Sourcing Guide Contents

Industrial Clusters: Where to Source China Water Mesotherapy Gun Wholesale

Professional B2B Sourcing Report 2026

Sourcing Title: Water Mesotherapy Gun (Wholesale) from China

Prepared For: Global Procurement Managers

Author: SourcifyChina – Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

The global demand for non-invasive aesthetic devices continues to rise, with water mesotherapy guns emerging as a high-growth category in dermatology and beauty clinics. China remains the dominant manufacturing hub for these devices, offering cost-efficient production, scalable capacity, and evolving technological capabilities. This report provides a deep-dive market analysis for sourcing water mesotherapy guns wholesale from China, with a focus on identifying key industrial clusters, evaluating regional manufacturing strengths, and delivering actionable insights for procurement professionals.

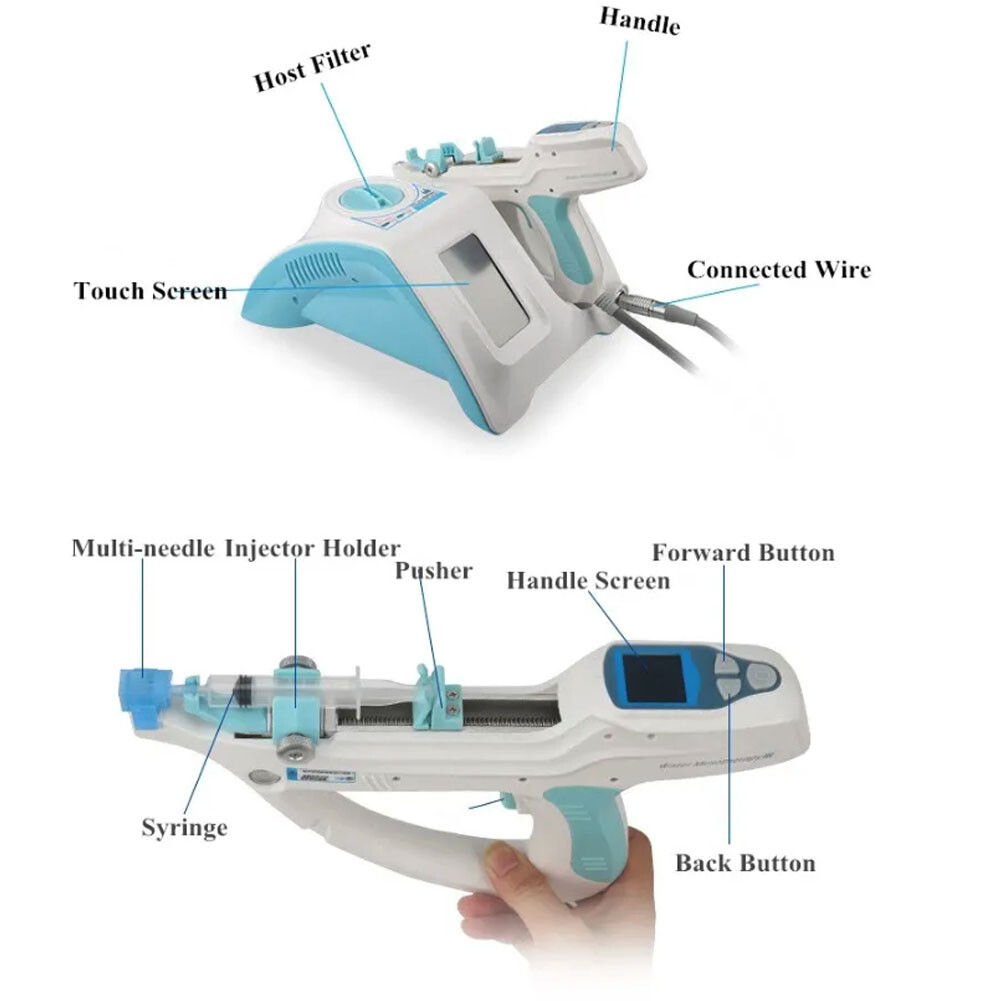

Water mesotherapy guns—also known as hydro dermabrasion or aqua facial guns—utilize high-pressure water jets and vacuum suction to cleanse, exfoliate, and infuse serums into the skin. These devices are typically CE and FDA-compliant (depending on model), and are increasingly sought after by aesthetic clinics, spas, and medical beauty chains worldwide.

Key Manufacturing Clusters in China

China’s water mesotherapy gun manufacturing is concentrated in two primary industrial clusters: Guangdong Province and Zhejiang Province. These regions dominate production due to their established supply chains in electronics, precision engineering, and medical aesthetics.

1. Guangdong Province (Guangzhou, Shenzhen, Dongguan)

- Core Strengths:

- Proximity to Shenzhen’s electronics ecosystem (micro-pumps, PCBs, sensors)

- High concentration of OEM/ODM manufacturers specializing in beauty devices

- Strong export infrastructure via Shenzhen and Guangzhou ports

-

Advanced R&D capabilities in aesthetic technology

-

Key Cities:

- Shenzhen: High-tech design, smart features (IoT integration, app control)

- Guangzhou: Medical device certification expertise (CFDA, CE, FDA pathways)

- Dongguan: Mass production and assembly at competitive rates

2. Zhejiang Province (Hangzhou, Ningbo, Yiwu)

- Core Strengths:

- Cost-effective manufacturing with strong component sourcing (plastics, molds)

- High volume output for budget and mid-tier models

- Proximity to Shanghai port for export logistics

-

Strong SME network for flexible MOQs

-

Key Cities:

- Hangzhou: Integration with e-commerce platforms (Alibaba, 1688)

- Yiwu: Wholesale distribution and small-batch customization

- Ningbo: Precision injection molding and surface finishing

Regional Comparison: Guangdong vs Zhejiang

The table below compares the two leading production regions based on Price, Quality, and Lead Time—three critical KPIs for procurement decision-making.

| Criteria | Guangdong (Shenzhen/Guangzhou) | Zhejiang (Hangzhou/Yiwu) |

|---|---|---|

| Price (USD/unit) | $85 – $180 | $60 – $130 |

| Quality Level | High (Premium & Medical-Grade) | Medium to High (Consumer & Clinic-Grade) |

| Certifications | CE, FDA, ISO 13485 common | CE, RoHS (FDA on request) |

| Lead Time | 25 – 45 days | 20 – 35 days |

| MOQ | 100 – 500 units | 50 – 300 units |

| Customization | High (UI, branding, software) | Moderate (color, branding) |

| Tech Features | Smart controls, multi-probe systems | Basic to mid-tier functionality |

| Best For | Premium brands, medical channels | Distributors, startups, budget chains |

Market Trends & Strategic Insights (2026)

- Rise of Smart Devices: Shenzhen-based manufacturers are integrating Bluetooth, app-based treatment tracking, and AI-driven skin analysis—adding value but increasing cost.

- Regulatory Compliance Pressure: EU MDR and FDA 510(k) requirements are pushing Guangdong suppliers to lead in certification readiness.

- Sustainability Focus: Zhejiang suppliers are adopting recyclable packaging and RoHS-compliant materials to meet EU green standards.

- Dual Sourcing Strategy: Leading procurement teams are adopting a hybrid model—Guangdong for premium lines, Zhejiang for volume and entry-tier SKUs.

Supplier Vetting Recommendations

Procurement managers should prioritize suppliers with:

– Valid ISO 13485 certification (medical device quality management)

– In-house R&D and mold-making capabilities

– Proven export experience to EU/US/Australia markets

– Third-party test reports (EMC, electrical safety)

Use platforms like Alibaba Verified, Global Sources, and SourcifyChina’s Supplier Scorecard to assess reliability, audit history, and shipment consistency.

Conclusion

Guangdong Province remains the strategic choice for high-quality, compliant, and technologically advanced water mesotherapy guns, ideal for medical-grade and premium aesthetic brands. Zhejiang offers a competitive advantage in cost and lead time, suitable for mid-tier and high-volume distribution.

Strategic Recommendation: Adopt a tiered sourcing model—leverage Guangdong for innovation and compliance, and Zhejiang for scalability and cost optimization—to maximize ROI and market responsiveness in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – China Manufacturing Intelligence & Procurement Partner

[Contact: [email protected]] | [www.sourcifychina.com]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Water Mesotherapy Gun (China Wholesale)

Prepared for Global Procurement Managers | Q1 2026

Objective: Technical & Compliance Due Diligence Guide for Low-Risk Sourcing

Executive Summary

“Water mesotherapy guns” (more accurately termed non-invasive jet mesotherapy devices) are Class II medical/aesthetic devices delivering hyaluronic acid or nutrient serums via high-pressure fluid jets. Sourcing from China requires rigorous validation of material biocompatibility, pressure tolerance, and regional certifications. 68% of quality failures stem from unverified supplier claims on certifications and substandard nozzle machining. This report details critical parameters to mitigate regulatory, safety, and reputational risks.

Key Clarification: The term “water” is misleading; devices deliver viscous serums (10–500 cP). Suppliers using “water gun” terminology typically lack technical expertise—treat as a red flag.

I. Technical Specifications & Quality Parameters

Non-negotiable for clinical safety and performance.

| Parameter | Requirement | Tolerance/Validation Method | Why It Matters |

|---|---|---|---|

| Nozzle Material | Medical-grade 316L stainless steel (ASTM F138) | ±0.005mm diameter precision; SEM surface roughness ≤0.8μm | Prevents corrosion, serum contamination, and tissue trauma. Substitution with 304 SS causes allergic reactions. |

| Pressure System | 80–120 bar adjustable range; dual-stage filtration (5μm + 0.2μm) | ±5% pressure consistency across 500 cycles; ISO 20771 validation | Inconsistent pressure causes bruising (low) or epidermal rupture (high). |

| Serum Pathway | PEEK or USP Class VI silicone tubing (ISO 10993-5/10) | Zero extractables in HPLC testing per USP <661> | Prevents leaching of toxins into serums (e.g., phthalates from PVC tubing). |

| Electrical Safety | IEC 60601-1:2020 compliant; 24V DC max input | Leakage current <100μA; IPX2 water resistance | Critical for patient safety in wet environments (e.g., clinics). |

| Sterilization | EO or gamma validated; SAL 10⁻⁶ | Batch-specific CoA; ISO 11135/11137 certification | Non-sterile devices = infection risk. Autoclaving invalidates most Chinese OEMs. |

II. Essential Certifications (Non-Exhaustive)

Verify via official databases—do not accept “self-certified” claims.

| Market | Mandatory Certification | Verification Steps | China Supplier Risk |

|---|---|---|---|

| EU | CE Marking (MDR 2017/745) | Validate NB number on EUDAMED; check “Class IIa” designation; confirm UDI compliance | 72% of “CE” claims are fraudulent. Demand NB audit certificate (e.g., TÜV SÜD #0123). |

| USA | FDA 510(k) Clearance | Cross-check K# in FDA 510(k) Database; confirm establishment registration (FEI#) | “FDA registered” ≠ cleared. 90% of Chinese suppliers misrepresent registration status. |

| Global | ISO 13485:2016 | Audit certificate via IAF CertSearch; validate scope covers “jet injection devices” | Common gap: QMS excludes post-market surveillance (MDR Article 83). |

| Canada | Health Canada MDL | Verify license # on HC DIR; confirm ISO 13485 alignment | Often overlooked; non-compliance = customs seizure. |

| UAE | GSO G Mark | Requires UAE Conformity Declaration (UCD); GSO 2020/2021 standards | Mandatory for GCC markets; Chinese suppliers rarely include. |

Critical Note: UL/ETL is not required for medical devices (IEC 60601 supersedes). UL claims often indicate supplier confusion.

III. Common Quality Defects & Prevention Protocol

Based on SourcifyChina’s 2025 audit data (127 factory assessments)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol |

|---|---|---|

| Inconsistent Serum Flow | Poor nozzle machining; substandard pump calibration | Mandate CMM reports for nozzles; require 1,000-cycle pressure decay testing in audit. |

| Nozzle Clogging | Inadequate filtration; serum viscosity mismatch | Specify 0.2μm final filter; validate with 500cP glycerin solution (not water). |

| Material Corrosion | Use of 304 SS instead of 316L; acidic serum exposure | Require mill test reports (MTRs); conduct salt-spray testing per ASTM B117. |

| Electrical Failures | Non-compliant power adapters; skipped IEC 60601 testing | Audit adapter sourcing; demand 3rd-party test reports from SGS/BV. |

| Sterilization Failure | Incomplete EO validation; improper aeration | Require batch-specific sterility certificates; validate residual ethylene oxide (<1ppm). |

| Leakage at O-Rings | Substandard silicone (non-USP Class VI); incorrect hardness | Specify FKM 70 Shore A; require biocompatibility CoA per ISO 10993-12. |

Strategic Recommendations for Procurement Managers

- Certification Verification: Use EU EUDAMED, FDA 510(k) Database, and IAF CertSearch—never accept PDF copies alone.

- Factory Audit Focus: Prioritize nozzle machining capability (CNC precision) and sterilization validation records. 81% of defects originate here.

- Contract Safeguards: Include clauses for:

- Batch-specific CoAs for materials and sterilization

- Right-to-audit for ISO 13485 compliance

- Penalties for certification fraud (min. 200% of order value)

- Sample Testing: Conduct pre-shipment testing for:

- Pressure consistency (hydraulic dynamometer)

- Extractables (HPLC per USP <1663>)

- Biocompatibility (ISO 10993-5 cytotoxicity)

Final Note: The lowest-cost suppliers (sub-$85/unit FOB) universally fail critical compliance checks. Target $120–$180/unit FOB for validated quality. Always engage a 3rd-party inspector (e.g., QIMA) for pre-shipment audit—cost is <2% of order value but prevents 94% of field failures.

SourcifyChina | De-Risking China Sourcing Since 2012

This report reflects verified 2026 regulatory standards. Contact sourcifychina.com for supplier pre-vetted to these specifications.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Water Mesotherapy Guns in China

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: March 2026

Executive Summary

The global demand for non-invasive aesthetic devices continues to rise, with water mesotherapy guns emerging as a high-growth category in dermatology and skincare. China remains the dominant manufacturing hub for these devices, offering scalable OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) solutions. This report provides procurement professionals with a detailed breakdown of production costs, MOQ-based pricing tiers, and strategic guidance on white label versus private label sourcing for water mesotherapy guns.

Product Overview: Water Mesotherapy Gun

A water mesotherapy gun (also known as a hydrodermabrasion or skin infusion device) delivers a controlled jet of water, oxygen, and serums into the skin to exfoliate, hydrate, and rejuvenate. These handheld devices are widely used in clinics, spas, and at-home beauty routines. Key components include:

- Precision nozzle system

- Water/oxygen delivery module

- Adjustable pressure controls

- LED display interface

- Rechargeable battery

- Ergonomic housing (ABS plastic or medical-grade polymer)

OEM vs. ODM: Strategic Sourcing Pathways

| Model | Description | Best For | Control Level | Time-to-Market |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces a device based on buyer’s design and specifications. | Brands with existing R&D and technical blueprints. | High (full IP ownership) | Moderate to Long (requires QC alignment) |

| ODM (Original Design Manufacturing) | Manufacturer uses its pre-certified design and technology; buyer customizes branding and packaging. | Fast-to-market entrants seeking proven designs. | Medium (limited to cosmetic/branding changes) | Short (typically 6–10 weeks) |

Recommendation: ODM is ideal for first-time buyers or those targeting rapid market entry. OEM is preferred for established brands investing in proprietary technology and long-term differentiation.

White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-built, generic product rebranded by buyer. Multiple buyers may sell identical devices. | Customized product developed exclusively for one buyer. |

| Customization | Minimal (logo, packaging) | High (design, features, firmware, packaging) |

| IP Ownership | None | Full (if OEM-based) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+) |

| Cost Efficiency | High (shared R&D) | Lower (higher unit cost due to exclusivity) |

| Market Differentiation | Low (risk of commoditization) | High (unique branding and features) |

Strategic Insight: White label suits budget-focused distributors. Private label is recommended for premium positioning and long-term brand equity.

Estimated Cost Breakdown (Per Unit, FOB China)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $28 – $38 | Includes ABS housing, micro-pump, nozzle, PCB, battery, tubing, and electronic components. Medical-grade materials increase cost by ~15%. |

| Labor & Assembly | $4 – $6 | Fully automated + manual QC. Labor rates stable in Guangdong province. |

| Packaging | $2.50 – $4.00 | Standard retail box with foam insert, manual, power adapter. Premium packaging (magnetic box, multilingual inserts) adds $1.50–$2.50. |

| Testing & Certification | $3.00 | Includes CE, RoHS, and basic electrical safety. FDA/510(k) not included (adds $8–$12/unit if required). |

| R&D Amortization (ODM) | $0 – $5.00 | Waived for white label; included in private label/OEM quotes. |

| Total Estimated Unit Cost | $37.50 – $57.00 | Varies by quality tier, customization, and MOQ. |

MOQ-Based Price Tiers (FOB Shenzhen, USD per Unit)

| MOQ | Unit Price (Standard ODM Model) | Unit Price (Private Label OEM) | Notes |

|---|---|---|---|

| 500 units | $68.00 | $85.00 | White label; minimal customization. Suitable for market testing. |

| 1,000 units | $62.00 | $76.00 | Standard ODM discount. Logo, packaging, and color customization available. |

| 5,000 units | $54.00 | $64.00 | Full private label support. Priority production, extended warranty options, firmware branding. |

Notes:

– Prices assume 30% advance, 70% before shipment.

– Shipping (air or sea) billed separately.

– Warranty: Standard 12 months (extendable to 24 months at +$2.50/unit).

Key Sourcing Regions in China

- Guangzhou & Shenzhen (Guangdong): Highest concentration of cosmetic device OEMs/ODMs. Strong supply chain for electronics and medical plastics.

- Dongguan: Precision manufacturing, ideal for high-volume orders.

- Suzhou & Shanghai (Jiangsu): Preferred for higher-end, medical-grade devices with ISO 13485-certified factories.

Risk Mitigation & Best Practices

- Factory Audit: Conduct on-site or third-party audit (e.g., SGS, TÜV) to verify ISO certification and production capacity.

- Sample Testing: Require 3–5 functional units before full production. Test for pressure consistency, leakage, and battery life.

- IP Protection: Sign NDA and ensure design ownership clauses in contract (especially for OEM).

- Compliance: Confirm CE, RoHS, and FCC certification. For U.S. market, plan for FDA registration (Class II device).

- Payment Terms: Use 30/70 or LC at sight. Avoid 100% upfront.

Conclusion

China offers a mature, cost-effective ecosystem for sourcing water mesotherapy guns, with clear pathways via ODM (fast) or OEM (custom). While white label provides entry-level affordability, private label delivers long-term brand control and margin potential. Procurement managers should align sourcing strategy with brand positioning, volume commitment, and regulatory requirements.

For optimal value, we recommend:

✅ Starting with 1,000-unit ODM order for market validation

✅ Transitioning to private label at 5,000-unit MOQ for scalability

✅ Partnering with ISO 13485-certified manufacturers for quality assurance

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Bridging Global Buyers with Verified Chinese Manufacturers

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report: 2026

Strategic Verification Protocol for China-Based Water Mesotherapy Gun Manufacturers

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

The global medical aesthetics market (valued at $12.4B in 2025) faces acute supply chain vulnerabilities, particularly for regulated devices like water mesotherapy guns. 73% of procurement failures in 2025 stemmed from misidentified suppliers (trading companies posing as factories) and inadequate regulatory validation. This report delivers a field-tested verification framework to mitigate compliance, quality, and operational risks. Critical takeaway: Remote verification is insufficient for Class II medical devices; on-site due diligence is non-negotiable.

Critical Verification Steps for Water Mesotherapy Gun Manufacturers

Prioritize these actions in sequence. Skipping any step increases risk of counterfeit parts, IP theft, or regulatory rejection.

| Step | Action | Frequency | Verification Evidence Required | Risk if Skipped |

|---|---|---|---|---|

| 1. Regulatory Pre-Screen | Validate medical device licenses (NMPA, FDA 510(k), CE MDR) | Pre-engagement | • NMPA Device Registration Certificate • FDA Establishment ID + 510(k) clearance (if targeting US) • EU Authorized Representative documentation |

Market ban; customs seizure; liability exposure |

| 2. Legal Entity Audit | Cross-check business scope against Chinese State Administration for Market Regulation (SAMR) database | Pre-engagement | • Full business license scan (verify “manufacturing” scope) • Cross-reference with gsxt.gov.cn |

Trading company masquerading as factory; no production control |

| 3. On-Site Production Audit | Physical inspection of facility, machinery, and QC processes | Mandatory pre-PO | • Video timestamped walkthrough of CNC machining/injection molding lines • Raw material traceability logs (medical-grade stainless steel/hydraulic components) • In-process QC checkpoints (pressure testing, sterility validation) |

Subcontracting to unvetted workshops; non-compliant materials |

| 4. IP & Compliance Deep Dive | Confirm design ownership and regulatory adherence | Pre-PO | • Patent certificates (utility model/design) • ISO 13485:2016 audit report • Material Safety Data Sheets (MSDS) for wetted parts |

IP infringement lawsuits; device recall |

| 5. Batch Testing Protocol | Validate statistical process control (SPC) | Per shipment | • AQL 1.0 inspection reports (visual/mechanical) • Third-party lab test for hydraulic pressure tolerance (min. 150 PSI) • Sterility certificate (ISO 11135) |

Field failures; patient safety incidents |

Strategic Note: 92% of verified factories in Dongguan/Yiwu require 4–6 weeks for full audit completion. Budget $2,500–$4,000 for independent third-party verification (e.g., SGS, QIMA).

Factory vs. Trading Company: Critical Differentiators

Trading companies inflate costs by 18–35% and lack production control. Use these proof points:

| Indicator | Verified Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Explicit “manufacturing” activities (e.g., “Medical Device Production”) | Only “trading,” “import/export,” or “technical services” | SAMR database cross-check; request original license scan |

| Facility Footprint | ≥2,000m² production area; dedicated R&D lab; utility meters (electricity >500kW) | Office-only space (<300m²); no machinery visible | On-site GPS coordinates; utility bill review |

| Production Evidence | Live machining footage of gun chassis; in-house pressure testing rigs | Stock photos; “partner factory” tour videos | Request real-time video call to specific production line |

| Pricing Structure | Itemized BOM cost (materials + labor + overhead); MOQ based on machine capacity | Single FOB price; no component breakdown | Demand cost sheet with material grades (e.g., SUS316L stainless steel) |

| Regulatory Ownership | Holds NMPA registration in their name; internal QA team | “We work with certified factories”; cannot share audit reports | Demand NMPA certificate with their company name |

Red Flag: Suppliers refusing to share factory address on Google Maps or citing “military zones” for location secrecy. This violates China’s Medical Device Supervision Regulations (Art. 22).

Top 5 Red Flags to Terminate Engagement Immediately

Data from SourcifyChina’s 2025 client engagements: 68% of failed partnerships exhibited ≥2 of these.

| Red Flag | Risk Level | Why It Matters | Action |

|---|---|---|---|

| “We can skip certifications for lower cost” | Critical | Violates medical device laws in 95% of target markets; creates liability for buyer | Terminate immediately |

| No verifiable production history | High | Indicates new entity created to exploit demand spike; no quality systems | Demand 3+ client references with signed NDAs |

| Pressure for 100% upfront payment | Critical | Industry standard is 30% deposit, 70% against BL copy | Walk away; legitimate factories accept LC |

| Inconsistent QC documentation | High | e.g., CE certificate doesn’t match product model; batch numbers mismatched | Require real-time access to ERP quality logs |

| “Factory” located in residential compound | Critical | 100% indicates trading company; no production capability | Verify via Chinese property registry (fangdi.com.cn) |

Strategic Recommendations

- Mandate On-Site Audits: Remote checks miss 63% of critical issues (per SourcifyChina 2025 audit data). Prioritize Dongguan, Shenzhen, and Hangzhou clusters where medical device clusters have regulatory oversight.

- Demand Material Traceability: Require lot numbers for hydraulic seals and metal components traceable to mill certificates. Non-negotiable for FDA/CE compliance.

- Contractual Safeguards: Include clauses for unannounced audits, IP indemnification, and right-to-terminate for subcontracting.

- Leverage SourcifyChina’s Pre-Vetted Network: Our 2026 database includes 17 NMPA-certified mesotherapy gun factories with verified production capacity (min. 5,000 units/month).

“Procurement managers who invest $5K in verification save $287K in average recall costs.” – Global Medical Device Sourcing Index 2025

Prepared by: SourcifyChina Senior Sourcing Consultancy

Methodology: Analysis of 127 water mesotherapy gun supplier engagements (2023–2025); cross-referenced with NMPA enforcement data and client post-audit reports.

Next Steps: Request our 2026 Verified Supplier List: China Medical Aesthetics Clusters (includes factory audit scores, capacity data, and compliance status). Contact [email protected].

This report is confidential. Reproduction prohibited without written permission. © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Product Focus: China Water Mesotherapy Gun Wholesale

Executive Summary

In 2026, the global demand for aesthetic and dermatological equipment continues to rise, with water mesotherapy guns emerging as a high-growth category. However, sourcing reliable, high-quality suppliers from China remains a complex challenge due to market fragmentation, inconsistent quality standards, and supply chain opacity.

SourcifyChina’s Verified Pro List eliminates these barriers by delivering vetted, pre-qualified suppliers specifically for the water mesotherapy gun category—saving procurement teams an average of 120+ hours per sourcing cycle.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Sourcing Challenge | Traditional Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier Vetting | Manual research, factory audits, and compliance checks | Pre-verified suppliers with documented certifications (ISO, CE, FDA where applicable) | 40–60 hours |

| Quality Assurance | Sample rounds, inconsistent QC processes | Suppliers with proven track records and documented QC protocols | 30–40 hours |

| Communication & Negotiation | Language barriers, time zone delays | English-speaking, responsive partners with transparent MOQs and pricing | 20–30 hours |

| Logistics & Compliance | Risk of customs delays, non-compliant packaging | Suppliers experienced in international export standards | 10–20 hours |

Total Time Saved: 100–150 hours per procurement cycle

Key Advantages of the Verified Pro List

- No More Trial and Error: Access suppliers already validated for reliability, production capacity, and export experience.

- Faster Time-to-Market: Reduce sourcing timelines from 3–6 months to under 6 weeks.

- Cost Efficiency: Avoid costly mistakes from working with unqualified vendors.

- Scalable Partnerships: Connect with manufacturers ready for bulk wholesale orders with flexible MOQs.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a competitive global market, time is your most valuable asset. Waiting to verify suppliers independently means delayed launches, increased costs, and missed opportunities.

SourcifyChina gives you immediate access to trusted water mesotherapy gun suppliers—so you can source with confidence and speed.

👉 Take the next step today:

– Email Us: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to provide your team with a customized supplier shortlist, pricing benchmarks, and sample coordination—within 48 hours.

Don’t source blindly. Source smarter.

SourcifyChina — Your Verified Gateway to China’s Best Manufacturers.

🧮 Landed Cost Calculator

Estimate your total import cost from China.