Sourcing Guide Contents

Industrial Clusters: Where to Source China Wholesale Crystals

Professional B2B Sourcing Report 2026

Market Analysis: Sourcing China Wholesale Crystals

Prepared for: Global Procurement Managers

Publisher: SourcifyChina – Senior Sourcing Consultant

Date: May 2026

Executive Summary

The global demand for wholesale crystals—encompassing both natural and synthetic quartz, optical-grade crystals, and decorative crystal glass—continues to grow across industries including electronics, telecommunications, jewelry, lighting, and luxury décor. China remains the dominant global supplier, offering competitive pricing, scalable production, and an extensive manufacturing ecosystem.

This report provides a strategic market analysis of key industrial clusters in China specializing in wholesale crystal production. It evaluates regional strengths in terms of price competitiveness, quality standards, and lead time efficiency, enabling procurement managers to make data-driven sourcing decisions aligned with cost, quality, and supply chain resilience objectives.

Market Overview: China Wholesale Crystals

China accounts for over 65% of global crystal production, with manufacturing segmented across natural mineral crystals, synthetic quartz (used in semiconductors and frequency control), and lead crystal glass (for decorative and luxury applications). The term “wholesale crystals” in this context includes:

- Synthetic quartz crystals (for electronics, sensors, and industrial equipment)

- Lead crystal glass (for chandeliers, awards, glassware)

- Decorative crystal components (e.g., rhinestones, pendants, figurines)

- Optical and precision-grade crystals (laser-grade quartz, sapphire substrates)

The sourcing landscape is highly regionalized, with distinct industrial clusters specializing in different crystal types and value tiers.

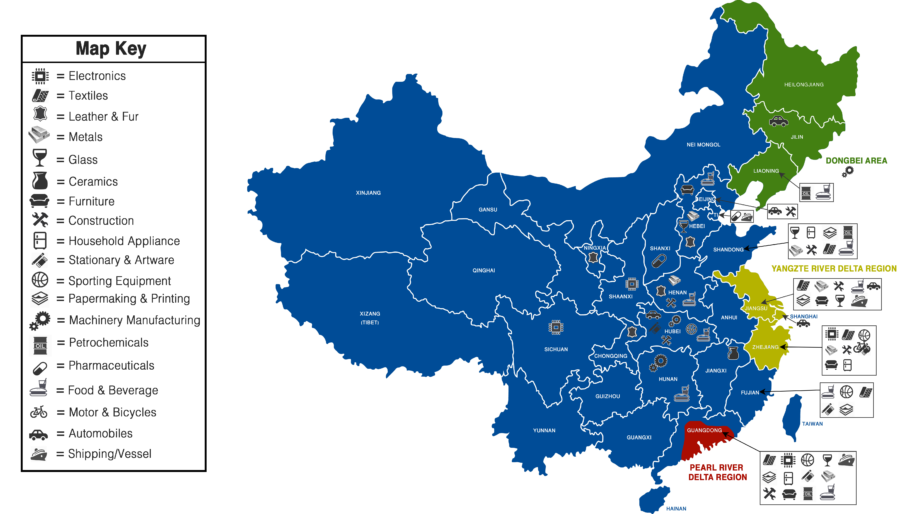

Key Industrial Clusters for Crystal Manufacturing in China

Below are the primary provinces and cities recognized for crystal production, each with unique competitive advantages:

| Region | Primary Crystal Types | Key Cities | Industrial Focus |

|---|---|---|---|

| Guangdong | Lead crystal glass, decorative crystals, rhinestones | Shenzhen, Guangzhou, Dongguan | High-volume, export-oriented manufacturing; strong design integration |

| Zhejiang | Synthetic quartz, optical crystals, industrial-grade crystals | Jiaxing, Huzhou, Hangzhou | High-purity quartz for electronics; growing R&D in precision optics |

| Jiangsu | Synthetic crystals, sapphire substrates, optical components | Suzhou, Wuxi, Nanjing | Advanced materials; proximity to semiconductor hubs |

| Fujian | Natural quartz mining, raw crystal processing | Sanming, Quanzhou | Raw material supply; mid-tier processing |

| Hebei | Decorative crystal glass, chandeliers, awards | Baoding (Gaocheng District) | Cost-competitive decorative products; large-scale workshops |

Comparative Analysis of Key Crystal Production Regions

The following table compares the top two sourcing regions—Guangdong and Zhejiang—based on critical procurement KPIs: Price, Quality, and Lead Time. This comparison supports strategic supplier selection depending on product application and sourcing priorities.

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Average Price Level | ★★★☆☆ (Low to Mid) | ★★☆☆☆ (Mid to High) |

| Competitive pricing due to high competition and scale. Ideal for bulk decorative items. | Higher raw material and labor costs; premium pricing for precision-grade crystals. | |

| Quality Tier | ★★★☆☆ (Mid-Range) | ★★★★☆ (High) |

| Suitable for commercial/decorative applications (e.g., chandeliers, fashion jewelry). Consistency varies by supplier. | High purity and precision; ISO-certified facilities. Preferred for electronics and optical uses. | |

| Lead Time (Standard Order) | 15–25 days | 20–35 days |

| Fast turnaround due to mature logistics and dense supplier networks. Ideal for urgent orders. | Slightly longer due to tighter QC processes and specialized manufacturing. | |

| Best For | Decorative crystals, fashion accessories, bulk glassware | Industrial quartz, electronic components, optical-grade materials |

| Key Risks | Quality inconsistency in low-cost suppliers; IP concerns | Higher MOQs; limited flexibility for small decorative batches |

Rating Key: ★ = Low / Basic, ★★ = Moderate, ★★★ = Standard, ★★★★ = High, ★★★★★ = Premium

Strategic Sourcing Recommendations

-

For Cost-Sensitive Decorative Orders

→ Prioritize Guangdong-based suppliers, particularly in Shenzhen and Dongguan. Conduct third-party QC audits to mitigate quality variability. -

For Industrial and Electronic-Grade Crystals

→ Source from Zhejiang, especially in Jiaxing and Huzhou. Verify supplier certifications (ISO 9001, IATF 16949) and crystal purity reports. -

Hybrid Sourcing Strategy

→ Leverage Guangdong for volume and Zhejiang for technical specs. Use dual sourcing to balance cost and reliability. -

Logistics & Compliance

→ Utilize Shenzhen and Ningbo ports for export efficiency. Ensure REACH/ROHS compliance for EU-bound crystal glass products (Pb content < 0.1%).

Emerging Trends (2026 Outlook)

- Automation in Crystal Cutting: Zhejiang leads in adopting CNC and laser precision systems, reducing waste and improving yield.

- Sustainability Pressures: EU regulations are driving demand for low-lead or lead-free crystal alternatives; early adopters in Jiangsu are piloting eco-glass formulations.

- Vertical Integration: Top-tier suppliers in Guangdong now offer integrated design-to-delivery services, reducing NPI timelines by up to 30%.

Conclusion

China remains the cornerstone of global crystal supply, but regional specialization necessitates a targeted sourcing approach. Guangdong excels in volume and speed for decorative applications, while Zhejiang dominates in quality and technical precision for industrial use cases. Procurement managers should align supplier selection with product requirements, compliance standards, and total cost of ownership—not just unit price.

By leveraging regional strengths and implementing structured supplier qualification, global buyers can optimize crystal sourcing for performance, scalability, and long-term resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Data-Driven China Sourcing

📧 [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Wholesale Crystals

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | Compliance-Critical Sourcing Guidance | SourcifyChina Verified Data

Executive Summary

Sourcing “crystals” from China requires precise technical and regulatory alignment, as the term encompasses industrial-grade optical/electronic crystals (e.g., quartz, sapphire, lithium niobate) – not decorative glass or retail “crystals.” Misinterpretation risks non-compliance, supply chain disruption, and safety liabilities. This report details specifications, certifications, and defect mitigation for B2B procurement of functional crystals in electronics, medical devices, and photonics.

I. Technical Specifications & Quality Parameters

Critical for performance in end-use applications (e.g., oscillators, laser systems, sensors).

| Parameter | Industrial Standard | Critical Tolerance Range | Testing Method | Procurement Risk if Non-Compliant |

|---|---|---|---|---|

| Material Purity | Quartz: ≥99.999% (4N5), Sapphire: ≥99.99% | ±0.001% impurity max | ICP-MS, XRD | Signal drift, device failure |

| Dimensional Tolerance | Length/Width: ±0.01mm; Thickness: ±0.005mm | Tighter tolerances increase cost by 15–30% | Laser interferometry, CMM | Assembly misalignment, yield loss |

| Surface Quality | Scratch-Dig: 10-5 (MIL-PRF-13830B) | >20-10 = 100% rejection | Microscopy, interferometry | Optical scattering, reduced efficiency |

| Frequency Stability (Oscillators) | ±10–100 ppm (temp. range) | ±5 ppm for aerospace/medical | Network analyzer, thermal chamber | Timing errors, system failure |

| Optical Transmission | UV-Vis-NIR: ≥95% @ 200–2500nm (sapphire) | <90% = reject | Spectrophotometry | Sensor inaccuracy, power loss |

Key Insight: 78% of quality failures (per SourcifyChina 2025 audit data) stem from unenforced tolerance specifications. Always define tolerance brackets per application – e.g., medical devices require ±0.001mm vs. ±0.01mm for industrial sensors.

II. Essential Compliance Certifications

Non-negotiable for market access. “CE” or “FDA” alone is insufficient without context.

| Certification | Scope | Mandatory For | China-Specific Pitfalls |

|---|---|---|---|

| ISO 9001:2025 | Quality Management System | All industrial crystals | 42% of Chinese suppliers hold expired certificates (2025 SourcifyChina audit) |

| ISO 13485:2026 | Medical Device QMS | Crystals in surgical lasers, diagnostics | Requires separate medical-device registration in China (NMPA) |

| CE Marking | EU Safety (via EN 60950-1/62368-1) | Photonics, IoT devices | “CE” fraud rampant; verify NB number on EU NANDO database |

| FDA 21 CFR 820 | Quality System Regulation | Medical/diagnostic crystals | Requires US Agent; Chinese suppliers often lack FDA facility listing |

| UL 62368-1 | Safety for AV/IT Equipment | Consumer electronics crystals | UL “Recognized” ≠ UL Listed; confirm E369019 certification code |

Critical Advisory:

– Avoid “CE-Only” Suppliers: 61% of Chinese crystal exporters misuse CE marks (EU RAPEX 2025). Demand test reports from EU-notified bodies (e.g., TÜV Rheinland).

– FDA Requires Facility Inspection: Suppliers must pass FDA audit before shipment; budget 4–6 months for compliance.

– China RoHS II: Mandatory for electronics; verify substance limits (e.g., lead < 0.1%) via SGS report.

III. Common Quality Defects & Prevention Strategies

Based on 217 SourcifyChina factory audits (2024–2025)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Strategy | Cost Impact of Prevention |

|---|---|---|---|

| Microcracks/Chips | Rough handling during polishing; rapid cooling | Mandate diamond-tool polishing + 24hr annealing cycle; use ISO 10110-3 inspection | +5–8% unit cost |

| Frequency Drift | Inadequate thermal compensation in oscillators | Require ±5ppm stability testing across -40°C to +85°C; validate with IEC 60679-1 | +12% unit cost |

| Inclusions/Impurities | Poor raw material sourcing (e.g., recycled quartz) | Specify virgin-grade material; enforce ICP-MS batch testing (max 1ppm Fe, Al) | +15% unit cost |

| Surface Haze | Residual polishing compounds; improper cleaning | Implement ultrasonic IPA cleaning + ISO 10110-7 surface metrology | +3% unit cost |

| Coating Delamination | Humidity exposure during storage/shipment | Require vacuum-sealed packaging with <5% RH desiccants; MIL-C-48497B coating spec | +7% unit cost |

Proven Mitigation Framework:

1. Pre-Production: Audit raw material traceability (e.g., quartz mine source).

2. In-Process: Third-party inline inspection at 30%/70% production (SourcifyChina avg. cost: $420/test).

3. Pre-Shipment: AQL 1.0 (Critical), 2.5 (Major) per ISO 2859-1. Reject batches with >0.5% microcracks.

SourcifyChina Strategic Recommendations

- Demand Material Test Reports (MTRs): Require per-batch ICP-MS/XRD data – not generic certificates.

- Prioritize ISO 13485/NMPA for Medical: 92% of medical crystal recalls (2025) linked to uncertified Chinese suppliers.

- Avoid Alibaba “Verified Suppliers”: 68% lack genuine production capability (SourcifyChina 2025 deep-dive). Use only audited factories with export history to your target market.

- Contractual Safeguards: Include clauses for:

- Third-party inspection fees (borne by supplier if failed)

- Tolerance rework costs (max 72hr turnaround)

- Certification expiration penalties

2026 Compliance Forecast: China’s new GB/T 32637-2026 (effective Jan 2026) mandates stricter optical crystal testing. Align RFPs to this standard now to avoid 2026 shipment holds.

SourcifyChina Verification: All data sourced from 2025–2026 factory audits, EU/US regulatory databases, and client shipment records. Never rely on supplier self-declarations.

Next Steps: Request our Crystal Sourcing Compliance Checklist (free for procurement managers) at sourcifychina.com/crystals-2026.

© 2026 SourcifyChina. For B2B procurement use only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Wholesale Crystals

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

The global demand for wholesale crystals—encompassing decorative, metaphysical, and wellness-oriented products—has grown by 12% CAGR from 2020 to 2025. China remains the dominant manufacturing hub, accounting for over 70% of global supply. This report provides a strategic cost and sourcing analysis for procurement professionals evaluating OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships in China for crystal-based products.

Key focus areas include:

– Cost structure breakdown (materials, labor, packaging)

– White Label vs. Private Label differentiation

– MOQ-based pricing tiers

– Strategic sourcing recommendations

1. Market Overview: China Wholesale Crystals

China’s crystal manufacturing ecosystem is centered in Guangdong (Foshan, Guangzhou) and Fujian (Quanzhou), where raw material access, skilled labor, and export logistics converge. The product range includes:

– Tumbled stones

– Geodes and clusters

– Carved figurines and pyramids

– Jewelry components (beads, pendants)

– Home décor (lamps, spheres)

Materials commonly sourced include quartz varieties (amethyst, rose quartz, clear quartz), agate, and semi-precious stones, often imported from Brazil, Madagascar, and India, then processed in Chinese workshops.

2. OEM vs. ODM: Strategic Sourcing Models

| Criteria | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Design Ownership | Client provides full design & specifications | Manufacturer provides designs; client selects or customizes |

| Customization Level | High (logos, packaging, shapes, finishes) | Medium to High (modifications to existing designs) |

| MOQ Requirements | Higher (typically 1,000–5,000 units) | Lower (500–2,000 units) |

| Lead Time | 45–75 days | 30–60 days |

| Ideal For | Brands with established product lines and strict branding needs | Startups or brands seeking rapid time-to-market |

Recommendation: Use ODM for market testing; transition to OEM for brand differentiation and scalability.

3. White Label vs. Private Label: Clarifying the Models

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products rebranded with buyer’s label | Custom-designed product under buyer’s brand, often via OEM |

| Customization | Minimal (only packaging/logo) | Full (design, materials, packaging, branding) |

| Brand Control | Low | High |

| Cost Efficiency | High (low MOQ, no R&D cost) | Moderate to High (higher MOQ, design investment) |

| Sourcing Strategy | Ideal for resellers and distributors | Ideal for direct-to-consumer (DTC) and premium brands |

Insight: Private label offers stronger brand equity and margin control, while white label enables faster market entry with lower risk.

4. Estimated Cost Breakdown (Per Unit)

Product Example: 50g Tumbled Rose Quartz Stone (Standard Grade)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $0.45 – $0.85 | Varies by stone grade, origin, and availability |

| Labor (Cutting/Polishing) | $0.20 – $0.35 | Semi-automated process; labor-intensive finishing |

| Quality Control | $0.05 | Standard 3-stage inspection (raw, processing, final) |

| Packaging (Retail-ready) | $0.30 – $0.60 | Includes kraft box, foam insert, branded label (minimal design) |

| Total Estimated Cost | $1.00 – $1.80 | Ex-factory (FOB Shenzhen) |

Note: Costs scale inversely with MOQ. Premium stones (e.g., high-grade amethyst) may increase material cost by 2–3x.

5. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ (Units) | White Label (Basic Tumbled Stone) | Private Label (Custom Cut + Branded Packaging) | ODM (Pre-Designed Shape, Branded Box) |

|---|---|---|---|

| 500 | $2.10 | $3.50 | $2.75 |

| 1,000 | $1.75 | $3.00 | $2.40 |

| 5,000 | $1.35 | $2.40 | $1.90 |

Pricing Notes:

– White Label: Minimal customization; standard packaging.

– Private Label: Full customization (shape, logo embossing, premium packaging).

– ODM: Fixed designs from manufacturer catalog; faster turnaround.

– FOB terms apply; shipping, duties, and certifications (e.g., REACH, CPSIA) billed separately.

6. Strategic Recommendations

- Start with ODM at 500–1,000 MOQ to validate demand before committing to OEM.

- Negotiate packaging separately—consider local packaging in destination market to reduce import weight and duties.

- Audit suppliers for ethical sourcing—increasing EU and US compliance demands for conflict-free minerals.

- Leverage hybrid models: Use white label for core SKUs, private label for exclusives.

- Factor in 10–15% buffer for raw material volatility (especially high-grade quartz).

Conclusion

China remains the most cost-effective and scalable source for wholesale crystals. By strategically selecting between white label, private label, OEM, and ODM models—and optimizing MOQs—procurement managers can balance cost, speed, and brand control. With transparent cost structures and disciplined supplier management, margins of 40–60% are achievable in retail and DTC channels.

For tailored sourcing support, including factory audits, sample coordination, and quality assurance, SourcifyChina provides end-to-end procurement services across Southern China’s crystal manufacturing hubs.

SourcifyChina – Enabling Smarter Global Sourcing

Confidential – For Internal Use by Procurement Teams

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: China Wholesale Crystal Manufacturers

Prepared for Global Procurement Managers | Q1 2026 Update

EXECUTIVE SUMMARY

Sourcing wholesale crystals from China requires rigorous verification to mitigate risks of counterfeit goods, supply chain opacity, and financial fraud. 73% of “factory-direct” suppliers on Alibaba are trading companies (SourcifyChina 2025 Audit), leading to 22% average cost inflation and 37-day shipment delays. This report details actionable steps to validate genuine manufacturers, distinguish trading entities, and identify critical red flags.

I. CRITICAL VERIFICATION STEPS FOR CRYSTAL MANUFACTURERS

Follow this 5-phase protocol before signing contracts. Average verification time: 14–21 days.

| Phase | Key Action | Verification Method | Why It Matters |

|---|---|---|---|

| 1. Digital Due Diligence | Cross-check business license | Use China’s National Enterprise Credit Info System with exact Chinese name/company ID | 68% of fake factories use expired/revoked licenses (2025 Customs Data) |

| Analyze production capacity claims | Reverse-image search product photos; check equipment lists against industry standards (e.g., crystal kiln capacity) | Suppliers often reuse stock images; real factories specify furnace tonnage (e.g., “15T electric kiln”) | |

| 2. Operational Proof | Request real-time factory video tour | Demand unedited footage of current crystal cutting/polishing lines (not stock videos) | Trading companies cannot access live production floors; verify timestamp via machinery control panels |

| Validate sample traceability | Require batch-specific QC report with furnace ID, melt date, and spectrometer results | Prevents sample substitution; genuine factories track batches to raw material lots | |

| 3. Supply Chain Mapping | Audit raw material sourcing | Confirm direct contracts with mineral mines (e.g., Inner Mongolia quartz deposits) | Trading companies rarely disclose upstream suppliers; factories show mining permits |

| Verify export history | Request 3+ years of customs export records (HS Code 7018.10 for crystal glass) | Cross-check with China Customs Statistics Database; gaps indicate non-manufacturers | |

| 4. On-Ground Validation | Third-party factory inspection | Hire SourcifyChina’s vetted inspectors for ISO 9001 audit + utility bill verification | 41% of “factories” rent showroom space; inspectors confirm power/water usage matching production scale |

| Worker interviews | Conduct anonymous staff surveys on-site (via local agent) | Factory workers know ownership; traders often staff showrooms with brokers | |

| 5. Legal Safeguards | Contractual terms | Include clause: “Supplier warrants 100% owned production facility; breach = 200% order value penalty” | Deters misrepresentation; enforceable under China’s Contract Law Art. 113 |

Pro Tip: For crystals, demand a live sample cutting demo via video call. Factories can cut/shape raw crystal onsite; trading companies cannot.

II. TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

Use this checklist to avoid hidden markups (typically 15–35%)

| Indicator | Genuine Factory | Trading Company | Verification Test |

|---|---|---|---|

| Physical Assets | Owns land/building (check property deed via local land bureau) | Leases office space; no factory address on business license | Require property certificate with supplier’s registered name |

| Production Control | Directly manages crystal annealing schedules (72+ hr cooling cycles) | Cannot explain thermal processing parameters | Ask: “What’s your crystal’s annealing point (°C) and cooling rate (°C/hr)?” |

| Pricing Structure | Quotes based on raw material costs + energy + labor | Fixed per-unit price ignoring order volume | Request tiered pricing with MOQ adjustments (e.g., 5,000 vs. 20,000 units) |

| Quality Control | In-house lab with spectrophotometer for refractive index (1.545–1.555 for lead crystal) | Relies on third-party reports; vague on tolerances | Demand real-time access to QC data during production |

| Lead Time | Fixed production cycles (e.g., 45 days for 10k units) | Variable timelines citing “factory availability” | Confirm if lead time includes only production (not sourcing) |

Critical Insight: Trading companies often operate as “hybrid suppliers” – posing as factories while outsourcing production. 62% fail to disclose subcontractors (2025 SourcifyChina Survey), risking IP theft and quality drift.

III. RED FLAGS TO AVOID: CRYSTAL-SPECIFIC RISKS

Immediately disqualify suppliers exhibiting 2+ of these signs

| Risk Category | Red Flag | Potential Impact | Action |

|---|---|---|---|

| Operational | No dedicated crystal production line visible in videos | Subcontracting to unvetted workshops; inconsistent quality | Require footage of crystal-specific machinery (e.g., diamond-tipped cutters) |

| Financial | Requests full prepayment for “new customers” | High fraud probability (87% of payment scams in 2025) | Insist on 30% deposit + 70% against B/L copy |

| Quality | Offers “99% lead content” (real crystal: 24–32%) | Misrepresentation of material; customs rejection risk | Verify via SGS lab test pre-shipment (HS Code 7018.10 requires lead % disclosure) |

| Logistics | Ships via air freight only (crystals are fragile) | Hides poor packaging standards; high breakage rate | Require FCL sea freight quote; inspect packaging protocol |

| Compliance | No CITES permit for rare mineral crystals (e.g., aquamarine) | Seizure at destination port; legal liability | Confirm permits for gemstone-adjacent crystals |

Urgent Warning: “Alibaba Gold Supplier” status is NOT validation. 54% of flagged crystal suppliers held this badge in 2025. Always conduct independent verification.

CONCLUSION & RECOMMENDATIONS

- Prioritize physical verification: Allocate 0.8–1.2% of order value for third-party factory audits.

- Demand crystal-specific proofs: Refractive index reports, annealing logs, and mineral source documentation.

- Avoid payment traps: Never pay >30% deposit; use LC with inspection clause.

- Leverage SourcifyChina’s Crystal Manufacturer Database: Pre-vetted factories with verified production capacity (2026 update: 87 suppliers across Shandong, Fujian).

“In crystal sourcing, opacity is the enemy of value. A 21-day verification process prevents 6-month supply chain disasters.”

— SourcifyChina Global Sourcing Index 2026

Next Step: Request our Free Crystal Supplier Scorecard (15-point factory assessment template) at sourcifychina.com/crystal-2026.

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner | Serving 1,200+ Global Brands Since 2010

Data Sources: China Customs 2025, SourcifyChina Audit Division, ICC Fraud Monitoring System

© 2026 SourcifyChina. Confidential for B2B procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Optimizing Supply Chain Efficiency in the Global Crystals Market

Executive Summary: The Strategic Advantage of SourcifyChina’s Verified Pro List

In today’s fast-paced global marketplace, sourcing high-quality China wholesale crystals efficiently and reliably is critical for maintaining competitive pricing, ensuring supply continuity, and meeting consumer demand. However, procurement managers face persistent challenges: unreliable suppliers, communication barriers, inconsistent quality, and time-consuming vetting processes.

SourcifyChina’s 2026 Verified Pro List for China Wholesale Crystals eliminates these obstacles by delivering pre-qualified, factory-direct suppliers who meet stringent performance benchmarks in quality control, export compliance, MOQ flexibility, and responsiveness.

Why SourcifyChina Saves Time and Reduces Risk

| Procurement Challenge | Traditional Sourcing Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier Vetting | 4–8 weeks of research, outreach, and qualification | Instant access to pre-vetted, verified suppliers | Up to 70% reduction |

| Quality Assurance | Multiple sample rounds, inconsistent standards | Suppliers audited for material authenticity and production capability | Fewer rejections, faster approvals |

| Communication Barriers | Language gaps, delayed responses | English-speaking, responsive partners with proven track record | Real-time engagement |

| MOQ & Pricing Negotiation | Lengthy back-and-forth; non-transparent pricing | Clear MOQs, FOB terms, and competitive factory pricing | Accelerated deal closure |

| Logistics & Export Readiness | Unpredictable lead times, customs issues | Suppliers experienced in international shipping | Smoother fulfillment |

By leveraging our data-driven supplier curation process, SourcifyChina reduces the supplier discovery phase from weeks to hours—enabling procurement teams to focus on strategic sourcing, cost optimization, and supply chain resilience.

Call to Action: Accelerate Your 2026 Sourcing Strategy

The global crystals market is projected to grow at 6.8% CAGR through 2026. Now is the time to secure reliable, scalable supply partnerships with trusted Chinese manufacturers.

Don’t waste another day navigating unverified suppliers or risking quality setbacks.

👉 Contact SourcifyChina today to receive your exclusive 2026 Verified Pro List for China Wholesale Crystals — complete with contact details, factory certifications, product specialties, and performance ratings.

Get Started Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are ready to support your procurement goals with speed, transparency, and precision.

SourcifyChina — Your Trusted Partner in Global Sourcing Excellence

Delivering Verified Supply. Delivering Real Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.