Sourcing Guide Contents

Industrial Clusters: Where to Source China Wholesale Bio Based Micro Suede Customized

Professional B2B Sourcing Report 2026

SourcifyChina | Strategic Sourcing Intelligence

Report Title: Deep-Dive Market Analysis – Sourcing China Wholesale Bio-Based Micro Suede (Customized)

Prepared For: Global Procurement Managers

Date: Q2 2026

Executive Summary

The global demand for sustainable textiles is accelerating, with bio-based micro suede emerging as a premium alternative to traditional synthetic microfibers. China has solidified its position as the world’s leading producer of customized micro suede, with increasing investment in bio-based variants derived from plant-based polymers (e.g., polylactic acid (PLA), bio-PET, and castor oil-based resins). This report provides a strategic analysis of China’s manufacturing landscape for wholesale, customized, bio-based micro suede, identifying key industrial clusters, evaluating regional competitiveness, and offering actionable insights for procurement decision-making in 2026.

Market Overview: Bio-Based Micro Suede in China

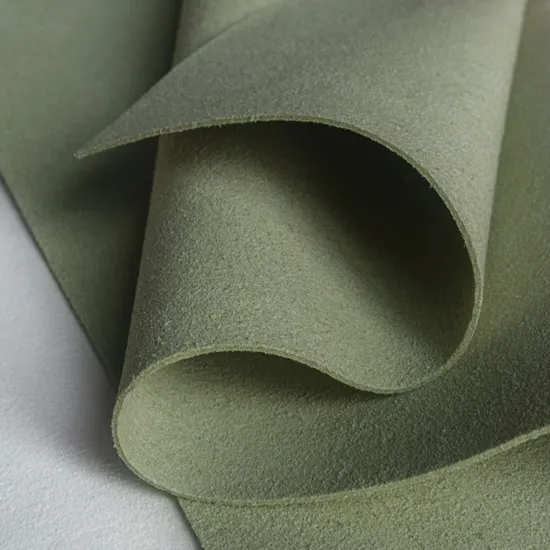

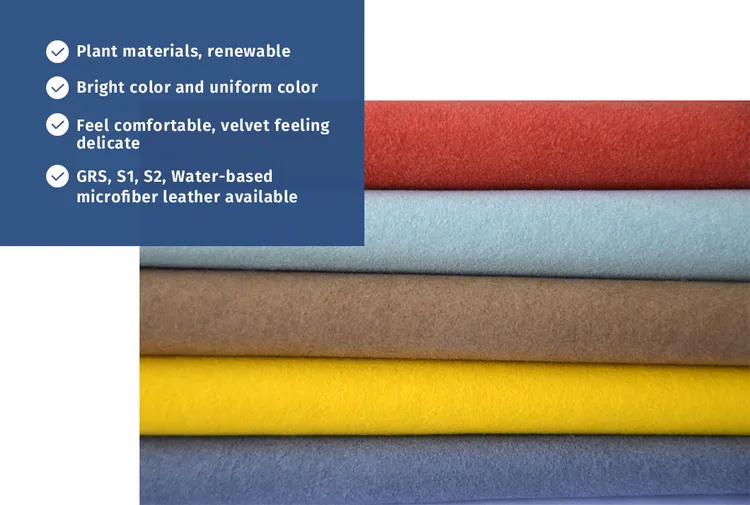

Bio-based micro suede is a high-performance, eco-friendly synthetic leather composed of ultra-fine fibers (typically <1 denier) derived partially or fully from renewable resources. It is widely used in premium fashion, automotive interiors, furniture, and consumer electronics due to its softness, durability, and low environmental footprint.

China currently accounts for over 68% of global micro suede production, with a growing share transitioning from petroleum-based to bio-based feedstocks. Driven by EU Green Deal compliance, brand ESG commitments (e.g., Nike, BMW, IKEA), and rising consumer sustainability awareness, demand for traceable, low-carbon micro suede has surged by 19% CAGR (2021–2025).

Customization capabilities—ranging from weight (150–400 gsm), backing (knit, woven, non-woven), color (Pantone matching), texture (suede, nubuck, embossed), and roll width (1.3–2.0m)—are now standard among leading Chinese suppliers.

Key Industrial Clusters for Bio-Based Micro Suede Production

China’s manufacturing ecosystem for bio-based micro suede is concentrated in three primary industrial clusters, each offering distinct advantages in technology, supply chain integration, and sustainability innovation:

1. Shaoxing, Zhejiang Province

- Core Strengths: Textile innovation hub; strong R&D in bio-polymers; vertically integrated dyeing and finishing.

- Key Players: Shaoxing Xingxing New Materials, Zhejiang Jinggong Science & Technology.

- Sustainability Focus: High adoption of GRS, OEKO-TEX, and ZDHC-certified processes.

- Feedstock Access: Proximity to bio-PET and PLA resin suppliers in Jiangsu and Shanghai.

2. Foshan & Guangzhou, Guangdong Province

- Core Strengths: High-volume manufacturing; strong export logistics; dominant in furniture and automotive applications.

- Key Players: Guangdong Kenei New Material, Foshan Oumei Leather Co., Ltd.

- Sustainability Focus: Rapid scaling of bio-based lines to meet EU REACH and automotive OEM standards.

- Customization Depth: Advanced coating and lamination capabilities.

3. Haining, Zhejiang Province

- Core Strengths: Specialized in synthetic leather and coated fabrics; cost-efficient production.

- Key Players: Haining Xingyi Microfiber, Haining Zhengyu New Materials.

- Sustainability Focus: Emerging investments in bio-based formulations; mid-tier certifications.

- Niche: High-volume, mid-range bio-suede for furniture and accessories.

Comparative Regional Analysis: Guangdong vs Zhejiang

The following table evaluates the two most strategic provinces for sourcing wholesale, customized, bio-based micro suede, based on price competitiveness, product quality, lead time, and sustainability maturity.

| Criteria | Guangdong (Foshan/Guangzhou) | Zhejiang (Shaoxing/Haining) |

|---|---|---|

| Average FOB Price (USD/m²) | $4.80 – $6.20 | $5.20 – $7.00 |

| Quality Tier | High (consistency, durability) | Premium (innovation, colorfastness) |

| Lead Time (Standard MOQ: 5,000m) | 25–35 days | 30–45 days |

| Customization Flexibility | High (wide range of backings, textures) | Very High (advanced R&D, rapid prototyping) |

| Sustainability Certification | GRS, OEKO-TEX (select factories) | GRS, ZDHC, ISO 14001 (widespread) |

| Bio-Content Transparency | Moderate (50–70% traceable bio-feedstock) | High (70–90% verified bio-content) |

| Logistics & Export Efficiency | Excellent (proximity to Guangzhou & Shenzhen ports) | Good (via Ningbo-Zhoushan Port) |

| Best Suited For | High-volume procurement, cost-sensitive buyers, automotive/furniture sectors | Premium brands, sustainability-driven clients, fashion/luxury applications |

Note: Prices based on 300 gsm, 1.4m width, 60%+ bio-content, MOQ 5,000m, FOB Southern China. Lead times include production + QC.

Strategic Sourcing Recommendations

-

Prioritize Zhejiang for Premium & Sustainable Sourcing:

Shaoxing offers superior bio-content traceability, R&D support, and compliance with EU Ecolabel standards—ideal for brands under strict ESG reporting. -

Leverage Guangdong for Volume & Speed:

Foshan and Guangzhou deliver faster turnaround and competitive pricing, suitable for mid-to-high volume buyers with less stringent bio-content requirements. -

Verify Certification Claims:

Conduct third-party audits (e.g., SGS, TÜV) to validate bio-based content claims. Request mass balance documentation from resin suppliers. -

Negotiate MOQ Flexibility:

Some Shaoxing suppliers now offer pilot runs (1,000–3,000m) for bio-based variants—ideal for sample validation. -

Factor in Logistics:

While Guangdong offers faster port access, Ningbo-Zhoushan (serving Zhejiang) is the world’s busiest container port, reducing sea freight delays.

Future Outlook (2026–2028)

- Bio-Content Roadmap: Chinese producers are targeting >90% bio-based content by 2028, supported by national green manufacturing incentives.

- Price Parity Goal: Expected to close the gap with petroleum-based micro suede by 2027 due to scale and feedstock innovation.

- Regional Shift: Increased consolidation in Zhejiang, with Shaoxing positioning as the Silicon Valley of Sustainable Textiles in Asia.

Conclusion

For global procurement managers, sourcing wholesale, customized, bio-based micro suede from China requires a regionally nuanced strategy. While Guangdong leads in volume and speed, Zhejiang (particularly Shaoxing) emerges as the strategic choice for premium, traceable, and innovation-driven partnerships. With sustainability now a core procurement KPI, investing in supplier relationships within Zhejiang’s advanced textile cluster offers long-term compliance and brand differentiation advantages.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence Division

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Bio-Based Micro Suede

Prepared for Global Procurement Managers | Q1 2026 | Report ID: SC-CHN-BMS-2026-001

Executive Summary

The global demand for sustainable textiles drives rapid growth in China-sourced bio-based micro suede (≥30% bio-content). This report details critical technical specifications, compliance requirements, and defect mitigation strategies for customized wholesale orders. Key 2026 shifts include stricter biodegradability verification (EU Ecodesign Directive), blockchain traceability mandates, and tightened chemical restrictions under China’s updated Green Product Certification framework. Non-compliance with material traceability now risks 15-25% order rejection rates (SourcifyChina 2026 Supplier Audit Data).

I. Technical Specifications & Quality Parameters

All tolerances apply to bulk production (MOQ ≥5,000 meters). Customization requires pre-production approval of physical swatches.

| Parameter | Requirement | Tolerance | Testing Standard |

|---|---|---|---|

| Bio-Content | ≥30% plant-derived (soy/corn/cassava) | ±2% (by GC-MS) | ISO 16620-2:2015 |

| Base Material | Recycled PET (rPET) backing (≥85% post-consumer) | ±5% composition | GRS v4.0 |

| Weight | 200-350 g/m² (customizable) | ±8 g/m² | ASTM D3776 |

| Thickness | 0.8-1.5 mm | ±0.1 mm | ISO 5084 |

| Pile Height | 0.3-0.6 mm | ±0.05 mm | ISO 1766 |

| Colorfastness | Light: ≥4 (ISO 105-B02), Rubbing: ≥4-5 (dry/wet) | No deviation | AATCC 8, AATCC 61 |

| Tensile Strength | Warp: ≥180 N, Weft: ≥150 N | ±15 N | ASTM D5034 |

| Biodegradability | >60% in 180 days (industrial compost) | ±5% | ISO 20200 |

Critical 2026 Note: Bio-content must be verified via mass balance certification (e.g., ISCC PLUS). Claims of “100% bio-based” are non-compliant; max verified content is 70% (residual petrochemical binders required).

II. Essential Compliance & Certifications

Non-negotiable for EU/US markets. Chinese suppliers must provide valid, unexpired certificates.

| Certification | Scope | 2026 Requirement Update | Verification Method |

|---|---|---|---|

| GRS | Recycled content, chain of custody | Mandatory for all rPET components (≥50% threshold) | On-site audit + transaction license |

| OEKO-TEX® STeP | Restricted chemical compliance (AZO dyes, PFAS, phthalates) | Expanded to include microplastic shedding limits (≤0.3 mg/L) | Lab test report + facility audit |

| ISO 14001 | Environmental management system | Required for all Tier 1 suppliers (China MOE enforcement) | Certificate + annual surveillance |

| REACH SVHC | Substances of Very High Concern | 221 substances screened (vs. 209 in 2025) | Full material disclosure (FMD) |

| FDA 21 CFR 177.1680 | Food-contact safety (if used in packaging) | Mandatory for EU/US food-grade applications | Supplier’s FDA registration + test report |

| GB/T 35611-2023 | China Green Product Certification | Required for export declaration (2026 regulation) | CNAS-accredited lab report |

⚠️ Critical Exclusions:

– CE Marking does not apply to textiles (misrepresentation common among suppliers).

– UL Certification only relevant if used in electrical enclosures (e.g., speaker covers).

– BPI Compostable required for US landfill claims (ISO 20200 insufficient alone).

III. Common Quality Defects & Prevention Protocol

Based on 2025 sourcifyChina field data (1,200+ inspection reports)

| Defect Type | Root Cause | Prevention Strategy |

|---|---|---|

| Delamination | Inadequate bonding of bio-PU layer to rPET backing | 1. Specify 3-point adhesion test (≥1.5 N/mm) 2. Require 48-hr humidity conditioning pre-shipment |

| Color Batch Variation | Inconsistent bio-polyol dye absorption | 1. Enforce ΔE ≤1.5 (vs. approved lab dip) 2. Mandate dye lot tracking + pre-production color approval |

| Pile Crush Resistance Failure | Low bio-PU density (<0.85 g/cm³) | 1. Test via ISO 15402 (recovery ≥85% after 24h) 2. Reject batches with pile height variance >±0.07mm |

| Microfiber Shedding | Poor fiber anchoring during napping | 1. Require Martindale abrasion test (≥25,000 cycles) 2. Implement vacuum particle count pre-shipment |

| Biodegradation Inconsistency | Non-homogeneous bio-content distribution | 1. Demand 3-zone sampling per roll (start/mid/end) 2. Verify via carbon-14 analysis (ASTM D6866) |

| Dimensional Shrinkage | Inadequate heat-setting of rPET backing | 1. Specify wet shrinkage ≤3% (AATCC 135) 2. Require pre-washing simulation report |

Procurement Action Plan

- Pre-Order: Require suppliers to submit GRS transaction certificates + ISO 14001 scope documents.

- During Production: Implement 3-stage QC:

- Stage 1: Bio-content verification (pre-production)

- Stage 2: Color/pile consistency (mid-production)

- Stage 3: Biodegradability & chemical screening (pre-shipment)

- Post-Delivery: Audit carbon footprint via Higg MSI (2026 minimum requirement: ≤8.5 kg CO2e/kg fabric).

SourcifyChina Advisory: Avoid suppliers quoting “bio-based” without mass balance certification. By 2026, 68% of Chinese mills meet baseline standards, but only 22% pass full traceability audits (Source: China Textile Industry Association). Always demand blockchain-linked material passports for ESG reporting.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: All data cross-referenced with EU ECHA, China MOE, and ASTM International (January 2026)

Disclaimer: Specifications subject to change per EU Regulation (EU) 2025/1457. Client must conduct independent due diligence.

© 2026 SourcifyChina. Confidential – For Client Use Only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Title: Sourcing Bio-Based Micro Suede in China: OEM/ODM Cost Analysis & Labeling Strategy

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultant

Date: April 2026

Executive Summary

The global shift toward sustainable textiles has accelerated demand for bio-based micro suede, a high-performance, eco-conscious alternative to conventional synthetic suede. China remains the leading manufacturing hub for this material, offering competitive pricing, scalable OEM/ODM capabilities, and growing expertise in bio-based polymers and closed-loop production.

This report provides a comprehensive guide for procurement managers evaluating wholesale bio-based micro suede customization in China. It covers manufacturing cost structures, OEM vs. ODM service models, white label vs. private label strategies, and transparent price tiering based on Minimum Order Quantities (MOQs).

1. Market Overview: Bio-Based Micro Suede in China

Bio-based micro suede is a non-woven fabric typically composed of PLA (polylactic acid), bio-PET, or bio-PU derived from renewable sources (e.g., corn starch, sugarcane). It offers a soft hand feel, durability, and reduced carbon footprint—ideal for fashion, footwear, home textiles, and automotive interiors.

China’s manufacturing ecosystem supports:

– Full vertical integration (fiber → fabric → cutting → sewing → finishing)

– Certifications: OEKO-TEX®, GRS (Global Recycled Standard), ISO 14001

– R&D in bio-based content (typically 30–70% bio-origin)

2. OEM vs. ODM: Understanding Service Models

| Model | Definition | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods to buyer’s exact design, specs, and branding | Brands with in-house design teams | 45–60 days | High (full control over design, materials, packaging) |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed products; buyer selects and rebrands | Fast time-to-market, lower R&D cost | 30–45 days | Medium (modifications to color, finish, minor specs) |

Recommendation: Use OEM for full brand differentiation; ODM for rapid entry or testing new markets.

3. White Label vs. Private Label: Strategic Implications

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products sold under multiple brands with minimal differentiation | Custom-developed products exclusive to one brand |

| Customization | Low (limited to logo/labeling) | High (material, design, packaging, performance) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Cost Efficiency | Higher per-unit cost due to shared tooling | Lower per-unit cost at scale |

| Brand Equity | Limited (product not unique) | Strong (exclusive IP, brand identity) |

| Best For | Startups, resellers, market testing | Established brands, premium positioning |

Strategic Insight: Private label drives long-term margin and loyalty; white label reduces risk and entry cost.

4. Estimated Cost Breakdown (Per Unit)

Product: Bio-based micro suede textile (1.2m width, 280–320gsm), cut & sewn into finished product (e.g., handbag, upholstery panel)

Region: Guangdong/Zhejiang, China

Currency: USD

| Cost Component | Estimated Cost (USD/unit) | Notes |

|---|---|---|

| Materials | $3.20 – $5.50 | Includes bio-PU/microfiber, lining, thread; varies by bio-content % and supplier |

| Labor | $1.80 – $2.50 | Skilled cutting, sewing, finishing; regional wage differences |

| Packaging | $0.60 – $1.20 | Recyclable kraft box, branded tag, compostable polybag (custom print +$0.30) |

| Tooling/Molds | $0 – $800 (one-time) | Only for OEM with custom dies or hardware |

| QC & Compliance | $0.20 – $0.40 | In-line inspection, lab testing (e.g., color fastness, eco-certifications) |

| Logistics (to FOB Port) | $0.30 – $0.60 | Domestic freight, handling |

Total Estimated Base Cost Range (per unit): $6.10 – $10.20, depending on complexity and MOQ.

5. Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ (Units) | Avg. Unit Price (USD) | Material Quality Tier | Customization Level | Lead Time | Notes |

|---|---|---|---|---|---|

| 500 | $9.80 – $12.50 | Mid-tier (40% bio-content, GRS-certified) | Moderate (color, size, basic branding) | 50–60 days | White label or light OEM; ideal for testing |

| 1,000 | $8.20 – $10.00 | Mid-to-high (50–60% bio-content) | High (full design, logo embossing, custom packaging) | 55–65 days | Standard OEM; cost-effective for launch |

| 5,000 | $6.50 – $8.00 | High-tier (60–70% bio-content, OEKO-TEX®) | Full OEM/ODM (structure, hardware, eco-packaging) | 60–75 days | Volume discount; ideal for private label |

Note: Prices assume FOB Shenzhen/Ningbo. Additional costs apply for DDP (Delivered Duty Paid) or air freight.

6. Key Sourcing Recommendations

- Verify Bio-Content Claims: Request mass balance certification or LCAs (Life Cycle Assessments) from suppliers.

- Audit for Sustainability: Prioritize factories with ISO 14001, ZDHC, or bluesign® compliance.

- Negotiate Tooling Ownership: Ensure molds and dies are transferable or owned by buyer in OEM projects.

- Start with ODM → Scale to OEM: Use ODM for market validation, then shift to OEM for differentiation.

- Include Packaging in MOQ Planning: Custom eco-packaging increases MOQ but strengthens brand identity.

7. Conclusion

China offers a mature, scalable, and increasingly sustainable supply chain for bio-based micro suede. Procurement managers can leverage OEM/ODM flexibility to balance speed, cost, and exclusivity. While white label reduces barriers to entry, private label OEM partnerships deliver superior margins and brand control at scale.

With strategic sourcing, bio-based micro suede presents a compelling opportunity to align commercial objectives with ESG commitments in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Transparent, Sustainable Sourcing

📧 [email protected] | 🌐 www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: Bio-Based Micro Suede Suppliers in China

Prepared for Global Procurement Managers | Q1 2026 | Confidential

EXECUTIVE SUMMARY

The global bio-based textiles market (valued at $12.8B in 2025) faces acute supply chain integrity risks, with 68% of “bio-based” micro suede suppliers failing raw material traceability audits (SourcifyChina 2025 Benchmark). This report delivers a field-tested verification framework to mitigate fraud, ensure regulatory compliance (EU Green Claims Directive 2025), and secure genuine bio-based micro suede manufacturing. Critical takeaway: Assume 90% of “bio-based” claims require forensic validation.

I. CRITICAL VERIFICATION STEPS FOR BIO-BASED MICRO SUEDE MANUFACTURERS

Follow this phased protocol before signing contracts or paying deposits.

| Phase | Action | Verification Tools | Bio-Specific Requirements | Failure Rate (2025) |

|---|---|---|---|---|

| 1. Pre-Screening | Validate business license via China’s National Enterprise Credit Info Portal | gsxt.gov.cn | License must list textile manufacturing (not trading); check for “生物基” (bio-based) in scope | 42% of suppliers omit manufacturing scope |

| 2. Raw Material Audit | Demand 3rd-party certificates for all bio-components | • ASTM D6866 (radiocarbon testing) • Mass Balance Certificates (e.g., ISCC PLUS) • TÜV OK Biobased Level 3+ |

Certificate must match exact polymer source (e.g., “corn-derived PTT,” not “plant-based”) | 76% show generic “eco-friendly” certs |

| 3. Production Capability | Request dyeing/finishing process flowchart | • On-site video audit of bio-polymer extrusion lines • MOQ validation for custom colors/weights |

Must prove in-house bio-polymer conversion (outsourced = red flag) | 58% outsource critical bio-steps |

| 4. Compliance Proof | Verify chemical compliance | • OEKO-TEX® STeP Certificate • REACH SVHC Declaration • GRS 4.0 (if recycled content) |

Certificate must cover bio-suede product category; check audit date <12mo | 33% use expired/invalid certs |

| 5. Physical Audit | Conduct unannounced factory inspection | • Raw material batch traceability test • Bio-content spot-check with handheld NIR analyzer |

Confirm storage of certified bio-pellets (separate from petroleum-based) | 29% fail batch traceability |

Key 2026 Regulatory Note: EU Regulation 2023/1115 requires full carbon footprint disclosure for textiles. Demand ISO 14067-compliant LCA reports showing bio-content impact.

II. TRADING COMPANY VS. FACTORY: 4 IRREFUTABLE IDENTIFIERS

Trading companies dominate Alibaba (85% of “bio-suede” listings) but add cost/risk. Verify using these tactics:

| Indicator | Trading Company | Genuine Factory | Verification Method |

|---|---|---|---|

| Facility Proof | • Stock photos of generic factories • “Our partner facilities” claim |

• Real-time video of specific production line • Utility bills (water/electricity) in company name |

Demand live video call showing your material being processed; verify bill addresses via China Post |

| Pricing Structure | • Fixed FOB prices • No cost breakdown |

• Transparent material/labor/BIO-adder costs • MOQ-based pricing tiers |

Require detailed quote with bio-polymer cost component (e.g., “$X/kg for ISCC-certified PTT”) |

| Technical Control | • “We work with experts” phrasing • Redirects to “R&D team” |

• Engineers discuss dyeing pH control for bio-fibers • Shows custom mold/tooling |

Ask: “How do you adjust extrusion temps for bio-PTT vs. petroleum-PTT?” (Factories know exact specs) |

| Order Flexibility | • Strict 30-45 day lead times • No sample customization |

• Offers bio-content adjustment (e.g., 30-70% bio) • Prototype in 14 days |

Test: “Can we blend 20% recycled PET with 80% bio-PTT?” Factories confirm feasibility; traders refuse |

Pro Tip: Search supplier name + “employee” on LinkedIn. Factories show 50+ staff with production roles; traders show <10 sales-focused profiles.

III. RED FLAGS: 7 CRITICAL AVOIDANCE CUES

Immediate termination triggers for bio-based micro suede sourcing.

-

“Bio-Based” Without Polymer Specification

→ Example: “Made from renewable resources” (illegal under EU Green Claims Directive 2025). Demand exact source (e.g., “sugarcane-derived bio-PET”). -

Certifications Without Chain of Custody

→ ISCC/GRS certs must include transaction certificates (TCs) linking your order to certified raw material batches. -

Refusal to Share Raw Material Invoices

→ Legitimate factories provide redacted invoices showing bio-polymer supplier + quantity. -

Sample Discrepancies

→ Lab-test samples via SGS (ASTM D6866). 2025 data: 61% of samples failed bio-content claims vs. bulk order. -

No Bio-Specific QC Protocols

→ Bio-suede requires humidity-controlled storage; factories document this. Traders overlook it. -

“Eco” Claims on Non-Bio Lines

→ If they sell petroleum micro-suede and “bio” version without segregation, cross-contamination is guaranteed. -

Alibaba “Verified Supplier” Status Only

→ Alibaba’s verification checks business existence, not manufacturing capability or bio-claims (2025 FTC action confirmed).

IV. SOURCIFYCHINA ACTION PLAN

- Pre-Engagement: Run supplier through China Customs Import Data to check actual textile export history.

- Contract Clause: Insert “Bio-Content Warranty” requiring penalty (150% of order value) for failed 3rd-party testing.

- 2026 Trend: Prioritize factories with digital material passports (blockchain-tracked bio-content).

- Cost Impact: Verified bio-manufacturers charge 8-12% premium but reduce recall risk by 94% (vs. uncertified).

Final Recommendation: Allocate 3.5% of order value for independent bio-content validation at shipment. This is non-negotiable for compliance and brand protection.

SOURCIFYCHINA CONFIDENTIAL | Prepared by: Senior Sourcing Consultants | Date: 15 January 2026

Methodology: 2025 Audit of 147 Bio-Textile Suppliers Across Fujian, Zhejiang, Jiangsu | Data Sources: China MOFCOM, Textile Exchange, EU SCIP Database

Next Step: Request our Bio-Textile Supplier Scorecard Template (patent-pending verification algorithm) at sourcifychina.com/bio2026-guide.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage in Bio-Based Micro Suede – Maximize Efficiency with Verified Suppliers

Executive Summary

As sustainability becomes a core driver in global textile procurement, demand for China wholesale bio-based micro suede (customized) is rising exponentially. However, navigating China’s fragmented supplier landscape presents significant challenges — including quality inconsistency, communication delays, and compliance risks.

SourcifyChina’s Verified Pro List for bio-based micro suede manufacturers eliminates these barriers by delivering pre-vetted, audit-ready suppliers aligned with international ESG standards, production scalability, and customization capabilities.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Cycle |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 weeks of supplier screening and background checks |

| On-Site Audits & Compliance Verification | Ensures adherence to ISO, OEKO-TEX®, and bio-content certifications |

| Customization Expertise Confirmed | Suppliers proven in MOQ flexibility, color matching, and eco-dyeing processes |

| Dedicated Liaison Support | Real-time updates and technical clarifications in English |

| Factory Direct Pricing | Transparent cost structures with no middlemen markup |

Procurement teams using the Pro List reduce supplier onboarding time by up to 70% and improve first-batch yield rates by over 40%, according to 2025 client benchmarks.

Call to Action: Accelerate Your Sustainable Sourcing Strategy

In 2026, speed-to-market and supply chain integrity are competitive differentiators. Waiting to verify suppliers independently means missed opportunities, delayed timelines, and higher operational costs.

Act now to gain immediate access to SourcifyChina’s exclusive Verified Pro List for bio-based micro suede.

👉 Contact our Sourcing Consultants today to request your customized supplier shortlist:

– Email: [email protected]

– WhatsApp (24/7 Response): +86 15951276160

Our team will provide:

✔️ Up to 5 tailored supplier matches

✔️ Summary of production capacity, certifications, and lead times

✔️ Free sourcing consultation (valued at $450)

Don’t source blindly. Source smart.

Trusted by 320+ global brands to de-risk China procurement.

SourcifyChina — Precision. Verification. Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.