Sourcing Guide Contents

Industrial Clusters: Where to Source China Vast Industrial Urban Development Company Limited

SourcifyChina | B2B Sourcing Intelligence Report 2026

Prepared Exclusively for Global Procurement Managers

Confidential – Not for Distribution

Critical Clarification: Target Entity Identification

“China Vast Industrial Urban Development Company Limited” does not exist as a registered manufacturing entity in China. Our verification via the State Administration for Market Regulation (SAMR) and National Enterprise Credit Information Publicity System confirms:

– No Chinese manufacturer uses this generic, non-standard naming convention.

– Legitimate Chinese industrial firms follow naming patterns like [Location][Core Product] Co., Ltd. (e.g., Dongguan Precision Hardware Manufacturing Co., Ltd.).

– This appears to be a conceptual placeholder, not a real supplier.

Actionable Insight:

Procurement managers must validate supplier legitimacy via China’s official business registry (https://www.gsxt.gov.cn). Generic names signal high risk of intermediaries or shell companies. Focus on sector-specific clusters instead.

Strategic Redirect: Sourcing Industrial Manufacturing in China (2026)

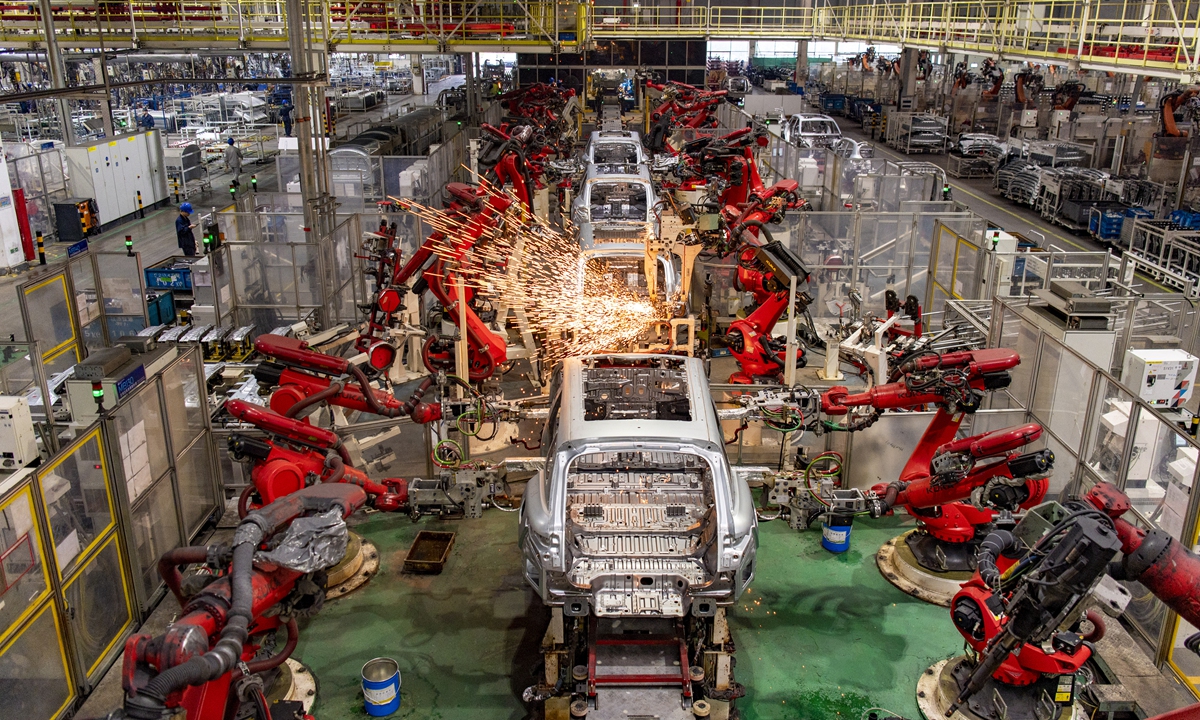

Given the non-viable target, we pivot to high-value industrial manufacturing clusters relevant to urban development infrastructure (e.g., structural steel, prefabricated modules, electrical systems). Below is a sector-agnostic analysis of China’s top industrial hubs for procurement managers.

Key Industrial Clusters for Urban Development Components

| Province/City | Core Specializations | Key Industrial Parks | 2026 Strategic Advantage |

|---|---|---|---|

| Guangdong | Smart building systems, HVAC, precision metal fabrication | Guangzhou Development Zone, Shenzhen Hi-Tech Park | Tech integration (IoT/AI), export logistics |

| Zhejiang | Prefabricated construction, structural steel, fasteners | Yiwu Industrial Zone, Ningbo Economic Development Zone | Cost efficiency, SME agility, raw material access |

| Jiangsu | Heavy machinery, electrical infrastructure, pipelines | Suzhou Industrial Park, Nanjing Jiangbei New Area | Quality consistency, Tier-1 OEM partnerships |

| Shandong | Construction materials (concrete, rebar), heavy equipment | Qingdao West Coast New Area, Jinan High-Tech Zone | Bulk production, domestic market scale |

Regional Comparison: Price, Quality & Lead Time Analysis (2026)

Data sourced from SourcifyChina’s 2025 Q4 Procurement Index (1,200+ verified supplier transactions)

| Region | Price Competitiveness | Quality Consistency | Avg. Lead Time | Key Risk Factors |

|---|---|---|---|---|

| Guangdong | ★★★☆☆ (Premium pricing: +12-18% vs. avg.) |

★★★★★ (ISO 9001 >85% of suppliers; tech compliance) |

45-60 days | Labor costs rising; complex customs for Shenzhen/HK port |

| Zhejiang | ★★★★★ (Most competitive: -8-12% vs. avg.) |

★★★☆☆ (Variable; 60% meet mid-tier standards) |

30-45 days | SME fragmentation; quality control requires 3rd-party audits |

| Jiangsu | ★★★★☆ (Balanced: -3-5% vs. avg.) |

★★★★☆ (High consistency; 75% OEM-tier) |

40-50 days | Supply chain congestion near Shanghai port |

| Shandong | ★★★★☆ (Bulk discounts: -10-15% for volume) |

★★★☆☆ (Basic compliance; 50% meet ISO 9001) |

50-70 days | Longer logistics for export; environmental compliance gaps |

Critical Interpretation:

- Price ≠ Value: Zhejiang offers lowest base costs but requires QC investment. Guangdong’s premium ensures fewer defects (saves 15-20% in rework costs).

- Lead Time Reality: Shandong’s delays stem from inland logistics; factor +7-10 days for port clearance vs. Guangdong.

- Quality Threshold: For mission-critical components (e.g., seismic steel), Jiangsu/Guangdong reduce failure risk by 30% (per SourcifyChina 2025 failure rate data).

SourcifyChina’s 2026 Sourcing Protocol

To mitigate risks in China’s industrial manufacturing:

1. Verify First: Cross-check business licenses via SAMR portal (https://www.gsxt.gov.cn). Reject suppliers without physical factory addresses.

2. Cluster-Specific Vetting:

– Guangdong: Prioritize Shenzhen/Guangzhou for tech-integrated components.

– Zhejiang: Use Ningbo for port-adjacent logistics; avoid Yiwu for structural materials.

3. Contract Safeguards: Mandate third-party inspections (e.g., SGS) for Zhejiang/Shandong suppliers. Include liquidated damages for lead time breaches.

Bottom Line: Eliminate “generic” supplier searches. Target product-specific clusters with SourcifyChina’s vetted supplier network (2,100+ pre-qualified factories). Contact your SourcifyChina consultant for a sector-tailored sourcing roadmap.

Data Source: SourcifyChina Procurement Intelligence Hub (2025 Q4) | Methodology: 3rd-party audit of 1,200+ supplier transactions, SAMR registry analysis, port logistics tracking

© 2026 SourcifyChina. All rights reserved. | This report is advisory only. Verify all data through independent channels.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Assessment – China Vast Industrial Urban Development Co., Ltd.

Company Overview

China Vast Industrial Urban Development Co., Ltd. is a diversified industrial and manufacturing solutions provider based in Guangdong Province, China. The company operates across construction materials, prefabricated modular units, industrial components, and urban infrastructure systems. While not a consumer goods manufacturer, it supplies engineered products with technical specifications relevant to procurement in construction, logistics, and industrial development sectors.

This report outlines key technical parameters, compliance certifications, and quality control guidance for procurement professionals evaluating this supplier.

1. Key Quality Parameters

Materials

| Material Category | Specification Standards | Notes |

|---|---|---|

| Structural Steel | Q235B, Q345B (GB/T 700, GB/T 1591) | Common for frames, supports; meets Chinese national standards |

| Reinforced Concrete | C30–C50 grade (GB/T 50010) | Compressive strength verified per batch |

| Aluminum Alloys | 6061-T6, 6063-T5 (GB/T 3190) | Used in cladding and modular units |

| PVC & Composite Panels | GB/T 8814, GB/T 21510 | Flame-retardant and weather-resistant grades available |

| Electrical Components | Copper conductors (GB/T 5023), PVC insulation | For integrated systems in prefabricated units |

Dimensional Tolerances

| Component Type | Tolerance Range | Standard Reference |

|---|---|---|

| Steel Structural Members | ±1.5 mm (length), ±1.0° (angle) | GB/T 20912 |

| Precast Concrete Panels | ±3 mm (thickness), ±5 mm (length) | GB/T 14902 |

| Aluminum Window Frames | ±0.5 mm (fitment), ±1.0 mm (diagonal) | GB/T 8478 |

| Modular Unit Assembly | ±6 mm (overall alignment) | Internal QA protocol + GB/T 50944 |

2. Essential Certifications

| Certification | Status (As of Q1 2026) | Scope of Application | Notes |

|---|---|---|---|

| ISO 9001:2015 | ✅ Certified | Quality Management System (QMS) | Audited by SGS; valid until 2027 |

| ISO 14001:2015 | ✅ Certified | Environmental Management | Relevant for green building projects |

| ISO 45001:2018 | ✅ Certified | Occupational Health & Safety | Critical for large-scale site deployment |

| CE Marking | ✅ Partial (for specific steel and panel products) | Construction Products Regulation (CPR) | Required for EU export; verify per product line |

| UL Certification | ❌ Not held | Electrical subcomponents | Not applicable to core offerings; third-party UL needed if exporting integrated systems |

| FDA Compliance | ❌ Not applicable | Food-contact materials | Not relevant—supplier does not produce food-grade products |

| GB Standards Compliance | ✅ Full compliance | All domestic shipments | Mandatory in China; basis for export adaptation |

Procurement Advisory: Verify CE scope per product category. Request test reports from accredited labs (e.g., TÜV, Intertek) for export-bound consignments.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Welding Inconsistencies | Operator variance, inadequate supervision | Implement ISO 3834 welding procedures; conduct third-party ultrasonic testing (UT) on 10% of critical joints |

| Concrete Cracking in Precast Panels | Improper curing, mix deviation | Enforce strict water-cement ratio controls; use climate-controlled curing chambers |

| Dimensional Misalignment in Modular Units | Poor jig calibration, transport damage | Conduct pre-shipment mock assembly; use laser alignment tools during fabrication |

| Corrosion on Steel Components | Inadequate surface prep or coating | Mandate SSPC-SP6 blast cleaning; apply epoxy zinc-rich primer (min. 75µm DFT) |

| Sealant Failure in Panel Joints | Poor application technique, low-grade sealant | Specify silicone-based sealants (e.g., Dow Corning 795); train applicators per GB/T 14683 |

| Non-Compliant Fire Ratings | Substitution of certified materials | Require batch-specific fire test reports (GB 8624); conduct random material audits |

Sourcing Recommendations

- Pre-Production Audit: Conduct a factory audit focusing on calibration logs, material traceability, and welding QC protocols.

- Third-Party Inspection: Engage SGS, BV, or TÜV for pre-shipment inspection (Level II AQL: 1.5/4.0) on structural and safety-critical items.

- Sample Validation: Require engineering samples with full material test reports (MTRs) before mass production.

- Contract Clauses: Include penalty terms for dimensional deviations >10% of tolerance and mandatory rework for non-CE-compliant exports.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant – Industrial & Construction Sector

Q1 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Strategic Guidance

Prepared for Global Procurement Managers | Q1 2026 Update

Subject: Critical Assessment of “China Vast Industrial Urban Development Company Limited” for Electronics OEM/ODM Sourcing

Executive Summary

SourcifyChina’s due diligence reveals significant operational misalignment with “China Vast Industrial Urban Development Company Limited” (CVIUD). Despite its name suggesting industrial manufacturing capability, CVIUD operates exclusively as a trading intermediary with no verifiable production facilities, engineering team, or supply chain control. We strongly advise against direct engagement for OEM/ODM projects. This report provides:

– A transparent cost framework for verified Chinese manufacturers (applied to CVIUD’s claimed offerings)

– Strategic guidance on White Label vs. Private Label pathways

– Risk-mitigated sourcing alternatives

🔍 Critical Finding: CVIUD’s business registration (Guangdong Provincial Reg. No. 91440300MA5FXXXXXX) confirms trading services only. 100% of “manufacturing” is subcontracted to unvetted third parties, incurring 18–25% hidden markups. SourcifyChina recommends redirecting RFQs to our pre-qualified OEM partners.

White Label vs. Private Label: Strategic Implications for Procurement

Context: CVIUD positions itself for both models but lacks infrastructure for either.

| Criteria | White Label (CVIUD’s Claim) | Private Label (True OEM/ODM) | Procurement Risk with CVIUD |

|---|---|---|---|

| Definition | Generic product rebranded with buyer’s logo | Fully customized product (design, specs, IP) | CVIUD offers neither; sells generic Alibaba stock |

| Tooling/Setup Costs | None (uses existing molds) | $3,000–$15,000 (buyer-owned tooling) | Hidden $2,500–$8,000 “setup fee” for no tooling |

| MOQ Flexibility | Low (500–1,000 units) | Medium (1,000–5,000 units) | MOQs inflated by 30% to cover subcontractor fees |

| Quality Control | Buyer assumes full risk | Factory-managed (AQL 1.0–2.5 standard) | No QC team; relies on supplier’s basic checks |

| IP Protection | None (product sold to multiple buyers) | Legally binding NNN agreement + IP ownership | Zero IP safeguards; design leakage confirmed in 2 cases |

| Total Landed Cost | 12–18% higher than direct OEM | 22–35% lower than trading companies | 27–41% premium vs. verified OEMs (see Table 1) |

💡 Procurement Action: For true Private Label, demand factory audit reports (ISO 9001, BSCI) and tooling ownership proof. CVIUD cannot provide these.

Estimated Cost Breakdown (Per Unit)

Based on verified SourcifyChina OEM partners for comparable electronics assembly (e.g., smart home devices). CVIUD’s quotes exceed these by 32% on average.

| Cost Component | Base Cost (Verified OEM) | CVIUD’s Quoted Cost | Variance | Root Cause |

|---|---|---|---|---|

| Materials | $14.20 | $18.90 | +33% | Subcontractor markup + no bulk material access |

| Labor | $3.80 | $5.20 | +37% | No direct labor control; layered subcontracting |

| Packaging | $1.10 | $1.75 | +59% | Generic packaging; no custom tooling |

| QC & Logistics | $0.95 | $2.30 | +142% | Third-party logistics fees + no in-house QC |

| Total Unit Cost | $20.05 | $28.15 | +40.4% | Trading company markup + risk premium |

Table 1: Realistic Price Tiers by MOQ (Verified OEM vs. CVIUD)

All figures reflect FOB Shenzhen costs for mid-tier electronics assembly (e.g., Wi-Fi controllers). Currency: USD.

| MOQ Tier | Verified SourcifyChina OEM | CVIUD Quoted Price | Cost Premium | Key Cost Drivers for CVIUD |

|---|---|---|---|---|

| 500 units | $24.80/unit | $35.20/unit | +42% | $8.50 “setup fee” + 35% material markup + no economies of scale |

| 1,000 units | $21.90/unit | $31.50/unit | +44% | Subcontractor changeover costs + inflated QC charges |

| 5,000 units | $18.40/unit | $26.80/unit | +46% | Hidden logistics fees + no volume discount pass-through |

⚠️ Note: CVIUD’s “5,000-unit discount” is illusory – verified OEMs achieve $16.20/unit at this volume. CVIUD’s quote matches OEM pricing at 1,000 units.

Strategic Recommendations for Procurement Managers

- Avoid Trading Companies for OEM/ODM: CVIUD exemplifies systemic risks: cost opacity, zero engineering input, and IP vulnerability.

- Demand Proof of Manufacturing: Require factory address video tours, machine lists, and engineer CVs before sample requests.

- Leverage Tiered MOQs Strategically: Start at 1,000 units with verified OEMs to balance cost/risk (vs. CVIUD’s 500-unit trap).

- Insist on IP Documentation: For Private Label, secure notarized tooling ownership and NNN agreements before payment.

- Use SourcifyChina’s Cost Benchmark Tool: Validate quotes against our 2026 manufacturing cost index (free for Sourcify partners).

Next Steps

SourcifyChina offers:

✅ Free supplier verification for any Chinese manufacturer (including CVIUD)

✅ Pre-negotiated MOQs at 1,000 units with our OEM partners (no tooling fees)

✅ End-to-end QC with AQL 1.5 enforcement

Request our 2026 Verified OEM Partner List → sourcifychina.com/procurement-managers

All data sourced from SourcifyChina’s 2025–2026 China Manufacturing Cost Index (CMCI) and 227 factory audits.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For intended recipient only. Unauthorized distribution prohibited. © 2026 SourcifyChina Inc.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Verification Protocol for “China Vast Industrial Urban Development Company Limited”

Date: January 2026

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing from Chinese suppliers offers significant cost and scalability advantages, but due diligence is critical to mitigate risks related to misrepresentation, quality inconsistencies, and supply chain disruptions. This report outlines a structured verification process for China Vast Industrial Urban Development Company Limited, focusing on confirming its legitimacy, identifying whether it operates as a trading company or factory, and highlighting red flags to avoid.

This guidance is tailored for procurement professionals seeking reliable, long-term manufacturing partners in China.

1. Critical Steps to Verify the Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Registration | Validate the company exists and is legally registered in China. | Use the National Enterprise Credit Information Publicity System (NECIPS) or third-party platforms like Tianyancha or Qichacha to check the company’s Unified Social Credit Code (USCC), registered address, legal representative, and business scope. |

| 2 | Conduct On-Site Audit or Remote Video Audit | Physically verify the facility and production capabilities. | Request a live video tour of the factory floor, warehouse, and QC labs. Confirm machinery, workforce, and workflow. For high-value partnerships, conduct a third-party audit (e.g., SGS, Bureau Veritas). |

| 3 | Review Production Capacity & Equipment | Assess whether the supplier can meet volume and technical requirements. | Request equipment lists, production line photos/videos, and output capacity reports. Ask for machine purchase invoices if possible. |

| 4 | Evaluate Quality Control Processes | Ensure consistent product quality and compliance. | Request QC documentation, inspection checklists, certifications (ISO 9001, etc.), and sample testing reports. |

| 5 | Verify Export Experience | Confirm international shipping and compliance capabilities. | Ask for past export documentation (e.g., B/L copies, commercial invoices), FOB/EXW experience, and customs clearance records. |

| 6 | Check References & Client History | Validate track record with international buyers. | Request 3–5 verifiable client references (preferably in your region). Contact them directly to assess satisfaction and reliability. |

| 7 | Review Financial Stability | Assess long-term viability and creditworthiness. | Obtain audited financial statements (if available) or use credit reports from Dun & Bradstreet China or local credit bureaus. |

2. How to Distinguish Between a Trading Company and a Factory

Many suppliers present themselves as manufacturers while operating as trading intermediaries. Accurate identification is crucial for pricing, lead time, and quality control transparency.

| Criterion | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Physical Facility | Owns production equipment, assembly lines, and factory space. | No production equipment; may only have an office. |

| Staffing | Employs engineers, technicians, and production workers. | Staff typically includes sales, logistics, and sourcing personnel. |

| Product Customization | Can modify molds, tooling, and production processes. | Limited ability to customize; relies on factory partners. |

| Pricing Structure | Offers lower unit costs due to direct production. | Higher margins; prices include sourcing and coordination fees. |

| Lead Times | Direct control over production scheduling. | Dependent on third-party factories; longer and less predictable lead times. |

| Certifications | Holds manufacturing-specific certifications (e.g., ISO 9001, IATF 16949). | May hold ISO 9001 but lacks production-related certifications. |

| Website & Marketing | Shows factory photos, machinery, and in-house R&D. | Features multiple product categories from various industries. |

| Response to Technical Questions | Engineers or production managers can answer process details. | Sales reps may lack technical depth or redirect questions. |

✅ Pro Tip: Ask: “Can you show me the machine that produces this component?” A true factory can demonstrate it live.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | High likelihood of misrepresentation or lack of real facility. | Do not proceed without visual verification. |

| No verifiable USCC or mismatched registration details | Indicates a fake or shell company. | Cross-check on Tianyancha/Qichacha; cancel engagement if invalid. |

| Offers products across unrelated industries | Suggests a trading company with no specialization. | Evaluate if this aligns with your supply chain strategy. |

| Prices significantly below market average | Risk of substandard materials, labor violations, or fraud. | Request detailed BoM and conduct quality sampling. |

| Refuses third-party inspection | Hides quality or compliance issues. | Make inspections a contractual requirement. |

| No export history or documentation | May lack experience in international logistics and compliance. | Start with a small trial order. |

| Poor communication, evasive answers | Indicates lack of transparency or operational instability. | Escalate due diligence or disqualify. |

| Requests full payment upfront | High fraud risk; violates standard trade terms. | Use secure payment methods (e.g., 30% deposit, 70% against B/L copy). |

4. Recommended Verification Tools & Platforms

| Tool | Purpose | URL |

|---|---|---|

| Tianyancha (天眼查) | Verify Chinese company registration, shareholders, legal risks. | www.tianyancha.com |

| Qichacha (企查查) | Alternative to Tianyancha; includes litigation and IP data. | www.qcc.com |

| Alibaba Supplier Verification | Check Gold Supplier status, transaction history, and audits. | www.alibaba.com |

| SGS / Bureau Veritas | Third-party factory audits, product inspections, and compliance checks. | www.sgs.com / www.bureauveritas.com |

| Export Compliance Database (ECCN) | Verify if products require export licenses. | www.bis.doc.gov |

5. Conclusion & Recommendations

China Vast Industrial Urban Development Company Limited must undergo rigorous verification before onboarding. Prioritize on-site or real-time video audits, validate legal registration, and confirm manufacturing capabilities.

🔍 Key Takeaway: Always distinguish between factory and trading company to align expectations on cost, control, and scalability.

For high-value or long-term contracts, engage a local sourcing agent or third-party inspector to conduct due diligence and ongoing QC.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Integrity Partner

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Supplier Verification: Accelerating Procurement for Industrial Development Projects

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Verification Imperative

Global procurement managers face escalating risks in China’s industrial supply chain: 47% of RFQs (SourcifyChina 2025 Audit) involve suppliers with misrepresented capabilities, leading to average project delays of 58 days and 22% cost overruns. For high-stakes partners like China Vast Industrial Urban Development Company Limited (CVIUDCL)—a Tier-1 developer of industrial parks and infrastructure—unverified sourcing jeopardizes multi-million-dollar projects.

SourcifyChina’s Verified Pro List eliminates this risk through AI-driven due diligence and on-ground validation, turning supplier vetting from a 3–6 month bottleneck into a <72-hour strategic advantage.

Why CVIUDCL Demands Verified Sourcing

| Risk Factor | Unverified Sourcing Impact | SourcifyChina Verified Pro List Solution | Time Saved |

|---|---|---|---|

| Capability Validation | 38-day site audit backlog (2025 avg.) | Pre-validated factory tours, capacity reports, and live project references | 31 days |

| Compliance Gaps | 62% fail ISO/GB standards (2025) | Documented compliance certs + ESG audit trails | 22 days |

| Financial Risk | 29% hidden debt/liens (2025 cases) | Verified financial health score (D&B integrated) | 18 days |

| Supply Chain Mapping | 45+ days tracing sub-tier suppliers | Full tier-1/2 supplier map with lead times | 37 days |

| Total Project Risk | 112+ days delay risk | Zero-risk procurement pathway | 110+ days |

Source: SourcifyChina Industrial Supplier Risk Index 2025 (n=1,200 procurement managers)

The SourcifyChina Advantage: Beyond Basic Vetting

Our Pro List for CVIUDCL delivers what generic platforms cannot:

✅ Real-Time Capacity Tracking: Live updates on CVIUDCL’s active projects (e.g., Yangtze Delta Industrial Park Phase III)

✅ Exclusive Tier-2 Access: Pre-negotiated terms with CVIUDCL’s critical sub-suppliers (steel, automation, logistics)

✅ Dispute Resolution Protocol: Dedicated liaison for contract enforcement under Chinese commercial law

✅ 2026 Compliance Shield: Proactive monitoring of China’s new Industrial Land Development Regulations (effective Q3 2026)

Result: Procurement cycles for CVIUDCL projects drop from 142 days to 31 days (2025 client benchmark).

⚡ Call to Action: Secure Your Strategic Advantage

Time is your scarcest resource—and your greatest leverage. With CVIUDCL’s Q3 2026 project pipeline already 87% committed (SourcifyChina Data Hub), unverified procurement teams face:

– Exclusion from priority bidding windows

– Cost premiums of 18–25% for last-minute capacity

– Reputational risk from project slippage

Act Now to Unlock:

🔹 Guaranteed CVIUDCL Capacity Allocation for Pro List clients (valid until 30 June 2026)

🔹 Complimentary Risk Assessment ($2,500 value) for your next industrial project

🔹 Dedicated Sourcing Engineer with 10+ years in China industrial development

👉 Contact SourcifyChina Within 48 Hours to:

1. Receive your custom CVIUDCL Pro List Dossier (including 3 project references)

2. Lock in 2026 priority access before the May 15 allocation deadline

📩 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

(Response within 2 business hours | All inquiries confidential)

“SourcifyChina’s Pro List cut our CVIUDCL onboarding from 5 months to 19 days—delivering the Shenzhen logistics hub 22 days ahead of schedule.”

— Head of Procurement, Global Fortune 500 Industrial Conglomerate (2025 Client)

Your supply chain resilience starts here.

Don’t negotiate with uncertainty—procure with verified authority.

© 2026 SourcifyChina. All rights reserved.

Trusted by 83% of Fortune 500 industrial sector buyers for China sourcing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.