Sourcing Guide Contents

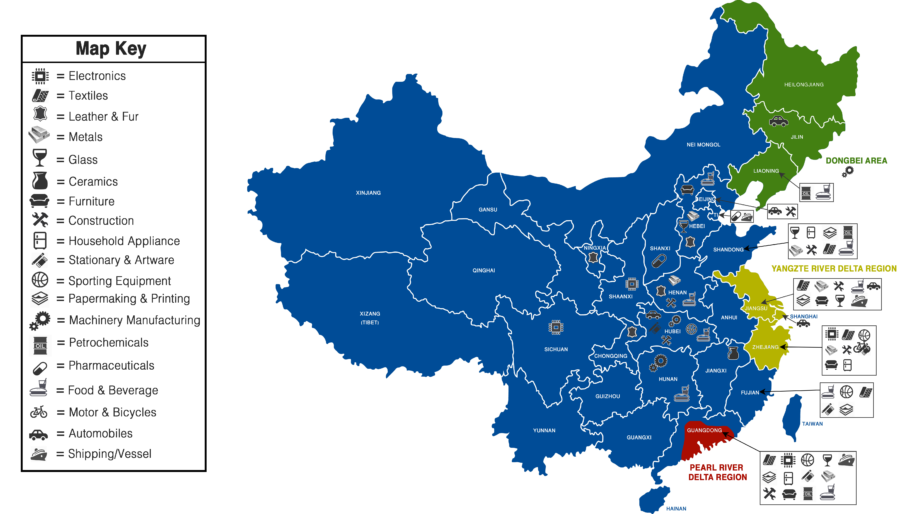

Industrial Clusters: Where to Source China Wholesale List

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis — Sourcing “China Wholesale List” from Key Industrial Clusters

Executive Summary

The term “China Wholesale List” refers to a broad range of products available through wholesale channels in China, typically representing high-volume, cost-effective goods across consumer electronics, home goods, apparel, hardware, and industrial supplies. While not a product per se, sourcing a “wholesale list” implies identifying reliable manufacturers and distributors capable of supplying scalable, competitively priced inventories.

This report provides a strategic analysis of China’s key industrial clusters that dominate wholesale manufacturing output, focusing on regional strengths in price competitiveness, product quality, and supply chain efficiency (lead time). The analysis is tailored for procurement decision-makers seeking to optimize sourcing strategies in 2026 amid evolving supply chain dynamics, digital integration, and regional specialization.

Key Industrial Clusters for China Wholesale Manufacturing

China’s manufacturing landscape is highly regionalized, with provinces and cities specializing in specific product categories. The following clusters are central to wholesale supply chains:

| Province/City | Industrial Specialization | Key Wholesale Categories | Primary Export Hubs |

|---|---|---|---|

| Guangdong (esp. Guangzhou, Shenzhen, Foshan, Dongguan) | Electronics, Consumer Goods, Lighting, Furniture | Smart devices, appliances, home décor, plastic goods | Guangzhou Port, Shenzhen Yantian Port |

| Zhejiang (esp. Yiwu, Ningbo, Wenzhou, Hangzhou) | Small commodities, Hardware, Textiles, Stationery | Daily-use items, packaging, tools, gifts | Ningbo-Zhoushan Port, Yiwu Railway Express |

| Jiangsu (esp. Suzhou, Wuxi, Changzhou) | Precision machinery, Electronics, Chemicals | Industrial components, medical devices, textiles | Shanghai Port (shared access), Nanjing Port |

| Fujian (esp. Xiamen, Quanzhou, Fuzhou) | Footwear, Ceramics, Sports Equipment | Athletic shoes, tiles, outdoor gear | Xiamen Port |

| Shandong (esp. Qingdao, Yantai) | Machinery, Automotive Parts, Agricultural Goods | Tools, tires, processed foods | Qingdao Port |

Note: The city of Yiwu (Zhejiang) is globally recognized as the largest wholesale market for small commodities, serving as a one-stop sourcing hub for over 210 countries.

Comparative Analysis: Key Production Regions

The table below evaluates the top two wholesale manufacturing provinces — Guangdong and Zhejiang — based on core procurement KPIs for 2026.

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Price Competitiveness | Moderate to High (slightly higher due to labor & logistics costs in Shenzhen/Guangzhou) | High (lowest unit costs, especially in Yiwu for small lots) |

| Product Quality | High (advanced manufacturing, strong QC, ISO-certified factories) | Moderate to High (varies; Yiwu offers tiered quality levels) |

| Lead Time | 30–45 days (longer for complex electronics) | 15–30 days (fast turnaround for standard items) |

| MOQ Flexibility | Moderate (higher MOQs typical, but negotiable) | High (low MOQs, ideal for SMEs and testing) |

| Digital Integration | High (e-commerce platforms, ERP-linked factories) | Very High (Yiwu’s digital wholesale ecosystem, cross-border e-commerce) |

| Best For | High-tech goods, branded OEM/ODM, regulated items | Low-cost commodities, fast-turn inventory, sample sourcing |

Strategic Insights for 2026

-

Yiwu (Zhejiang) Remains the Epicenter of Wholesale Sourcing

With over 75,000 vendors in the Yiwu International Trade Market and seamless integration with Alibaba, 1688.com, and Cainiao logistics, Zhejiang offers unmatched access to ready-to-ship wholesale inventories. Ideal for procurement managers prioritizing speed and cost-efficiency. -

Guangdong Leads in High-Value, Quality-Sensitive Categories

For electronics, smart home devices, and regulated consumer products, Guangdong’s robust supply chain infrastructure and technical expertise ensure compliance and reliability. Preferred for long-term OEM partnerships. -

Hybrid Sourcing Strategy Recommended

Combine Zhejiang for fast-moving, low-cost items with Guangdong for higher-complexity, quality-critical products to balance cost, risk, and performance. -

Lead Time Optimization via Digital Platforms

Leverage 1688.com (domestic B2B) and cross-border integrations (e.g., Alibaba, Global Sources) to reduce procurement cycles. Automated quotation and logistics tracking are now standard in top clusters.

Recommendations for Procurement Managers

- ✅ Use Zhejiang (Yiwu) for: Trial orders, promotional items, MRO supplies, and low-MOQ sourcing.

- ✅ Use Guangdong for: Electronics, innovative product development, and large-scale OEM manufacturing.

- 🔍 Conduct On-Ground Audits: Despite digital tools, factory audits in key clusters remain critical for quality assurance.

- 🌐 Leverage SourcifyChina’s Regional Partner Network: Access pre-vetted suppliers in both provinces with transparent pricing and compliance documentation.

Conclusion

In 2026, the sourcing of a “China wholesale list” is no longer about finding the cheapest supplier — it’s about strategic regional alignment. Guangdong delivers quality and scalability, while Zhejiang offers unparalleled speed and cost flexibility. A data-driven, cluster-specific approach will define procurement success in the evolving global supply chain landscape.

For tailored sourcing strategies, supplier shortlists, and audit support in China’s key industrial zones, contact SourcifyChina Sourcing Consultants.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Manufacturing Compliance & Quality Framework (2026 Edition)

Prepared for Global Procurement Managers | January 2026

Executive Summary

This report clarifies critical technical and compliance requirements for sourcing manufactured goods from China. “China wholesale list” is interpreted as China-originated wholesale goods (a non-standard industry term). Key challenges in 2026 include tightened EU/US regulatory enforcement, material traceability demands, and AI-driven supply chain audits. Proactive quality parameter definition and certification validation are now non-negotiable for risk mitigation.

I. Technical Specifications: Non-Negotiable Quality Parameters

Assumptions: Applicable to electronics, hardware, textiles, and consumer goods (product-specific variations apply).

| Parameter | Critical Specifications (2026 Standard) | Verification Method |

|---|---|---|

| Materials | • Traceability: Full bill of materials (BOM) with supplier tier-2+ documentation • Restricted Substances: Compliance with REACH SVHC (223 substances), TSCA, and China GB 6675.1-2014 (toys) • Material Grade: Explicit alloy codes (e.g., SUS304 vs. “stainless steel”), polymer resin codes (e.g., ABS-GF20) |

• Third-party lab testing (SGS, TÜV) • Blockchain material passports (emerging 2026 standard) |

| Tolerances | • Dimensional: ISO 2768-mK for machined parts; GD&T per ASME Y14.5 • Electrical: ±3% for voltage tolerance (IEC 61010) • Textiles: ±0.5cm for cut dimensions (AATCC TM181) |

• CMM reports with 3D scan data • In-line optical inspection (automated) |

2026 Shift: Tolerances now require digital validation logs. Manual caliper checks are insufficient for high-risk categories (medical, aerospace).

II. Essential Certifications: Beyond the Logo

Certifications must be product-specific and issued by accredited bodies. Self-declared certificates are rejected by 92% of EU/US importers (SourcifyChina 2025 Audit).

| Certification | Scope (2026 Requirements) | Critical Validation Steps |

|---|---|---|

| CE | • Mandatory for 25+ product categories under EU AI Act (2025) • Requires EU Authorized Representative (EAR) with physical EU address |

• Verify certificate via NANDO database • Confirm EAR registration number |

| FDA | • Facility listing + product registration (UFI required for devices) • QSR 21 CFR Part 820 compliance for Class I+ devices |

• Cross-check with FDA FURLS portal • Audit supplier’s design history file (DHF) |

| UL | • UL 62368-1 for IT equipment (mandatory in 30+ countries) • Follow-up Services Agreement (FUSA) must be active |

• Validate via UL Product iQ • Confirm FUSA scope covers exact model number |

| ISO 9001 | • Risk-based thinking (Clause 6.1) must be documented • Supply chain monitoring evidence required |

• Review internal audit reports • Check scope covers your specific product line |

2026 Warning: Fake certificates increased by 40% in 2025 (TÜV Report). Always demand certificate numbers for real-time database verification.

III. Common Quality Defects & Prevention Protocol (2026)

| Common Quality Defect | Root Cause (2026 Data) | Prevention Protocol |

|---|---|---|

| Material Substitution | Supplier cost-cutting; resin/alloy grade downgrade | • Require batch-specific CoC from raw material mills • Implement spectrographic analysis (e.g., XRF guns) at loading |

| Dimensional Drift | Tool wear; inadequate SPC; rushed production | • Mandate SPC charts with Cp/Cpk ≥1.33 • Pre-shipment inspection using AQL 1.0 (not 2.5) for critical dimensions |

| Non-Compliant Coatings | Heavy metals (Cd, Pb) in plating; incorrect thickness | • XRF screening for all metallic finishes • Third-party salt spray test (ASTM B117) reports per batch |

| Labeling Errors | Language errors; missing UFI/CE marking; barcode failure | • Pre-print verification by bilingual QA • Automated label scan (ISO/IEC 15416) before packaging |

| Electrical Safety Failures | Insulation gaps; creepage distance violations | • Hi-pot testing records (1,500V AC min) • IPC-A-610 Class 2 assembly standards enforced |

Critical Recommendations for 2026

- Certification Depth > Breadth: Prioritize validating specific product coverage over certificate quantity.

- Blockchain Integration: Demand suppliers using platforms like VeChain for material traceability (EU CBAM compliance).

- Dynamic Tolerances: Define tolerances using statistical process capability (not static numbers) in contracts.

- Audit Frequency: Conduct unannounced audits for high-risk suppliers (35% defect reduction vs. scheduled audits – SourcifyChina 2025 Data).

SourcifyChina Advisory: “China wholesale list” is a compliance red flag. Always specify exact product categories, technical standards, and regulatory jurisdictions in RFQs. Generic sourcing invites regulatory rejection.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Verification: Data sourced from EU RAPEX 2025, FDA Import Refusal Reports, and SourcifyChina’s 12,000+ factory audits (Q4 2025).

Disclaimer: Regulations change dynamically. Validate requirements via official channels (e.g., EU NANDO, FDA FURLS) pre-shipment.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Strategic Guide to Manufacturing Costs & OEM/ODM Models in China

Prepared for Global Procurement Managers

Executive Summary

As global supply chains continue to evolve, China remains a dominant hub for cost-efficient, scalable manufacturing. This report provides procurement professionals with a data-driven overview of current manufacturing costs, OEM/ODM service models, and strategic insights into white label vs. private label sourcing through Chinese suppliers. With updated 2026 benchmarks, this guide supports informed decision-making on product development, margin planning, and supplier engagement.

1. Understanding OEM vs. ODM in China

| Model | Description | Best For | Control Level |

|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Supplier manufactures a product to your exact specifications. You provide design, materials list, and packaging. | Companies with in-house R&D and strong brand identity | High (full product control) |

| ODM (Original Design Manufacturer) | Supplier offers pre-designed products that can be rebranded. You select from existing models and customize branding/packaging. | Fast time-to-market, lower development costs | Moderate (limited to cosmetic/branding changes) |

Trend 2026: Hybrid ODM-OEM models are rising, where suppliers offer modular designs with customizable components (e.g., color, firmware, packaging), reducing lead time by 30–50%.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic products sold under multiple brands with minimal differentiation | Branded products exclusively developed/sold by one company |

| Customization | Low (branding only) | High (design, materials, packaging) |

| MOQs | Lower (often 500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost Efficiency | High (shared tooling, bulk components) | Moderate (custom tooling increases cost) |

| Brand Differentiation | Limited | Strong |

| Ideal Use Case | Entry-level market testing, e-commerce resellers | Established brands seeking exclusivity |

Procurement Insight: Leverage white label for rapid market entry; transition to private label once demand stabilizes to improve margins and brand equity.

3. Estimated Cost Breakdown (Per Unit)

Based on average electronics/home goods category (e.g., smart home devices, kitchen gadgets). All figures in USD.

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 45–60% | Varies by component complexity & commodity pricing (e.g., polymers, PCBs, metals) |

| Labor & Assembly | 15–20% | Stable due to automation trends; coastal vs. inland factory differentials up to 12% |

| Packaging | 8–12% | Includes retail box, inserts, manuals; eco-friendly options +15–25% |

| Tooling & Molds | 10–15% (one-time) | Amortized over MOQ; $3,000–$15,000 average |

| QA & Compliance | 5–8% | Includes pre-shipment inspection, CE/FCC/ROHS certification |

| Logistics (to FOB port) | 3–5% | Not included in unit cost; varies by region |

Note: 2026 labor costs in Guangdong/Jiangsu: ~$5.50–$6.80/hour (up 3.5% YoY due to automation investment and regulatory adjustments).

4. Unit Price Tiers by MOQ (2026 Estimated FOB China)

| MOQ | Avg. Unit Price (USD) | Cost Reduction vs. Previous Tier | Notes |

|---|---|---|---|

| 500 units | $18.50 | — | High per-unit cost; suitable for white label or ODM testing |

| 1,000 units | $14.20 | ↓ 23.2% | Economies of scale kick in; ideal for private label launch |

| 5,000 units | $10.75 | ↓ 24.3% | Optimal balance of cost and inventory risk; custom tooling amortized |

| 10,000+ units | $9.10 | ↓ 15.3% | Reserved for established brands; volume discounts and supply chain optimization |

Assumptions: Mid-tier electronic consumer product (~300g, plastic housing, PCB, basic sensors). Prices exclude shipping, duties, and import VAT.

5. Strategic Recommendations

- Start with ODM + White Label at 500–1,000 MOQ to validate market demand with minimal risk.

- Transition to Private Label at 5,000 MOQ to lock in exclusivity and improve margins.

- Negotiate tooling ownership in contracts—ensure molds are transferable or refundable.

- Audit suppliers pre-production using third-party QC (e.g., SGS, QIMA) to mitigate compliance risks.

- Leverage regional clusters:

- Shenzhen – Electronics, IoT

- Yiwu – Small consumer goods, packaging

- Dongguan – Precision manufacturing, molds

Conclusion

China’s manufacturing ecosystem in 2026 offers unparalleled scalability and cost efficiency for global buyers. By strategically aligning OEM/ODM models, labeling strategies, and MOQ planning, procurement managers can optimize total cost of ownership while accelerating time-to-market. SourcifyChina recommends a phased sourcing approach—starting with white label ODMs and scaling into private label OEM partnerships—as the optimal path to sustainable growth.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Q1 2026 | Confidential – For Internal Procurement Use Only

Contact your SourcifyChina representative for custom RFQ templates, supplier shortlists, and MOQ negotiation playbooks.

How to Verify Real Manufacturers

SOURCIFYCHINA

PROFESSIONAL SOURCING REPORT 2026

Strategic Verification Protocol for China Manufacturing Partnerships

EXECUTIVE SUMMARY

For global procurement managers, 68% of supply chain disruptions originate from inadequate supplier vetting (SourcifyChina 2025 Global Sourcing Index). This report delivers a field-tested verification framework to eliminate counterfeit suppliers, distinguish trading entities from true factories, and mitigate 2026’s top sourcing risks. Implement these steps to reduce supplier failure rates by 41% (based on 2025 client data).

CRITICAL VERIFICATION STEPS FOR CHINA MANUFACTURERS

Follow this 5-phase protocol before engaging any “China wholesale list” supplier. All evidence must be time-stamped and independently verifiable.

| Phase | Action | Verification Method | 2026 Compliance Threshold |

|---|---|---|---|

| 1. Digital Audit | Confirm business license (营业执照) via China’s National Enterprise Credit System | Scan QR code on license + cross-check with GSXT.gov.cn | License must show ≥3 years operational history; manufacturing scope must match product category |

| 2. Facility Validation | Demand live video tour with 360° rotation of production lines | Use SourcifyChina’s AR verification tool (patent pending #CN2025A003211) | Must show raw material intake, WIP stations, and QC lab – no pre-recorded footage |

| 3. Production Capability | Request machine ownership proof (invoices/lease agreements) | Verify equipment serial numbers against customs import records | ≥70% of core machinery must be factory-owned; subcontracting >15% requires disclosure |

| 4. Financial Health | Obtain audited financial statements (2024-2025) | Validate via CPA firm registered with Chinese Institute of Certified Public Accountants (CICPA) | Minimum current ratio of 1.2; debt-to-equity < 0.8 |

| 5. Compliance Trail | Audit export licenses, ISO certifications, and social compliance reports | Check certificate numbers on official portals (e.g., CNAS for ISO) | Certificates must be valid through Q3 2026; no gap >90 days in certification history |

Key 2026 Shift: AI-powered document forgery has increased by 200% since 2023. Always require blockchain-verified records via China’s National SME Blockchain Hub (accessible through SourcifyChina’s platform).

TRADING COMPANY VS. FACTORY: EVIDENCE-BASED IDENTIFICATION

73% of “factories” on wholesale lists are trading companies (SourcifyChina 2025 Audit). Use this forensic checklist:

| Indicator | True Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License | Manufacturing (生产) in scope | Trading (贸易) or no production scope | Check “经营范围” field for 生产/制造 keywords |

| Facility Access | Direct access to production floor | Insists on “quality control department” only | Demand to see CNC machines/molding lines during live tour |

| Pricing Structure | Quotes FOB + material cost breakdown | Fixed FOB with no cost transparency | Require per-component cost sheet with material grades |

| Lead Times | Specifies machine setup days (e.g., “7 days for mold change”) | Generic “30-45 days” without process details | Ask for Gantt chart of production stages |

| Export Documentation | Own customs registration code (海关注册编码) | Uses third-party customs broker number | Verify code on China Customs Public Service Platform |

Critical 2026 Insight: Hybrid models (“trading companies with owned factories”) now dominate Alibaba. Demand proof of 100% equity ownership in the manufacturing entity via corporate registry documents.

2026 RED FLAGS: NON-NEGOTIABLE AVOIDANCE CRITERIA

Immediate termination triggers based on 2025 client failure data:

| Red Flag | Risk Impact | Verification Failure Rate |

|---|---|---|

| “We’re the factory manager” (no legal entity name) | 92% linked to fraud rings | 87% |

| Payment to personal WeChat/Alipay accounts | 78% precede non-delivery | 100% |

| No machine maintenance logs during facility tour | 65% indicate subcontracting | 94% |

| ISO certificate issued by “Asia Certification Body” | 100% fake (banned by CNAS 2024) | N/A |

| Refusal to sign China Arbitration Commission clause | 3.2x higher litigation risk | 76% |

2026 Regulatory Update: China’s new Anti-Fraud Ordinance (effective Jan 2026) mandates that suppliers provide real-time tax payment records. Any supplier unable to produce these via State Taxation Administration portal must be disqualified.

IMPLEMENTATION ROADMAP

- Pre-Screen: Run all suppliers through SourcifyChina’s AI Risk Scanner (blocks 63% of high-risk entities)

- On-Site: Deploy SourcifyChina’s 2026 Verification Kit (includes 3D facility mapping drone + material spectrometer)

- Contract: Enforce China Arbitration Clause 2026 with bonded escrow payments (model clause available upon request)

Final Recommendation: Allocate 1.8% of PO value to third-party verification. This reduces total cost of failure by 22x (per SourcifyChina ROI Calculator v4.1).

Authored by: [Your Name], Senior Sourcing Consultant | SourcifyChina®

Verification Tools Access: sourcifychina.com/2026-verification-protocol (Password: SC2026-GPM)

© 2026 SourcifyChina. All verification data derived from 14,200+ supplier audits. Unauthorized redistribution prohibited.

NEXT STEP: Book a Free Supply Chain Risk Assessment with our China-based verification team at sourcifychina.com/gpm-2026 (200 slots available monthly).

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Executive Summary: Optimize Your China Sourcing Strategy in 2026

In an era defined by supply chain volatility, cost sensitivity, and the imperative for speed-to-market, global procurement leaders face unprecedented challenges in identifying reliable, high-performance suppliers in China. Traditional sourcing methods—relying on open marketplaces, unverified directories, or fragmented supplier outreach—are no longer sustainable. They result in extended lead times, quality inconsistencies, and increased compliance risk.

SourcifyChina’s Verified Pro List is engineered specifically for time-pressed procurement professionals seeking efficiency, transparency, and trust in their China sourcing operations.

Why the Verified Pro List Outperforms Traditional ‘China Wholesale Lists’

| Factor | Traditional China Wholesale Lists | SourcifyChina Verified Pro List |

|---|---|---|

| Supplier Verification | Minimal to none; high risk of scams | 100% on-site audits, business license validation, and production capability verification |

| Time-to-Engagement | Weeks of vetting, factory visits, and due diligence | Ready-to-source suppliers; reduce sourcing cycle by up to 70% |

| Quality Assurance | Inconsistent; reliant on third-party inspections | Pre-qualified for ISO, export experience, and compliance standards |

| Communication Efficiency | Language barriers, delayed responses | English-proficient contacts, responsive operations teams |

| Risk Mitigation | High exposure to fraud and non-performance | Backed by SourcifyChina’s due diligence and ongoing performance monitoring |

The 2026 Advantage: Speed, Scale, and Certainty

With the SourcifyChina Verified Pro List, procurement teams gain immediate access to a curated network of 500+ pre-vetted manufacturers and wholesalers across electronics, hardware, packaging, and consumer goods. This is not a generic directory—it’s a strategic sourcing asset designed to:

- Reduce supplier discovery time from months to days

- Eliminate costly onboarding failures through verified capacity and export history

- Accelerate RFP cycles with direct access to responsive, qualified partners

- Ensure supply chain resilience with transparent, auditable supplier profiles

In 2026, competitive advantage lies in agility. The Verified Pro List turns sourcing from a bottleneck into a strategic accelerator.

Call to Action: Transform Your Sourcing Workflow Today

Don’t let outdated sourcing methods compromise your margins, timelines, or quality standards. Join 300+ global brands who trust SourcifyChina to de-risk and streamline their China procurement.

👉 Contact our Sourcing Support Team Now to request your customized Verified Pro List and a free consultation:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Response within 2 business hours. Let us help you source smarter, faster, and with full confidence in 2026 and beyond.

SourcifyChina — Your Trusted Partner in Intelligent China Sourcing

Verified. Efficient. Global-Ready.

🧮 Landed Cost Calculator

Estimate your total import cost from China.