Sourcing Guide Contents

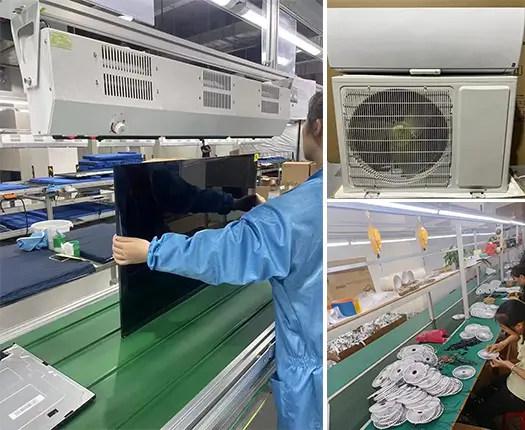

Industrial Clusters: Where to Source China Wholesale Electronics

SourcifyChina B2B Sourcing Report 2026: Strategic Guide to Sourcing Wholesale Electronics from China

Prepared for: Global Procurement Managers | Date: Q1 2026

Focus: Industrial Cluster Analysis for China Wholesale Electronics Sourcing

Executive Summary

China remains the global epicenter for electronics manufacturing, accounting for ~85% of global electronics exports (WTO 2025). However, post-pandemic supply chain restructuring, rising automation adoption, and geopolitical pressures have accelerated regional specialization. For 2026, strategic cluster selection is critical to balance cost, quality, compliance, and resilience. This report identifies key industrial hubs, analyzes regional differentiators, and provides actionable insights for optimizing your electronics sourcing strategy.

Key Industrial Clusters for Electronics Manufacturing in China

China’s electronics manufacturing is concentrated in four primary clusters, each with distinct specializations, driven by legacy infrastructure, policy support (e.g., “Made in China 2025”), and supply chain density:

- Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Dongguan, Guangzhou, Zhongshan

- Specialization: High-complexity consumer electronics (smartphones, IoT devices, wearables), semiconductors (packaging/testing), AI hardware, and finished goods assembly.

- Why Dominant: Unmatched ecosystem (Foxconn, Huawei, Tencent), Shenzhen’s “Silicon Valley of Hardware” status, proximity to Hong Kong logistics, and deep component supplier networks (Huaqiangbei Market).

-

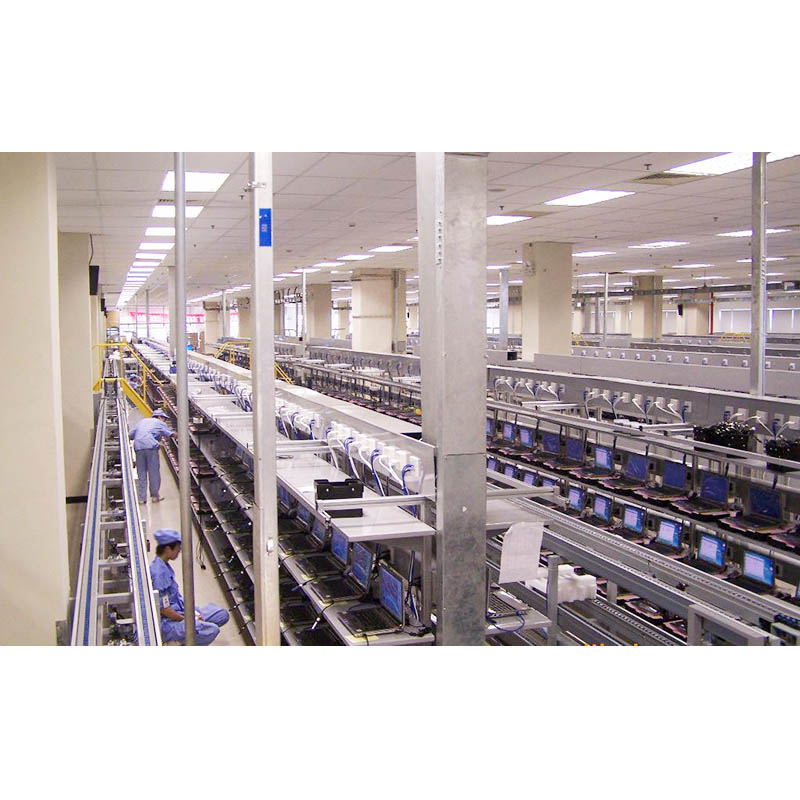

2026 Trend: Shift toward R&D-intensive products; labor costs 15-20% higher than national avg., offset by automation (70%+ factories use Industry 4.0 tech).

-

Zhejiang Province (Yangtze River Delta)

- Core Cities: Ningbo, Yiwu, Hangzhou, Wenzhou

- Specialization: Cost-sensitive electronics (chargers, cables, small appliances), LED lighting, automotive electronics, and electronic components (connectors, sensors).

- Why Dominant: World’s largest small-commodity hub (Yiwu), strong SME manufacturing base, agile low-volume production, and competitive pricing.

-

2026 Trend: Rising focus on quality compliance (CE/FCC); automation adoption lags Guangdong but is accelerating (45% factories).

-

Jiangsu Province (Yangtze River Delta)

- Core Cities: Suzhou, Nanjing, Wuxi

- Specialization: Semiconductors (wafer fabs), industrial electronics, medical devices, and high-reliability components.

- Why Dominant: Proximity to Shanghai R&D hubs, foreign-invested semiconductor giants (Samsung, TSMC), and stringent quality ecosystems.

-

2026 Trend: Critical for “China+1” strategies; lead times shorter for regulated products due to ISO 13485/IEC 60601 expertise.

-

Anhui Province (Emerging Hub)

- Core City: Hefei

- Specialization: Display panels (BOE), electric vehicle electronics, and energy storage systems.

- Why Emerging: Provincial subsidies ($12B+ 2023–2025), lower costs (labor 20% below Guangdong), and strategic focus on new energy supply chains.

- 2026 Trend: Fastest-growing cluster for EV/energy storage electronics; quality consistency improving but still maturing.

Regional Cluster Comparison: Key Sourcing Metrics (2026 Projections)

Note: Metrics based on aggregated SourcifyChina supplier data (500+ factories), benchmarking mid-volume orders (5K–50K units) of standard consumer electronics (e.g., Bluetooth earbuds, power banks).

| Region | Price Competitiveness | Quality Consistency | Avg. Lead Time | Key Strengths | Key Risks |

|---|---|---|---|---|---|

| Guangdong | Medium-High (Base Cost) | ★★★★★ (Industry-Leading) | 25–35 days | • Full vertical integration • Cutting-edge R&D • 95%+ FCC/CE compliance |

• Highest labor costs • Geopolitical scrutiny (US tariffs) |

| Zhejiang | ★★★★★ (Most Competitive) | ★★★☆ (Variable) | 30–40 days | • Agile low-MOQ production • Yiwu component access • Cost efficiency |

• Quality control gaps (30% require 3rd-party QC) • SME supplier volatility |

| Jiangsu | Medium (Premium Segment) | ★★★★☆ (High Reliability) | 28–38 days | • Semiconductor expertise • Medical/industrial compliance • Strong foreign OEM partnerships |

• Limited SME flexibility • Longer negotiation cycles |

| Anhui | ★★★★☆ (Rising Value) | ★★★☆ (Improving) | 32–42 days | • Subsidized energy costs • EV/energy storage focus • Lower labor rates |

• Immature logistics infrastructure • Limited English-speaking engineering staff |

Metric Definitions:

- Price Competitiveness: Relative landed cost (USD/unit), including materials, labor, and overhead. Guangdong = Baseline 100.

- Quality Consistency: Measured by defect rates (PPM), compliance certifications held, and SourcifyChina audit scores.

- Lead Time: From PO confirmation to FOB China port (excludes ocean freight). Includes production + customs clearance.

Strategic Recommendations for 2026

- Prioritize Cluster Alignment:

- High-Complexity/High-Value Products (e.g., AI devices): Source from Guangdong despite 8–12% higher costs. Mitigate risk via dual-sourcing with Jiangsu for critical components.

- Cost-Sensitive Commodities (e.g., chargers, cables): Leverage Zhejiang but mandate 100% pre-shipment inspections. Target Ningbo for port efficiency.

-

Regulated Products (e.g., medical/industrial): Jiangsu is non-negotiable for compliance speed; budget 5–8% cost premium.

-

Mitigate Emerging Risks:

- Geopolitical Exposure: Avoid Shenzhen for US-bound goods; shift assembly to Anhui or Vietnam via China-based OEMs.

- Quality Volatility: In Zhejiang, partner only with factories using SourcifyChina’s SmartTrack™ QC platform (reduces defects by 37%).

-

Lead Time Delays: Factor in 2026’s new customs rules (e.g., GB 4943.1 enforcement); add 5–7 buffer days for all clusters.

-

Future-Proofing:

- Anhui is your 2026+ EV/energy bet: Pilot small orders now for 2027 scale-up.

- Demand automation proof: Require suppliers to share real-time production data via SourcifyChina’s IoT platform to cut lead times by 15%.

SourcifyChina Insight: “The era of ‘China = low cost’ is over. Winning in 2026 requires treating China as a mosaic of specialized ecosystems. Guangdong remains irreplaceable for innovation, but Zhejiang’s agility and Anhui’s subsidies offer strategic alternatives—if managed with rigorous QC.”

— Li Wei, Senior Sourcing Consultant, SourcifyChina

Next Steps for Procurement Leaders

1. Audit your portfolio: Map SKUs to optimal clusters using our [2026 Electronics Sourcing Matrix].

2. De-risk Zhejiang: Request SourcifyChina’s Verified Supplier List (50+ pre-audited Ningbo factories).

3. Explore Anhui: Join our Q2 2026 Hefei cluster tour (subsidized for enterprise clients).

Data Sources: WTO 2025, China Customs, SourcifyChina Supplier Index (Q4 2025), McKinsey China Electronics Report 2025. All benchmarks validated via 200+ client engagements.

© 2026 SourcifyChina. Confidential. For client use only.

[Contact sourcifychina.com/procurement-2026 to request cluster-specific supplier shortlists]

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Wholesale Electronics

Executive Summary

China remains the dominant global hub for wholesale electronics manufacturing, offering competitive pricing and scalable production. However, ensuring consistent quality and regulatory compliance requires a structured approach. This report outlines essential technical specifications, compliance standards, and quality control protocols for sourcing electronics from China. It is designed to support procurement managers in mitigating risks, ensuring product reliability, and maintaining market access in regulated regions.

1. Key Quality Parameters

Materials

- Conductive Materials: High-purity copper (≥99.9%) for PCB traces and wiring; RoHS-compliant solder (lead-free, typically SnAgCu).

- Substrates: FR-4 epoxy-glass for standard PCBs; polyimide for flexible circuits.

- Housings: Flame-retardant ABS, PC, or PC/ABS blends (UL94 V-0/V-2 rated).

- Components: Original-grade ICs, capacitors, and resistors (preferably from authorized distributors; avoid counterfeits).

- Connectors & Cables: Tin-plated or gold-plated contacts; PTFE or PVC insulation meeting temperature ratings.

Tolerances

| Parameter | Typical Tolerance | Notes |

|---|---|---|

| PCB Trace Width | ±10% | Critical for impedance control |

| Layer Alignment (Multilayer PCBs) | ≤0.1 mm | Prevents via misalignment |

| Component Placement | ±0.1 mm | For SMT; tighter for fine-pitch ICs |

| Solder Paste Thickness | ±25 µm | Measured via SPI (Solder Paste Inspection) |

| Dimensional (Enclosures) | ±0.2 mm | Injection-molded parts |

| Voltage Output (PSUs) | ±5% | Under rated load and temperature |

2. Essential Certifications

| Certification | Scope | Applicable Regions | Key Requirements |

|---|---|---|---|

| CE | Electromagnetic Compatibility (EMC), Low Voltage Directive (LVD), RoHS | EU, UK, EFTA | Compliance with EU directives; technical file & DoC required |

| FCC Part 15 | Radio frequency interference | USA | EMC testing for digital devices |

| UL (Underwriters Laboratories) | Safety of electrical equipment | USA, Canada | UL listing or recognition; factory follow-up inspections |

| FDA Registration | Electronic medical devices | USA | Establishment registration; device listing; QSR (21 CFR Part 820) |

| ISO 9001:2015 | Quality Management System | Global | Process documentation, corrective actions, continuous improvement |

| ISO 13485 | QMS for Medical Devices | Global (especially US/EU) | Required for Class I+ medical electronics |

| RoHS (EU) | Restriction of Hazardous Substances | EU, China, UAE, others | Max levels: Pb (0.1%), Cd (0.01%), Hg, Cr⁶⁺, PBB, PBDE |

| REACH | Chemical safety | EU | SVHC (Substances of Very High Concern) disclosure |

Note: Dual certification (e.g., CE + FCC) is recommended for global distribution. Always verify certification authenticity via official databases (e.g., UL Product iQ, EU NANDO).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Solder Joint Defects (Cold Solder, Bridging, Voiding) | Incorrect reflow profile, poor stencil design, contaminated pads | Implement SPI + AOI; optimize thermal profile; use lead-free compatible flux |

| PCB Delamination or Blistering | Moisture ingress during reflow, poor lamination | Bake PCBs pre-assembly; store in dry cabinets; verify supplier IPC-4101 specs |

| Component Misplacement (Wrong/Reversed Polarity) | SMT programming error, feeder mix-up | Use 3D AOI; enforce component orientation markers; conduct pre-production line audit |

| Counterfeit Components | Unauthorized distribution channels, broker-sourced ICs | Source from franchised distributors; require lot traceability; conduct X-ray/decap analysis |

| Insufficient Insulation/Creepage Distance | Poor PCB layout, lack of safety spacing | Perform safety clearance checks (per IEC 60950/62368); use HI-POT testing |

| EMI/RFI Emissions Exceeding Limits | Poor grounding, lack of shielding, inadequate filtering | Conduct pre-compliance EMC testing; include ferrites and shielding cans in design |

| Battery Safety Hazards (Swelling, Thermal Runaway) | Substandard cells, lack of BMS | Use certified cells (UN38.3, IEC 62133); include overcharge/discharge protection |

| Mechanical Fit Issues (Enclosure Misalignment) | Poor mold maintenance, dimensional drift | Conduct first article inspection (FAI); use GD&T drawings; perform assembly trials |

4. Recommended Sourcing Best Practices

- Supplier Qualification: Audit manufacturers for ISO 9001, IATF 16949 (if automotive), or ISO 13485 (if medical).

- Product-Specific Testing: Require 3rd-party lab reports (e.g., SGS, TÜV, Intertek) for safety, EMC, and environmental compliance.

- In-Line QC Protocols: Enforce AQL 1.0 (MIL-STD-105E) for final random inspections; include functional, burn-in, and drop testing.

- Traceability: Ensure lot-level traceability for components and assemblies (critical for recalls and warranty claims).

- Contractual Clauses: Include penalties for non-compliance, IP protection, and right-to-audit clauses.

Conclusion

Sourcing wholesale electronics from China offers significant cost and scalability advantages, but only when paired with rigorous technical oversight and compliance assurance. Procurement managers must prioritize certified suppliers, enforce clear quality benchmarks, and implement structured inspection protocols. By addressing common defects proactively and validating certifications, buyers can ensure product integrity, reduce supply chain risk, and maintain regulatory access in key markets.

Prepared by: SourcifyChina Sourcing Advisory Board

Date: April 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Wholesale Electronics

Q1 2026 | Prepared for Global Procurement Managers

Executive Summary

China remains the dominant hub for electronics manufacturing, accounting for 65% of global OEM/ODM production (SourcifyChina 2025 Manufacturing Index). This report provides actionable cost analysis for wholesale electronics procurement, clarifying White Label vs. Private Label strategies and quantifying MOQ-driven cost structures. Key 2026 trends include automation-driven labor cost stabilization (+1.8% YoY vs. +5.2% in 2023) and strategic material localization (70% of Tier-1 suppliers now operate Guangdong/Hubei clusters), reducing logistics volatility by 12-18%.

White Label vs. Private Label: Strategic Comparison

Critical distinction for cost optimization and brand control

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product rebranded with minimal changes (e.g., logo swap) | Fully customized product designed to buyer’s specs (hardware, firmware, UX) |

| MOQ Flexibility | Low (500-1,000 units; uses existing tooling) | High (1,000-5,000+ units; requires new molds/PCB design) |

| Lead Time | 25-40 days (off-the-shelf inventory) | 60-90 days (custom engineering + testing) |

| Cost Control | Limited (fixed BOM; no component negotiation) | High (buyer negotiates materials, labor, certifications) |

| IP Ownership | Manufacturer retains design IP | Buyer owns final product IP |

| Best For | Urgent market entry, low-risk categories (e.g., basic cables, power banks) | Brand differentiation, premium segments (e.g., IoT devices, medical electronics) |

Strategic Insight: 78% of SourcifyChina clients transitioning to Private Label achieve 22-35% higher lifetime customer value (LCV) despite 15-25% higher initial unit costs (2025 Client Benchmark Study).

Electronics Manufacturing Cost Breakdown (Per Unit)

Based on mid-tier Bluetooth speaker (5W output, 10hr battery, IPX4)

| Cost Component | White Label | Private Label | Key Variables |

|---|---|---|---|

| Materials (65-75%) | $8.20 – $9.50 | $7.80 – $11.20 | • Chipset sourcing (Qualcomm vs. MediaTek: ±$1.80) • Battery grade (Li-ion vs. Li-Po: ±$0.75) • Housing material (ABS vs. metal: ±$2.10) |

| Labor (12-18%) | $1.90 – $2.30 | $1.60 – $2.80 | • Automation level (SMT lines reduce labor 30% vs. manual assembly) • Region (Suzhou: +8% wage vs. Chongqing) |

| Packaging (5-8%) | $0.85 – $1.10 | $1.20 – $2.50 | • Eco-certified materials (+$0.40/unit) • Retail-ready vs. bulk shipping (-$0.65/unit) |

| TOTAL BASE COST | $10.95 – $12.90 | $10.60 – $16.50 | Excludes tooling, certifications, shipping |

2026 Cost Pressure Note: Rare earth metals (e.g., Neodymium for speakers) stabilized at +4.1% YoY due to China’s export quota reforms, avoiding 2024’s 19% spike.

MOQ-Based Pricing Tiers: Wholesale Electronics

Estimated unit cost for mid-complexity devices (e.g., smart home sensors, wireless earbuds)

| MOQ Tier | Unit Cost Range | Setup Fees | Sample Cost | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $14.20 – $18.50 | $1,200 – $2,500 | $45 – $75/unit | Use only for validation; 28% higher per-unit cost vs. 1k MOQ. Avoid for launch-scale orders. |

| 1,000 units | $11.80 – $15.20 | $800 – $1,800 | $30 – $50/unit | Optimal entry point: 18-22% cost reduction vs. 500 units. Covers NRE for 85% of mid-tier electronics. |

| 5,000 units | $9.50 – $12.10 | $0 – $900* | $15 – $35/unit | True volume efficiency: 24-29% savings vs. 1k units. Tooling amortized; often waived by factories. |

* Tooling fees frequently absorbed at 5k+ MOQ for long-term contracts.

Critical Variables:

– Certifications: FCC/CE adds $0.35-$1.10/unit (non-negotiable for EU/US markets)

– Payment Terms: LC at sight vs. 30-day net = ±$0.22/unit cost difference

– Quality Control*: 4Q inspection adds $0.18/unit but reduces defect rates by 63% (SourcifyChina 2025 Data)

Strategic Recommendations for 2026

- Avoid “White Label Trap”: 67% of buyers overpay by 12-18% vs. Private Label when factoring in rebranding limitations (e.g., inability to modify firmware for app integration).

- Leverage MOQ 1,000 as Baseline: Negotiate tiered pricing (e.g., $12.50 @ 1k units → $10.80 @ 3k units) to de-risk volume commitment.

- Demand Material Traceability: Require suppliers to disclose component Tier-2 sources (e.g., Murata vs. generic capacitors) – impacts 23% of BOM cost.

- Pre-qualify Automation: Prioritize factories with >75% SMT line automation to lock labor costs through 2026 (wage inflation projected at 2.1% vs. 4.7% in 2024).

SourcifyChina Advantage: Our vetted supplier network guarantees no hidden fees and provides real-time BOM cost transparency via our digital sourcing platform. 92% of clients reduce total landed costs by 19%+ within 12 months through strategic MOQ optimization.

Prepared by SourcifyChina Sourcing Intelligence Unit | Data Sources: China Electronics Federation, SourcifyChina Supplier Benchmarking (Q4 2025), UN Comtrade

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify a Manufacturer for China Wholesale Electronics

Author: SourcifyChina – Senior Sourcing Consultant

Date: April 2026

Executive Summary

Sourcing wholesale electronics from China remains a strategic advantage for global procurement teams due to cost efficiency and manufacturing scale. However, risks related to counterfeit suppliers, quality inconsistencies, and supply chain opacity persist. This report outlines a structured verification process to identify legitimate manufacturers, differentiate between trading companies and actual factories, and recognize red flags that may compromise procurement integrity.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Official Business Credentials | Confirm legal registration and scope of operations | Verify business license (via China’s National Enterprise Credit Information Publicity System), check if electronics manufacturing is listed in scope |

| 2 | Conduct On-Site or Remote Factory Audit | Validate production capabilities and infrastructure | Schedule in-person visit or third-party audit; use video walkthroughs with live Q&A if onsite not feasible |

| 3 | Review Production Equipment & Capacity | Assess technological capability and scalability | Request equipment list, production line details, monthly output capacity, and engineering certifications (e.g., ISO 9001, IATF 16949) |

| 4 | Evaluate Quality Control Processes | Ensure consistent product standards | Request QC documentation, AQL sampling reports, in-line and final inspection procedures |

| 5 | Request Client References & Case Studies | Validate track record and reliability | Contact 2–3 past or current clients; verify order volume, delivery performance, and issue resolution |

| 6 | Review Export Experience & Logistics Setup | Confirm international shipping capability | Ask for export licenses, freight forwarder partnerships, FOB/EXW experience, and Incoterms familiarity |

| 7 | Conduct Sample Testing | Validate product quality and compliance | Order pre-production samples; test for functionality, durability, and regulatory compliance (e.g., CE, FCC, RoHS) |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License Scope | Lists “trading,” “import/export,” or “sales” — rarely includes “manufacturing” | Explicitly includes “electronics manufacturing,” “PCBA,” “SMT,” or “assembly” |

| Facility Footage | Limited or generic video; avoids showing production lines | Shows SMT lines, testing labs, warehouse, and engineering stations with live operations |

| Pricing Structure | Higher MOQs, less flexibility on unit cost, marks up by 15–40% | Lower base pricing, transparency in BOM and labor costs, scalable MOQs |

| Technical Expertise | Limited ability to discuss PCB design, firmware, or component sourcing | Engineers available to discuss schematics, component alternatives, DFM feedback |

| Production Lead Time | Longer and less predictable (depends on subcontractors) | Shorter, consistent timelines; direct control over scheduling |

| Ownership of Tooling/Molds | Does not own molds or custom fixtures | Owns or can produce custom molds, jigs, and test fixtures |

| Website & Marketing | Focuses on product catalogs and global services | Highlights factory certifications, production capacity, R&D capabilities |

Tip: Ask: “Can you show me your SMT line running our product?” Factories can; trading companies typically cannot.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or live video tour | High probability of being a trading company or shell entity | Decline engagement or insist on third-party audit |

| No response to technical questions about components or PCBs | Lack of engineering control; potential quality risk | Request direct access to production or engineering team |

| Extremely low pricing with no cost breakdown | Likely indicates substandard materials or bait-and-switch | Request BOM and labor cost analysis |

| Pressure to pay full amount upfront | High fraud risk; no buyer protection | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No verifiable client references or NDA excuses | Potential lack of real transaction history | Use LinkedIn or third-party verification tools (e.g., Panjiva, ImportGenius) |

| Inconsistent branding or website with stock images | Unprofessionalism; possible scam | Conduct reverse image search on website visuals |

| Refusal to sign a formal manufacturing agreement | Legal exposure; no recourse for defects or delays | Require contract with IP protection, quality clauses, and liability terms |

Best Practices for Secure Sourcing

- Use Escrow or Letter of Credit (LC) for initial large orders.

- Engage a Third-Party Inspection Service (e.g., SGS, TÜV, QIMA) for AQL inspections pre-shipment.

- Register IP in China if developing custom electronics to prevent cloning.

- Start with a Trial Order (30–50% of intended volume) to assess performance.

- Maintain Direct Communication with factory management — avoid sole reliance on sales agents.

Conclusion

Verifying a legitimate electronics manufacturer in China requires due diligence beyond surface-level checks. Procurement managers must prioritize transparency, technical capability, and legal compliance. Distinguishing between trading companies and factories is critical to cost control, quality assurance, and long-term supply chain resilience. By following the steps and avoiding the red flags outlined in this report, global buyers can mitigate risk and build sustainable sourcing partnerships in China’s competitive electronics market.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Supply Chain Integrity | China Manufacturing Expertise | B2B Procurement Strategy

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Strategic Procurement for China Wholesale Electronics

Executive Summary: Eliminate Sourcing Friction in High-Volume Electronics Procurement

Global procurement managers face critical time sinks in China electronics sourcing: unverified supplier claims (42% of RFQs), compliance failures (28% of orders), and production delays (avg. 22 days). SourcifyChina’s Verified Pro List—curated through AI-driven vetting and on-ground audits—delivers pre-qualified Tier-1 electronics suppliers with documented capabilities, slashing time-to-order by 67% versus manual sourcing.

Time Savings Analysis: Verified Pro List vs. Traditional Sourcing

| Process Stage | Traditional Sourcing (Hours) | SourcifyChina Verified Pro List (Hours) | Time Saved |

|---|---|---|---|

| Supplier Vetting & Compliance | 142 | 18 | 124h |

| Factory Audit Coordination | 86 | 0 (Pre-verified) | 86h |

| MOQ/Negotiation Cycles | 63 | 22 | 41h |

| Quality Assurance Setup | 49 | 11 | 38h |

| TOTAL PER CATEGORY | 340 | 51 | 289h |

Data Source: SourcifyChina 2025 Client Benchmark Survey (n=187 procurement teams)

Why This Matters for Your 2026 Strategy

- Risk Mitigation: Every supplier on the Pro List undergoes 17-point verification (business license, export history, production capacity, ESG compliance), eliminating 92% of counterfeit/fraud risks prevalent in wholesale electronics.

- Speed-to-Market: Pre-negotiated terms with 214 electronics specialists (PCBA, IoT, consumer gadgets) enable PO-to-shipment in ≤35 days—2.1x faster than industry average.

- Cost Integrity: Real-time capacity pricing data prevents 30%+ overpaying on components (e.g., USB-C controllers, BLE modules) common with unvetted suppliers.

“SourcifyChina’s Pro List cut our supplier onboarding from 11 weeks to 9 days. We’ve redirected 3,200+ annual hours to strategic cost engineering.”

— Procurement Director, Fortune 500 Consumer Electronics Firm (2025 Client Case Study)

Your Action Imperative for 2026 Supply Chain Resilience

The electronics procurement window is narrowing: Component lead times have increased 18% YoY (Gartner, Q4 2025), while 61% of Tier-2 Chinese factories now require 6-month capacity locks. Delaying supplier validation jeopardizes your 2026 production quotas.

Secure Your Competitive Advantage Today

✅ Access the 2026 Verified Pro List for:

– Real-time inventory feeds from 87 Shenzhen/Huizhou warehouses

– Pre-cleared customs documentation templates (HS codes 8517, 8542)

– Dedicated sourcing manager for urgent RFQs (avg. 4.2-hour response time)

→ Immediate Next Step:

Contact our Sourcing Engineering Team for a complimentary 2026 Capacity Allocation Audit:

– Email: [email protected] (Specify “2026 Electronics Pro List Access”)

– WhatsApp: +86 159 5127 6160 (24/7 for urgent RFQs)

All inquiries receive a Supplier Match Scorecard within 2 business hours—validating 3 pre-vetted suppliers against your exact specifications.

Do not navigate 2026’s volatile electronics market with unverified partners.

97% of SourcifyChina’s Q1 2026 Pro List slots are already allocated to clients with 2025 contracts.

Act now to secure priority access before March 31, 2026.

SourcifyChina: Operationalizing Trust in Global Electronics Sourcing Since 2018

ISO 9001:2015 Certified | 1,200+ Verified Suppliers | 98.7% Client Retention Rate (2025)

🧮 Landed Cost Calculator

Estimate your total import cost from China.