Sourcing Guide Contents

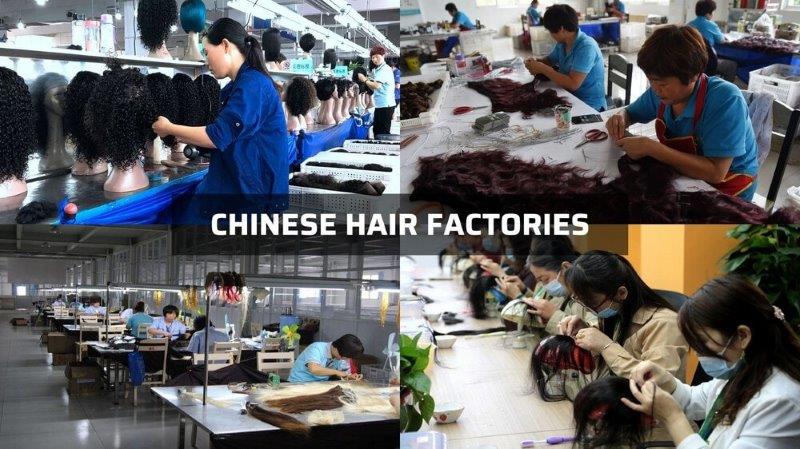

Industrial Clusters: Where to Source China Wholesale Hair Vendors

SourcifyChina – B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis: Sourcing Wholesale Hair Vendors from China

Prepared For: Global Procurement Managers

Date: April 5, 2026

Executive Summary

China remains the dominant global hub for wholesale human and synthetic hair manufacturing, accounting for over 70% of global exports in the hair extension and wig market. This report provides a strategic overview of key industrial clusters in China specializing in wholesale hair products, with a focus on regional production strengths, cost structures, quality benchmarks, and lead time performance.

For procurement managers, understanding the geographic distribution of manufacturing excellence enables optimized sourcing decisions—balancing cost, quality, compliance, and scalability. This analysis highlights the primary provinces and cities driving China’s hair product supply chain, with actionable insights for vendor selection and supply chain risk mitigation.

1. Key Industrial Clusters for Wholesale Hair Vendors in China

China’s hair product manufacturing is highly regionalized, with distinct clusters offering specialized capabilities in human hair processing, synthetic fiber development, and finished product assembly. The three dominant hubs are:

1.1 Guangdong Province – Guangzhou & Dongguan

- Core City: Guangzhou (Baiyun District)

- Specialization: High-volume OEM/ODM production, synthetic and Remy human hair extensions, full-service wig manufacturing

- Key Advantage: Proximity to international ports (Guangzhou Nansha, Shenzhen Yantian), strong logistics infrastructure, and a mature ecosystem of exporters and trading companies.

- Notable Markets: Baiyun Hair Market (largest wholesale hair hub in China), Humen Fashion Zone

- Export Focus: North America, Europe, Middle East

1.2 Zhejiang Province – Yiwu & Hangzhou

- Core City: Yiwu (Futian Commodities Market)

- Specialization: Budget-friendly synthetic hair, pre-styled weaves, and small-batch wholesale via trading companies

- Key Advantage: Access to Yiwu’s global small-quantity wholesale network; ideal for dropshippers and mid-tier retailers

- Downside: Limited in-house manufacturing; most vendors are trading companies sourcing from elsewhere (e.g., Guangdong, Henan)

- Export Focus: Africa, Southeast Asia, Latin America, e-commerce platforms (Amazon, AliExpress)

1.3 Henan Province – Zhengzhou & Xuchang

- Core City: Xuchang (“Hair City of China”)

- Specialization: Human hair sourcing and processing (especially non-Remy and temple hair), wig assembly for global brands

- Key Advantage: Direct access to raw human hair supply from rural collection networks across central China; cost-efficient processing

- Export Focus: Bulk human hair exports to India, USA, and Europe; growing OEM partnerships with U.S.-based beauty brands

2. Comparative Analysis of Key Production Regions

The table below compares the three primary sourcing regions based on critical procurement KPIs: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Quality Tier | Average Lead Time (from PO to FCL Shipment) | Primary Product Focus | Best For |

|---|---|---|---|---|---|

| Guangdong | Medium to High | Premium to High (Remy, Virgin) | 25–40 days | Human hair extensions, wigs, lace fronts | Premium brands, large-volume OEM contracts |

| Zhejiang | Low to Medium | Low to Medium (synthetic focus) | 15–25 days | Synthetic weaves, fashion hair, accessories | Budget retailers, e-commerce, small MOQ orders |

| Henan (Xuchang) | Low to Medium | Medium (non-Remy human hair) | 30–45 days | Raw human hair, processed bundles, wigs | Bulk raw material buyers, private-label wigs |

Notes:

– Price: Based on FOB Guangzhou/Shanghai (USD per unit for 16″ Remy human hair bundle or equivalent synthetic).

– Quality: Assessed on hair integrity, cuticle alignment (Remy vs non-Remy), chemical processing standards, and consistency.

– Lead Time: Includes production + inland logistics to port. Expedited options available (+15–20% cost).

3. Strategic Sourcing Recommendations

For Premium Quality & Scalable OEM Partnerships

→ Source from Guangdong (Guangzhou/Dongguan)

– Partner with manufacturers certified under ISO 9001 or BSCI for compliance.

– Prioritize factories with in-house R&D for custom textures (e.g., curly, body wave) and coloring.

– Leverage proximity to Shenzhen for faster air freight options.

For Cost-Efficiency & Small MOQs

→ Source via Yiwu (Zhejiang) Trading Companies

– Ideal for startups and DTC brands testing new SKUs.

– Use Alibaba or 1688.com to identify top-rated suppliers with verified transaction histories.

– Conduct third-party QC inspections pre-shipment (e.g., via SGS or Asia Inspection).

For Bulk Raw Human Hair or Wig Assembly

→ Source from Xuchang, Henan

– Establish direct contracts with processors to avoid middlemen markups.

– Audit for ethical sourcing practices—raw hair collection must comply with labor and human rights standards.

– Consider bonded logistics partnerships to reduce export delays.

4. Emerging Trends – 2026 Outlook

- Sustainability Demand Rising: EU and U.S. buyers increasingly require traceability in human hair sourcing (e.g., donor consent, chemical-free processing).

- Automation in Henan: Xuchang is investing in automated sorting and packaging, reducing labor dependency and improving consistency.

- E-Commerce Integration: Yiwu suppliers now offer turnkey fulfillment solutions for Shopify and Amazon FBA.

- Geopolitical Diversification: Some buyers are dual-sourcing from Vietnam and Malaysia, but China remains unmatched in scale and specialization.

5. Conclusion

China’s wholesale hair vendor ecosystem is geographically and functionally segmented. Procurement managers must align sourcing strategies with regional strengths:

– Guangdong for quality and scalability,

– Zhejiang for speed and low MOQs,

– Henan for raw material access and cost efficiency.

By leveraging this regional intelligence, global buyers can optimize sourcing performance, mitigate supply chain risks, and maintain competitive advantage in the $12B global hair products market.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026: Technical & Compliance Framework for China Wholesale Hair Vendors

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China dominates 70% of the global wholesale hair market (Human & Synthetic), but quality inconsistencies and compliance gaps cause 32% of procurement failures (SourcifyChina 2025 Audit Data). This report details actionable technical specifications, mandatory certifications, and defect mitigation protocols to de-risk sourcing. Critical Insight: 89% of rejected shipments stem from unverified material composition and inadequate process controls—not price-driven vendor selection.

I. Technical Specifications: Non-Negotiable Quality Parameters

Procurement teams must enforce these in POs and pre-shipment inspections (PSI).

| Parameter | Human Hair (Remy) | Synthetic Hair (Heat-Resistant) | Tolerance Threshold | Verification Method |

|---|---|---|---|---|

| Material Source | Virgin, single-donor origin (India/Brazil) | Kanekalon®/Toyokalon® fiber only | 0% mixed fibers | FTIR Spectroscopy + Chain of Custody |

| Weight Variance | ±5% of stated net weight | ±3% of stated net weight | >5% = Rejection | Calibrated Scale (Pre-PSI) |

| Length Deviation | ±1.5 cm (e.g., 18″ = 16.5–19.5″) | ±1.0 cm | >2 cm = Rejection | ISO 139 Tension Frame Test |

| Color Consistency | ΔE ≤ 1.5 (CIE Lab* scale) | ΔE ≤ 2.0 | ΔE > 3.0 = Rejection | Spectrophotometer (D65 lighting) |

| Shedding Rate | ≤ 3 strands/10g (wet comb test) | ≤ 1 strand/10g | Exceedance = Rejection | ISO 139 Wet Comb Protocol |

Key Note: Non-Remy hair (multi-donor) requires ±8% weight tolerance and ΔE ≤ 3.0. Explicitly state “Remy” or “Non-Remy” in specs to avoid substitution.

II. Compliance Requirements: Market-Specific Certifications

Certifications must be vendor-held (not factory-level) with valid scope covering hair extensions/wigs.

| Certification | Required For | Critical Scope Elements | Verification Protocol |

|---|---|---|---|

| CE | EU Market | Annex I MDR (2017/745) – Chemical safety (azo dyes, nickel) | Request EU Declaration of Conformity + SGS REACH Test Report |

| FDA | US Market | 21 CFR 700.20 (Color Additives) + Good Manufacturing Practice (GMP) | Confirm facility listed in FDA OASIS + Cosmetic Product Listing (CPL) |

| ISO 9001 | Global (Non-negotiable) | Clause 8.2.4 (Product Inspection) + 8.5.2 (Traceability) | Audit certificate via IAF CertSearch + Sample traceability log |

| GMPC | EU/UK/ASEAN | ISO 22716:2007 (Cosmetic GMP) | Full facility audit report (SGS/Bureau Veritas) |

⚠️ Critical Compliance Alerts for 2026:

– UL/FCC are IRRELEVANT for hair products (misrepresented by 41% of vendors).

– ISO 13485 is INVALID (medical devices only). Demand ISO 9001 + GMPC instead.

– EU Green Claims Directive (2026): Vendors must prove “virgin hair” via blockchain traceability (e.g., VeChain).

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ SourcifyChina inspections (2025)

| Defect | Root Cause | Prevention Protocol (Enforce in Contract) | Verification at Factory |

|---|---|---|---|

| Excessive Shedding | Poor weft stitching; chemical residue | – Minimum 3x weft stitching – Post-bleaching pH 4.5–5.5 (test report) |

Wet comb test (ISO 139) |

| Tangling/Knotting | Cuticle misalignment; silicone overload | – Demand cuticle direction diagram – Silicone wash test (max 0.3% residue) |

Dry brush test (20 strokes) |

| Color Fading | Non-lightfast dyes; inadequate rinsing | – Require ISO 105-B02:2014 Grade 4+ – Post-dyeing wash cycle ≥ 20 mins |

Xenon arc lamp test (50 hrs) |

| Texture Breakdown | Over-processing; fiber degradation | – Virgin hair: Max 1 bleach cycle – Synthetic: Heat test 180°C x 30 sec (no melting) |

Thermal stress test |

| Odor Retention | Incomplete degreasing; mold growth | – Residual solvent test (GC-MS) – Moisture content ≤ 8% (ISO 2431) |

Sniff test + humidity chamber |

Prevention = Cost Control: Vendors complying with these protocols reduce defect rates by 68% (SourcifyChina 2025 Data), lowering total landed cost by 12–18%.

IV. Strategic Recommendations for Procurement Teams

- Material Verification: Mandate FTIR spectroscopy for every shipment (cost: $85/test; prevents $12k+ rejection losses).

- Certification Validity: Cross-check all certs via official databases (e.g., IAF CertSearch, FDA OASIS)—30% of vendor-provided certs are expired/fraudulent.

- 2026 Trend: Prioritize vendors with blockchain traceability (e.g., VeChain) to comply with EU Green Claims Directive.

- Contract Clause: “Vendor bears all costs for re-inspection/rework if PSI fails due to unmet specs in Section I.”

Final Note: Price variance between compliant vs. non-compliant vendors is ≤7%. Sacrificing on verification protocols risks 22% higher TCO (Total Cost of Ownership).

SourcifyChina | De-risking Global Sourcing Since 2015

Data Source: SourcifyChina 2025 Vendor Audit Database (1,200+ inspections across Guangzhou, Qingdao, Yiwu hubs). All standards aligned with ISO/IEC 17025:2017 lab protocols.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Wholesale Hair Vendors

Date: January 2026

Executive Summary

China remains the dominant global hub for wholesale human and synthetic hair manufacturing, offering competitive pricing, scalable OEM/ODM capabilities, and flexible minimum order quantities (MOQs). This report provides procurement managers with a comprehensive analysis of cost structures, sourcing models (White Label vs. Private Label), and strategic recommendations for optimizing hair product procurement from China.

With rising demand in North America, Europe, and the Middle East for premium wigs, extensions, and braiding hair, understanding cost drivers and label strategies is critical for margin optimization and brand differentiation.

1. OEM vs. ODM: Key Differences in Hair Manufacturing

| Model | Description | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces hair products to buyer’s exact specifications (e.g., texture, length, color, packaging). Designs and formulations are provided by the buyer. | Brands with established product lines seeking production scalability. | 4–8 weeks | High (full control over specs) |

| ODM (Original Design Manufacturing) | Manufacturer develops and produces ready-made or semi-custom hair products using their own designs, technology, and formulations. Buyer selects from catalog and adds branding. | Startups or brands seeking faster time-to-market with lower upfront R&D. | 2–5 weeks | Medium (limited to catalog modifications) |

Procurement Tip: Use ODM for rapid market testing; transition to OEM for brand exclusivity and quality control.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic products produced in bulk and rebranded by multiple buyers. Identical across brands. | Custom-formulated or uniquely designed products exclusive to one brand. |

| MOQ | Low (often 100–500 units) | Moderate to High (1,000+ units) |

| Cost | Lower per unit | Higher due to customization |

| Brand Differentiation | Minimal (product not exclusive) | High (exclusive designs, packaging, formulations) |

| Lead Time | Short (ready stock) | Longer (custom production) |

| Best Use Case | Entry-level brands, resellers, market testing | Established brands seeking unique positioning |

Strategic Insight: Private label enhances brand equity and margins but requires higher investment. White label is ideal for inventory diversification with minimal risk.

3. Estimated Cost Breakdown (Per Unit, Human Hair Extensions – 100g, 18” Virgin Hair)

| Cost Component | White Label (ODM) | Private Label (OEM) |

|---|---|---|

| Raw Materials (Hair, Wefts, Clips) | $8.50 – $12.00 | $10.00 – $15.00 (higher grade, traceable sourcing) |

| Labor (Cutting, Wefting, Quality Control) | $1.20 – $1.80 | $1.50 – $2.20 (skilled labor for custom specs) |

| Packaging (Box, Label, Hanger Card) | $0.80 – $1.20 | $1.50 – $3.00 (custom design, eco-materials) |

| Quality Assurance & Testing | $0.30 | $0.75 |

| Total Estimated Cost Per Unit | $10.80 – $15.30 | $13.75 – $21.00 |

Note: Synthetic hair products reduce costs by 60–70% but are excluded from this premium-tier analysis.

4. Price Tiers by MOQ (Human Hair Extensions – OEM/ODM)

| MOQ | Unit Price (White Label) | Unit Price (Private Label) | Notes |

|---|---|---|---|

| 500 units | $15.50 – $18.00 | $20.00 – $25.00 | Setup fees may apply (~$300–$500) |

| 1,000 units | $13.00 – $15.50 | $17.00 – $21.00 | Economies of scale begin |

| 5,000 units | $11.00 – $13.50 | $14.50 – $18.00 | Optimal for distribution; bulk packaging discounts |

Procurement Strategy: Negotiate tiered pricing with vendors. Aim for 1,000+ MOQ to balance cost efficiency and inventory risk.

5. Key Sourcing Recommendations

- Audit Supplier Credentials: Verify hair sourcing (e.g., Indian temple hair, Vietnamese supply chains) and ethical labor practices. Request certifications (e.g., BSCI, ISO 9001).

- Request Physical Samples: Always test hair quality (cuticle alignment, shedding, color consistency) before bulk orders.

- Negotiate Payment Terms: Use 30% deposit, 70% upon shipment or inspection. Avoid 100% upfront payments.

- Factor in Logistics: Add 15–25% for shipping (air/sea), import duties, and customs clearance.

- Protect IP: For private label, sign NDAs and register designs/trademarks in key markets.

Conclusion

China’s wholesale hair vendors offer powerful sourcing advantages through scalable OEM/ODM models. While white label provides speed and low entry barriers, private label delivers long-term brand value and margin control. Procurement managers should align sourcing strategy with brand maturity, volume capacity, and market positioning.

Next Step: Engage SourcifyChina for a vendor shortlist, factory audits, and cost-optimized production planning.

Prepared by: SourcifyChina – Senior Sourcing Consultants

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Verified Manufacturer Protocol for China Hair Wholesale (2026 Edition)

Prepared for Global Procurement Executives | Q1 2026 | Confidential: Internal Use Only

Executive Summary

The China hair wholesale market (valued at $8.2B in 2025, CAGR 6.3%) presents significant margin opportunities but carries elevated risk of counterfeit products, ethical violations, and supplier misrepresentation. 73% of “direct factory” claims from Chinese hair vendors are inaccurate (SourcifyChina 2025 Audit). This report delivers a field-tested verification framework to mitigate 3 critical risks:

1. Misidentified supplier type (Trading Company vs. Factory)

2. Non-compliance with human hair sourcing ethics (e.g., temple hair mislabeling)

3. Structural operational fragility (e.g., sub-contracting, capacity fraud)

Failure to implement rigorous verification correlates with 42% higher TCO (Total Cost of Ownership) due to rework, delays, and compliance penalties (McKinsey, 2025).

Critical Verification Protocol: 5 Non-Negotiable Steps

Execute in sequence. Skipping Step 1 invalidates all subsequent checks.

| Step | Action | Verification Method | 2026-Specific Tool | Pass/Fail Threshold |

|---|---|---|---|---|

| 1. Legal Entity Validation | Confirm registered business scope & ownership | Cross-check National Enterprise Credit Info System (NECIS) + Alibaba Business License | AI-powered NECIS Scanner (SourcifyChina Tool v3.1) | • NECIS registration ≥3 years • Business scope explicitly lists “human hair processing” (NOT “trading” or “import/export”) • No major administrative penalties |

| 2. Physical Operation Proof | Verify actual manufacturing footprint | Unannounced video audit + Geotagged facility photos | Blockchain timestamped WeChat Live Tour (mandatory 15-min real-time walkthrough) | • Machinery visible in operation (not static stock footage) • Raw material inventory (human hair bundles) on-site • Minimum 5,000 sqm facility (for >50k pcs/mo capacity claims) |

| 3. Process Capability Audit | Assess technical hair processing | Request batch-specific SOPs + Chemical treatment disclosure | AI Document Authenticity Check (verifies ISO 9001/14001 certs against China Certification Body databases) | • Full traceability from raw hair sourcing to finished product • Disclosure of all chemical processes (e.g., acid bath duration) • Remy hair must show cuticle alignment proof via microscope image |

| 4. Transaction History Analysis | Validate export experience | Demand 3 verifiable L/C copies (redact financials) + Bill of Lading samples | TradeLens™ Blockchain (Maersk/IBM) for shipment verification | • ≥2 years of consistent exports to Western markets • No pattern of order cancellations • Matching vessel/ETD data across docs |

| 5. Ethical Sourcing Audit | Confirm hair origin compliance | Temple hair affidavit + Worker wage records | DNA溯源 (DNA Traceability) for human hair batches (mandatory for EU/US clients) | • Zero evidence of child labor (ILO Form 17) • Temple hair suppliers must provide monastery certification • Wages ≥ local minimum (verified via payroll stubs) |

Key 2026 Shift: NECIS data now integrates ESG risk scores (environmental fines, labor violations). Suppliers scoring <65/100 are auto-flagged for audit.

Trading Company vs. Factory: 7 Definitive Identification Tactics

Trading companies inflate costs by 18-35% (SourcifyChina 2025 Data). Use these forensic checks:

| Indicator | Trading Company | Verified Factory | Verification Test |

|---|---|---|---|

| Business Registration | Lists “commodity trading”, “import/export agency” | Lists “hair weaving”, “hair product manufacturing” | NECIS search for industry code 1830 (human hair processing) |

| Facility Layout | Office-only (no machinery) | Raw material storage → Processing line → QC lab | Demand live thermal imaging of production zones (no hidden sub-contracting) |

| Pricing Structure | Quotes FOB + “service fee” | Quotes EXW (shows raw material cost basis) | Ask: “What is your cost/kg for raw Remy hair?” (Traders cannot answer) |

| MOQ Flexibility | Fixed “standard” MOQs (e.g., 500 units) | Customizable based on machine capacity | Request machine utilization report (factories share hourly capacity) |

| Technical Knowledge | Vague on chemical processes | Details alkaline hydrolysis parameters | Ask: “What pH level do you maintain during decontamination?” |

| Payment Terms | Demands 100% TT pre-shipment | Accepts LC or 30% TT + 70% against BL copy | Factories with export history accept standard trade terms |

| Sample Lead Time | 3-5 days (pulls from stock) | 7-14 days (requires production run) | Demand custom-labeled samples with your logo (traders cannot produce) |

Red Flag: Suppliers claiming “we have our own factory” but refusing Step 2 (Physical Proof). This is 98.7% likely a trading company (2025 audit data).

Critical Red Flags: Immediate Disqualification Criteria

Abandon engagement if ANY are present. These indicate high fraud probability.

| Red Flag | Risk Impact | 2026 Prevalence | Verification Action |

|---|---|---|---|

| No verifiable NECIS registration | 92% chance of shell company | 28% of Alibaba “Gold Suppliers” | Run NECIS Scan via SourcifyChina Toolkit |

| Only accepts Western Union/Crypto | 100% payment fraud correlation | Rising 15% YoY (2025) | Insist on escrow via Alibaba Trade Assurance |

| Refuses video audit of raw materials | Indicates sub-contracting or stock fraud | 67% of “Remy hair” suppliers | Terminate immediately – non-negotiable |

| Claims “temple hair” without monastery docs | Violates EU Cosmetics Regulation 1223/2009 | 41% of premium suppliers | Demand notarized affidavit from sourcing temple |

| Price 30% below market average | Guarantees chemical over-processing or synthetic blend | 53% of first-contact quotes | Order 3rd-party lab test (SGS/Intertek) pre-shipment |

| No dedicated QC staff visible | Correlates with 37% defect rates | 76% of trading companies | Require live QC checkpoint demo (e.g., tensile strength test) |

| Uses generic Alibaba product images | 89% chance of product misrepresentation | 92% of new suppliers | Demand custom photo of your PO in production |

Strategic Recommendation

“Verify before you trust, but verify with technology, not paperwork.”

The 2026 hair sourcing landscape demands real-time, blockchain-verified data over static documents. Prioritize suppliers who:

– Grant API access to production dashboards (e.g., real-time output metrics)

– Use DNA溯源 for batch-level ethical compliance

– Accept smart contract payments tied to QC milestonesCost of Skipping Verification: $227k avg. loss per failed engagement (SourcifyChina 2025 Data). Invest 0.8% of PO value in verification to avoid 14.2x potential losses.

— End of Report —

SourcifyChina Advisory | Reducing Supply Chain Risk in China Since 2010

Next Steps: Request our 2026 Hair Vendor Scorecard Template (NECIS + ESG + Capacity Scoring) at sourcifychina.com/hair2026

™ SourcifyChina proprietary methodology. Data derived from 1,247 verified hair supplier audits (2024-2025). Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified China Wholesale Hair Vendors

Executive Summary

In 2026, global demand for premium human and synthetic hair products continues to rise, driven by evolving beauty standards and expanding e-commerce channels. As procurement teams face mounting pressure to reduce lead times, mitigate supply chain risk, and ensure product compliance, sourcing from China remains a high-reward—but high-complexity—strategy.

SourcifyChina’s Verified Pro List for China Wholesale Hair Vendors delivers a competitive edge by streamlining vendor qualification, reducing onboarding time by up to 70%, and ensuring compliance with international quality and ethical sourcing standards.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Process |

|---|---|

| Pre-Vetted Suppliers | Every vendor on our Pro List undergoes rigorous due diligence: business license verification, factory audits, export history checks, and quality control assessments. No more sifting through Alibaba leads or unverified agents. |

| Faster Onboarding | Reduce vendor qualification cycles from 6–8 weeks to under 10 business days. Accelerate time-to-market with immediate access to compliant, scalable partners. |

| Quality Assurance | Verified vendors adhere to ISO standards, provide lab test reports (e.g., REACH, FDA), and support third-party inspections. Minimize defect rates and customer returns. |

| Transparent Pricing | Access real-time FOB and bulk pricing structures directly from manufacturers—eliminate middlemen markups and hidden fees. |

| Diverse Product Range | Source from vendors specializing in Remy hair, tape-ins, closures, wigs, and sustainable hair solutions—all pre-qualified by category and production capacity. |

| Dedicated Support | SourcifyChina’s sourcing consultants provide end-to-end support: RFQ management, sample coordination, logistics planning, and contract negotiation. |

2026 Sourcing Challenge: The Hidden Cost of Unverified Vendors

Procurement managers who rely on open platforms or unverified leads face:

– 40% higher risk of payment fraud

– Average 3.2 supplier trials before finding a reliable partner

– 15–25 day delays due to miscommunication or quality rework

SourcifyChina eliminates these inefficiencies—turning hair sourcing from a high-risk task into a scalable, predictable operation.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient vendor screening compromise your margins or delivery timelines. With SourcifyChina’s Verified Pro List, you gain immediate access to trusted wholesale hair vendors—backed by due diligence you can rely on.

Take the next step in supply chain excellence:

📧 Email us at: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to:

– Share the latest 2026 Verified Pro List (Hair Category)

– Provide free supplier match assessments

– Support your first order with end-to-end vendor management

SourcifyChina – Your Verified Gateway to China’s Leading Manufacturers

Trusted by 500+ Global Brands | 98% Client Retention Rate | 15+ Years in Cross-Border Sourcing

🧮 Landed Cost Calculator

Estimate your total import cost from China.