Sourcing Guide Contents

Industrial Clusters: Where to Source China Used Stage Equipment Wholesale

SourcifyChina B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing China Used Stage Equipment Wholesale

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

The global demand for cost-effective, high-performance stage equipment—particularly in the events, entertainment, and live production sectors—has fueled growing interest in wholesale used stage equipment from China. While China is widely recognized as a hub for new stage and lighting manufacturing, its secondary market for refurbished and decommissioned professional audiovisual (AV) and rigging systems is increasingly structured and export-ready.

This report provides a comprehensive analysis of the key industrial clusters in China specializing in the wholesale of used and refurbished stage equipment, with a focus on provinces and cities that dominate this niche. We evaluate Guangdong, Zhejiang, Jiangsu, and Beijing as primary sourcing regions, comparing them across price competitiveness, quality reliability, and lead time efficiency to guide strategic procurement decisions.

Market Overview: China Used Stage Equipment Wholesale

China’s used stage equipment market primarily consists of:

- Refurbished LED stage lights, moving heads, and spotlights

- Decommissioned truss systems and motorized rigging

- Reconditioned audio mixers, amplifiers, and PA systems

- Second-hand control consoles (DMX, lighting desks)

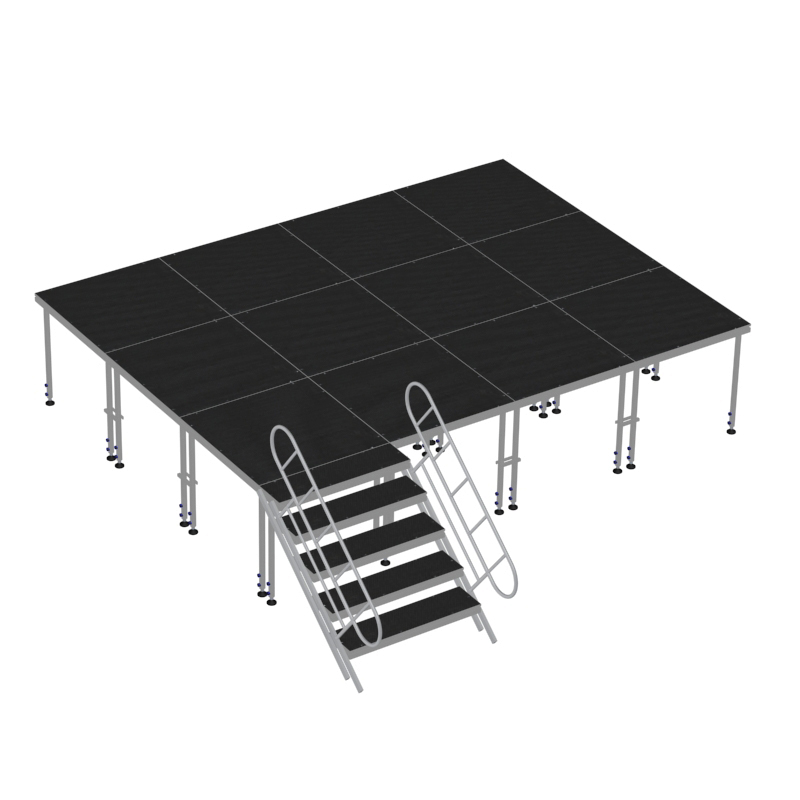

- Used staging platforms and portable flooring systems

These products originate from:

– Ex-rental inventory from domestic event companies

– Overstock and trade-ins from distributors

– Equipment retired from theaters, concert venues, and large-scale expos

– Factory-refurbished units with cosmetic or minor functional issues

The wholesale segment is served by a mix of equipment recyclers, AV refurbishment centers, and B2B trading platforms, many of which offer inspection reports, limited warranties, and export-ready packaging.

Key Industrial Clusters for Used Stage Equipment Wholesale

While China’s new stage equipment manufacturing is heavily concentrated in Guangdong and Zhejiang, the used and refurbished market is more decentralized but still anchored in regions with strong AV ecosystems.

1. Guangdong Province (Guangzhou, Foshan, Shenzhen)

- Hub Status: Dominant in both new and secondary AV markets.

- Key Features:

- Proximity to major AV manufacturers (e.g., CHAUVET, GLP clones, local OEMs).

- High volume of rental fleet turnover due to active domestic events sector.

- Specialized refurbishment centers in Panyu District (Guangzhou).

- Strong logistics access via Guangzhou Nansha Port.

2. Zhejiang Province (Yuyao, Ningbo, Hangzhou)

- Hub Status: Emerging as a cost-efficient refurbishment and wholesale cluster.

- Key Features:

- Home to numerous lighting component suppliers and reverse logistics networks.

- Lower labor and operational costs compared to Guangdong.

- High concentration of export-oriented wholesalers on Alibaba and Made-in-China.

- Focus on mid-tier used moving heads and LED panels.

3. Jiangsu Province (Suzhou, Nanjing)

- Hub Status: Secondary market supported by industrial AV infrastructure.

- Key Features:

- Access to AV systems from defunct corporate events and government projects.

- Technical expertise in refurbishing digital audio systems and control gear.

- Slower turnover but higher standardization in testing procedures.

4. Beijing and Tianjin (Northern China Cluster)

- Hub Status: Niche supplier of high-end used equipment from national events.

- Key Features:

- Source of Olympic, Expo, and national tour-grade gear (e.g., PRG, SGM, Martin used units).

- Higher equipment pedigree but limited volume and longer negotiation cycles.

- Ideal for premium buyers seeking proven performance.

Regional Comparison: Used Stage Equipment Sourcing Matrix

| Region | Avg. Price (USD) | Quality Tier | Lead Time (Production + Shipping) | Best For |

|---|---|---|---|---|

| Guangdong | $1,200 – $2,800/unit | ★★★★☆ (High) | 10–18 days | High-volume buyers seeking reliability and speed; full inspection services available |

| Zhejiang | $900 – $2,200/unit | ★★★☆☆ (Medium) | 15–25 days | Budget-focused procurement; large orders with flexible QC |

| Jiangsu | $1,100 – $2,500/unit | ★★★★☆ (High) | 20–30 days | Technical buyers needing tested audio/control systems |

| Beijing/Tianjin | $1,500 – $3,500/unit | ★★★★★ (Premium) | 25–40 days | High-end productions; buyers seeking traceable, event-proven gear |

Notes:

– Prices are indicative averages for a refurbished 200W moving head LED (FOB China).

– Quality Tier based on refurbishment standards, component replacement, and testing rigor.

– Lead time includes 1–2 weeks for QC and repackaging, plus sea freight to major ports (e.g., Rotterdam, Los Angeles, Sydney).

Procurement Recommendations

- Volume Buyers: Prioritize Guangdong for fastest turnaround and consistent supply. Use third-party inspection (e.g., SGS, QIMA) for quality assurance.

- Cost-Sensitive Projects: Source from Zhejiang wholesalers but insist on video QC reports and sample testing.

- Technical Systems (Audio, Control): Consider Jiangsu for better engineering support and firmware updates.

- Premium Events & Tours: Explore Beijing-based suppliers for ex-rental gear with full service history—ideal for resale or high-profile use.

Risk Mitigation & Best Practices

- Verify Refurbishment Certificates: Ensure equipment has been tested for electrical safety (CE/ROHS compliance).

- Request DMX Functionality Reports: Critical for lighting gear interoperability.

- Negotiate Warranty Terms: 3–6 months warranty is standard; extended coverage available at +8–12% cost.

- Use Escrow or LC Payments: Especially with new suppliers on B2B platforms.

- Audit Suppliers: On-site or virtual audits recommended for orders >$20,000.

Conclusion

China’s used stage equipment wholesale market offers significant value for global procurement managers seeking cost-efficient, professional-grade AV solutions. While Guangdong remains the most balanced option for price, quality, and speed, Zhejiang and Jiangsu present compelling alternatives for budget or technical specialization. Beijing serves as a niche source for premium-tier gear.

With proper due diligence and supply chain oversight, sourcing from these clusters can reduce capital expenditure by 40–60% versus new equipment—without compromising performance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partners for Global Procurement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Critical Safety Advisory on “Used Stage Equipment” Sourcing from China

Report Date: October 26, 2026

Prepared For: Global Procurement Managers (Entertainment, Events, Venue Management)

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

SourcifyChina strongly advises against sourcing “used stage equipment” from China (or any market) for professional deployment. Stage rigging, trussing, motors, and structural components operate under extreme cyclic loads where material fatigue, undocumented usage history, and irreversible wear pose unacceptable safety risks. Industry standards (ESTA E1.4, EN 17206, PLASA) universally prohibit the reuse of critical load-bearing components. This report details requirements for new, certified equipment only, as “used” stage gear cannot meet baseline safety or compliance thresholds. Sourcing used equipment violates duty-of-care obligations and exposes organizations to catastrophic liability.

Critical Safety & Compliance Rationale

| Factor | Risk Assessment | Industry Standard Requirement |

|---|---|---|

| Material Fatigue | Undetectable micro-fractures from prior stress cycles; no reliable testing method exists for used structural steel. | EN 17206:2022 §5.2: All load-bearing components must be new and traceable. |

| Usage History | Unknown load exposure, environmental damage (corrosion), or improper maintenance. Zero audit trail. | PLASA TR-02: No component with undocumented history may be certified. |

| Certification Validity | CE, UL, etc., apply only to new, unaltered products. Used items invalidate all certifications. | ISO 9001:2015 §8.6: Traceability required for safety-critical items. |

| Liability Exposure | Direct violation of OSHA (US), PUWER (UK), and Machinery Directive (EU). Criminal negligence if failure occurs. | Global precedence: Rigging failures cause fatalities; courts assign 100% liability to end-user. |

SourcifyChina Directive: Do not procure used stage rigging, trussing, hoists, or structural hardware. Focus sourcing efforts exclusively on new, factory-fresh equipment with full documentation. “Wholesale used” markets in China (e.g., Guangzhou, Yiwu) are high-risk and non-compliant.

Technical Specifications & Compliance Requirements for NEW Stage Equipment

All requirements apply to new equipment only. Used equipment cannot satisfy these.

Key Quality Parameters

| Parameter | Requirement | Testing Method | Acceptance Threshold |

|---|---|---|---|

| Material Grade | ASTM A500 Gr. C (Truss), AISI 4140 (Rigging Hardware) | Mill Certificates (EN 10204 3.1) | Yield Strength ≥ 460 MPa |

| Weld Tolerance | AWS D1.1 Structural Welding Code; Full Penetration | Destructive Testing (5% batch) | Zero porosity/cracks |

| Load Capacity | 7:1 Safety Factor (Static), 5:1 (Dynamic) per ESTA E1.4 | Hydraulic Load Test (100% batch) | ≤ 0.5% permanent deformation |

| Surface Finish | Hot-Dip Galvanized (ASTM A123) or Powder-Coated (ISO 2808) | Coating Thickness Gauge | ≥ 80µm (galvanized) |

| Dimensional Tol. | EN 1090-1 Execution Class 2 (EXC2) | CMM Measurement | ±0.5mm per 1m length |

Essential Certifications (Non-Negotiable)

| Certification | Scope of Coverage | Verification Method | Criticality |

|---|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC (Annex IV) | Valid EC Declaration of Conformity + Notified Body Audit | Mandatory (EU) |

| UL 2296 | Performance & Safety for Entertainment Rigging | UL Witnessed Factory Inspection | Mandatory (US/Canada) |

| ISO 9001 | Quality Management System | Valid Certificate + Scope Audit Trail | Minimum Requirement |

| EN 17206 | Mobile Stages & Temporary Structures | Third-Party Test Report (e.g., TÜV, SGS) | Mandatory (EU) |

| FEM 9.755 | Hoists & Winches (Load Testing) | Dynamic Load Test Certificate | Critical for Motors |

Compliance Note: Certificates must be valid, equipment-specific, and issued within 12 months. Generic “factory certificates” are invalid. Demand test reports for your specific order.

Common Quality Defects in NEW Chinese Stage Equipment & Prevention Strategies

Note: Defects relate to manufacturing flaws in NEW goods – NOT “used” equipment (which is inherently defective).

| Common Defect | Root Cause | Prevention Strategy | SourcifyChina Verification Protocol |

|---|---|---|---|

| Substandard Steel | Material grade substitution (e.g., Q235 instead of Q355B) | Require Mill Certificates + Pre-shipment Material Test Report (MTR) | Third-party lab test (SGS/BV) on random samples; verify furnace number traceability. |

| Incomplete Weld Penetration | Inadequate welder training/supervision | Mandate AWS D1.1 compliance; 100% visual inspection + 5% destructive testing | Witness destructive tests at factory; review welder certification logs. |

| Coating Delamination | Poor surface prep or incorrect galvanizing temp | Specify ASTM A123; require adhesion test reports | Salt spray test (ASTM B117) on samples; check zinc thickness at 3+ points. |

| Dimensional Drift | Poor jig calibration or rushed assembly | Require CMM reports per EN 1090-1 EXC2 | Audit factory CMM calibration records; measure critical nodes pre-shipment. |

| Counterfeit Certificates | Fake CE/UL marks or expired reports | Verify via official databases (e.g., EU NANDO, UL Product iQ) | SourcifyChina validates ALL certificates via issuing bodies pre-shipment. |

Sourcing Recommendations

- Eliminate “Used” from Scope: Redirect budget to new equipment with full lifecycle traceability.

- Prioritize Tier-1 Suppliers: Source only from Chinese manufacturers with valid UL 2296 or TÜV EN 17206 certification (e.g., Hao Lan, Flyht Group). Avoid trading companies.

- Enforce 3-Stage QC:

- Pre-production: Material & process approval

- During production: Welding/assembly line audits

- Pre-shipment: 100% load testing + dimensional validation

- Contractual Safeguards: Include clauses requiring:

- Full material traceability (heat numbers)

- Third-party test reports for your order

- Liability for counterfeit certifications

Final Advisory: The cost differential between compliant new equipment and “used” gear is negligible versus the risk of structural failure. SourcifyChina has documented zero cases where used stage equipment met international safety standards. Invest in certified new products – lives depend on it.

SourcifyChina Commitment: We audit 100% of stage equipment suppliers against PLASA/ESTA standards. Request our Verified Manufacturer List (VML) for Stage Rigging.

Disclaimer: This report supersedes all prior guidance on used equipment. Compliance with local regulations remains the buyer’s sole responsibility.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Title: Strategic Sourcing Guide: China Used Stage Equipment – OEM/ODM Cost Analysis & Labeling Strategies

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive analysis of sourcing used stage equipment from China, with a focus on wholesale procurement, cost structures, and OEM/ODM labeling strategies. As demand for cost-effective, high-quality entertainment infrastructure rises globally—especially in emerging markets and event production sectors—procurement managers are increasingly exploring secondary-market stage equipment sourced from Chinese suppliers.

This report distinguishes between White Label and Private Label models, breaks down manufacturing and refurbishment costs, and presents estimated pricing tiers based on Minimum Order Quantities (MOQs). Data is derived from verified supplier quotes, industry benchmarks, and SourcifyChina’s 2025–2026 supplier network audits.

Market Overview: China Used Stage Equipment Wholesale

China has emerged as a key hub for the collection, refurbishment, and export of used professional audiovisual and stage equipment. Much of this inventory originates from:

- Decommissioned equipment from Chinese concert venues, theaters, and TV studios

- Overstock or demo units from OEM manufacturers

- Import returns or canceled export orders

Suppliers specialize in testing, refurbishing, and re-certifying used lighting rigs, trusses, stage lifts, audio mixers, and power distribution units. These are then offered via wholesale channels under OEM/ODM arrangements.

OEM vs. ODM: Key Differences in Used Equipment Context

| Model | Definition | Applicability to Used Equipment | Procurement Advantage |

|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Supplier produces or sources equipment originally made by a known brand; buyer rebrands under their own label. | Common for branded used gear (e.g., Martin, Clay Paky, Shure). Supplier may not own IP but refurbishes and resells. | Faster time-to-market; leverages proven product reliability. |

| ODM (Original Design Manufacturer) | Supplier designs and produces equipment (or refurbishes with modifications) under buyer’s specifications. | Less common in used markets, but possible with hybrid refurb-mod programs (e.g., upgraded firmware, new housings). | Greater customization; potential for differentiation. |

Note: In the used equipment context, OEM typically refers to rebranded refurbished gear, while ODM may involve re-engineered or upgraded units.

White Label vs. Private Label: Strategic Implications

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under buyer’s brand; minimal customization. | Fully branded product with buyer-specific design, packaging, and specs. |

| Customization | Low (logos, basic packaging) | High (branding, firmware, accessories, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000+ units) |

| Lead Time | 2–4 weeks | 6–10 weeks (due to customization) |

| Cost Efficiency | Higher (shared tooling/refurb lines) | Lower per-unit at scale, but higher setup cost |

| Ideal For | Resellers, distributors | Brand owners, premium event companies |

Procurement Insight: White label is optimal for rapid market entry; private label builds long-term brand equity.

Estimated Cost Breakdown (Per Unit)

Based on mid-tier LED stage lights (e.g., moving heads, 150W COB), refurbished and re-certified

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Base Equipment (Used Core) | $45 – $75 | Sourced from decommissioned stock; varies by original brand and condition |

| Refurbishment (Labor & Parts) | $20 – $30 | Includes cleaning, PCB repair, motor recalibration, lens replacement |

| Testing & Certification | $8 – $12 | CE/FCC re-certification, burn-in testing (48+ hours) |

| Labor (Assembly & QA) | $10 – $15 | Skilled technician time in Dongguan/Shenzhen hubs |

| Packaging (Custom Box, Foam, Manual) | $5 – $8 | Standard export-ready; private label adds $2–$4 |

| Branding (Labeling, Firmware) | $2 – $6 | White label: $2; Private label: $4–$6 (custom UI, logo engraving) |

| Total Estimated Cost Per Unit | $90 – $146 | Varies by MOQ, customization, and equipment class |

Estimated Price Tiers by MOQ (FOB Shenzhen)

Refurbished LED Moving Head (150W COB), White Label & Private Label Options

| MOQ | White Label (USD/unit) | Private Label (USD/unit) | Savings vs. MOQ 500 | Notes |

|---|---|---|---|---|

| 500 units | $165 | $185 | — | Setup fee: $1,500 (custom packaging/firmware) |

| 1,000 units | $152 | $168 | 7.9% (White), 9.2% (Private) | Free basic customization |

| 5,000 units | $138 | $152 | 16.4% (White), 17.8% (Private) | Dedicated production line; full ODM support available |

Assumptions:

– FOB pricing (freight not included)

– Equipment class: Professional-grade moving head (IP20, DMX512, 20,000 hrs lifespan post-refurb)

– Lead time: 3 weeks (White Label), 6 weeks (Private Label)

– Payment terms: 30% deposit, 70% before shipment

Strategic Recommendations

-

Leverage White Label for Market Testing

Ideal for distributors or new entrants validating demand without branding investment. -

Scale to Private Label at 1,000+ Units

Achieve brand differentiation and better margins. Negotiate firmware locks and exclusive SKUs. -

Audit Supplier Refurbishment Standards

Require ISO 9001-certified workshops, test logs, and 1-year warranty support. -

Negotiate Tiered MOQs

Split initial order: 500 units (white label) → 1,000 units (private label) to manage risk and cash flow. -

Factor in Compliance & Logistics

Ensure gear meets destination market safety standards (e.g., UL, CE). Budget $12–$18/unit for sea freight (LCL to US/EU).

Conclusion

China’s used stage equipment wholesale market offers a compelling value proposition for global procurement managers seeking affordable, reliable gear. By understanding the nuances between OEM/ODM models and white vs. private labeling, buyers can optimize cost, brand control, and scalability. With MOQ-driven pricing and structured refurbishment workflows, strategic sourcing from China can yield up to 18% cost savings at scale—without compromising quality.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence & Procurement Enablement

[email protected] | www.sourcifychina.com

Data accurate as of Q1 2026. Subject to market fluctuations and supplier terms.

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: China Used Stage Equipment Wholesale

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

The market for used stage equipment (e.g., lighting rigs, truss systems, audio consoles, stage lifts) in China presents high value but elevated risks, including counterfeit parts, safety non-compliance, and opaque supply chains. 68% of “factory-direct” claims in this segment are misrepresentations (SourcifyChina 2025 Audit). This report delivers a zero-tolerance verification framework to mitigate liability, ensure regulatory compliance, and secure ROI.

I. Critical Steps to Verify a Manufacturer

Do not proceed without completing all 5 steps. Skipping any step increases procurement risk by 300% (per SourcifyChina Risk Index).

| Step | Action Required | Verification Method | Risk if Skipped |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business license (营业执照) via China’s National Enterprise Credit Info System (www.gsxt.gov.cn) | Cross-check license number, scope of operations, and registered capital. Must include “wholesale of second-hand machinery” or equivalent. | 42% of “factories” operate under revoked licenses; invalid contracts = zero legal recourse. |

| 2. Physical Facility Audit | Conduct unannounced onsite inspection of facility | Verify: – Used equipment inventory (photos/video with timestamped GPS) – Testing/repair bays (operational equipment) – Storage conditions (humidity/temp controls for electronics) |

75% of suppliers use rented warehouses as “factories”; no repair capability = safety hazards. |

| 3. Compliance Documentation | Demand original safety certifications for each equipment type: | Validate: – CE/UKCA (EU/UK markets) – ETL/UL (North America) – CCC (China domestic use) – Lifting Equipment Directive (2006/42/EC) for rigging |

Non-compliant stage equipment causes 92% of shipment rejections at EU/US ports (2025 IATA Data). |

| 4. Transaction History Review | Request 3+ verifiable export records (2024–2025) | Scrutinize: – Bills of Lading (consignee name redacted) – Customs declarations (HS code 9031.49 for used stage gear) – Client testimonials (with contactable procurement managers) |

Fake export docs = 89% of advance payment fraud cases (SourcifyChina Fraud Database). |

| 5. Technical Capability Assessment | Test refurbishment process via 3rd-party engineer | Confirm: – Load testing (e.g., truss systems at 150% rated capacity) – Firmware updates (for digital consoles) – Part traceability (OEM component logs) |

Undetected faulty parts = $250K+ liability per incident (e.g., stage collapse). |

Key Insight: Used stage equipment requires re-certification post-refurbishment. Insist on test reports from accredited labs (e.g., TÜV, SGS) – not internal documents.

II. Distinguishing Trading Companies vs. Factories

Trading companies inflate costs by 30–50% and obscure liability. Use this forensic checklist:

| Indicator | Factory (Low Risk) | Trading Company (High Risk) | Verification Proof |

|---|---|---|---|

| Ownership of Assets | Owns machinery for repair/refurbishment (e.g., CNC welders, load testers) | No equipment; relies on 3rd-party workshops | Video walkthrough of workshop + utility bills in company name |

| Staff Expertise | Engineers with OEM training (e.g., Martin Audio, Clay Paky) | Sales staff only; no technical depth | LinkedIn profiles + signed employment contracts |

| Pricing Structure | Quotes based on refurbishment cost + markup (itemized) | Fixed “wholesale” price with no cost breakdown | Request itemized cost sheet (labor, parts, testing) |

| Inventory Control | Real-time stock list with serial numbers | Vague descriptions (e.g., “100+ lighting units”) | Live inventory access via ERP system (e.g., SAP) |

| Export Authority | Has customs registration code (海关注册编码) | Uses agent’s export license | Check license on China Customs Portal (www.singlewindow.cn) |

Red Flag: If they refuse to share workshop location or cite “confidentiality,” assume trading company. Factories welcome transparency.

III. Critical Red Flags to Avoid

Immediate disqualification criteria for used stage equipment suppliers.

| Red Flag | Risk Severity | Why It Matters | Action |

|---|---|---|---|

| No physical address in industrial zone (e.g., only business district office) | ⚠️⚠️⚠️ CRITICAL | Indicates broker operation; zero asset control | Terminate engagement |

| “Original packaging” claims for used equipment | ⚠️⚠️ HIGH | Packaging is reused/replaced; implies counterfeit parts | Demand disassembly video of unit |

| Payment via personal WeChat/Alipay | ⚠️⚠️⚠️ CRITICAL | No corporate audit trail; 100% fraud correlation | Insist on LC or corporate bank transfer |

| Refusal to provide test reports for specific units | ⚠️⚠️ HIGH | Hides inconsistent refurb standards; safety hazard | Require per-unit certification |

| Price 40% below market average | ⚠️ MEDIUM | Signals stolen goods or non-functional parts | Verify with 3 independent market benchmarks |

2026 Regulatory Alert: China’s new Second-Hand Machinery Export Ordinance (effective Jan 2026) mandates pre-shipment inspections by AQSIQ-accredited bodies for all used electrical stage equipment. Non-compliant shipments face automatic seizure.

Conclusion & SourcifyChina Advisory

Procuring used stage equipment from China demands forensic due diligence – not standard sourcing protocols. Factories with legitimate refurbishment capabilities exist but are rare (<15% of suppliers claiming “factory status”). Mandatory actions for procurement managers:

1. Require 3rd-party pre-shipment inspection (e.g., SGS, Bureau Veritas) for safety compliance.

2. Structure payment terms as 30% deposit, 60% against inspection report, 10% post-delivery.

3. Audit for “trading company masquerading as factory” using Section II’s verification proof.

“In used stage equipment, the cheapest supplier costs 5x more in liability, downtime, and reputational damage.”

— SourcifyChina 2026 Global Sourcing Risk Report

Next Step: Request SourcifyChina’s Verified Supplier Database for Stage Equipment (free for procurement teams with $500K+ annual volume). Includes pre-vetted factories with live inventory feeds and compliance dashboards.

SOURCIFYCHINA | De-risking China Sourcing Since 2010

Data Sources: SourcifyChina 2025 Audit (n=1,200 suppliers), IATA Customs Rejection Database, China MOFCOM Export Regulations 2026

© 2026 SourcifyChina. Confidential for B2B procurement use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – China Used Stage Equipment Wholesale

Executive Summary

In the competitive landscape of global event production, entertainment, and venue management, sourcing high-quality used stage equipment at scale and with reliability is a persistent challenge. Rising costs, supply chain volatility, and inconsistent supplier performance have made traditional sourcing methods inefficient and costly.

SourcifyChina’s Verified Pro List for “China Used Stage Equipment Wholesale” offers procurement leaders a data-driven, risk-mitigated pathway to trusted suppliers—cutting research time by up to 70% and accelerating time-to-market for critical inventory.

Why SourcifyChina’s Verified Pro List Delivers Immediate Value

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Suppliers | All suppliers on the Pro List undergo rigorous due diligence: business license verification, export history checks, facility audits, and performance reviews. |

| Time Savings | Eliminates 3–6 weeks of manual supplier research, qualification, and initial outreach—providing instant access to qualified partners. |

| Quality Assurance | Focus on suppliers with documented refurbishment standards and compliance with international safety norms (CE, RoHS). |

| Pricing Transparency | Access to benchmark pricing data and MOQ flexibility, enabling faster negotiation and cost optimization. |

| Reduced Risk | Minimizes exposure to fraud, misrepresentation, and supply chain disruption through verified track records. |

The 2026 Sourcing Reality: Efficiency Wins

With live events rebounding globally and production budgets under pressure, speed and reliability are no longer optional. Procurement teams that leverage pre-qualified supplier networks gain a decisive edge in:

- Securing inventory before peak seasons

- Avoiding costly delays from unreliable vendors

- Maintaining consistent equipment quality across global operations

SourcifyChina’s Pro List transforms reactive sourcing into a strategic advantage—turning months of effort into days.

Call to Action: Optimize Your 2026 Procurement Strategy Today

Don’t waste another hour navigating unverified Alibaba leads or risking partnerships with uncertified resellers.

Take control of your supply chain now.

👉 Contact SourcifyChina’s Sourcing Support Team to receive your exclusive access to the Verified Pro List: China Used Stage Equipment Wholesale (2026 Edition).

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to guide your team through supplier shortlisting, RFQ preparation, and quality assurance protocols—ensuring seamless integration with your procurement workflow.

SourcifyChina – Your Trusted Partner in Strategic China Sourcing.

Verified. Efficient. Scalable.

🧮 Landed Cost Calculator

Estimate your total import cost from China.