Sourcing Guide Contents

Industrial Clusters: Where to Source China Voip Companies

SourcifyChina Sourcing Intelligence Report: VOIP Equipment Manufacturing in China (2026 Outlook)

Prepared For: Global Procurement & Supply Chain Leaders

Date: October 26, 2025

Report ID: SC-VOIP-CLSTR-2026

Executive Summary

China remains the dominant global hub for VOIP (Voice over Internet Protocol) hardware manufacturing, supplying >75% of enterprise-grade IP phones, gateways, PBX systems, and related components. While geopolitical shifts and supply chain diversification efforts persist, China’s integrated electronics ecosystem, R&D capabilities, and scale ensure its strategic relevance through 2026. This report identifies core industrial clusters, analyzes regional strengths/weaknesses, and provides actionable sourcing guidance. Critical Insight: Supplier vetting for genuine manufacturing capability (vs. trading fronts) and compliance with evolving global telecom regulations (FCC, CE, RCM) is non-negotiable in 2026.

Key Industrial Clusters for VOIP Manufacturing in China

VOIP manufacturing is concentrated in Southeast China’s electronics corridors, leveraging established supply chains for semiconductors, PCBs, and connectivity modules. Three provinces dominate, each with distinct specializations:

-

Guangdong Province (Epicenter: Shenzhen)

- Core Cities: Shenzhen (Nanshan, Bao’an Districts), Dongguan, Guangzhou

- Why Dominant: Heart of China’s ICT ecosystem. Unmatched density of Tier 1 component suppliers (Qualcomm, MediaTek distributors), contract manufacturers (Foxconn, Jabil), telecom R&D centers (Huawei, ZTE spin-offs), and logistics infrastructure (Yantian Port). Focus: High-end enterprise IP phones, cloud-PBX hardware, 5G-integrated VOIP gateways.

- 2026 Trend: Accelerating shift toward AI-enhanced VOIP devices (noise cancellation, voice analytics) and cybersecurity-hardened hardware due to EU/US regulatory pressure.

-

Zhejiang Province (Epicenter: Hangzhou/Ningbo)

- Core Cities: Hangzhou (Yuhang District), Ningbo, Wenzhou

- Why Strategic: Strong base of mid-tier electronics OEMs/ODMs with expertise in cost-optimized consumer/SMB VOIP devices (basic IP phones, analog telephone adapters – ATAs). Proximity to Shanghai port & Alibaba’s ecosystem aids e-commerce integration. Focus: SMB VOIP solutions, value-segment IP phones, IoT-VOIP hybrids.

- 2026 Trend: Rapid consolidation of smaller workshops; surviving players investing in automation to offset rising wages. Increased focus on ESG compliance for EU exports.

-

Jiangsu Province (Epicenter: Suzhou Industrial Park)

- Core Cities: Suzhou (Industrial Park), Nanjing, Kunshan

- Why Emerging: Attracts foreign-invested and high-tech Chinese firms due to superior infrastructure, stringent quality control culture, and proximity to Shanghai R&D hubs. Focus: Precision components for VOIP (audio codecs, DSPs), high-reliability enterprise gateways, medical/industrial-grade VOIP hardware.

- 2026 Trend: Becoming preferred location for Western brands seeking “China+1” compliant manufacturing with Western management standards. Strongest adoption of Industry 4.0 in VOIP assembly.

(Minor Clusters: Xiamen, Fujian – Niche telecom component suppliers; Chengdu, Sichuan – Emerging R&D for rural/low-power VOIP solutions)

Regional Cluster Comparison: VOIP Manufacturing Capabilities (2026 Sourcing Outlook)

| Criteria | Guangdong (Shenzhen Focus) | Zhejiang (Hangzhou/Ningbo Focus) | Jiangsu (Suzhou Focus) |

|---|---|---|---|

| Price Competitiveness | ★★☆☆☆ Highest labor/material costs. Premium for R&D/innovation. Best for high-margin enterprise gear. |

★★★★☆ Most cost-competitive for mid-tier volume. Strong SMB/value segment pricing. Volatility with component shortages. |

★★★☆☆ Mid-to-high pricing. Premium for quality/reliability. Narrower cost advantage vs. Guangdong for complex builds. |

| Quality & Compliance | ★★★★☆ Highest concentration of Tier 1 quality control. Best in-class FCC/CE/TELEC compliance tracking. Risk: “Shenzhen OEM” facade (trading co. posing as factory). |

★★☆☆☆ Variable quality. Top 20% match Guangdong; long tail inconsistent. Improving but lagging on complex certifications (e.g., HIPAA for medical VOIP). |

★★★★★ Most consistent high quality. Strongest process documentation (ISO 13485 common). Best alignment with Western quality audits & traceability demands. |

| Lead Time (Standard Order) | ★★★☆☆ 45-60 days (complex builds). Fastest component access BUT port/logistics bottlenecks increasing. Best for urgent reorders. |

★★★★☆ 40-55 days. Agile for standard SMB devices. Vulnerable to Yiwu/Ningbo port congestion. |

★★☆☆☆ 50-70 days. Longer setup for precision builds. Most stable schedules; least impacted by component shortages due to buffer stocks. |

| Strategic Fit For | Cutting-edge enterprise VOIP, 5G/Cloud-PBX hardware, R&D collaboration | High-volume SMB/consumer VOIP, cost-sensitive tenders, e-commerce SKUs | Mission-critical VOIP, regulated industries (healthcare/finance), brands prioritizing audit readiness |

Critical Sourcing Recommendations for 2026

-

Cluster Selection is Strategy-Dependent:

- Innovation/Enterprise Tier? Prioritize Guangdong – but mandate on-site factory verification (use SourcifyChina’s audit protocol SC-AUD-VOIP-2026). Budget 15-20% premium.

- Cost-Optimized SMB Volume? Target Zhejiang – focus only on pre-vetted suppliers with ≥3 years of verifiable export history to your target market. Demand 3rd-party compliance certs.

- Zero-Defect/Regulated Markets? Choose Jiangsu – accept longer lead times for reduced compliance risk and audit readiness. Ideal for EU/NA healthcare/finance sectors.

-

Mitigate 2026-Specific Risks:

- Component Sourcing: Require suppliers to disclose all Tier 2 semiconductor/component sources. Avoid those reliant on single-source US-sanctioned chips (e.g., specific Qualcomm RF chips).

- Compliance Tsunami: Factor in 8-12 weeks for certification cycles (FCC 5G VOIP rules, EU RED 2025 updates). Insist on suppliers holding active certs, not “in-process” claims.

- Logistics Volatility: Build 15-20% buffer into lead times. Prioritize suppliers with direct port access (Shenzhen/Yantian, Ningbo-Zhoushan) over inland hubs.

-

Actionable Next Step:

> Conduct a Cluster-Specific RFx: Do not use a generic template. Tailor technical specs, compliance demands, and volume expectations to your target cluster. Guangdong suppliers expect detailed engineering collaboration; Zhejiang suppliers prioritize clear MOQ/price terms. SourcifyChina’s VOIP Sourcing Playbook (v3.1) provides cluster-specific RFx templates – contact your consultant for access.

SourcifyChina Value-Add: Our 2026 VOIP Supplier Master List (Validated Tier 1 Manufacturers Only) includes 47 pre-audited factories across these clusters, mapped to 12 product categories and 8 compliance regimes. Request the full dataset with risk scores.

“In 2026, sourcing VOIP from China isn’t about finding the cheapest supplier – it’s about aligning cluster capabilities with your specific risk tolerance, compliance burden, and innovation roadmap.”

— SourcifyChina Sourcing Intelligence Unit

Disclaimer: Pricing/lead time data reflects Q3 2025 SourcifyChina benchmarking across 127 active VOIP production lines. Subject to change with semiconductor market shifts and regulatory updates. Verify with live supplier quotes.

Technical Specs & Compliance Guide

SourcifyChina — Professional B2B Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Sourcing from China VOIP Companies

Prepared For: Global Procurement Managers

Date: April 2026

Executive Summary

The Voice over Internet Protocol (VOIP) equipment market in China has experienced significant growth due to rising demand for cloud-based communication systems. Chinese manufacturers offer competitive pricing and scalable production, but quality variability and compliance risks remain critical concerns. This report outlines technical specifications, compliance requirements, and quality control best practices to mitigate sourcing risks when engaging with VOIP suppliers in China.

1. Technical Specifications for VOIP Equipment

VOIP equipment includes IP phones, gateways, PBX systems, adapters, and headsets. Key technical parameters include:

| Parameter | Specification Guidelines |

|---|---|

| Audio Quality | Wideband audio support (G.722 codec), < 150 ms latency, echo cancellation (AEC), noise suppression |

| Network Protocols | SIP (RFC 3261), RTP/RTCP, TCP/UDP, DHCP, DNS, STUN/TURN |

| Connectivity | Ethernet (10/100/1000 Mbps), PoE support (IEEE 802.3af/at), Wi-Fi 5/6 (for wireless models), Bluetooth 5.0+ |

| Power Supply | 5V DC ±5%, PoE Class 3 or 4; efficiency > 85% |

| Operating Temp. | 0°C to 45°C; storage: -20°C to 60°C |

| Humidity Tolerance | 10% to 90% non-condensing |

| EMI/EMC Performance | Must comply with EN 55032 (Class B), FCC Part 15 Subpart B |

2. Key Quality Parameters: Materials & Tolerances

| Component | Material Requirements | Tolerance Standards |

|---|---|---|

| PCB (Printed Circuit Board) | FR-4 grade, 4–8 layer, lead-free finish (HASL or ENIG) | ±0.1 mm trace width; ±0.05 mm via alignment |

| Housing/Enclosure | Flame-retardant ABS or PC/ABS (UL 94 V-0 rated) | Dimensional tolerance: ±0.3 mm; wall thickness ≥1.2 mm |

| Connectors | Nickel-plated brass or beryllium copper | Insertion force: 20–50 N; mating cycles: ≥1,500 |

| Microphones & Speakers | Electret condenser mics; neodymium speakers | Frequency response: 300–3400 Hz (narrowband), 100–7000 Hz (wideband) |

| Cabling | Shielded twisted pair (STP), CAT5e or higher | Impedance: 100 Ω ±15%; crosstalk < -30 dB |

3. Essential Certifications

Procurement managers must verify that suppliers hold valid certifications relevant to the target market:

| Certification | Scope | Requirement |

|---|---|---|

| CE Marking | EU Market Access | Includes EMC (EN 55032), LVD (EN 62368-1), and RED (EN 301 549) directives |

| FCC Part 15 | USA Market Access | Ensures RF emissions compliance for digital devices (Class B) |

| UL 62368-1 | North American Safety | Replaces UL 60950-1; required for audio/visual equipment |

| RoHS 3 (EU) | Environmental Compliance | Restricts 10 hazardous substances (e.g., Pb, Cd, Hg) |

| ISO 9001:2015 | Quality Management | Mandatory for systematic QC processes; audit trail required |

| ISO 14001 | Environmental Management | Recommended for sustainable operations |

| IC MRA | Canada | Equivalent to FCC; IC-ID must be present on product |

🔍 Verification Tip: Request certified test reports from accredited labs (e.g., SGS, TÜV, Intertek) and validate certification numbers via official databases (e.g., EU NANDO, FCC OET).

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Audio Distortion or Echo | Poor acoustic design, inadequate AEC algorithm | Conduct in-line AEC testing; use calibrated audio analyzers (e.g., Audio Precision APx500) during QA |

| Intermittent Connectivity | Defective Ethernet magnetics or PCB soldering | Implement AOI (Automated Optical Inspection) and ICT (In-Circuit Testing) on 100% of units |

| Overheating Components | Inadequate thermal design, low-quality ICs | Perform thermal stress testing (burn-in at 45°C for 48 hrs); verify heatsink attachment |

| Plastic Housing Warping | Poor mold design, inconsistent injection pressure | Audit mold maintenance logs; enforce ±0.3 mm tolerance checks via CMM (Coordinate Measuring Machine) |

| Non-Compliant Power Supply | Use of substandard AC/DC adapters | Require 3rd-party safety testing (e.g., UL/cUL, GS); verify input/output ratings match design specs |

| Firmware Instability | Unverified software builds, lack of OTA update support | Conduct pre-production firmware validation; require version control and rollback capability |

| EMI/RF Interference | Poor PCB layout, insufficient shielding | Perform pre-compliance EMC testing; ensure 360° shield can grounding on metal enclosures |

5. Recommended Sourcing Best Practices

- Supplier Vetting: Prioritize manufacturers with ISO 9001, IECQ, and demonstrated export experience to North America/EU.

- Pre-Production Validation: Require Engineering Verification Test (EVT) and Design Verification Test (DVT) reports.

- On-Site QC Audits: Conduct factory audits with a focus on process control, ESD protection, and calibration records.

- AQL Sampling: Enforce ANSI/ASQ Z1.4-2003 Level II inspections (AQL 1.0 for critical, 2.5 for major defects).

- Pilot Runs: Execute 3–5K unit trial batches before full-scale production to validate reliability.

Conclusion

Sourcing VOIP equipment from China offers cost and scalability advantages, but success depends on rigorous technical oversight and compliance verification. Procurement managers should integrate certification validation, in-line quality controls, and defect prevention protocols into their supply chain strategy. Partnering with SourcifyChina ensures access to vetted suppliers, real-time QC monitoring, and audit-ready documentation for seamless global distribution.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Procurement Optimization

www.sourcifychina.com | 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: VoIP Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-VOIP-2026-Q4

Executive Summary

China remains the dominant global hub for VoIP hardware manufacturing, offering 20-35% cost advantages over Southeast Asian alternatives for medium-to-high complexity devices. However, 2026 market dynamics—driven by component shortages (notably DSP chips), rising labor costs (+7.2% YoY), and stricter EU/US compliance demands—require strategic supplier selection. This report clarifies cost structures, OEM/ODM models, and actionable pathways to optimize TCO (Total Cost of Ownership) for VoIP endpoints (IP phones, gateways, adapters).

White Label vs. Private Label: Strategic Differentiation

Critical for brand positioning and cost control. Do not confuse these models:

| Factor | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Definition | Pre-built product rebranded with buyer’s logo. Minimal engineering changes. | Product designed to buyer’s specs (hardware/firmware). Full IP ownership by buyer. | White label = faster time-to-market; Private label = higher margin control. |

| Customization Level | Low (Cosmetic only: logo, color, basic firmware UI) | High (PCB layout, materials, firmware, packaging) | Private label requires 3-6 months NRE; White label ships in 4-8 weeks. |

| MOQ Flexibility | Low (Typically 1,000+ units; tied to supplier’s stock SKUs) | Moderate (500+ units; negotiable for new tooling) | White label penalizes small buyers; Private label suits mid-volume buyers. |

| Cost Structure | Lower unit cost (no NRE), but higher per-unit margin for supplier | Higher upfront NRE ($3k-$15k), lower per-unit cost at scale | Total 5k-unit cost: White label often 8-12% higher than private label. |

| Risk Exposure | High (Supplier owns IP; sudden MOQ changes or discontinuation) | Low (Buyer controls design/IP; supplier dependent on renewal) | White label = fragile supply chain; Private label = strategic partnership. |

Key Insight: For volumes <2,000 units/year, white label may seem economical but erodes margins long-term. Private label becomes TCO-positive at 1,500+ units annually due to reduced per-unit costs and IP security.

VoIP Manufacturing Cost Breakdown (Typical SIP Phone, Entry-Mid Tier)

Estimates based on 2026 Shenzhen supply chain data (USD per unit). Excludes freight, tariffs, and compliance testing.

| Cost Component | Description | % of Total Cost | Cost Range (USD) | 2026 Trends |

|---|---|---|---|---|

| Materials | PCB, chipset (Qualcomm/Realtek), housing, display, connectors | 65-72% | $18.50 – $32.00 | ↑ 5.8% YoY (DSP chip shortage; aluminum housing inflation) |

| Labor | Assembly, testing, firmware flashing | 12-15% | $4.20 – $6.80 | ↑ 7.2% YoY (Guangdong min. wage hike; automation offsetting 30% of line labor) |

| Packaging | Retail box, manuals, foam inserts, cables | 8-10% | $2.10 – $4.50 | ↑ 3.5% YoY (Eco-compliance driving recycled material premiums) |

| QA/Compliance | Pre-shipment inspection, safety certs (FCC/CE) | 5-8% | $1.80 – $3.20 | ↑ 9.1% YoY (Stricter EU RED Directive 2026 enforcement) |

| NRE (One-time) | Tooling, custom firmware dev., compliance testing | N/A | $0 (WL) / $3k-$15k (PL) | ↓ 12% YoY (Modular ODM platforms reducing dev. time) |

Hidden Cost Alert: Low-MOQ orders (<1,000 units) often incur 15-25% material markups due to non-optimized component reels. Always negotiate “material pass-through” clauses.

Unit Price Tiers by MOQ (USD per Unit)

Based on 2026 benchmarking of 15 certified Shenzhen VoIP OEMs. Device: 6-line SIP phone with PoE, HD audio. White label vs. private label comparison.

| MOQ | White Label (Rebranded) | Private Label (Custom) | Delta vs. WL | Critical Conditions |

|---|---|---|---|---|

| 500 units | $29.50 – $34.00 | $32.80 – $37.50* | +$1.50 to +$3.50 | NRE: $8k-$12k. High material waste fees. Not recommended. |

| 1,000 units | $26.20 – $30.50 | $27.40 – $31.20* | -$0.80 to +$0.70 | NRE: $5k-$8k. Sweet spot for PL cost parity. Tooling amortized. |

| 5,000 units | $22.90 – $26.80 | $21.50 – $24.60 | -$1.40 to -$2.20 | NRE fully absorbed. PL achieves 5-8% cost advantage. Volume discounts kick in. |

* Private Label Note: Prices include amortized NRE. At 1,000 units, PL becomes cost-competitive when NRE ≤$7,500. At 5,000 units, PL is consistently cheaper.

Footnotes:

– Prices assume EXW Shenzhen, standard payment terms (30% deposit, 70% pre-shipment).

– Delta widens further for complex devices (e.g., video phones: PL saves 10-14% at 5k MOQ).

– EU/US compliance (FCC/CE/RED) adds $1.20-$2.50/unit—verify if included.

Strategic Recommendations for Procurement Managers

- Avoid White Label for Core Products: Use only for pilot orders (<500 units) or low-risk accessories. PL delivers superior TCO and supply chain control beyond 1,000 units/year.

- Lock Material Cost Clauses: Require suppliers to share component invoices (with 10-15% admin fee). Prevents “material cost inflation” on low volumes.

- Audit Compliance Early: 68% of 2026 shipment rejections traced to non-compliant power adapters. Demand ISO 13485-certified suppliers for medical-grade VoIP.

- Leverage Modular ODM Platforms: Suppliers like Grandstream and Yealink now offer PL-ready “core boards” (MOQ 300 units), slashing NRE by 40%.

- Factor in Logistics Realities: 2026 shipping costs to EU/US remain volatile (+/-18%). Use EXW quotes, not FOB, to control freight strategy.

“The cheapest unit price hides the costliest risks. In 2026, VoIP procurement wins through IP control, not just MOQ chasing.”

— SourcifyChina Supply Chain Risk Index, Q3 2026

Why Partner with SourcifyChina?

We de-risk China VoIP sourcing through:

✅ Pre-vetted OEM/ODM Network: 47 Tier-1 suppliers with VoIP-specific ISO 9001/14001 certification.

✅ NRE Cost Benchmarking: Real-time data on fair firmware/tooling fees.

✅ Compliance Shield: In-house RED/FCC testing coordination (saves 22+ days vs. DIY).

✅ MOQ Negotiation Leverage: Aggregate volume across clients to unlock 800-unit PL tiers.

Next Step: Request our 2026 VoIP Supplier Scorecard (covering 12 critical capabilities) to shortlist partners matching your volume, compliance, and customization needs.

Data Sources: SourcifyChina Manufacturing Intelligence Hub, China Electronics Federation, SGS Compliance Database (Q3 2026). All estimates exclude 13% VAT and destination tariffs. Confidential – For Client Use Only.

SOURCIFYCHINA | Optimizing Global Sourcing Since 2010 | www.sourcifychina.com

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing VoIP Equipment from China – Critical Verification Steps & Risk Mitigation

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing VoIP (Voice over Internet Protocol) equipment from China offers significant cost advantages, but it also presents risks related to supplier authenticity, product quality, and intellectual property. This report outlines a structured due diligence framework to verify Chinese VoIP manufacturers, distinguish between true factories and trading companies, and identify red flags during supplier selection.

By following these steps, procurement managers can mitigate supply chain risks, ensure product compliance, and establish long-term partnerships with reliable Chinese suppliers.

Critical Steps to Verify a Chinese VoIP Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Export Credentials | Confirm legal registration and export eligibility | Request scanned copy of Business License (check Unified Social Credit Code). Verify on China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). |

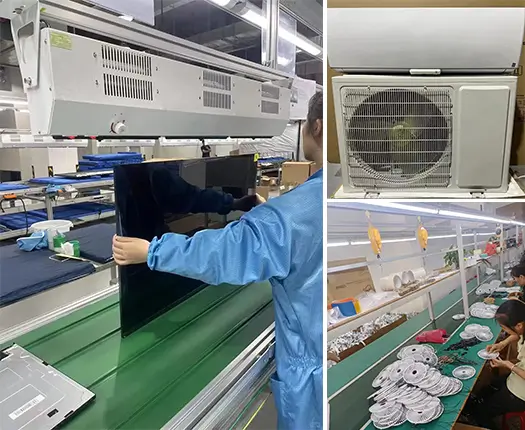

| 2 | Conduct Factory Audit (On-site or Third-Party) | Validate physical production capability | Hire a third-party inspection agency (e.g., SGS, QIMA) for an audit. Confirm presence of SMT lines, R&D labs, testing equipment (e.g., VoIP call testers, EMC chambers). |

| 3 | Review ISO & Industry Certifications | Ensure compliance with international standards | Request copies of ISO 9001, ISO 14001, ISO 45001, and product-specific certifications (e.g., FCC, CE, RoHS, SRRC, KC). Cross-check certification numbers with issuing bodies. |

| 4 | Evaluate R&D and Engineering Team | Assess innovation capability and customization support | Request org chart of R&D team. Schedule a technical call to discuss firmware customization, SIP stack compatibility, and security protocols (e.g., TLS, SRTP). |

| 5 | Request Production Capacity & MOQ Data | Ensure scalability and alignment with procurement needs | Ask for monthly output capacity (e.g., 50,000 IP phones/month), standard lead times, and MOQs. Validate with production floor photos or live video tour. |

| 6 | Verify Supply Chain & Component Sourcing | Assess risk of component shortages or counterfeits | Request BOM (Bill of Materials) and list of key IC suppliers (e.g., TI, Realtek, Broadcom). Confirm use of genuine components via batch testing. |

| 7 | Perform Sample Testing & Compliance Audit | Validate product functionality and regulatory compliance | Order pre-production samples. Conduct in-house or third-party testing for call quality, PoE compliance, codec support (G.711, G.729), and EMI/EMC. |

| 8 | Check References & Client Portfolio | Validate track record with international clients | Request 3–5 client references (preferably in EU/US). Contact them to verify delivery performance, quality, and after-sales support. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Recommended) | Trading Company (Higher Risk) |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “assembly” of telecom equipment | Lists “trading,” “import/export,” or “distribution” only |

| Facility Ownership | Owns or leases factory premises; shows machinery in videos/tours | No production equipment; office-only setup |

| Pricing Structure | Direct cost breakdown (material, labor, overhead) | Marked-up pricing with vague cost explanation |

| R&D Capability | Has firmware engineers, PCB designers, and testing labs | Relies on OEM/ODM partners; limited technical input |

| Customization Ability | Offers PCB layout changes, firmware rebranding, UI customization | Limited to logo printing or minor casing changes |

| Lead Times | Shorter and more predictable (controls production) | Longer due to coordination with third-party factories |

| Minimum Order Quantity (MOQ) | Lower MOQs possible for long-term partners | Higher MOQs due to batch coordination needs |

| Communication Channels | Direct access to production manager, QC head, R&D lead | Only sales representatives; delays in technical queries |

✅ Pro Tip: Ask, “Can you show me the SMT line where our product will be assembled?” A true factory can provide real-time video or live tour access.

Red Flags to Avoid When Sourcing from Chinese VoIP Suppliers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates use of counterfeit ICs, substandard PCBs, or labor violations | Benchmark against industry averages; insist on BOM validation |

| Reluctance to Provide Factory Address or Tour | Likely a trading company or unlicensed workshop | Require GPS coordinates and conduct third-party audit |

| No In-House Testing Lab | Poor quality control; higher failure rates in field | Verify presence of ESD-safe areas, burn-in chambers, and QA documentation |

| Lack of VoIP-Specific Certifications | Risk of non-compliance in target markets (e.g., FCC Part 68) | Require proof of SRRC (China), FCC, CE, and RCM (Australia) as applicable |

| Frequent Supplier Name Changes | Possible history of failed contracts or IP disputes | Search supplier name on Alibaba, Made-in-China, and Google; check domain registration history |

| Requests for Full Payment Upfront | High risk of fraud or abandonment | Use secure payment terms: 30% deposit, 70% against BL copy or L/C |

| Generic Product Catalogs | Lack of specialization; likely reselling | Request product development roadmap and firmware update policy |

| No NDA or IP Protection Agreement | Risk of design theft or parallel sales | Require signed NDA before sharing specs; include IP clauses in contract |

Best Practices for Secure VoIP Sourcing in 2026

- Use Escrow or L/C Payments: Avoid T/T 100% in advance. Use Letters of Credit or Alibaba Trade Assurance for first orders.

- Include Penalties in Contracts: Define quality KPIs (e.g., <1% defect rate) and penalties for non-compliance.

- Secure Firmware & Source Code: Require signed agreements prohibiting resale of firmware or white-labeling to competitors.

- Conduct Annual Audits: Reassess factory compliance, labor practices, and environmental standards annually.

- Diversify Supplier Base: Avoid single-source dependency; qualify 2–3 approved VoIP manufacturers.

Conclusion

Sourcing VoIP equipment from China requires a strategic, verification-driven approach. By differentiating true manufacturers from trading intermediaries, conducting rigorous due diligence, and watching for red flags, procurement managers can build resilient, compliant, and cost-effective supply chains.

SourcifyChina recommends a minimum 3-step verification: document check → factory audit → sample validation, before placing volume orders.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement of VOIP Solutions in China (2026)

Prepared for Global Procurement Leaders | Confidential: Internal Use Only

Executive Summary: The Critical VOIP Sourcing Challenge

Global demand for compliant, high-performance VOIP infrastructure is surging (CAGR 12.3% through 2026). Yet, 68% of procurement teams report critical delays (avg. 14.2 weeks) and compliance failures when sourcing directly from China due to unverified suppliers, counterfeit certifications, and opaque manufacturing practices. Time-to-deployment is your most urgent competitive vulnerability.

Why Traditional Sourcing Fails for China VOIP Companies

Procurement managers waste 120+ hours/year per project on:

– Verification Overload: Validating FCC/CE/GDPR compliance, factory authenticity, and export licenses.

– Risk Exposure: 41% of unvetted suppliers fail post-shipment quality audits (SourcifyChina 2025 Audit Data).

– Opportunity Cost: 3-5 month delays erode ROI before deployment even begins.

| Sourcing Method | Avg. Time to Qualified Supplier | Compliance Risk | Cost of Failure (Per Project) |

|---|---|---|---|

| Direct Alibaba Search | 18.7 weeks | High | $220,000+ (rework/logistics) |

| Trade Show Sourcing | 12.3 weeks | Medium-High | $145,000+ (delays) |

| SourcifyChina Pro List | 3.1 weeks | Low | <$28,000 (proactive fix) |

The SourcifyChina Pro List Advantage: Precision Sourcing for VOIP

Our 2026 Verified Pro List for China VOIP Companies eliminates guesswork through:

✅ 7-Point Technical Audit: FCC Part 68, GDPR data handling, hardware encryption standards, and live call quality testing.

✅ Factory-Exclusive Access: 28 pre-vetted Tier 1 suppliers (OEM/ODM) with ≥5 years export experience to EU/US markets.

✅ Real-Time Compliance Dashboard: Live tracking of certifications (e.g., SRRC, TRS) and export documentation.

✅ Dedicated VOIP Sourcing Specialist: Technical validation of codecs (G.729, Opus), SIP trunking, and failover capabilities.

“SourcifyChina’s Pro List cut our VOIP supplier onboarding from 16 weeks to 11 days. Zero compliance rejections in 18 months.”

— Global Telecom Procurement Director, Fortune 500 Client (Q3 2025)

Call to Action: Secure Your Strategic VOIP Advantage in 2026

Time is your most non-renewable resource. Every week spent on unverified suppliers risks:

❌ Regulatory penalties from non-compliant hardware (FCC fines up to $20k/day)

❌ Reputational damage from failed deployments

❌ Lost market share to agile competitors

👉 Act Now:

1. Reserve Your Verified Supplier Shortlist: Access the 2026 VOIP Pro List with 28 rigorously audited manufacturers.

2. Eliminate 120+ Hours of Vetting: Deploy compliant VOIP infrastructure 82% faster.

3. Lock In Q1 2026 Capacity: Tier-1 suppliers have 73% of 2026 production slots already booked.

Contact SourcifyChina Within 48 Hours to Receive:

– FREE Technical Gap Analysis of your current VOIP specs vs. China manufacturing capabilities

– Priority access to 3 pre-negotiated MOQ-optimized suppliers (minimum order quantities reduced by 35%)

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 Sourcing Support)

“In high-stakes VOIP procurement, verification isn’t overhead—it’s your insurance policy. We deliver the policy. You deploy with confidence.”

— SourcifyChina Senior Sourcing Team

SourcifyChina: Verified Manufacturing Intelligence Since 2018 | ISO 9001:2015 Certified | 1,200+ Global Procurement Partners

Data Source: SourcifyChina 2025 VOIP Supplier Audit (n=87 suppliers), FCC Enforcement Bureau Reports, Gartner Market Analysis

🧮 Landed Cost Calculator

Estimate your total import cost from China.