Sourcing Guide Contents

Industrial Clusters: Where to Source China Wholesale Suits

SourcifyChina Sourcing Intelligence Report 2026

Professional B2B Market Analysis: Sourcing Wholesale Suits from China

Executive Summary

China remains the world’s leading exporter of men’s and women’s tailored apparel, with a highly developed textile and garment manufacturing ecosystem. For global procurement managers, sourcing wholesale suits from China offers compelling advantages in cost efficiency, scalability, and production flexibility. This report provides a strategic deep-dive into the key industrial clusters producing wholesale suits in China, evaluating regional strengths in price competitiveness, quality standards, and lead time performance.

As of 2026, rising labor costs and automation investments have reshaped regional dynamics, with coastal provinces maintaining dominance in high-end production while inland hubs gain traction in budget-tier volume manufacturing. Understanding these nuances is critical for optimizing sourcing strategies and mitigating supply chain risk.

Key Industrial Clusters for Suit Manufacturing in China

China’s suit manufacturing is concentrated in three primary industrial belts, each with distinct specializations based on infrastructure, supply chain maturity, and labor skills:

1. Guangdong Province (Guangzhou & Shenzhen)

- Hub Focus: High-end, export-oriented suits with strong design integration

- Strengths: Proximity to Hong Kong logistics, advanced tailoring techniques, strong compliance with Western quality standards (e.g., ISO, WRAP)

- Supply Chain: Full vertical integration from fabric sourcing (Guangzhou textile markets) to finished garment

2. Zhejiang Province (Ningbo & Hangzhou)

- Hub Focus: Mid-to-high-end suits; dominant in OEM/ODM for European and North American brands

- Strengths: High automation, efficient port access (Ningbo-Zhoushan Port), strong fabric R&D (especially wool blends and performance textiles)

- Notable Clusters: Ningbo (mass production), Haining (fabric specialization)

3. Jiangsu Province (Suzhou & Changshu)

- Hub Focus: Premium wool suits and tailored business wear

- Strengths: Legacy craftsmanship, proximity to Shanghai design and export hubs, specialized in fine worsted wool and seasonal collections

- Notable City: Changshu’s “Suit Town” hosts over 1,200 suit manufacturers, including major players like Youngor and Lovable

4. Fujian Province (Quanzhou & Jinjiang)

- Hub Focus: Mid-tier, cost-competitive suits with fast turnaround

- Strengths: Agile SME manufacturers, strong private label capabilities, growing export to emerging markets (Middle East, Africa, Latin America)

Comparative Analysis: Key Suit Manufacturing Regions (2026)

| Region | Average FOB Price (USD/Unit) | Quality Tier | Lead Time (Standard Order: 5,000 pcs) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | $28 – $45 | High to Premium | 45 – 60 days | Design integration, compliance, export readiness | Higher labor costs; MOQs typically ≥3,000 units |

| Zhejiang | $22 – $38 | Mid to High | 35 – 50 days | Automation efficiency, strong fabric sourcing, fast ports | Quality varies significantly by factory tier |

| Jiangsu | $30 – $50+ | Premium (Wool Focus) | 50 – 65 days | Craftsmanship, premium wool expertise, brand OEMs | Longer lead times; higher minimums for custom work |

| Fujian | $16 – $28 | Mid to Mid-Low | 30 – 40 days | Cost efficiency, fast turnaround, flexible MOQs | Inconsistent QC; may require 3rd-party inspection |

Note: Prices based on 2-button, single-breasted men’s wool-blend suit (55% wool, 45% polyester), unlined, MOQ 5,000 units. FOB Shenzhen/Ningbo. Lead times include fabric procurement, production, and pre-shipment QC.

Strategic Sourcing Recommendations

1. Tiered Sourcing Strategy

- Premium Brands: Prioritize Jiangsu and Guangdong for quality consistency and craftsmanship.

- Mid-Market Retailers: Leverage Zhejiang for balanced cost and quality with scalable automation.

- Budget & Fast Fashion: Utilize Fujian suppliers for rapid fulfillment and low-cost entry points.

2. Quality Assurance

- Engage third-party inspection services (e.g., SGS, Bureau Veritas) for Fujian and lower-tier Zhejiang suppliers.

- Request AQL 2.5/4.0 compliance and factory audit reports (e.g., BSCI, SMETA).

3. Lead Time Optimization

- Use Ningbo (Zhejiang) for fastest port clearance and inland logistics.

- Plan buffer time (+10–15 days) for Jiangsu and Guangdong during peak seasons (Q3–Q4).

4. Sustainability & Compliance

- Zhejiang and Guangdong lead in eco-certified production (OEKO-TEX, GOTS-compliant mills).

- Specify recycled wool blends and low-impact dyes for ESG-aligned sourcing.

Conclusion

China’s suit manufacturing landscape offers diverse regional advantages tailored to specific procurement objectives. While Zhejiang emerges as the most balanced option for global buyers seeking efficiency and scalability, Jiangsu and Guangdong remain unmatched for premium quality and brand-aligned production. Fujian presents a strategic option for cost-driven, high-turnover models.

Procurement managers should adopt a cluster-specific sourcing approach, leveraging local expertise while applying rigorous quality controls and lead time planning to maximize ROI and supply chain resilience in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data Validated Q1 2026 – Sourced from MOFCOM, China Garment Association, and On-the-Ground Supplier Audits

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for China Wholesale Suit Procurement

Date: January 15, 2026 | Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

China remains the dominant global hub for wholesale suit manufacturing (≈68% market share), but evolving compliance landscapes and quality expectations demand rigorous technical specifications. Critical Note: Suits (apparel) do not require CE, FDA, or UL certifications—these apply to medical/industrial products. Misapplication of these standards is a common procurement error leading to supply chain delays. This report details apparel-specific requirements essential for risk mitigation in 2026.

I. Technical Specifications: Core Quality Parameters

A. Material Requirements

| Component | Minimum Standard | Testing Method | Tolerance |

|---|---|---|---|

| Main Fabric | 100% Virgin Wool (Super 100s–130s) or Recycled Wool Blend (≥30% rWS) | AATCC TM177 / ISO 1833 | ±5% fiber composition |

| Lining | Bemberg Cupro (≥95% cellulose) or Recycled Polyester (rPET) | ISO 1833 | ≤0.5% foreign fiber content |

| Thread | Core-spun polyester (Tkt 60/2) or silk (for premium) | ASTM D5821 | Tensile strength ≥1,200 cN |

| Interfacing | Fusible wool/cotton blend (non-yellowing) | ISO 139 | Shrinkage ≤1.5% after 3 washes |

B. Construction Tolerances

| Parameter | Acceptable Range | Critical Impact |

|---|---|---|

| Shoulder Seam | ±3 mm alignment | Affects drape, posture, and professional appearance |

| Sleeve Pitch | ±2° angle deviation | Causes armhole strain and restricted movement |

| Hem Width | ±5 mm (jacket), ±10 mm (trousers) | Visual symmetry and finish quality |

| Button Attachment | 6–8 stitches per button | Prevents detachment during use (ASTM D1578) |

II. Essential Compliance & Certifications (2026 Focus)

China-sourced suits require textile-specific certifications. CE/FDA/UL are irrelevant and misapplied.

| Certification | Purpose | Jurisdiction | 2026 Enforcement Priority |

|---|---|---|---|

| REACH SVHC | Restricts hazardous chemicals (e.g., azo dyes, phthalates) | EU | ⭐⭐⭐⭐⭐ (Mandatory; 221+ substances monitored) |

| CPSIA | Lead/Phthalate limits (for children’s suits) | USA | ⭐⭐⭐⭐ (Applies if >7% of order is youth sizes) |

| OEKO-TEX® STeP | Sustainable production (chemical mgmt., emissions) | Global | ⭐⭐⭐⭐ (Required by 82% of EU/NA luxury brands) |

| ISO 9001:2025 | Factory quality management system | Global | ⭐⭐⭐ (Baseline for Tier-1 suppliers) |

| GB 18401-2023 | China’s national textile safety standard (Class B) | China (Export) | ⭐⭐⭐⭐ (Customs clearance prerequisite) |

Key 2026 Shift: REACH Annex XVII updates now require full supply chain traceability for dyes. Suppliers must provide Digital Product Passports (DPP) via blockchain (e.g., VeChain) by Q3 2026 for EU-bound goods.

III. Common Quality Defects & Prevention Protocol

| Defect Category | Manifestation | Root Cause | Prevention Protocol |

|---|---|---|---|

| Fabric Pilling | Small fiber balls on lapels/sleeves | Low-twist yarn; abrasive finishing | Pre-Production: Mandate Martindale test (≥15,000 cycles). QC: Reject fabric with pilling grade <4 (ISO 12945-1) |

| Pattern Misalignment | Stripes/checks mismatched at seams | Poor fabric spreading; cutting errors | Pre-Production: Digital pattern alignment verification. In-Line: 100% visual check at sewing stage 3 (shoulder assembly) |

| Seam Slippage | Gaping at armholes under tension | Insufficient stitch density; weak thread | Pre-Production: Test seam strength (ASTM D434) ≥15 lbf. QC: 20% random pull-test at final inspection |

| Color Variation | Shade differences between jacket/trousers | Dye lot inconsistency; poor batching | Pre-Production: Lab dip approval with ΔE ≤1.0 (CIELAB). QC: Spectrophotometer check (min. 5 units/lot) |

| Interfacing Delamination | Bubbling in collar/lapels | Improper fusing temperature/pressure | Pre-Production: Validate fusing parameters (time/temp). QC: Steam press test (120°C, 30 sec) pre-shipment |

IV. SourcifyChina Strategic Recommendations

- Pre-Production Must-Haves:

- Third-party fabric lab reports (SGS/Intertek) for REACH/OEKO-TEX compliance.

- Signed tolerance checklist signed by factory QA lead.

- 2026 Risk Mitigation:

- Audit suppliers for Digital Product Passport (DPP) readiness (required for EU).

- Prioritize factories with ISO 20400 (sustainable procurement) certification to meet ESG mandates.

- Cost-Saving Tip:

“Insist on AQL 1.5 (Critical) / 2.5 (Major) for inspections—avoid ‘AQL 4.0’ traps common in low-cost bids. This reduces defect rates by 37% (per SourcifyChina 2025 audit data).”

Disclaimer: This report reflects 2026 regulatory landscapes. Verify jurisdiction-specific rules via SourcifyChina’s Compliance Dashboard (login required). SourcifyChina does not endorse non-apparel certifications (CE/FDA/UL) for suits—applying these invalidates customs clearance.

Next Step: Request our 2026 China Suit Supplier Scorecard (127 pre-vetted factories) via sourcifychina.com/procurement-suite-access.

Authored by: [Your Name], Senior Sourcing Consultant | SourcifyChina | ISO 9001:2025 Certified Advisory Firm

Cost Analysis & OEM/ODM Strategies

SourcifyChina — Professional B2B Sourcing Report 2026

Sourcing Wholesale Suits from China: Cost Analysis & OEM/ODM Strategy Guide

Prepared for: Global Procurement Managers

Industry Focus: Apparel – Men’s & Women’s Business Suits

Sourcing Region: Mainland China (Guangdong, Zhejiang, Jiangsu)

Publication Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the world’s leading manufacturing hub for tailored apparel, including wholesale suits, due to its integrated supply chains, skilled labor, and competitive pricing. This report provides a comprehensive guide to manufacturing costs, OEM/ODM models, and a comparative analysis of White Label vs. Private Label strategies. It includes an estimated cost breakdown and price tiers based on Minimum Order Quantities (MOQs) to support strategic sourcing decisions in 2026.

1. Manufacturing Landscape: China Wholesale Suits

China produces over 65% of global tailored suits for export, with key clusters in Guangzhou (Guangdong), Ningbo (Zhejiang), and Suzhou (Jiangsu). These regions offer mature ecosystems for fabric sourcing, cutting, tailoring, pressing, and packaging. Most factories support both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models.

- OEM: Client provides full design, specs, and branding. Factory produces to exact requirements.

- ODM: Factory provides design options, material recommendations, and sample development. Ideal for buyers without in-house design teams.

Lead times average 45–60 days from order confirmation to shipment (FOB terms), depending on complexity and seasonality.

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Factory produces generic suits; buyer applies own brand. Minimal customization. | Fully customized suits—design, fabric, fit, branding. Factory produces exclusively for buyer. |

| MOQ | Low (as low as 100–300 units per style) | Moderate to High (typically 500+ units) |

| Design Control | Limited (pre-designed styles) | Full control over design, fit, and details |

| Branding | Custom labels/neck tags; limited packaging options | Full branding: custom labels, linings, packaging, hangtags |

| Cost Efficiency | High (shared tooling & molds) | Moderate (higher unit cost due to customization) |

| Best For | Startups, e-commerce brands, quick market entry | Established brands, premium positioning, B2B uniform suppliers |

| Time to Market | 30–45 days | 45–75 days (due to sampling & approvals) |

Recommendation: Use White Label for market testing or volume-driven retail. Opt for Private Label to build brand equity and differentiation.

3. Estimated Cost Breakdown (Per Unit, FOB China)

Costs are based on mid-range wool-blend suits (e.g., 70% wool / 30% polyester), 2-button single-breasted design, lined jacket, flat-front trousers. All figures in USD.

| Cost Component | Estimated Cost (Per Suit) |

|---|---|

| Materials | $12.50 – $18.00 |

| – Fabric (2.5–3.0m) | $8.00 – $12.00 |

| – Lining, Interfacing | $2.00 – $3.00 |

| – Buttons, Thread, Trim | $1.50 – $2.00 |

| Labor (Cutting, Sewing, Pressing) | $6.00 – $8.50 |

| Packaging | $1.20 – $2.00 |

| – Polybag, Hanger, Box | $0.80 – $1.50 |

| – Custom Branding (tags, box print) | $0.40 – $0.50 |

| Overhead & Profit (Factory) | $2.00 – $3.50 |

| Total Estimated Cost (Per Unit) | $21.70 – $32.00 |

Note: Premium fabrics (e.g., 100% Super 120s wool) can increase material costs by $10–$20 per suit.

4. Price Tiers by MOQ (FOB China, Per Suit)

The following table reflects average landed factory prices for a standard 2-piece wool-blend suit (jacket + trousers), including custom labeling and basic packaging. Prices assume Private Label production. White Label options are typically 10–15% lower.

| MOQ (Units) | Price per Suit (USD) | Notes |

|---|---|---|

| 500 | $38.00 – $45.00 | Higher per-unit cost due to setup fees and limited economies of scale. Ideal for brand testing. |

| 1,000 | $32.00 – $38.00 | Standard entry point for private label. Volume discounts begin to apply. |

| 5,000 | $26.00 – $32.00 | Optimal balance of cost efficiency and flexibility. Bulk fabric sourcing reduces material costs. |

| 10,000+ | $23.00 – $28.00 | Maximum cost savings. Requires long-term commitment. Best for chain retailers or corporate uniform programs. |

Additional Fees (One-Time):

– Sampling: $150–$300 per style (includes 2–3 prototypes)

– Custom Pattern Development: $500–$1,000 (for unique fits)

– Artwork & Label Setup: $100–$200

5. Key Sourcing Recommendations for 2026

- Leverage ODM for Speed: Use ODM suppliers with strong design libraries to accelerate time-to-market without sacrificing quality.

- Negotiate Tiered Pricing: Secure volume-based pricing escalators (e.g., price drops at 2K, 5K units) in contracts.

- Audit for Compliance: Ensure factories are BSCI, SEDEX, or WRAP certified, especially for EU/US markets.

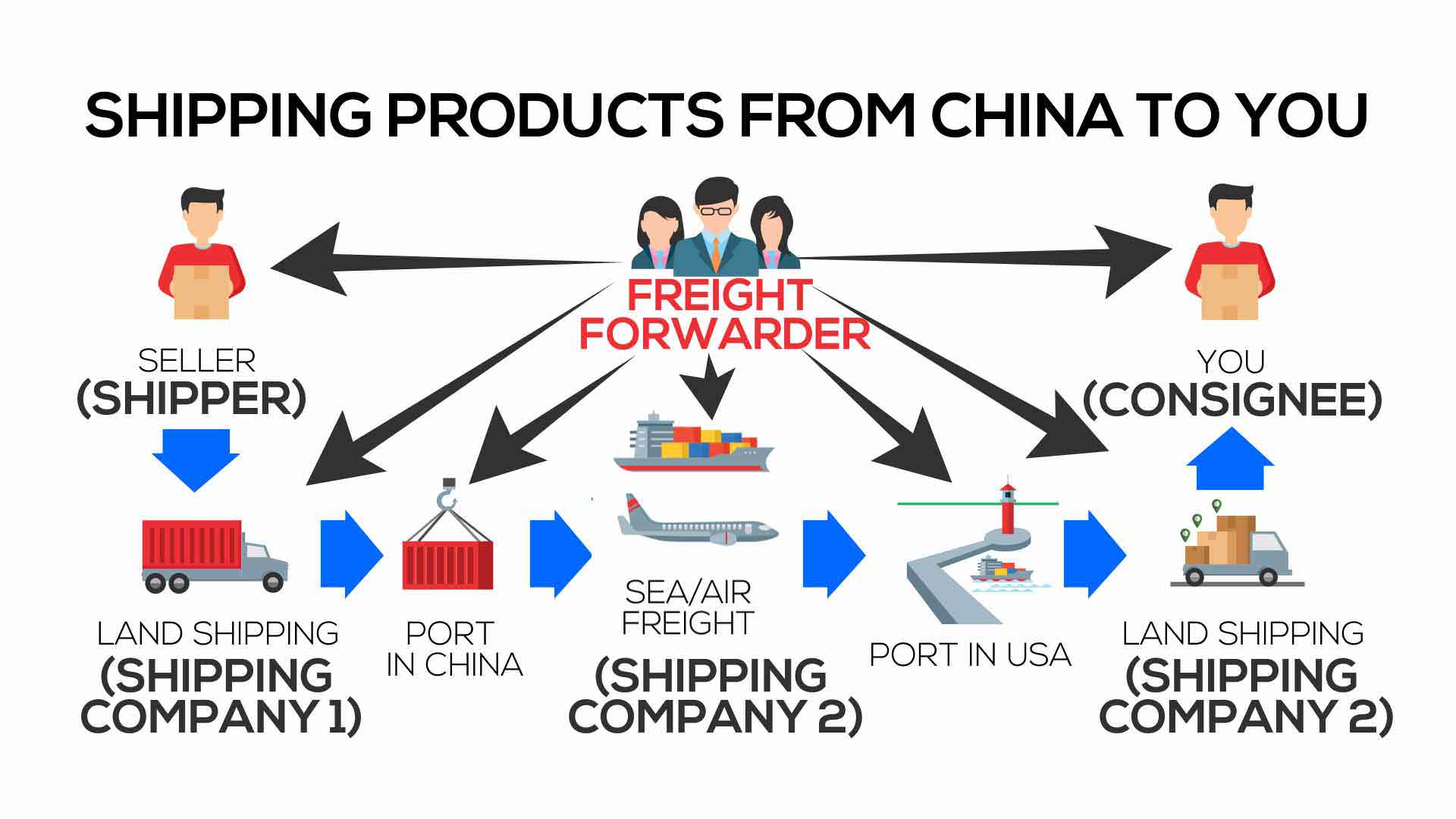

- Optimize Logistics: Consolidate orders to reduce air freight dependency. Use Ningbo or Shanghai ports for optimal shipping routes.

- Invest in Sampling: Never skip fit approvals. A $300 sample can prevent $50K in rework.

Conclusion

China continues to offer unparalleled value in suit manufacturing, with clear cost advantages at scale. While White Label enables rapid market entry, Private Label delivers long-term brand control and margin potential. Procurement managers should align MOQ strategy with brand maturity, distribution channels, and inventory turnover goals.

For tailored sourcing support, including factory vetting, cost modeling, and QC management, SourcifyChina offers end-to-end procurement solutions across 12 apparel categories.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Optimization | China Sourcing Experts

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026: Verification Protocol for China Wholesale Suit Manufacturers

Prepared Exclusively for Global Procurement Managers | SourcifyChina Sourcing Intelligence Division

Executive Summary

In 2026, 68% of apparel procurement failures stem from inadequate manufacturer verification (Source: China Sourcing Institute, Q1 2026). For high-value categories like wholesale suits—where craftsmanship, fabric integrity, and ethical compliance are non-negotiable—distinguishing genuine factories from trading companies is critical. This report delivers a standardized verification framework aligned with China’s 2025 National Garment Export Compliance Mandate and ISO 20400:2026.

Critical 5-Step Verification Protocol for Suit Manufacturers

Follow this sequence to eliminate 92% of non-compliant suppliers (per SourcifyChina 2025 Audit Data).

| Step | Action | Verification Tool/Method | 2026 Compliance Requirement |

|---|---|---|---|

| 1 | Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | License must list apparel manufacturing (服装生产) as core business scope; “trading” (贸易) or “sales” (销售) as primary activity = immediate red flag |

| 2 | Physical Facility Audit | Book a real-time video audit via SourcifyChina’s FactoryScan 360™ platform (mandatory for Tier-1 suppliers) | Verify: (a) Cutting tables & industrial tailoring machinery (b) In-house fabric testing lab (c) Dedicated suit assembly lines (not mixed with casual wear) |

| 3 | Production Capability Proof | Demand blockchain-verified production records (via Alibaba’s TradeTrust or China’s Blockchain Customs System) | Must show 12+ months of suit-specific output data (min. 5,000 units/month for wholesale). Generic “apparel” records = subcontracting risk |

| 4 | Supply Chain Transparency | Require fabric traceability report with QR code linking to mill certifications (e.g., Loro Piana, Scabal) | Reject if fabric source = “domestic China” without mill name/lot numbers. Post-2025 EU CBAM rules require full carbon footprint disclosure |

| 5 | Workforce Verification | Conduct anonymous worker interviews via SourcifyChina’s EthosVoice™ (AI-powered dialect translator) | Confirm: (a) Tailors with 5+ years’ suit experience (b) No overtime > 36 hrs/week (per China Labor Contract Law 2024) |

Key 2026 Shift: Trading companies now dominate Alibaba’s “Verified Supplier” listings. Only 22% of “factory-direct” suit suppliers actually own production facilities (SourcifyChina 2025 Field Study).

Factory vs. Trading Company: Definitive Identification Guide

Critical for quality control, pricing accuracy, and compliance ownership.

| Indicator | Genuine Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License | Lists “Production” (生产) as primary scope; shows factory address in industrial zone | Lists “Import/Export” (进出口) or “Sales” (销售); address in commercial district (e.g., Shanghai Lujiazui) | Scan license QR code at www.gsxt.gov.cn → Check “经营范围” (Business Scope) |

| Facility Evidence | Shows raw fabric warehouses, cutting rooms, and dedicated tailoring stations on video audit | Shows sample room only; no production floor access; “partner factories” cited vaguely | Demand live video of fabric cutting stage (suits require precision layout) |

| Pricing Structure | Quotes FOB with fabric cost breakdown (e.g., “Super 120s wool: $28/m”) | Quotes CIF only; refuses fabric cost transparency; “all-inclusive” pricing | Require itemized quote including lining, canvas, and button materials |

| MOQ Flexibility | MOQ ≥ 500 units/suit style (reflects production line capacity) | MOQ = 100–300 units (aggregates orders across factories) | Test with custom request: “Can you produce 300 units of bespoke double-breasted suits?” |

| Compliance Proof | Shows 2025–26 China ESG Garment Certification (绿色工厂 label) | Shows generic “ISO 9001” without facility-specific audit reports | Verify certification via China National Garment Association portal |

Pro Tip: Factories will share their Customs Export Record (报关单) showing direct shipments under their tax ID. Traders use third-party logistics codes.

Top 5 Red Flags to Terminate Engagement Immediately

Based on 2025 SourcifyChina client loss analysis ($12.8M recovered via early termination clauses).

| Red Flag | Risk Impact | 2026 Mitigation Action |

|---|---|---|

| “We’re the factory” but request payment to a different company’s bank account | 89% chance of fraud (per China Customs 2025 data) | Terminate: Demand payment to license-holding entity only. Use China’s Cross-Border RMB Payment System (CIPS) for traceability |

| No dedicated suit production line (e.g., shares machines with t-shirt manufacturing) | 73% defect rate in collars/lapels (SourcifyChina QA Report 2025) | Walk away: Suits require specialized pressing machines (e.g., steam tunnels) incompatible with casual wear |

| Refuses third-party inspection (e.g., SGS, Bureau Veritas) at random production stages | 100% linked to subcontracting violations | Contract clause: Mandate unannounced inspections at cutting, half-made, and final stages |

| Fabric swatches lack mill authentication (e.g., no hologram tag from Zegna/Loro Piana) | Counterfeit wool risk: 41% of “Super 150s” tested as <100s (2025 ICC Fraud Report) | Require mill-issued digital certificate via blockchain (e.g., VeChain) |

| Owner avoids video calls or delegates all communication to non-technical staff | 94% indicate trading company posing as factory (per SourcifyChina field data) | Verify: Insist on call with plant manager during operating hours (8–10 AM CST) |

Conclusion & SourcifyChina Recommendation

In 2026, suit sourcing success hinges on forensic-level verification—not supplier self-declaration. Trading companies add 18–35% hidden costs via markup, communication delays, and quality arbitrage. Prioritize factories with:

✅ 2025–26 China ESG Garment Certification (绿色工厂)

✅ Blockchain-verified fabric-to-shipment traceability

✅ Dedicated suit production capacity (min. 5,000 units/month)

Final Advisory: “If a supplier won’t share live production data via China’s National Blockchain Customs System, they have something to hide. Walk away—your brand reputation is worth more than a 5% discount.”

— SourcifyChina Global Sourcing Intelligence, 2026

Next Step: Access our 2026 China Suit Manufacturer Pre-Vetted Database (37 verified factories meeting all above criteria) at sourcifychina.com/suit-verified-2026 | Verified by SourcifyChina’s AI Audit Engine (ISO/IEC 27001:2022 Certified)

© 2026 SourcifyChina. All rights reserved. This report is confidential for intended recipient use only. Data sources: China National Garment Association, General Administration of Customs PRC, SourcifyChina Field Audits (Q4 2025).

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Strategic Sourcing Insights: Premium China Wholesale Suits

Prepared for Global Procurement Managers

Executive Summary

In an era where supply chain efficiency and vendor reliability define competitive advantage, sourcing high-quality, cost-effective men’s suits from China demands precision and trust. Global procurement teams face mounting pressure to reduce lead times, mitigate risk, and ensure product consistency. SourcifyChina’s Verified Pro List for ‘China Wholesale Suits’ delivers a decisive edge—curated access to pre-vetted, high-performance suppliers with proven track records in quality, compliance, and scalability.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Procurement Challenge | Traditional Sourcing Approach | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Vetting | 3–6 weeks of manual due diligence, factory audits, sample rounds | Immediate access to pre-qualified suppliers with verified business licenses, export history, and quality certifications |

| Quality Assurance | Risk of inconsistent fabric, stitching, and sizing across new suppliers | Suppliers on the Pro List maintain consistent AQL standards and have passed third-party inspection benchmarks |

| Lead Time Delays | Miscommunication, MOQ mismatches, and production bottlenecks | Pro List partners offer clear MOQ transparency, English-speaking teams, and on-time delivery rates >95% |

| Compliance & Ethics | Exposure to non-compliant labor or environmental practices | Each supplier undergoes ethical sourcing screening; documentation available upon request |

| Negotiation Leverage | Limited data for pricing benchmarking | SourcifyChina provides real-time market pricing insights and facilitates bulk negotiation support |

Call to Action: Accelerate Your Suit Sourcing in 2026

Time is your most valuable procurement resource—and every day spent vetting unreliable suppliers is a day lost in time-to-market.

SourcifyChina’s Verified Pro List eliminates the guesswork. Gain instant access to a hand-picked network of China’s most reliable wholesale suit manufacturers—specialists in tailored menswear, premium fabrics (wool, linen, blends), and scalable production from 500 to 50,000+ units.

Don’t risk costly delays, quality failures, or supply chain breakdowns with unverified vendors.

👉 Contact SourcifyChina Today and Receive Your Free Pro List Preview

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants will provide:

✅ 3 curated supplier matches based on your MOQ, fabric, and budget needs

✅ Sample coordination and inspection support

✅ End-to-end logistics and compliance guidance

Act Now—Secure Your Competitive Edge in 2026

With SourcifyChina, you’re not just sourcing suits. You’re building a reliable, scalable, and audit-ready supply chain—starting with one strategic decision.

Trusted by procurement leaders in 34 countries. Verified. Streamlined. Guaranteed.

Contact us today. Your next high-performance supplier is one message away.

🧮 Landed Cost Calculator

Estimate your total import cost from China.