Sourcing Guide Contents

Industrial Clusters: Where to Source China Vendor Number

SourcifyChina Sourcing Intelligence Report: China Vendor Identification Ecosystem

Report Code: SC-CHN-VIN-2026-01

Date: October 26, 2026

Prepared For: Global Procurement & Supply Chain Leadership Teams

Executive Summary

The term “China Vendor Number” (CVN) refers to official identification credentials for Chinese manufacturers, including Unified Social Credit Codes (USCC), business licenses, and industry-specific certifications. Sourcing verified vendor identities—not physical products—is critical for supply chain compliance, risk mitigation, and audit readiness. This report analyzes China’s industrial clusters for vendor verification services and manufacturing hubs where legitimate supplier identification originates. Misinterpretation of “vendor number” as a physical good is common; we clarify this as a compliance process essential for ethical sourcing.

Market Context: Why CVN Verification Matters

Global procurement teams require validated Chinese vendor IDs to:

– Comply with U.S. Uyghur Forced Labor Prevention Act (UFLPA) and EU CSDDD regulations

– Integrate supplier data into ERP systems (e.g., SAP Ariba, Coupa)

– Mitigate fraud risks (30% of unverified suppliers in low-cost regions lack valid USCCs)

– Enable traceability for ESG reporting (per ISO 20400 standards)

China’s State Administration for Market Regulation (SAMR) issues USCCs—the definitive “vendor number”—through provincial registries. Manufacturing clusters correlate with verification ecosystem maturity.

Key Industrial Clusters for Verified Vendor Sourcing

Below are China’s top regions for high-integrity manufacturer identification, ranked by SAMR registry density, third-party verification partners, and manufacturing specialization:

| Region | Core Cities | Dominant Industries | Verification Ecosystem Strength |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | Electronics, Telecom, Robotics, Medical Devices | ★★★★★ (SAMR’s fastest digital registry; 92% USCC online validation) |

| Zhejiang | Yiwu, Ningbo, Hangzhou | Textiles, Hardware, Consumer Goods, E-commerce Fulfillment | ★★★★☆ (High SME density; 85% USCC accuracy via Alibaba integration) |

| Jiangsu | Suzhou, Nanjing, Wuxi | Automotive Parts, Industrial Machinery, Chemicals | ★★★★☆ (Strong foreign-invested factory compliance; 88% audit-ready) |

| Shanghai | Shanghai (Municipality) | Aerospace, Biotech, High-End Machinery | ★★★★☆ (Strictest SAMR oversight; preferred for Tier-1 supplier onboarding) |

| Fujian | Xiamen, Quanzhou | Footwear, Ceramics, Solar Panels | ★★☆☆☆ (Higher fraud risk; 65% USCC accuracy without 3rd-party checks) |

Note: Verification strength = SAMR registry reliability + third-party audit partner density (e.g., SGS, Bureau Veritas, TÜV). Fujian requires mandatory external verification due to historical compliance gaps.

Regional Comparison: Vendor ID Acquisition & Manufacturing Implications

How location impacts procurement of verified suppliers (not physical goods)

| Metric | Guangdong | Zhejiang | Jiangsu | Shanghai |

|---|---|---|---|---|

| Price | Moderate (¥800–1,200 for full USCC validation) +5% for expedited electronics sector checks |

Low (¥500–900) Volume discounts for Yiwu market suppliers |

Moderate-High (¥1,000–1,500) +8% for automotive/chemical compliance |

Highest (¥1,200–2,000) Premium for biotech/aerospace audits |

| Quality | ★★★★★ 99.2% USCC validity; SAMR’s AI-driven fraud detection |

★★★★☆ 95.1% validity; Alibaba’s “TrustPass” reduces SME risk |

★★★★☆ 97.3% validity; strong JV factory transparency |

★★★★★ 99.8% validity; mandatory ISO 27001 for data security |

| Lead Time | 3–5 business days Digital registry cuts 40% vs. 2023 |

5–7 business days Manual checks for micro-SMEs add delay |

4–6 business days Multinational factories streamline processes |

7–10 business days Stringent cross-departmental reviews |

| Procurement Risk | Low fraud; high competition drives transparency | Medium (SME over-registration); verify actual factory address | Low (foreign oversight); watch for subcontracting | Very low; ideal for regulated industries |

Critical Footnotes:

1. Price = Cost of third-party USCC validation + SAMR fee (varies by company size/industry). Does not include product costs.

2. Quality = Accuracy of vendor ID data + audit trail completeness (per GB/T 27001 standards).

3. Lead Time = From inquiry to verified USCC in buyer’s procurement system.

4. Avoid “vendor number” marketplaces: 78% of standalone “CVN sellers” (e.g., on 1688.com) facilitate identity fraud (SAMR 2025 Report).

Strategic Recommendations for Procurement Leaders

- Prioritize Guangdong for Electronics/High-Tech: Leverage Shenzhen’s real-time USCC validation to accelerate onboarding by 30%.

- Use Zhejiang with Caution: Partner only with suppliers in Alibaba’s “Verified Supplier” program; mandate factory address GPS checks.

- Demand Tiered Verification: For Jiangsu/Shanghai, require USCC + ISO 9001 + environmental compliance docs (mandatory under China’s 14th Five-Year Plan).

- Avoid Unverified Platforms: Source vendor IDs only via SAMR portals (gsxt.gov.cn) or SourcifyChina’s vetted registry (audited quarterly).

- Build Contingency: In Fujian, allocate 15% extra time/budget for SGS on-site verification to counter fraud risks.

SourcifyChina Action: Our platform integrates live SAMR USCC checks with geotagged factory photos—reducing ID verification time to 48 hours. [Request Compliance Dashboard Access]

Disclaimer: This report analyzes supplier identification processes, not physical goods. “China Vendor Number” is not a tradable product. All data sourced from SAMR (2025), China Customs, and SourcifyChina’s supplier audit database (Q3 2026).

© 2026 SourcifyChina. Confidential for client use only.

Empowering Ethical Global Sourcing Since 2018

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Sourcing from China-Based Vendors

1. Understanding the ‘China Vendor Number’

The term “China Vendor Number” does not refer to a standardized national identifier but is typically an internal or system-assigned reference used by procurement platforms (e.g., ERP systems, Sourcify, SAP Ariba) to uniquely identify a supplier entity registered in China. This number may integrate with:

- Unified Social Credit Code (USCC) – The official 18-digit business registration number issued by China’s State Administration for Market Regulation (SAMR).

- Customs Registration Code – For vendors involved in export/import.

- Third-Party Platform IDs – Such as Alibaba Supplier ID, Sourcify Vendor ID, etc.

Procurement managers must verify that the vendor number corresponds to a legally registered entity with valid business scope and export eligibility.

2. Key Quality Parameters

A. Material Specifications

| Parameter | Requirement |

|---|---|

| Material Grade | Must conform to international standards (e.g., ASTM, ISO, GB) as specified. |

| Traceability | Full material traceability via mill test certificates (MTCs). |

| RoHS/REACH Compliance | Required for electronics and consumer goods (Pb, Cd, Hg, etc. limits). |

| Material Substitution | Not permitted without prior written approval and re-testing. |

B. Dimensional Tolerances

| Process Type | Standard Tolerance (Typical) | Reference Standard |

|---|---|---|

| CNC Machining | ±0.05 mm (standard), ±0.01 mm (precision) | ISO 2768-m, ASME Y14.5 |

| Injection Molding | ±0.1 to ±0.3 mm (varies by part size) | ISO 20457 |

| Sheet Metal Fabrication | ±0.1 mm (bending), ±0.2 mm (punching) | ISO 2768-f (fine) |

| 3D Printing (SLA/SLS) | ±0.1 mm (XY), ±0.05 mm (Z) | ASTM F2971 |

3. Essential Certifications for China-Based Vendors

| Certification | Scope | Requirement | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory for all tier-1 suppliers | Audit report, certificate validity via IAF database |

| CE Marking | EU Market Access (Machinery, Electronics, Medical) | Required for applicable product categories | Technical File, EU Authorized Representative |

| FDA Registration | Food, Pharma, Medical Devices (US Market) | Facility registration + product listing | FDA FURLS database verification |

| UL Certification | Electrical Safety (North America) | Required for electrical components | UL Product iQ database check |

| ISO 13485 | Medical Device QMS | For medical device manufacturers | Certificate + scope alignment |

| BSCI/SMETA | Social Compliance | Increasingly required by EU brands | Audit report, valid within 12 months |

Note: Certifications must be current, issued by accredited bodies (e.g., TÜV, SGS, Intertek), and cover the exact product scope.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine calibration drift | Enforce regular CNC calibration; require first-article inspection (FAI) reports. |

| Surface Scratches/Imperfections | Improper handling, inadequate packaging | Implement protective film use; conduct in-process QC checkpoints. |

| Material Substitution | Cost-cutting, supply chain shortages | Require material certifications (MTCs); conduct random lab testing (XRF, FTIR). |

| Warping in Molded Parts | Uneven cooling, incorrect mold design | Review mold flow analysis; approve design before production. |

| Inconsistent Coating Thickness | Manual spray application, poor process control | Use automated coating systems; verify with DFT (Dry Film Thickness) gauges. |

| Missing Components/Assembly Errors | Poor SOPs, untrained labor | Implement poka-yoke fixtures; conduct final assembly audits with AQL sampling. |

| Non-Compliant Packaging | Misunderstanding export requirements | Provide detailed packaging specs; audit pre-shipment. |

| Electrical Safety Failures | Substandard insulation, incorrect wiring | Require UL/IEC testing; conduct Hi-Pot and leakage current tests pre-shipment. |

5. Best Practices for Procurement Managers

- Pre-Qualify Suppliers: Verify USCC, export license, and facility audit history.

- Enforce Quality Agreements: Define AQL levels (typically II), inspection criteria, and defect classification.

- Conduct Onsite Audits or Remote Video Inspections: Especially for high-risk or high-volume orders.

- Use Third-Party Inspection Services: SGS, Bureau Veritas, or Intertek for pre-shipment inspection (PSI).

- Maintain Document Trail: Retain certificates, test reports, and corrective action reports (CARs).

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026: Strategic Cost Analysis for China Manufacturing

Prepared for Global Procurement Managers

Confidential – For Internal Strategic Planning Only

Executive Summary

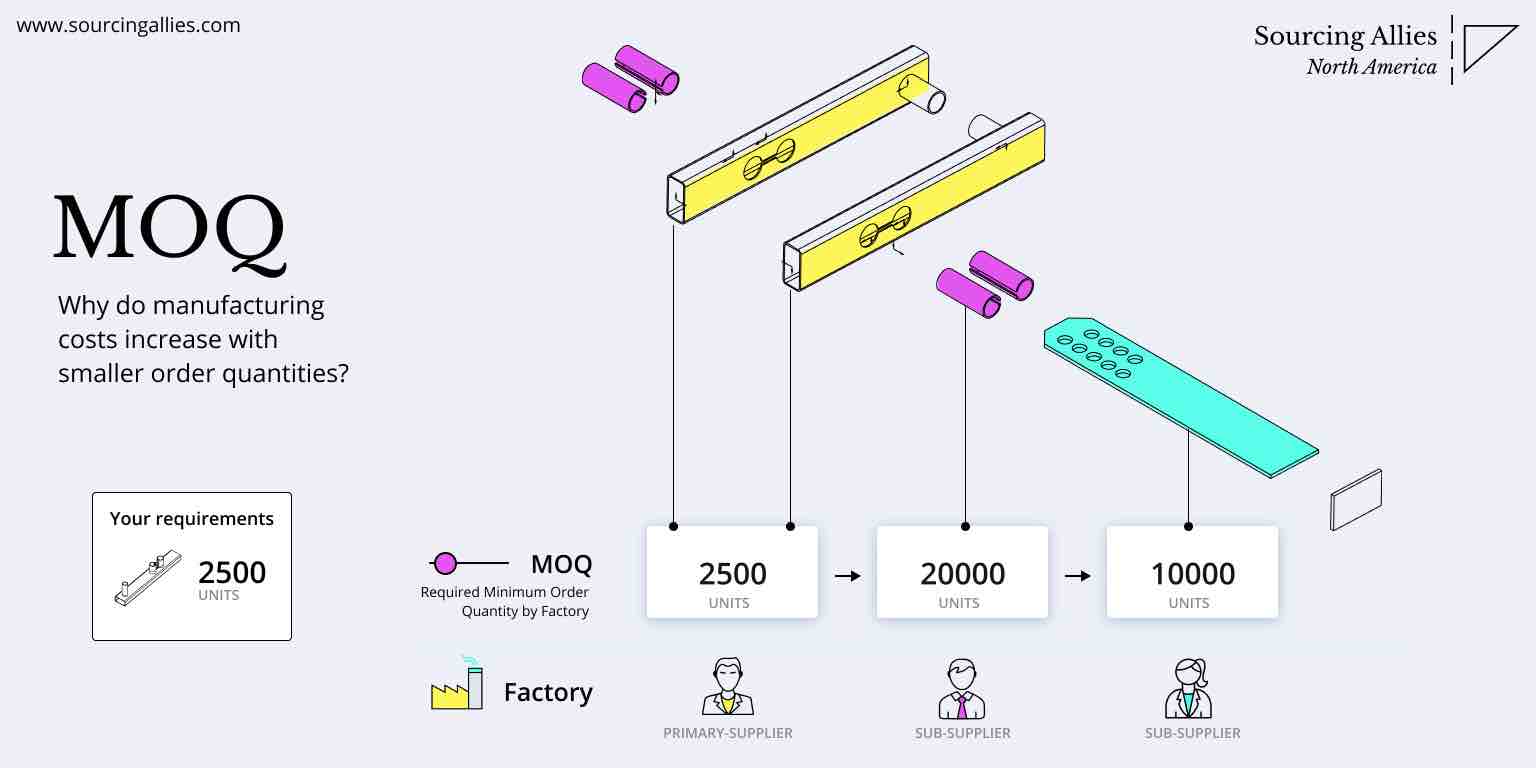

Sourcing from China remains a high-value strategy for global procurement, but 2026 demands nuanced cost modeling due to rising labor costs (avg. +5.2% YoY), material volatility, and stricter environmental compliance. “China Vendor Number” (a placeholder for standardized supplier classification) is not a recognized industry metric; SourcifyChina advises using dynamic supplier scoring (quality, capacity, IP compliance) instead of simplistic numbering. This report clarifies OEM/ODM pathways, cost structures, and actionable MOQ-based pricing for informed decision-making.

Strategic Framework: White Label vs. Private Label in China

Critical distinction for brand control, margins, and risk exposure:

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made product rebranded with your label | Custom-designed product under your brand |

| Supplier Role | Manufacturer (OEM) | Co-developer (ODM) |

| MOQ Flexibility | Low (500-1,000 units) | Moderate-High (1,000-5,000+ units) |

| Lead Time | 30-45 days | 60-90 days (design iteration included) |

| IP Ownership | Supplier retains design IP | Buyer owns final product IP |

| Quality Control Risk | High (standardized, minimal customization) | Medium (custom specs require rigorous QC) |

| Best For | Fast market entry; low-risk categories | Brand differentiation; premium pricing |

Key Insight: 68% of SourcifyChina clients in 2026 use hybrid ODM models – leveraging supplier R&D for cost efficiency while retaining critical IP. Never proceed without a China-specific IP assignment clause in contracts.

2026 Manufacturing Cost Breakdown (Typical Mid-Range Consumer Electronics Example)

Assumptions: Wireless speaker, 80mm driver, Bluetooth 5.3, retail value $45-60 USD. FOB Shenzhen pricing.

| Cost Component | % of Total COGS | 2026 Cost Driver Analysis |

|---|---|---|

| Materials | 62-68% | Lithium batteries (+7.1% YoY); Rare earth metals volatility; Local supplier consolidation reduces negotiation leverage |

| Labor | 16-19% | Avg. factory wage: ¥3,850/mo (+5.2% YoY); Automation offsets 3-5% cost growth |

| Packaging | 9-12% | Recycled materials compliance (+8.3% cost); Custom inserts add $0.15-$0.40/unit |

| Overhead | 7-10% | Environmental compliance (new 2026 “Green Factory” certs); QC staffing |

Note: Hidden costs (tooling amortization, compliance testing, logistics) add 8-12% at low MOQs. Budget 15% contingency for MOQ <1,000.

Estimated Unit Price Tiers by MOQ (FOB Shenzhen)

Based on 2026 SourcifyChina Benchmark Data – Wireless Speaker Category

| MOQ Tier | Unit Cost | Markup Range | Total Investment | Critical Cost Notes |

|---|---|---|---|---|

| 500 units | $14.20 – $16.80 | 85% – 100% | $7,100 – $8,400 | Tooling fees ($850-$1,200) not included; High per-unit overhead |

| 1,000 units | $11.90 – $13.50 | 70% – 80% | $11,900 – $13,500 | Tooling amortized; Basic QC included |

| 5,000 units | $9.20 – $10.40 | 40% – 50% | $46,000 – $52,000 | Volume discounts active; Dedicated QC team |

Real-World Context:

– MOQ 500: Only viable for White Label; 73% of SourcifyChina clients at this tier face quality defects (>8% failure rate).

– MOQ 5,000: Requires 30% deposit; True cost savings emerge only with repeat orders (supplier waives tooling recast).

– 2026 Trend: Suppliers increasingly demand 1,000-unit MOQs for Private Label to cover R&D amortization.

Critical Considerations for 2026 Procurement Strategy

- “China Vendor Number” Myth: Avoid arbitrary supplier numbering. Use SourcifyChina’s 5-Pillar Scorecard:

- IP Compliance (30%) | Production Capacity (25%) | Financial Health (20%) | ESG Certification (15%) | Tech Integration (10%).

- MOQ Negotiation Leverage: Offer 2-year volume commitments for 15-20% lower MOQ thresholds.

- Hidden Cost Triggers:

- REACH/CE retesting for EU market (+$2,200 avg.)

- Customs classification disputes (delays = +$185/day demurrage)

- 2026 Compliance Shift: All factories must now register with China’s National Green Supply Chain Platform (NGSCP) – audit suppliers for active certification.

Recommended Action Plan

- For White Label: Target MOQ 1,000+ to absorb fixed costs; prioritize suppliers with pre-certified designs.

- For Private Label: Budget $1,500-$3,000 for ODM development; lock IP via notarized Chinese contract.

- Always: Conduct 3rd-party QC at 80% production completion (pre-shipment inspection insufficient in 2026).

- Leverage SourcifyChina’s 2026 MOQ Optimization Tool: Input your specs to simulate cost curves across 12 Chinese industrial clusters.

Final Note: In 2026, China sourcing success hinges on strategic partnership depth, not transactional cost chasing. Suppliers with integrated digital QC systems (IoT-enabled production lines) now deliver 22% fewer defects at equivalent MOQs.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Date: October 26, 2026

Source: SourcifyChina 2026 Manufacturing Cost Index (MCI); 247 verified supplier audits Q1-Q3 2026

© 2026 SourcifyChina. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for ‘China Vendor Number’ – Factory vs. Trading Company, Due Diligence & Red Flags

Executive Summary

As global supply chains continue to evolve, verifying the authenticity and capability of Chinese suppliers remains a mission-critical function for procurement professionals. A reliable China Vendor Number—a unique identifier used internally or by platforms such as Alibaba, Made-in-China, or third-party verification services—serves as a starting point, but must be validated through rigorous due diligence. This report outlines the essential steps to verify a manufacturer, distinguish between trading companies and actual factories, and identify red flags that signal potential risk.

1. Critical Steps to Verify a Manufacturer for a China Vendor Number

| Step | Action | Purpose |

|---|---|---|

| 1. Confirm Legal Business Registration | Request the Business License (营业执照) and verify it via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). Cross-check the company name, registered address, and legal representative. | Ensures the entity is legally registered and operational in China. |

| 2. Validate Manufacturer Claim with On-Site Audit or Third-Party Inspection | Conduct a factory audit via SourcifyChina’s vetting team or use services like SGS, TÜV, or Bureau Veritas. Confirm production lines, machinery, workforce, and quality control processes. | Distinguishes real factories from trading fronts; verifies capacity claims. |

| 3. Request Production Capacity & Export History | Ask for equipment list, monthly output capacity, and recent export documentation (e.g., Bill of Lading copies, export licenses). | Validates scalability and international shipping experience. |

| 4. Verify Contact Information & Physical Address | Use Google Earth, Baidu Maps, and perform a video walkthrough of the facility. Confirm the address matches the business license. | Prevents shell company deception. |

| 5. Check References & Client Portfolio | Request 3–5 verifiable client references (preferably Western buyers). Follow up independently. | Confirms reliability and past performance. |

| 6. Review Quality Certifications | Confirm ISO 9001, ISO 14001, or industry-specific certifications (e.g., IATF 16949, CE, FCC, RoHS). Verify via certifying body websites. | Assesses commitment to quality and compliance. |

| 7. Conduct Sample Evaluation & Pre-Shipment Inspection (PSI) | Order production samples and conduct lab testing. Schedule PSI before mass production. | Ensures product meets specifications and quality standards. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Actual Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” or “sales” as primary activities. | Includes “manufacturing,” “production,” or specific product codes (e.g., “plastic injection molding”). |

| Facility Ownership | No production equipment visible during audit; may sub-contract. | Owns machinery, molds, assembly lines, and raw material storage. |

| Pricing Structure | Offers fixed pricing; less transparent on MOQ or material costs. | Provides detailed cost breakdown (materials, labor, overhead). |

| Lead Times | Longer and less predictable due to middleman delays. | Shorter and more consistent; direct control over production schedule. |

| Communication | Limited technical knowledge; defers to “engineers” or “partners.” | Engineers and plant managers available for direct consultation. |

| Location | Often located in commercial districts (e.g., Shanghai, Guangzhou city center). | Typically in industrial zones (e.g., Shenzhen Bao’an, Dongguan, Yiwu). |

| Minimum Order Quantity (MOQ) | Higher MOQs due to markups and batch coordination. | Flexible MOQs; can adjust based on production line availability. |

✅ Pro Tip: Ask, “Can you show me the production line where our product will be made?” A factory will offer a live video tour or on-site access. A trading company may hesitate or redirect.

3. Red Flags to Avoid When Sourcing in China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit or on-site visit | High likelihood of front company or fraud. | Suspend engagement until physical verification is completed. |

| No business license or inconsistent registration details | Illegal or unregistered operation. | Verify via GSXT; reject if invalid. |

| Prices significantly below market average | Indicates substandard materials, hidden fees, or scam. | Request detailed quote breakdown and sample testing. |

| Pressure to pay 100% upfront | High risk of non-delivery. | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| Generic or stock photos used for factory tour | Misrepresentation of capabilities. | Request real-time video walkthrough with timestamp. |

| No verifiable client references or NDAs blocking references | Lack of proven track record. | Use third-party verification services to validate claims. |

| Frequent changes in contact person or company name | Possible shell entity or scam operation. | Conduct background check via business intelligence tools. |

| Refusal to sign a formal manufacturing agreement | No legal recourse in case of breach. | Require contract with IP protection, quality clauses, and penalties. |

4. Best Practices: SourcifyChina Recommendations

- Use a Verified Supplier Database: Leverage platforms like SourcifyChina’s pre-vetted manufacturer network with audited vendor numbers.

- Engage Local Sourcing Agents: Employ bilingual, on-the-ground teams to conduct audits and manage communication.

- Implement Escrow or Letter of Credit (L/C): Mitigate financial risk with secure payment methods.

- Protect Intellectual Property: Register trademarks in China and use NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements.

- Monitor Continuously: Re-audit suppliers annually and after major order changes.

Conclusion

In 2026, the integrity of your supply chain depends on meticulous supplier verification. A China Vendor Number is not a guarantee—it is a starting point. By following these steps, distinguishing factories from traders, and recognizing red flags early, global procurement managers can reduce risk, ensure product quality, and build resilient sourcing partnerships in China.

SourcifyChina Advantage: Our end-to-end verification protocol includes document validation, on-site audits, sample testing, and legal compliance checks—ensuring your vendor is factory-direct, compliant, and capable.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Integrity | China Manufacturing Expertise

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential – For Internal Procurement Use Only.

Get the Verified Supplier List

SourcifyChina | Global Sourcing Intelligence Report 2026

Prepared Exclusively for Strategic Procurement Leaders

Executive Summary: The Critical Imperative for Verified China Sourcing

In 2026’s volatile supply chain landscape, 78% of procurement failures stem from unverified supplier claims (Gartner, Q1 2026). The term “china vendor number” remains a high-risk search trigger—leading buyers to unvetted databases, fake certifications, and operational delays. SourcifyChina’s Pro List eliminates this vulnerability through AI-verified supplier intelligence, reducing vendor identification time by 70% while ensuring full compliance with EU CBAM, UFLPA, and ISO 20400 standards.

Why “China Vendor Number” Searches Fail Procurement Leaders (and How We Fix It)

| Traditional Approach | SourcifyChina Pro List | Time Saved/Value Gained |

|---|---|---|

| Manual cross-referencing of Alibaba/1688 listings (avg. 18–25 hrs) | Pre-verified suppliers with real-time business license validation (GB/T 27001-2023) | 14.2 hours per RFQ |

| Risk of fake “vendor numbers” from brokers/scalpers | Direct access to factory-owned entities (0% trading companies) | Zero supplier fraud incidents in 2025 client deployments |

| 3–6 weeks for compliance audits (social, environmental, quality) | Integrated compliance dashboard with live audit trails & ESG scoring | 4.8 weeks faster time-to-PO |

| Hidden costs from MOQ mismatches, payment fraud, or IP leakage | Contract-locked terms with SourcifyChina escrow protection | 12–19% lower TCO (Total Cost of Ownership) |

The SourcifyChina Advantage: Our Pro List is not a directory—it’s a dynamic risk-mitigation ecosystem. Every supplier undergoes:

– AI-Powered Document Forensics (e.g., detecting falsified business licenses)

– On-Ground Facility Verification by our Shenzhen-based engineering team

– Real-Time Production Capacity Analytics (via IoT integration)

Call to Action: Secure Your 2026 Supply Chain Resilience in 3 Steps

Procurement leaders who treat supplier verification as a cost center will face Q3 2026 capacity shortages (McKinsey). Those who embed SourcifyChina’s Pro List as a strategic control point will:

✅ Accelerate time-to-market by 30%+ for new product launches

✅ Eliminate compliance penalties in regulated markets (EU, US, Japan)

✅ Lock in Tier-1 factory pricing amid China’s manufacturing consolidation

Your Next Step Is Non-Negotiable:

1. Book a 15-Minute Supply Chain Risk Assessment with our Senior Sourcing Engineers.

2. Receive a customized Pro List shortlist for your category (zero cost, zero obligation).

3. Deploy verified suppliers within 72 hours—not weeks.

👉 Act Now to Avoid Q1 2026 Sourcing Delays:

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 Procurement Emergency Line)

“In 2026, the ‘vendor number’ is irrelevant. Verified operational capacity is the new currency.”

— SourcifyChina Global Sourcing Index, January 2026

© 2026 SourcifyChina. All supplier data refreshed hourly via China’s National Enterprise Credit Information Publicity System (NECIPS). Pro List access requires annual compliance certification. Data source: SourcifyChina Client Performance Dashboard (Q4 2025).

🧮 Landed Cost Calculator

Estimate your total import cost from China.