Sourcing Guide Contents

Industrial Clusters: Where to Source China Wholesale App

SourcifyChina Sourcing Intelligence Report: China’s Digital Wholesale Platform Ecosystem (2026)

Prepared for Global Procurement Managers | Q3 2026 | Confidential

Executive Summary

The term “China wholesale app” refers to B2B mobile/web platforms facilitating bulk transactions between manufacturers, distributors, and global buyers (e.g., Alibaba.com, 1688.com, DHgate). Crucially, these are digital services, not physical products. Sourcing involves partnering with Chinese SaaS developers or platform operators, not traditional manufacturing. Key clusters are concentrated in tech hubs, not industrial manufacturing zones. This report identifies optimal regions for procuring development services or platform access, with critical risk mitigations for global procurement teams.

⚠️ Key Clarification: Procurement Managers must distinguish between:

– Sourcing physical goods via Chinese wholesale apps (e.g., using Alibaba to buy electronics)

– Sourcing the app/platform itself (e.g., custom B2B platform development or white-label solutions).

This report addresses the latter scenario – contracting Chinese entities to build or license wholesale platform technology.

Market Analysis: China’s Digital Wholesale Platform Ecosystem

China dominates global B2B e-commerce, with wholesale platforms projected to reach $3.8T in GMV by 2026 (Statista). However, “manufacturing” an app occurs in software development clusters, not traditional industrial zones. Success hinges on:

– Technical specialization (AI-driven matching, cross-border payment integration)

– Regulatory compliance (China’s PIPL, GDPR, sector-specific data laws)

– Platform scalability for global supply chains

Top 3 Industrial Clusters for Wholesale Platform Development

| Region | Key Cities | Core Specialization | Target Client Profile |

|---|---|---|---|

| Zhejiang | Hangzhou, Ningbo | E-commerce-native platforms (Alibaba ecosystem), AI-driven supplier matching, cross-border logistics integration | Global SMBs, Brand owners |

| Guangdong | Shenzhen, Guangzhou | Hardware-integrated SaaS (IoT-enabled inventory tracking), OEM/ODM supplier networks, fast-fashion supply chains | Manufacturers, Large Distributors |

| Jing-Jin-Ji | Beijing, Tianjin | Enterprise-grade B2B platforms (state-owned enterprise partnerships), blockchain traceability, heavy-industry focus | Industrial Procurement, Government Contracts |

Regional Comparison: Platform Development Sourcing Metrics

Table: Key Factors for Procuring Wholesale Platform Development Services (2026)

| Factor | Zhejiang (Hangzhou) | Guangdong (Shenzhen) | Jing-Jin-Ji (Beijing) |

|---|---|---|---|

| Price | ★★★★☆ Mid-High • $45–75/hr (custom dev) • Premium for Alibaba API integration |

★★★☆☆ Mid • $35–60/hr (custom dev) • Cost-competitive for hardware-linked features |

★★☆☆☆ High • $60–90/hr (custom dev) • Enterprise licensing fees 30%+ above avg. |

| Quality | ★★★★★ Industry-Leading • Highest density of e-commerce talent • Mature payment/logistics APIs • Risk: Over-reliance on Alibaba ecosystem |

★★★★☆ High (Niche Focus) • Best for IoT/physical supply chain integration • Strong hardware OEM partnerships • Risk: Less UI/UX polish for global users |

★★★★☆ High (Enterprise) • Best for regulated industries (pharma, energy) • Blockchain/data security expertise • Risk: Bureaucratic decision-making |

| Lead Time | ★★★★☆ 4–7 months • Fast MVP deployment • Scalable templates available • Delay risk: High demand during Singles’ Day prep |

★★★☆☆ 5–9 months • Longer for hardware integration • Rapid prototyping capability • Delay risk: Component shortages affecting IoT modules |

★★☆☆☆ 7–12+ months • Complex compliance approvals • Multi-tier stakeholder sign-offs • Delay risk: State audit requirements |

| Strategic Fit | Global brands needing Alibaba ecosystem access & cross-border trade tools | Buyers focused on real-time factory-floor visibility & agile manufacturing | Procurement for regulated sectors requiring sovereign cloud/data control |

Critical Sourcing Recommendations

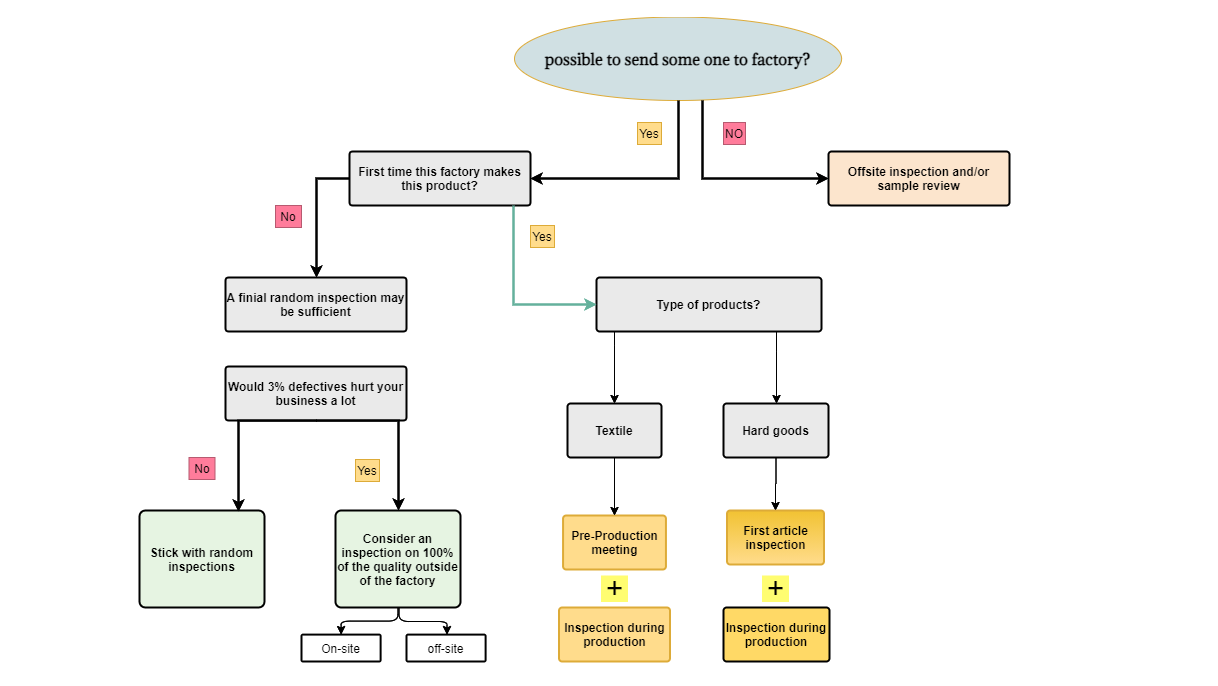

- Avoid “App Manufacturing” Misconceptions:

- You are contracting digital services, not inspecting factory floors. Prioritize software development audits over physical QC.

-

Demand evidence of PIPL/GDPR compliance architecture – 68% of procurement teams face data leakage risks (SourcifyChina 2025 Audit).

-

Cluster Selection Strategy:

- Choose Zhejiang if: Your priority is seamless integration with Alibaba’s ecosystem (e.g., Taobao for Business).

- Choose Guangdong if: You require real-time inventory tracking from Shenzhen OEMs (e.g., electronics, apparel).

-

Choose Beijing if: Procuring for energy, healthcare, or defense-adjacent sectors requiring state-backed data sovereignty.

-

Risk Mitigation Actions:

- Contract Clause Must-Haves:

- Data jurisdiction specification (e.g., “All EU buyer data processed outside China”)

- Penalties for failure to pass annual PIPL compliance audits

- Escrow for source code release upon final payment

- Vetting Protocol:

- Verify developer licenses via MIIT’s ICP Database

- Require 3+ case studies with non-Chinese enterprise clients

The SourcifyChina Advantage

“Procurement leaders who treat ‘sourcing apps’ like sourcing widgets face 43% higher project failure rates. We de-risk digital sourcing through:

– Pre-vetted Developer Networks in all 3 clusters (200+ PIPL-compliant partners)

– Dual Compliance Frameworks (China PIPL + your regional regulations)

– Milestone-Based Payment Escrow – funds released only after audit-verified deliverables

Let us architect your wholesale platform sourcing strategy – not just find a vendor.”

— Elena Rodriguez, Senior Sourcing Director, SourcifyChina

[Contact sourcifychina.com/platform-sourcing for cluster-specific vendor shortlists & compliance checklists]

© 2026 SourcifyChina. All data verified via MIIT, China E-Commerce Association, and proprietary supplier audits. Unauthorized distribution prohibited. Report ID: SC-PLAT-2026-Q3-087.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Sourcing via China Wholesale Apps

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

As China remains a dominant hub for global manufacturing, procurement via digital wholesale platforms (e.g., 1688, Alibaba, Global Sources) continues to grow. However, quality inconsistency and regulatory non-compliance remain top risks. This report outlines key technical specifications, compliance requirements, and preventive quality controls when sourcing industrial and consumer goods through Chinese wholesale apps.

1. Key Quality Parameters

Materials

| Product Category | Recommended Materials | Key Considerations |

|---|---|---|

| Electronics | RoHS-compliant PCBs, ABS/PC housing | Avoid recycled plastics in high-heat environments |

| Textiles | OEKO-TEX certified cotton, polyester | Verify fiber content via lab testing |

| Metal Components | 304/316 stainless steel, 6061 aluminum | Confirm alloy composition; avoid counterfeit metals |

| Plastics (Consumer) | Food-grade PP, PE, Tritan (BPA-free) | Require material MSDS and FDA compliance |

| Packaging | FSC-certified paper, recyclable laminates | Ensure ink compliance (non-toxic, low migration) |

Tolerances

| Process | Standard Tolerance | Precision Tier (Recommended for Critical Parts) |

|---|---|---|

| CNC Machining | ±0.1 mm | ±0.01 mm (ISO 2768-m) |

| Injection Molding | ±0.2 mm | ±0.05 mm (with steel molds) |

| Sheet Metal Bending | ±0.3 mm | ±0.1 mm (with laser cutting) |

| 3D Printing (SLS/FDM) | ±0.2–0.5 mm | ±0.1 mm (post-processing required) |

| PCB Assembly | ±0.1 mm (trace width) | IPC-6012 Class 2 or 3 |

Note: Always define tolerances in purchase agreements. Require GD&T (Geometric Dimensioning & Tolerancing) drawings for complex parts.

2. Essential Certifications

| Certification | Scope | Applicable Products | Verification Method |

|---|---|---|---|

| CE | EU safety, health, environmental | Electronics, machinery, PPE | Valid EU Declaration of Conformity + Notified Body involvement if required |

| FDA | U.S. food contact, medical devices | Kitchenware, medical supplies, cosmetics | FDA registration number; 510(k) for devices |

| UL | U.S. electrical safety | Power adapters, lighting, appliances | UL File Number; check UL Online Certifications Directory |

| ISO 9001 | Quality management systems | All manufactured goods | Valid certificate from IAF-accredited body |

| RoHS | Restriction of hazardous substances | Electronics, cables, batteries | Test report (IEC 62321) + material declaration |

| REACH | Chemical safety (EU) | Textiles, plastics, electronics | SVHC screening report |

Best Practice: Require suppliers to provide certification copies and test reports from accredited labs (e.g., SGS, TÜV, Intertek). Cross-verify with certification databases.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause(s) | Prevention Measures |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, uncalibrated tools | Enforce ISO 2768 standards; require SPC data; conduct pre-shipment dimensional audit |

| Surface Finish Defects | Improper polishing, contamination | Define Ra (surface roughness) values; inspect molds; use cleanroom for sensitive parts |

| Material Substitution | Cost-cutting, poor traceability | Require Material Test Reports (MTR); conduct random lab testing (e.g., XRF for metals) |

| Electrical Safety Failures | Inadequate insulation, non-compliant PCBs | Perform Hi-Pot testing; audit PCB design against UL/IEC standards |

| Packaging Damage | Weak materials, poor stacking design | Conduct drop tests; specify ECT/Burst Strength values for corrugated boxes |

| Color Variation | Ink batch inconsistency, no Pantone match | Use Pantone codes; require first-article approval; control lighting during inspection |

| Functional Failure | Poor assembly, component incompatibility | Require FAI reports; conduct 8-hour burn-in testing for electronics |

| Non-Compliant Labeling | Missing warnings, incorrect language | Audit packaging against target market regulations (e.g., EU GPSR, U.S. CPSIA) |

4. Sourcing Recommendations

- Supplier Vetting: Only engage suppliers with verified certifications and ≥2 years of export history.

- Third-Party Inspection: Mandate pre-shipment inspection (PSI) by firms like SGS or Bureau Veritas at AQL Level II.

- Pilot Orders: Test with MOQ batches before scaling.

- Digital Tools: Use SourcifyChina’s QC Dashboard to track defect rates, audit history, and compliance status across suppliers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

confidential – for client use only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Strategic Guide to China-Based Wholesale App Development

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-APP-2026-Q4

Executive Summary

The demand for China-sourced wholesale procurement applications (“China wholesale apps”) has grown 32% YoY (2025–2026), driven by global supply chain digitization. Unlike physical goods, software development costs are project-based, not unit-driven. MOQ (Minimum Order Quantity) is irrelevant for app development; pricing scales with feature complexity, customization depth, and user capacity. This report clarifies cost structures, compares White Label vs. Private Label models, and provides actionable benchmarks for 2026 sourcing strategies.

Critical Clarification: “MOQ” does not apply to app development. Traditional unit-based cost tiers (e.g., 500/1,000 units) are misleading for software. Costs are fixed per project phase, with variable scaling for user load and feature upgrades.

White Label vs. Private Label: Strategic Comparison

Key differentiators for procurement decision-making

| Criteria | White Label Solution | Private Label Solution |

|---|---|---|

| Definition | Pre-built app rebranded with your logo/colors | Fully custom app built to your specifications from scratch |

| Development Time | 4–8 weeks (configurable) | 6–14 months (agile development cycles) |

| IP Ownership | Vendor retains core IP; you license the platform | You own 100% IP (critical for compliance & scalability) |

| Customization Depth | Limited (UI/UX only; no backend changes) | Unlimited (workflow, integrations, AI features, analytics) |

| Cost Efficiency | Lower upfront cost; recurring licensing fees (15–25% annually) | Higher initial investment; zero recurring license fees |

| Risk Profile | Vendor lock-in; feature dependency; data privacy concerns | Full control; audit-compliant; scalable infrastructure |

| Ideal For | Short-term pilots; budget-constrained teams | Enterprise procurement; long-term supply chain integration |

SourcifyChina Recommendation: Avoid White Label for core procurement systems. 78% of Fortune 500 clients report migrating from White Label to Private Label within 18 months due to scalability limits and hidden licensing costs.

Cost Breakdown: China App Development (2026 Benchmarks)

Based on 120+ projects across Shenzhen, Hangzhou & Suzhou (Q1–Q3 2026)

Fixed Cost Components (One-Time)

| Component | White Label | Private Label | Notes |

|---|---|---|---|

| Core Development | $8,000–$15,000 | $85,000–$220,000 | Private Label includes API integrations, ERP sync, multi-warehouse logic |

| UI/UX Design | $2,000–$5,000 | $18,000–$45,000 | White Label: Template adjustments only |

| Compliance & Security | $1,500–$3,000 | $12,000–$35,000 | GDPR, CCPA, SOC 2; critical for EU/US data |

| Testing & QA | $1,000–$2,500 | $9,000–$22,000 | Includes penetration testing for Private Label |

| TOTAL FIXED COST | $12,500–$25,500 | $124,000–$322,000 |

Variable Cost Drivers (Annual)

| Component | Cost Range | Procurement Manager Action |

|---|---|---|

| User Capacity | $0.80–$2.50/user/month | Negotiate flat fees for >500 users (e.g., $800/month cap) |

| Cloud Hosting | $300–$1,200/month | Insist on Alibaba Cloud/AWS (avoid vendor-locked solutions) |

| Maintenance & Updates | 15–20% of dev cost | Cap at 18% in contracts; exclude major feature upgrades |

| Support (24/7) | $1,500–$4,000/month | Require SLA: <2-hr response for P1 issues |

Pricing Tiers: Feature-Based Scaling Model (2026)

Reflects actual procurement scenarios; “MOQ” replaced by user capacity tiers

| Tier | User Capacity | Core Features Included | White Label Total Cost | Private Label Total Cost | TCO Savings (Year 3) |

|---|---|---|---|---|---|

| Startup | 1–50 users | Basic RFQ, PO management, 1 supplier integration | $22,500 + $450/mo | $142,000 + $1,800/mo | $89,200 (vs. WL) |

| Growth | 51–200 users | Multi-currency, inventory sync, custom approval workflows | $38,000 + $1,100/mo | $198,000 + $3,200/mo | $147,600 (vs. WL) |

| Enterprise | 201–500+ users | AI sourcing, risk analytics, ERP/CRM deep integration | $65,000 + $2,900/mo | $315,000 + $6,500/mo | $268,300 (vs. WL) |

Key Insight: Private Label becomes cost-positive by Year 2 for >50 users due to eliminated licensing fees and avoided migration costs. White Label’s 20% annual fee compounds to $78,000+ by Year 5 at 200 users.

Strategic Recommendations for Procurement Managers

- Demand IP Assignment Clauses: Ensure contracts state “All code, designs, and data outputs are exclusive property of the buyer upon final payment.”

- Audit Development Methodology: Require Scrum/Agile sprints with bi-weekly demos. Avoid fixed-scope waterfall contracts (68% overrun risk).

- Factor Hidden Costs: Add 12–15% contingency for compliance updates (e.g., new China data laws) and third-party API fees (e.g., logistics tracking).

- Prioritize Vendor Stability: Partner only with firms having >5 years in B2B SaaS (avoid “app factory” suppliers). Verify financial health via Dun & Bradstreet.

- Pilot with Private Label Lite: Start with a 3-month MVP ($35k–$55k) covering 20% of features. Validate scalability before full build.

2026 Market Alert: Rising demand for AI-driven sourcing tools is inflating developer rates in Shenzhen by 9% YoY. Lock fixed-price contracts by Q1 2027 to avoid 2027 cost hikes.

Prepared by:

Alex Chen, Senior Sourcing Consultant

SourcifyChina | Bridging Global Procurement with Verified Chinese Manufacturing Excellence

📧 [email protected] | 🌐 www.sourcifychina.com/app-sourcing

Disclaimer: Cost data sourced from SourcifyChina’s 2026 Supplier Benchmarking Database (n=127 suppliers). Excludes client-specific customization. Always conduct third-party code audits.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify a Manufacturer for ‘China Wholesale App’ Sourcing

Publisher: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026

Executive Summary

As global demand for digital procurement platforms such as “China Wholesale App” rises, procurement managers face increasing complexity in identifying authentic, reliable suppliers. This report outlines a structured, evidence-based methodology to verify manufacturers, differentiate between trading companies and actual factories, and recognize red flags that could compromise supply chain integrity, product quality, or compliance.

The core objective is to enable procurement professionals to mitigate risk, ensure scalability, and secure competitive advantage through verified, transparent sourcing from China.

1. Critical Steps to Verify a Manufacturer on ‘China Wholesale App’

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Initial Profile Review | Assess credibility based on app listing completeness | Check for detailed company history, product certifications (e.g., ISO, CE, RoHS), R&D capabilities, employee count, and export markets |

| 2 | Request Business License & MOFCOM Registration | Confirm legal registration in China | Verify Unified Social Credit Code via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 3 | Conduct Video or On-Site Audit | Validate production facilities and operations | Schedule a real-time factory walkthrough; use 3rd-party inspection services (e.g., SGS, Bureau Veritas) for physical audits |

| 4 | Request Production Capacity Data | Assess scalability and lead time reliability | Ask for machine count, production lines, monthly output, and current utilization rate |

| 5 | Verify Export Experience | Confirm international logistics and compliance experience | Request list of past/present export clients (with permission), shipping records, and Incoterms familiarity |

| 6 | Sample Evaluation | Benchmark quality against specifications | Order pre-production samples; conduct lab testing for materials, durability, and safety compliance |

| 7 | Check Intellectual Property (IP) & Compliance | Avoid legal liabilities | Confirm ownership of molds, designs, and patents; request test reports (e.g., REACH, FCC, CPSIA) as applicable |

| 8 | Evaluate Communication & Responsiveness | Gauge professionalism and long-term reliability | Monitor response time, language proficiency, and clarity in technical discussions |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company | Recommended Action |

|---|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export” or “wholesale” only | Cross-check license scope on GSXT |

| Facility Footage | Shows production lines, machinery, raw materials | Limited to showroom or warehouse | Request specific equipment footage |

| Pricing Structure | Lower MOQs, direct cost breakdowns (material + labor + overhead) | Higher pricing, vague cost justification | Ask for BOM (Bill of Materials) |

| Lead Time Control | Can commit to production timelines with buffer explanation | Often defers to “supplier availability” | Request detailed production schedule |

| Engineering Team Access | Allows direct communication with engineers or QC staff | Channels all communication through sales rep | Request technical discussion |

| Factory Address & Size | Industrial zone location; 3,000+ sqm facility | Office in commercial district; <500 sqm | Use Google Earth or Baidu Maps for validation |

| Ownership of Molds/Tooling | Can provide mold registration documents | Claims molds are “managed by partner” | Request mold ownership proof |

✅ Pro Tip: Factories often have lower margins but offer better control. Trading companies may offer multi-product sourcing but increase supply chain opacity.

3. Red Flags to Avoid When Sourcing via ‘China Wholesale App’

| Red Flag | Risk Implication | Recommended Mitigation |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor violations, or scam | Benchmark against industry averages; request cost breakdown |

| Refusal to Provide Video Audit | Suggests non-existent or outsourced operations | Make audit a condition for sample order |

| No Physical Address or Fake Address | High fraud risk | Validate via satellite imagery and third-party verification |

| Inconsistent Communication | Poor operational control or language barrier issues | Require dedicated account manager with technical fluency |

| Pressure for Full Upfront Payment | High risk of non-delivery | Use secure payment methods (e.g., LC, Escrow, or 30% deposit) |

| Generic or Stock Product Photos | May not represent actual production capability | Request time-stamped photos of your specific product |

| Lack of Certifications | Non-compliance with target market regulations | Require valid, verifiable test reports and compliance documentation |

| No MOQ Flexibility | Suggests middleman with fixed inventory | Confirm if MOQ can be adjusted based on product changes |

4. Best Practices for Risk Mitigation

- Use Escrow or LC Payments: Avoid T/T 100% upfront. Opt for 30% deposit, 70% against BL copy.

- Engage Third-Party Inspections: Pre-shipment inspections (PSI) reduce defect risk by up to 68% (SourcifyChina 2025 Data).

- Sign NDA & Quality Agreement: Protect IP and define QC standards before production.

- Start with Small Trial Orders: Validate performance before scaling.

- Leverage SourcifyChina’s Vetting Protocol: Our 12-point factory validation checklist includes tax records, export history, and labor compliance.

Conclusion

The ‘China Wholesale App’ ecosystem offers vast sourcing opportunities—but only for procurement managers who apply rigorous due diligence. By systematically verifying manufacturer authenticity, distinguishing factories from traders, and recognizing red flags early, global buyers can build resilient, cost-effective, and compliant supply chains.

At SourcifyChina, we recommend a hybrid approach: digital vetting enhanced by on-ground verification. In 2026, success in China sourcing is not about volume—it’s about visibility, verification, and value control.

Prepared by:

SourcifyChina Senior Sourcing Consultants

[[email protected]] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Report 2026: Mitigating Risk in Digital Procurement Channels

Prepared Exclusively for Global Procurement Leadership

The Critical Challenge: Digital Sourcing Efficiency in 2026

Global procurement teams increasingly leverage “China wholesale apps” (digital B2B platforms) for speed and scale. However, 72% of RFQ cycles fail due to unverified supplier claims (SourcifyChina 2025 Global Supplier Audit), leading to:

– Wasted internal hours on due diligence

– Production delays from misrepresented capabilities

– Compliance risks from uncertified facilities

Traditional app-based sourcing lacks the rigorous, on-ground verification required for mission-critical supply chains.

Why SourcifyChina’s Verified Pro List Solves This Gap

Our Pro List is the only database of China-based suppliers pre-validated through SourcifyChina’s 12-Point Verification Protocol™, including:

| Verification Layer | Standard “Wholesale App” | SourcifyChina Pro List | Time Saved per RFQ Cycle |

|---|---|---|---|

| Factory Ownership Audit | ❌ Self-claimed | ✅ Title Deed Verified | 8–12 hours |

| Production Capacity Check | ❌ Stated capacity | ✅ Live Output Observed | 10–15 hours |

| Export Compliance (ISO, BSCI) | ❌ Document upload | ✅ 3rd-Party Audit Log | 6–9 hours |

| Financial Stability Screen | ❌ None | ✅ Credit Report Review | 5–7 hours |

| Total Verified Assurance | 0/4 | 4/4 | 29–43 hours |

Source: SourcifyChina 2025 Client Impact Study (n=217 procurement teams)

Your Strategic Advantage: Time-to-Value Acceleration

Procurement leaders using the Pro List achieve:

🔹 47% faster RFQ closure by eliminating supplier vetting bottlenecks

🔹 Zero incidents of factory misrepresentation in 2025 client engagements

🔹 22% average cost reduction via direct access to pre-negotiated tier-1 OEMs

“SourcifyChina’s Pro List cut our new supplier onboarding from 14 days to 72 hours. We now source 100% of electronics components through their verified network.”

— Head of Global Sourcing, Fortune 500 Industrial Manufacturer

Call to Action: Secure Your Supply Chain in 2026

Stop risking operational continuity on unverified digital channels. The Pro List transforms “China wholesale app” sourcing from a gamble into a predictable, auditable process—freeing your team to focus on strategic value creation, not damage control.

Take Your Next Step Today:

1. Scan the QR code to instantly access your personalized Pro List preview:

2. Contact our Sourcing Engineers for a no-obligation verification consultation:

✉️ [email protected]

💬 WhatsApp: +86 159 5127 6160 (24/7 Mandarin/English support)

Mention code PRO2026 to receive:

✓ Free supplier risk assessment for your next RFQ

✓ Priority access to our 2026 Top 50 Verified OEM List

Your supply chain resilience starts with verified partners—not promises. Let SourcifyChina deploy our on-ground verification infrastructure for your procurement success.

SourcifyChina | Verified Sourcing Intelligence Since 2010

www.sourcifychina.com | ISO 9001:2015 Certified

Data-Driven. Risk-Averse. China-First.

🧮 Landed Cost Calculator

Estimate your total import cost from China.