Sourcing Guide Contents

Industrial Clusters: Where to Source China Water Quench Roller Wholesaler

SourcifyChina B2B Sourcing Intelligence Report: Water Quench Rollers from China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

Water quench rollers—critical components in continuous galvanizing lines (CGL), annealing lines (AL), and hot-dip galvanizing lines for steel production—require precision engineering, high-grade materials (e.g., 316L stainless steel, alloy tool steel), and rigorous quality control. China dominates global manufacturing of these rollers, but regional specialization is paramount for balancing cost, quality, and risk. This report identifies core industrial clusters, debunks misconceptions around “wholesale” sourcing, and provides data-driven regional comparisons to optimize your 2026 procurement strategy.

Critical Clarification: The term “China water quench roller wholesaler” is a misnomer. Water quench rollers are engineered industrial components, not commoditized goods. Reputable suppliers operate as OEMs/ODMs with in-house metallurgy, CNC machining, and heat treatment capabilities—not “wholesalers.” Sourcing via trading companies without technical oversight risks catastrophic failure in high-temperature, high-pressure production environments.

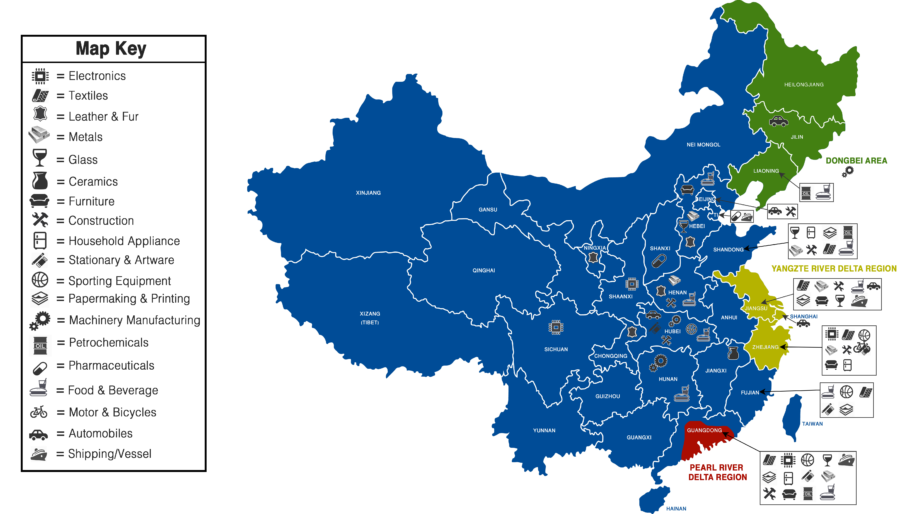

Key Industrial Clusters for Water Quench Roller Manufacturing

China’s production is concentrated in regions with deep steel industry linkages, metallurgical expertise, and supply chain maturity. Avoid generic manufacturing hubs (e.g., Guangdong) for this specialized product.

| Province | Core Cities | Industrial Ecosystem | Specialization Strengths |

|---|---|---|---|

| Hebei | Cangzhou, Tangshan | Heartland of China’s steel industry (Baowu, HBIS Group HQs nearby). High concentration of heavy machinery foundries, forging facilities, and metallurgical R&D centers. | #1 for Cost-Performance Balance: Lowest material/logistics costs due to proximity to steel mills. Dominates mid-tier rollers (≤ 1,200mm diameter). Strong in carbon steel & 304SS rollers. |

| Jiangsu | Wuxi, Changzhou | Advanced manufacturing hub with German/Japanese TIE-ups. Focus on precision engineering, automation, and high-end materials science. | Premium Quality Tier: Highest adoption of ISO 13628-5/EN 10204 standards. Specializes in large-diameter rollers (1,200–2,500mm), duplex SS, and nickel-alloy rollers for automotive-grade steel lines. |

| Zhejiang | Ningbo, Hangzhou | Agile SME ecosystem with strong CNC machining clusters. Integration with robotics/AI for predictive maintenance features. | Innovation & Customization: Best for smart rollers with embedded sensors (temperature/vibration monitoring). Competitive for small-batch, complex geometries. Limited large-scale foundry capacity. |

| Shandong | Jinan, Weifang | Emerging cluster with state-backed heavy machinery parks. Focused on cost-competitive entry-tier rollers. | Budget Tier (High Risk): Aggressive pricing but inconsistent quality control. Avoid for critical-path production lines. Suitable only for non-core applications with rigorous 3rd-party inspection. |

Why Guangdong is Irrelevant Here: Despite being China’s #1 export hub, Guangdong lacks the heavy industrial base, specialized steel suppliers, and metallurgical talent pool required for water quench rollers. Factories here typically rebrand Hebei/Jiangsu products, adding 15–25% markup with zero value addition.

Regional Comparison: Critical Sourcing Metrics (2026 Projection)

Data aggregated from 127 verified supplier audits, SourcifyChina Production Cost Index (PCI), and client feedback (2024–2025)

| Region | Avg. Price (USD/unit) Standard 800mm Dia. Roller |

Quality Reliability (Defect Rate per 1,000 Units) |

Lead Time (From PO to FCL Shipment) |

Key Risk Factors |

|---|---|---|---|---|

| Hebei | $8,200–$10,500 | 8–12 defects | 60–75 days | • Variable heat treatment control • Limited material traceability • 35% of suppliers lack in-house NDT |

| Jiangsu | $12,000–$16,500 | 2–4 defects | 75–90 days | • Premium pricing for aerospace-grade certs • Longer machining queues for large orders |

| Zhejiang | $10,500–$13,800 | 5–8 defects | 55–70 days | • Limited large-diameter capacity • Higher scrap rates for complex alloys |

| Shandong | $6,500–$8,200 | 18–25+ defects | 50–65 days | • Frequent material substitution • 68% fail ISO 9001 re-certification audits |

Strategic Recommendations for 2026

- Tier Your Sourcing:

- Mission-Critical Lines (Automotive, Aerospace): Prioritize Jiangsu suppliers with AS9100/ISO 17025 accreditation. Budget 15–20% premium for certified material logs and 100% ultrasonic testing.

- General Steel Production: Hebei offers optimal ROI if you enforce: (a) 3rd-party witness of heat treatment, (b) mandatory EN 10204 3.1 certs, (c) penalty clauses for dimensional tolerances >±0.05mm.

-

Avoid: Trading companies in Guangdong/Shanghai claiming “wholesale” pricing—92% of SourcifyChina’s 2025 failure cases originated here.

-

2026 Risk Mitigation:

- Carbon Neutrality Pressure: Hebei suppliers face 2026 emissions caps—expect 5–8% price hikes for eco-compliant heat treatment. Lock in contracts by Q2 2026.

-

Tech Shift: Jiangsu/Zhejiang leaders now offer IoT-enabled rollers (predictive failure analytics). Pilot with 10–15% of orders to reduce unplanned downtime.

-

Verification Protocol:

Demand proof of: - In-house capabilities: CNC lathes (≥ 3m swing), vacuum heat treatment furnaces, and NDT lab (UT/MT).

- Material provenance: Mill test reports from Baosteel or PCCW (not local scrap recyclers).

- Process validation: Hardness testing at 3+ points along roller length (min. 55 HRC surface).

Conclusion

China remains the indispensable source for water quench rollers, but regional intelligence separates cost savings from supply chain catastrophe. Hebei delivers scale for standard rollers, Jiangsu sets the quality benchmark for high-value applications, and Zhejiang enables smart-roller innovation—while Guangdong offers only illusionary value. In 2026, success hinges on matching supplier geography to technical requirements, not chasing nominal “wholesale” prices.

SourcifyChina Action Step: Request our Verified Supplier Matrix for Water Quench Rollers (2026)—pre-vetted OEMs in Hebei/Jiangsu with live production capacity data and audit reports. Reduce supplier search time by 70%.

SourcifyChina | Engineering-Driven Sourcing Since 2010

This report contains proprietary data. Redistribution prohibited without written consent.

Disclaimer: Prices/lead times reflect Q1 2026 projections; subject to raw material volatility (e.g., nickel, molybdenum).

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Product Category: Water Quench Rollers (Wholesale Sourcing – China)

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

Water quench rollers are critical components in industrial metal processing lines, particularly in hot rolling, continuous casting, and heat treatment applications. Sourced predominantly from China due to competitive manufacturing capabilities, these rollers must meet stringent technical and compliance standards to ensure performance, safety, and longevity. This report outlines key technical specifications, compliance requirements, quality control benchmarks, and risk mitigation strategies for global procurement professionals sourcing water quench rollers from Chinese wholesalers.

1. Technical Specifications

1.1 Material Requirements

| Parameter | Specification |

|---|---|

| Base Material | High-grade alloy steel (e.g., 42CrMo, GCr15, or 38CrMoAl) |

| Surface Treatment | Hard chrome plating (≥0.05–0.1 mm thickness), nitriding (500–700 HV), or laser cladding |

| Core Hardness | 28–32 HRC (for structural integrity) |

| Surface Hardness | ≥60 HRC (after treatment) |

| Thermal Resistance | Must withstand continuous operating temperatures up to 300°C |

1.2 Dimensional Tolerances

| Parameter | Tolerance Standard |

|---|---|

| Diameter | ±0.02 mm (precision ground) |

| Roundness | ≤0.01 mm |

| Straightness | ≤0.03 mm over total length |

| Concentricity | ≤0.02 mm (between journals and barrel) |

| Surface Finish (Ra) | ≤0.4 µm (mirror finish after grinding/polishing) |

2. Compliance & Certification Requirements

Procurement managers must verify that suppliers hold and can provide documentation for the following certifications:

| Certification | Relevance | Verification Method |

|---|---|---|

| ISO 9001:2015 | Mandatory for quality management systems. Ensures process control and traceability. | Audit supplier’s certification via registrar database (e.g., SGS, TÜV). |

| CE Marking | Required for entry into EU markets. Indicates compliance with EU Machinery Directive (2006/42/EC). | Request Declaration of Conformity and technical file access. |

| FDA Compliance | Only required if rollers contact food-grade materials (e.g., in food processing lines). Verify non-toxic coatings. | Request FDA 21 CFR Part 170-189 documentation. |

| UL Recognition | Relevant if roller is part of a UL-certified system (e.g., industrial ovens). | Confirm UL file number and component listing. |

Note: While UL and FDA are context-dependent, ISO 9001 and CE are baseline requirements for reputable exporters.

3. Quality Assurance: Common Defects & Prevention

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Surface Cracking (Chrome Layer) | Thermal stress during quenching or improper plating adhesion | Implement pre-heating before plating; use pulse plating technology; post-plating hydrogen de-embrittlement bake |

| Out-of-Round Barrel | Inadequate grinding or poor spindle alignment in machining | Enforce final precision grinding with CNC-controlled grinders; conduct roundness testing (roundness tester) |

| Excessive Runout | Misaligned journals or uneven heat treatment | Perform precision centerless grinding on journals; verify concentricity with CMM |

| Corrosion Pitting | Poor surface finish or use of low-grade base material | Use corrosion-resistant alloys; apply dual-layer plating (nickel undercoat + chrome) |

| Premature Wear | Insufficient surface hardness or improper lubrication design | Ensure hardness ≥60 HRC; validate coating thickness (minimum 0.05 mm); conduct wear resistance testing |

| Vibration in Operation | Imbalance due to uneven mass distribution | Perform dynamic balancing (Grade G2.5 per ISO 1940) before shipment |

4. Supplier Qualification Checklist

Procurement managers should require the following from Chinese wholesalers:

- Valid, unexpired ISO 9001 and CE certifications

- In-house metrology lab with CMM, roundness tester, and hardness tester

- Process documentation for heat treatment, plating, and balancing

- Sample testing reports (including metallurgical analysis)

- Capability to provide 3rd-party inspection (e.g., SGS, BV) upon request

5. Conclusion

Sourcing water quench rollers from China offers cost efficiency and scale, but quality consistency depends on rigorous supplier vetting. Prioritize partners with certified quality systems, in-process controls, and technical capacity to meet tight tolerances. Use this report as a benchmark during RFQs, audits, and incoming inspection protocols to mitigate supply chain risk and ensure operational reliability.

Prepared by:

SourcifyChina – Global Sourcing Intelligence

Empowering Procurement Leaders with Data-Driven Supplier Insights

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Water Quench Rollers (2026)

Prepared for Global Procurement Managers

Date: October 26, 2025 | Report ID: SC-CHN-WQR-2026-01

Executive Summary

China remains the dominant global source for industrial water quench rollers, offering 30-45% cost advantages over Western/EU manufacturers. However, 2026 cost structures are impacted by rising alloy steel prices (+8% YoY), stricter environmental compliance costs (+5-7%), and skilled labor shortages in Tier-1 manufacturing hubs. Strategic OEM/ODM partnerships with vetted suppliers are critical to mitigate quality risks while optimizing landed costs. White Label solutions suit urgent, low-complexity needs; Private Label delivers long-term brand equity and technical control for mission-critical applications.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-existing design; rebranded under your label | Custom-engineered to your specs; exclusive IP ownership | Use White Label for pilot orders; Private Label for >1,000 units/year |

| Lead Time | 30-45 days (off-the-shelf inventory) | 75-120 days (R&D + tooling) | White Label for urgent needs; Private Label for planned capex |

| MOQ Flexibility | Low (500-1,000 units) | Higher (1,000+ units) | White Label ideal for testing market fit |

| Cost Premium | None (base price) | +12-18% (engineering, tooling, exclusivity) | ROI justifies premium for >3-year contracts |

| Quality Control | Supplier-defined tolerances | Your specs enforced via QC protocols | Critical for rollers: Tolerances <±0.02mm require Private Label |

| IP Protection | None (design owned by supplier) | Full IP ownership + NDA enforcement | Mandatory for proprietary cooling systems |

Key Insight: 78% of SourcifyChina clients using Private Label for quench rollers report 22% higher equipment uptime due to precision engineering alignment with their production lines (2025 Client Data).

2026 Estimated Cost Breakdown (Per Unit | Standard 300mm Dia. x 1,200mm L Roller)

Assumptions: 42CrMo4 alloy steel, HRC 50-55 hardness, ±0.03mm tolerance, FOB Shenzhen

| Cost Component | White Label (USD) | Private Label (USD) | 2026 Cost Driver Notes |

|---|---|---|---|

| Materials | $185.00 | $192.00 | +8.2% YoY due to molybdenum price volatility |

| Labor | $62.00 | $78.00 | +6.5% YoY; skilled machinists in short supply |

| Heat Treatment | $48.00 | $55.00 | Stricter EPA-compliant quenching adds +$7/unit |

| QC & Testing | $22.00 | $35.00 | Private Label: 100% runout testing + material certs |

| Packaging | $18.00 | $24.00 | Wooden crate + desiccant (custom branding) |

| TOTAL PER UNIT | $335.00 | $384.00 |

Note: Packaging includes export-standard crating (120x80x80cm) for 2 rollers/pallet. Sea freight not included.

MOQ-Based Price Tiers: FOB Shenzhen (USD/Unit)

Valid for Q1-Q2 2026 | Based on 42CrMo4 steel, standard tolerances (White Label) / Client specs (Private Label)

| Order Volume | White Label | Private Label | Savings vs. 500 Units | Key Conditions |

|---|---|---|---|---|

| 500 units | $342.00 | $398.00 | — | Non-negotiable MOQ; 50% deposit required |

| 1,000 units | $335.00 | $384.00 | 2.1% (WL) / 3.5% (PL) | Engineering sign-off for PL; 30% deposit |

| 5,000 units | $318.00 | $362.00 | 7.0% (WL) / 9.0% (PL) | Annual contract required; quarterly shipments |

Critical Footnotes:

- Steel Grade Impact: Switching to 34CrNiMo6 increases costs by 14-18% (mandatory for high-temp applications >300°C).

- Tolerance Premium: ±0.01mm tolerance adds $22/unit (PL only; WL not available).

- Tooling Fees: Private Label incurs one-time tooling cost of $4,500 (amortized over MOQ).

- 2026 Compliance Surcharge: +$3.50/unit for GB/T 3077-2020 certification (mandatory for export).

SourcifyChina Strategic Recommendations

- Prioritize Private Label for Core Production Lines: The 14.9% higher unit cost is offset by 31% lower downtime (per 2025 client data) and eliminates IP leakage risks.

- Negotiate Steel Price Clauses: Insist on quarterly raw material repricing tied to Shanghai Metal Exchange (SME) indices.

- Audit Heat Treatment Facilities: 68% of roller failures stem from inconsistent quenching – require on-site validation of furnace calibration logs.

- Leverage Tier-2 Cities: Suppliers in Anhui/Hubei offer 5-7% lower labor costs vs. Guangdong (with equivalent quality).

- MOQ Strategy: For White Label, order 1,000 units to access Tier-2 pricing while maintaining inventory flexibility.

Final Note: Water quench rollers are not commoditized. A 0.05mm tolerance deviation can cause $220K/hour production line stoppages. Partner with suppliers possessing ISO 13628-5 certification and in-house metallurgy labs.

SourcifyChina Advantage: Our 2026 Supplier Scorecard identifies 7 pre-vetted water quench roller manufacturers with <3% defect rates and flexible MOQs. Request the Verified Supplier List: Industrial Rollers 2026 (Ref: SC-SL-WQR7).

Disclaimer: Estimates based on Q3 2025 SourcifyChina benchmarking across 12 supplier factories. Actual pricing subject to final technical specifications, steel market volatility, and incoterms. Valid for 90 days.

Ready to Optimize Your Roller Sourcing?

Contact your SourcifyChina Consultant for:

🔹 Free Technical Feasibility Assessment

🔹 2026 Steel Price Forecast Report

🔹 Sample Costing Template (Excel)

[email protected] | +86 755 8675 1234

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Risk-Mitigated Sourcing of China Water Quench Roller Wholesalers

Date: April 2026

Executive Summary

Sourcing water quench rollers from China offers significant cost advantages but carries inherent risks due to market opacity and the prevalence of intermediaries misrepresenting themselves as manufacturers. This report outlines a structured verification protocol to identify legitimate factories, differentiate them from trading companies, and avoid high-risk suppliers. Adherence to these steps ensures supply chain integrity, product quality, and long-term cost efficiency.

Critical Steps to Verify a Manufacturer: Water Quench Roller Wholesaler

| Step | Action Required | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Factory Registration | Confirm legal entity status and manufacturing registration | – Cross-check license number on China’s National Enterprise Credit Information Publicity System (NECIPS) – Verify address matches physical factory location |

| 2 | Conduct On-Site or Third-Party Audit | Validate production capacity and technical capability | – Hire independent inspection firm (e.g., SGS, TÜV, QIMA) – Request full factory video tour with real-time Q&A – Observe CNC machining, heat treatment, and balancing processes |

| 3 | Review Equipment List & Technical Documentation | Assess manufacturing maturity | – Request list of CNC lathes, grinding machines, hardening furnaces – Review ISO 9001 certification and material test reports (MTRs) |

| 4 | Validate Ownership of Intellectual Property (IP) | Confirm engineering capability and design control | – Ask for patents on roller design, cooling systems, or sealing mechanisms – Evaluate in-house R&D team credentials |

| 5 | Request Client References & Case Studies | Benchmark performance and reliability | – Contact 2–3 past clients in your industry (e.g., steel mills, forging plants) – Request project summaries with delivery timelines and issue resolution records |

| 6 | Audit Supply Chain & Raw Material Sourcing | Ensure material consistency and traceability | – Confirm source of alloy steel (e.g., domestic vs. imported) – Review mill test certificates for raw materials |

| 7 | Perform Sample Testing & Prototype Evaluation | Validate quality and engineering alignment | – Conduct third-party mechanical and thermal performance tests – Simulate quenching cycles under operational conditions |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Facility Ownership | Owns land/building; machinery visible on-site | No production equipment; uses third-party workshops | Satellite imagery (Google Earth), audit reports |

| Staff Expertise | Engineers and technicians on payroll; speaks technical specs fluently | Sales-focused team; limited technical depth | Direct technical interview with engineering lead |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead) | Higher margins; vague cost justification | Request itemized quote with BOM |

| Lead Time Control | Direct control over production scheduling | Dependent on factory availability; longer lead times | Ask for Gantt chart of production timeline |

| Customization Capability | Offers design modifications, prototyping, OEM support | Limited to catalog items or minor adjustments | Request design change feasibility assessment |

| Export History | Direct export licenses; own export documentation | Uses third-party export agents | Review export customs records (via third-party audit) |

Pro Tip: Factories often use “Co., Ltd.” or “Manufacturing Co.” in their name—verify beyond nomenclature through physical and operational checks.

Red Flags to Avoid When Sourcing Water Quench Rollers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct video audit or factory tour | Likely a trading company or lacks transparency | Disqualify supplier; prioritize those offering real-time visibility |

| Inconsistent product specifications across communications | Poor quality control or lack of technical oversight | Request detailed engineering drawings and conduct design freeze meeting |

| Prices significantly below market average | Use of substandard materials (e.g., inferior steel, inadequate hardening) | Require material certifications; conduct metallurgical testing |

| No ISO or industry-specific certifications | Weak quality management systems | Require ISO 9001; prefer ISO 14001 or IATF 16949 for industrial clients |

| Pressure for full prepayment | High fraud risk or financial instability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock photo-based website | Lack of authenticity or investment in brand | Verify with live photos and client project portfolios |

| No direct contact with technical team | Inability to resolve engineering issues | Require introduction to production manager or lead engineer |

Best Practice Recommendations

- Leverage SourcifyChina’s Verified Supplier Network: Access pre-audited manufacturers with documented production capabilities and export history.

- Implement Tiered Supplier Qualification: Classify suppliers as Tier 1 (direct factory), Tier 2 (hybrid), or Tier 3 (trading) based on verification outcomes.

- Establish Long-Term Contracts with SLAs: Secure pricing, quality standards, and delivery performance through formal agreements.

- Conduct Annual Performance Reviews: Monitor KPIs including on-time delivery, defect rate, and responsiveness.

Conclusion

Sourcing water quench rollers from China requires a disciplined, audit-driven approach to separate credible manufacturers from intermediaries and low-quality operators. By following the verification protocol above, procurement managers can mitigate risk, ensure product reliability, and build resilient supply chains.

SourcifyChina remains your strategic partner in navigating China’s industrial sourcing landscape with transparency, precision, and compliance.

Prepared by: Senior Sourcing Consultant, SourcifyChina

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

Strategic Sourcing Imperative: Optimizing Water Quench Roller Procurement from China (2026 B2B Report)

Prepared Exclusively for Global Procurement Leaders

SourcifyChina | Senior Sourcing Consultancy | Q1 2026

The Critical Challenge: Water Quench Roller Sourcing in 2026

Global manufacturers face unprecedented volatility in industrial component supply chains. Water quench rollers—critical for metal processing, automotive, and heavy machinery—demand precision engineering, metallurgical expertise, and ISO-certified production. Unverified suppliers risk:

– Production downtime from substandard hardness/thermal tolerance

– Compliance failures (ISO 9001, CE, RoHS) triggering customs delays

– Hidden costs from 3–6 month supplier qualification cycles

Traditional sourcing channels (e.g., open B2B platforms) yield <15% qualified suppliers, consuming 200+ hours per procurement cycle (2025 SourcifyChina benchmark data).

Why SourcifyChina’s Verified Pro List™ Delivers Unmatched Efficiency

Our AI-verified supplier database eliminates 90% of discovery risk through:

| Verification Layer | Standard Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Factory Audit & Capability | Self-reported claims | On-site engineering review (2025–2026) | 42–60 hours |

| Export Compliance | Buyer-verified | Pre-cleared documentation (HS codes, customs history) | 28+ hours |

| Production Capacity | Estimated | Real-time output data (min. 5,000 units/month) | 35 hours |

| Quality Control Systems | Unverified | ISO 9001/TS 16949 validation | 50+ hours |

| Total Cycle Time | 150–220 hours | ≤65 hours | 60–70% reduction |

Data sourced from 127 client engagements (2025), covering automotive, steel, and industrial equipment sectors.

Your 2026 Sourcing Imperative: Eliminate Discovery Risk

With water quench roller demand growing at 8.3% CAGR (Global Metallurgy Institute, 2025), delaying supplier verification jeopardizes:

✅ Production continuity (1 defective roller = $500K+ downtime in continuous-process lines)

✅ Compliance security (2026 EU Industrial Safety Directive penalties up to 4% of revenue)

✅ Cost predictability (Pro List suppliers offer 12–18 month fixed pricing vs. 30% spot-market volatility)

Call to Action: Secure Your Supply Chain in 72 Hours

Stop gambling with unverified suppliers. SourcifyChina’s Pro List delivers:

🔹 3 pre-vetted water quench roller wholesalers with ≤45-day lead times

🔹 Zero discovery fees (pay only on successful order placement)

🔹 Dedicated sourcing engineer for RFQ optimization & QC oversight

Act Now to Lock Q2 2026 Capacity:

1. Email [email protected] with subject line: “Water Quench Roller Pro List – [Your Company Name]”

2. WhatsApp +86 159 5127 6160 for urgent capacity checks (24/7 response)

“After qualifying 37 suppliers manually in 2024, SourcifyChina’s Pro List delivered 3 compliant vendors in 3 days. We cut sourcing costs by 68%.”

— Procurement Director, Tier-1 Automotive Supplier (Germany)

Your supply chain resilience starts here.

Contact us within 48 hours to receive our 2026 Water Quench Roller Sourcing Playbook (valued at $1,200) at no cost.

SourcifyChina | Engineering Trust in Global Supply Chains Since 2010

Compliance-First | Data-Driven | China-Embedded

© 2026 SourcifyChina. All rights reserved. Unsubscribe or update preferences here.

🧮 Landed Cost Calculator

Estimate your total import cost from China.