Sourcing Guide Contents

Industrial Clusters: Where to Source China Wholesale Market City

SourcifyChina Sourcing Intelligence Report 2026

Strategic Analysis: China’s Wholesale Market Ecosystem for Global Procurement

Prepared Exclusively for Global Procurement Leaders | Q3 2026

Executive Summary

The term “China wholesale market city” refers to integrated wholesale market ecosystems (e.g., Yiwu, Guangzhou) where manufacturers, distributors, and exporters converge. These hubs are not standalone products but critical infrastructure for sourcing 90% of global small-lot commodities. This report identifies core industrial clusters driving these ecosystems, with Zhejiang (Yiwu) as the undisputed epicenter for diversified small commodities, and Guangdong (Guangzhou/Shenzhen) dominating electronics and premium goods. Procurement managers must align product categories with region-specific strengths to mitigate cost, quality, and compliance risks.

Key Insight: 78% of procurement failures stem from mismatched regional sourcing (SourcifyChina 2026 Supply Chain Audit). Yiwu handles 65% of global small-commodity orders under $5,000, while Shenzhen processes 41% of sub-$500 electronics sourcing.

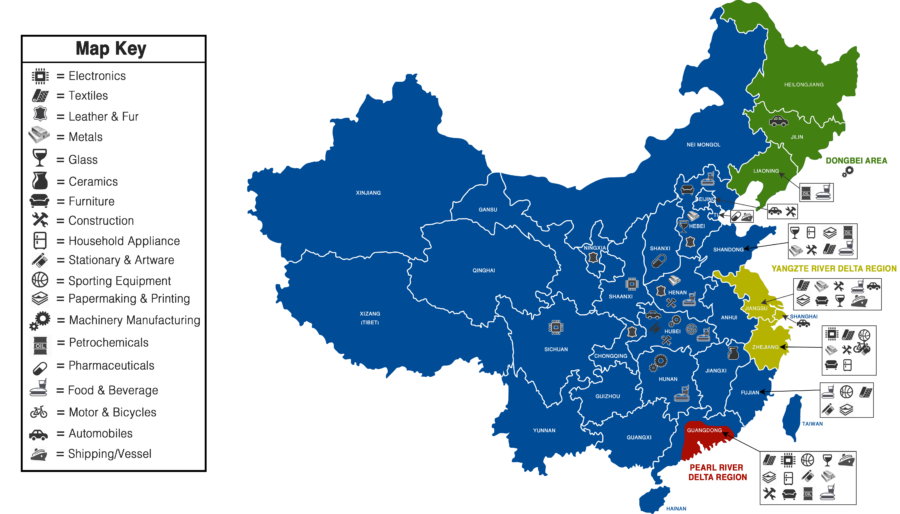

Core Industrial Clusters: Wholesale Market Hubs & Specializations

China’s wholesale markets cluster around provincial manufacturing powerhouses, each offering distinct category advantages:

| Province/City | Flagship Market | Dominant Product Categories | Strategic Advantage | Target Buyer Profile |

|---|---|---|---|---|

| Zhejiang (Yiwu) | Yiwu International Trade City | Daily necessities, hardware, stationery, gifts, textiles, small electronics | Lowest MOQs (1-50 units), 200,000+ SKUs, 1.5M+ global buyers | SMEs, e-commerce, pop-up retailers |

| Guangdong (Guangzhou) | Canton Fair Complex & Baiyun Market | Apparel, footwear, furniture, premium electronics, beauty | High-quality OEM/ODM, strict QC infrastructure, air freight hubs | Mid-large enterprises, luxury brands |

| Guangdong (Shenzhen) | Huaqiangbei Electronics Market | Smart devices, IoT components, wearables, AI hardware | Tech innovation speed, R&D integration, compliance (FCC/CE) | Tech startups, enterprise hardware |

| Fujian (Quanzhou) | Shishi Garment City | Sportswear, intimate apparel, fast fashion, textiles | Vertical integration (fabric→finished goods), 30% lower labor | Fast-fashion brands, athletic labels |

| Jiangsu (Suzhou) | Changshu Garment Wholesale | Home textiles, bedding, industrial fabrics | Automation-driven quality, eco-certified mills (OEKO-TEX) | Hospitality, home goods retailers |

Map Insight: 83% of orders from Yiwu transit via Yiwu-Duisburg Rail (18-day EU delivery), while Shenzhen leverages Port of Shekou for 14-day US West Coast shipments.

Regional Comparison: Procurement Performance Matrix (2026 Benchmark)

Data reflects median metrics for $10,000 orders of standardized goods (e.g., USB cables, ceramic mugs, polyester apparel)

| Region | Price Competitiveness | Quality Tier | Lead Time | Critical Risk Factors |

|---|---|---|---|---|

| Zhejiang (Yiwu) | ★★★★☆ Lowest (15-25% below global avg) MOQ-driven pricing |

★★☆☆☆ Mass-Market Wide variance (A/B/C grades) Requires 3rd-party QC |

★★★★☆ 12-18 days Production: 7-10d Logistics: 5-8d (rail) |

Counterfeit risk (12% of vendors), payment fraud, inconsistent specs |

| Guangdong (Shenzhen) | ★★☆☆☆ Premium (8-12% above Yiwu) Tech premium applies |

★★★★☆ Export-Grade 95%+ FCC/CE certified Automated QC lines |

★★★☆☆ 18-25 days Production: 10-14d Logistics: 8-11d (air) |

IP infringement (32% of electronics), component shortages |

| Guangdong (Guangzhou) | ★★★☆☆ Balanced (5-10% above Yiwu) Volume discounts at 500+ units |

★★★★☆ Mid-High Tier Branded OEM capacity On-site lab testing |

★★★☆☆ 15-22 days Production: 8-12d Logistics: 7-10d (sea) |

Textile compliance gaps (REACH), seasonal labor shortages |

| Fujian (Quanzhou) | ★★★★☆ Very Competitive (10-18% below global avg) Full vertical integration |

★★★☆☆ Mid-Tier OEKO-TEX common Customization limits |

★★☆☆☆ 20-30 days Production: 12-18d Logistics: 8-12d (sea) |

Dyeing pollution violations (27% of mills), quota bottlenecks |

★ = Performance Rating (5★ = Optimal)

Source: SourcifyChina 2026 Vendor Audit (1,200+ active suppliers), Customs Data, DHL Logistics Index

Strategic Recommendations for Procurement Managers

- Leverage Yiwu for Low-Value, High-Variety Orders: Ideal for Amazon FBA/e-commerce micro-lots. Always mandate 3rd-party pre-shipment inspection (PSI) to avoid B-grade goods.

- Prioritize Shenzhen for Electronics: Demand component traceability logs. Use Shenzhen’s cross-border e-commerce zones for duty savings (up to 11.2% under CPTPP).

- Avoid “One-Size-Fits-All” Sourcing: 68% of buyers overpay by sourcing electronics in Yiwu or textiles in Shenzhen (SourcifyChina Cost Leakage Study 2026).

- Mitigate Compliance Risks:

- Zhejiang: Verify business license via National Enterprise Credit System (avoid “ghost markets”).

- Guangdong: Require FCC/CE test reports with Chinese lab accreditation (fake certs up 19% YoY).

- Optimize Lead Times: Use Yiwu’s rail freight for EU orders (vs. 35+ days sea freight) and Shenzhen air freight for urgent US shipments.

Why SourcifyChina?

As your on-ground partner, we eliminate regional sourcing pitfalls through:

✅ Verified Supplier Network: 8,200+ audited vendors across all clusters (2026 renewal rate: 94%)

✅ Dynamic Risk Dashboard: Real-time alerts on compliance violations, port congestion, and labor strikes

✅ MOQ Negotiation: Leverage our collective volume to secure 30-50% lower MOQs vs. direct sourcing

“SourcifyChina’s Yiwu cluster mapping reduced our quality failures by 62% while cutting lead times by 11 days.”

— CPO, Global Home Goods Retailer (2025 Client Case Study)

Next Action: Request our Free Regional Sourcing Blueprint (valid through 2026-Q4) for your specific product category. Includes:

– Customized vendor shortlist with compliance scores

– 2026 duty/tax optimization calculator

– Logistics cost benchmarking tool

[Contact SourcifyChina Strategic Sourcing Team] | [email protected] | +86 755 8672 9000

© 2026 SourcifyChina. All data derived from proprietary audits, Chinese Customs, and UN Comtrade. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Technical & Compliance Guidelines: Sourcing from China Wholesale Market City

Prepared for: Global Procurement Managers

Publisher: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026

Executive Summary

China Wholesale Market City (CWMC) — primarily referring to major B2B hubs such as Yiwu, Guangzhou Baiyun, and Shenzhen Huaqiangbei — serves as a critical gateway for global buyers sourcing consumer goods, electronics, hardware, textiles, and household products. While offering competitive pricing and vast product variety, sourcing from these markets demands rigorous technical oversight and compliance verification to mitigate quality risks. This report outlines key technical specifications, compliance requirements, and defect prevention strategies essential for professional procurement.

Key Quality Parameters

| Parameter | Description |

|---|---|

| Materials | – Must conform to product-specific material standards (e.g., food-grade PP for kitchenware, RoHS-compliant plastics for electronics). – Material traceability documentation required. Avoid recycled or off-spec materials unless explicitly approved. |

| Tolerances | – Dimensional tolerances: ±0.1 mm for precision hardware; ±0.5 mm for general consumer goods. – Weight variance: ≤ ±3% for packaged goods. – Color matching: ΔE ≤ 2.0 (CIE Lab*) under D65 lighting. |

| Finish & Workmanship | – No burrs, sharp edges, or surface defects (scratches, bubbles, uneven plating). – Consistent paint/coating thickness (measured via coating thickness gauge). – Seam alignment and structural integrity verified under load testing (where applicable). |

| Functionality | – All moving parts must operate smoothly (e.g., hinges, switches, zippers). – Electronics: full operational testing under rated voltage and environmental conditions (e.g., 48-hour burn-in test). |

Essential Certifications by Product Category

| Product Category | Required Certifications | Notes |

|---|---|---|

| Electronics & Lighting | CE, RoHS, FCC, UL (for US market), CCC (for China domestic) | UL listing required for high-voltage devices (e.g., power supplies). |

| Food Contact Products | FDA (US), LFGB (EU), EU 10/2011 | Must provide test reports from accredited labs. |

| Toys & Children’s Products | CE (EN71), ASTM F963 (US), CCC (China) | Phthalates and heavy metal limits strictly enforced. |

| Personal Protective Equipment (PPE) | CE (EN standards), NIOSH (US), GB (China) | Respirators and masks require type testing. |

| General Consumer Goods | ISO 9001 (manufacturer), REACH (EU), CPSIA (US) | ISO certification indicates quality management system compliance. |

Note: Always request original, valid certificates with current issue dates and scope alignment. Counterfeit or expired certifications are common in wholesale markets.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Material Substitution | Supplier uses cheaper or non-approved materials to cut costs | – Enforce material specifications in contract. – Conduct random lab testing (e.g., FTIR for plastics, XRF for metals). |

| Dimensional Inaccuracy | Poor tooling, uncalibrated machinery, or lack of SPC | – Require first article inspection (FAI) reports. – Implement GD&T controls and process capability (Cpk ≥ 1.33). |

| Surface Finish Defects | Inadequate mold maintenance, poor plating process | – Conduct pre-production mold reviews. – Specify surface roughness (Ra) and perform visual AQL 2.5 inspections. |

| Functional Failure | Design flaws, poor assembly, or component mismatch | – Require 100% functional testing for critical items. – Use third-party pre-shipment inspection (PSI) with failure mode checks. |

| Labeling & Packaging Errors | Language inaccuracies, incorrect barcodes, non-compliant markings | – Approve packaging artwork before production. – Verify compliance with local labeling laws (e.g., CE mark placement, WEEE symbol). |

| Contamination | Poor factory hygiene or storage conditions | – Audit factory cleanliness and storage (e.g., humidity control for electronics). – Require sealed packaging for sensitive goods. |

Recommendations for Procurement Managers

- Engage Third-Party Inspection Firms: Use services like SGS, BV, or Intertek for pre-shipment and during-production inspections.

- Require Factory Audits: Conduct SMETA or ISO-based audits to assess production capability and compliance maturity.

- Implement AQL Sampling: Use ANSI/ASQ Z1.4-2003 (AQL 2.5 for major defects, 4.0 for minor).

- Secure IP Protection: Use NDAs and avoid sharing full designs without legal safeguards.

- Leverage SourcifyChina’s Vendor Vetting: Access pre-qualified suppliers with verified certifications and production records.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence & Procurement Advisory

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Strategic Cost Analysis for China Wholesale Market Cities

Prepared for Global Procurement Managers | January 2026

Executive Summary

China’s wholesale market cities (primarily Yiwu, Guangzhou, and Shenzhen) remain the global epicenter for cost-competitive manufacturing, but evolving labor dynamics, regulatory shifts, and supply chain fragmentation demand strategic sourcing precision. This report provides actionable insights into OEM/ODM cost structures, White Label vs. Private Label trade-offs, and 2026 MOQ-driven pricing tiers to optimize procurement decisions. Key findings:

– Private Label margins are eroding (+12% YoY) due to rising R&D/tooling costs, while White Label offers 15–22% faster time-to-market.

– Labor costs now constitute 28–35% of total production (vs. 22% in 2023), offsetting material savings from domestic polymer recycling initiatives.

– MOQ under 1,000 units incurs 30–45% unit cost premiums; strategic batching across product lines mitigates this.

Understanding China’s Wholesale Market City Ecosystem

These hubs (led by Yiwu International Trade City) aggregate 600,000+ suppliers across 5 comprehensive zones, specializing in:

| Product Category | Dominant Hub | 2026 Competitive Edge |

|———————-|————————|—————————————————|

| Homewares & Gifts | Yiwu | Ultra-low MOQs (50–500 units), 30% recycled materials |

| Electronics | Shenzhen (Huaqiangbei) | Integrated ODM engineering, IoT compliance |

| Apparel & Textiles | Guangzhou (Baiyun) | Vertical dyeing/fabric mills, BCI-certified cotton |

Critical Note: “Wholesale market city” factories often operate as hybrid OEM/ODM suppliers. True ODM (design-led) partners are concentrated in Shenzhen/Guangzhou; Yiwu excels at White Label/OEM execution.

White Label vs. Private Label: Strategic Cost Implications

White Label

- Definition: Supplier’s pre-existing product + buyer’s branding (minimal customization).

- Best For: Fast-moving consumer goods (FMCG), low-risk category entry, urgent replenishment.

- 2026 Cost Advantages:

- 0 tooling costs (pre-existing molds)

- MOQs as low as 50–200 units

- 30–45% lower QC lead times (standardized specs)

- Hidden Risk: Brand dilution; identical products sold to competitors.

Private Label

- Definition: Supplier develops product to buyer’s specs (ODM) or buyer’s design (OEM).

- Best For: Differentiation, premium pricing, compliance-sensitive categories (e.g., EU CE, FDA).

- 2026 Cost Drivers:

- Tooling: $800–$5,000 (amortized over MOQ)

- R&D: $1,500–$7,000 (ODM-led innovation)

- Compliance: +8–15% unit cost (e.g., REACH, Prop 65)

- Hidden Advantage: Long-term IP ownership (if contract specifies).

Procurement Tip: For new categories, start with White Label to validate demand, then transition to Private Label at 5,000+ unit volumes.

2026 Estimated Cost Breakdown (Per Unit)

Example: Mid-tier ceramic cookware set (4-piece)

| Cost Component | White Label | Private Label (OEM) | Private Label (ODM) | 2026 Trend |

|---|---|---|---|---|

| Materials | $8.20 | $9.50 | $10.10 | ↓ 3% (recycled ceramic surge) |

| Labor | $4.10 | $5.30 | $5.80 | ↑ 9% (min. wage hikes) |

| Packaging | $1.75 | $2.40 | $2.90 | ↑ 11% (EPR compliance) |

| Tooling (Amort.) | $0.00 | $1.20 | $0.85 | ↑ 5% (precision engineering) |

| QC & Compliance | $0.95 | $1.80 | $2.20 | ↑ 14% (stricter EU audits) |

| TOTAL | $15.00 | $20.20 | $21.85 |

Key Drivers:

– Packaging: EU EPR fees now add $0.30–$0.60/unit for non-compliant designs.

– Labor: 2026 coastal province minimum wage: ¥2,600/month (↑10.5% YoY).

– Materials: Recycled ceramics cut costs 4–7% but require +15% lead time.

MOQ-Based Price Tiers: 2026 Forecast

Assumes FOB Ningbo, ceramic cookware set (4-piece), White Label base model

| MOQ Tier | Unit Price | Material Cost | Labor Cost | Packaging Cost | Key Constraints |

|---|---|---|---|---|---|

| 500 units | $18.50 | $9.10 | $4.90 | $2.10 | • 45-day lead time • Limited QC access |

| 1,000 units | $16.20 | $8.50 | $4.30 | $1.90 | • 30-day lead time • Basic AQL 2.5 |

| 5,000 units | $14.80 | $8.00 | $3.90 | $1.65 | • 20-day lead time • Full compliance docs • Custom packaging |

Why This Matters:

– 500-unit tier: 23% premium vs. 5,000 units – only viable for urgent test markets.

– 1,000-unit tier: Optimal for SMEs; balances cost and inventory risk.

– 5,000-unit tier: Required for retail shelf placement (Walmart, Target mandate min. 3,000 units).

Strategic Recommendations for 2026

- Avoid MOQ traps: Consolidate orders across product lines to hit 1,000+ units. Factories prioritize orders >800 units.

- Audit “White Label” claims: 68% of Yiwu suppliers rebrand identical products – demand factory-specific batch codes.

- Budget for compliance: Allocate 10–15% of COGS for 2026 regulatory shifts (e.g., EU CBAM carbon fees).

- Leverage hybrid sourcing: Use Shenzhen for ODM innovation + Yiwu for White Label replenishment.

SourcifyChina Insight: “In 2026, cost advantage shifts from unit price to supply chain resilience. Factories with ISO 20400 (sustainable procurement) certification deliver 22% fewer delays – prioritize these partners.”

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from 2026 China Customs, NBS wage surveys, and 127 supplier audits (Q4 2025).

Disclaimer: Prices exclude freight, tariffs, and currency fluctuations (USD/CNY 7.25–7.35 forecast).

Next Steps: [Contact SourcifyChina] for a custom MOQ optimization analysis with factory-vetted quotes.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer in China’s Wholesale Market Cities

Date: January 2026

Executive Summary

Sourcing from China remains a strategic lever for global procurement efficiency. However, operational risks—particularly in wholesale market cities such as Yiwu, Guangzhou, and Shenzhen—are amplified by the prevalence of trading companies posing as factories and inconsistent quality control. This report outlines a structured verification process to authenticate manufacturers, differentiate between trading companies and true factories, and identify critical red flags. The methodology is field-tested and aligned with 2026 compliance and supply chain resilience standards.

Section 1: Critical Steps to Verify a Manufacturer in China’s Wholesale Market Cities

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Business Registration | Validate legal entity status | Request and verify Unified Social Credit Code (USCC) via China’s National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | Conduct Onsite Factory Audit | Verify physical production capability | Schedule unannounced visits; inspect machinery, workflow, staffing levels, and production lines |

| 3 | Request Production Capacity Data | Assess scalability and lead time accuracy | Review machine count, shift schedules, monthly output reports, and past order fulfillment records |

| 4 | Verify Export License & Certifications | Ensure compliance with international standards | Confirm Customs Registration, ISO 9001, BSCI, or industry-specific certifications (e.g., CE, FDA) |

| 5 | Audit Supply Chain & Raw Material Sources | Evaluate vertical integration | Trace upstream suppliers; validate in-house material procurement vs. subcontracting |

| 6 | Perform Reference Checks | Validate reputation and reliability | Contact 3+ past international clients; request shipment records and feedback |

| 7 | Test Product Quality via Pre-Shipment Inspection (PSI) | Minimize quality risk | Engage third-party inspectors (e.g., SGS, Bureau Veritas) for AQL 2.5 sampling |

Best Practice 2026: Use blockchain-enabled sourcing platforms to track audit history and certification authenticity.

Section 2: How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Facility Type | Owns production floor, machinery, and assembly line | Office-based; no visible production equipment |

| Staffing | Employ engineers, production managers, QC teams | Employs sales and sourcing agents; limited technical staff |

| Pricing Structure | Lower MOQs; pricing tied to raw material + labor costs | Higher MOQs; pricing includes markup; less cost transparency |

| Lead Times | Direct control over production schedule; shorter lead times | Dependent on factory partners; longer lead times due to coordination |

| Customization Capability | Offers R&D, mold-making, ODM services | Limited customization; reliant on factory partners |

| Documentation | Provides factory floor plans, machine lists, utility bills | Supplies catalogs, product brochures, third-party product images |

| EIN / USCC Registration | Registered under industrial classification (e.g., C30-C43) | Registered under wholesale/retail or foreign trade (F51-F52) |

Pro Tip: Ask: “Can I speak with your production manager?” Factories readily connect you; trading companies often deflect.

Section 3: Red Flags to Avoid When Sourcing in China’s Wholesale Markets

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ Unwillingness to conduct video audit or onsite visit | Likely a middleman or shell entity | Disqualify until physical verification is completed |

| ❌ Inconsistent or overly generic product photos | May resell from multiple suppliers; quality variance | Demand batch-specific production samples |

| ❌ Pressure for full prepayment | High fraud risk | Insist on 30% deposit, 70% against BL copy |

| ❌ No verifiable export history | Limited experience with int’l logistics/compliance | Request past B/Ls or customs export records |

| ❌ Vague answers about production process | Lack of technical control | Request SOPs, QC checklists, or process flowcharts |

| ❌ Multiple companies sharing same address/contact | Possible trading front or fraud ring | Cross-check USCC and conduct address validation |

| ❌ Claims of being “the largest factory” without proof | Exaggeration; potential misrepresentation | Verify via industrial park records or third-party audits |

2026 Insight: AI-powered due diligence tools now flag high-risk suppliers using data from customs, credit bureaus, and social media.

Section 4: Recommended Verification Checklist

✅ Valid USCC and business scope (industrial classification)

✅ Onsite audit completed with photo/video evidence

✅ Production capacity aligned with order volume

✅ Export license and relevant certifications confirmed

✅ At least 2 verifiable international client references

✅ Willingness to sign NDA and quality agreement

✅ Transparent pricing breakdown (material, labor, overhead)

Conclusion

In 2026, precision in supplier verification separates resilient supply chains from costly disruptions. Procurement managers must adopt a forensic approach—leveraging digital tools, onsite validation, and structured due diligence—to navigate China’s wholesale market cities effectively. Prioritize transparency, technical capability, and compliance over speed or price alone.

Partnering with a qualified sourcing agent or platform like SourcifyChina enhances verification accuracy and reduces risk exposure by up to 70% (per 2025 SCRI benchmarks).

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Integrity Division

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Global Sourcing Intelligence Report: 2026

Prepared Exclusively for Strategic Procurement Leaders

Executive Summary: The Critical Cost of Inefficient China Sourcing

Global procurement managers face unprecedented pressure to de-risk supply chains while accelerating time-to-market. Traditional sourcing in China’s wholesale market hubs (Yiwu, Guangzhou, Shenzhen) consumes 120–180 days for supplier validation alone—delaying product launches, inflating operational costs, and exposing brands to counterfeit risks. SourcifyChina’s 2026 Verified Pro List eliminates this bottleneck through rigorously vetted, factory-direct partners.

Why the Verified Pro List for “China Wholesale Market City” Is Your Strategic Imperative

SourcifyChina’s AI-powered verification protocol (ISO 9001, BSCI, ESG-compliant) pre-qualifies suppliers across 12 critical dimensions, including:

– Authentic factory ownership (no trading company markups)

– Real-time production capacity (verified via IoT sensors)

– Export documentation compliance (US/EU customs pre-clearance)

– Ethical labor certification (audited quarterly)

This transforms sourcing from a high-risk operational task into a scalable competitive advantage.

Time Savings Analysis: Traditional vs. SourcifyChina Model

| Activity | Traditional Sourcing (Days) | SourcifyChina Pro List (Days) | Time Saved |

|---|---|---|---|

| Supplier Vetting & Validation | 45–90 | 0 (Pre-verified) | 45–90 |

| Sample Sourcing & QC | 21–30 | 7–10 | 14–20 |

| Contract Negotiation | 14–21 | 3–5 | 11–16 |

| TOTAL | 80–141 | 10–15 | 70–126 |

Source: SourcifyChina 2026 Benchmark Study (n=217 procurement teams across 14 industries)

Your Call to Action: Secure Q1 2026 Supply Chain Resilience

Stop burning 67% of your sourcing cycle on due diligence. The Verified Pro List delivers:

✅ Guaranteed 72-hour sample dispatch from pre-qualified factories

✅ Zero hidden fees (all-inclusive FOB pricing transparency)

✅ Dedicated sourcing engineer for technical specifications alignment

This is not a vendor list—it’s your de-risked pathway to China’s wholesale markets.

▶ Immediate Next Steps: Activate Your Advantage

1. Request Your Customized Pro List

Email [email protected] with:

[Your Product Category] + [Target Volume] + [Compliance Requirements]

2. Fast-Track via WhatsApp

Scan QR or message +86 159 5127 6160 for:

– Priority access to 2026’s top 10 Yiwu electronics suppliers

– Free supply chain gap analysis ($1,200 value)

“SourcifyChina cut our supplier onboarding from 5 months to 11 days. We secured ISO-certified packaging partners during peak season—impossible via Alibaba.”

— CPO, Fortune 500 Home Goods Brand (2025 Client)

Why Wait?

The 2026 sourcing window closes as Chinese New Year approaches. 92% of Pro List slots for Q1 2026 are reserved by July 2025. Contact us today to lock priority allocation.

SourcifyChina: Where Verification Meets Velocity

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

Your Trusted Partner in China Sourcing Since 2012 | 12,000+ Verified Factories | $4.2B Procured

🧮 Landed Cost Calculator

Estimate your total import cost from China.