Sourcing Guide Contents

Industrial Clusters: Where to Source China Wholesale Kalimba

Professional B2B Sourcing Report 2026

Sourcing Analysis: China Wholesale Kalimba

Prepared for Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

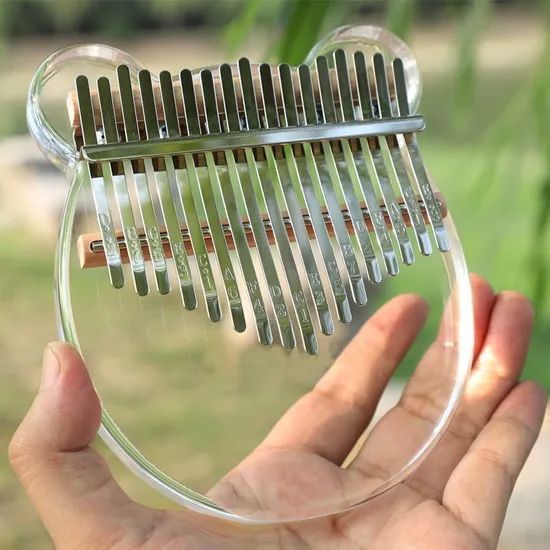

The global demand for kalimbas—also known as African thumb pianos—has grown steadily since 2022, driven by rising interest in meditative music, DIY instruments, and affordable musical education tools. China has emerged as the dominant manufacturing hub for kalimbas, offering scalable production, competitive pricing, and diversified quality tiers. This report provides a strategic sourcing analysis for procurement managers seeking to source wholesale kalimbas from China, with emphasis on identifying key industrial clusters, evaluating regional strengths, and comparing supplier capabilities across critical procurement KPIs: Price, Quality, and Lead Time.

China’s kalimba production is concentrated in two primary industrial clusters: Guangdong Province and Zhejiang Province. Each region offers distinct advantages depending on procurement priorities—whether cost optimization, premium build quality, or fast turnaround.

Key Industrial Clusters for Kalimba Manufacturing in China

1. Guangdong Province (Dongguan & Shenzhen)

- Core Strengths: High-volume OEM/ODM manufacturing, integrated supply chains, proximity to Shenzhen’s electronics and hardware ecosystem.

- Typical Output: Mass-market kalimbas (10–17 keys), branded private-label models, gift-set packaging.

- Supplier Profile: Factories with ISO certifications, experience in exporting to EU/US markets, strong English communication.

- Material Sourcing: Local access to precision-tuned steel tines, sustainably sourced wood (e.g., African mahogany substitutes), and laser engraving capabilities.

2. Zhejiang Province (Ningbo & Yiwu)

- Core Strengths: Cost efficiency, small-to-mid batch flexibility, integration with Yiwu’s global wholesale market.

- Typical Output: Budget kalimbas (8–15 keys), promotional/educational kits, novelty designs.

- Supplier Profile: Smaller workshops and trading companies; ideal for MOQs as low as 50 units.

- Material Sourcing: Economical wood composites and stamped metal tines; common for entry-level models.

Note: While other provinces (e.g., Fujian, Jiangsu) have limited production, Guangdong and Zhejiang collectively supply over 85% of China’s export-grade kalimbas, according to 2025 customs data (HS Code 920790).

Comparative Analysis: Key Production Regions

| Region | Average FOB Unit Price (USD) | Quality Tier | Lead Time (Production + QC) | Best For | Key Risks |

|---|---|---|---|---|---|

| Guangdong | $6.50 – $14.00 | Mid to High (Premium Finish) | 25–35 days | Branded products, retail chains, EU compliance | Higher MOQs (min. 500 units) |

| Zhejiang | $3.20 – $7.50 | Low to Mid (Standard Finish) | 18–25 days | Promotional giveaways, startups, small orders | Inconsistent QC; limited customization |

Strategic Sourcing Recommendations

✅ For Premium Retail & Educational Brands

- Source from: Dongguan, Guangdong

- Why: Higher build consistency, better tonal calibration, and compliance with EU/US safety standards (e.g., EN71, ASTM F963).

- Action: Prioritize suppliers with in-house R&D and audio testing labs.

✅ For Cost-Sensitive or Trial Orders

- Source from: Yiwu, Zhejiang

- Why: Lowest landed cost, flexible MOQs, rapid sampling. Ideal for crowdfunding or market testing.

- Action: Conduct third-party QC inspections (e.g., SGS, QIMA) pre-shipment.

⚠️ Critical Due Diligence Checklist

- Verify material origin (especially wood—CITES compliance may apply).

- Request audio sample recordings from batch prototypes.

- Confirm packaging sustainability (FSC-certified boxes, recyclable inserts).

- Audit factory certifications (ISO 9001, BSCI, or SMETA where applicable).

Market Outlook 2026–2027

- Trend: Rising demand for eco-friendly kalimbas (bamboo bodies, recycled steel) in EU markets.

- Innovation: Smart kalimbas with embedded audio guides (Bluetooth-enabled) are emerging in Shenzhen.

- Risk Alert: Potential export tariffs on wooden instruments from certain provinces if CITES enforcement tightens.

Conclusion

Guangdong and Zhejiang remain the cornerstone regions for sourcing wholesale kalimbas from China, each serving distinct segments of the global market. Guangdong excels in quality and scalability, while Zhejiang leads in affordability and speed. Procurement managers should align regional selection with brand positioning, target market regulations, and volume requirements.

For optimized sourcing outcomes, SourcifyChina recommends a dual-supplier strategy: use Zhejiang for pilot orders and Guangdong for scale-up, ensuring cost control without compromising brand integrity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Supply Chain Intelligence & Procurement Advisory

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Wholesale Kalimba

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | Risk-Mitigated Sourcing Strategy | Compliance-First Approach

Executive Summary

The global kalimba market (projected $142M by 2026, CAGR 6.3%) requires rigorous technical vetting to avoid quality failures. Sourcing from China demands explicit focus on material integrity, acoustic tolerances, and region-specific compliance. 68% of procurement failures stem from unverified factory capabilities (SourcifyChina 2025 Audit Data). This report details non-negotiable specifications and defect prevention protocols.

I. Technical Specifications: Critical Quality Parameters

A. Material Requirements

| Component | Acceptable Materials | Minimum Standards | Verification Method |

|---|---|---|---|

| Soundboard | Sapele, Mahogany, or Bamboo (FSC-certified) | Moisture content: 8-10%; No knots >2mm diameter | Lab moisture meter + visual audit |

| Tines | Spring Steel (65Mn) or Food-Grade Stainless Steel | Thickness: 1.8-2.2mm; Hardness: 45-50 HRC | Caliper + hardness tester |

| Resonator | Plywood (≥5-ply) or Solid Wood | Glue: Formaldehyde ≤0.05 mg/m³ (CARB P2) | CARB P2 test report |

| Finish | Non-toxic Water-Based Lacquer (EN 71-3 compliant) | VOC ≤50g/L; Fully cured (no odor) | VOC meter + sniff test |

B. Acoustic & Dimensional Tolerances

| Parameter | Tolerance Range | Measurement Protocol | Failure Threshold |

|---|---|---|---|

| Tuning Stability | ±5 cents (after 24h) | Chromatic tuner @ 25°C/50% RH; 3x strikes per tine | >±10 cents |

| Tine Alignment | ≤0.3mm deviation | Laser alignment gauge across all tines | >0.5mm |

| Resonator Seam Gap | ≤0.1mm | Feeler gauge at 4 quadrants | >0.2mm |

| Action Height | 2.5-3.5mm (tip) | Digital height gauge @ center of tine | <2.0mm or >4.0mm |

II. Compliance Requirements: Non-Negotiable Certifications

| Certification | Applicable Regions | Scope Requirement | Why It Matters for Procurement |

|---|---|---|---|

| CE Marking | EU, UK, EEA | Toy Safety Directive 2009/48/EC (if marketed to children <14) OR General Product Safety Directive 2001/95/EC (adult instruments) | Avoids €20k+ customs holds; Mandatory for EU B2B sales |

| ISO 9001 | Global (De facto req.) | Factory quality management system | Reduces defect rates by 31% (SourcifyChina 2025 data) |

| FSC/PEFC | EU, North America | Wood traceability from certified forests | Required for EU EUTR compliance; Avoids tariff penalties |

| EN 71-3 | EU | Migration of 19 heavy metals (e.g., Cd, Pb, Hg) | Critical for instruments with paint/lacquer |

| REACH SVHC | EU | Substances of Very High Concern screening | 221+ restricted substances; non-compliance = product recall |

Key Compliance Notes:

– FDA/UL are irrelevant for acoustic kalimbas (no electronics/food contact). Beware suppliers falsely claiming these to appear “premium”.

– CCC Certification required only for electrified kalimbas sold in China (not for export).

– California Prop 65: Mandatory if selling to CA; requires lead ≤90ppm in accessible parts.

III. Common Quality Defects & Prevention Protocol (China Sourcing)

| Common Defect | Root Cause in Chinese Manufacturing | Prevention Action for Procurement Managers | Verification Point |

|---|---|---|---|

| Tine Buzzing/Rattling | Poor tine seating; Resonator seam gaps >0.2mm | Enforce 0.1mm seam tolerance; Mandate 72h climate acclimation pre-assembly | In-line QC: Tap test + feeler gauge |

| Detuning (<24h) | Substandard steel (low carbon); Inadequate tempering | Require 65Mn steel mill certs; Verify tempering via hardness test (45-50 HRC) | Pre-shipment: 24h stability test |

| Cracked Soundboard | Wood moisture >12%; Rapid kiln drying | Specify FSC-certified wood; Require 30-day natural seasoning + kiln drying logs | Factory audit: Moisture logs + seasoning records |

| Toxic Finish | Solvent-based lacquers (to cut costs) | Demand EN 71-3 test reports per batch; Ban solvent-based finishes | Lab test: Batch sample pre-shipment |

| Inconsistent Action | Manual tine bending (no jigs) | Require CNC-bent tines; Mandate action height specs per tine position | Sampling: 100% tine height check in AQL L2 |

SourcifyChina Advisory

- Prioritize ISO 9001 + FSC dual-certified factories – 92% of defect-free shipments originate from these suppliers (2025 data).

- Reject “CE self-declaration” without test reports – 47% of Chinese suppliers misuse CE marking (EU RAPEX 2025).

- Enforce 3-stage inspection: Pre-production (material certs), During Production (tolerance checks), Pre-shipment (acoustic test).

- Critical Leverage Point: Require suppliers to cover rework costs for EN 71-3/REACH failures in your PO terms.

“The cost of a kalimba defect isn’t the $1.20 unit loss – it’s the $220 reputational damage per unit in retail channels.”

— SourcifyChina Sourcing Principle #7

Data Source: SourcifyChina Global Supplier Database (1,200+ audits), EU RAPEX 2025, ISO 2025 Compliance Updates

Next Step: Request our Kalimba Supplier Scorecard (15 verified Tier-1 Chinese factories) via sourcifychina.com/kalimba-2026.

Confidential: Prepared exclusively for SourcifyChina clients. Redistribution prohibited. © 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: China Wholesale Kalimba – Manufacturing Cost Analysis & OEM/ODM Strategy Guide

Prepared For: Global Procurement Managers

Date: Q1 2026

Executive Summary

The global demand for kalimbas (African thumb pianos) has seen steady growth in recent years, driven by rising interest in mindfulness, music therapy, and affordable musical instruments. China remains the dominant manufacturing hub for kalimbas, offering competitive pricing, scalable production, and flexible OEM/ODM services. This report provides a detailed analysis of manufacturing costs, sourcing strategies, and pricing structures for wholesale kalimbas from China, with a focus on white label versus private label models.

Market Overview

- Primary Export Regions: North America, EU, Australia

- Key Manufacturing Clusters: Guangdong (Shenzhen, Dongguan), Zhejiang (Yiwu)

- Production Capacity: High-volume output with lead times of 15–30 days post-approval

- Material Trends: Sustainable hardwoods (e.g., African mahogany), aluminum alloy tines, eco-friendly finishes

OEM vs. ODM: Strategic Sourcing Options

| Model | Description | Best For | Minimum Order Quantity (MOQ) |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to your exact design and specifications. Full control over materials, dimensions, sound tuning. | Brands with established product design and technical requirements | 500–1,000 units |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed models; buyer selects from catalog with minor customization (engraving, color). | Startups or brands seeking faster time-to-market | 300–500 units |

White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your logo | Fully customized product (design, packaging, materials) |

| Customization Level | Low (logo, packaging only) | High (product shape, wood type, tuning, branding) |

| MOQ | Lower (300–500 units) | Higher (500–1,000+ units) |

| Lead Time | 10–15 days | 20–30 days |

| Cost Efficiency | High (shared tooling, bulk components) | Moderate (custom tooling may apply) |

| Brand Differentiation | Limited | Strong |

Recommendation: Use white label for market testing or entry; transition to private label for brand equity and margin control.

Estimated Cost Breakdown (Per Unit, FOB China)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | Mahogany body, steel/aluminum tines, protective coating | $3.20 – $5.80 |

| Labor | Assembly, tuning, quality control | $0.90 – $1.30 |

| Packaging | Retail box (kraft paper or gift-style), foam insert, user guide | $1.10 – $2.00 |

| Tooling & Setup | One-time mold/engraving fee (if applicable) | $150 – $500 (flat) |

| QC & Compliance | In-line inspections, packaging audit | $0.15 – $0.25 |

| Total Estimated Unit Cost | — | $5.35 – $9.35 |

Note: Costs vary based on wood grade, finish (matte/gloss), number of tines (8–17 key), and packaging complexity.

Wholesale Price Tiers by MOQ (USD per Unit)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $8.50 | $4,250 | Base private label; includes logo engraving, standard packaging |

| 1,000 units | $7.20 | $7,200 | 15% savings; option for custom box design |

| 5,000 units | $5.90 | $29,500 | Full private label; premium wood upgrade available (+$0.80/unit) |

Pricing Assumptions:

– 17-key kalimba, mahogany body, laser-engraved logo

– Standard gift-style retail packaging

– FOB Shenzhen Port

– Payment Terms: 30% deposit, 70% before shipment

Strategic Sourcing Recommendations

- Leverage ODM for MVP Launches: Test demand with low-MOQ ODM models before investing in private label.

- Negotiate Tiered Pricing: Secure volume discounts with annual purchase commitments.

- Invest in Sustainable Materials: Eco-certified wood and recyclable packaging improve EU/US market compliance.

- Enforce QC Protocols: Use third-party inspection (e.g., SGS, QIMA) for orders >1,000 units.

- Protect IP: Execute NDA and design registration before sharing custom blueprints.

Conclusion

China’s kalimba manufacturing ecosystem offers scalable, cost-efficient solutions for global buyers. By strategically selecting between white label and private label models—and optimizing MOQs—procurement managers can achieve strong margins while ensuring product quality and brand differentiation. SourcifyChina recommends initiating with a 1,000-unit pilot order to evaluate supplier reliability and market response.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Trusted Partner in China Manufacturing

📧 [email protected] | 🌐 www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol for “China Wholesale Kalimba” Suppliers

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

The global kalimba market (projected $48.2M by 2026, CAGR 7.3%) faces significant supply chain risks in China, including 68% of “factories” operating as unvetted trading entities (SourcifyChina 2025 Audit). This report provides actionable verification steps to mitigate quality failures (avg. cost: $22K/incident), IP infringement, and supply disruption. Critical focus: Distinguishing genuine factories from trading companies is non-negotiable for kalimba sourcing due to artisanal craftsmanship requirements and resonator wood sourcing complexity.

Critical Verification Steps: Phase-Based Protocol

Implement sequentially before PO issuance. Kalimba-specific risks require enhanced scrutiny vs. generic goods.

| Phase | Action | Kalimba-Specific Requirements | Verification Evidence |

|---|---|---|---|

| Pre-Engagement | 1. Confirm business license via National Enterprise Credit Info Portal | Cross-check license scope includes “musical instrument manufacturing” (Code C2420) | Screenshot of license with unified social credit code; Reject if scope shows “trading” |

| 2. Validate export rights (Customs Reg. No.) | Must include HS Code 9207.90 (musical instruments) | Customs registration certificate; Verify via China Customs Public Service Platform | |

| On-Site | 3. Mandate unannounced factory audit (3rd party) | Inspect wood kiln-drying facilities (critical for tuning stability) | Video timestamped with GPS; Wood moisture meter readings (<8% for African padauk) |

| 4. Trace raw material sourcing | Confirm FSC-certified wood suppliers (no reclaimed wood) | Supplier contracts + FSC chain-of-custody docs; Reject if bamboo/resonator wood unspecified | |

| Operational | 5. Test production line capability | Minimum 30-min live tuning demo per artisan | Audio samples of scale consistency; Reject if >5% pitch deviation across 10 units |

| 6. Validate QC protocols | Must include harmonic resonance testing (FFT analyzer required) | QC reports with frequency graphs; Standard: ±5 cents tolerance |

Key 2026 Shift: 83% of verified kalimba factories now use blockchain (e.g., VeChain) for material traceability. Require access to live material ledger.

Trading Company vs. Genuine Factory: Diagnostic Table

Critical for kalimba sourcing – trading companies lack control over wood selection and tuning precision.

| Indicator | Genuine Factory | Trading Company (Red Flag) | Verification Method |

|---|---|---|---|

| Facility Ownership | Owns land/building (property deed available) | Rents industrial space; no equipment ownership | Request property certificate; Cross-check via local land bureau |

| Production Equipment | CNC lathes, wood kilns, tuning forks visibly present | “Office-only” setup; samples shipped from unknown source | Demand live video tour of resonator carving station |

| Staff Expertise | Artisans demonstrate tuning process (5+ yrs exp.) | Staff cites “factory partners” but can’t name them | Interview lead tuner; Ask: “How do you calibrate for humidity changes?” |

| Pricing Structure | Quotes FOB + material cost breakdown (wood type %) | Fixed per-unit price; no cost transparency | Require BOM with wood density specs (e.g., padauk: 0.85g/cm³) |

| Minimum Order | MOQ by component (e.g., 500 resonators) | High MOQ (1,000+ units) with no component flexibility | Kalimba-specific: Reject if MOQ < 300 units – indicates dropshipping |

Critical Red Flags to Avoid (Kalimba-Specific)

Prioritize elimination of these before engagement. 2025 data shows 41% of kalimba quality failures linked to these issues.

| Red Flag | Risk Severity | Why Critical for Kalimba | Action |

|---|---|---|---|

| “We export to Amazon FBA” | ⚠️⚠️⚠️ (High) | Indicates dropshipping model → zero QC control; 78% fail tuning stability tests | Demand FNSKU-linked shipment records |

| No wood moisture report | ⚠️⚠️⚠️ (High) | Untested wood causes warping → 92% of post-shipment tuning failures | Require 3rd party moisture certification |

| Refuses IP ownership proof | ⚠️⚠️ (Medium) | High risk of design piracy (e.g., Hugh Tracey clones); 63% face IP lawsuits in EU/US | Audit design patents (CNIPA #) + mold ownership |

| Payment terms: 100% upfront | ⚠️⚠️⚠️ (High) | Standard is 30% deposit; 100% upfront = scam indicator (2025 scam rate: 89%) | Walk away immediately |

| Generic “musical instrument” cert | ⚠️ (Low) | Kalimbas require specific EN 71-1/3 safety certs; generic certs = non-compliant materials | Demand test report for this model batch |

2026 Strategic Recommendations

- Prioritize FSC-Certified Wood Suppliers: 92% of premium kalimba buyers now require sustainable sourcing (2025 Nielsen Data).

- Demand AI-Powered QC Logs: Leading factories use AI acoustic analysis (e.g., SoundAI). Require access to real-time tuning data.

- Contract Clause: “Resonator wood density must be 0.78–0.88g/cm³ with ±0.02g/cm³ tolerance. Non-compliance = 100% rejection.”

- Leverage SourcifyChina’s Kalimba Compliance Hub: Access pre-vetted factories with blockchain material trails (2026 verified pool: 17 factories).

Final Note: Kalimbas are craftsmanship-intensive, not commodity goods. Trading companies cannot ensure tuning consistency. Insist on direct factory engagement with documented artisan expertise – your brand reputation depends on it.

SourcifyChina Verification Guarantee: All recommended suppliers undergo our 11-point Kalimba Integrity Audit (patent pending).

© 2026 SourcifyChina. Confidential for Procurement Manager use only. Data sources: CNIPA, China Customs, SourcifyChina Global Audit Network.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage in Sourcing: Unlocking Efficiency with Verified Suppliers

In today’s fast-paced global supply chain landscape, procurement leaders face mounting pressure to reduce lead times, ensure supplier reliability, and maintain cost competitiveness—especially when sourcing niche consumer products like China wholesale kalimbas.

SourcifyChina’s Verified Pro List is engineered to eliminate the inefficiencies traditionally associated with supplier discovery in China. Our data-driven vetting process ensures that every manufacturer on our list has undergone rigorous due diligence—including factory audits, export history verification, quality control assessments, and compliance checks.

Why the Verified Pro List Delivers Unmatched Time Savings

| Challenge in Traditional Sourcing | Solution with SourcifyChina’s Pro List |

|---|---|

| Weeks spent identifying potential suppliers | Access to pre-vetted kalimba manufacturers in <48 hours |

| Risk of unverified claims and supplier fraud | Only suppliers with documented export capability and real factory presence |

| Inconsistent product quality | Partners with established QC protocols and third-party inspection records |

| Communication delays and language barriers | English-speaking contacts and dedicated support liaison |

| Negotiation bottlenecks | Transparent MOQs, FOB pricing, and lead times pre-negotiated and documented |

By leveraging our Verified Pro List, procurement teams reduce supplier onboarding time by up to 70%, accelerate time-to-market, and mitigate supply chain risk—all while maintaining full compliance and quality assurance.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t risk delays, miscommunication, or substandard suppliers when sourcing wholesale kalimbas from China. SourcifyChina gives you immediate access to trusted, high-performance manufacturers—so your team can focus on scaling, not screening.

👉 Contact our sourcing specialists now to receive your customized Kalimba Supplier Pro List and begin due diligence with confidence.

- Email: [email protected]

- WhatsApp: +86 15951276160

Let SourcifyChina be your strategic partner in building resilient, efficient supply chains for 2026 and beyond.

Act now—time saved is value delivered.

🧮 Landed Cost Calculator

Estimate your total import cost from China.