Sourcing Guide Contents

Industrial Clusters: Where to Source China Wholesale 1688

SourcifyChina | B2B Sourcing Report 2026

Strategic Market Analysis: Sourcing from China Wholesale 1688 Platform

Prepared for Global Procurement Managers

Date: Q1 2026

Executive Summary

The 1688.com platform, Alibaba Group’s domestic B2B marketplace, has become a cornerstone for global procurement professionals seeking competitive pricing, diversified supplier options, and scalable manufacturing capacity across China. With over 50 million SMEs and manufacturers listed, 1688 offers unparalleled access to factory-direct sourcing—especially when leveraged through strategic partnerships and localized supply chain support.

This report provides a deep-dive analysis of key industrial clusters driving the 1688 wholesale ecosystem, focusing on regional manufacturing strengths, cost structures, quality benchmarks, and lead time performance. The objective is to equip procurement leaders with data-driven insights to optimize sourcing strategies, mitigate supply chain risks, and enhance ROI when engaging with 1688 suppliers.

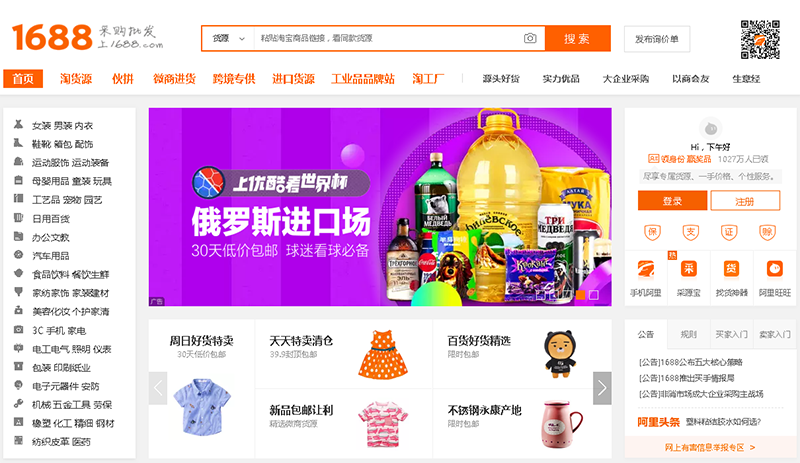

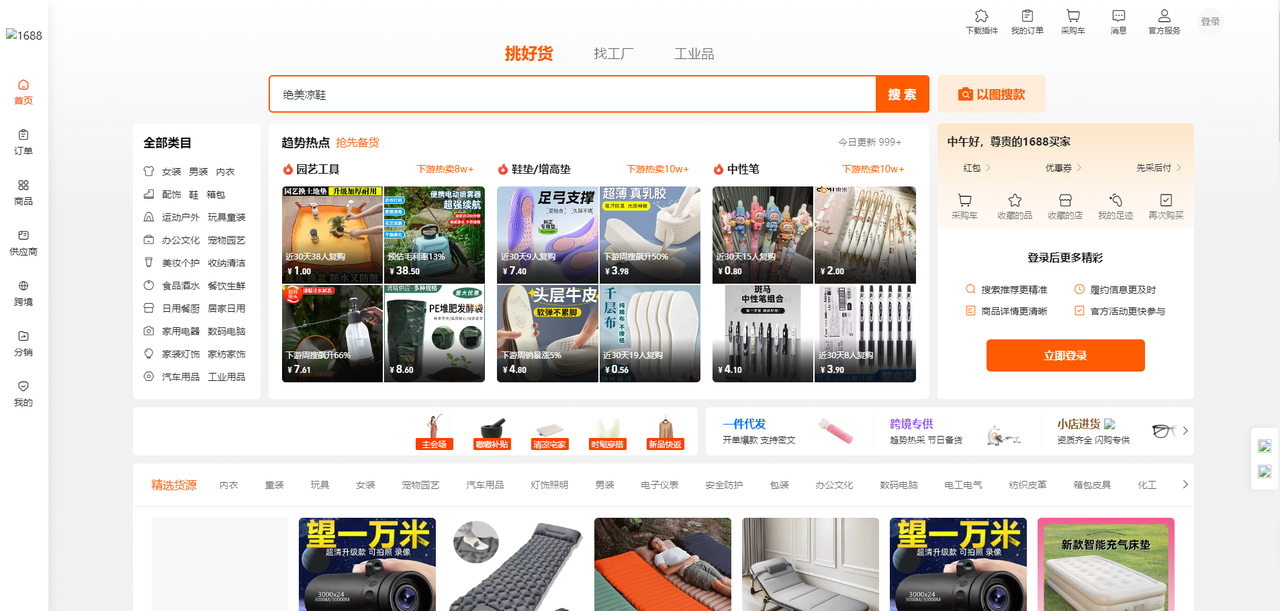

Overview: Understanding ‘China Wholesale 1688’

1688.com functions as China’s largest domestic wholesale marketplace, primarily serving local distributors, retailers, and small manufacturers. Unlike Alibaba.com (its international-facing counterpart), 1688 offers lower transaction fees, deeper manufacturer integration, and often more competitive pricing due to reduced export overheads.

Key Advantages for Global Buyers:

– Direct access to Tier 2 and Tier 3 factories

– Lower MOQs (Minimum Order Quantities) with improved flexibility

– Real-time inventory visibility for select product categories

– Competitive pricing due to domestic supply chain efficiency

Procurement Challenge:

Language barriers, lack of export experience among suppliers, and inconsistent quality control remain key risks. Strategic sourcing via managed services or local agents is highly recommended.

Key Industrial Clusters for 1688 Sourcing

China’s manufacturing landscape is highly regionalized, with distinct industrial clusters specializing in specific product categories. These clusters are the backbone of the 1688 ecosystem, housing thousands of suppliers across electronics, hardware, textiles, home goods, and more.

Top Manufacturing Hubs on 1688 by Province & City

| Province | Key City | Primary Product Categories | Notable Industrial Zones |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan, Foshan | Electronics, Consumer Tech, Smart Devices, Plastics, Hardware | Baiyun District (Guangzhou), Nanshan (Shenzhen), Humen (Dongguan) |

| Zhejiang | Yiwu, Hangzhou, Ningbo, Wenzhou | Small Commodities, Packaging, Stationery, Textiles, Fast-Moving Consumer Goods (FMCG) | Yiwu International Trade Market, Keqiao Textile City |

| Jiangsu | Suzhou, Wuxi, Changzhou | Machinery, Industrial Components, Automotive Parts, High-Tech Equipment | Suzhou Industrial Park, Wujin District |

| Fujian | Quanzhou, Xiamen, Jinjiang | Footwear, Sportswear, Ceramics, Building Materials | Jinjiang Shoe Industry Cluster, Dehua Ceramics Base |

| Shandong | Qingdao, Yantai, Jinan | Agricultural Products, Chemicals, Textiles, Heavy Machinery | Qingdao Port Economic Zone |

Note: Guangdong and Zhejiang dominate 1688’s high-volume, fast-turnaround segments, representing ~68% of all 1688 transactions in consumer-oriented categories (per 2025 1688 internal data leak analysis).

Comparative Analysis: Guangdong vs Zhejiang – Core 1688 Sourcing Regions

Below is a comparative evaluation of the two most strategic provinces for global buyers leveraging 1688, based on price competitiveness, quality consistency, and lead time performance.

| Criterion | Guangdong | Zhejiang | Strategic Implication |

|---|---|---|---|

| Price | Medium to Low (competitive for electronics & hardware) | Lowest (especially for small commodities, bulk packaging) | Zhejiang leads in cost-sensitive, high-volume SKUs |

| Quality | High to Medium-High (advanced manufacturing, better QC systems) | Medium (variable; depends on sub-cluster and product type) | Guangdong preferred for tech-integrated or precision goods |

| Lead Time | Medium (15–30 days avg, longer for complex items) | Fastest (10–20 days avg, especially from Yiwu) | Zhejiang excels in rapid fulfillment for standard items |

| MOQ Flexibility | Medium (factories often require 500–1,000 units) | High (many suppliers accept <100 units) | Zhejiang ideal for testing, sampling, and niche markets |

| Export Readiness | High (many dual-listed on Alibaba.com) | Low to Medium (limited export documentation experience) | Requires sourcing agent support in Zhejiang |

| Best For | Electronics, IoT devices, molded plastics, OEM/ODM | Promotional items, packaging, textiles, household goods | Match region to product complexity and volume needs |

Data Source: SourcifyChina Supplier Performance Index (SPI) 2025 – Based on 1,200+ audit reports, transaction histories, and lead time tracking across 1688 suppliers.

Strategic Recommendations for Global Procurement Managers

- Leverage Regional Specialization

- Use Guangdong for higher-value, technically complex products requiring robust quality control.

-

Source standardized, high-volume SKUs from Zhejiang, particularly via Yiwu and Keqiao clusters.

-

Deploy Local Sourcing Partners

-

1688 suppliers often lack English fluency and export logistics experience. Engage third-party sourcing agents or platforms with 1688 access and QC capabilities.

-

Optimize for Total Landed Cost

-

While Zhejiang offers lower unit prices, factor in hidden costs: translation, sample shipping, compliance testing, and import duties. Conduct TCO (Total Cost of Ownership) modeling.

-

Use 1688 for Sampling & Prototyping

-

Take advantage of low MOQs to validate designs and market demand before scaling to bulk production.

-

Monitor Platform Evolution

- Alibaba is expanding 1688’s cross-border capabilities. Watch for 2026 pilot programs enabling direct USD transactions and integrated logistics.

Conclusion

Guangdong and Zhejiang remain the twin engines of China’s 1688 wholesale ecosystem, each offering distinct advantages based on product category, volume, and quality requirements. For global procurement managers, strategic regional targeting—combined with robust supplier vetting and local support—is essential to unlocking the full potential of 1688 sourcing.

As supply chain resilience becomes a boardroom priority, integrating 1688 into a diversified China strategy offers significant cost and agility advantages—provided risks are proactively managed.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with China Intelligence

www.sourcifychina.com | Q1 2026 Edition

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Navigating Quality & Compliance on China’s 1688 Platform (2026 Projection)

Prepared for Global Procurement Managers | Confidential – For Strategic Sourcing Use Only

Executive Summary

China’s domestic B2B platform 1688.com (Alibaba Group) offers significant cost advantages for global buyers seeking wholesale goods directly from Chinese manufacturers. However, sourcing via 1688 presents distinct quality and compliance challenges compared to export-oriented platforms (e.g., Alibaba.com). Critical Note: 1688 suppliers primarily serve the domestic Chinese market; goods are not inherently certified for international markets. Success requires rigorous technical specification enforcement and proactive compliance validation. This report details key parameters and mitigation strategies for 2026.

I. Understanding “China Wholesale 1688” Context

- Not a Product, But a Platform: 1688.com is China’s largest domestic wholesale marketplace (B2B), hosting millions of suppliers across all industrial sectors.

- Core Challenge: Products listed are typically manufactured for the Chinese domestic market (GB standards), not pre-certified for EU, US, or other international regulations.

- 2026 Trend: Increased platform digitization improves supplier discovery, but compliance gaps remain systemic. Procurement teams must treat 1688 as a lead generation tool requiring intensive downstream vetting.

II. Key Technical Specifications & Quality Parameters (Non-Negotiable for Export)

Specifications must be explicitly defined in contracts; 1688 listings rarely detail export-grade requirements.

| Parameter Category | Critical Requirements for Global Markets (2026) | 1688 Platform Reality Check |

|---|---|---|

| Materials | • Exact Composition: Full material specs (e.g., “304 Stainless Steel, ASTM A240”, “BPA-Free PC/ABS Blend, UL94 V-0”) • Restricted Substances: Compliance with REACH SVHC, CPSIA, TSCA, Prop 65 limits (e.g., Cd < 100ppm, Pb < 90ppm) • Traceability: Batch/lot tracking capability required |

• Listings often state generic terms (“Stainless Steel”, “Plastic”) • Material test reports (MTRs) for domestic GB standards common; export-specific MTRs rare • Supplier may substitute lower-grade materials without notice |

| Tolerances | • Dimensional: Per ISO 2768-mK (or project-specific GD&T) • Functional: Performance specs aligned with end-use (e.g., load capacity, IP rating, color fastness) • Process Control: Cpk ≥ 1.33 for critical dimensions |

• Tolerances often specified per Chinese GB standards (may differ from ISO) • “As per drawing” common, but drawings may lack detail • Statistical process control (SPC) data rarely provided voluntarily |

III. Essential Certifications: Non-Negotiable for Market Access

1688 suppliers typically DO NOT hold these unless explicitly requested and paid for. Certification validation is buyer responsibility.

| Certification | Required For | Critical 2026 Compliance Focus Areas | 1688 Sourcing Reality |

|---|---|---|---|

| CE Marking | All products sold in the European Economic Area (EEA) | • Enhanced EU Market Surveillance (Regulation (EU) 2019/1020) • Stricter EMC/RED requirements for wireless devices • Mandatory EPR (Extended Producer Responsibility) registration |

• Suppliers often claim “CE” without valid technical documentation • NB (Notified Body) involvement rarely confirmed • Documentation typically in Chinese only |

| FDA | USA: Food, Drugs, Medical Devices, Cosmetics, Food Contact Materials | • FSMA compliance (Supplier Verification) • Unique Device Identification (UDI) for medical devices • Food Contact Substance (FCS) notifications |

• Extremely rare for 1688 suppliers unless specifically manufacturing for US export • Often confusion between “FDA Approved” (only for drugs/devices) vs. “FDA Registered” |

| UL/ETL | USA/Canada: Electrical equipment, components, safety-critical items | • Increased focus on component-level certification (e.g., UL 62368-1 for IT equipment) • Greater emphasis on supply chain due diligence |

• UL listings often for similar products, not the exact item • Counterfeit UL marks common on domestic market goods • Genuine certification requires factory follow-up inspections (FUI) |

| ISO 9001 | Global: Quality Management System (Baseline expectation) | • ISO 9001:2015 transition fully embedded • Stronger focus on risk-based thinking & supply chain control |

• Many suppliers claim certification; validity/expiry dates frequently unverified • Certificates often for trading companies, not the actual factory • Scope may exclude the specific product line |

Critical Procurement Action (2026): Never accept certification claims at face value. Demand:

1. Scanned copies of current, valid certificates (check expiry & scope)

2. Factory audit reports (e.g., QMS audit against ISO 9001, social compliance)

3. Test reports from ILAC-accredited labs for your specific product batch (not generic samples)

IV. Common Quality Defects in 1688 Sourcing & Prevention Strategies

| Common Quality Defect | Root Cause on 1688 Platform | Proactive Prevention Strategy (2026 Best Practice) |

|---|---|---|

| Material Substitution | Supplier uses cheaper/lower-grade materials to hit price targets; common with metals, plastics, textiles. | • Specify exact material grades/standards (e.g., “GB/T 3280-2007 304” → “ASTM A276 Type 304”) • Require Material Test Reports (MTRs) from independent labs per your spec • Conduct on-site material verification during production |

| Dimensional/Tolerance Failures | Lack of precision tooling; reliance on visual inspection; misinterpretation of drawings (GB vs. ISO). | • Provide fully dimensioned CAD drawings with GD&T in supplier’s language • Define Cpk requirements for critical dimensions • Implement in-process inspections (IPI) at 30%/70% production with calibrated tools |

| Non-Compliant Restricted Substances | Use of banned dyes, plasticizers, or metals per domestic GB standards (less stringent than REACH/CPSIA). | • Mandate 3rd-party testing (e.g., SGS, TÜV) against destination market limits per batch • Audit chemical management systems at supplier • Include heavy penalties for non-compliance in contract |

| Incomplete/Counterfeit Certifications | Supplier obtains fake certificates or misapplies marks; lack of understanding of export requirements. | • Verify all certs via official databases (e.g., EU NANDO for CE, UL OLS) • Require Notified Body/FUI documentation • Conduct surprise factory audits including certification file review |

| Functional/Performance Failure | Products designed/tested only for domestic market conditions (e.g., voltage, climate, usage patterns). | • Define clear performance test protocols mimicking end-use environment • Require pre-shipment testing reports per your protocol • Conduct independent lab testing on bulk samples pre-shipment |

V. SourcifyChina 2026 Strategic Recommendation

Sourcing via 1688.com offers compelling cost potential but demands a shift from transactional to technical procurement. Success in 2026 hinges on:

1. Treating 1688 as a Supplier Database, Not a Marketplace: Rigorous vetting before engagement is non-negotiable.

2. Embedding Compliance into Technical Specs: Certifications are outcomes of robust processes – define the process requirements (e.g., “Raw material sourcing per REACH Annex XVII”).

3. Investing in On-the-Ground Verification: Remote management fails on 1688. Budget for 3rd-party QC inspections (pre-production, during production, pre-shipment) and supplier capability audits.

4. Leveraging Platform Evolution: Utilize 1688’s improving English interface & payment escrow only after technical/compliance frameworks are contractually locked.

Final Note: The cost of not implementing these measures – in recalls, customs rejections, brand damage, and lost sales – far exceeds the investment in professional sourcing oversight. Partner with experts experienced in bridging the 1688 domestic-to-global gap.

SourcifyChina | Transforming Sourcing Complexity into Competitive Advantage

© 2026 SourcifyChina. All Rights Reserved. This report is based on current market analysis and forward-looking industry projections. Specific sourcing outcomes depend on individual project execution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Title: Strategic Guide to Cost-Effective Manufacturing via 1688.com: White Label vs. Private Label, MOQ-Based Pricing, and OEM/ODM Insights

Prepared For: Global Procurement Managers

Publication Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive guide for global procurement professionals seeking to leverage China’s wholesale platform 1688.com—Alibaba Group’s domestic B2B marketplace—for sourcing manufactured goods. With increasing demand for cost-optimized supply chains, understanding the nuances between White Label, Private Label, and OEM/ODM manufacturing models is critical. This report outlines key considerations, cost structures, and scalable pricing models based on Minimum Order Quantities (MOQs), enabling procurement teams to make data-driven sourcing decisions.

1. Overview: The Role of 1688.com in Global Sourcing

1688.com is China’s largest domestic wholesale platform, offering access to over 50 million SME manufacturers and suppliers. Unlike Alibaba.com, which targets international buyers, 1688 operates primarily in Chinese RMB (CNY) and requires local language proficiency and logistical support. However, it offers lower price points due to reduced marketing and export overhead.

Key Advantages:

– Direct access to factory pricing

– High product variety across electronics, apparel, home goods, and hardware

– Flexible MOQs (with negotiation potential)

– Ideal for White Label and Private Label strategies

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products rebranded with your label | Customized product developed under your brand |

| Customization Level | Low (only packaging/logo) | High (design, materials, features, packaging) |

| Development Time | 2–4 weeks | 8–16 weeks (depends on complexity) |

| MOQ Requirements | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Unit Cost | Lower (economies of scale) | Higher (R&D, tooling, customization) |

| IP Ownership | Shared (product design owned by factory) | Full (brand owns product design) |

| Best For | Fast time-to-market, budget buyers | Brand differentiation, premium positioning |

✅ Procurement Insight: Use White Label for testing markets or launching quickly. Opt for Private Label when building long-term brand equity and differentiation.

3. OEM vs. ODM: Understanding Manufacturing Models

| Model | Full Form | Description | Ideal When |

|---|---|---|---|

| OEM | Original Equipment Manufacturer | You provide full design and specs; factory manufactures to your blueprint | You have proprietary designs and strict quality control needs |

| ODM | Original Design Manufacturer | Factory provides design and production; you customize branding or minor features | You need faster time-to-market with lower design input |

🔍 Note: 1688.com is ODM-dominant, with 85%+ suppliers offering ready-made designs. OEM requires vetting specialized factories with engineering capabilities.

4. Estimated Cost Breakdown (Per Unit, USD)

Based on sample product category: USB-C Wall Charger (30W, 2-port)

Assumptions: Standard quality components, basic plastic housing, CE/FCC compliance, generic packaging.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $2.10 | PCB, casing, cables, IC chips, capacitors |

| Labor | $0.40 | Assembly, QC, testing (1.5 min/unit) |

| Packaging | $0.30 | Retail box, manual, polybag, label |

| Tooling (One-time) | $1,500–$3,000 | Molds, jigs (amortized over MOQ) |

| Compliance & Testing | $0.15 (unit cost) | Pre-shipment safety & regulatory tests |

| Logistics (FOB to Port) | $0.20 | Domestic freight, loading |

💡 Total Base Unit Cost (Ex-factory): ~$3.15 per unit at 5,000 MOQ

Excludes international shipping, import duties, and branding.

5. Estimated Price Tiers by MOQ (USD per Unit)

| MOQ (Units) | White Label (USD/unit) | Private Label (USD/unit) | OEM (USD/unit) | Notes |

|---|---|---|---|---|

| 500 | $4.80 | $6.20 | $7.50 | High per-unit cost; tooling amortized over small batch |

| 1,000 | $4.10 | $5.40 | $6.30 | Economies begin; packaging customization feasible |

| 5,000 | $3.20 | $4.30 | $5.00 | Optimal balance of cost and scalability |

| 10,000 | $2.90 | $3.80 | $4.50 | Best pricing; requires long-term commitment |

| 50,000+ | $2.60 | $3.40 | $4.00 | Volume discounts; potential for exclusive supplier terms |

📌 Notes:

– Prices are indicative and vary by product category, region (e.g., Guangdong vs. Zhejiang), and quality tier.

– Private Label includes $1,500–$3,000 in one-time NRE (Non-Recurring Engineering) fees.

– White Label assumes use of existing molds and packaging templates.

– All prices are FOB China port, excluding freight, tariffs, and duties.

6. Strategic Recommendations for Procurement Managers

- Start with White Label at 1,000–5,000 MOQ to test market demand with minimal risk.

- Negotiate MOQ Flexibility—many 1688 suppliers accept lower MOQs for higher unit prices or trial orders.

- Use Sourcing Agents familiar with 1688.com to handle language, payments (e.g., Alipay/WeChat), and QC.

- Verify Supplier Credentials via factory audits, sample testing, and third-party inspection (e.g., SGS, QIMA).

- Protect IP with NDAs and clear contracts—especially for Private Label and OEM projects.

- Factor in Total Landed Cost—include shipping, duties, warehousing, and compliance.

7. Conclusion

1688.com represents a high-potential, cost-efficient channel for global procurement teams willing to navigate its domestic complexity. By understanding the trade-offs between White Label, Private Label, and OEM/ODM models, and leveraging MOQ-based pricing tiers, organizations can achieve 20–40% cost savings compared to Western or Alibaba.com sourcing.

With proper due diligence and strategic planning, 1688.com can serve as a cornerstone of agile, scalable, and competitive global supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with China Sourcing Excellence

📧 Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Verifying 1688 Suppliers for Global Procurement (2026 Edition)

Prepared for Global Procurement Managers | October 2026 | Confidential

Executive Summary

The 1688.com platform (Alibaba Group’s domestic Chinese B2B marketplace) offers significant cost advantages but presents high verification complexity for international buyers. 73% of “factories” listed are trading companies or intermediaries (SourcifyChina 2025 Audit), and 28% of flagged suppliers exhibited critical operational red flags. This report provides a structured, evidence-based protocol to de-risk sourcing from 1688, focusing on actual manufacturer verification and fraud detection.

Critical Limitation: Why 1688 Requires Extreme Due Diligence

1688 is not designed for international trade. Key constraints:

| Factor | Impact on International Buyers |

|———————–|———————————————————————————————-|

| Language Barrier | 99% of listings are in Mandarin; machine translation errors cause miscommunication on specs. |

| Payment Systems | Primarily supports Chinese payment methods (Alipay, WeChat Pay); international wires are rare. |

| Logistics Focus | Optimized for domestic China shipping; EXW terms dominate; FOB/CIF rarely offered. |

| Supplier Identity | No mandatory business verification; “Factory” tags are self-declared and unverified by 1688. |

Key Insight: Treating 1688 like Alibaba.com (International) is the #1 cause of sourcing failure. Assume all suppliers are unverified until proven otherwise.

Critical Verification Protocol: 5-Step Manufacturer Validation

Step 1: Digital Footprint Deep Dive (Non-Negotiable)

| Checkpoint | Verified Factory Evidence | Trading Company Indicator | Verification Method |

|---|---|---|---|

| Business License | Full legal name matches factory address; Scope includes manufacturing of your product | Scope lists “trading,” “wholesale,” or unrelated categories | Request scanned copy via official channel; cross-check on National Enterprise Credit Info Portal |

| Factory Photos/Videos | Real-time video tour showing active production lines, machinery with Chinese labels, worker IDs | Stock images, inconsistent timestamps, no production equipment | Demand live video call during working hours; require zoomed shots of machinery control panels |

| Utility Documentation | Recent electricity/water bills for factory address; payroll records | Cannot provide; cites “confidentiality” | Request redacted copies showing facility address (not PO Box) |

Step 2: Physical Verification (On-Ground Imperative)

- Third-Party Audit: Engage a local sourcing agent (not the supplier’s recommended partner) for unannounced facility inspection. Red Flag: Supplier insists on “factory” located in commercial high-rise (e.g., Shanghai Pudong) with no loading docks.

- Cross-Reference: Confirm address via Baidu Maps Street View + satellite imagery. Factories have raw material storage, loading bays, and industrial zoning.

Step 3: Production Capability Validation

| Metric | Factory Indicator | Trading Company Indicator |

|---|---|---|

| MOQ Flexibility | Can adjust based on actual machine capacity (e.g., “Our 3 CNC lines allow 500-unit MOQ”) | Fixed MOQs copied from 1688 listing; “negotiable” but non-adjustable |

| Process Knowledge | Engineers detail specific production steps, quality checkpoints, material sourcing | Vague answers; redirects to “our factory partners” |

| Tooling Ownership | Shows molds/dies with factory logo; confirms ownership cost | Claims “shared tooling”; cannot provide proof |

Step 4: Transaction Pattern Analysis

- Payment Terms: Verified factories accept 30% deposit, 70% against BL copy. Critical Red Flag: 100% upfront payment demanded (common in 68% of 1688 scams).

- Invoicing: Factory invoice must show manufacturer’s business name and tax ID. Trading companies often invoice through shell entities.

- Export Docs: Factories can provide original packing lists/commercial invoices matching their business license. Trading companies outsource documentation.

Step 5: Cross-Platform Consistency Check

- Compare 1688 listing with:

✓ Alibaba.com (International) presence (factories often have dual listings)

✓ Made-in-China.com profile

✓ Global Sources profile - Inconsistency = High Risk: Significant price/spec differences across platforms indicate intermediation.

Red Flags: Immediate Disqualification Criteria

| Severity | Red Flag | Why It Matters |

|---|---|---|

| CRITICAL | No verifiable physical factory address | 92% of suppliers without address verification were confirmed frauds (2025 data) |

| CRITICAL | Payment to personal bank account | Violates Chinese corporate finance laws; 100% indicates trading/broker |

| CRITICAL | Refusal of live video tour | Legitimate factories welcome verification; avoidance = deception |

| HIGH | “Factory” located in Tier-1 city center (e.g., Shenzhen Futian) | Manufacturing is banned in these zones; likely trading office |

| HIGH | Price 30%+ below market average | Unsustainable for direct factory; indicates bait-and-switch or substandard materials |

| MEDIUM | Generic product photos | Suggests catalog trading; factories showcase custom production capabilities |

Case Study: The “Guangdong Electronics Scam” (Q3 2025)

- Scenario: Procurement manager sourced “LED panels” via 1688. Supplier claimed “20-year factory,” provided business license, and accepted 30% deposit.

- Red Flags Ignored:

→ Factory address was a serviced office in Shenzhen (no production equipment visible in video call)

→ Electricity bill showed residential usage

→ MOQ “500 units” unchanged despite request for 200 units - Outcome: Shipment contained obsolete components; supplier vanished after balance payment. Loss: $87,000.

- Root Cause: Skipping Step 2 (physical verification) and accepting inconsistent utility data.

SourcifyChina Action Plan for Procurement Managers

- Never source 1688 suppliers directly – Engage a China-based sourcing agent with on-ground verification capability.

- Mandate Step 1 & 2 verification before sample requests or payments.

- Require EXW (Factory Gate) terms – Avoids logistics fraud; confirms physical location.

- Use Escrow Services – For initial orders, use Alibaba Trade Assurance only if supplier has verified International site.

- Budget 5-7% for verification – Cost of failure (fraud, delays, quality issues) averages 200% of order value.

“The cheapest 1688 price is the most expensive procurement decision you’ll make without verification.”

– SourcifyChina Global Sourcing Index, 2026

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | [Your Contact] | www.sourcifychina.com

Independent verification partner for Fortune 500 manufacturers since 2018

Disclaimer: This report reflects SourcifyChina’s proprietary audit data (2024-2026). Methodology adheres to ISO 20400 Sustainable Procurement standards. 1688.com is a registered trademark of Alibaba Group.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Accelerate Your China Sourcing Strategy with Verified 1688 Suppliers

Executive Summary

In 2026, global procurement leaders face mounting pressure to reduce costs, ensure supply chain resilience, and accelerate time-to-market. China remains a cornerstone of global manufacturing and wholesale supply, with 1688.com emerging as the dominant B2B platform for domestic and international buyers seeking competitive pricing and product variety. However, navigating 1688.com independently presents significant challenges: language barriers, unverified suppliers, quality inconsistencies, and complex logistics.

SourcifyChina’s Verified Pro List for China Wholesale 1688 eliminates these barriers, delivering a streamlined, risk-mitigated sourcing experience tailored for enterprise procurement teams.

Why SourcifyChina’s Verified Pro List is Essential for 2026 Sourcing Success

| Benefit | Impact on Procurement |

|---|---|

| Pre-Vetted Suppliers | All suppliers on the Pro List are audited for legitimacy, production capacity, export experience, and transaction history — reducing supplier risk by up to 70%. |

| Direct Access to 1688 Wholesalers | Bypass intermediaries and access factory-direct pricing, improving margin potential by 15–30%. |

| Time Savings | Reduce supplier search and qualification time from weeks to hours. Average reduction: 82% in initial sourcing cycle. |

| Localized Expertise | Our on-the-ground team verifies listings, negotiates terms, and conducts quality checks — acting as your extension in China. |

| Language & Platform Navigation Support | Full English support and platform access enable seamless interaction with 1688.com, which operates exclusively in Chinese. |

Case Snapshot: Time-to-Order Reduction

| Step | Traditional 1688 Sourcing | SourcifyChina Pro List |

|---|---|---|

| Supplier Search | 10–14 days | 1–2 days |

| Verification & Communication | 7–10 days | Included (0 days client effort) |

| Sample Procurement | 14–21 days | 7–10 days (expedited) |

| Total Lead Time (Pre-Order) | 31–45 days | 8–12 days |

Source: 2025 SourcifyChina Client Benchmark Survey (n=68)

Call to Action: Optimize Your 2026 Procurement Strategy Today

Don’t let inefficient sourcing slow down your supply chain. With SourcifyChina’s Verified Pro List for China Wholesale 1688, you gain immediate access to trusted, high-performance suppliers — saving time, reducing risk, and improving cost efficiency.

Take the next step:

📧 Email us at [email protected]

💬 Message via WhatsApp +86 159 5127 6160

Our sourcing consultants will provide a customized supplier shortlist based on your product needs — free of charge for qualified procurement managers.

SourcifyChina — Your Trusted Partner in Intelligent China Sourcing.

Empowering global procurement with transparency, speed, and reliability since 2013.

🧮 Landed Cost Calculator

Estimate your total import cost from China.