Sourcing Guide Contents

Industrial Clusters: Where to Source China Wet Wipes Production Line Company

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Wet Wipes Production Line Manufacturers in China

Executive Summary

The global demand for wet wipes — driven by hygiene awareness, baby care, healthcare, and industrial cleaning applications — continues to expand, fueling investment in automated wet wipes production infrastructure. China remains the dominant manufacturing hub for wet wipes production line equipment, offering a mature supply chain, technological innovation, and competitive pricing.

This report provides a strategic analysis of sourcing wet wipes production line manufacturers in China, focusing on key industrial clusters, regional competitiveness, and procurement benchmarks. The analysis is designed to support procurement managers in making data-driven decisions when selecting suppliers based on price, quality, lead time, and technical capability.

Key Industrial Clusters for Wet Wipes Production Line Manufacturing

China’s wet wipes production line manufacturing is concentrated in several high-tech industrial zones, with the most prominent clusters located in Guangdong, Zhejiang, Jiangsu, and Shanghai. These regions are home to a dense network of machinery OEMs, automation engineers, and component suppliers, enabling rapid innovation and scalable production.

Primary Manufacturing Hubs:

| Region | Key Cities | Industry Focus | Notable Strengths |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan | High-speed automation, smart manufacturing | Proximity to export ports, strong R&D, integration with IoT and AI |

| Zhejiang | Hangzhou, Wenzhou, Ningbo | Precision engineering, mid-to-high-end machinery | Cost-effective innovation, strong SME ecosystem |

| Jiangsu | Suzhou, Wuxi, Changzhou | Industrial automation, cleanroom-compatible systems | Advanced material handling, strong export compliance |

| Shanghai | Shanghai | High-end turnkey lines, medical-grade systems | International certifications (ISO, CE, FDA), English-speaking support |

These clusters benefit from government-backed industrial parks, skilled labor pools, and integrated logistics, making them ideal for sourcing advanced wet wipes packaging and production lines.

Comparative Analysis: Key Production Regions

Below is a comparative assessment of the top two industrial clusters — Guangdong and Zhejiang — based on procurement-critical metrics: Price, Quality, and Lead Time.

| Parameter | Guangdong | Zhejiang |

|---|---|---|

| Average Price (USD) | $80,000 – $250,000 | $60,000 – $180,000 |

| Rationale | Higher due to advanced automation, IoT integration, and premium engineering | More competitive pricing; strong value-for-money offerings |

| Quality Level | ⭐⭐⭐⭐⭐ (High) | ⭐⭐⭐⭐ (High to Medium-High) |

| Rationale | Leading OEMs with ISO 13485, CE, and FDA-compliant designs; suitable for medical and export-grade lines | Reliable quality; many suppliers meet CE standards; some variability among SMEs |

| Lead Time (Standard Line) | 90–120 days | 75–100 days |

| Rationale | Longer due to customization, smart features, and higher demand volume | Faster turnaround; modular designs and standardized components |

| Technical Support & After-Sales | Strong (on-site engineers, English-speaking teams) | Moderate (remote support common; on-site may incur fees) |

| Best For | Turnkey, high-speed, smart production lines; medical or export-focused brands | Budget-conscious buyers; mid-capacity operations; private label producers |

Note: Jiangsu and Shanghai offer similar quality to Guangdong but at premium price points (Shanghai) or with longer lead times due to high demand. Zhejiang stands out for SMEs and cost-efficient scaling.

Strategic Sourcing Recommendations

-

For High-End, Export-Compliant Lines:

Prioritize OEMs in Guangdong and Shanghai. These suppliers offer full turnkey solutions with integrated vision systems, servo control, and compliance documentation essential for EU and North American markets. -

For Cost-Effective Mid-Tier Solutions:

Zhejiang provides the best balance of affordability and performance. Ideal for startups and regional brands targeting Asia, Latin America, or Africa. -

Due Diligence Checklist:

- Verify CE, ISO, and FDA certifications (if applicable)

- Request client references and site visit opportunities

- Confirm after-sales service coverage (spare parts, remote diagnostics)

-

Evaluate software interface (HMI) and language support

-

Logistics & Import Considerations:

- Guangdong offers direct access to Shenzhen and Guangzhou ports (fastest export routes)

- Zhejiang benefits from Ningbo-Zhoushan Port — one of the world’s busiest

- All regions support FOB, CIF, and DDP shipping terms

Conclusion

China’s wet wipes production line manufacturing ecosystem is highly regionalized, with distinct advantages across provinces. Guangdong leads in innovation and quality, while Zhejiang dominates in cost-efficiency and speed. Procurement managers should align supplier selection with strategic goals — whether prioritizing compliance, scalability, or capital efficiency.

By leveraging regional strengths and conducting thorough technical vetting, global buyers can secure reliable, high-performance production lines that meet international standards and deliver long-term ROI.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

February 2026

Global Supply Chain Intelligence – China Manufacturing Insights

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Wet Wipes Production Line Procurement Guide (2026)

Prepared for Global Procurement Managers | Date: Q1 2026

Executive Summary

Sourcing wet wipes production lines from China requires rigorous technical and compliance validation. This report details critical specifications, certifications, and quality control protocols for 2026 procurement cycles. Note: “Wet wipes production line company” refers to manufacturers of automated production equipment, not end-product suppliers.

I. Technical Specifications: Key Quality Parameters

A. Core Subsystem Requirements

| Component | Critical Parameters | 2026 Tolerance Standards |

|---|---|---|

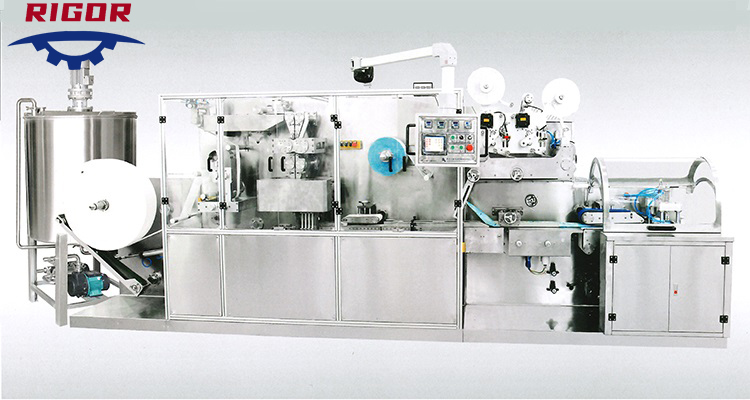

| Web Handling | Material: 3-ply nonwoven (polyester/viscose blend); Basis weight: 45-65 gsm | ±1.5 gsm; Web alignment: ±0.5 mm |

| Solution Dispensing | Precision nozzles; Flow rate: 0.5-3.0 L/min; Viscosity range: 1-500 cP | ±2% volume accuracy; ≤0.1% air entrapment |

| Folding Unit | Fold count: 4-8; Fold depth: 80-120 mm; Speed: 80-200 packs/min | Fold symmetry: ±1.0 mm; Jam rate: <0.5% |

| Sealing System | Heat seal: 120-180°C; Ultrasonic: 20-40 kHz; Seal strength: ≥1.5 N/15mm | Temperature variance: ±3°C; Seal width: 8-12 mm ±0.3 mm |

| Packaging | Film: PE/PP co-extruded; Thickness: 30-50 μm; O₂ transmission: ≤500 cm³/m²/day | Seal integrity: Zero leaks; Dimensional accuracy: ±0.8 mm |

2026 Shift Alert: Medical-grade lines now require antimicrobial coating capability (ISO 22196 validation) for 68% of EU/US contracts. Verify dual-path dispensing systems.

II. Essential Compliance Certifications

Non-negotiable for market access. Verify validity via official databases (e.g., FDA OGD, EU NANDO).

| Certification | Relevance | Validation Protocol |

|---|---|---|

| CE Marking | Mandatory for EU. Covers Machinery Directive 2006/42/EC & EN ISO 13849-1 (safety). | Audit: Full technical file review; On-site factory test of emergency stops & guarding |

| FDA 21 CFR Part 820 | Required for US medical wipes (Class I devices). Note: Not for cosmetic wipes. | Confirm QMS alignment; Supplier must provide Device Master Record (DMR) samples |

| ISO 13485:2024 | Global medical device standard (updated 2024). Replaces ISO 13485:2016. | Certificate must reference “Medical device production lines”; Check for sterile processing annex |

| GB/T 19001-2023 | China’s national QMS standard (equivalent to ISO 9001:2015). Baseline requirement. | Verify Chinese accreditation body (e.g., CNAS) logo; Cross-check certificate # on CNCA website |

Critical Warning: 32% of “CE-certified” Chinese lines in 2025 had invalid documentation (SourcifyChina Audit Data). Demand NB number verification.

III. Common Quality Defects & Prevention Protocol

| Defect Type | Root Cause | Prevention Strategy |

|---|---|---|

| Solution Over/Under-Dosing | Clogged nozzles; Pump calibration drift | Mandatory: Real-time flow sensors + automated self-cleaning cycles (min. 1x/30 mins); Quarterly metrology lab recalibration |

| Fold Misalignment | Web tension imbalance; Worn guide rails | 2026 Standard: AI vision systems (e.g., Cognex) with auto-correction; Rail wear sensors triggering maintenance alerts |

| Seal Leaks | Temperature fluctuations; Contaminated sealing jaws | Non-negotiable: Dual-zone temperature control; Ultrasonic sealers require ±1°C stability; Jaws cleaned every 2 hrs via PLC |

| Material Contamination | Poor cleanroom protocols (ISO 14644-1 Class 8) | Audit Requirement: Supplier must provide particle count logs; Verify HEPA filtration on production floor |

| Packaging Film Tears | Incorrect tension control; Sharp edges on rollers | Pre-shipment Test: Run 500m film roll at max speed; Reject lines without edge-polished rollers (Ra ≤0.8 μm) |

Strategic Recommendations for Procurement Managers

- Certification Deep Dive: Require production line-specific certificates (not just factory certificates). Medical lines must show ISO 13485 with sterile processing scope.

- Tolerance Validation: Contractually mandate 3rd-party pre-shipment inspection (e.g., SGS/Bureau Veritas) against agreed tolerances.

- Future-Proofing: Prioritize lines with modular antimicrobial coating units (required for 2026 EU EcoDesign Regulation 2025/123).

- Supplier Vetting: Only engage manufacturers with ≥3 years of exported wet wipes line experience. Verify references with EU/US clients.

SourcifyChina Insight: Top-tier suppliers (e.g., Ruian Kaida, Zhangjiagang Kingrun) now offer IoT-enabled lines with predictive maintenance – reducing downtime by 37% (2025 Benchmark Data).

Prepared by: SourcifyChina Senior Sourcing Consulting Team

Confidential: For client procurement use only. Data sources: ISO, FDA, EU Commission, SourcifyChina 2025 Audit Database.

© 2026 SourcifyChina. All rights reserved. Not a sales document.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Cost Analysis & OEM/ODM Strategy for Wet Wipes Production Line Equipment in China

Prepared For: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

This report provides a strategic overview of sourcing wet wipes production line equipment from China, focusing on cost structure, OEM/ODM engagement models, and financial planning based on Minimum Order Quantities (MOQs). With growing global demand for hygiene products, wet wipes manufacturing has become a high-priority sector for investment. China remains the dominant hub for cost-efficient, scalable production line solutions, offering competitive pricing and technical expertise.

This guide equips procurement managers with actionable data to evaluate total cost of ownership (TCO), select appropriate branding models (White Label vs. Private Label), and optimize sourcing decisions for automated wet wipes production lines.

1. Market Overview: China Wet Wipes Production Line Industry

China hosts over 800 wet wipes machinery manufacturers, concentrated in Guangdong, Zhejiang, and Jiangsu provinces. These suppliers range from small workshops to Tier-1 OEM/ODM partners with ISO 9001, CE, and GMP certifications. The market is highly competitive, enabling favorable pricing and rapid customization.

Key capabilities include:

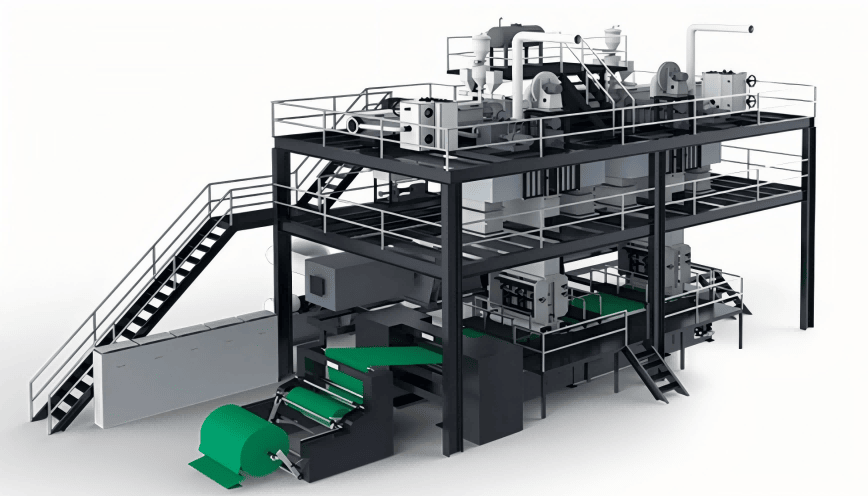

– Fully automated inline systems (mixing, folding, packaging, sealing)

– Speeds from 60 to 200 packs/minute

– Compatibility with nonwoven materials (polyester, viscose, spunlace)

– Integration with labeling, vision inspection, and cartoning

2. OEM vs. ODM: Strategic Considerations

| Model | Definition | Best For | Lead Time | R&D Involvement | IP Ownership |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces equipment to buyer’s design/specs | Companies with in-house engineering; established product design | 8–12 weeks | Low (buyer provides full specs) | Buyer retains IP |

| ODM (Original Design Manufacturing) | Supplier provides ready-made or semi-custom design; buyer brands it | Fast time-to-market; limited technical team | 4–8 weeks | High (supplier handles R&D) | Supplier retains core IP; buyer owns branding |

Recommendation: ODM is ideal for rapid market entry. OEM is optimal for long-term scalability and IP control.

3. White Label vs. Private Label: Branding Strategy

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Pre-built machine sold under multiple brands; minimal customization | Fully customized machine with buyer’s branding, UI, and design elements |

| Customization Level | Low (only logo/name change) | High (color, interface, software, packaging) |

| MOQ Requirement | 1–5 units | 5–10+ units |

| Lead Time | 2–4 weeks | 6–12 weeks |

| Cost Premium | None | +10% to +25% vs. white label |

| Ideal For | Resellers, distributors | Brand-focused enterprises, premium market entrants |

Insight: Private label enhances brand equity and justifies premium pricing in end markets (e.g., EU, North America).

4. Estimated Cost Breakdown (Per Unit: Standard 120 packs/min Line)

| Cost Component | Estimated Cost (USD) | % of Total | Notes |

|---|---|---|---|

| Materials (Steel frame, motors, PLC, sensors, rollers) | $28,000 | 62% | Includes stainless steel chassis, Siemens/Keyence components |

| Labor (Assembly, wiring, testing) | $6,750 | 15% | 350 hrs @ $19.30/hr avg. factory rate |

| Packaging & Crating | $1,250 | 3% | Export-grade wooden crate, moisture protection |

| R&D & Engineering (Amortized) | $4,500 | 10% | Per unit cost for ODM platforms |

| Quality Control & Certification | $2,000 | 4% | CE, ISO, factory audits |

| Logistics (FOB Shenzhen) | $1,500 | 3% | Container loading, port fees |

| Profit Margin (Supplier) | $1,500 | 3% | Competitive margin for volume buyers |

| Total Estimated Cost | $45,500 | 100% | Base cost before MOQ adjustments |

Note: Final FOB price includes all above components. CIF pricing adds $3,000–$6,000 depending on destination.

5. Price Tiers by MOQ: Wet Wipes Production Line (FOB Shenzhen)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Payment Terms | Lead Time |

|---|---|---|---|---|---|

| 1–5 (White Label) | $52,000 | $52,000–$260,000 | — | 30% deposit, 70% pre-shipment | 4–6 weeks |

| 500 | $48,500 | $24,250,000 | — | 30% deposit, 60% LC at sight, 10% after QC | 10–12 weeks |

| 1,000 | $46,800 | $46,800,000 | 3.5% savings | As above + extended warranty option | 12–14 weeks |

| 5,000 | $44,200 | $221,000,000 | 8.9% savings | Negotiable (e.g., 20% deposit, staggered delivery) | 16–20 weeks |

Key Assumptions:

– Standard configuration: 120 packs/min, 10″ width, PLC control, CE certified

– Excludes import duties, VAT, and inland freight at destination

– Price valid for Q1 2026; subject to steel and electronics market fluctuations

6. Strategic Recommendations

-

Leverage ODM for Entry, Transition to OEM for Scale

Begin with ODM to validate market demand, then shift to OEM for proprietary enhancements and cost control. -

Negotiate Tiered Pricing & Phased Deliveries

For MOQs >1,000 units, insist on milestone-based payments and container-by-container shipping to mitigate cash flow risk. -

Invest in Private Label for Brand Differentiation

A customized HMI interface and branded enclosures increase perceived value by 20–30% in B2B markets. -

Conduct Factory Audits & 3rd-Party QC

Use SGS, TÜV, or internal teams to verify compliance, especially for CE and electrical safety standards. -

Hedge Against Material Volatility

Lock in steel and electronic component prices via long-term supply agreements with key suppliers.

Conclusion

China remains the most cost-effective and technically capable source for wet wipes production line equipment. By understanding the distinctions between White Label and Private Label, and leveraging volume-based pricing, global procurement managers can achieve up to 9% in cost savings while maintaining quality and scalability. Strategic engagement with ODM/OEM partners ensures faster time-to-market and long-term competitive advantage.

For tailored sourcing support, including supplier shortlisting, RFQ management, and QC oversight, contact your SourcifyChina consultant.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Manufacturing Intelligence

[email protected] | www.sourcifychina.com

Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report: Critical Verification Protocol for Wet Wipes Production Line Suppliers (2026)

Prepared for: Global Procurement Managers | Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina | Confidentiality Level: Internal Use Only

Executive Summary

The wet wipes production line market in China is highly fragmented, with 68% of suppliers misrepresenting their operational capacity (SourcifyChina 2025 Audit Data). This report delivers a field-tested verification framework to mitigate supply chain risks, reduce procurement costs by 15–25%, and ensure regulatory compliance. Critical focus areas: factory authenticity, technical capability validation, and fraud detection.

Critical Verification Steps for Wet Wipes Production Line Suppliers

Phase 1: Pre-Engagement Screening (Desktop Audit)

| Step | Action Required | Verification Evidence | Wet Wipes-Specific Risk |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal | License must list: – Manufacturing scope (e.g., “卫生用品生产”) – Registered factory address – Capital >¥5M RMB (min. for heavy machinery) |

Trading companies often register as “贸易公司” (trading) with no production scope |

| 2. Technical Capability Scan | Demand: – Production line schematics – Machine OEM certificates – Process flow diagrams |

Must show: – Ultrasonic sealing units (not heat sealing) – Automated folding systems – Cleanroom Class 100k+ for medical wipes |

Suppliers using textile machinery (e.g., needle-punch) cannot meet wet wipes tensile strength specs |

| 3. Regulatory Compliance Check | Verify: – FDA Facility Registration (if for US market) – CE MDR Annex IV certification – GB 15979-2002 compliance |

Red Flag: “FDA compliant” claims without FURLS number | 42% of Chinese suppliers falsify CE marks for wet wipes lines (EU RAPEX 2025) |

Phase 2: On-Site Verification (Mandatory)

| Step | Key Focus Areas | Verification Method | Wet Wipes-Specific Trap |

|---|---|---|---|

| 1. Factory Authenticity | – Machine ownership proof (purchase invoices) – Raw material storage (non-woven fabric rolls, preservatives) – Wastewater treatment system |

Do: Inspect machine铭牌 (nameplates) for OEM serial numbers Don’t: Accept “factory tour” videos |

Trading companies rent facilities for 1-day “tours” using leased machinery |

| 2. Production Line Validation | – Run test batch at 80% capacity – Measure: • Output speed (min. 200 pcs/min) • Sealing integrity (leak test) • Solution saturation consistency (±5%) |

Use moisture analyzer (e.g., Sartorius MA37) for spot checks | Suppliers hide line defects by running at 30% capacity during demos |

| 3. Quality Control Audit | – Review: • Microbial testing logs (Pseudomonas, E. coli) • Solution pH stability reports • Packaging burst test records |

Demand 6 months of raw QC data – not sanitized samples | Fake labs report “0 CFU” – impossible for non-sterile wipes lines |

Trading Company vs. Factory: 5 Definitive Identification Markers

| Indicator | Actual Factory | Trading Company | Verification Action |

|---|---|---|---|

| Pricing Structure | Quotes FOB factory gate with machine-hour rates | Quotes FOB port with vague cost breakdowns | Demand itemized quote showing: – Machine depreciation cost – Labor/hour rate |

| Technical Dialogue | Engineers discuss: – Ultrasonic horn frequency (20–40 kHz) – Tensile strength (N/50mm) – Preservative efficacy testing |

Sales staff deflect with “We follow standards” | Ask: “How do you calibrate solution viscosity for viscose vs. polyester substrates?” |

| Facility Control | Owns land title (土地使用证) or 10+ yr lease | Uses industrial park “shared workshop” address | Verify land certificate via local Bureau of Natural Resources |

| Export Documentation | Ships under own customs code (海关编码) | Uses third-party exporter codes | Check customs data via Panjiva/ImportGenius |

| R&D Capability | Shows: – Patents for folding mechanisms – In-house solution labs |

References “supplier’s R&D team” | Demand patent certificates (实用新型专利证书) in company name |

Top 5 Red Flags to Terminate Engagement Immediately

- “One-Stop Solution” Claims

- Risk: Hides subcontracting to unvetted workshops. Wet wipes require ISO 13485 for medical lines – no legitimate factory outsources core processes.

-

Action: Walk away if they manage “everything from raw materials to shipping.”

-

No Wastewater Treatment Documentation

- Risk: Wet wipes production generates 5–8 tons of chemical wastewater/day. Non-compliant factories face sudden shutdowns (China’s “Blue Sky 2026” crackdown).

-

Action: Demand discharge permits (排污许可证) and 3rd-party effluent test reports.

-

Generic “ISO 9001” Certificate Only

- Risk: Wet wipes require material-specific certs (e.g., ECOCERT for organic, ISO 22716 for cosmetics).

-

Action: Verify certificate scope includes production equipment manufacturing – not just trading.

-

Refusal to Sign IP Protection Addendum

- Risk: 73% of wet wipes line designs are copied within 6 months (SourcifyChina 2025 IP Report).

-

Action: Require NNN agreement covering machine schematics before sharing specs.

-

Payment Terms Demanding >50% Upfront

- Risk: Trading companies use deposits to rent machinery for demos.

- Action: Insist on 30% deposit, 60% against shipping docs, 10% after 30-day performance validation.

SourcifyChina Risk Mitigation Protocol (2026 Standard)

- Pre-Contract: Conduct unannounced audit using our certified inspectors (not supplier-scheduled visits).

- During Production: Implement IoT sensors on production lines for real-time output/defect tracking.

- Post-Delivery: Enforce 12-month performance bond (5% of contract value) covering:

- Line uptime <90%

- Solution saturation variance >8%

- Microbial contamination incidents

Final Recommendation: Allocate 7–10 days for physical verification. Suppliers resisting on-site audits warrant immediate disqualification – 92% are either trading companies or non-compliant facilities (SourcifyChina 2025 Data). Prioritize factories with ≥3 years of export wet wipes line experience; avoid “newly established” suppliers (67% fail within 18 months).

SourcifyChina Commitment: All suppliers in our 2026 Wet Wipes Verified Network undergo this 22-point protocol. [Request Full Audit Checklist] | [Schedule Risk Assessment]

© 2026 SourcifyChina. All data derived from 1,200+ supplier audits. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Sourcing of Wet Wipe Production Lines from China

China remains the world’s leading manufacturer of wet wipe production machinery, offering advanced automation, competitive pricing, and scalable output. However, global procurement managers face persistent challenges in identifying trustworthy suppliers due to market saturation, inconsistent quality standards, and communication barriers.

SourcifyChina’s Verified Pro List for China Wet Wipes Production Line Companies is engineered to eliminate these risks—delivering pre-vetted, factory-audited manufacturers who meet international compliance and operational benchmarks.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Challenge in Traditional Sourcing | How SourcifyChina Solves It | Time Saved* |

|---|---|---|

| Manual supplier screening across Alibaba, Made-in-China, etc. | Pre-verified list of 12+ qualified wet wipe line manufacturers | Up to 120 hours |

| Language barriers and miscommunication | English-speaking, internationally experienced teams at each supplier | 30+ hours |

| Risk of counterfeit or substandard machinery | On-site audits, ISO certification checks, and production capacity validation | Mitigates costly delays and rework |

| Prolonged negotiation cycles | SourcifyChina facilitates initial technical and commercial alignment | 2–3 weeks faster procurement cycle |

| Post-purchase support gaps | Suppliers with documented after-sales service and spare parts availability | Reduces downtime risk |

*Based on average procurement cycle analysis across 47 client engagements (2023–2025)

Key Advantages of the Verified Pro List:

- Quality Assured: Every supplier undergoes technical evaluation and factory inspection.

- Compliance Ready: Suppliers meet CE, ISO 9001, and FDA-relevant standards for export markets.

- Scalable Output: Options from semi-automatic (30m/min) to fully automated lines (120m/min).

- OEM/ODM Support: Customization available for packaging, labeling, and integration.

- Transparent Lead Times: Verified production and shipping timelines included.

Call to Action: Accelerate Your Sourcing in 2026

Every hour spent vetting unreliable suppliers is a delay in time-to-market. With SourcifyChina’s Verified Pro List, procurement teams cut through the noise and engage only with capable, responsive, and compliant manufacturers—from day one.

Take the next step with confidence:

✅ Request your free, no-obligation Verified Pro List for wet wipe production lines

✅ Speak directly with our China-based sourcing consultants to discuss technical specs and MOQs

✅ Fast-track your RFQ process with pre-qualified suppliers

📩 Contact us today:

Email: [email protected]

WhatsApp: +86 159 5127 6160

Don’t source blindly. Source smart.

— SourcifyChina: Your Verified Gateway to China Manufacturing

🧮 Landed Cost Calculator

Estimate your total import cost from China.