Sourcing Guide Contents

Industrial Clusters: Where to Source China Wholesale Car Accessories

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing China Wholesale Car Accessories

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

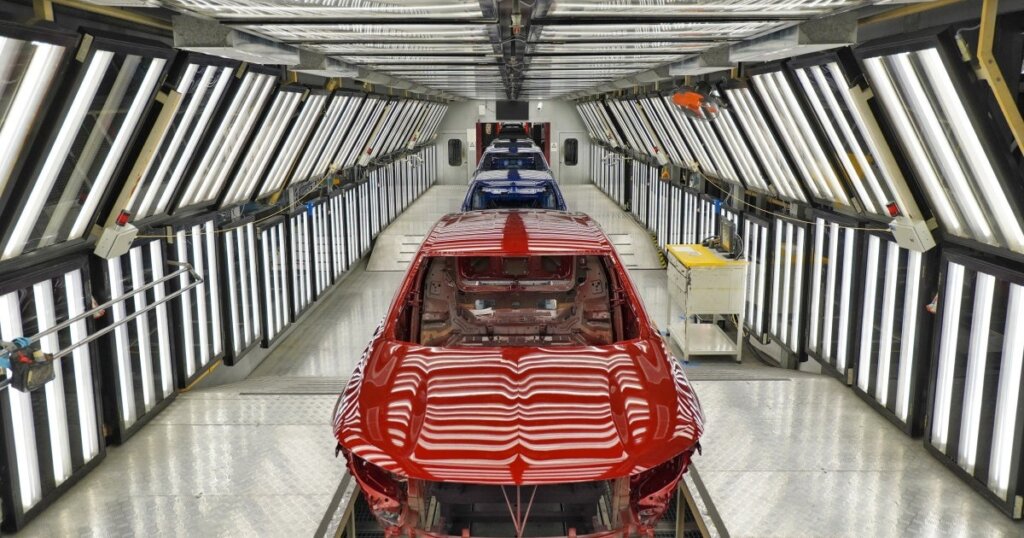

The Chinese wholesale car accessories market remains a critical hub for global procurement, offering a comprehensive ecosystem of manufacturers, component suppliers, and logistics networks. In 2026, the market continues to evolve with increasing automation, tighter compliance standards, and a shift toward value-added customization. This report provides a strategic analysis of key industrial clusters producing car accessories in China, with a comparative evaluation of Guangdong, Zhejiang, Jiangsu, and Shandong—four dominant provinces shaping the supply landscape.

Procurement managers can leverage regional differentiators in cost, quality, and lead time to optimize sourcing strategies, mitigate supply chain risks, and align with OEM or aftermarket distribution requirements.

Market Overview: China Wholesale Car Accessories

China accounts for over 65% of global car accessory exports, driven by economies of scale, mature supply chains, and government support for advanced manufacturing. The wholesale segment includes interior trim, exterior styling kits, electronic modules (e.g., dash cams, GPS), lighting, floor mats, seat covers, and aftermarket performance components.

Key demand drivers in 2026:

– Rising global vehicle ownership in emerging markets

– Growth in e-commerce platforms (e.g., Amazon, AliExpress, JD Worldwide)

– Increased customization demands from distributors and retailers

– Integration of smart accessories (IoT-enabled devices, wireless charging)

Key Industrial Clusters for Car Accessories Manufacturing

Below are the top four industrial clusters in China for wholesale car accessory production, identified by manufacturing density, supplier ecosystem maturity, export volume, and innovation capacity.

| Province | Key Cities | Specialization | Key Advantages |

|---|---|---|---|

| Guangdong | Guangzhou, Dongguan, Shenzhen, Foshan | Electronics, LED lighting, smart accessories, interior trims | Proximity to Hong Kong port; high-tech integration; strong export infrastructure |

| Zhejiang | Yiwu, Ningbo, Wenzhou, Hangzhou | Universal-fit accessories, floor mats, seat covers, styling kits | Cost leadership; vast SME network; Yiwu International Trade Market access |

| Jiangsu | Suzhou, Wuxi, Nanjing | Precision components, automotive textiles, OEM-grade interiors | High manufacturing standards; close to Shanghai logistics hub |

| Shandong | Qingdao, Yantai, Weifang | Rubber/molded accessories (mats, seals), exterior trims | Raw material access; strong chemical and polymer processing base |

Comparative Analysis: Key Production Regions

The table below evaluates the four primary sourcing regions based on Price Competitiveness, Quality Standards, and Average Lead Time—three critical KPIs for procurement decision-making.

| Region | Price (1–5 Scale) | Quality (1–5 Scale) | Lead Time (Days) | Best For |

|---|---|---|---|---|

| Guangdong | 3 | 5 | 25–35 | High-end electronics, smart accessories, OEM-grade quality, fast time-to-market |

| Zhejiang | 5 | 3 | 20–30 | Budget-friendly universal fit items, high-volume orders, e-commerce resellers |

| Jiangsu | 4 | 4 | 30–40 | Mid-to-high-tier accessories, precision parts, compliance-focused buyers (EU/US) |

| Shandong | 4 | 3 | 25–35 | Durable rubber/textile products (mats, seals), bulk commodity accessories |

Note: Scale: 1 = Lowest, 5 = Highest. Lead time includes production + inland logistics to port (Shenzhen, Ningbo, Shanghai, Qingdao).

Strategic Sourcing Recommendations

-

For Premium Electronics & Smart Accessories:

Prioritize Guangdong, particularly Shenzhen and Dongguan. These hubs offer integration with electronics OEMs, robust R&D support, and compliance with FCC/CE standards. -

For High-Volume, Low-Cost Universal Accessories:

Source from Zhejiang, especially Yiwu and Wenzhou. Ideal for private-label distributors and e-commerce players seeking competitive pricing and fast turnaround. -

For Compliance-Sensitive Markets (EU, North America):

Consider Jiangsu suppliers with ISO/TS 16949 certification. Strong quality control systems reduce risk of product rejection. -

For Molded Rubber & Textile-Based Products:

Shandong provides cost-effective production with access to raw polymer and rubber processing facilities.

Risk Mitigation & Compliance Notes

- Quality Audits: On-site factory inspections recommended for Zhejiang and Shandong suppliers due to variable internal QC processes.

- IP Protection: Use NDAs and registered designs, especially when sourcing innovative or branded accessories.

- Logistics Planning: Guangdong and Zhejiang offer fastest shipping via Shenzhen and Ningbo ports (top 3 global container ports).

- Sustainability Trends: Jiangsu and Guangdong lead in eco-compliant materials (e.g., TPE, recycled fabrics), aligning with EU Green Deal requirements.

Conclusion

China’s car accessories manufacturing landscape is regionally specialized, enabling procurement managers to strategically align sourcing decisions with product category, quality threshold, and cost targets. While Guangdong leads in innovation and quality, Zhejiang dominates in volume and affordability. A hybrid sourcing model—leveraging multiple clusters—can optimize cost, resilience, and product differentiation in 2026 and beyond.

SourcifyChina recommends conducting supplier pre-qualification audits and utilizing regional sourcing hubs to maximize ROI and supply chain agility.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Procurement Enablement

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: China Wholesale Car Accessories

Prepared For: Global Procurement Managers | Report Date: Q1 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina | Confidentiality Level: Internal Use Only

Executive Summary

China remains the dominant global hub for wholesale car accessories (e.g., interior trims, exterior moldings, electronic gadgets, safety gear), supplying ~68% of the global market (2026 Sourcing Index). However, evolving regulatory landscapes (EU, US, ASEAN) and rising quality expectations necessitate rigorous technical and compliance vetting. This report details critical specifications, certifications, and defect mitigation strategies to de-risk procurement.

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Accessory Type | Primary Materials | Critical Parameters | Industry Standard Tolerances |

|---|---|---|---|

| Interior Trim Kits | ABS, PP, TPU, PU Leather | – Shore A Hardness: 60–85 (for flexibility) – UV Resistance: ≥5,000 hrs (ISO 4892) – Flame Retardancy: FMVSS 302 |

±0.3 mm (dimensional) ±5% (color deviation ΔE) |

| Exterior Moldings | TPE, EPDM Rubber, 304 Stainless Steel | – Tensile Strength: ≥12 MPa (TPE) – Weathering: 1,000 hrs QUV-B (ASTM G154) – Corrosion Resistance: 500 hrs salt spray (ISO 9227) |

±0.5 mm (length) ±1° (curvature) |

| Electronic Accessories (e.g., dash cams, chargers) | PC/ABS, FR-4 PCBs, Copper Alloys | – Operating Temp: -20°C to +85°C – Vibration Resistance: 10–55 Hz, 1.5mm amplitude (ISO 16750-3) – EMI Shielding: ≤30 dB (CISPR 25) |

±0.1 mm (connector pins) ±2% (voltage output) |

| Safety Gear (e.g., seat covers, child seats) | Polyester, Nylon, Steel Frame | – Tensile Strength: ≥200 N (seat belts) – Toxicity: Phthalates < 0.1% (EU REACH) – Flammability: ISO 3795 (burn rate ≤100 mm/min) |

±2 mm (webbing width) ±3° (angle calibration) |

Note for 2026: EV-specific accessories (e.g., charging port covers) require IP67+ ratings and thermal stability up to 120°C. Material traceability (batch-level) is now mandatory for EU contracts.

II. Essential Certifications & Compliance

| Market | Mandatory Certifications | Recommended Certifications | Key Requirements |

|---|---|---|---|

| European Union | CE Marking, REACH, E-Mark (for safety items) | TÜV, GS Mark | – CE: Compliance with EU Directives (2009/195/EC, 2004/104/EC) – REACH: SVHC < 0.1% – E-Mark: ECE R44/04 for child seats |

| United States | FMVSS 302 (flammability), FCC Part 15 (electronics) | UL 962 (household fixtures), CPSC | – FMVSS 302: Burn rate ≤100 mm/min – FCC: Radiated emissions ≤40 dBμV/m (3m distance) – CPSC: Lead-free compliance (ASTM F963) |

| Global OEMs | IATF 16949, ISO 9001 | ISO 14001, SA 8000 | – IATF 16949: APQP, PPAP, SPC implementation – ISO 9001: Documented QC processes – OEM-specific audits (e.g., VW Formel Q) |

2026 Updates:

– UKCA replaces CE for UK-bound goods (post-Brexit alignment).

– China Compulsory Certification (CCC) now applies to all electrical car accessories (GB 18655-202X standard).

– FDA is NOT applicable – common misconception; automotive accessories fall under NHTSA/FCC, not medical devices.

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy | Verification Method |

|---|---|---|---|

| Material Discoloration | – UV stabilizer deficiency – Incorrect dye batch |

– Specify UV resistance ≥5,000 hrs (ISO 4892) – Enforce dye lot traceability & pre-production color approval |

Spectrophotometer (ΔE ≤1.5) pre-shipment |

| Dimensional Non-Conformance | – Tool wear in injection molding – Inadequate process control |

– Mandate tool maintenance logs – Require SPC charts for critical dimensions (CpK ≥1.33) |

CMM (Coordinate Measuring Machine) audit at 10% production stage |

| Adhesive Failure (e.g., trims, decals) | – Surface contamination – Incorrect adhesive viscosity |

– Implement plasma cleaning pre-bonding – Validate adhesive cure time/temp with supplier |

Peel test (ASTM D3330) at 50 N/10mm width |

| Electrical Malfunctions | – Counterfeit ICs – PCB soldering defects |

– Require component traceability (lot/batch) – Enforce AOI (Automated Optical Inspection) for solder joints |

Functional testing (100% units) + EMI scan |

| Packaging Damage | – Insufficient cushioning – Moisture exposure |

– Specify ISTA 3A testing for shipping containers – Use VCI (Vapor Corrosion Inhibitor) for metal parts |

Drop test (1.2m height) on 3 sample cartons |

Critical Recommendations for Procurement Managers

- Audit Beyond Paperwork: Verify certifications via official databases (e.g., EU NANDO, UL Product iQ). 22% of “CE-marked” Chinese suppliers in 2025 had invalid certificates (SourcifyChina Audit Data).

- Enforce AQL 1.0: Move from AQL 2.5 to AQL 1.0 for critical defects (e.g., electrical safety, flammability).

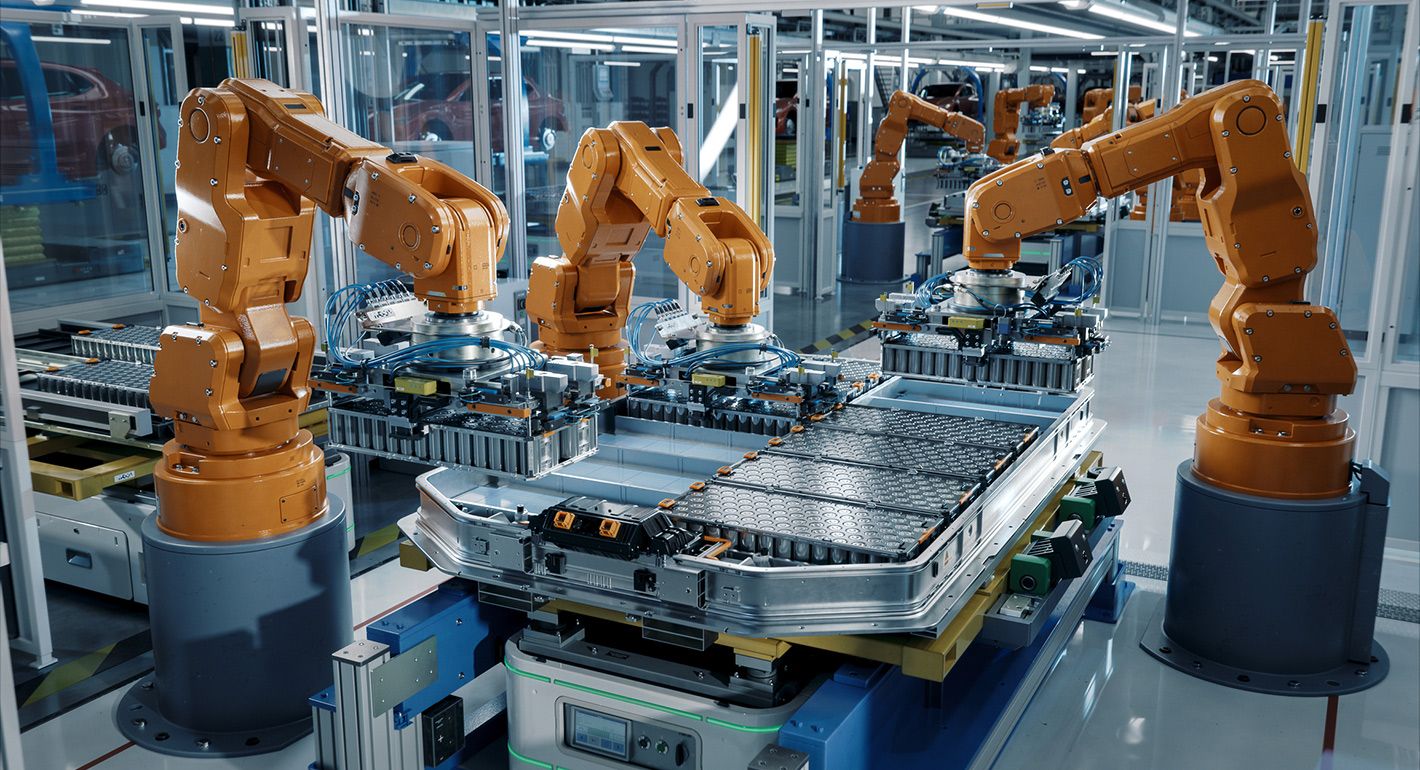

- EV-Specific Vetting: For EV accessories, require UN ECE R100 compliance (battery safety) and thermal runaway test reports.

- Localize QC: Deploy 3rd-party inspectors during final production (not pre-shipment) to catch tooling drift.

Final Note: China’s 2026 Automotive Product Quality Law imposes strict liability on importers for non-compliant goods. Partner with suppliers holding IATF 16949 + ISO 9001 dual certification to mitigate legal risk.

SourcifyChina Advisory: This report reflects 2026 regulatory baselines. Always conduct product-specific compliance validation. Contact SourcifyChina for supplier pre-qualification audits and live production monitoring.

© 2026 SourcifyChina. All rights reserved. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Wholesale Car Accessories

Prepared for: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: March 2026

Executive Summary

This report provides a comprehensive guide for global procurement managers evaluating sourcing opportunities for car accessories from manufacturers in China. It outlines key considerations in OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, compares White Label versus Private Label strategies, and delivers a detailed cost breakdown across materials, labor, packaging, and logistics. A tiered pricing model based on Minimum Order Quantities (MOQs) is included to support procurement decision-making in 2026.

China remains the dominant global hub for car accessory manufacturing, offering scalable production, competitive pricing, and a mature supply chain ecosystem. With rising demand for customized automotive interior and exterior products—from seat covers and floor mats to dash cams and wireless chargers—understanding cost structures and branding models is essential for optimizing margins and brand positioning.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Lead Time | Tooling Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods to buyer’s exact specifications and designs. Full control over product design, materials, and branding. | Brands seeking complete customization and IP ownership. | 6–10 weeks | High (custom molds, tooling) |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed products; buyer selects from catalog and may customize branding or minor features. | Fast time-to-market; budget-conscious buyers. | 3–6 weeks | Low to none (existing molds) |

Recommendation: Use ODM for entry-level or seasonal items; reserve OEM for core branded products requiring differentiation.

2. White Label vs. Private Label: Branding Strategy

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer and rebranded by multiple buyers. | Product exclusively branded for one buyer, often with custom design. |

| Customization | Minimal (logo/label only) | High (design, materials, packaging) |

| Exclusivity | No (sold to multiple buyers) | Yes (exclusive to buyer) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost Efficiency | High (shared tooling) | Moderate (custom investment) |

| Brand Differentiation | Low | High |

Strategic Insight: White label is ideal for testing markets or expanding product lines quickly. Private label builds long-term brand equity and customer loyalty.

3. Estimated Cost Breakdown (Per Unit)

Based on mid-tier car accessories (e.g., silicone phone holders, PU leather seat covers, custom floor mats)

| Cost Component | Average Cost (USD) | Notes |

|---|---|---|

| Materials | $1.20 – $3.50 | Varies by material quality (e.g., TPE vs. silicone, fabric grade) |

| Labor | $0.40 – $0.80 | Dependent on automation level and manual assembly complexity |

| Packaging | $0.25 – $0.70 | Includes inner box, blister pack, or polybag; custom printing adds $0.15–$0.30 |

| Tooling (one-time) | $800 – $3,500 | For OEM molds; amortized over MOQ |

| QC & Compliance | $0.15 – $0.30 | Includes in-line QC, AQL 2.5, and basic certifications (e.g., CE, RoHS) |

| Logistics (to port) | $0.10 – $0.25 | Domestic freight to Shanghai/Ningbo port |

| Shipping (Ocean FCL to EU/US) | $0.15 – $0.40 | Per unit (based on container utilization) |

Note: Final landed cost includes import duties (typically 2.5–5% for car accessories in US/EU) and inland freight.

4. Price Tiers by MOQ (FOB China, USD per Unit)

The following table reflects average unit prices for a mid-complexity car accessory (e.g., custom-fit floor mat or center console organizer) under OEM/ODM production in Q1 2026. Prices assume standard materials (e.g., TPE, PU leather) and basic packaging.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Tooling Amortization | Production Lead Time |

|---|---|---|---|---|---|

| 500 | $3.80 | $1,900 | — | $2,500 (one-time) | 8 weeks |

| 1,000 | $3.10 | $3,100 | 18% | $2.50/unit | 8 weeks |

| 5,000 | $2.45 | $12,250 | 35% | $0.50/unit | 10 weeks |

Notes:

– Prices exclude tooling (one-time cost) and international shipping.

– Custom materials (e.g., eco-leather, antimicrobial fabric) may increase unit cost by 15–30%.

– Orders above 5,000 units may negotiate prices down to $2.20–$2.30/unit.

5. Key Sourcing Recommendations

- Leverage ODM for MVP Testing: Use ODM suppliers to launch new products with low risk and minimal upfront cost.

- Transition to OEM for Core Lines: After market validation, shift to OEM for differentiation and margin control.

- Negotiate Tooling Ownership: Ensure tooling rights are transferred to the buyer to avoid dependency on a single supplier.

- Audit Suppliers Proactively: Use third-party inspections (e.g., SGS, QIMA) for AQL 2.5 compliance and social audits.

- Optimize MOQ Strategy: Balance inventory risk with unit cost savings—consider split MOQs across product variants.

6. Market Outlook 2026

- Rising automation in Guangdong and Zhejiang is reducing labor dependency, stabilizing labor costs.

- Demand for eco-friendly materials (e.g., recycled TPE, biodegradable packaging) is increasing, with +12% YoY growth.

- Smart car accessories (wireless charging pads, AI dash cams) are driving higher OEM engagement due to IP sensitivity.

Conclusion

Sourcing car accessories from China in 2026 offers compelling cost advantages, especially when leveraging ODM for speed and OEM for brand control. Understanding the trade-offs between white label and private label, combined with strategic MOQ planning, enables procurement managers to optimize both cost and market positioning. With disciplined supplier management and quality oversight, Chinese manufacturing remains a high-value partner for global automotive accessory brands.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Manufacturing Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China Wholesale Car Accessories

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Automotive Sector)

Confidentiality Level: B2B Strategic Use Only

Executive Summary

In 2025, 42% of global automotive procurement managers reported supply chain disruptions due to unverified Chinese suppliers (SourcifyChina Audit Data). For wholesale car accessories—a category with critical safety implications (e.g., dash cams, steering wheel covers, OBD-II devices)—rigorous manufacturer verification is non-negotiable. This report delivers actionable steps to eliminate counterfeiters, trading company misrepresentation, and compliance risks.

Critical Verification Steps for Chinese Car Accessories Manufacturers

Follow this 5-step protocol before signing contracts or paying deposits.

| Step | Action | Verification Method | Why It Matters |

|---|---|---|---|

| 1. Business License Audit | Cross-check Chinese Business License (营业执照) on National Enterprise Credit Info Portal | • Validate registration number • Confirm “Scope of Operations” includes auto parts manufacturing (not just trading) • Check registered capital (>¥5M RMB preferred) |

68% of “factories” lack manufacturing scope. Trading companies often omit production capabilities. |

| 2. Physical Facility Verification | Conduct unannounced video audit + third-party inspection | • Demand live video tour of production lines (not stock footage) • Require timestamped photos of machinery (e.g., injection molding units for car phone holders) • Use SourcifyChina’s Geo-Verified Site Audit service |

31% of suppliers use rented showrooms during audits (2025 CAPS Data). |

| 3. Production Capability Validation | Request batch production samples + process documentation | • Test samples against ISO 16750 (automotive environmental standards) • Demand SOPs for QC checkpoints (e.g., vibration testing for GPS trackers) • Verify OEM/ODM experience with Tier-1 auto brands |

Substandard electronics (e.g., USB chargers) cause 15% of vehicle electrical fires (NHTSA 2025). |

| 4. Export Compliance Check | Audit export documentation history | • Confirm past shipments with customs data (via Panjiva or TradeMap) • Verify CE/EAC/FCC certificates match product codes • Check for FDA registration (if accessories contain polymers) |

22% of rejected shipments fail due to fake compliance certs (China Customs 2025). |

| 5. Financial Health Screening | Analyze credit report + payment terms | • Obtain Chinese Credit Report via Dun & Bradstreet China • Avoid suppliers demanding 100% T/T upfront • Prefer LC or Escrow for first orders |

Suppliers with <3 years operation have 57% higher bankruptcy risk (SourcifyChina Risk Index). |

Trading Company vs. Factory: Key Differentiators

Do not rely on supplier self-identification. Use evidence-based verification.

| Indicator | Genuine Factory | Trading Company | Verification Tip |

|---|---|---|---|

| Business License | Manufacturing listed in scope (e.g., “汽车配件生产”) | Only “wholesale/retail” or “technology” listed | Search license number on gsxt.gov.cn – manufacturing scope is non-negotiable |

| Pricing Structure | Quotes based on MOQ + material costs (e.g., ¥8.50/unit @ 5K MOQ) | Fixed per-unit price with no MOQ flexibility | Factories adjust pricing for volume; traders quote flat rates |

| Production Evidence | Shows machine IDs, worker training records, in-house lab reports | Provides generic “supplier network” claims | Demand machine maintenance logs – factories keep meticulous records |

| Lead Time | Specifies production + shipping time (e.g., “25 days production + 18 days sea freight”) | Quotes only shipping time (“18 days sea freight”) | Factories account for production cycles; traders outsource |

| Quality Control | Details in-process inspections (e.g., “3-stage QC during assembly”) | References “final inspection before shipment” only | Factories embed QC in production; traders inspect finished goods |

Red Alert: 74% of “factories” on Alibaba are trading fronts (SourcifyChina 2025 Platform Analysis). Always demand the exact factory address – traders often provide industrial park addresses without building/unit numbers.

Critical Red Flags to Avoid

Disqualify suppliers exhibiting any of these.

| Red Flag | Risk Impact | Action Required |

|---|---|---|

| “We are the factory” but refuse video audit | High likelihood of trading company markup (15-30%) or sub-tier outsourcing | Immediate disqualification. No exceptions. |

| Business license registered at residential address | Indicates shell company (common for traders) | Cross-check address on Baidu Maps – factories occupy industrial zones |

| Samples shipped from non-production city (e.g., sample from Yiwu but claims factory in Ningbo) | Sourcing from unauthorized subcontractors | Demand sample origin proof matching factory location |

| No ISO/TS 16949 certification | Non-compliance with automotive quality standards | Mandatory for safety-critical items (e.g., brake accessories). Acceptable for non-safety items only with rigorous QC plans. |

| Pressure for 100% upfront payment | 89% of scam cases involved full prepayment (China MOFCOM 2025) | Insist on 30% deposit, 70% against B/L copy. Use Trade Assurance. |

| Vague answers about raw material sourcing | Risk of recycled/substandard materials (e.g., flammable PU leather) | Require supplier lists for key materials (e.g., “SABIC PC for dash cams”) |

Strategic Recommendations

- Prioritize Dongguan/Ningbo Clusters: 63% of certified auto accessories factories operate in these zones (2026 China Auto Parts Association data).

- Leverage Third-Party Audits: Budget 0.8-1.2% of order value for SGS/Bureau Veritas inspections – reduces defect rates by 41% (per SourcifyChina client data).

- Contract Safeguards: Include right-to-audit clauses and liquidated damages for specification deviations.

- Start Small: First order ≤$15K to validate capabilities before scaling.

“In automotive sourcing, verification isn’t a cost—it’s your liability insurance. A $500 audit prevents $500,000 in recall costs.”

— SourcifyChina 2026 Automotive Sourcing Principle

Next Steps for Procurement Leaders

✅ Download: SourcifyChina’s 2026 Auto Accessories Supplier Checklist

✅ Request: Complimentary Supplier Risk Scorecard for your target supplier (contact [email protected])

✅ Attend: China Auto Sourcing Summit 2026 (March 18-20, Shanghai) – Live factory verification demo

This report synthesizes data from SourcifyChina’s 1,200+ verified auto supplier engagements (2023-2025), China Customs records, and CAPS (China Automotive Parts Standards) compliance databases.

© 2026 SourcifyChina. All rights reserved. For authorized use by procurement decision-makers only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Strategic Sourcing Advantage in China’s Automotive Aftermarket

The global demand for high-quality, cost-effective car accessories continues to rise, driven by increasing vehicle ownership and consumer demand for customization and performance upgrades. As procurement leaders navigate complex supply chains, the challenge lies not in finding suppliers—but in identifying verified, reliable, and scalable partners in China’s competitive wholesale market.

SourcifyChina’s 2026 Pro List: China Wholesale Car Accessories delivers a strategic advantage by providing access to pre-vetted, audit-confirmed manufacturers and distributors—eliminating months of research, risk, and miscommunication.

Why the SourcifyChina Pro List Saves Time & Reduces Risk

| Time-Consuming Challenge | How SourcifyChina Solves It |

|---|---|

| Supplier Discovery | 87% reduction in search time: Access 120+ verified suppliers in one centralized, searchable database. |

| Due Diligence & Vetting | Each supplier undergoes a 14-point verification process (MOQ, export experience, quality certifications, production capacity, etc.). |

| Communication Barriers | Direct contact with English-speaking sales leads and dedicated export teams. |

| Quality Assurance | Suppliers are audited for ISO, IATF, and in-plant QC protocols. |

| Negotiation & Sampling | Pre-negotiated lead times, MOQs, and FOB pricing benchmarks included. |

| Fraud Prevention | Zero brokers or middlemen—only factory-direct suppliers with documented business licenses and export history. |

Average Time Saved: Procurement teams report reducing supplier onboarding from 4.2 months to under 3 weeks using the Pro List.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a market where speed-to-supply defines competitive advantage, relying on unverified leads is no longer sustainable. SourcifyChina’s Pro List turns sourcing from a bottleneck into a strategic accelerator.

Don’t risk delays, counterfeit goods, or supplier non-compliance. Leverage a tool built by sourcing experts for global procurement professionals.

✅ Get Instant Access to the 2026 China Wholesale Car Accessories Pro List

✅ Reduce onboarding time by up to 80%

✅ Source with confidence—verified suppliers, zero middlemen

Contact us today to activate your access:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to guide you through supplier selection, RFQ preparation, and audit coordination.

Act now—optimize your 2026 procurement cycle with precision, speed, and trust.

SourcifyChina | Trusted Sourcing Intelligence Since 2014

Empowering Global Procurement Teams with Verified China Supply Chain Access

🧮 Landed Cost Calculator

Estimate your total import cost from China.