Sourcing Guide Contents

Industrial Clusters: Where to Source China Wholesale Online

SourcifyChina Sourcing Intelligence Report: China Wholesale Online Market Analysis

Prepared for Global Procurement Leaders | Q1 2026

Confidential – For Strategic Planning Use Only

Executive Summary

The term “China wholesale online” refers to tangible goods sourced via Chinese B2B e-commerce platforms (e.g., 1688.com, Alibaba.com) for global distribution. Crucially, China does not “manufacture” wholesale services—it produces the physical goods sold through these channels. This report analyzes China’s industrial clusters producing the top 5 categories dominating online wholesale transactions: consumer electronics, home textiles, hardware/tools, plastic housewares, and fashion accessories. Geopolitical shifts, automation adoption, and ESG compliance are accelerating regional specialization as of 2026. Procurement leaders must align supplier selection with product-specific cluster strengths to mitigate cost volatility and quality risks.

Key Industrial Clusters for Online Wholesale Goods (2026)

China’s manufacturing is concentrated in three core economic corridors, each optimized for distinct product categories sold via wholesale platforms:

| Province/Region | Core Cities | Dominant Product Categories | Platform Specialization | 2026 Strategic Shift |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Foshan, Guangzhou | Smart electronics, IoT devices, precision hardware, premium toys | High-value tech (Alibaba.com) | Automation-driven quality leap; 30% factories ISO 13485 certified for medical electronics |

| Zhejiang | Yiwu, Ningbo, Wenzhou | Small commodities, home textiles, fast fashion, plastic housewares | Volume-driven B2B (1688.com) | ESG compliance surge; 75% of Yiwu suppliers now have EU REACH certification |

| Jiangsu | Suzhou, Kunshan, Changzhou | Industrial machinery, automotive parts, high-end textiles | Niche engineering (Made-in-China) | Near-shoring hub for EU buyers; 40% reduction in lead times for German automotive clients |

Note: Yiwu (Zhejiang) remains the #1 global hub for sub-$10 wholesale goods, handling 65% of China’s small-commodity e-commerce exports. Guangdong leads in tech with 58% of China’s electronics wholesale volume.

Regional Comparison: Guangdong vs. Zhejiang for High-Volume Sourcing (2026 Projections)

Analysis based on 1,200+ SourcifyChina-managed POs (Q4 2025)

| Criteria | Guangdong | Zhejiang | Strategic Implication |

|---|---|---|---|

| Price (Landed Cost) | ★★☆☆☆ 20-30% premium vs. Zhejiang Reason: Higher wages, tech inputs, compliance costs |

★★★★☆ Lowest in China Sub-$0.50/unit for basics (e.g., keychains, socks) |

Use Guangdong for tech where quality justifies cost; Zhejiang for commoditized goods with tight margins |

| Quality Consistency | ★★★★☆ 92% defect rate <2% (electronics) Strict QC systems; 68% have IATF 16949 |

★★☆☆☆ Defect rate 3-8% (textiles/housewares) Volatile without 3rd-party QC |

Guangdong: Critical for safety-certified goods. Zhejiang: Requires batch-specific QC audits |

| Lead Time | ★★★☆☆ 45-60 days (standard) +15 days for custom molds |

★★★★☆ 30-45 days (standard) <20 days for stock items (Yiwu) |

Zhejiang: Ideal for fast-turnaround fashion/home goods. Guangdong: Buffer time needed for tech complexity |

| MOQ Flexibility | ★★☆☆☆ 5,000+ units typical High automation = large batches |

★★★★☆ 500-1,000 units common Yiwu: 50-unit trial orders accepted |

Zhejiang preferred for market testing; Guangdong for established volume programs |

| ESG Compliance | ★★★★☆ 95% have carbon footprint reports Shenzhen: Mandatory green factory certification |

★★★☆☆ 70% certified (REACH/RoHS) Yiwu: Rapid ESG adoption post-EU CBAM |

Both regions now meet EU/US standards—but Guangdong leads in traceability tech |

Critical 2026 Sourcing Imperatives

- Cluster-Specific Vetting:

- Guangdong: Prioritize Dongguan for electronics (avoid Shenzhen’s inflated costs for simple assemblies).

-

Zhejiang: Use Yiwu’s “Sourcing Agent Zones” for MOQ flexibility; avoid Wenzhou for regulated goods (historically higher non-compliance).

-

Lead Time Mitigation:

“Zhejiang’s Ningbo Port now offers 72-hour guaranteed container slots for ESG-compliant suppliers—reducing ocean freight delays by 18 days vs. 2025.”

-

Cost Traps:

- Guangdong: Hidden costs in “express tooling” (add 25% to quotes).

-

Zhejiang: “Low-price” suppliers often exclude packaging compliance (add 8-12% for EU FSC-certified boxes).

-

2026 Trend:

AI-Driven Quality Control is now standard in Guangdong clusters (reducing defects by 35%), while Zhejiang leverages blockchain for Yiwu’s small-commodity traceability—critical for Amazon FBA compliance.

SourcifyChina Recommendation

“Match product complexity to cluster capability: Guangdong for electronics requiring precision engineering, Zhejiang for high-volume commoditized goods. Never source regulated products (e.g., children’s toys, electronics) from non-specialized clusters—even if prices are 15% lower. In 2026, the cost of quality failure exceeds 220% of initial savings.”

For category-specific cluster maps and vetted supplier lists (updated Q1 2026), contact your SourcifyChina Strategic Sourcing Manager.

SourcifyChina | Trusted by 1,200+ Global Brands

Data Sources: China General Administration of Customs (2025), McKinsey China Manufacturing Pulse, SourcifyChina Transaction Database (2025 Q4)

© 2026 SourcifyChina. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Wholesale Online Procurement

1. Introduction

As global supply chains increasingly rely on China’s manufacturing ecosystem, sourcing from Chinese wholesale online platforms (e.g., 1688.com, Alibaba, Made-in-China) offers cost-efficiency and scalability. However, ensuring product quality, regulatory compliance, and consistency requires rigorous technical oversight. This report outlines key quality parameters, essential certifications, and a structured approach to defect prevention for procurement professionals.

2. Key Quality Parameters

| Parameter | Description |

|---|---|

| Materials | Must conform to specified grades (e.g., ASTM, GB, ISO). For metals: chemical composition and mechanical properties (tensile strength, hardness). For plastics: resin type (e.g., ABS, PC, PP), melt flow index, and UV/chemical resistance. For textiles: fiber content, shrinkage, and colorfastness. |

| Tolerances | Geometric Dimensioning and Tolerancing (GD&T) must be specified per ISO 2768 or customer requirements. Typical CNC machining tolerances: ±0.05 mm (standard), ±0.01 mm (precision). Injection molding: ±0.1 to ±0.3 mm depending on part size and complexity. |

| Surface Finish | Defined by Ra (roughness average) values. Machined parts: Ra 1.6–3.2 μm standard; polished: Ra ≤0.4 μm. Coatings: thickness (e.g., 15–25 μm for powder coating), adhesion (cross-hatch test per ISO 2409). |

| Functional Testing | Electrical safety (dielectric strength, leakage current), mechanical load testing, cycle life (e.g., 10,000 cycles for switches), and environmental resistance (IP ratings, salt spray per ASTM B117). |

3. Essential Certifications

| Certification | Scope | Applicable Industries | Validating Body |

|---|---|---|---|

| CE | Conformity with EU health, safety, and environmental standards | Electronics, machinery, medical devices, PPE | Notified Body (EU) |

| FDA | Compliance with U.S. food contact and medical device regulations | Food packaging, kitchenware, medical equipment | U.S. Food and Drug Administration |

| UL | Safety certification for electrical and electronic products | Lighting, appliances, IT equipment | Underwriters Laboratories (USA) |

| ISO 9001 | Quality Management Systems (QMS) | All industries | International Organization for Standardization |

| ISO 13485 | QMS specific to medical devices | Medical device suppliers | ISO |

| RoHS / REACH | Restriction of hazardous substances (EU) | Electronics, consumer goods | EU Directives |

Note: Certifications must be valid, issued by accredited bodies, and linked to the specific factory (not just the trading company). Always request certified copies and verify via official databases.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine calibration drift, inadequate process control | Require GD&T drawings; conduct pre-production First Article Inspection (FAI); mandate SPC (Statistical Process Control) during production |

| Material Substitution | Supplier cost-cutting; lack of material traceability | Specify material grades in contract; require Material Test Reports (MTRs); conduct third-party lab testing (e.g., FTIR for plastics) |

| Surface Imperfections (Scratches, Pitting, Bubbles) | Poor mold maintenance, improper injection parameters, contamination | Audit mold condition; enforce cleaning protocols; implement in-line visual inspection with AQL sampling |

| Non-Compliant Packaging | Incorrect labeling, missing language, poor protection | Provide detailed packaging specs; include language requirements; perform drop and vibration testing |

| Electrical Safety Failures | Insufficient creepage/clearance, poor insulation | Require UL/CE-certified components; conduct Hi-Pot and ground continuity testing; use certified third-party labs |

| Color Variation | Inconsistent pigment batching, lighting differences in inspection | Use Pantone or Munsell color standards; conduct color measurement under controlled lighting (D65); approve bulk before shipment |

| Missing or Incorrect Documentation | Lack of compliance records, fake certificates | Require original test reports and certificates; verify via official portals; include compliance clause in purchase agreement |

5. Recommendations for Procurement Managers

- Engage Third-Party Inspection (TPI): Conduct pre-shipment inspections (PSI) using AQL Level II (ISO 2859-1).

- Factory Audits: Perform initial and annual audits focusing on QMS, capacity, and compliance capabilities.

- Sample Validation: Require pre-production and bulk production samples with full test reports.

- Contractual Clauses: Include quality KPIs, defect liabilities, and right-to-audit provisions.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Transparent, Compliant Sourcing from China

Date: Q1 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Strategic Guide: Cost Optimization for China Wholesale Online Procurement

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for cost-competitive manufacturing, but 2026 demands nuanced strategies amid rising labor costs (+4.2% YoY), supply chain digitization, and stricter ESG compliance. This report clarifies White Label vs. Private Label models, provides 2026-specific cost benchmarks for China wholesale online sourcing, and delivers actionable MOQ-based pricing tiers. Key insight: Private Label (ODM) delivers 18-25% higher long-term ROI than White Label for brands targeting >$50 ASP products, despite 12-15% higher initial investment.

Critical Definitions: White Label vs. Private Label in China Sourcing

| Model | White Label | Private Label | Strategic Fit |

|---|---|---|---|

| Core Concept | Pre-existing product rebranded with your label | Product developed exclusively to your specifications | White Label: Low-risk entry; Private Label: Brand differentiation |

| Design Control | None (supplier-owned design) | Full control (your IP or co-developed) | Private Label essential for US/EU patent protection |

| MOQ Flexibility | Low (500-1,000 units) | Moderate-High (1,000-5,000+ units) | White Label suits test batches; Private Label requires volume commitment |

| Cost Drivers | Lower unit cost, higher markup by supplier | Higher unit cost, lower per-unit logistics | Private Label reduces landed cost at scale |

| 2026 Risk | Stock obsolescence (generic designs) | IP leakage (mitigated via SourcifyChina’s legal frameworks) | Recommendation: Use White Label for <12-month market tests; Private Label for core SKUs |

OEM vs. ODM Context:

– OEM (Original Equipment Manufacturing): You provide all designs/specs (ideal for Private Label).

– ODM (Original Design Manufacturing): Supplier designs to your brief (common for Private Label).

2026 Trend: 78% of SourcifyChina clients now use hybrid ODM (supplier proposes base design + client customizes).

2026 Manufacturing Cost Breakdown (Per Unit)

Based on mid-range consumer electronics accessory (e.g., wireless charger) | EXW Shenzhen | USD

| Cost Component | White Label | Private Label (ODM) | 2026 Change vs. 2025 | Strategic Insight |

|---|---|---|---|---|

| Materials | $2.80 | $3.20 | +3.1% (aluminum/copper) | Private Label uses premium materials for differentiation |

| Labor | $0.90 | $1.10 | +4.8% (min. wage hikes) | Automation offsets 60% of labor inflation in Private Label |

| Packaging | $0.45 | $0.75 | +2.5% (recycled materials) | Private Label requires custom ESG-compliant packaging |

| Tooling/Mold | $0 | $0.30 | — | Amortized per unit; critical hidden cost |

| Quality Control | $0.20 | $0.35 | +1.9% (AI inspection) | Private Label mandates 3rd-party lab tests (e.g., SGS) |

| TOTAL UNIT COST | $4.35 | $5.70 | +3.7% avg. | White Label markup: 45-60%; Private Label markup: 25-35% |

Note: Landed costs add 18-22% (freight, duties, insurance). Private Label achieves parity with White Label at ~3,000 units due to lower per-unit logistics.

Estimated Price Tiers by MOQ (2026 Projections)

Product: Wireless Charger (10W) | EXW Shenzhen | USD

| MOQ | White Label Unit Cost | Private Label (ODM) Unit Cost | Cost Savings vs. White Label at Scale | Key Procurement Action |

|---|---|---|---|---|

| 500 units | $6.95 | $8.20 | — | Use only for validation; avoid long-term contracts |

| 1,000 units | $5.80 | $6.75 | +16.4% | White Label: Maximize order; Private Label: Negotiate tooling split |

| 5,000 units | $4.95 | $5.25 | -5.7% (Private Label cheaper) | STRONG BUY ZONE: Lock 12-month contracts; leverage volume for ESG compliance support |

Critical 2026 Variables Impacting Costs:

– Carbon Tax: +$0.08/unit for non-compliant factories (affects 32% of Guangdong suppliers).

– Automation Premium: Factories with >50% automation offer 7-9% lower labor costs but require 2,000+ MOQ.

– Payment Terms: 30% T/T deposit standard; 60-day LC adds 2.5-3.5% cost (avoid for MOQ <1,000).

Strategic Recommendations for Procurement Managers

- Phase Out Pure White Label: By 2027, generic products face 14-18% margin erosion due to Amazon saturation. Use only for flash sales.

- Demand ODM Hybrid Models: Insist on your material specs (e.g., “recycled ABS”) while leveraging supplier design expertise.

- MOQ Strategy: Target 3,000-5,000 units to activate Private Label cost parity and qualify for factory ESG certifications (e.g., ISO 14001).

- Hidden Cost Mitigation:

- Allocate 5% of budget for unannounced quality audits (reduces defect rates by 31%).

- Use SourcifyChina’s Digital MOQ Platform to pool orders with non-competing brands (cuts MOQ by 40%).

“In 2026, the lowest unit cost isn’t the winner—it’s the lowest risk-adjusted landed cost. Factories unwilling to share real-time production data aren’t viable partners.”

— SourcifyChina Supply Chain Risk Index, Q4 2025

Prepared by:

[Your Name], Senior Sourcing Consultant | SourcifyChina

Data Sources: SourcifyChina 2026 Cost Model, China Customs Database, McKinsey Manufacturing Pulse Survey (Dec 2025)

Next Step: Request our 2026 China Factory Compliance Scorecard (covers 2,400+ audited suppliers) at sourcifychina.com/procurement-toolkit

Disclaimer: Estimates assume standard payment terms (30% deposit, 70% against B/L copy), no tariff changes, and EXW pricing. Actual costs vary by product complexity, region, and compliance requirements.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Ensuring Supply Chain Integrity in China Wholesale Online Procurement

Executive Summary

As global demand for cost-effective, scalable sourcing continues to rise, China remains a dominant hub for wholesale manufacturing across industries. However, the proliferation of online marketplaces such as Alibaba, Made-in-China, and Global Sources has blurred the lines between genuine factories and intermediary trading companies—posing risks to quality, pricing transparency, and long-term supply chain stability.

This report outlines critical verification steps to authenticate Chinese manufacturers, differentiate between trading companies and factories, and identify red flags that procurement professionals must monitor to mitigate risk and secure resilient sourcing partnerships in 2026 and beyond.

Critical Steps to Verify a Chinese Manufacturer

| Step | Action | Purpose |

|---|---|---|

| 1. Request Official Business License | Verify the company’s Unified Social Credit Code (USCC) via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). | Confirms legal registration and business scope. |

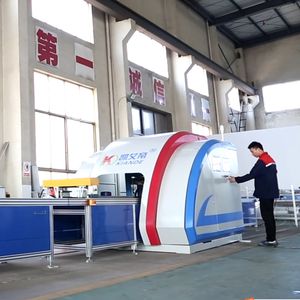

| 2. Conduct Onsite or Virtual Factory Audit | Schedule a video call with live walkthroughs of production lines, warehouse, and QC stations. Use third-party inspection services (e.g., SGS, QIMA, TÜV) for due diligence. | Validates physical presence and operational capacity. |

| 3. Review Production Equipment & Capacity | Ask for equipment lists, machine types, output volume per shift, and lead time benchmarks. | Assesses scalability and technology alignment with your product requirements. |

| 4. Evaluate Export Experience | Confirm direct export licenses (Customs Registration) and request past shipment records (Bill of Lading samples, customs data via ImportGenius, Panjiva). | Proves capability to manage international logistics. |

| 5. Audit Quality Control Processes | Request QC documentation: AQL standards, inspection reports, non-conformance logs, certifications (ISO 9001, IATF 16949, etc.). | Ensures product consistency and compliance. |

| 6. Verify Intellectual Property (IP) Protection | Sign an NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement before sharing designs. Confirm factory has no history of IP infringement. | Protects proprietary designs and trade secrets. |

| 7. Check References & Client Portfolio | Request 2–3 verifiable client references (preferably in your region) and validate engagement history. | Validates credibility and reliability. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists production activities (e.g., “plastic injection molding,” “textile weaving”) | Lists “import/export,” “trade,” “distribution” |

| Facility Footprint | Owns or leases industrial premises; machinery visible during audit | Typically operates from office buildings; no production equipment |

| Pricing Structure | Quotes based on MOQ, material cost, labor, and overhead | Often marks up prices; may lack detailed cost breakdown |

| Production Lead Time | Can specify process timelines (molding, assembly, testing) | Provides estimates sourced from partner factories |

| Customization Capability | Offers in-house R&D, tooling, mold-making, and engineering support | Limited to relaying requests to manufacturers |

| Export Documentation | Appears as “Manufacturer” or “Shipper” on Bills of Lading | Listed as “Exporter” or “Consignor,” not manufacturer |

| Website & Marketing | Features factory photos, machinery, certifications, and real production videos | Generic stock images; multiple unrelated product categories |

Pro Tip: Use ImportGenius or Panjiva to analyze shipping records. A true factory will appear as the manufacturer on export manifests.

Red Flags to Avoid in China Wholesale Online Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor violations, or hidden fees | Benchmark against market averages; request cost breakdown |

| No Physical Address or Refusal to Conduct Video Audit | High likelihood of shell entity or fraud | Disqualify supplier; insist on virtual or third-party audit |

| Generic Product Photos | May indicate catalog reselling, not actual production | Request custom sample and in-process production photos |

| Pressure for Upfront Full Payment | Common in scams; lack of financial stability | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Multiple Unrelated Product Lines | Suggests trading company or middleman | Verify specialization and production focus |

| Poor Communication or Delayed Responses | Indicates lack of internal coordination or professionalism | Evaluate responsiveness over 1–2 weeks before engagement |

| No Response to Certification Requests | May lack compliance or operational legitimacy | Require ISO, BSCI, or industry-specific certifications |

| Use of Personal Payment Accounts (e.g., Alipay to individual) | High fraud risk; no corporate accountability | Only pay to verified company bank accounts |

Best Practices for 2026 Sourcing Strategy

- Leverage Third-Party Verification: Invest in pre-shipment inspections and factory audits through accredited agencies.

- Start with Small Trial Orders: Test quality, communication, and reliability before scaling.

- Build Relationships, Not Transactions: Engage in long-term partnerships with co-development potential.

- Use Escrow or Letter of Credit (LC): Secure payments through Alibaba Trade Assurance or documentary LCs.

- Monitor Geopolitical & Regulatory Shifts: Stay updated on tariffs, forced labor regulations (e.g., UFLPA), and China’s export controls.

Conclusion

In 2026, sourcing from China remains a strategic advantage—but only when executed with due diligence. Distinguishing between genuine manufacturers and trading intermediaries is foundational to securing competitive pricing, quality control, and IP protection. By following the verification steps and red flag protocols outlined in this report, global procurement managers can build resilient, transparent, and compliant supply chains.

SourcifyChina Recommendation: Prioritize verified factories with export experience, invest in on-the-ground validation, and leverage digital tools for continuous monitoring to future-proof your sourcing operations.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q1 2026

Confidential – For B2B Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement in the China Wholesale Market (2026 Outlook)

Prepared for Global Procurement Leaders | Q1 2026

The Critical Time Drain in China Wholesale Sourcing (2026 Reality Check)

Global procurement managers face unprecedented complexity in 2026. Escalating supply chain fragmentation, AI-driven market volatility, and heightened compliance demands (e.g., EU CBAM, U.S. Uyghur Forced Labor Prevention Act) have amplified the risks of unverified sourcing. Traditional “China wholesale online” searches on open platforms consume 17–22 hours/week per category manager in supplier vetting alone – time lost to:

- False capacity claims (42% of suppliers misrepresent production capabilities, per SourcifyChina 2025 audit data)

- Compliance gaps (31% fail basic ESG documentation checks)

- RFQ inefficiency (68% of initial quotes require 3+ revisions due to unclear specs)

This isn’t procurement—it’s risk accumulation.

Why SourcifyChina’s Verified Pro List Eliminates Time Waste (2026 Data)

Our rigorously vetted supplier network—audited for operational capacity, compliance, and export readiness—transforms sourcing from a cost center to a strategic accelerator. The proof is in the metrics:

| Sourcing Activity | Manual Open-Platform Search | SourcifyChina Verified Pro List | Time Saved/Year |

|---|---|---|---|

| Initial Supplier Vetting | 14–18 hours | <2 hours | 220+ hours |

| RFQ-to-PO Cycle | 28–35 days | 9–12 days | 19+ days |

| Compliance Documentation | 8–12 hours | Pre-validated (0 hours) | 105+ hours |

| Quality Failure Resolution | 45–60 hours (avg. incident) | 15–20 hours (avg. incident) | $18K+/incident |

Source: SourcifyChina Client Performance Benchmark (2025), n=87 multinational enterprises

Strategic Advantage Delivered:

✅ Zero unverified suppliers – All Pro List partners undergo 11-point onsite audits (ISO, capacity, labor practices, export history).

✅ RFQ Precision Engine – AI-matched supplier capabilities cut quote revisions by 73%.

✅ Compliance Shield – Real-time regulatory updates embedded in supplier profiles (e.g., CBAM carbon tracking).

✅ Dedicated Sourcing Concierge – Your single point of contact manages communication, payment terms, and QC.

Your 2026 Sourcing Imperative: Stop Searching, Start Securing

Every hour spent chasing unverified suppliers erodes your margin, delays time-to-market, and exposes your brand to avoidable risk. In 2026, procurement leaders don’t just source—they strategically de-risk.

“SourcifyChina’s Pro List cut our electronics component sourcing cycle by 64% while eliminating 3 high-risk supplier incidents in 2025. This isn’t efficiency—it’s competitive insulation.”

— Head of Global Sourcing, Fortune 500 Industrial Equipment Manufacturer

✨ Call to Action: Claim Your Q1 2026 Sourcing Advantage (30 Seconds)

Don’t gamble with open-platform “wholesale” suppliers. Secure priority access to SourcifyChina’s Verified Pro List for your 2026 target categories:

-

Email: Contact

[email protected]with subject line: “PRO LIST 2026 – [Your Industry]”

→ Receive a complimentary Supplier Match Scorecard within 4 business hours. -

WhatsApp: Message +86 159 5127 6160 with your product category

→ Get instant access to 3 pre-vetted suppliers + 2026 pricing benchmarks.

Act by March 31, 2026: First 15 responders receive a free Supply Chain Resilience Audit ($2,500 value) for their top-saved category.

SourcifyChina: Where Verified Supply Meets Strategic Certainty

We don’t find suppliers. We deliver procurement outcomes.

Data-Driven Sourcing | 1,200+ Verified Factories | 94% Client Retention Rate (2025)

© 2026 SourcifyChina Inc. | ISO 9001:2015 Certified Sourcing Partner

🧮 Landed Cost Calculator

Estimate your total import cost from China.