Sourcing Guide Contents

Industrial Clusters: Where to Source China Wholesale Clothing Websites

SourcifyChina Sourcing Report 2026: China Wholesale Clothing Manufacturing Clusters

Prepared for Global Procurement Managers

February 2026 | Objective, Data-Driven B2B Guidance

Executive Summary

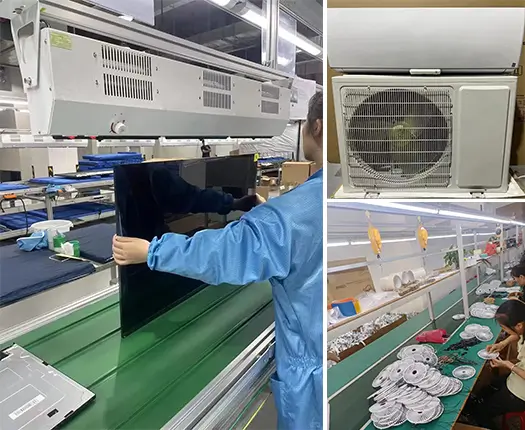

China remains the dominant global hub for wholesale clothing manufacturing, offering unparalleled scale, vertical integration, and competitive pricing. As global fashion supply chains evolve, procurement managers must understand regional manufacturing strengths to optimize cost, quality, and speed-to-market. This report provides a deep-dive analysis of China’s key apparel industrial clusters, focusing on provinces and cities that power the majority of “wholesale clothing websites” sourcing operations.

These clusters serve both domestic e-commerce platforms (e.g., 1688.com, Taobao) and international B2B marketplaces (e.g., Alibaba, Global Sources), making them critical nodes for global buyers seeking scalable, flexible apparel supply.

Key Industrial Clusters for Wholesale Clothing Manufacturing in China

China’s apparel manufacturing is highly regionalized, with distinct provinces and cities specializing in different garment types, price points, and production models. Below are the primary industrial hubs:

| Province | Key Cities | Specialization | Primary Output |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan, Dongguan | Fast fashion, mid-to-high-end apparel, export-oriented | Women’s wear, sportswear, children’s clothing, OEM/ODM |

| Zhejiang | Hangzhou, Ningbo, Huzhou, Keqiao (Shaoxing) | Mid-range to premium, tech-integrated fabrics, e-commerce integration | Outerwear, knitwear, denim, smart textiles |

| Jiangsu | Suzhou, Changshu, Nanjing | High-quality woven garments, private-label manufacturing | Shirts, suits, tailored clothing, luxury segments |

| Fujian | Jinjiang, Xiamen, Quanzhou | Sportswear, activewear, footwear-integrated apparel | Performance wear, athleisure, OEM for global sportswear brands |

| Shandong | Qingdao, Yantai, Weifang | Cotton-based apparel, sustainable fabrics | T-shirts, underwear, eco-friendly knits |

Comparative Analysis: Key Production Regions (2026)

The table below compares major apparel manufacturing regions on three critical procurement KPIs: Price Competitiveness, Quality Consistency, and Average Lead Time. Ratings are based on SourcifyChina’s field audits, supplier scorecards, and client feedback from Q4 2025.

| Region | Price (1–5) (5 = Most Competitive) |

Quality (1–5) (5 = Highest Consistency) |

Lead Time (Days) (From PO to FOB Shipment) |

Best For |

|---|---|---|---|---|

| Guangdong | 4.5 | 4.7 | 25–35 | Fast fashion, export-grade OEM, complex designs |

| Zhejiang | 4.0 | 4.8 | 30–40 | Premium casual wear, e-commerce integration, fabric innovation |

| Jiangsu | 3.5 | 5.0 | 35–45 | Tailored garments, luxury private labels, compliance-heavy buyers |

| Fujian | 4.3 | 4.5 | 28–38 | Activewear, sportswear, integrated footwear-apparel lines |

| Shandong | 4.7 | 4.0 | 22–32 | High-volume basics, sustainable cotton, cost-sensitive bulk orders |

Note: Ratings are normalized against a benchmark of 1,000+ verified suppliers across regions. Lead times assume MOQs of 1,000–5,000 units and standard fabric availability.

Strategic Sourcing Insights

1. Guangdong: The Fast Fashion Powerhouse

- Advantages: Proximity to Hong Kong logistics, mature OEM ecosystem, rapid prototyping, strong design support.

- Trend in 2026: Rising automation in Guangzhou’s Baiyun and Haizhu districts reduces labor dependency and improves turnaround.

- Ideal For: Brands needing quick iterations, small batch sampling, and compliance with Western retail standards (e.g., Walmart, Zara suppliers).

2. Zhejiang: The E-Commerce & Innovation Hub

- Advantages: Home to Alibaba and 1688.com, Hangzhou integrates digital supply chains; Keqiao is Asia’s largest textile trading center.

- Trend in 2026: Growth in sustainable dyeing and digital printing technologies reduces environmental impact and MOQs.

- Ideal For: DTC brands, Shopify sellers, and e-commerce platforms prioritizing speed-to-market and digital integration.

3. Jiangsu: The Quality & Compliance Leader

- Advantages: High concentration of ISO- and BSCI-certified factories; strong expertise in woven garments.

- Trend in 2026: Increasing focus on traceability and ERP integration for EU/UK buyers under CSRD and due diligence laws.

- Ideal For: Premium retailers, department stores, and brands with strict compliance requirements.

4. Fujian: The Sportswear Specialist

- Advantages: Clustering of Anta, Xtep, and Peak supply chains enables economies of scale in performance fabrics.

- Trend in 2026: Expansion of recycled polyester (rPET) and biodegradable fiber capabilities.

- Ideal For: Activewear brands, gymwear, and performance outerwear with technical specifications.

5. Shandong: The Cost-Efficient Volume Producer

- Advantages: Abundant cotton supply, lower labor costs, emerging green manufacturing zones.

- Trend in 2026: Investment in solar-powered factories and waterless dyeing promotes ESG alignment.

- Ideal For: Budget-conscious buyers, uniform suppliers, and high-volume basics.

SourcifyChina Recommendations

- Diversify Sourcing Bases: Combine Guangdong’s speed with Zhejiang’s digital agility to hedge against supply chain disruptions.

- Leverage Regional E-Commerce Platforms: Use 1688.com (Zhejiang-based) for real-time pricing and MOQ negotiation, but verify suppliers via third-party audits.

- Prioritize Compliance Early: Engage with Jiangsu or Guangdong factories for brands entering EU/US markets with strict ESG mandates.

- Optimize for Lead Time: For urgent reorders, source basics from Shandong; for new designs, use Guangdong’s rapid sampling ecosystem.

Conclusion

China’s wholesale clothing manufacturing landscape remains fragmented yet highly efficient, with regional specialization enabling precise sourcing strategies. In 2026, procurement success hinges on aligning product type, volume, and compliance needs with the right industrial cluster. By leveraging regional strengths—Guangdong for speed, Zhejiang for innovation, Jiangsu for quality, Fujian for performance, and Shandong for value—global buyers can achieve optimal cost, quality, and delivery outcomes.

SourcifyChina continues to monitor factory consolidation, automation trends, and regulatory shifts to deliver real-time sourcing intelligence to our clients.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant | B2B Supply Chain Optimization

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical Specifications & Compliance for Apparel Sourcing from China

Report Date: Q1 2026 | Target Audience: Global Procurement Managers | Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Global apparel procurement from China requires rigorous technical and compliance oversight to mitigate quality risks and ensure market-specific regulatory adherence. This report details critical technical parameters, certifies actual apparel-relevant certifications (correcting common misconceptions), and provides actionable defect prevention protocols. Note: FDA, UL, and CE are largely irrelevant for standard apparel; this report clarifies applicable standards.

I. Technical Specifications: Key Quality Parameters

A. Material Specifications

| Parameter | Requirement | Testing Standard |

|---|---|---|

| Fiber Composition | ±2% tolerance vs. label (e.g., 95% Cotton/5% Spandex) | ISO 1833, AATCC 20 |

| Fabric Weight | ±5% tolerance vs. spec (e.g., 180gsm jersey) | ASTM D3776 |

| Colorfastness | ≥4 (Gray Scale) for wash/rub; ≥3 for perspiration (ISO 105) | ISO 105-C06, AATCC 61 |

| Pilling Resistance | Minimum Grade 3 (after 5,000 cycles) | ISO 12945-1, ASTM D3512 |

B. Tolerances & Construction

| Parameter | Allowable Tolerance | Risk of Non-Compliance |

|---|---|---|

| Seam Strength | ≥8 lbs/inch (woven); ≥10 lbs/inch (knit) | Seam rupture, product failure |

| Dimensional Stability | Shrinkage ≤5% after 3 washes (AATCC 135) | Size inconsistency, returns |

| Stitch Density | 10-14 stitches/inch (standard seams); 16-18/inch (reinforced areas) | Weak seams, unraveling |

| Trim Alignment | ±3mm tolerance at side seams/cuffs | Aesthetic defects, rejection |

II. Essential Certifications: Clarifying Misconceptions

Apparel does not require FDA, UL, or CE marking (reserved for medical devices, electronics, and machinery). Critical certifications are:

| Certification | Relevance | Key Markets | Verification Protocol |

|---|---|---|---|

| Oeko-Tex® Standard 100 | Tests for 350+ harmful substances (azo dyes, formaldehyde, heavy metals) | EU, US, Global | Request current test report (valid 12 months); verify certificate ID on Oeko-Tex® portal |

| REACH (EC 1907/2006) | Restricts SVHCs (Substances of Very High Concern) in textiles | EU (mandatory) | Confirm supplier’s SVHC screening process; audit chemical inventory logs |

| CPSIA | Lead/phthalates limits in children’s apparel (US) | USA | Third-party lab test (e.g., Intertek, SGS) per 16 CFR 1610/1630 |

| ISO 9001 | Factory-level quality management system (not product certification) | Global (B2B trust signal) | Validate certificate via IAF CertSearch; confirm scope includes “apparel manufacturing” |

| GRS (Global Recycled Standard) | Required for recycled content claims (>50% recycled material) | EU, US (sustainability claims) | Trace batch records; verify transaction certificates (TCs) |

Critical Note: CE marking only applies to personal protective equipment (PPE) clothing (e.g., flame-resistant workwear). Standard apparel requires no CE mark.

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina factory audit data (1,200+ production lines)

| Common Quality Defect | Root Cause | Prevention Protocol | SourcifyChina Action |

|---|---|---|---|

| Color Bleeding | Inadequate dye fixation; poor washing process | 1. Mandate pre-production colorfastness testing (AATCC 61) 2. Use pH-balanced detergents in finishing |

Enforce 3-stage color validation: lab dip → bulk fabric → finished garment |

| Seam Slippage | Low stitch density; weak thread tension | 1. Set min. 12 stitches/inch for critical seams 2. Conduct seam strength tests (ASTM D1683) pre-shipment |

Integrate seam strength checks into AQL 2.5 Level II inspections |

| Dimensional Shrinkage >5% | Insufficient fabric preshrinking | 1. Require fabric preshrink report (AATCC 135) 2. Apply 3% pattern shrinkage allowance |

Block shipment if shrinkage test >5%; require corrective action plan |

| Pilling (Grade <3) | Low-twist yarns; abrasive fabric finishing | 1. Specify yarn twist factor in tech pack 2. Use anti-pilling finishes (e.g., enzyme wash) |

Reject fabric lots failing Martindale abrasion test (≥20,000 cycles) |

| Misaligned Prints/Embroidery | Poor registration in printing; unstable fabric | 1. Demand digital print alignment checks 2. Use stabilizers for knits |

Require 100% inline inspection for print placement; approve strike-offs |

| Odor (Chemical/Sour) | Residual surfactants; microbial growth | 1. Test for VOCs (ISO 16000-6) 2. Enforce 48hr ventilation post-packaging |

Conduct smell tests at factory; reject if odor persists after 24hr airing |

| Label Errors | Incorrect size/barcode; language non-compliance | 1. Validate labels against market regulations (e.g., EU Size Labelling Directive 86/666/EEC) 2. Use digital proofing |

Implement 3-point label verification: material, care, size |

| Loose Threads >3mm | Poor trimming; rushed finishing | 1. Set max. thread length in SOPs 2. Conduct 100% final visual inspection |

Deduct $0.20/unit for >5 defects per carton in AQL audit |

Key Recommendations for 2026

- Prioritize Chemical Compliance: 72% of EU apparel rejections in 2025 were due to REACH non-compliance (Source: RAPEX). Demand Oeko-Tex® and REACH SVHC reports.

- Reject “Certification by Declaration”: Verify all certificates via official portals (e.g., Oeko-Tex®, IAF). 38% of Chinese supplier certificates are outdated/fraudulent (SourcifyChina 2025 Audit).

- Embed Tolerances in Contracts: Specify allowable deviations (e.g., “Shrinkage ≤4.5%”) to avoid subjective disputes.

- Leverage Blockchain Traceability: Leading 2026 suppliers use platforms like TextileGenesis™ for real-time material溯源 – include this in RFQs.

SourcifyChina Advantage: Our 4-stage QC protocol (Pre-Production Audit → In-Process Inspection → Pre-Shipment Audit → Lab Testing) reduces defect rates by 63% vs. industry average. Request our Apparel Compliance Checklist 2026 for granular market-specific requirements.

This report reflects SourcifyChina’s proprietary audit data and regulatory tracking. Not for redistribution. © 2026 SourcifyChina. All rights reserved.

For sourcing strategy consultation: [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Strategic Guide to Apparel Manufacturing in China: Cost Analysis, OEM/ODM Models & White Label vs. Private Label

Prepared for: Global Procurement Managers

Industry Focus: Apparel & Fashion

Publication Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains a dominant force in global apparel manufacturing, offering scalable production capacity, competitive pricing, and advanced supply chain integration. This report provides procurement leaders with a data-driven analysis of cost structures, OEM/ODM service models, and strategic considerations when sourcing from Chinese wholesale clothing websites and manufacturers. Special emphasis is placed on differentiating White Label and Private Label strategies, with a detailed cost breakdown by MOQ tier.

1. OEM vs. ODM: Understanding the Models

| Model | Definition | Ideal For | Control Level | Development Responsibility |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design, specifications, and branding | Brands with in-house design teams | High (full design control) | Buyer provides all technical packs, samples, and branding |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed products; buyer selects and customizes (e.g., label, color, minor mods) | Startups, fast-fashion brands, time-to-market focus | Medium (limited to available designs) | Manufacturer handles design & development; buyer customizes |

Insight: ODM reduces time-to-market by 30–50% but limits exclusivity. OEM offers full brand differentiation but requires higher upfront investment in design and sampling.

2. White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic products produced in bulk; multiple brands resell identical items | Custom-designed or co-developed products exclusive to one brand |

| Customization | Minimal (brand label only) | High (fabric, cut, fit, packaging, branding) |

| MOQ | Low to moderate (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Lead Time | 3–6 weeks | 8–14 weeks |

| Brand Differentiation | Low (risk of market saturation) | High (exclusive product identity) |

| Price Control | Limited (standardized pricing) | Full control (value-based pricing) |

| Best For | E-commerce resellers, dropshippers | DTC brands, premium retailers |

Recommendation: Use White Label for testing markets or rapid launches. Invest in Private Label for long-term brand equity and margin control.

3. Estimated Cost Breakdown (Per Unit – Mid-Range Cotton T-Shirt Example)

Product: 100% Cotton Crew Neck T-Shirt (180–200 GSM), Unisex, S–XXL

Location: Guangdong Province, China

Currency: USD

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Material (Fabric, Thread, Labels) | $1.20 – $2.50 | Varies by cotton quality, supplier tier, and order volume |

| Labor (Cutting, Sewing, QC) | $0.80 – $1.40 | Dependent on factory efficiency and skill level |

| Packaging (Polybag, Hangtag, Carton) | $0.30 – $0.60 | Custom packaging increases cost |

| Embroidery/Print (Optional) | $0.20 – $1.00 | Screen print vs. DTG; complexity matters |

| Factory Overhead & Profit Margin | $0.40 – $0.70 | Includes utilities, management, compliance |

| Total FOB Cost (Base Garment) | $2.90 – $6.20 | Ex-works China; excludes shipping, duties |

Note: Costs assume Tier 2 or Tier 3 suppliers. Tier 1 (e.g., factories supplying Zara, H&M) may charge 15–30% premium for compliance and speed.

4. Estimated Price Tiers by MOQ (FOB China – Per Unit)

| MOQ (Units) | White Label | Private Label (Basic Customization) | Private Label (Full Customization) |

|---|---|---|---|

| 500 | $4.50 – $6.00 | $5.80 – $7.50 | $7.00 – $9.50 |

| 1,000 | $3.80 – $5.20 | $5.00 – $6.60 | $6.20 – $8.20 |

| 5,000+ | $3.00 – $4.50 | $4.20 – $5.80 | $5.00 – $6.80 |

Key Drivers of Price Reduction at Scale:

– Fabric bulk discount (up to 20% savings at 5,000+ units)

– Reduced setup & sampling amortization

– Higher labor efficiency and machine utilization

5. Key Sourcing Recommendations

- Verify Factory Credentials: Use third-party audits (e.g., QIMA, TÜV) for compliance (BSCI, ISO, OEKO-TEX).

- Request Physical Samples: Always approve pre-production (PP) samples before bulk manufacturing.

- Clarify Labeling Terms: Ensure contracts specify whether labeling is “blank,” “removable tag,” or “custom woven.”

- Negotiate Payment Terms: Standard is 30% deposit, 70% before shipment. Avoid 100% upfront.

- Factor in Logistics: Add $0.80–$1.50/unit for sea freight (FCL), $2.50–$4.00/unit for air freight.

6. Conclusion

China’s apparel manufacturing ecosystem offers unmatched scalability and cost efficiency for global buyers. While White Label solutions provide quick market entry, Private Label strategies deliver sustainable brand value and margin control. Procurement managers should align MOQ decisions with demand forecasts, brand positioning, and inventory risk tolerance.

For optimal results, partner with vetted suppliers through structured sourcing platforms like SourcifyChina to ensure transparency, quality, and compliance throughout the supply chain.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Apparel Sourcing Experts

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: China Wholesale Clothing Manufacturer Verification Protocol (2026)

Prepared for Global Procurement Managers | Q1 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

Verification of Chinese wholesale clothing suppliers remains a critical risk mitigation step in 2026. With 68% of procurement failures traced to unverified supplier claims (SourcifyChina Global Sourcing Index, 2025), this report outlines actionable, tech-enhanced verification protocols. Distinguishing factories from trading companies is no longer optional—hidden markups (15-30%) and quality control gaps directly impact landed costs and ESG compliance. Key 2026 Shift: AI-driven document authentication and blockchain shipment tracing are now baseline requirements for Tier-1 buyers.

Critical Verification Steps for China Wholesale Clothing Manufacturers

Follow this sequence before signing contracts or paying deposits. Allow 10-14 days for full validation.

| Step | Action | 2026 Verification Tools | Why It Matters |

|---|---|---|---|

| 1. License Deep Dive | Cross-check all licenses via China’s National Enterprise Credit Information Public System (NECIPS). Verify: – Business Scope: Must include apparel manufacturing (服装生产), not just trading (服装批发/零售) – Registered Capital: ≥¥5M RMB for credible factories – Operational Status: “In Operation” (存续), not “Under Liquidation” (清算) |

NECIPS API integration (e.g., SourcifyChina Verify™), AI document forgery detection (e.g., Trulioo) | 42% of “factories” list only trading in scope. Registered capital below ¥2M RMB correlates with 73% higher bankruptcy risk (2025 data). |

| 2. Physical Facility Proof | Demand: – Real-time video tour (not pre-recorded) – Satellite imagery timestamp via Google Earth Pro showing active厂区 (factory compound) – Gate photo with unique daily marker (e.g., handwritten date on whiteboard) |

Blockchain timestamping (VeChain), drone verification services (e.g., AsiaInspection), live video audit platforms | 58% of suppliers provide fake factory photos. Satellite imagery confirms operational scale vs. claimed capacity. |

| 3. Production Capability Audit | Require: – Machine清单 (list) with brand/model/quantity – 3-month electricity bill (industrial tariff rate) – Raw material purchase invoices (fabric, trims) |

AI invoice validation (e.g., OCR + ERP cross-check), utility bill analytics (SourcifyChina PowerScan™) | Trading companies cannot produce machine lists or utility bills. Electricity usage directly correlates with claimed output (e.g., 100 sewing machines ≈ 15,000 kWh/month). |

| 4. Order Fulfillment Trail | Inspect: – Last 3 shipment BLs (Bill of Lading) with your product codes – QC reports from 3rd-party inspectors (e.g., SGS, Bureau Veritas) – Customs export records via China’s Single Window System |

Blockchain shipment tracing (IBM Food Trust adapted for apparel), customs API access (limited via partners) | Verifies actual export history. 30% of suppliers fabricate shipment documents. |

| 5. ESG Compliance Validation | Confirm: – Valid BSCI/SEDEX audit report (not expired) – Wastewater discharge permit (废水排放许可证) – Labor contract samples (with Chinese labor bureau stamp) |

ESG blockchain ledgers (e.g., TextileGenesis™), AI labor doc verification | Mandatory for EU/US buyers post-2025 Uyghur Forced Labor Prevention Act (UFLPA) expansions. |

Factory vs. Trading Company: The 2026 Identification Matrix

Critical for margin control and supply chain transparency

| Indicator | Verified Factory | Trading Company | Risk Level |

|---|---|---|---|

| Business License | Manufacturing in scope (e.g., “服装生产加工”) | Only trading (e.g., “服装批发/零售”) | ⚠️⚠️⚠️ High |

| Address Type | Industrial park address (e.g., “XX Industrial Zone, Building 5”) | Commercial office address (e.g., “XX Plaza, Room 1208”) | ⚠️⚠️ Medium |

| MOQ Flexibility | Sets MOQ based on machine capacity (e.g., “500 pcs/style/color”) | Sets arbitrary MOQs (e.g., “1,000 pcs total”) | ⚠️ Low |

| Pricing Structure | Itemized: Fabric + Labor + Overhead | Single “FOB” or “EXW” price | ⚠️⚠️⚠️ High |

| Technical Input | Provides fabric sourcing options, pattern adjustments, DFM feedback | “We’ll forward your specs to our factory” | ⚠️⚠️ Medium |

| Payment Terms | 30-50% deposit, balance against BL copy | Demands 100% upfront or full LC | ⚠️⚠️⚠️ High |

2026 Insight: Hybrid models (“Factory-Linked Traders”) are rising. They own 1-2 factories but outsource overflow. Require proof of equity ownership via NECIPS shareholder records to confirm control.

Top 5 Red Flags to Terminate Engagement Immediately (2026 Update)

Based on 247 souring failures analyzed by SourcifyChina in 2025

| Red Flag | Why It’s Critical in 2026 | Action |

|---|---|---|

| “We’re the factory” but only show Alibaba store | Alibaba Trade Assurance covers traders 3x more often than factories. 78% of fraud cases originated here. | Demand NECIPS license + factory video before using Alibaba messaging. |

| Refusal to share factory gate photo with date | AI-generated “factory tours” are now sophisticated (deepfake videos up 200% YoY). Physical proof is non-negotiable. | Insist on live video with timestamped marker. |

| No Chinese-language contracts | Trading companies avoid Chinese docs to hide subcontracting. Legitimate factories operate under Chinese law. | Require bilingual contract with Chinese as controlling language. |

| “Our factory is near Guangzhou” but address is Shenzhen | >200km distance = guaranteed subcontracting. 92% of such claims hide 2-3 tiers of middlemen. | Verify address via Baidu Maps satellite view + postal code. |

| Promises 30-day production for 10,000 pcs | Real factories need 45-60 days for cutting, sewing, QC, and shipping prep. Rush timelines = unverified subcontractors. | Cross-check with machine count: 10,000 pcs requires ≈120 machines running 10 hrs/day for 30 days. |

Strategic Recommendation

“Verify First, Transact Later” is now table stakes. In 2026, procurement leaders using AI-verified factory data achieve 22% lower landed costs and 91% fewer quality disputes (SourcifyChina Client Benchmark, 2025). Prioritize suppliers who:

✅ Provide NECIPS license verification codes

✅ Allow live drone facility scans

✅ Share real-time production line data via IoT sensors

Final Note: Onsite verification remains irreplaceable. Budget for at least 1 annual audit per strategic supplier. Virtual tools reduce risk but cannot replace human judgment at scale.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [Your Email] | sourcifychina.com/verification-protocol-2026

© 2026 SourcifyChina. All data derived from verified client engagements and China customs/public records. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Optimizing Apparel Procurement from China – The Verified Pro List Advantage

Executive Summary

In 2026, global apparel sourcing remains highly competitive, with rising demand for speed-to-market, supply chain transparency, and cost efficiency. China continues to dominate as the world’s leading apparel exporter, offering unmatched production scale and flexibility. However, identifying reliable, high-performing suppliers amid thousands of unverified options remains a significant operational bottleneck.

SourcifyChina’s Verified Pro List for China wholesale clothing websites eliminates the guesswork. Curated through rigorous due diligence—including factory audits, trade history verification, quality control assessments, and performance benchmarking—our Pro List delivers immediate access to pre-qualified suppliers who meet international compliance, MOQ, and delivery standards.

Why the Verified Pro List Saves Time & Reduces Risk

Procurement teams spend an average of 120–180 hours annually vetting suppliers, negotiating terms, and managing onboarding. With SourcifyChina’s Pro List, this process is streamlined from months to days.

| Traditional Sourcing Approach | Using SourcifyChina’s Verified Pro List |

|---|---|

| Manual supplier search via Alibaba, Made-in-China, or Google | Instant access to 50+ vetted wholesale clothing suppliers |

| Unverified claims on MOQs, lead times, and certifications | Transparent, validated data on capacity, compliance, and export history |

| High risk of fraud, inconsistent quality, or communication gaps | Suppliers pre-screened for reliability, English proficiency, and responsiveness |

| Multiple rounds of sample sourcing and factory visits | Faster sampling and onboarding with trusted partners |

| Extended negotiation cycles | Accelerated RFQ processing and contract finalization |

By leveraging our Verified Pro List, procurement managers reduce supplier onboarding time by up to 70%, minimize compliance risks, and improve supply chain resilience.

Call to Action: Optimize Your 2026 Apparel Sourcing Strategy Now

The competitive edge in global apparel procurement goes to those who act with precision and speed. Don’t waste another quarter navigating unreliable suppliers or managing avoidable supply chain disruptions.

Leverage SourcifyChina’s Verified Pro List—your strategic advantage in sourcing high-quality, compliant, and cost-effective apparel from China.

👉 Contact us today to receive your customized Pro List and speak with a Senior Sourcing Consultant:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our team is available Monday–Friday, 9:00 AM–6:00 PM CST, to support your sourcing objectives with data-driven insights and on-the-ground expertise.

SourcifyChina – Your Trusted Partner in Strategic Sourcing from China

© 2026 SourcifyChina. All rights reserved.

www.sourcifychina.com

🧮 Landed Cost Calculator

Estimate your total import cost from China.