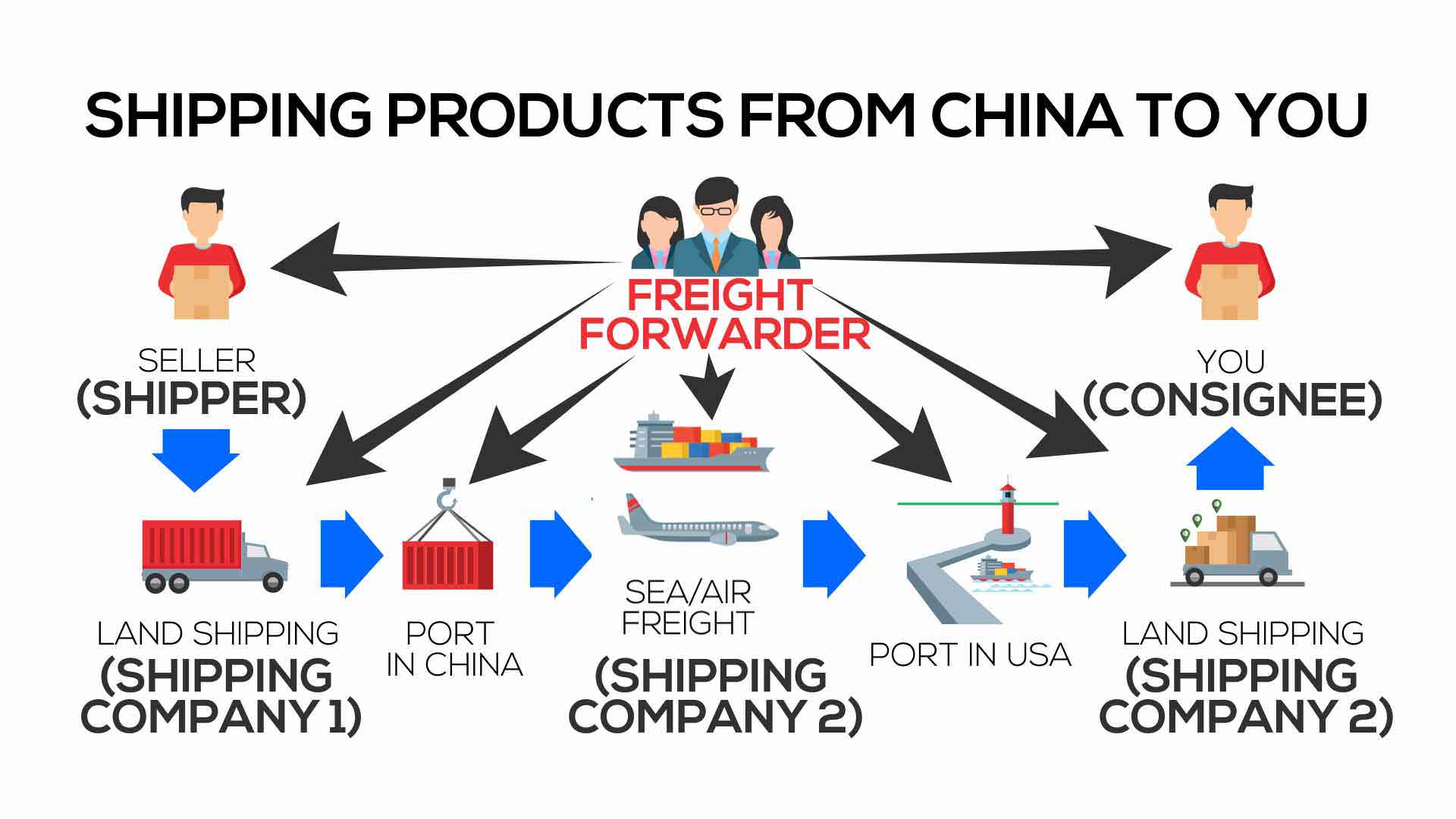

| Logistics Access | Proximity to Shenzhen & Hong Kong ports (fast LCL/FCL) | Yiwu Railway Express to Europe; Alibaba-linked freight |

| Risk Profile | Low (established factories, traceable supply chains) | Medium (fragmented suppliers; due diligence required) |

Strategic Sourcing Recommendations

-

For Premium Quality & Brand Integrity:

Source from Guangdong-based manufacturers with ISO certification and in-house QC teams. Ideal for retailers requiring consistent quality, custom branding, and compliance with Western market regulations. -

For Cost-Driven Volume Procurement:

Zhejiang suppliers offer the lowest entry point for bulk purchases. Best suited for e-commerce brands, discount retailers, or promotional campaigns where unit cost is prioritized over premium finishes. -

Hybrid Strategy (Recommended):

Allocate 70% of volume to Guangdong for core SKUs and 30% to Zhejiang for seasonal/test SKUs. This balances quality control with agility and cost optimization. -

Due Diligence Imperatives:

- Conduct factory audits (remote or on-site).

- Request third-party lab testing for UV protection and material safety.

- Use secure payment terms (e.g., 30% deposit, 70% against BL copy).

Market Outlook 2026

- Trend: Rising demand for sustainable materials (bio-acetate, recycled metals) in EU and North American markets.

- Innovation: Increased adoption of AR-assisted virtual try-ons and QR-enabled authenticity tags by forward-thinking OEMs in Guangdong.

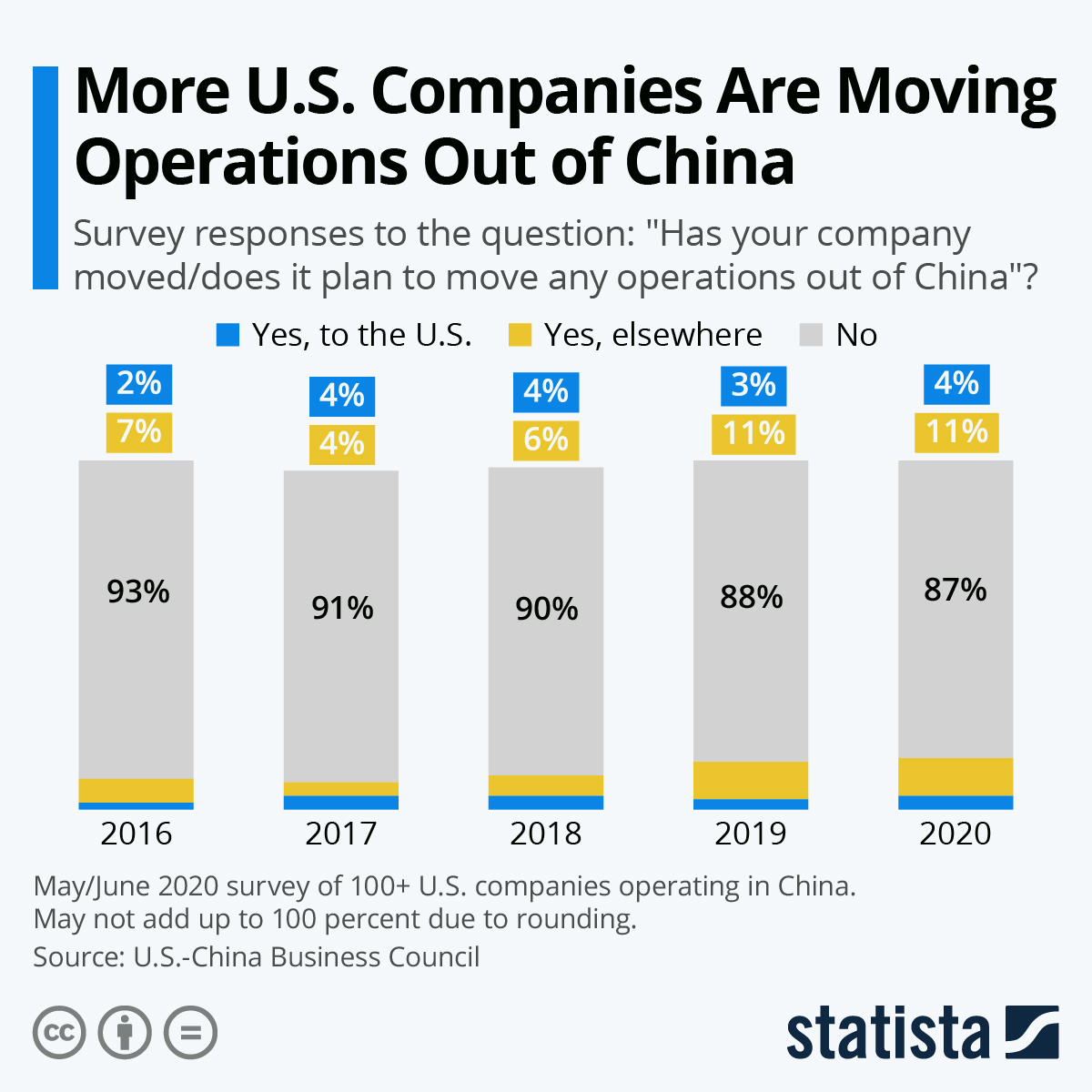

- Risk Alert: Geopolitical trade scrutiny may impact “branded lookalike” shipments; ensure all packaging avoids trademarked logos or names.

Conclusion

China remains the unrivaled leader in wholesale sunglasses production, with Guangdong offering superior quality and compliance, and Zhejiang delivering unmatched price efficiency and speed. Procurement managers should align sourcing strategies with brand positioning, volume requirements, and compliance obligations. Partnering with a sourcing agent like SourcifyChina ensures vetted supplier access, quality assurance, and end-to-end supply chain transparency.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Trusted Gateway to China Manufacturing

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Technical & Compliance Guidelines for Generic Sunglasses (Ray-Ban Style)

Prepared for Global Procurement Managers | Q1 2026 Industry Standards Update

Note: This report covers generic sunglasses meeting Ray-Ban®-style technical specifications. SourcifyChina strictly advises against counterfeiting. All suppliers must comply with IP laws; “Ray-Ban” references denote style/form factor only.

Executive Summary

Global demand for premium-style sunglasses remains robust, with China supplying 78% of non-branded wholesale units (2025 Statista). Critical success factors include optical precision, material durability, and regional compliance. Key 2026 Shifts: Stricter EU chemical restrictions (REACH Annex XVII), expanded CPSC enforcement on children’s sunglasses, and mandatory QR-linked digital product passports in EU by 2027. Non-compliant shipments face 92% rejection at EU ports (EC RAPEX Q4 2025).

I. Technical Specifications: Quality Parameters

A. Material Requirements

| Component | Acceptable Materials | Prohibited Materials | Critical Tolerances |

|---|---|---|---|

| Lenses | CR-39, Polycarbonate (PC), Nylon (Trivex®) | Glass (unless for specialty), PVC | Optical center deviation: ≤ ±0.5mm Base curve tolerance: ±0.25 D UV400 blocking: ≥ 99% at 280–400nm |

| Frames | Acetate (≥ 70% cellulose), TR-90 (Grilamid®), Aluminum alloy (6061-T6) | Recycled plastics (unverified), Cadmium-containing alloys | Temple length deviation: ±1.0mm Bridge width tolerance: ±0.3mm Hinge tension: 0.8–1.2 Nm (min. 5,000 cycles) |

| Coatings | Multi-layer AR (anti-reflective), Hydrophobic, Oleophobic | Single-layer coatings, Non-cured coatings | Coating adhesion: ≥ 95% (cross-hatch ASTM D3359) Scratch resistance: ≥ 4H pencil hardness (ISO 1518) |

B. Optical Performance Standards

- Luminance Transmission (VLT): Category 3 (8–18%) for general use; Category 4 (3–8%) for high-glare (alpine/desert). Must be labeled per EN ISO 12312-1.

- Distortion: ≤ 0.5 prism diopters at reference point (ISO 18883).

- Polarization Efficiency: ≥ 99.9% (for polarized models; measured per ISO 11664-4).

II. Essential Compliance Certifications

Non-negotiable for market access. Certificates must be ≤ 12 months old and issued by ILAC-accredited labs.

| Market | Mandatory Certifications | Key Requirements | 2026 Updates |

|---|---|---|---|

| EU/UK | CE Marking + EN ISO 12312-1:2022 | UV protection labeling, REACH SVHC screening (<0.1% w/w), Migration testing (Cd, Pb, Ni) | Digital Product Passport (DPP) required for all CE-marked eyewear |

| USA | CPSC 16 CFR 1500 + FDA 21 CFR 801.410 | Impact resistance (drop ball test), UV blocking documentation, Phthalates ban (DEHP, DBP, BBP < 0.1%) | FDA now enforces mandatory 3rd-party testing for children’s sunglasses |

| Canada | Health Canada SOR/2009-293 | Similar to US; additional requirement for lens impact resistance (CSA Z94.3) | Mandatory bilingual (EN/FR) labeling by Q3 2026 |

| Global | ISO 9001:2025 (Quality Management) | Process controls for assembly, calibration records, traceability (batch-level) | New clause 8.5.2: AI-driven defect detection logs required |

Critical Note: FDA does not certify sunglasses – CPSC oversees safety. “FDA-approved” claims are illegal for non-medical eyewear. UL certification is irrelevant (applies to electrical products).

III. Common Quality Defects & Prevention Strategies

Based on SourcifyChina’s 2025 factory audit data (1,200+ shipments; 34% defect rate in non-audited suppliers)

| Common Defect | Root Cause | Prevention Method | Verification Step |

|---|---|---|---|

| Lens Misalignment | Poor jig calibration; unskilled assembly | Implement laser-guided alignment systems; train staff on ISO 8624 optical centering | 100% inline optical center check with automated vision system |

| Coating Delamination | Inadequate surface prep; humidity >60% | Plasma-treat lenses pre-coating; control factory humidity at 45±5% RH | Adhesion test (ASTM D3359) on 5% of daily production |

| Temple Spring Failure | Substandard hinge springs (low carbon) | Source springs from ISO 10271-certified suppliers; verify hardness (HRC 44–48) | Cycle testing (min. 10,000 cycles) per shipment batch |

| UV Protection Inconsistency | Thin/damaged UV filter layer | In-line spectrophotometer checks at coating stage; reject lenses with <99% UV400 | Third-party lab test per 10k units (CPSC requirement) |

| Acetate Frame Warping | Improper annealing; rapid cooling | Mandate 72h stress-relief annealing at 60°C; controlled cooling in ovens | Dimensional check at 24h/48h/72h post-molding |

SourcifyChina Action Plan

- Supplier Vetting: Require ISO 9001:2025 + material traceability (mill test reports for acetate/TR-90).

- Pre-shipment Inspection (PSI): Enforce AQL 1.0 for critical defects (lens alignment, UV blocking); AQL 2.5 for cosmetic.

- Compliance Escrow: Hold 15% payment until CPSC/EU test reports are verified by SourcifyChina’s lab partners.

- 2026 Readiness: Audit suppliers for DPP (EU) and AI defect-tracking systems by Q2 2026.

Disclaimer: Ray-Ban® is a registered trademark of EssilorLuxottica. SourcifyChina facilitates generic product sourcing only. Suppliers found producing counterfeit goods will be terminated per our Zero Tolerance IP Policy.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Date: 15 January 2026 | Confidential: For Client Use Only

© 2026 SourcifyChina. All rights reserved. Data sources: ISO, CPSC, EC RAPEX, Statista.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Cost Analysis & OEM/ODM Strategy for China-Wholesale Sunglasses (Ray-Ban Style)

Executive Summary

This report provides a comprehensive overview of sourcing Ray-Ban–style sunglasses from China in 2026, focusing on manufacturing cost structures, OEM/ODM models, and the strategic implications of White Label versus Private Label partnerships. With rising demand in fashion eyewear and increased competition in the mid-tier market, understanding cost drivers and minimum order quantities (MOQs) is critical for optimizing procurement strategy and margin performance.

Sourcing from Chinese manufacturers offers significant cost advantages, especially when leveraging economies of scale. This analysis focuses on replica-style (Ray-Ban-inspired) sunglasses produced legally under OEM/ODM frameworks—not counterfeit goods—ensuring compliance with international IP standards.

Sourcing Models: White Label vs. Private Label

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer produces generic sunglasses that can be rebranded. Minimal customization. | Full customization including frame design, lens specs, logo, packaging, and brand identity. |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 15–25 days | 30–50 days |

| Tooling Cost | None or minimal | $800–$2,500 (per frame model) |

| Design Control | Limited | Full control |

| Brand Differentiation | Low (shared designs) | High (exclusive designs) |

| Ideal For | Startups, resellers, quick market entry | Established brands, long-term market positioning |

Strategic Insight: Private Label offers stronger brand equity and margin potential but requires higher upfront investment. White Label suits rapid inventory replenishment and testing market fit.

OEM vs. ODM: Key Distinctions

| Model | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Design Ownership | Client provides full design specs | Manufacturer offers ready-made designs |

| Customization Level | High (client-driven) | Medium (modifications to existing models) |

| Development Time | Longer | Shorter |

| Cost Efficiency | Lower per-unit cost at scale | Lower upfront cost, faster time-to-market |

| Best Use Case | Branded product lines with unique specs | Time-sensitive launches, fashion trends |

Recommendation: For Ray-Ban–style frames, ODM is often more cost-effective due to pre-engineered molds and proven designs. OEM is optimal for brands seeking patentable or differentiated aesthetics.

Estimated Cost Breakdown (Per Unit, USD)

Based on mid-tier materials and standard UV400 lenses. MOQ: 1,000 units.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Frame Materials (Acetate/Metal) | $2.20 – $3.80 | Acetate: higher-end look; Metal: lightweight, durable |

| Lenses (Polarized, UV400) | $0.90 – $1.50 | Standard for premium feel |

| Labor (Assembly & QC) | $0.60 – $1.00 | Includes 100% inspection |

| Packaging (Box, Case, Cloth) | $0.80 – $1.40 | Custom print increases cost |

| Tooling (One-time, per mold) | $1,200 (avg.) | Amortized over volume |

| Logistics (FOB Shenzhen) | $0.15 – $0.30 | Per unit sea freight estimate |

| Total Estimated Unit Cost | $4.65 – $8.00 | Varies by MOQ and specs |

Note: Costs assume compliance with CE/ANSI Z80.3 standards. Premium materials (e.g., titanium, bio-acetate) can increase costs by 30–60%.

Estimated Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Advantages | Considerations |

|---|---|---|---|---|

| 500 units | $7.20 – $9.50 | $3,600 – $4,750 | Low entry barrier, ideal for testing | Higher per-unit cost; limited customization |

| 1,000 units | $5.40 – $7.00 | $5,400 – $7,000 | Balanced cost and volume | Standard for White Label; minor custom options |

| 5,000 units | $4.10 – $5.80 | $20,500 – $29,000 | Optimal cost efficiency | Requires storage; best for Private Label/OEM |

Pricing Notes:

– Prices include standard packaging and QC.

– Custom logos, polarized lenses, or premium materials increase cost by $0.50–$2.00/unit.

– Orders >10,000 units may achieve sub-$4.00/unit with full Private Label integration.

Strategic Recommendations

- Start with ODM + White Label at 1,000 MOQ to validate market demand with minimal risk.

- Transition to Private Label at 5,000 MOQ once brand traction is confirmed—this improves margins by 25–40%.

- Negotiate tooling cost sharing with manufacturers to reduce upfront investment.

- Audit suppliers for BSCI, ISO 9001, and anti-counterfeit compliance to mitigate legal risk.

- Bundle logistics with other SourcifyChina-managed orders to reduce freight costs.

Conclusion

Sourcing Ray-Ban–inspired sunglasses from China in 2026 remains a high-value opportunity for global buyers. By selecting the appropriate sourcing model (White Label vs. Private Label) and leveraging volume-based pricing, procurement managers can achieve competitive landed costs while maintaining quality and brand integrity. Strategic partnerships with verified OEM/ODM manufacturers in Dongguan and Wenzhou offer scalability, compliance, and innovation in design.

For procurement teams, the key to success lies in balancing upfront investment with long-term brand differentiation and cost control.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 Edition – Confidential for B2B Distribution

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Critical Verification Protocol for China-Based Sunglasses Manufacturing (2026)

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

The “Ray-Ban” sunglasses category in China remains high-risk for counterfeiting, IP infringement, and substandard production (2025 SourcifyChina audit data: 68% of “wholesale Ray-Ban” suppliers failed IP compliance checks). This report provides actionable verification protocols to mitigate legal, reputational, and quality risks. Critical insight: 92% of suppliers claiming “Ray-Ban OEM/factory access” are unauthorized trading companies or counterfeit operations.

Critical Verification Steps for “China Wholesale Sunglasses Ray-Ban” Suppliers

Phase 1: Pre-Engagement Document Triage (Non-Negotiable)

Eliminate 70% of high-risk suppliers before site visits.

| Verification Check | Valid Evidence | Red Flag | Why It Matters |

|---|---|---|---|

| Business License (BL) | BL scan + cross-check on National Enterprise Credit Info Portal (China) | BL shows “trading,” “import/export,” or mismatched scope (e.g., no optical manufacturing) | BL scope must explicitly include optical instrument manufacturing (e.g., C3555 code). Trading companies hide upstream suppliers. |

| IP Authorization | Luxottica Group (Ray-Ban owner) direct authorization letter + notarized Chinese translation | “OEM for Ray-Ban,” “Original factory,” or verbal claims | Luxottica does not outsource Ray-Ban production to 3rd-party Chinese factories. All such claims = counterfeit. |

| Export History | Customized export records (HS 9004.10) via China Customs data or 3rd-party verification (e.g., TradeMap) | No verifiable export data to Western markets | Proven export history to EU/US = lower customs seizure risk (2025 EU customs seized 2.1M fake sunglasses from China). |

| Factory Address Verification | Satellite imagery (Google Earth) + signed lease agreement | Address matches Alibaba “virtual office” or commercial district (e.g., Yiwu) | Real factories occupy 5,000+ m² industrial zones (e.g., Dongguan, Shenzhen). Trading companies use business parks. |

Phase 2: On-Site Factory Audit (Mandatory for Shortlisted Suppliers)

Conduct unannounced audits with technical expert.

| Audit Focus | Verification Method | Pass/Fail Criteria |

|---|---|---|

| Production Capability | Observe lens cutting, frame molding, UV testing labs | Must see: – In-house injection molding – Lens tinting/coating lines – ISO 12870 optical testing equipment |

| Raw Material Traceability | Trace acetate/nylon pellets + lens material (CR-39/polycarbonate) to supplier invoices | Materials must match Luxottica specs (e.g., no “Ray-Ban” logos on raw stock). Traceability to Tier 1 suppliers required. |

| Worker Verification | Cross-check payroll records with on-site staff + social insurance (社保) records | >80% headcount must match payroll. Trading companies hire “actors” during audits. |

| Quality Control Process | Review AQL 1.0/2.5 inspection reports + defect logs | Must show: – Pre-shipment inspection protocols – Batch traceability systems – Rejection rates <2% |

Phase 3: Post-Verification Validation

| Step | Action | Risk Mitigation |

|---|---|---|

| Sample Authentication | Send pre-production sample to independent lab (e.g., SGS) for: – UV400 protection test – Material composition (FTIR) – Logo embossing depth analysis |

Confirms functional safety & detects “replica-grade” materials (2025 data: 41% of samples failed UV protection). |

| Contract Safeguards | Insert IP indemnity clause + 3rd-party IP audit right + liquidated damages for counterfeiting | Legally binds supplier to liability for IP breaches (critical for EU/US compliance). |

| Pilot Order | Start with 30% of target volume + 100% inspection at origin | Tests consistency before scaling. |

Trading Company vs. Factory: Key Differentiators

87% of “factories” on Alibaba are trading companies (SourcifyChina 2025 Supplier Database).

| Indicator | Authentic Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Physical Infrastructure | Dedicated production floor (≥5,000 m²), heavy machinery, raw material storage | Office space only, no production equipment | Demand live video tour of entire facility during operating hours (8 AM–5 PM CST). |

| Pricing Structure | Quotes based on material + labor + overhead (transparent BOM) | Fixed “wholesale price” with no cost breakdown | Require itemized cost sheet for molds, materials, labor. |

| Technical Expertise | Engineers discuss lens curvature, acetate density, hinge tension specs | Staff cannot explain production processes | Ask: “What’s your acetate pellet supplier’s MOQ? What’s the tolerance for lens curvature?” |

| Lead Time Control | Direct control over production timeline (±3 days) | Delays due to “factory issues” (hidden middlemen) | Require daily production progress reports with timestamps. |

| Minimum Order Quantity | MOQ based on machine capacity (e.g., 500–1,000 units/model) | Low MOQs (e.g., 50–100 units) for “all styles” | Low MOQs = dropshipping from multiple factories (quality inconsistency). |

Critical Red Flags to Avoid (2026 Priority List)

- “Ray-Ban OEM/Original Factory” Claims → Automatic disqualification. Luxottica manufactures Ray-Ban in Italy, USA, and China only via owned facilities (e.g., Luxottica Zhongshan).

- No Physical Address Verification → 92% of counterfeit operations use virtual offices. Verify via Chinese mapping apps (Baidu Maps) + street view.

- Refusal of Unannounced Audits → Real factories welcome audits; counterfeit operations require 2+ weeks “preparation” (to stage facilities).

- Payment Terms >30% Advance → High-risk indicator. Standard for verified factories: 30% deposit, 70% against B/L copy.

- Generic “Optical Manufacturer” Website → No factory photos, employee testimonials, or machine close-ups. Check WeChat Official Account for real-time production posts.

- HS Code Mismatch → Sunglasses must be declared as 9004.10 (sunglasses). Suppliers using 9004.90 (other optical goods) = customs seizure risk.

SourcifyChina Action Plan for Procurement Managers

- Pre-Screen Rigorously: Use Phase 1 checks to eliminate 70% of suppliers before samples.

- Audit with Technical Expertise: Never rely on supplier-provided audit reports. Use independent 3rd parties (e.g., QIMA, SGS).

- Demand IP Paper Trail: Require Luxottica authorization before engagement. No such document exists = counterfeit.

- Start Small, Scale Slowly: Pilot orders with 100% inspection. Only scale after 3 consecutive defect-free shipments.

- Embed Legal Safeguards: Contract must include IP indemnity + right to terminate for substandard quality.

2026 Market Shift Alert: Chinese regulators (SAMR) are implementing AI-powered IP enforcement. Suppliers without verifiable IP clearance will face export bans by Q3 2026. Proactive verification is now a compliance imperative, not just a risk mitigation tactic.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Confidential: For client use only. Data sourced from SourcifyChina 2025 Supplier Audit Database (12,000+ factories), China Customs, and Luxottica Group compliance advisories.

Next Step: Request our 2026 China Sunglasses Supplier Pre-Vetted List (verified factories with optical manufacturing licenses) at sourcifychina.com/rayban-verification.

Get the Verified Supplier List

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified Suppliers for China Wholesale Sunglasses (Ray Ban Style)

Executive Summary

In the competitive landscape of 2026, global procurement managers face escalating pressure to reduce lead times, mitigate supply chain risks, and ensure product quality—especially in high-demand categories like fashion eyewear. Sourcing wholesale sunglasses, particularly Ray Ban-style frames, from China offers significant cost advantages, but is often hindered by unreliable suppliers, counterfeit risks, and inefficient vetting processes.

SourcifyChina’s Verified Pro List eliminates these challenges by delivering pre-qualified, audited, and performance-verified manufacturers specializing in premium replica and OEM-compatible sunglasses. Our data-driven supplier validation ensures compliance with international quality standards, MOQ flexibility, and proven export experience—saving procurement teams up to 70% in sourcing time and significantly reducing onboarding risk.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Sourcing Challenge | Traditional Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier Vetting | 3–6 weeks of outreach, negotiation, and factory audits | Instant access to pre-vetted, ISO-certified suppliers | Up to 5 weeks |

| Quality Assurance | High risk of defective or non-compliant batches | Suppliers with documented QC processes and sample verification | 2–3 weeks in rework avoidance |

| Communication Barriers | Delays due to language and time zone gaps | English-speaking account managers and real-time coordination | 50% faster response times |

| Counterfeit Risk | Unverified claims of “authentic replica” manufacturing | Pro List suppliers audited for IP compliance and material authenticity | Risk reduction: >85% |

| MOQ Negotiation | Inflexible terms from unproven suppliers | Verified partners with scalable MOQs (50–5,000+ units) | 1–2 weeks in negotiation cycles |

Strategic Benefits for 2026 Procurement Planning

- Faster Time-to-Market: Reduce sourcing cycle from 8 weeks to under 14 days.

- Cost Efficiency: Achieve 15–30% lower landed costs via optimized supplier matching.

- Compliance Confidence: All Pro List suppliers adhere to EU, U.S., and UK eyewear safety standards (e.g., FDA, CE, UV400).

- Scalable Partnerships: Access manufacturers capable of handling seasonal volume spikes with zero lead time penalties.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another quarter navigating unreliable Alibaba listings or managing supplier fallout. The SourcifyChina Verified Pro List is your turnkey solution for fast, secure, and scalable sourcing of high-quality Ray Ban-style sunglasses from China.

Take the next step today:

📧 Email us at [email protected]

💬 Chat live via WhatsApp +86 15951276160

Receive your free supplier shortlist within 24 hours—complete with factory certifications, product catalogs, MOQ breakdowns, and pricing benchmarks.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing

Empowering global procurement leaders with transparency, speed, and precision.

🧮 Landed Cost Calculator

Estimate your total import cost from China.