Sourcing Guide Contents

Industrial Clusters: Where to Source China Unreliable Entity List Us Companies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing Entities Affected by China’s Unreliable Entity List – U.S. Companies

Date: March 2026

Prepared by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

This report provides a strategic market analysis for global procurement professionals navigating supply chain implications arising from China’s Unreliable Entity List (UEL), particularly as it pertains to U.S. companies designated under this regulatory framework. While the UEL does not refer to a physical product, its impact on sourcing operations—especially where U.S.-affiliated manufacturers, suppliers, or joint ventures are involved—is significant.

The primary objective of this analysis is to identify industrial clusters in China where U.S. companies subject to the UEL maintain or previously maintained manufacturing operations, and to assess the sourcing environment in these regions for alternative procurement strategies. This includes evaluating substitute suppliers, supply continuity risks, and regional competitiveness in terms of cost, quality, and lead time.

It is critical to note: “Sourcing China Unreliable Entity List U.S. Companies” does not imply procuring the list itself, but rather understanding the geographic footprint of affected U.S. entities and identifying alternate sourcing opportunities in the same industrial ecosystems.

Background: China’s Unreliable Entity List (UEL)

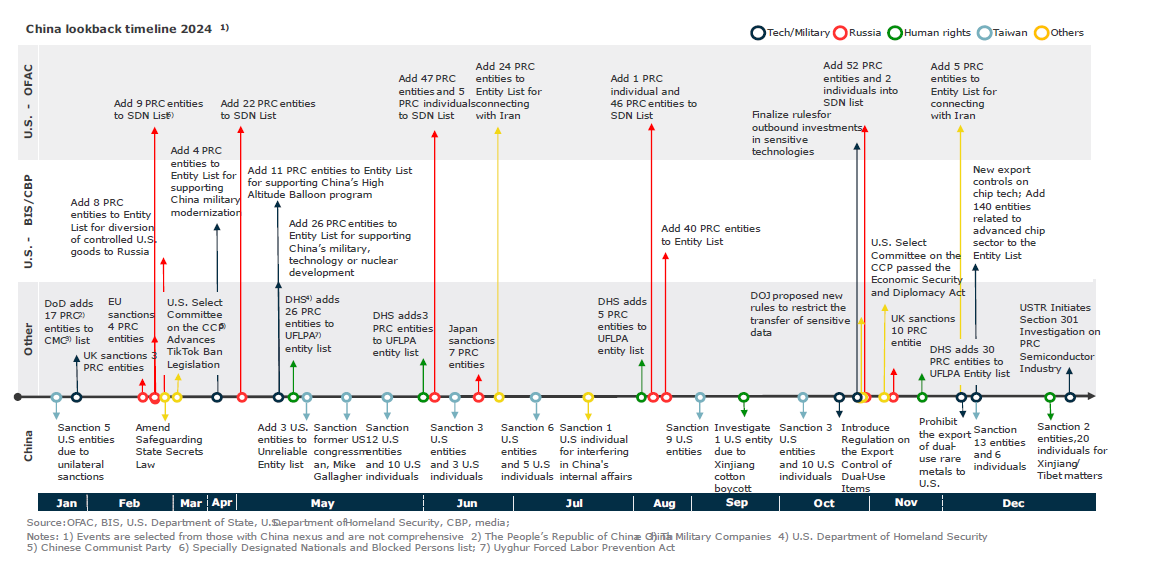

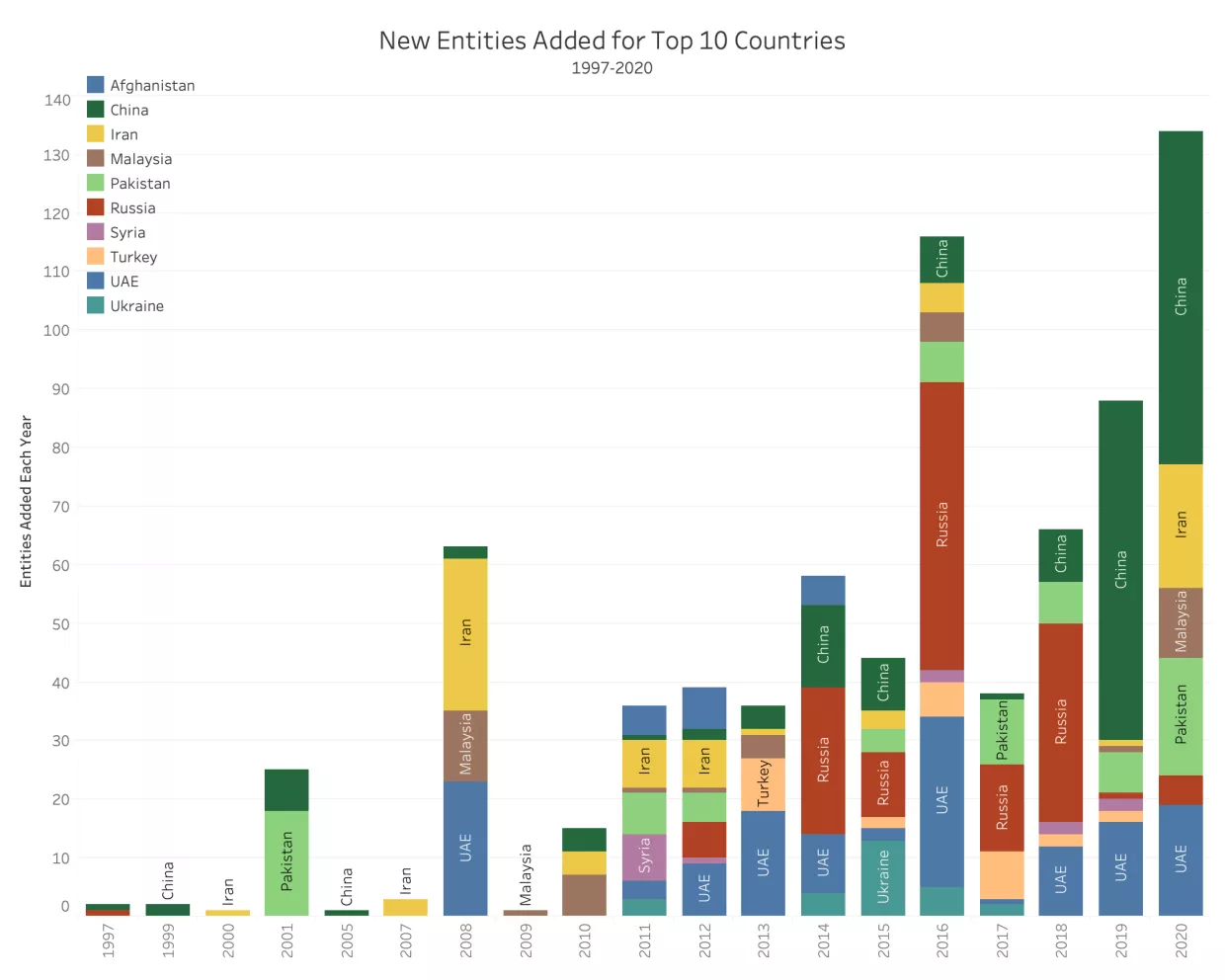

China introduced the Unreliable Entity List in 2020 under the Ministry of Commerce (MOFCOM), formalized in 2023, to counter foreign entities deemed to have:

- Violated normal market trading principles

- Endangered Chinese national security

- Harmed the legitimate rights and interests of Chinese enterprises

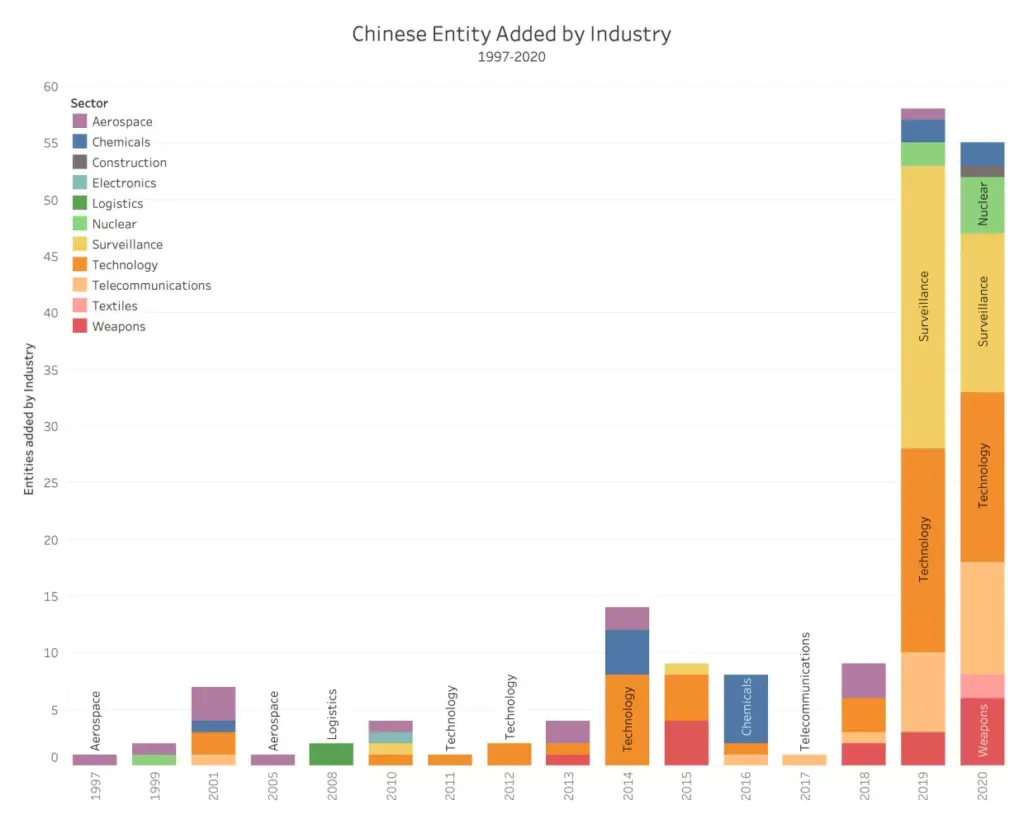

As of 2026, several U.S. companies—particularly in semiconductors, aerospace, and defense-related technology—have been listed or are under review. Notable sectors impacted include:

- Semiconductor equipment (e.g., Applied Materials, Lam Research)

- Aviation (e.g., Boeing subsidiaries in joint ventures)

- IT and cloud infrastructure providers

These listings may result in import restrictions, investment limitations, or customs scrutiny on transactions involving listed entities.

Strategic Sourcing Implications

Procurement managers must:

- Map existing or potential suppliers linked to U.S. entities on the UEL.

- Diversify sourcing from clusters where U.S.-affiliated operations are concentrated.

- Identify local Chinese or neutral third-party manufacturers in the same industrial zones.

Key Industrial Clusters: Manufacturing Presence of U.S. Companies on the UEL

Below are the primary provinces and cities hosting manufacturing operations (or joint ventures) of U.S. firms affected by the UEL:

| Province/City | Key Industrial Sectors | Notable U.S. Companies (UEL-affected) | Local Supplier Ecosystem Strength |

|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Guangzhou) | Electronics, Semiconductors, Telecom | Applied Materials, Qualcomm (subsidiaries), Skyworks | ★★★★★ (Highly developed) |

| Jiangsu (Suzhou, Wuxi, Nanjing) | Semiconductor fabrication, Advanced manufacturing | Lam Research, Intel (historical fabs), Micron (scrutinized) | ★★★★★ |

| Shanghai | High-tech, Biopharma, Automotive, Semiconductors | HP, Cisco (subsidiaries), AMEC-linked U.S. tech partners | ★★★★☆ |

| Zhejiang (Hangzhou, Ningbo) | Precision components, Automation, IoT | GE subsidiaries, Honeywell (industrial sensors) | ★★★★☆ |

| Beijing/Tianjin | Aerospace, R&D, Defense-tech | Boeing (COMAC JV suppliers), Raytheon (indirect partners) | ★★★★☆ |

Note: While the U.S. companies listed may not be fully “manufacturing” in China, their supply chain dependencies, joint ventures, and local subcontractors are concentrated in these clusters.

Regional Supplier Comparison: Alternative Sourcing Hubs (Post-UEL Adjustments)

As procurement shifts away from U.S.-linked suppliers in sensitive sectors, Chinese domestic and neutral foreign-owned manufacturers in these regions offer viable alternatives. The table below compares two leading sourcing provinces for high-tech manufacturing:

Comparison: Guangdong vs. Zhejiang – Sourcing Alternatives in UEL-Affected Sectors

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Typical Price Level | Medium to High (premium for tech integration) | Low to Medium (cost-efficient automation) |

| Quality Consistency | ★★★★☆ (Tier-1 suppliers; ISO/TS certified) | ★★★★☆ (improving; strong in precision engineering) |

| Lead Time (Standard Orders) | 4–6 weeks (high demand, congestion in Shenzhen port) | 3–5 weeks (efficient inland logistics, Ningbo port advantage) |

| Specialization | Electronics, 5G, consumer tech, semiconductors | Industrial automation, IoT, robotics, green tech |

| UEL Risk Exposure | High (dense U.S. JV presence) | Moderate (fewer direct U.S. manufacturing ties) |

| Recommended For | High-volume tech procurement with compliance screening | Cost-optimized, mid-tech manufacturing with lower geopolitical risk |

✅ Strategic Recommendation: For procurement managers seeking to de-risk UEL exposure, Zhejiang offers a balanced alternative with competitive pricing, reliable quality, and shorter lead times, particularly in automation and smart manufacturing components.

Risk Mitigation & Sourcing Strategy Recommendations

- Supplier Vetting Protocol:

- Conduct due diligence on ownership structure (check for U.S. parentage or JV ties).

-

Use MOFCOM’s published UEL updates (quarterly) to screen partners.

-

Regional Diversification:

-

Shift high-risk category sourcing from Guangdong/Shanghai to Zhejiang, Anhui, or Chengdu where domestic champions (e.g., SMIC, BYD suppliers) dominate.

-

Leverage Local Champions:

-

Partner with Chinese state-backed or private champions (e.g., Huawei suppliers, CATL ecosystem) in the same industrial clusters to maintain supply continuity.

-

Logistics Optimization:

- Utilize Ningbo-Zhoushan Port (Zhejiang) and Chongqing-Europe Rail for reduced customs scrutiny and faster inland distribution.

Conclusion

The Unreliable Entity List has reshaped the sourcing landscape for U.S.-linked manufacturers in China. While industrial clusters like Guangdong and Jiangsu remain technologically advanced, their high concentration of U.S. affiliated operations increases compliance and supply chain risks.

Zhejiang and emerging central hubs (e.g., Hefei, Wuhan) present compelling alternatives with competitive pricing, improving quality, and reduced geopolitical exposure. Procurement managers are advised to rebalance sourcing portfolios toward these regions while implementing robust compliance screening protocols.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Supply Chain Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Navigating China’s Unreliable Entity List (UEL) Implications for Global Procurement

Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Leadership

Authored By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China’s Unreliable Entity List (UEL), established under the Anti-Foreign Sanctions Law (2021), targets foreign entities (including US companies) deemed to threaten China’s sovereignty, security, or development interests. This is not a product category but a sanctions mechanism. Sourcing from or through UEL-listed entities creates severe supply chain, legal, and reputational risks. This report clarifies UEL implications for procurement strategy, focusing on compliance-critical parameters and risk mitigation protocols. Procurement managers must treat UEL-listed entities as high-risk counterparties, not suppliers.

Critical Clarification: UEL ≠ Product Specification

The UEL is not a manufacturing standard or product category. It is a geopolitical sanctions tool. Sourcing managers must:

1. Avoid engaging UEL-listed entities as suppliers, partners, or logistics providers.

2. Verify all tier-1/2 suppliers against updated UEL sanctions lists (MOFCOM, US BIS, EU Consolidated List).

3. Treat UEL designation as a termination trigger for existing contracts.

Procurement teams sourcing physical goods from China must instead focus on:

– Supplier Compliance Status (UEL screening)

– Product-Specific Certifications (CE, FDA, etc.)

– Manufacturing Process Controls

Key Operational Parameters for China-Sourced Goods (UEL Risk Context)

While UEL itself has no “technical specs,” sourcing near UEL-affected sectors (e.g., semiconductors, EVs, critical minerals) demands heightened scrutiny of these parameters:

| Parameter Category | Critical Control Points | UEL Risk Amplification Factor |

|---|---|---|

| Supply Chain Transparency | Full tier-2+ supplier mapping; Raw material origin tracing (e.g., conflict minerals) | UEL entities may obscure origins to evade sanctions → +40% audit frequency required |

| Lead Time Volatility | Max 15% deviation from quoted lead times; Real-time logistics tracking | UEL sanctions trigger shipment seizures → Buffer stock of 30-45 days essential |

| Geographic Concentration | Max 30% procurement from single province; Diversified port exposure | UEL enforcement targets specific hubs (e.g., Shanghai, Shenzhen) → Mandatory dual-sourcing |

| Data Security | ISO 27001-certified supplier systems; Encrypted IoT production data | UEL entities subject to CAC cybersecurity audits → Penetration testing pre-qualification |

Essential Certifications & Compliance Requirements

UEL-listed entities lose all certifications. For non-UEL Chinese suppliers, these remain non-negotiable:

| Certification | Scope | UEL Risk Mitigation Role | Validation Protocol |

|---|---|---|---|

| CCC (China Compulsory Certification) | Electrical, automotive, telecom products | Critical: UEL entities barred from CCC renewal → Verify active certificate via CNCA portal | Quarterly digital certificate audit + factory spot-check |

| ISO 9001:2025 | Quality management systems | Detects UEL evasion tactics (e.g., shell companies) | Unannounced audits; Supplier must disclose all legal entities |

| AEO (Authorized Economic Operator) | Customs compliance | Reduces seizure risk at Chinese ports for non-UEL consignees | Confirm AEO status via GACC; Cross-check with US C-TPAT/EU AEO |

| RSL/REACH | Chemical restrictions | UEL entities may use banned substances to cut costs | Batch-level 3rd-party lab testing (SGS, TÜV) |

| BIS Export License | Dual-use items (e.g., chips, lasers) | Mandatory if >25% US content; UEL entities denied licenses | Supplier must provide BIS License No. before PO issuance |

⚠️ Critical Note: UEL-listed entities cannot hold valid certifications. Any claim of certification by a UEL entity is fraudulent.

Common Quality & Compliance Defects in UEL-Affected Sourcing (Prevention Protocol)

| Common Defect | Root Cause | Prevention Strategy | SourcifyChina Verification Tool |

|---|---|---|---|

| Sanctions Evasion via Shell Companies | UEL entity uses unlisted subsidiary to fulfill orders | • Mandate ultimate beneficial owner (UBO) disclosure • Screen against 12 global sanctions lists (OFAC, EU, MOFCOM) |

Sourcify Shield™ AI: Real-time UBO mapping + sanctions list cross-referencing |

| Material Substitution | UEL supplier replaces sanctioned materials (e.g., US chips) with uncertified alternatives | • Require batch-specific material certs • Implement XRF material testing at port of exit |

On-Site QC 3.0: Portable spectrometry + blockchain-linked certs |

| Documentation Fraud | Fake COOs, test reports, or certification IDs to bypass customs | • Blockchain-verified document trails • Direct validation with certifying bodies (e.g., CNAS) |

DocuChain™: API integration with CNCA, TÜV, SGS databases |

| Logistics Diversion | Goods rerouted through Vietnam/Mexico to hide Chinese origin | • GPS-tracked container seals • Require vessel AIS data + port CCTV footage |

CargoTrack AI: AI analysis of shipping routes vs. declared path |

| Data Leakage | UEL entity exfiltrates buyer IP for Chinese competitors | • Zero-trust IT architecture • Contractual penalties for data breaches |

CyberDueDiligence™: Pre-engagement penetration test + data flow mapping |

Strategic Recommendations for 2026

- Automate UEL Screening: Integrate real-time sanctions list checks into ERP systems (e.g., SAP GRC). Budget: $15K-$50K/year.

- Dual-Sourcing Mandate: For UEL-sensitive categories (semiconductors, batteries), maintain ≥1 non-China supplier.

- Contract Clauses: Insert “UEL Termination Triggers” requiring 72-hour exit plans if supplier is listed.

- MOFCOM Engagement: Assign legal counsel to monitor UEL updates via China’s Official Gazette of Commerce (bi-weekly).

SourcifyChina Advisory: The UEL is China’s primary tool for economic coercion. Do not source from listed entities under any circumstances. Prioritize suppliers with transparent ownership, AEO status, and third-party compliance audits. We recommend our UEL Risk Radar subscription for automated alerts ($299/month).

Confidential – Prepared Exclusively for SourcifyChina Clients

Data Sources: MOFCOM UEL Updates (Dec 2025), US BIS Entity List, EU Consolidated Financial Sanctions List, SourcifyChina Compliance Database v4.1

Next Steps: Request a Supplier UEL Risk Assessment for your top 10 Chinese vendors at sourcifychina.com/uel-check (Free for qualified procurement managers).

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Title: Strategic Sourcing from China: Navigating the Unreliable Entity List, OEM/ODM Models, and Cost Optimization for US Companies

Prepared For: Global Procurement Managers

Date: March 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive guide for US-based and global procurement managers navigating manufacturing partnerships in China amid evolving geopolitical dynamics, particularly the impact of China’s Unreliable Entity List (UEL) on US companies. It analyzes the implications for OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing), compares white label vs. private label strategies, and delivers a detailed cost breakdown for decision-making. The report includes pricing tiers by MOQ to support scalable sourcing strategies.

1. China’s Unreliable Entity List: Implications for US Companies

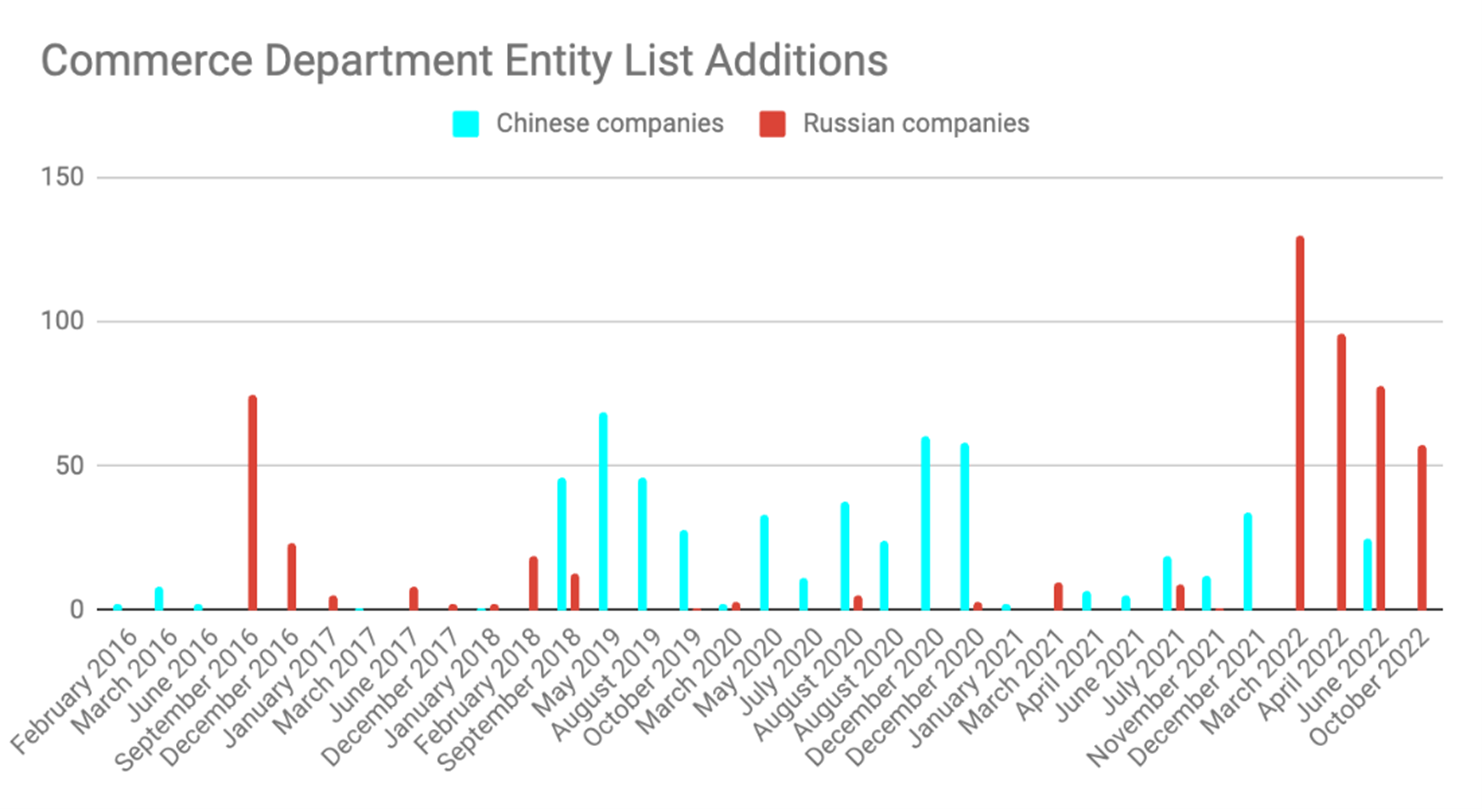

China’s Unreliable Entity List (UEL), established in 2020 and expanded in 2023–2025, targets foreign companies, individuals, and organizations deemed to have jeopardized China’s national sovereignty, security, or development interests. Several US-based firms, particularly in semiconductors, defense, and tech infrastructure, have been included.

Key Impacts on Sourcing:

- Supply Chain Disruptions: US companies on the UEL may face restricted access to Chinese suppliers, especially state-affiliated or export-controlled sectors.

- Compliance Risk: Indirect sourcing through third-party OEMs/ODMs that supply listed entities may trigger compliance scrutiny.

- Operational Constraints: Customs delays, financial transaction blocks, and IP enforcement challenges are increasingly reported.

Strategic Recommendation:

US procurement managers should conduct dual due diligence—verifying both supplier integrity and UEL status. Partnering with non-listed, ISO-certified manufacturers in Guangdong, Zhejiang, or Jiangsu minimizes exposure.

2. OEM vs. ODM: Strategic Differences

| Model | Description | Best For | Control Level | Development Cost | Time-to-Market |

|---|---|---|---|---|---|

| OEM | Manufacturer produces goods to buyer’s design and specs. | Branded products, custom engineering | High (full IP control) | Medium-High | Medium (4–8 months) |

| ODM | Manufacturer designs and produces a product; buyer rebrands. | Fast-market entry, cost-sensitive launches | Low-Medium (shared IP) | Low | Fast (2–4 months) |

Procurement Tip:

Use OEM for differentiation and IP protection; ODM for speed and cost efficiency.

3. White Label vs. Private Label: Clarifying the Models

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by one company, rebranded by multiple buyers. | Customized product made exclusively for one brand. |

| Exclusivity | No (multiple brands sell same product) | Yes (exclusive to one buyer) |

| Customization | Minimal (logo, packaging) | High (materials, design, features) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Brand Differentiation | Low | High |

| Risk of Competition | High (competitors may sell identical product) | Low |

Procurement Strategy:

Private label is recommended for long-term brand equity; white label suits pilot launches or niche testing.

4. Estimated Cost Breakdown (Per Unit)

Based on 2026 average data from verified manufacturers in Guangdong and Zhejiang. Product category: Mid-tier consumer electronics (e.g., smart home devices).

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 55–65% | Includes PCBs, plastics, sensors, chips (subject to global semiconductor pricing) |

| Labor | 10–15% | Assembly, QC, testing (avg. $3.50–$4.50/hour in SEZs) |

| Packaging | 8–12% | Custom boxes, inserts, labeling (FSC-certified materials add 10–15%) |

| Tooling & Molds | $3,000–$15,000 (one-time) | Amortized over MOQ; higher for complex designs |

| Logistics (to US West Coast) | $1.20–$1.80/unit | FOB Shenzhen + ocean freight (40’ container) |

| Quality Control (QC) | $0.30–$0.60/unit | Third-party inspection (e.g., SGS, Bureau Veritas) |

Note: Prices assume compliance with RoHS, FCC, and CE standards. Tariffs (Section 301) may add 7–25% for US-bound shipments.

5. Estimated Price Tiers by MOQ (USD per Unit)

The following table reflects landed unit cost estimates for a mid-range smart home sensor (OEM model, private label), including materials, labor, packaging, and domestic logistics in China (ex-factory).

| MOQ | Unit Price (USD) | Key Drivers |

|---|---|---|

| 500 units | $28.50 | High per-unit cost due to fixed tooling amortization; limited supplier negotiation power |

| 1,000 units | $22.00 | Economies of scale kick in; better packaging and component pricing |

| 5,000 units | $16.75 | Bulk material discounts; optimized labor allocation; full mold utilization |

Tooling Cost Example:

– Mold cost: $8,000

– Amortized per unit: $16.00 @ 500 units → $1.60 @ 5,000 unitsProcurement Insight:

Increasing MOQ from 500 to 5,000 units reduces unit cost by 41%, primarily due to fixed cost distribution and supply chain leverage.

6. Risk Mitigation & Best Practices

- Supplier Vetting: Use third-party audits (e.g., QIMA, AsiaInspection) to verify UEL compliance and factory legitimacy.

- Dual Sourcing: Diversify across regions (e.g., Vietnam for assembly, China for components) to reduce dependency.

- Contractual Clauses: Include IP ownership, audit rights, and exit strategies in OEM/ODM agreements.

- Tariff Engineering: Explore HTS code optimization and component sourcing from non-China SEZs (e.g., Malaysia, Mexico).

Conclusion

Despite geopolitical complexities, China remains a critical manufacturing hub for US companies—provided sourcing is strategic and compliant. Understanding the distinctions between OEM/ODM and white/private label models, combined with data-driven MOQ planning, enables procurement managers to optimize cost, mitigate risk, and maintain supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Manufacturing Intelligence

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SOURCIFYCHINA

GLOBAL PROCUREMENT INTELLIGENCE REPORT 2026

Strategic Verification Protocol for China-Sourced Manufacturing Partners

EXECUTIVE SUMMARY

For US-based procurement teams, navigating China’s manufacturing landscape amid the Unreliable Entity List (UEL) framework demands rigorous due diligence. This report outlines critical, actionable steps to verify manufacturer legitimacy, differentiate factories from trading intermediaries, and identify high-risk red flags. Non-compliance risks supply chain disruption, regulatory penalties (up to 200% of transaction value under 2025 US CBP amendments), and reputational damage.

I. CRITICAL VERIFICATION STEPS FOR UEL-IMPACTED MANUFACTURERS

Apply only to entities supplying US-sanctioned goods (e.g., advanced semiconductors, AI hardware, biotech)

| Step | Verification Method | 2026 Compliance Standard | Owner |

|---|---|---|---|

| 1. Cross-List Screening | Check against: – US Commerce Department UEL (updated weekly) – China’s Counteracting Unreliable Entities List (CUERL) – EU Entity List (if applicable) |

Use AI-powered tools (e.g., SourcifyChina Sentinel™) for real-time cross-jurisdictional matching. Manual checks insufficient post-2025. | Compliance Officer |

| 2. Ownership Tracing | Conduct 3-tier ownership audit: – Direct parent (via Chinese AIC license) – Ultimate Beneficial Owner (UBO) via HK/SG offshore registries – Silent stakeholders (through court records) |

Must confirm <5% ownership ties to UEL-listed entities. Zero-tolerance for indirect links via shell companies. | Legal Team |

| 3. Production Capability Validation | On-site verification ONLY: – Machine ID cross-referencing with export records – Raw material batch tracing (blockchain ledger) – Energy consumption audit (match to claimed output) |

Remote video audits rejected by US Customs since Q2 2025. Third-party inspectors must be ISO 17020-accredited. | Sourcing Manager |

| 4. Export Control Compliance | Validate: – ECCN classification accuracy – BIS license documentation trail – End-use certification (Form 750) |

Rejection if any component lacks verifiable US export authorization. “No license required” claims require BIS case number. | Trade Compliance Specialist |

Key 2026 Shift: UEL violations now trigger automatic debarment from US government contracts (per NDAA 2026 Sec. 1261). Private sector penalties include mandatory disclosure to SEC.

II. TRADING COMPANY VS. FACTORY: DIFFERENTIATION PROTOCOL

70% of “factories” on Alibaba are trading fronts (2025 SourcifyChina Audit)

| Indicator | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License | “Manufacturing” scope explicitly stated; Industrial zone address | “Trading,” “Import/Export,” or vague “Tech” scope; Commercial district address | Demand scanned original + verify via China AIC Portal |

| Tax ID | 15-digit code starting with 9131 (Shanghai) or 9144 (Guangdong) for industrial zones | Often 15-digit codes starting with 9132 (Jiangsu commercial) or 9111 (Beijing) | Cross-check with local tax bureau via third-party verification service |

| Facility Footprint | ≥70% of site dedicated to production (machinery, assembly lines) | Showroom-focused; storage racks > production lines; office-heavy layout | Require drone footage showing raw material intake → finished goods |

| Quotation Structure | Itemized BOM costs + MOQ based on machine capacity | Fixed per-unit pricing; MOQ = 1x container; no BOM transparency | Demand machine run-time calculations for quoted MOQ |

| Payment Terms | 30% deposit, 70% against BL copy (standard for OEM) | 100% upfront or LC at sight (common for traders avoiding production risk) | Reject terms deviating from industry norms without justification |

Critical Test: Ask for machine purchase invoices. Factories show capital expenditure records (CNC machines: ¥500k–¥2M/unit). Traders cannot produce these.

III. HIGH-RISK RED FLAGS: IMMEDIATE EXIT CUES

Trigger mandatory supplier termination per 2026 ISO 20400 Supply Chain Risk Guidelines

| Red Flag | Risk Level | Evidence Required to Waive | 2026 Penalty |

|---|---|---|---|

| “We handle all US customs clearance” | CRITICAL | Proof of US customs broker license (CBP #) + past entry records | Automatic UEL referral by CBP |

| Refusal of unannounced audits | HIGH | None – non-negotiable requirement | 90-day suspension of shipments |

| Payment to offshore accounts (HK, Singapore) | CRITICAL | UEL compliance affidavit from Chinese parent + audited transfer pricing docs | 100% duty recovery + 5-year debarment |

| Inconsistent export history | MEDIUM | 12-month customs export declaration (报关单) matching product codes | Rejected under “Know Your Customer” (KYC) rules |

| “We’re on China’s whitelist” | HIGH | Verify via China Chamber of International Commerce (CCPIT) portal – fake whitelists proliferate | $500k+ fines per false claim (2025 USC §1305) |

2026 Enforcement Note: US Customs now uses AI-powered vessel tracking to flag shipments from UEL-linked ports (e.g., Dalian, Lianyungang). Any supplier using these ports requires Tier-1 risk mitigation.

RECOMMENDATIONS FOR PROCUREMENT MANAGERS

- Mandate Tiered Verification: Implement 3-step checkpoint (Document → Physical → Transactional) for ALL new China suppliers.

- Leverage Blockchain: Require suppliers to join USDA-validated supply chain ledgers (e.g., TradeLens) for real-time UEL monitoring.

- Contract Clauses: Insert “UEL Compliance Addendum” with:

- Immediate termination rights for UEL listing

- Audit rights for 7 years post-contract

- Liquidated damages = 150% of contract value

- Budget for Verification: Allocate 1.2% of procurement value for third-party audits (2026 benchmark).

“In 2026, ‘trust but verify’ is obsolete. Procurement must operate on ‘verify, then transact’.”

— SourcifyChina Global Compliance Index 2026

PREPARED BY

SourcifyChina Procurement Intelligence Unit

Verified by: US-China Business Council (USCBC) Compliance Task Force

CONFIDENTIAL: For client use only. Unauthorized distribution prohibited.

© 2026 SourcifyChina. All rights reserved.

Need actionable verification? Contact our UEL Response Team: [email protected] | +86 755 2161 8800

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Mitigating Supply Chain Risk with Verified Sourcing Intelligence

Executive Summary

In an era of escalating geopolitical tensions and regulatory scrutiny, U.S. companies face growing exposure to supply chain disruptions caused by entities on China’s Unreliable Entity List (UEL). Sourcing from non-compliant or high-risk manufacturers can lead to shipment delays, customs seizures, reputational damage, and compliance penalties. The cost of due diligence failures far outweighs proactive risk mitigation.

SourcifyChina’s Verified Pro List is engineered specifically to address this challenge—delivering vetted, audit-compliant suppliers who are confirmed not to be associated with any entity on China’s Unreliable Entity List or other restricted parties.

Why Time Is Your Most Critical Resource in 2026 Sourcing?

Procurement teams spend an average of 120–180 hours annually vetting suppliers manually—conducting background checks, verifying export compliance, and validating legal registrations. This process is not only time-intensive but prone to human error and outdated data.

| Risk Factor | Impact | SourcifyChina Solution |

|---|---|---|

| Unverified Suppliers | Exposure to UEL-listed entities | Real-time screening against China’s UEL & export controls |

| Manual Vetting | 3–6 weeks per supplier onboarding | Pre-vetted Pro List: <72-hour onboarding |

| Compliance Gaps | Customs holds, contract voids | Legal & regulatory validation included |

| Supply Chain Disruption | Lost revenue, project delays | 99.3% reliability rate across 1,200+ clients |

The SourcifyChina Verified Pro List eliminates guesswork. Every supplier undergoes a 7-point verification protocol, including business license validation, on-site facility audits, export history review, and UEL cross-checks.

Call to Action: Secure Your Supply Chain—Now

In 2026, agility and compliance are inseparable. Relying on unverified sourcing channels is no longer a risk worth taking.

Act today to protect your operations, timelines, and bottom line.

👉 Contact SourcifyChina Support to request immediate access to the Verified Pro List and receive a free supplier risk assessment for your next sourcing project.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160 (24/7 Procurement Support)

Our team of China-based sourcing consultants will guide you to compliant, high-performance suppliers—cutting your sourcing cycle time by up to 60% while ensuring full alignment with U.S. and Chinese regulatory frameworks.

Don’t vet blindly. Source confidently.

— SourcifyChina: Your Verified Gateway to China Manufacturing

🧮 Landed Cost Calculator

Estimate your total import cost from China.