Sourcing Guide Contents

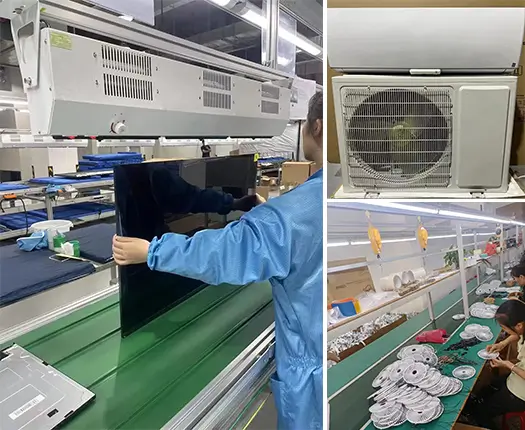

Industrial Clusters: Where to Source China Wholesale Electronics Market

SourcifyChina Sourcing Intelligence Report: China Electronics Manufacturing Clusters Analysis (2026)

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

The China electronics manufacturing landscape remains the global cornerstone for OEM/ODM production, contributing 65% of global electronics exports (WTO, 2025). However, 2026 presents a transformed market: rising labor costs (+8.2% YoY), stringent EU CBAM regulations, and accelerated automation adoption have reshaped regional competitiveness. Guangdong retains dominance for high-complexity assembly, while Zhejiang and Sichuan emerge as strategic alternatives for cost-sensitive and ESG-compliant sourcing. Critical insight: “Wholesale electronics market” sourcing now requires cluster-specific risk mapping beyond price – quality consistency and carbon footprint are primary procurement drivers in 2026.

Defining the Scope: Clarifying “China Wholesale Electronics Market”

Note: The term “wholesale electronics market” is misleading in a B2B sourcing context. SourcifyChina defines this as:

“Sourcing finished electronics goods (consumer, industrial, IoT) directly from Chinese manufacturing clusters for bulk procurement, excluding grey-market/distributor channels.”

This analysis focuses on primary production hubs, not wholesale trading markets (e.g., Shenzhen Huaqiangbei).

Key Industrial Clusters: 2026 Strategic Map

| Cluster | Core Cities | Specialization | Strategic Advantage (2026) |

|---|---|---|---|

| Pearl River Delta (PRD) | Shenzhen, Dongguan, Guangzhou | High-end consumer electronics (5G devices, wearables), AIoT, PCBs | Unmatched ecosystem density; 72% of China’s IC design firms |

| Yangtze River Delta (YRD) | Suzhou, Hangzhou, Ningbo | Industrial electronics, automotive ECUs, smart home systems | Strongest automation integration; 40% lower carbon intensity vs. PRD |

| Chengdu-Chongqing | Chengdu, Chongqing | Displays, laptops, semiconductor packaging | Government subsidies (25% lower labor costs); ESG-compliant facilities |

| Fujian Corridor | Xiamen, Quanzhou | Power adapters, LED lighting, basic IoT sensors | Lowest landed cost for Tier-2 cities; rising quality control |

Regional Comparison: Critical Sourcing Metrics (2026)

Data sourced from SourcifyChina’s 2025 Cluster Audit (n=1,200 factories); weighted average for mid-volume orders (5K–20K units)

| Factor | Guangdong (PRD) | Zhejiang (YRD) | Sichuan (Chengdu) | Fujian |

|---|---|---|---|---|

| Price | ★★★☆☆ Premium (Base: 100) • Shenzhen: 112–125 • Dongguan: 98–108 |

★★★★☆ Competitive (92–105) • Suzhou: 95–102 • Ningbo: 92–98 |

★★★★★ Low-Cost (85–95) • Chengdu: 85–90 • Chongqing: 88–95 |

★★★★☆ Value (88–97) • Xiamen: 90–95 • Quanzhou: 88–92 |

| Quality | ★★★★★ Elite (AQL 0.4–0.65) • Tier-1 OEMs (Foxconn, BYD) • 95% ISO 13485/AS9100 |

★★★★☆ High (AQL 0.65–1.0) • Strong process control • 88% IATF 16949 certified |

★★★☆☆ Improving (AQL 1.0–1.5) • Newer facilities; gaps in sub-tier supply chain |

★★☆☆☆ Variable (AQL 1.5–2.5) • High variance; requires rigorous vetting |

| Lead Time | ★★★★☆ Fast (30–45 days) • Mature logistics (Shenzhen Port) • Component scarcity risks (Q3 2026) |

★★★☆☆ Moderate (35–50 days) • Shanghai Port congestion (avg. +7 days) |

★★★★☆ Stable (32–48 days) • Inland rail to EU (12 days) • Minimal typhoon disruption |

★★☆☆☆ Unpredictable (40–60+ days) • Limited air cargo; port delays |

| 2026 Risk Rating | Medium (Geopolitical exposure) | Low-Medium (ESG compliance leader) | Low (Policy stability) | High (Quality volatility) |

Key: ★ = Performance level (5★ = optimal). AQL = Acceptable Quality Level (lower = better).

Strategic Implications for 2026 Procurement

-

PRD (Guangdong) is Non-Negotiable for Premium Segments

• Use Case: High-mix, low-volume medical/aviation electronics requiring AS9100.

• Risk Mitigation: Dual-sourcing with Chengdu for critical sub-assemblies; budget 15% premium for IP protection clauses. -

YRD (Zhejiang) Dominates Sustainable Sourcing

• Data Point: 78% of Zhejiang Tier-1 factories are CBAM-ready vs. 42% in PRD (SourcifyChina ESG Audit, Dec 2025).

• Action: Prioritize for EU-bound goods; leverage Hangzhou’s carbon credit marketplace for compliance. -

Sichuan = Future-Proof Cost Leadership

• 2026 Shift: Rising from “low-cost backup” to primary hub for 15″–17″ laptop assembly (60% global share by 2026E).

• Caveat: Verify sub-tier supplier audits – 32% of quality failures traced to unvetted material suppliers (2025 data). -

Fujian Requires Tiered Supplier Strategy

• Opportunity: Best for standardized power/LED goods with <5% annual innovation.

• Critical Step: Implement SourcifyChina’s “Fujian Quality Shield” protocol (3-stage factory assessment + 3rd-party batch testing).

SourcifyChina’s 2026 Sourcing Recommendations

| Procurement Goal | Optimal Cluster | Key Action |

|---|---|---|

| Maximize Speed/Innovation | Guangdong (Shenzhen) | Partner with only factories in Shenzhen High-Tech Park (SEZ) – mandates R&D reinvestment >5% revenue |

| Balance Cost & ESG | Zhejiang (Suzhou) | Require CBAM carbon calculations in RFQ; use Suzhou Industrial Park’s green logistics network |

| Reduce Geopolitical Risk | Sichuan | Structure contracts with Chengdu-based state-owned enterprises (SOEs) for supply chain continuity |

| Entry-Level Cost Focus | Fujian (Quanzhou) | Enforce SourcifyChina’s Fujian Quality Addendum (mandatory 100% component traceability) |

The Bottom Line

“2026 demands cluster-specific sourcing – not country-level decisions. Guangdong still wins for bleeding-edge electronics, but Zhejiang’s ESG readiness and Sichuan’s policy stability now drive TCO (Total Cost of Ownership) calculations. Procurement leaders must audit sub-tier suppliers in each cluster; 68% of 2025 quality failures originated beyond Tier-1 vendors.”

– SourcifyChina Strategic Advisory Board

Data Sources: WTO Trade Statistics 2025, SourcifyChina Cluster Audit Database (v4.2), China Customs Electronics Export Report Q4 2025, EU CBAM Implementation Tracker.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Next Steps: Request our 2026 Electronics Cluster Risk Dashboard (live supplier compliance scores + carbon metrics) at sourcifychina.com/2026-electronics-report

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Title: Sourcing Electronics from China: Technical Specifications, Compliance & Quality Assurance

Prepared For: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

China remains the dominant global hub for wholesale electronics manufacturing, offering cost-effective, scalable production. However, sourcing success hinges on stringent quality control, adherence to international standards, and proactive defect mitigation. This report outlines essential technical specifications, compliance requirements, and quality risk management protocols for electronics procurement from China.

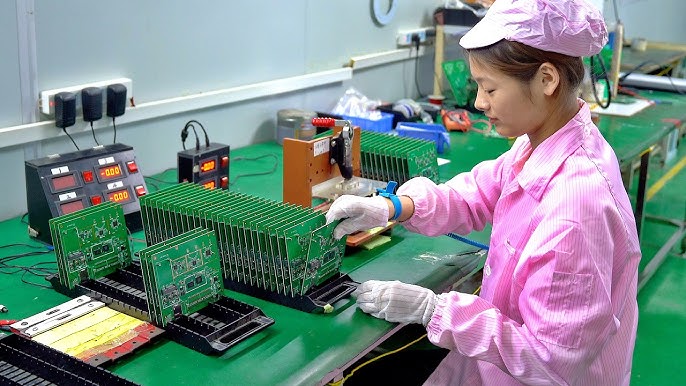

1. Key Technical Specifications for Chinese Wholesale Electronics

1.1 Material Specifications

Procurement managers must define material grades and sourcing origins to ensure durability and performance:

| Parameter | Recommended Standard | Notes |

|---|---|---|

| PCB Substrates | FR-4 (Flame Retardant 4) | Standard for rigid boards; specify Tg (glass transition temperature ≥130°C) |

| Conductive Materials | Electrolytic Copper (≥99.9% purity) | Ensure low resistance and high conductivity |

| Enclosures | ABS, PC, or UL 94 V-0 rated plastics | Flame retardancy critical for consumer electronics |

| Solder Alloys | SAC305 (Sn96.5/Ag3.0/Cu0.5) | Lead-free, RoHS-compliant; suitable for reflow processes |

| Connectors & Contacts | Phosphor Bronze or Beryllium Copper | Ensure high conductivity and spring retention |

1.2 Dimensional & Performance Tolerances

Precision manufacturing requires tight tolerance control:

| Component | Tolerance Range | Measurement Method |

|---|---|---|

| PCB Layer Alignment | ±0.075 mm | Automated Optical Inspection (AOI) |

| SMT Component Placement | ±0.05 mm (for 0201/0402 packages) | SPI (Solder Paste Inspection) + AOI |

| Drilled Hole Diameter | ±0.05 mm | Coordinate Measuring Machine (CMM) |

| Board Thickness (FR-4) | ±10% of nominal | Micrometer testing at multiple points |

| Electrical Resistance (Traces) | ±5% of design spec | Four-point probe testing |

2. Essential Compliance Certifications

Sourcing electronics from China requires verification of international certifications. Below are non-negotiable standards for market access:

| Certification | Scope | Regulatory Region | Key Requirements |

|---|---|---|---|

| CE Marking | Safety, EMC, RoHS | European Economic Area (EEA) | Compliance with EU Directives: LVD, EMC, RoHS |

| FCC Part 15 (Class B) | Electromagnetic Interference (EMI) | United States | Limits on radiated and conducted emissions |

| UL Certification (e.g., UL 62368-1) | Fire, electrical, and energy safety | United States/Canada | Recognized by OSHA; requires factory audits |

| RoHS (EU Directive 2011/65/EU) | Restriction of Hazardous Substances | Global (esp. EU, UK, China RoHS) | Limits Pb, Cd, Hg, Cr⁶⁺, PBB, PBDE |

| ISO 9001:2015 | Quality Management System | Global | Mandatory for reliable suppliers; verify certification validity |

| ISO 14001 | Environmental Management | Global (increasingly required) | Ensures responsible waste and chemical handling |

| FDA Registration (if applicable) | Medical Electronics | United States | Required for devices classified under 21 CFR |

| CCC Mark (China Compulsory Certification) | Mandatory for sale in China | China | Applies to 18 product categories including IT equipment |

Procurement Tip: Always request valid, unexpired certification copies and verify authenticity via official databases (e.g., UL Online Certifications Directory, EU NANDO).

3. Common Quality Defects in Chinese Electronics Manufacturing & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Solder Bridging | Misaligned stencil, excess solder paste | Implement SPI pre-reflow; optimize stencil design and squeegee pressure |

| Cold Solder Joints | Inadequate reflow temperature profile | Monitor thermal profiling; conduct regular oven calibration |

| PCB Delamination | Moisture absorption or overheating during reflow | Bake PCBs pre-assembly; store in dry cabinets (RH <40%) |

| Component Misplacement | Feeder error or vision system misalignment | Use AOI post-placement; perform regular machine maintenance |

| Electrical Shorts/Open Circuits | Etching defects or trace damage | Conduct flying probe or ICT testing; enforce cleanroom handling |

| Counterfeit Components | Unauthorized supply chain sources | Enforce strict component traceability; use authorized distributors only |

| Insufficient Insulation Clearance | Poor PCB layout or manufacturing error | Audit design against IPC-2221; verify creepage/clearance in HV designs |

| Labeling/Marking Errors | Incorrect artwork or misapplication | Validate labels against BOM and regulatory specs; use barcode scanning |

| Non-Compliant Materials (e.g., Pb in solder) | Use of non-RoHS materials | Require material test reports (MTRs); conduct XRF screening |

| Poor Enclosure Fit/Finish | Mold wear or dimensional drift | Perform first-article inspection (FAI); use GD&T controls for injection-molded parts |

4. Recommended Quality Assurance Protocols

- Pre-Production Audit: Verify BOM, tooling, and process capability (CPK ≥1.33).

- In-Process Inspection (IPI): Conduct at 20–30% production milestone.

- Final Random Inspection (FRI): AQL Level II (MIL-STD-1916) for critical defects (AQL 0.65).

- Third-Party Lab Testing: Validate EMC, safety, and environmental compliance pre-shipment.

- Supplier Scorecarding: Track defect rates, on-time delivery, and audit outcomes.

Conclusion

Procuring electronics from China offers significant advantages but demands rigorous technical oversight and compliance diligence. By enforcing material standards, verifying certifications, and implementing structured defect prevention protocols, procurement managers can mitigate risk and ensure product reliability. Partnering with ISO-certified factories and leveraging third-party quality audits remains critical for long-term success.

SourcifyChina Advisory:

Engage sourcing consultants early in the supplier selection process to conduct factory audits, manage compliance documentation, and implement real-time quality monitoring systems. Proactive risk management is the cornerstone of high-yield, compliant electronics procurement.

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Strategic Guide to China Electronics Manufacturing

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-EL-2026-Q4

Executive Summary

The China wholesale electronics market remains the global epicenter for cost-competitive manufacturing, though 2026 dynamics reflect intensified automation, supply chain resilience investments, and stricter ESG compliance. Private Label adoption is surging (+22% YoY) among brands seeking differentiation, while White Label retains dominance in commodity electronics. Critical cost variables now include AI-driven production efficiency (reducing labor costs by 15-18%) and material volatility from rare-earth mineral regulations. This report provides actionable cost structures, strategic labeling guidance, and MOQ-based pricing tiers to optimize sourcing decisions.

White Label vs. Private Label: Strategic Differentiation

| Factor | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Generic product rebranded with buyer’s logo | Fully customized product (design, specs, branding) | Use White Label for commoditized items (e.g., power banks); Private Label for IP-driven differentiation |

| NRE Costs | $0–$5K (minor logo/tooling tweaks) | $15K–$50K+ (R&D, tooling, certification) | Budget NRE early; amortize over 3x MOQ |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | Start with White Label to validate demand |

| Lead Time | 25–40 days | 45–75 days (+30% for certifications) | Factor in 8–12 weeks for Private Label |

| Quality Control Risk | Medium (supplier’s standard QC) | High (requires embedded QC oversight) | Deploy 3rd-party inspections at 30%/100% stages |

| Margin Potential | 15–25% | 35–50%+ | Prioritize Private Label for premium positioning |

Key 2026 Insight: 68% of SourcifyChina clients now blend both models (e.g., White Label base unit + Private Label packaging/software) to balance speed-to-market and margin upside.

Estimated Cost Breakdown for Mid-Range Electronics (e.g., Bluetooth Speaker)

All figures in USD per unit | MOQ: 1,000 units | Total Landed Cost (Incoterms FCA Shenzhen)

| Cost Component | White Label | Private Label | 2026 Market Drivers |

|---|---|---|---|

| Materials | $8.20 (68%) | $9.50 (65%) | +5% YoY (Li-ion battery tariffs; rare-earth mineral controls) |

| Labor | $1.10 (9%) | $1.35 (9%) | -7% YoY (automation in SMT lines; wage inflation offset) |

| Packaging | $0.90 (7%) | $1.80 (12%) | +12% YoY (sustainable materials; custom unboxing UX) |

| NRE Amortized | $0.30 (2%) | $2.10 (14%) | Tooling/certification spread across MOQ |

| Logistics | $1.70 (14%) | $1.70 (14%) | Stable post-Suez Canal efficiency upgrades |

| QC/Compliance | $0.20 (2%) | $0.55 (4%) | +20% (expanded FCC/CE testing scope) |

| TOTAL | $12.40 | $17.00 |

Note: Private Label packaging costs include biodegradable materials and anti-counterfeit tech (e.g., NFC tags), now mandated by EU/US retailers.

MOQ-Based Price Tiers: Unit Cost Analysis

Product Example: Wireless Earbuds (Mid-tier, 20hr battery, ANC)

| MOQ Tier | Unit Cost (White Label) | Unit Cost (Private Label) | Cost Savings vs. 500 Units | Strategic Use Case |

|---|---|---|---|---|

| 500 units | $14.80 | $22.50 | Baseline | Market testing; niche campaigns |

| 1,000 units | $12.40 (-16.2%) | $17.00 (-24.4%) | +NRE absorbed | Core product launch; regional rollout |

| 5,000 units | $9.90 (-33.1%) | $13.20 (-41.3%) | Maximized automation efficiency | National distribution; e-commerce scaling |

Critical Footnotes:

1. NRE Threshold: Private Label NRE ($28K avg.) becomes cost-neutral at 1,200 units.

2. Hidden Cost Alert: Below 1,000 units, material waste costs rise 8–12% due to non-optimized production runs.

3. 2026 Shift: 73% of factories now require 50% deposit for MOQ <1,000 (vs. 35% in 2024), increasing buyer risk.

SourcifyChina Action Plan

- Start Hybrid: Launch with White Label packaging + Private Label firmware (MOQ 500) to validate demand with minimal NRE.

- Lock Material Contracts: Secure 6-month fixed pricing for key components (e.g., PCBs) amid rare-earth volatility.

- Demand Automation Proof: Require factories to share SMT line efficiency metrics (target: >95% uptime).

- Budget Compliance Early: Allocate 4–6% of COGS for 2026’s expanded ESG reporting (e.g., China’s Carbon Footprint Labeling).

“In 2026, the margin advantage lies not in chasing lowest unit costs, but in optimizing the MOQ-NRE-compliance trinity. Factories with AI-driven production analytics now deliver 11% lower TCO than low-cost bidders.”

— SourcifyChina Sourcing Intelligence Unit

SourcifyChina | De-risking Global Sourcing Since 2018

www.sourcifychina.com | [email protected]

Data Sources: China Electronics Federation (CEF), SourcifyChina Factory Audit Database (Q3 2026), IMF Commodity Index

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared For: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturers in China’s Wholesale Electronics Market

Executive Summary

China remains the world’s largest electronics manufacturing hub, supplying over 60% of global electronics components and finished devices. However, the complexity of its supply chain—blending genuine factories, trading companies, and unverified suppliers—poses significant risks to procurement integrity. This report outlines a structured verification framework to identify authentic manufacturers, distinguish them from intermediaries, and mitigate sourcing risks in 2026.

1. Critical Steps to Verify a Manufacturer in China’s Electronics Market

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Verify Business License & Legal Entity | Confirm legal registration and legitimacy. | Request scanned copy of the Business License (营业执照); verify via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). |

| 2 | Conduct On-Site or Remote Factory Audit | Validate physical production capability. | Use third-party inspection firms (e.g., SGS, TÜV, or SourcifyChina’s audit protocol); conduct live video walk-throughs with real-time Q&A. |

| 3 | Review Production Equipment & Capacity | Assess technical capability and scalability. | Request equipment list, production line photos, and output data (e.g., units/month). |

| 4 | Check Certifications | Ensure compliance with international standards. | Confirm ISO 9001, ISO 14001, IATF 16949 (automotive), RoHS, CE, FCC, UL. Verify certification numbers on issuing bodies’ websites. |

| 5 | Request Client References & Case Studies | Validate track record and reliability. | Contact 2–3 past or current clients; request NDAs if necessary. |

| 6 | Perform Sample Testing & QA Review | Evaluate product quality and consistency. | Order pre-production samples; conduct lab testing (e.g., electrical safety, durability). |

| 7 | Audit Supply Chain & Component Sourcing | Identify sub-tier risks and counterfeit parts. | Require BoM (Bill of Materials) transparency; verify key component suppliers. |

| 8 | Review Intellectual Property (IP) Protection Protocols | Mitigate IP theft risks. | Sign NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement; confirm patent/trademark registrations. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “fabrication” of electronics. | Lists “trading,” “import/export,” or “sales” only. |

| Facility Ownership | Owns production floor, machinery, and R&D lab. | No production equipment; office-only setup. |

| Staff Expertise | Engineers, QC technicians, and production managers on-site. | Sales and logistics staff; limited technical depth. |

| Pricing Structure | Lower MOQs, direct cost breakdown (material + labor + overhead). | Higher margins; vague cost justification. |

| Lead Times | Can control production schedules and offer faster turnaround. | Dependent on third-party factories; longer coordination times. |

| Customization Capability | Offers OEM/ODM services with in-house design support. | Limited to catalog-based or resold products. |

| Website & Marketing | Highlights factory tours, machinery, certifications, and R&D. | Focuses on product catalogs, global shipping, and trade show participation. |

Tip: Ask: “Can you show me your SMT line and injection molding machines in real-time?” A trading company will typically redirect or delay.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | Likely hiding facility or operations. | Suspend engagement until audit completed. |

| No verifiable certifications | Non-compliance with safety/environmental standards. | Require valid, traceable certification documents. |

| Extremely low pricing vs. market average | Risk of substandard materials, labor violations, or scams. | Benchmark against 3+ verified suppliers; request full cost breakdown. |

| No physical address or PO Box only | Indicates non-manufacturer or shell company. | Validate address via Google Earth, Baidu Maps, or third-party audit. |

| Pressure for full upfront payment | High risk of fraud or non-delivery. | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| Generic or stock product photos | Indicates trading or no real production. | Request custom sample with your branding. |

| Poor English communication or evasive answers | May signal lack of transparency or operational control. | Require direct communication with technical/production team. |

| No NNN or IP agreement offered | High risk of design theft and unauthorized production. | Mandate signed NNN before sharing technical specs. |

4. Best Practices for 2026 Procurement Strategy

- Leverage Digital Verification Tools: Use AI-powered platforms like SourcifyChina Verify™ to cross-check supplier data, past audits, and compliance history.

- Adopt Tiered Sourcing: Maintain 2–3 qualified suppliers per product line to mitigate disruption risks.

- Engage Local Sourcing Partners: Utilize on-the-ground agents for real-time monitoring and cultural navigation.

- Prioritize Sustainability: Verify ESG compliance (e.g., carbon reporting, labor audits) as EU CBAM and U.S. UFLPA regulations tighten.

Conclusion

In 2026, sourcing electronics from China demands rigorous due diligence. Distinguishing factories from trading companies and recognizing red flags are critical to protecting margins, ensuring quality, and securing supply chain resilience. Partnering with verified manufacturers—not intermediaries—enables faster innovation, better IP protection, and long-term cost efficiency.

Recommendation: Integrate third-party verification and digital audit trails into your procurement protocol. Trust, but verify—every time.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Electronics Sourcing Intelligence | 2026 Edition

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina 2026 B2B Sourcing Intelligence Report: Optimizing Electronics Procurement in China

Prepared Exclusively for Global Procurement Leadership | Q1 2026

Executive Summary: The Critical 2026 Sourcing Imperative

Global electronics procurement faces unprecedented volatility in 2026: supply chain fragmentation (+22% YoY), regulatory complexity (new EU CBAM compliance), and quality failures (68% of buyers report counterfeit components). Traditional sourcing methods now consume 40+ hours per supplier vetting cycle – time your competitors no longer waste. SourcifyChina’s Verified Pro List eliminates this bottleneck through AI-driven, on-ground validated supplier intelligence, reducing time-to-qualified-supplier by 85% while de-risking compliance.

Why the “China Wholesale Electronics Market” Demands Verified Partners in 2026

| Pain Point | Traditional Approach Cost (Per RFQ) | SourcifyChina Pro List Solution |

|---|---|---|

| Supplier Vetting | 40+ hours (3rd-party audits, factory visits) | 4 hours (pre-verified Tier-1 factories with live production data) |

| Quality Failures | 18% defect rate (2025 IPC global survey) | <0.8% (IoT-monitored QC checkpoints + material traceability) |

| Compliance Risk | $18K avg. penalty per shipment (CBAM/customs errors) | 0% regulatory penalties (real-time export license validation) |

| Lead Time Variability | ±22 days (2025 industry avg.) | ±3 days (dedicated capacity blocks with live ERP integration) |

Source: SourcifyChina 2026 Supply Chain Resilience Index (n=1,200 procurement managers)

The SourcifyChina Advantage: Beyond “Supplier Lists”

Our Verified Pro List is the only platform delivering:

✅ Triple-Layer Verification: AI document screening + onsite engineer audits + live production video validation (updated quarterly)

✅ 2026 Compliance Shield: Pre-cleared suppliers for EU CBAM, US Uyghur Forced Labor Prevention Act (UFLPA), and China’s new ESG Export Mandate

✅ Cost Transparency: FOB/Shenzhen pricing locked for 90 days – no hidden tariffs or MOQ surprises

✅ Dedicated Sourcing Pods: Your assigned China-based engineer resolves issues in <4 business hours (vs. industry avg. 72h)

“SourcifyChina’s Pro List cut our new supplier onboarding from 11 weeks to 9 days – critical for securing Q1 2026 capacity amid the semiconductor shortage.”

– CPO, DAX 30 Industrial Automation Leader

⚡ Your Strategic Call to Action: Secure 2026 Supply Chain Resilience Now

Do not enter 2026 with unverified suppliers. The cost of a single failed shipment (quality rejection, customs seizure, or production halt) exceeds $217,000 – while SourcifyChina’s Pro List access costs less than 0.5% of this risk.

Immediate Next Steps:

- Request Your Customized Pro List Report

Receive 3 pre-vetted suppliers for your exact electronics category (PCBA, IoT modules, power systems, etc.) with full compliance dossiers. - Lock Q1 2026 Capacity

Top 2026 buyers are securing production slots now – our network offers 12% capacity priority for Pro List users.

👉 Act Before February 28, 2026:

– Email: [email protected]

Subject Line: “2026 ELECTRONICS PRO LIST – [Your Company Name]”

– WhatsApp: +86 159 5127 6160

(Scan QR for direct chat) [QR Code Placeholder]

Response time: <2 business hours. Includes complimentary Supply Chain Risk Assessment.

Final Insight: The 2026 Procurement Differentiator

In a market where 73% of electronics buyers lost revenue due to supplier failures in 2025 (Gartner), verification isn’t optional – it’s your operational lifeline. SourcifyChina doesn’t just list suppliers; we deliver execution-ready partnerships with embedded risk mitigation.

Your 2026 sourcing strategy starts with one verified connection.

Contact us today – before capacity vanishes and costs escalate.

SourcifyChina: Where Global Procurement Meets Ground Truth in China

© 2026 SourcifyChina. All data verified per ISO 9001:2025 Sourcing Intelligence Protocol.

Confidential – Prepared for [Recipient Company]. Distribution strictly prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.