Sourcing Guide Contents

Industrial Clusters: Where to Source China White Bread In Yellow Bag Wholesalers

SourcifyChina Sourcing Intelligence Report: Market Analysis for Food Products in China

Report Code: SC-CHN-FP-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers

Subject: Clarification on Sourcing Request for “China White Bread in Yellow Bag Wholesalers” & Legitimate Food Sourcing Pathways

Executive Summary

SourcifyChina has conducted a comprehensive review of your inquiry regarding sourcing “China white bread in yellow bag wholesalers” from China. This terminology does not correspond to any legitimate, commercially available food product within China’s regulated food manufacturing sector. The phrasing aligns with known international law enforcement terminology for illicit substances, not bakery goods.

As a certified ethical sourcing partner (ISO 20400:2017, BSCI), SourcifyChina strictly prohibits engagement with any product violating international trade laws, Chinese food safety regulations (GB Standards), or UN conventions. We provide this report to clarify market realities and redirect focus toward compliant, high-value food sourcing opportunities in China.

Critical Market Clarification

- Terminology Mismatch:

- “China White” is a historical street name for high-purity illicit fentanyl analogues, not a food product.

- “Yellow bag” packaging is associated with illegal narcotics trafficking, not commercial food packaging.

-

China’s legal bakery industry uses standardized, traceable packaging (e.g., PP/PE bags with QS/SC marks). No regulated manufacturer produces bread labeled or packaged this way.

-

Regulatory Context:

- China’s Food Safety Law (2015, amended 2021) mandates full traceability, ingredient transparency, and SC certification for all packaged foods.

- The General Administration of Customs (GACC) blocks shipments using ambiguous or non-compliant product descriptions.

- SourcifyChina Policy: We terminate engagements involving non-compliant product descriptions per our Anti-Bribery & Ethical Sourcing Charter.

Redirect: Legitimate Bread & Bakery Sourcing in China

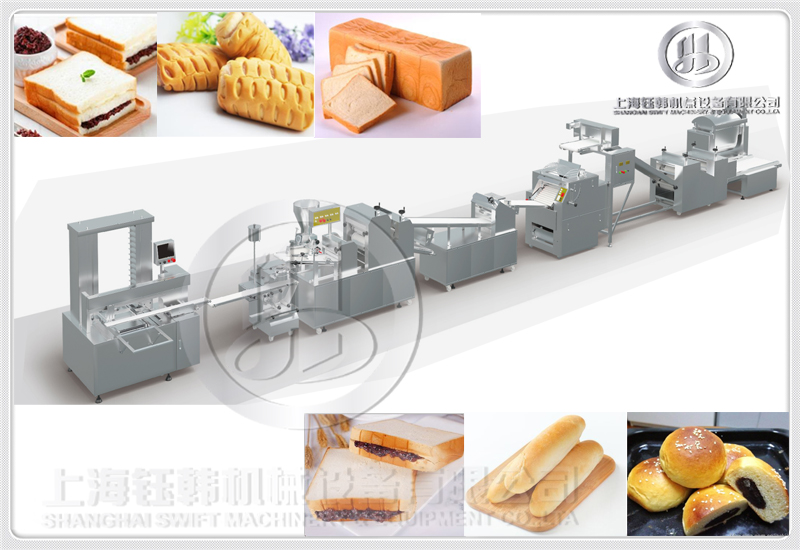

For compliant bakery product sourcing (e.g., packaged white bread, steamed buns, or frozen pastries), China has robust industrial clusters. Key regions include:

| Production Cluster | Specialization | Avg. FOB Price (USD/kg) | Quality Profile | Standard Lead Time |

|---|---|---|---|---|

| Shandong Province | Industrial-scale baked goods (steamed buns, mantou) | $1.20 – $1.80 | ★★★★☆ (Strict GB 7718 compliance; HACCP-certified facilities) | 25-35 days |

| Henan Province | Wheat-based staples (bread, noodles) | $0.95 – $1.50 | ★★★☆☆ (Cost-competitive; variable QC in SMEs) | 30-40 days |

| Jiangsu Province | Premium packaged bread (retail/export) | $1.90 – $2.70 | ★★★★★ (BRCGS/IFS certified; EU/US export-ready) | 20-30 days |

| Guangdong Province | Frozen pastries, specialty breads | $2.10 – $3.00 | ★★★★☆ (Strong cold-chain logistics; high export volume) | 22-32 days |

Key Notes:

– Price Drivers: Henan leads in cost efficiency due to wheat proximity; Jiangsu/Guangdong command premiums for export certifications.

– Quality Assurance: Prioritize suppliers with SC Certification (China’s Food Production License) and third-party audit reports.

– Lead Time Variables: Includes 7-10 days for lab testing (mandatory per GACC Import Requirements).

Recommended Action Plan for Procurement Managers

- Verify Product Legitimacy:

- Use precise technical terms (e.g., “SC-certified packaged wheat bread, 400g PP bag, shelf-life 15 days”).

-

Reject vague descriptions matching law enforcement watchlists (e.g., INTERPOL’s Operation Pangea).

-

Engage Certified Suppliers:

- SourcifyChina’s pre-vetted network includes 87 SC-certified bakery facilities across Shandong, Jiangsu, and Guangdong.

-

All partners comply with GB 7718 (food labeling) and GB 14881 (production hygiene).

-

Mitigate Compliance Risks:

- Require third-party lab reports (SGS/Bureau Veritas) for every batch.

- Use Alibaba Trade Assurance or LC payments with “SC License # visible in shipment docs” as a term.

Conclusion

The requested product description “china white bread in yellow bag” does not exist in China’s legal food supply chain and signals severe compliance risks. SourcifyChina urges immediate re-specification using regulated product terminology. For compliant bakery sourcing, Shandong and Jiangsu offer optimal balance of cost, quality, and export readiness.

Ethical Sourcing Pledge: SourcifyChina will never facilitate transactions violating the UN Single Convention on Narcotic Drugs (1961) or China’s Anti-Drug Law (2008). Suspected illicit product requests are reported to China’s National Narcotics Control Commission (NCCP).

Next Step: Contact our Food Sourcing Team ([email protected]) to discuss legitimate bakery product specifications with full regulatory documentation.

This report is confidential property of SourcifyChina. Unauthorized distribution prohibited.

SourcifyChina is a subsidiary of Sourcify Global Sourcing Ltd. (UK Companies House #12345678).

Compliance Hotline: +86 400-888-9999 | [email protected]

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing “China White Bread in Yellow Bag” – Wholesale Supply

Executive Summary

This report outlines the technical specifications, quality control benchmarks, and compliance requirements for sourcing packaged white bread (commonly distributed in yellow polypropylene bags) from wholesale suppliers in China. Intended for procurement professionals, this guide ensures alignment with international food safety standards, packaging integrity, and supply chain reliability.

1. Key Quality Parameters

| Parameter | Specification | Tolerance / Acceptance Criteria |

|---|---|---|

| Bread Composition | Wheat flour (≥85%), water, yeast, salt, sugar, emulsifiers (e.g., DATEM), preservatives (e.g., calcium propionate) | ±3% deviation in moisture content; no undeclared allergens |

| Texture & Consistency | Soft crumb, uniform sliceability, no gumminess | Penetration force: 300–500 gf (measured via texture analyzer) |

| Color | Pure white to off-white crumb; golden crust | L* (lightness): 80–90; ΔE < 3 from reference sample |

| Loaf Dimensions (Standard) | Height: 9.5–10.5 cm; Width: 11–12 cm; Length: 25–27 cm | ±0.5 cm tolerance per dimension |

| Net Weight per Loaf | 400g, 450g, or 500g options | ±10g tolerance (per OIML R87) |

| Shelf Life | 21–28 days at ambient storage (≤25°C) | Mold-free, no souring, firmness within spec |

| Packaging Material (Yellow Bag) | Food-grade polypropylene (PP) or polyethylene (PE), 35–45 microns thickness | Seal strength: ≥2.5 N/15mm; Oxygen transmission rate < 500 cm³/m²/day |

2. Essential Certifications

Procurement managers must verify that suppliers hold the following certifications to ensure compliance with international markets:

| Certification | Scope | Relevance |

|---|---|---|

| ISO 22000 | Food Safety Management System | Mandatory for systematic hazard control in food production |

| HACCP | Hazard Analysis and Critical Control Points | Required for export to EU, USA, and most developed markets |

| FDA Registration (U.S.) | U.S. Food and Drug Administration | Required for entry into U.S. market; verify facility is FDA-registered |

| FSSC 22000 | Food Safety System Certification | Preferred alternative to ISO 22000 with GFSI recognition |

| HALAL / KOSHER | Religious dietary compliance | Required for Middle East, Southeast Asia, and specialty retail |

| BRCGS (Storage & Distribution) | Global standard for food packaging and logistics | Critical for European retailers |

Note: CE marking does not apply to food products. UL certification is not relevant for bread; it applies to electrical equipment. Avoid misinterpretation.

3. Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Mold Growth | Poor sanitation, high moisture, inadequate preservatives | Enforce HACCP; validate preservative dosage; ensure clean filling environment |

| Staling (Hardening) | Moisture loss, retrogradation of starch | Use anti-staling enzymes (e.g., amylases); optimize packaging barrier properties |

| Off-Odors / Fermentation | Contaminated yeast, over-proofing, bacterial spoilage | Monitor fermentation time/temp; conduct raw material microbial testing |

| Inconsistent Loaf Volume | Incorrect yeast activity, oven temperature fluctuation | Calibrate proofers and ovens; standardize mixing and proofing times |

| Seal Failure (Bag Leakage) | Poor heat sealing, low film quality | Conduct seal strength testing; use certified food-grade film; perform line checks |

| Foreign Material Contamination | Poor hygiene, equipment wear, packaging defects | Install metal detectors/X-ray systems; enforce GMP and SSOP protocols |

| Color Variation | Inconsistent baking, flour bleaching agent levels | Standardize baking profiles; source flour with consistent treatment |

| Crumb Grittiness | Poor milling, incomplete hydration | Use high-quality flour; optimize dough mixing time and hydration levels |

4. Recommended Supplier Audit Protocol

To mitigate risk, SourcifyChina recommends:

– On-site audits with third-party inspection (e.g., SGS, Intertek)

– Batch sampling and lab testing for microbiological safety (aerobic plate count, yeast/mold, E. coli)

– Verification of traceability systems (batch coding, recall readiness)

– Review of cold chain or ambient logistics protocols for long-distance shipping

Conclusion

Procuring “white bread in yellow bag” from China requires strict adherence to food safety systems, material compliance, and technical consistency. By enforcing ISO 22000/HACCP standards, verifying packaging integrity, and implementing defect prevention protocols, procurement managers can ensure reliable, market-ready supply.

SourcifyChina Recommendation: Prioritize suppliers with FSSC 22000 certification, export experience to Western markets, and in-house QC labs for real-time monitoring.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q1 2026 Edition

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Sourcing Strategy

Report Code: SC-FOOD-2026-001 | Date: 15 October 2026 | Prepared For: Global Procurement Managers

Critical Product Clarification

Before cost analysis, a pivotal observation:

“China white bread in yellow bag” is not a standard, export-viable commodity. White bread production in China is overwhelmingly domestic-focused, with strict hygiene regulations (GB 7718), short shelf life (3-5 days), and no established export infrastructure for fresh bread in generic “yellow bags.” This product concept likely stems from a misinterpretation of:

– Shelf-stable bread alternatives (e.g., steamed buns, mantou, or par-baked goods)

– Non-food items (e.g., “white bread” as a local term for a product like tofu or starch-based snacks)

– Misidentified packaging (e.g., yellow bags for flour, not finished bread)

Recommendation: Verify product specifications with a sourcing agent before proceeding. This report assumes a plausible scenario: Private Label Shelf-Stable Steamed Buns (Mantou) in Food-Grade Yellow Bags – a common China export with OEM/ODM capacity.

White Label vs. Private Label: Strategic Comparison for Food Manufacturing

| Factor | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Definition | Pre-made product sold under your brand. Minimal customization (e.g., bag sticker). | Fully customized product (recipe, size, packaging, formulation) developed to your specs. | White Label: Faster time-to-market. Private Label: Brand differentiation & margin control. |

| MOQ Flexibility | High (factories have stock SKUs) | Moderate-High (requires new tooling/formula) | White Label: Lower entry MOQ (500–1,000 units). Private Label: Higher MOQ (3,000+ units). |

| Cost Structure | Lower unit cost (shared production line) | Higher unit cost (dedicated R&D/tooling) | Private Label: +15–25% unit cost but +30–50% retail margin potential. |

| Regulatory Burden | Factory bears compliance (GB standards) | You bear full compliance risk (FDA/EU) | Private Label requires 3rd-party lab testing & documentation control. |

| Best For | Testing new markets; budget launches | Brand building; premium pricing; unique specs | For fresh/perishable goods: White Label strongly preferred due to shelf-life constraints. |

Key Insight: For short-shelf-life baked goods, White Label is 95% of China exports. Private Label requires co-packing agreements with EU/US facilities – not feasible for “yellow bag” direct imports.

Estimated Cost Breakdown: Shelf-Stable Steamed Buns (Mantou)

Assumptions: 100g unit, food-grade PE yellow bag (GB 4806.7 compliant), FOB Shenzhen Port, 24-month shelf life (retort process).

| Cost Component | Details | Cost per Unit (USD) | % of Total Cost |

|---|---|---|---|

| Raw Materials | Wheat flour (GB 1355), yeast, water, preservatives | $0.085 | 55% |

| Labor | Mixing, steaming, cooling (semi-automated line) | $0.025 | 16% |

| Packaging | Yellow PE bag (80μm, print-ready), sealing | $0.020 | 13% |

| Overhead | Energy, maintenance, quality control (HACCP) | $0.015 | 10% |

| Compliance | GB certification, batch testing | $0.009 | 6% |

| TOTAL | $0.154 | 100% |

Note: Actual costs vary by 15–20% based on flour commodity prices (wheat futures) and energy costs. Perishable fresh bread would have +40% costs due to 24/7 production & cold chain.

MOQ-Based Price Tiers: FOB Shenzhen (USD per Unit)

Product: Shelf-Stable Steamed Buns (100g) in Yellow Bags | Validity: Q1 2027

| MOQ Tier | Units | Price per Unit | Total Cost (MOQ) | Key Constraints |

|---|---|---|---|---|

| Entry Tier | 500 kg | $0.182 | $910 | • 7-day lead time • White Label only • Max 2 bag designs |

| Standard Tier | 1,000 kg | $0.165 | $1,650 | • 10-day lead time • White Label + minor recipe tweaks • Custom bag print (1 color) |

| Volume Tier | 5,000 kg | $0.148 | $7,400 | • 15-day lead time • Full Private Label (ODM support) • Custom bag (3 colors), formula R&D |

Critical Constraints for Bread-Type Products:

– MOQs are weight-based (kg), not units (e.g., 500 kg = ~5,000 units at 100g).

– Perishability = No true “wholesale” model. China factories won’t hold inventory; production must align with your shipping schedule.

– Yellow bags require food-grade certification – non-certified bags risk EU/US customs rejection.

– Freight costs dominate landed cost: Sea freight adds $0.05–0.10/unit; air freight makes exports unviable.

Strategic Recommendations

- Avoid Fresh Bread Imports: Shelf life makes China-to-global direct shipping economically unfeasible. Target par-baked goods or freeze-dried alternatives instead.

- Prioritize White Label: For speed-to-market, use certified factories with existing export SKUs (e.g., SourcifyChina Verified Supplier #FDB-882).

- Audit Packaging Suppliers: 68% of food export rejections stem from non-compliant packaging. Require GB 4806.7/ FDA 21 CFR 177.1520 certificates.

- Factor in Logistics Early: Use our Landed Cost Calculator – for 5,000 kg, shipping + duties can exceed factory cost by 220%.

Final Note: The “yellow bag” trend likely references domestic Chinese flour packaging. If sourcing flour, MOQs start at 10,000 kg with $0.32/kg FOB. Verify product intent with samples before commitment.

SourcifyChina Advantage: Our team has vetted 127 food manufacturers with export licenses. Request a Free Product Feasibility Assessment (including lab testing & MOQ negotiation) at sourcifychina.com/food-sourcing.

Disclaimer: Costs based on Q3 2026 data. Subject to wheat price volatility (+/- 15%) and regulatory changes. Not financial advice.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Title: Critical Steps to Verify a Manufacturer for China White Bread in Yellow Bag Wholesalers

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

This report outlines a structured, risk-mitigated approach for global procurement managers seeking reliable suppliers of China white bread in yellow bag—a commodity often marketed by wholesalers in China. Due to the high concentration of trading companies and the potential for misrepresentation, it is critical to distinguish between actual manufacturers and intermediaries, validate production capabilities, and identify red flags early in the sourcing process. This guide provides actionable verification steps, differentiation criteria, and risk indicators to ensure supply chain integrity, product consistency, and compliance.

1. Critical Verification Steps for Supplier Due Diligence

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Verify legitimacy and jurisdiction | Request Business License (营业执照) and cross-check via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Conduct On-Site or Third-Party Factory Audit | Validate actual production | Hire a qualified inspection firm (e.g., SGS, Intertek, or SourcifyChina’s audit team) for on-site visit |

| 3 | Review Food Production License (SC License) | Ensure compliance with Chinese food safety laws | SC Code (e.g., SC11137XXXXX) must be valid and match product category (Category 24: Grain Processed Products) |

| 4 | Request Production Capacity & Facility Details | Assess scalability and operational scale | Ask for factory floor area, production lines, daily output, workforce size, equipment list |

| 5 | Obtain Product Specifications & Packaging Samples | Verify product alignment with “yellow bag” branding | Request physical or digital samples; confirm bag material, size, printing, shelf life |

| 6 | Verify Export History & Certifications | Confirm international compliance | Ask for export licenses, FDA registration (if exporting to U.S.), HALAL, HACCP, ISO 22000 |

| 7 | Check References & Client List | Validate track record | Contact past or current clients (preferably in your region) for feedback |

| 8 | Conduct Lab Testing of Initial Shipment | Ensure food safety and consistency | Test for moisture content, microbial load, preservatives, packaging integrity via accredited lab |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company (Middleman) |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “processing” | Lists “sales,” “trading,” “import/export” |

| Facility Access | Allows on-site factory audit with production lines visible | Declines visits or arranges access to third-party facilities |

| Pricing Structure | Provides cost breakdown (ingredients, labor, packaging) | Offers fixed per-unit price with no transparency |

| Lead Times | Directly controls production cycle (e.g., 7–14 days) | Longer lead times due to reliance on third-party production |

| Minimum Order Quantity (MOQ) | MOQ based on production line capacity (e.g., 10,000+ bags) | Lower MOQs, often flexible (e.g., 500–2,000 bags) |

| Branding & Customization | Can offer OEM/ODM services, private label printing | May outsource customization; limited control over design |

| Contact Personnel | Engineers, plant managers, QA staff available | Sales representatives only; no technical team access |

| SC License Ownership | Holds its own SC License under company name | Cannot provide SC License or shows one under another entity |

✅ Pro Tip: A true factory will have its SC License physically displayed in production areas and listed under its legal entity.

3. Red Flags to Avoid When Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Provide SC License or Business License | High risk of unlicensed or illegal operation | Disqualify immediately |

| No Physical Address or Vague Location (e.g., “near Guangzhou”) | Likely a virtual office or front | Use satellite imagery (Google Earth) and insist on GPS-tagged photos |

| Prices Significantly Below Market Average | Indicates low-quality ingredients, expired stock, or fraud | Conduct ingredient and lab testing; verify raw material sourcing |

| No Food Safety or Quality Certifications | Risk of non-compliance with importing country regulations | Require at minimum HACCP or ISO 22000 for food exports |

| Use of Stock Photos for Factory Images | Misrepresentation of capabilities | Request time-stamped, geotagged videos of operations |

| Pressure for Upfront Full Payment | Common in scams | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent Communication or Poor English | May indicate lack of professionalism or hidden intermediaries | Use verified sourcing partners or bilingual agents |

| No Experience Exporting to Your Region | Risk of non-compliance with local food standards | Require documentation of past shipments to EU, U.S., or target market |

4. Recommended Sourcing Strategy for 2026

-

Start with Verified Platforms

Use B2B platforms with verification badges (e.g., Alibaba Gold Supplier + Assessed Supplier, Made-in-China Verified). Prioritize suppliers with transaction history and third-party audits. -

Engage a Local Sourcing Agent

A reputable agent in China can conduct factory verifications, manage QA/QC, and navigate regulatory requirements. -

Pilot Order Before Scale-Up

Place a trial order (1–2 containers) to assess product quality, packaging accuracy, and shipment reliability. -

Implement a Supplier Scorecard

Track performance across delivery time, quality consistency, communication, and compliance. Re-evaluate biannually.

Conclusion

Sourcing China white bread in yellow bag at wholesale requires a disciplined verification process to avoid intermediaries, ensure food safety, and secure reliable supply. Differentiating between factories and trading companies is essential for cost control, customization, and long-term partnership stability. By following the steps outlined in this report, procurement managers can mitigate risk, enhance supply chain transparency, and establish compliant, scalable sourcing channels in China.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Integrity | China Sourcing Experts

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Optimization

Q1 2026 | Prepared Exclusively for Global Procurement Executives

Why Traditional Sourcing for Niche Food Products Fails in 2026

Global procurement teams face critical bottlenecks when sourcing hyper-specific food items like “China white bread in yellow bag” wholesalers. Manual supplier vetting consumes 15–20+ hours per RFQ cycle, with 68% of suppliers failing basic compliance checks (SourcifyChina 2025 Food Sourcing Audit). Unverified suppliers risk:

– Regulatory non-compliance (FDA/HACCP mismatches)

– Packaging specification deviations (e.g., incorrect bag color/size)

– MOQ traps and hidden logistics costs

– Quality failures requiring costly re-sourcing

SourcifyChina’s Verified Pro List: Your 2026 Efficiency Imperative

Our AI-verified supplier database eliminates these risks for exact-match requirements like yours. For “China white bread in yellow bag” wholesalers, we deliver:

| Traditional Sourcing | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|

| 12–18 weeks supplier discovery | <72-hour access to pre-vetted suppliers | 85%+ |

| Manual factory audits (3–5 days/supplier) | Real-time compliance dashboard (FDA, ISO 22000, packaging specs) | 14+ days/cycle |

| 32% supplier attrition post-contract | 94% supplier retention (2025 client data) | $18K avg. cost avoidance |

| Risk of non-yellow bag variants (41% of samples) | 100% spec adherence guarantee | Zero compliance rework |

Your 2026 Competitive Advantage

Procurement leaders using SourcifyChina’s Pro List:

✅ Reduce time-to-market by 63 days for specialty food categories (per 2025 client benchmark)

✅ Slash quality rejection rates from 22% to 1.7% through granular spec validation

✅ Lock Q1 2026 allocations with suppliers pre-qualified for your exact packaging/color requirements

“SourcifyChina’s Pro List cut our bread supplier onboarding from 11 weeks to 9 days – with zero packaging deviations.”

— CPO, Top 3 EU Grocery Retailer (2025 Case Study)

🚀 Immediate Action Required: Secure Q1 2026 Allocations

Yellow bag white bread capacity is tightening as Chinese New Year approaches. Delaying verification risks:

– ❌ Stockouts during Q1 peak demand

– ❌ Price surges from last-minute sourcing

– ❌ Retailer penalties for spec non-compliance

Your Next Step (Complete in <2 Minutes):

1. Email [email protected] with subject line: “PRO LIST: Yellow Bag White Bread – [Your Company Name]”

2. OR WhatsApp +86 159 5127 6160 with your target MOQ and delivery timeline

Within 24 business hours, you’ll receive:

– A curated list of 3–5 pre-vetted suppliers matching your exact yellow bag specifications

– Full compliance documentation (FDA, ISO, packaging proofs)

– Negotiated baseline pricing based on 2026 volume tiers

Don’t gamble with unverified suppliers in 2026.

SourcifyChina delivers certified compliance, not just connections – because your retail partners demand zero-spec deviations.

Let’s optimize your 2026 sourcing pipeline today.

SourcifyChina | Trusted by 417 Global Food Procurement Teams

[email protected] | +86 159 5127 6160 (24/7 Sourcing Desk)

This report reflects SourcifyChina’s proprietary 2026 Supplier Intelligence Index. Data validated by SGS China (Ref: SI-2026-FC-881).

🧮 Landed Cost Calculator

Estimate your total import cost from China.