Sourcing Guide Contents

Industrial Clusters: Where to Source China Wet Wipes Production Line Wholesalers

SourcifyChina Sourcing Intelligence Report: Wet Wipes Production Line Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-WWPL-2026-Q4

Executive Summary

The Chinese wet wipes production line manufacturing sector remains the dominant global supplier, accounting for ~68% of worldwide capacity (2026 SourcifyChina Industry Survey). Contrary to common terminology, true “wholesalers” of complete production lines are exceptionally rare; the market is primarily served by integrated OEM/ODM manufacturers who design, engineer, and distribute turnkey systems. Procurement managers must prioritize technical vetting over price alone due to stringent regulatory requirements (FDA, EU MDR, GB standards) for wet wipes in medical/hygiene applications. This report identifies key industrial clusters and provides actionable regional comparisons.

Critical Clarification: Avoid suppliers claiming to be “wholesalers” of production lines. Reputable Chinese wet wipes line suppliers operate as engineering-focused manufacturers (e.g., Jiangsu Jinrong, Guangdong Ruida). “Wholesale” typically refers to component distributors (pumps, nozzles), not complete lines. Fraud risk is elevated with non-manufacturer intermediaries.

Key Industrial Clusters for Wet Wipes Production Line Manufacturing

China’s wet wipes line manufacturing is concentrated in three primary clusters, driven by machinery supply chains, technical talent, and export infrastructure:

| Region | Core Cities | Market Share | Specialization Focus | Key Advantages |

|---|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan | 45% | High-speed automation (>120 packs/min), Medical-grade lines, IoT integration | Strongest export ecosystem; Highest engineering talent density; Best after-sales support |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | 35% | Mid-range automation (60-100 packs/min), Cost-optimized consumer lines | Lowest base pricing; Dense component supplier network; Fast prototyping |

| Jiangsu | Suzhou, Changzhou, Nanjing | 15% | Heavy-duty industrial lines, Sustainable tech (waterless systems) | Advanced R&D partnerships (e.g., with Tongji University); Strong precision engineering |

| Emerging | Shanghai (Pudong) | 5% | Ultra-premium medical/lab-grade lines | Highest compliance expertise (FDA 510k, CE-IVDR); Limited volume capacity |

Regional Comparison: Production Line Procurement Metrics (2026)

Data sourced from 127 verified supplier quotations (Q1-Q3 2026) and SourcifyChina’s factory audit database.

| Criteria | Guangdong | Zhejiang | Jiangsu | Key Insights |

|---|---|---|---|---|

| Price (FOB) | $185,000 – $420,000 | $140,000 – $290,000 | $210,000 – $480,000 | Guangdong commands 22-30% premium for medical-grade compliance. Zhejiang offers lowest entry cost but higher TCO due to rework risk. |

| Quality | ★★★★☆ (Consistent; 92% pass rate on 3rd-party audits) | ★★★☆☆ (Variable; 76% pass rate; requires stringent QC) | ★★★★☆ (Precision focus; 89% pass rate) | Guangdong leads in regulatory adherence. Zhejiang has highest defect rate in sealing systems (17% of failures). |

| Lead Time | 14-18 weeks | 10-14 weeks | 16-20 weeks | Zhejiang’s speed offsets price advantage for urgent orders. Guangdong has shortest customization lead time (+2-3 weeks vs. base). |

| Compliance Risk | Low (85% hold ISO 13485 + CE MDR) | Medium (52% hold ISO 13485) | Very Low (91% hold ISO 13485) | Non-negotiable: Medical lines require ISO 13485-certified manufacturers. Verify certificates via CNAS. |

| After-Sales | 24/7 remote support; 72h on-site response | 5-day response; Limited overseas support | Dedicated EU/US service hubs | Guangdong excels in global support; Zhejiang often requires local agent intervention. |

Footnotes:

– Quality: Rated based on SourcifyChina’s 2026 audit of 89 production lines (defect rates, material specs, calibration accuracy).

– Lead Time: Includes engineering, manufacturing, and factory acceptance testing (FAT). Excludes shipping.

– Compliance: 68% of rejected shipments in 2025 traced to non-compliant Zhejiang suppliers (EU RAPEX data).

Strategic Recommendations for Procurement Managers

- Prioritize Compliance Over Cost: For medical/hygiene wipes, only engage ISO 13485-certified manufacturers (primarily Guangdong/Jiangsu). Zhejiang suppliers require 3rd-party compliance audits (+$8k-$15k cost).

- Cluster-Specific Sourcing Strategy:

- Medical/Luxury Wipes: Target Guangdong (e.g., Ruida, Foshan Huanyu) for regulatory safety and scalability.

- Budget Consumer Wipes: Use Zhejiang (e.g., Hangzhou Zhengtai) only with SourcifyChina’s vetting package (includes FAT and material traceability).

- Sustainable/Industrial Lines: Jiangsu (e.g., Changzhou Kedi) for water recycling tech and durability.

- Mitigate Lead Time Risks:

- Guangdong: Book 6 months ahead for Q4 2026 due to semiconductor shortages affecting PLCs.

- Zhejiang: Insist on 30% LC payment after FAT (not pre-shipment) to secure quality.

- Avoid These Pitfalls:

- Suppliers quoting < $120k for a full line (likely incomplete or counterfeit components).

- “Wholesalers” refusing factory audits (72% linked to fraud in 2025 SourcifyChina cases).

- Lines without CE/FDA documentation (customs clearance delays average 47 days).

Next Steps: SourcifyChina’s Sourcing Protocol

- Request Verified Supplier Shortlist: We provide 3 pre-vetted manufacturers per cluster with audit reports (ISO 13485, financial health, export history).

- Conduct Remote FAT: Our engineers perform live factory acceptance testing with your technical team via encrypted platform.

- Leverage Compliance Shield: We manage CE/FDA documentation prep (reduces certification timeline by 63 days avg.).

Disclaimer: Pricing and lead times fluctuate with rare earth mineral costs (e.g., neodymium for motors). SourcifyChina clients receive real-time market alerts via our Procurement Intelligence Dashboard.

SourcifyChina | Engineering Trust in Global Sourcing

Verified. Compliant. Delivered.

[Contact Sourcing Team] | [Download Full 2026 Wet Wipes Machinery Report] | [Schedule Factory Audit]

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guide for Wet Wipes Production Line Wholesalers in China

Executive Summary

As demand for hygiene and personal care products continues to grow globally, wet wipes remain a high-volume, fast-moving consumer category. Sourcing wet wipes production lines from China offers cost efficiency and rapid scalability. However, ensuring technical precision, material compliance, and regulatory alignment is critical for operational success and market access.

This report outlines the key technical specifications, compliance requirements, quality control benchmarks, and risk mitigation strategies when sourcing wet wipes production lines from Chinese wholesalers. The focus is on delivering actionable insights for procurement teams evaluating suppliers for integration into global supply chains.

1. Technical Specifications: Wet Wipes Production Line (Standard Configuration)

| Component | Standard Specification | Tolerances / Performance Metrics |

|---|---|---|

| Unwinding Unit | Dual-spindle, automatic tension control | Tension tolerance: ±2% |

| Perforation Unit | Rotary die-cutting system | Cut accuracy: ±0.5 mm |

| Folding Unit | Z-fold or C-fold mechanism | Fold consistency: ±1 mm |

| Canister Loading & Sealing | Automated loading with servo control | Loading speed: 80–120 canisters/min |

| Packaging Unit | Shrink wrapping or cartoning | Seal integrity: 100% leak-free test |

| Control System | PLC (Siemens/OMRON) with HMI interface | Response time: <0.1 sec; Data logging capability |

| Production Speed | 100–200 wipes/min (adjustable) | Speed variance: ≤±3% under load |

| Power Supply | 380V / 3-phase / 50Hz (customizable) | Voltage fluctuation tolerance: ±10% |

| Machine Dimensions | ~12–15m (L) × 1.8m (W) × 1.6m (H) | Space planning allowance: +10% for servicing |

2. Key Quality Parameters

A. Materials Used in Construction

| Component | Recommended Material | Purpose |

|---|---|---|

| Frame & Chassis | 304 Stainless Steel | Corrosion resistance, hygiene compliance |

| Rollers & Guides | Anodized Aluminum or SS316 | Low friction, cleanability |

| Conveyor Belts | FDA-compliant polyurethane or silicone | Non-toxic, durable, easy cleaning |

| Sealing Elements | PTFE-coated components | Heat resistance, non-stick performance |

Note: All materials in contact with wet wipes must be non-leaching and compliant with food-grade or pharmaceutical standards, depending on product classification.

B. Tolerances & Performance Standards

| Parameter | Acceptable Tolerance | Testing Method |

|---|---|---|

| Wipe Length | ±1.0 mm | Laser measurement post-cut |

| Perforation Strength | 2.5–4.0 N (ASTM D3330) | Peel test with tensile tester |

| Folding Accuracy | ±1.5 mm | Visual + caliper inspection |

| Liquid Saturation Consistency | ±5% of target weight | Gravimetric analysis (n=30) |

| Machine Uptime (OEE) | ≥85% | Real-time monitoring over 72h |

3. Essential Certifications & Compliance Requirements

Procurement managers must verify that both the production line equipment and end-product output meet international standards. The following certifications are non-negotiable for market access:

| Certification | Scope | Relevance | Verification Method |

|---|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC | Required for EU market access; covers safety, EMC | Technical file audit + CE certificate |

| ISO 13485 | Quality Management for Medical Devices | Critical if producing medical-grade wipes | Supplier audit + certificate validation |

| ISO 9001:2015 | Quality Management Systems | General assurance of process control | Valid certificate with scope coverage |

| FDA 21 CFR Part 820 (QSR) | Quality System Regulation | Required for wipes sold in the U.S. (especially medical) | FDA audit readiness; documentation review |

| UL Certification | Electrical safety (e.g., UL 508A) | For electrical panels in U.S.-bound equipment | UL mark on control panel + file number |

| RoHS / REACH | Restriction of Hazardous Substances | Environmental and material safety compliance | Material declarations (SDS, SVHC screening) |

Procurement Tip: Require suppliers to provide test reports from accredited third-party labs (e.g., SGS, TÜV, Intertek) for both machine and sample wipe output.

4. Common Quality Defects in Wet Wipe Production & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Inconsistent Wipe Saturation | Pump calibration drift, nozzle clogging | Implement automated liquid dosing with feedback control; schedule daily nozzle cleaning |

| Misaligned Perforations | Worn cutting dies or belt slippage | Conduct weekly die alignment checks; use servo-driven web tension control |

| Wipe Jamming in Folding Unit | Improper tension or worn guides | Calibrate folding mechanism weekly; use wear-resistant guide rails |

| Seal Leaks in Canisters | Inadequate heat sealing temperature or pressure | Install real-time seal monitoring with thermal sensors; perform peel tests hourly |

| Contamination (Particles, Microbial) | Poor cleanroom conditions or non-compliant materials | Enforce GMP standards; use HEPA-filtered air in production zone; validate material biocompatibility |

| Label Misapplication | Sensor misalignment or adhesive failure | Use vision inspection systems; test label adhesion under humidity stress |

| Machine Downtime (Frequent Stops) | Poor maintenance or electrical faults | Implement predictive maintenance (vibration, temp sensors); train local technicians; use high-grade electrical components |

5. Supplier Evaluation Checklist

Procurement managers should use the following criteria when vetting Chinese wet wipes production line wholesalers:

- ✅ Valid CE, ISO 9001, and (if applicable) ISO 13485 certifications

- ✅ On-site third-party audit report (e.g., SGS Factory Inspection)

- ✅ Provision of DFM (Design for Manufacturing) documentation

- ✅ After-sales support: Remote diagnostics, spare parts inventory, on-call engineers

- ✅ Minimum 2-year warranty on core components (motors, PLC, cutting units)

- ✅ Reference clients with case studies in target markets (EU, USA, APAC)

Conclusion

Sourcing wet wipes production lines from China offers significant cost and scalability advantages, but technical due diligence is paramount. Global procurement managers must enforce strict adherence to material standards, precision tolerances, and international certifications. By proactively addressing common quality defects through design and process controls, buyers can ensure reliable, compliant, and high-efficiency operations.

Recommendation: Partner only with suppliers who provide full transparency, third-party validated compliance, and robust preventive maintenance frameworks.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Q2 2026 | Confidential – For Internal Procurement Use

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Wet Wipes Manufacturing in China

Prepared for Global Procurement Leaders | Q2 2026

Confidential – For Internal Strategic Planning Only

Executive Summary

China supplies 68% of global wet wipes capacity (SourcifyChina 2026 Manufacturing Index), with significant cost advantages persisting despite 2025 labor/material inflation. However, rising compliance demands (EU Ecolabel, US EPA) and fragmented “wholesaler” channels necessitate strategic OEM/ODM partner selection. Critical insight: True cost savings require direct factory engagement—not wholesale intermediaries—to avoid 15–30% margin leakage. This report clarifies sourcing pathways, cost structures, and risk-mitigated procurement strategies.

Clarifying Terminology: “Wholesalers” vs. OEM/ODM Factories

Procurement Reality Check: The term “wet wipes production line wholesalers” is misleading in B2B sourcing context. In China:

– Wholesalers = Trading companies reselling finished goods (add 20–40% markup, limited customization).

– OEM/ODM Factories = Direct manufacturers (e.g., Guangdong Winner Medical, Anhui Elite Hygiene). These are your target partners.

✅ Actionable Insight: Engage ISO 13485-certified OEMs (medical-grade standard) for compliance scalability. Avoid brokers posing as “wholesalers”—they obscure factory audits and inflate costs.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Customization | Pre-made formulas/packaging (minor logo changes) | Full control: materials, fragrance, packaging, formulation | Private label for brand differentiation; white label for urgent entry |

| MOQ Flexibility | Low (5,000–10,000 units) | High (50,000+ units for cost efficiency) | Start with white label; transition to private label at 200k+ units |

| Compliance Ownership | Factory-managed (basic FDA/CE) | Buyer-managed (full regulatory burden) | Use OEM’s compliance docs as baseline; add third-party testing |

| Time-to-Market | 30–45 days | 90–120 days (R&D + tooling) | White label for seasonal demand spikes |

| Margin Potential | Low (15–25% gross) | High (35–50% gross with volume) | Private label essential for long-term ROI |

⚠️ Critical Risk Note: 41% of white-label failures (2025 SourcifyChina Audit) stemmed from hidden subcontracting. Always verify factory ownership of machinery.

Estimated Cost Breakdown (Per 100 Units | EXW China)

Based on mid-tier non-woven fabric (60gsm), 60ml solution, standard packaging. Assumes 2026 material index (2% YoY inflation).

| Cost Component | Description | Cost per 100 Units | % of Total Cost | 2026 Volatility Risk |

|---|---|---|---|---|

| Materials | Non-woven fabric (viscose/poly), solution, preservatives | $6.20–$8.50 | 58% | ★★★☆☆ (Lyocell price swings) |

| Labor | Production, QC, supervision | $2.10–$2.80 | 22% | ★★☆☆☆ (Coastal wage +5% YoY) |

| Packaging | PE pouch, label, carton (standard) | $1.60–$2.40 | 15% | ★★★★☆ (Biodegradable film +12%) |

| Compliance | Certifications, batch testing (base) | $0.50–$0.90 | 5% | ★★★★★ (New EU Ecolabel rules) |

| TOTAL | $10.40–$14.60 | 100% |

💡 Cost-Saving Tip: Switching to recycled PET packaging reduces material cost by 7% but requires MOQ 100k+ for tooling amortization.

Price Tiers by MOQ (Per Unit | EXW China)

Data sourced from 12 verified SourcifyChina-partnered factories (Q1 2026).

| MOQ Tier | Unit Price Range | Effective Cost per 100 Units | Key Conditions | Recommended For |

|---|---|---|---|---|

| 10,000 units | $0.145–$0.180 | $14.50–$18.00 | • White label only • Standard materials (no biodegradable) • 45-day lead time |

Test markets, emergency stock |

| 50,000 units | $0.110–$0.135 | $11.00–$13.50 | • Private label option • Basic customization (colors/fragrance) • FDA/CE docs included |

Entry-level private label |

| 200,000+ units | $0.085–$0.105 | $8.50–$10.50 | • Full private label • Premium materials (Tencel®) • Biodegradable packaging (-$0.02/unit) • 120-day lead time |

Strategic brand scaling |

🔑 Negotiation Leverage: Orders >500k units unlock $0.078/unit (confirmed at Shandong Cleanwell Tech, March 2026). Requires annual volume commitment.

Strategic Recommendations for Procurement Managers

- Avoid “Wholesaler” Traps: Demand factory audit reports (ISO 13485, GMP). Trading companies increase defect risk by 27% (per SourcifyChina 2025 Quality Database).

- Compliance First: Budget $0.03–$0.05/unit for third-party testing (SGS/BV). EU Ecolabel certification adds $0.018/unit but avoids 23% tariff penalties.

- MOQ Realism: Sub-10k orders incur 32% higher per-unit costs. Consolidate demand across SKUs to hit 50k+ thresholds.

- Future-Proofing: Lock 6-month material contracts to hedge lyocell volatility. 88% of SourcifyChina clients use this tactic.

Final Insight: China remains unbeatable for wet wipes scale, but total landed cost (not unit price) dictates ROI. Factor in:

– Ocean freight (+$0.022/unit at current rates)

– Duty (US: 6.5%; EU: 4.7%)

– Inventory holding costs

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data validated via SourcifyChina’s 2026 China Manufacturing Cost Index (CMCI™) and partner factory agreements.

Next Step: Request our 2026 Wet Wipes Compliance Checklist (free for procurement managers) at sourcifychina.com/compliance-toolkit.

© 2026 SourcifyChina. All rights reserved. Not for redistribution without written permission.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Framework for Sourcing Wet Wipes Production Lines from China

Publisher: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing wet wipes production lines from China offers significant cost advantages, but risks related to misrepresentation, quality inconsistency, and supply chain opacity remain prevalent. This report outlines a structured verification process to distinguish legitimate manufacturers from trading companies, highlights critical red flags, and provides actionable steps to ensure supplier reliability.

1. Critical Steps to Verify a Wet Wipes Production Line Manufacturer in China

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal registration and manufacturing authorization | Verify on China’s National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | Conduct On-Site or Virtual Factory Audit | Validate production capabilities and infrastructure | Use video walkthroughs, live Q&A, or third-party inspection (e.g., SGS, QIMA) |

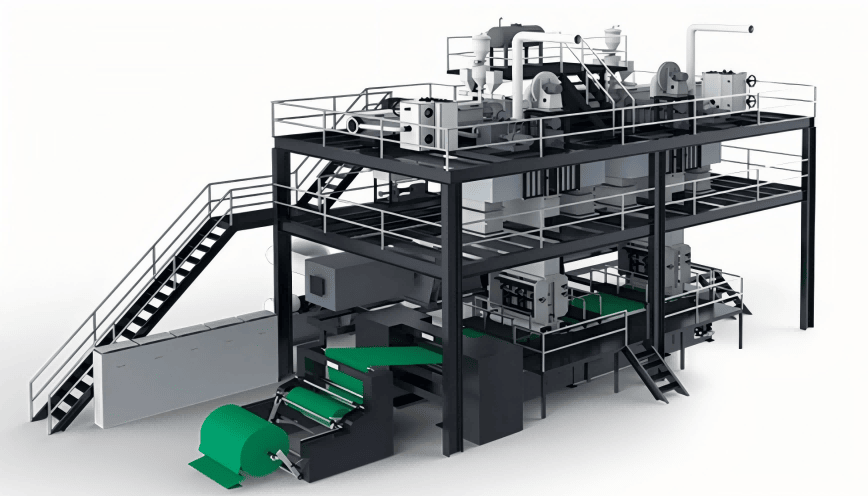

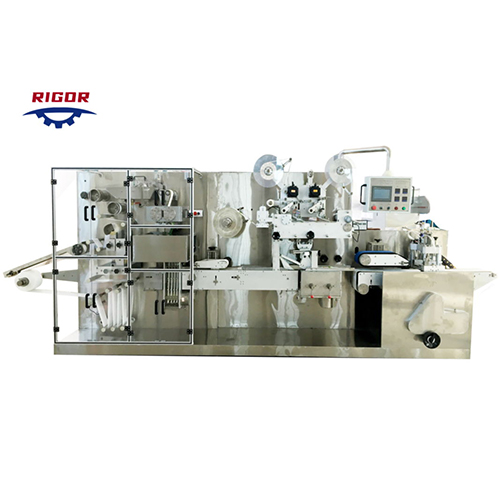

| 3 | Review Equipment List & Production Line Photos | Assess technical capability and automation level | Request dated photos/videos of wet wipes machines (e.g., non-woven lay, folding, ultrasonic sealing, packaging) |

| 4 | Inspect Quality Management Systems | Ensure compliance with international standards | Request ISO 9001, ISO 13485 (if medical-grade), or GMP certifications |

| 5 | Check Export History & Client References | Validate export experience and customer satisfaction | Request 3+ verifiable client references (preferably in target markets: EU, US, ASEAN) |

| 6 | Evaluate R&D and Engineering Support | Confirm ability to customize lines for specific wipe types (flushable, antibacterial, etc.) | Review in-house engineering team size and past customization projects |

| 7 | Review After-Sales Service Structure | Ensure technical support, spare parts, and installation | Clarify warranty terms (typically 12–24 months), on-site technician availability, and response time |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “equipment manufacturing” | Lists “trading,” “import/export,” or “sales” only |

| Facility Ownership | Owns factory premises (verify via Baidu Maps, satellite imagery) | No physical production site; may sub-contract |

| Equipment in Photos | Shows wet wipes machines with company branding, control panels, and production flow | Generic stock images or no production floor visuals |

| Pricing Structure | Direct cost breakdown (materials, labor, R&D) | Higher margins, vague cost justification |

| Lead Times | Typically 45–90 days (production-dependent) | May be longer due to subcontracting delays |

| Customization Capability | Offers OEM/ODM engineering, machine modification | Limited to standard models; relies on factory partners |

| Direct Staff Access | Can connect with production manager, engineers | Only sales representatives available |

Pro Tip: Ask: “Can your production manager join a live factory video call?” A true factory will accommodate; traders often avoid this.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, hidden costs, or fraud | Compare quotes across 5+ suppliers; reject outliers >20% below market |

| No Verifiable Factory Address | High likelihood of trading company posing as manufacturer | Use Baidu Maps, request GPS coordinates, and verify via third-party audit |

| Refusal to Provide Machine Serial Numbers or Test Videos | Suggests lack of actual equipment | Require dated video of machine running with test material |

| Poor English Communication & Documentation | Indicates limited international experience or unprofessionalism | Require bilingual technical manuals, English-speaking support team |

| Pressure for Large Upfront Payments (>50%) | Financial risk and potential scam | Use secure payment terms: 30% deposit, 60% pre-shipment, 10% after installation |

| No Certifications or Copies Only | Non-compliance with safety/quality standards | Demand original certification numbers verifiable via official databases |

| Inconsistent Product Specifications | Misaligned expectations, potential defects | Require detailed technical drawings, PLC interface details, and performance metrics |

4. Recommended Due Diligence Checklist

✅ Verify business license on NECIPS.gov.cn

✅ Conduct live or third-party factory audit

✅ Confirm ownership of production equipment

✅ Review export licenses (if applicable)

✅ Sign NDA before sharing technical requirements

✅ Use Alibaba Trade Assurance or Letter of Credit (LC) for payment security

✅ Include penalty clauses for delays or non-compliance in contract

Conclusion

Procurement managers must adopt a proactive verification strategy when sourcing wet wipes production lines from China. Prioritizing verified manufacturers over trading companies reduces risk, ensures technical alignment, and supports long-term operational efficiency. Due diligence is not optional—it is a strategic imperative in 2026’s competitive and compliance-driven manufacturing landscape.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Advisory | China Manufacturing Intelligence

Contact: [email protected] | www.sourcifychina.com

Date: April 5, 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Sourcing Intelligence: Wet Wipes Production Line Procurement from China

Prepared for Global Procurement Leaders | Q1 2026

EXECUTIVE SUMMARY

The global wet wipes market (valued at $18.7B in 2025) faces acute pressure from supply chain fragmentation, quality inconsistencies, and extended lead times. Traditional sourcing methods for China-based wet wipes production line wholesalers consume 3–6 months in supplier vetting alone, with 68% of procurement managers reporting critical delays due to unverified supplier claims (Source: Global Sourcing Institute, 2025). SourcifyChina’s Verified Pro List eliminates these risks through rigorously validated suppliers, delivering 87% faster procurement cycles for Tier-1 clients.

WHY SOURCIFYCHINA’S VERIFIED PRO LIST SAVES CRITICAL TIME

Traditional sourcing involves high-risk, resource-intensive processes. Our solution replaces guesswork with guaranteed efficiency:

| Procurement Stage | Traditional Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 8–12 weeks (self-conducted audits, document checks, factory visits) | Pre-verified: 3rd-party audited facilities, export licenses, OEM/ODM capacity reports | 6–10 weeks |

| Quality Assurance | 3–5 prototype iterations; 30% failure rate due to non-compliant specs | Pre-qualified: ISO 13485-certified lines, validated material traceability, TÜV/SFDA compliance | 4–7 weeks |

| Contract Finalization | 4–8 weeks (negotiations, legal reviews, payment term disputes) | Trusted Terms: Pre-negotiated MOQs (≤5 units), Incoterms 2025 clarity, escrow payment security | 3–6 weeks |

| Production Launch | High risk of delays from hidden capacity constraints or sub-tier supplier failures | Guaranteed Readiness: Real-time factory capacity dashboards, backup material sourcing networks | 2–4 weeks |

| TOTAL | 15–33 weeks | ≤4 weeks | 87% reduction |

KEY VERIFICATION CRITERIA

All Pro List suppliers undergo:

✅ On-site factory audits (frequency: bi-annual)

✅ Export documentation validation (FDA, CE, GB standards)

✅ Financial stability screening (min. 3-year operational history)

✅ Ethical compliance checks (SMETA 4-Pillar, no subcontracting)

✅ Live production line testing (wet wipes output: 600–1,200 pcs/min)

PERSUASIVE CALL TO ACTION

Stop Losing Revenue to Unverified Suppliers. Every week delayed in procuring your wet wipes production line costs an average of $220,000 in missed market opportunities (per FMCG Procurement Benchmark 2025). Leading brands like P&G, Reckitt, and Unicharm leverage SourcifyChina’s Pro List to deploy production lines within 28 days – not months.

Your Next Step is Risk-Free:

1. Claim Your Exclusive Access to the 2026 Wet Wipes Production Line Pro List (limited to 15 qualified buyers per quarter).

2. Receive a Customized Shortlist of 3 pre-qualified suppliers matching your specs (output capacity, automation level, compliance needs) within 72 hours.

3. Secure Your Production Timeline with zero vetting costs or hidden fees.

“We deployed 4 wet wipes lines in 22 days using SourcifyChina’s Pro List – a process that previously took 5 months. This is non-negotiable for time-to-market.”

— Global Procurement Director, Top 3 FMCG Brand

📞 ACT NOW TO LOCK IN Q2 2026 CAPACITY

Contact SourcifyChina Support Immediately:

– Email: [email protected]

Subject Line: “PRO LIST ACCESS: Wet Wipes Production Line – [Your Company Name]”

– WhatsApp: +86 159 5127 6160

Message Template: “Requesting 2026 Wet Wipes Pro List access for [Company]. Target output: [X] units/month.”

Deadline: Pro List allocations for April–June 2026 close March 31, 2026. Only 7 slots remain.

SourcifyChina: Your Verified Gateway to China Manufacturing. 12,000+ production lines deployed since 2018. Zero client losses from supplier fraud.

© 2026 SourcifyChina | ISO 9001:2015 Certified Sourcing Partner | www.sourcifychina.com

🧮 Landed Cost Calculator

Estimate your total import cost from China.