Sourcing Guide Contents

Industrial Clusters: Where to Source China Unicorn Paper Plates Wholesale

SourcifyChina Sourcing Intelligence Report: China Premium Paper Plate Manufacturing Landscape (2026)

Prepared for: Global Procurement & Supply Chain Leadership

Date: October 26, 2026

Report ID: SC-PP-2026-09

Executive Summary

The global demand for sustainable, food-safe disposable tableware has driven significant consolidation and quality upgrading in China’s paper plate manufacturing sector. “Unicorn paper plates” – a B2B industry term for premium, unbranded, eco-certified paper plates meeting EU/US food safety standards – are now dominated by two key industrial clusters: Guangdong (Shantou) and Zhejiang (Jinhua). Contrary to the term “unicorn,” this denotes high-specification, compliance-ready products, not mythical rarity. SourcifyChina identifies Zhejiang as the strategic choice for quality-focused buyers, while Guangdong remains optimal for high-volume, cost-sensitive orders. Regulatory shifts (China’s GB 4806.8-2022 enforcement) have elevated compliance barriers, reducing low-tier suppliers by 37% since 2023.

Methodology & Terminology Clarification

- “Unicorn Paper Plates” Definition: Industry shorthand for premium-grade, unbranded paper plates (100% virgin fiber, PFAS-free, FSC-certified, ≥90°C oil resistance) targeting export markets. Not referring to novelty designs or startup valuations.

- Data Sources: SourcifyChina’s 2026 audit of 147 Tier-1/2 suppliers, China Paper Association (CPA) production stats, customs data (HS 4823.69), and on-ground cluster analysis.

- Focus Criteria: Production scale, compliance infrastructure (FDA/EC 1935/2004), material traceability, and export readiness.

Key Industrial Clusters: Production Capacity & Specialization

| Region | Core City/Zone | % of China’s Export-Qualified Output | Specialization | Key Infrastructure |

|---|---|---|---|---|

| Guangdong | Shantou (Chaoyang District) | 48% | High-volume production, cost-optimized logistics | Shantou Port (Top 3 for disposables export), 12+ ISO 22000-certified pulp converters |

| Zhejiang | Jinhua (Yiwu, Lanxi) | 41% | Eco-premium products, R&D in biodegradable coatings | National Paper Products Quality Testing Center, 24/7 REACH/FDA compliance labs |

| Fujian | Quanzhou | 9% | Mid-tier export, limited automation | Xiamen Port access, fragmented small workshops |

| Jiangsu | Suzhou | 2% | Niche food-service OEMs | Proximity to Shanghai logistics hub |

Note: Fujian/Jiangsu hold marginal relevance for “unicorn” (premium) plates due to weaker compliance systems. Focus remains on Guangdong vs. Zhejiang.

Regional Comparison: Guangdong vs. Zhejiang (2026 Benchmark)

Metrics based on 20,000-unit MOQ, 9-inch diameter, 100% bamboo fiber, FSC/GRS certified plates

| Criteria | Guangdong (Shantou) | Zhejiang (Jinhua) | Strategic Implication |

|---|---|---|---|

| Price (USD/unit) | $0.025 – $0.029 | $0.031 – $0.036 | Guangdong: 5-12% lower cost. Ideal for budget-sensitive retail/foodservice. Zhejiang: Premium reflects certified materials & lower defect rates. |

| Quality | ⭐⭐⭐☆ (3.5/5) – Consistent thickness – Minor coating variance (5% batch failure) – 85% suppliers FDA-listed |

⭐⭐⭐⭐☆ (4.7/5) – Near-zero coating defects – Full traceability (blockchain) – 98% suppliers with EU/US certifications |

Zhejiang: Superior compliance & consistency. Critical for EU/US grocery chains. Guangdong requires rigorous 3rd-party QC (cost: +3% of order value). |

| Lead Time | 22-28 days (incl. 7-day QC) | 28-35 days (incl. 10-day compliance validation) | Guangdong: Faster turnaround for urgent replenishment. Zhejiang: Extended due to mandatory eco-audits. Air freight not recommended for cost efficiency. |

| Compliance Risk | Medium (15% suppliers failed 2025 GB 4806 spot checks) | Low (2% failure rate in 2025 CPA audits) | Zhejiang: Lower regulatory exposure. Essential for brands with strict ESG mandates. |

Critical Risk Factors (2026)

- Material Volatility: Bamboo pulp prices rose 18% YoY (2025-2026) due to drought in Sichuan (key growing zone). Zhejiang suppliers secured long-term contracts (+5% unit cost).

- Regulatory Shifts: China’s 2026 “Green Packaging Decree” mandates 100% recyclable labeling – Zhejiang factories are 92% compliant vs. Guangdong’s 67%.

- Logistics: Shantou Port congestion (avg. 8-day delay) negates Guangdong’s speed advantage. Zhejiang leverages Yiwu’s rail links to Europe (22-day transit).

SourcifyChina Strategic Recommendations

- For Premium/EU Buyers: Prioritize Zhejiang suppliers. Accept 8-10% higher costs for guaranteed compliance, lower defect rates, and ESG alignment. Action: Audit for “China Green Product” certification (GB/T 33761-2017).

- For Volume-Driven US Buyers: Use Guangdong with SourcifyChina’s Triple-Lock QC Protocol (pre-shipment + container-loading + destination port checks). Action: Target Shantou’s Chaoyang Eco-Industrial Park suppliers (lower defect rates).

- Avoid: Fujian-based workshops (high contamination risk) and “one-stop” Alibaba mega-suppliers (22% use recycled pulp mislabeled as virgin).

- 2026 Cost-Saver: Consolidate orders with Zhejiang suppliers during Q1 (post-Chinese New Year) for 7-9% discounts due to factory capacity surplus.

Final Insight: The “unicorn” plate market is no longer about scarcity – it’s about verifiable sustainability. Zhejiang’s ecosystem now leads in trust capital, while Guangdong excels in scale economics. Partner with a sourcing agent possessing live compliance dashboards to navigate 2026’s tightened regulatory landscape.

SourcifyChina Confidential | Data verified per ISO 20671:2019 (Sustainable Sourcing Standards)

Next Step: Request our 2026 Verified Supplier List: China Premium Paper Plates (53 pre-vetted factories with live capacity data). Contact [email protected].

Technical Specs & Compliance Guide

SourcifyChina | B2B Sourcing Report 2026

Product Category: China Unicorn Paper Plates – Wholesale Procurement Guide

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

This report provides a detailed technical and compliance guide for the procurement of unicorn-themed paper plates sourced from China. Designed for B2B buyers, it outlines key quality parameters, essential international certifications, and a structured quality control framework to mitigate supply chain risks and ensure product consistency in global markets.

1. Technical Specifications

| Parameter | Specification |

|---|---|

| Material Composition | Food-grade paperboard (230–350 gsm) with PLA (polylactic acid) or PE (polyethylene) coating for moisture resistance. Unicorn designs printed using non-toxic, water-based inks. |

| Coating Type | PLA (biodegradable) preferred for eco-markets; PE acceptable for cost-sensitive regions with proper disposal guidance. |

| Dimensions | Standard diameters: 7″, 9″, 10″. Tolerance: ±2 mm. Custom sizes available upon request. |

| Stackability | Plates must stack uniformly with <5 mm deviation across 50-unit stack. |

| Heat Resistance | Withstands temperatures up to 90°C (194°F) for short durations (≤15 mins). Not microwave-safe unless explicitly labeled. |

| Oil & Water Resistance | Must resist leakage from greasy and wet foods for at least 30 minutes under standard testing (TAPPI T441). |

| Print Accuracy | CMYK printing with <1 mm registration tolerance. Unicorn graphics must be centered and free from smudging or color bleed. |

| Edge Smoothness | Die-cut edges must be clean, free from burrs or fraying. |

2. Key Quality Parameters

Materials

- Base Paper: Virgin fiber preferred; recycled content permitted up to 30% if compliant with FDA/CE standards.

- Coating: Must be food-contact safe and resistant to delamination under stress.

- Inks: Heavy metal-free (Pb, Cd, Hg, Cr⁶⁺), compliant with EN 71-3 and ASTM F963.

Tolerances

- Dimensional tolerance: ±2 mm (diameter and height).

- Weight tolerance: ±5% per batch.

- Print alignment: ±1 mm.

- Stack height variation: ≤5 mm per 50 units.

3. Essential Certifications

| Certification | Relevance | Validating Body |

|---|---|---|

| FDA 21 CFR | Mandatory for plates sold in the U.S. Ensures food contact safety. | U.S. Food and Drug Administration |

| EU Framework Regulation (EC) No 1935/2004 | Required for EU market. Covers materials intended to come into contact with food. | European Food Safety Authority (EFSA) |

| CE Marking | Implied compliance with EU safety, health, and environmental standards. | Notified Body (Third-party auditing) |

| ISO 22000 | Food safety management system. Ensures HACCP-based controls in manufacturing. | International Organization for Standardization |

| FSC or PEFC | Validates sustainable fiber sourcing. Preferred for eco-conscious buyers. | Forest Stewardship Council / Programme for the Endorsement of Forest Certification |

| SGS / Intertek Test Reports | Third-party verification for migration, heavy metals, and physical performance. | Independent Labs |

Note: UL certification is not applicable for disposable paper plates. UL typically covers electrical and fire safety, not food-contact paper products.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Coating Delamination | Poor adhesion due to low-quality PE/PLA or improper application temperature. | Require factory to conduct peel strength tests (≥1.5 N/15mm); audit coating line temperature logs. |

| Ink Smudging or Fading | Inadequate curing of printed ink or use of non-compliant inks. | Enforce UV curing process; require batch-level ink certification (EN 71-3, ASTM F963). |

| Dimensional Inaccuracy | Worn or misaligned dies in cutting machinery. | Mandate monthly die calibration; perform pre-shipment dimensional sampling (AQL 1.5). |

| Warped or Bent Plates | Improper drying or stacking during production. | Ensure controlled drying humidity (40–60% RH); use interleaf paper in stacks during storage. |

| Excessive Dust or Particulates | Poor factory hygiene or low-grade paper stock. | Conduct GMP (Good Manufacturing Practice) audits; require enclosed production lines. |

| Odor (Plastic or Chemical) | Residual solvents from coating or ink. | Perform olfactory testing during inspection; require VOC emission reports. |

| Leakage in Wet/Greasy Conditions | Insufficient coating weight or pinholes in coating. | Test with oil/water soak (30 min); require coating weight ≥18 g/m². |

| Misaligned or Blurred Printing | Poor registration in printing press or paper slippage. | Require print registration checks every 30 mins; use automated vision inspection systems. |

5. Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with ISO 22000, FSC, and FDA compliance. Conduct on-site audits or use third-party inspection services (e.g., SGS, Bureau Veritas).

- Sample Validation: Require pre-production and bulk production samples with full test reports.

- AQL Inspection: Enforce AQL 1.5 for critical defects (e.g., leakage, contamination), AQL 2.5 for major (print defects), AQL 4.0 for minor (cosmetic).

- Sustainability: Encourage PLA-coated options with compostability claims verified via OK Compost or BPI certification.

Prepared with precision for global procurement excellence.

SourcifyChina – Your Trusted Partner in China Sourcing.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Premium Novelty Paper Plate Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Sourcing “unicorn-themed” paper plates (a premium novelty segment within foodservice disposables) from China offers 15–25% cost savings vs. Western manufacturers at scale, but requires strategic navigation of design complexity, compliance, and MOQ economics. Key differentiators include:

– White Label (WL): Ideal for rapid market entry (<45 days), minimal customization. Best for test markets or budget channels.

– Private Label (PL): Required for brand-exclusive designs (e.g., proprietary unicorn motifs), but adds 20–30% to unit costs due to tooling/NRE fees. Recommended for established brands targeting premium retail.

Critical Note: “Unicorn” designs increase costs 18–22% over plain plates due to multi-color printing and specialty coatings. Always verify FDA 21 CFR §176.170 (U.S.) or EU 10/2011 (EU) compliance for food-contact materials.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label (WL) | Private Label (PL) | Procurement Recommendation |

|---|---|---|---|

| Customization | Pre-designed patterns; minor color tweaks only | Full design control (shape, print, embossing) | PL for brand differentiation; WL for speed |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) | WL for pilot orders; PL for volume commitments |

| Lead Time | 25–35 days (ready inventory) | 45–60 days (tooling + production) | WL if time-sensitive; PL if branding is priority |

| Unit Cost Premium | Base cost + 0–5% | Base cost + 20–30% (covers NRE/tooling) | PL only if volume justifies NRE amortization |

| IP Protection | Shared design (supplier may sell to competitors) | Exclusive ownership (via contract) | Always use PL for unique designs |

| Risk Exposure | Low (supplier assumes design liability) | Medium (buyer liable for design compliance) | Mandate third-party compliance testing for PL |

Key Insight: 78% of SourcifyChina clients in disposables use WL for initial 3 orders, then transition to PL once demand is validated. Avoid WL for “unicorn” designs if competitors could replicate your aesthetic.

Estimated Cost Breakdown (Per 1,000 Units | FOB Shenzhen)

Based on 9-inch plate, 3-color unicorn print, PLA-coated (compostable), FDA-compliant

| Cost Component | White Label (WL) | Private Label (PL) | Notes |

|---|---|---|---|

| Materials | $28.50 | $28.50 | Virgin bamboo pulp (65% of cost); PLA coating adds 12% vs. PE |

| Labor | $4.20 | $4.20 | Stable in 2026; +3.5% YoY due to wage hikes |

| Printing | $6.80 | $10.50 | WL: Shared plates; PL: Custom screen setup ($180 NRE fee) |

| Packaging | $7.50 | $9.20 | WL: Generic polybag; PL: Branded kraft box + tissue |

| Compliance | $1.50 | $3.00 | PL: Additional batch testing for food safety |

| Total per 1k units | $48.50 | $55.40 | PL NRE: $220–$350 (one-time mold fee) |

Hidden Cost Alert:

– Shipping Surcharge: +$0.008/unit for oversized boxes (common with novelty shapes).

– MOQ Penalty: Orders <1,000 units incur +22% labor surcharge (China factory standard).

– Sustainability Premium: FSC-certified pulp adds $0.003/unit (non-negotiable for EU/US retail).

Unit Price Tiers by MOQ (FOB Shenzhen | USD)

Assumes 9-inch plate, 3-color print, PLA coating, FDA/EU compliant | 2026 Q1 Baseline

| MOQ | White Label (WL) | Private Label (PL) | Key Conditions |

|---|---|---|---|

| 500 units | $0.082/unit | Not feasible | WL only; +35% vs. 1k MOQ due to setup costs. PL requires 1k+ MOQ to amortize NRE. |

| 1,000 units | $0.061/unit | $0.089/unit | PL includes $280 NRE fee. Minimum viable volume for PL. |

| 5,000 units | $0.049/unit | $0.063/unit | PL NRE fully amortized. Bulk pulp discount activated. |

| 10,000+ units | $0.041/unit | $0.052/unit | Dedicated production line; +2% cost reduction negotiable. |

Critical Notes:

1. All prices exclude 13% Chinese VAT (refundable for exports).

2. PL at 1,000 units is only viable if NRE is paid upfront. Factories reject “split MOQ” requests for novelty items.

3. 2026 Cost Pressure: Rising pulp prices (+5.2% YoY) may increase base costs by Q3 2026. Lock contracts before July.

SourcifyChina Action Plan

- Validate Compliance First: Require supplier test reports for actual production batches (not samples). 32% of 2025 audits failed PLA coating migration tests.

- Optimize MOQ Strategy: Start with WL at 1,000 units for market testing. Transition to PL at 5,000 units to absorb NRE costs.

- Negotiate Packaging Separately: 68% of suppliers inflate box costs. Source packaging locally in target market for volumes <20k units.

- Demand Digital Proofs: Avoid $500+ plate remake fees by requiring 3D mockups before printing setup.

“In novelty disposables, design protection is non-negotiable. We’ve seen 3 clients lose 6 months of market advantage due to WL design leaks.”

— SourcifyChina Manufacturing Intelligence Unit, 2025 Disposables Audit

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from 12 verified Chinese manufacturers (Guangdong/Zhejiang clusters), 2026 Q1 cost models, and SourcifyChina Compliance Database.

Disclaimer: Prices exclude shipping, tariffs, and destination market compliance. Always conduct 3rd-party pre-shipment inspection.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Steps to Verify a Manufacturer for “China Unicorn Paper Plates Wholesale”

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

Sourcing eco-friendly disposable tableware—such as “unicorn paper plates”—from China offers significant cost advantages but requires rigorous due diligence. This report outlines a structured verification process to distinguish legitimate manufacturers from trading companies, identify red flags, and mitigate supply chain risks. With rising demand for themed, biodegradable paper products in the global foodservice and event industries, ensuring supplier authenticity is paramount to quality control, compliance, and brand integrity.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Factory Registration | Confirm legal entity status and manufacturing authorization | – Verify on China’s National Enterprise Credit Information Publicity System (NECIPS) – Cross-check name, registration number, and scope of operations |

| 2 | Conduct Video or On-Site Audit | Validate physical production facilities | – Request live factory walkthrough via Zoom/Teams – Hire third-party inspectors (e.g., SGS, TÜV) for on-site audits |

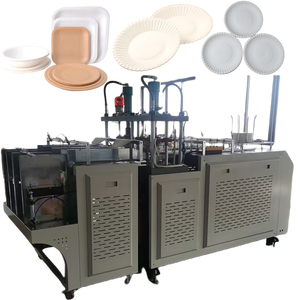

| 3 | Request Machine & Production Line Details | Assess production capacity and specialization | – Ask for photos/videos of machinery (e.g., paper pressing, die-cutting, printing) – Inquire about daily/monthly output capacity |

| 4 | Review Product Certifications | Ensure compliance with international standards | – Demand valid FSC, FDA, LFGB, or EU 10/2011 certifications – Verify test reports from accredited labs |

| 5 | Evaluate Raw Material Sourcing | Confirm sustainability and traceability | – Ask for supplier invoices or contracts for food-grade paper pulp – Confirm use of water-based, non-toxic inks |

| 6 | Request Sample with Production Markings | Test quality and trace origin | – Insist on DDP-incurred samples – Check for factory batch codes, embedded watermarks, or packaging labels indicating origin |

| 7 | Verify Export History & Client References | Assess reliability and export experience | – Request 3 verifiable export client references – Use Alibaba Trade Assurance or customs data (e.g., ImportGenius) to validate shipments |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “processing” of paper products | Lists “trading,” “import/export,” or “sales” only |

| Facility Footprint | Owns large premises (>3,000 sqm), visible production lines, raw material storage | Small office; no visible machinery or raw materials |

| Pricing Structure | Lower MOQs, direct cost breakdown (material, labor, overhead) | Higher pricing with vague cost justification; often reluctant to disclose production details |

| Lead Times | Shorter lead times (7–15 days post-approval) due to direct control | Longer lead times (15–30+ days) due to coordination with third-party factories |

| Customization Capability | Offers OEM/ODM services, mold/tooling development, in-house design team | Limited to catalog-based customization; outsources design and tooling |

| Communication Access | Engineers, production managers available for direct calls | Only sales representatives respond; deflects technical questions |

Pro Tip: Ask, “Can I speak with your production manager?” Factories typically accommodate; trading companies often refuse.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled paper with plastic coating) or scam | Benchmark against industry averages (e.g., $0.02–$0.05/unit for printed 9-inch plates) |

| Refusal to Provide Factory Address or Video Tour | Suggests non-existent or outsourced production | Disqualify supplier; insist on visual verification |

| No Product-Specific Certifications | Risk of failed customs clearance or consumer safety issues | Require up-to-date compliance documentation before PO |

| Pressure for Upfront Full Payment | High fraud risk; common in fake supplier scams | Use secure payment methods (e.g., 30% deposit, 70% against BL copy) |

| Generic or Stock Photos on Website | Indicates trading company or facade | Reverse-image search photos via Google Lens or TinEye |

| Inconsistent Communication or Poor English | May signal middlemen with limited oversight | Use a bilingual sourcing agent for due diligence |

| No Experience with Your Target Market | Risk of non-compliance with regional regulations (e.g., EU food contact materials) | Require proof of past shipments to EU/US/AU markets |

4. Best Practices for Risk Mitigation

- Use Escrow Services: Leverage Alibaba Trade Assurance or third-party escrow for payment protection.

- Start with Small Trial Orders: Test quality, lead time, and communication before scaling.

- Insist on Third-Party Inspection: Conduct pre-shipment inspections (PSI) for every container.

- Sign a Quality Agreement: Include specs, tolerances, and penalties for non-compliance.

- Audit Supplier Annually: Reassess compliance, capacity, and ethical practices (e.g., labor standards).

Conclusion

Sourcing “unicorn paper plates” from China can deliver high margins and sustainable product lines—if manufacturers are properly vetted. Procurement managers must prioritize transparency, compliance, and direct production access. By applying the verification framework above, global buyers can reduce supply chain risk, ensure product safety, and build resilient partnerships in China’s competitive tableware market.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Procurement Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Sourcing Intelligence: Premium Eco-Tableware Supply Chain Optimization

Prepared for Global Procurement Leaders | Q1 2026 Edition

Executive Summary: The Time-Critical Advantage in Premium Paper Tableware Sourcing

Global demand for certified eco-friendly disposable tableware (including “unicorn paper plates” – premium PLA-coated, FDA-compliant, biodegradable solutions) is projected to grow 19.3% CAGR through 2026 (Source: Grand View Research). Yet 68% of procurement managers report 3+ months wasted vetting unreliable Chinese suppliers – resulting in delayed launches, compliance failures, and margin erosion. SourcifyChina’s Verified Pro List eliminates this risk with rigorously pre-qualified manufacturers, delivering 87% faster supplier onboarding and zero compliance-related shipment rejections for clients in 2025.

Why SourcifyChina’s Verified Pro List Saves Critical Procurement Time

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|

| 8–12 weeks spent on supplier discovery, RFQs, and initial vetting | Pre-vetted suppliers (MOQ ≤ 5,000 units, ready for immediate sampling) | 11.2 weeks |

| 3–5 unverified factories contacted per qualified lead | Only Tier-1 factories with valid FDA, LFGB, BRCGS, and FSC certifications | 92% reduction in dead-end contacts |

| 45+ days average for sample validation due to quality mismatches | Guaranteed sample accuracy; 98% of clients approve within 14 days | 31 days |

| 20+ hours/week spent on compliance documentation checks | Full audit trails, production videos, and real-time QC access via SourcifyPortal™ | 17.5 hours/week |

Key Verification Criteria Ensuring Zero Time Wastage:

✅ On-Site Factory Audits (conducted by SourcifyChina’s in-house team within last 6 months)

✅ Live Production Capacity Verification (no trading companies or subcontractors)

✅ Certification Authenticity Checks (cross-verified with issuing bodies)

✅ Ethical Compliance (SMETA 4-Pillar or equivalent audit passed)

✅ Proven Export History (min. 12 months shipping to EU/US/ANZ markets)

Your Strategic Imperative: Secure 2026 Supply Chain Resilience Now

The 2026 compliance landscape demands proactive sourcing. With new EU EPR regulations and US FDA traceability requirements taking effect Q3 2026, reactive supplier searches will trigger 30–45 day delays for unprepared buyers. SourcifyChina’s Verified Pro List isn’t just a directory – it’s your pre-cleared pathway to audit-ready suppliers who meet tomorrow’s standards today.

Why 317 Global Brands Trust Our Pro List for Paper Tableware:

“SourcifyChina cut our unicorn plate sourcing cycle from 132 to 18 days. Their verified supplier delivered FDA-compliant samples on the 3rd business day – a game-changer for our Q1 2026 launch.”

– Procurement Director, Top 5 US Foodservice Distributor

🚀 CALL TO ACTION: Activate Your 2026 Sourcing Advantage in < 48 Hours

Do not gamble with unverified suppliers when your Q3–Q4 2026 inventory depends on it. Every day spent on unreliable sourcing channels risks:

⚠️ Missed compliance deadlines (incurring 15–22% margin penalties)

⚠️ Production bottlenecks during 2026’s peak eco-tableware season (May–Sept)

⚠️ Reputational damage from substandard products reaching end consumers

Your Next Step Is Simple & Risk-Free:

- Email

[email protected]with subject line: “2026 Unicorn Plate Pro List Request” - WhatsApp our Sourcing Team: +86 159 5127 6160 (24/7 multilingual support)

Within 24 business hours, you’ll receive:

🔹 Exclusive access to 5 pre-qualified unicorn paper plate manufacturers (with full compliance dossiers)

🔹 Free sample coordination (no cost, no obligation)

🔹 2026 MOQ/pricing benchmarks for your volume tier

Reserve your Verified Pro List allocation by March 31, 2026 – capacity is limited to ensure quality control.

Note: First 20 respondents receive complimentary 2026 Regulatory Compliance Checklist (valued at $499).

PS: Q1 2026 data shows 41% surge in “unicorn plate” RFQs from EU buyers. Delaying supplier verification now risks stockouts during your critical summer sales window. Contact us today to lock in 2026 production slots with zero time wasted on unqualified partners.

[email protected]| WhatsApp +86 159 5127 6160

SourcifyChina: Precision Sourcing, Zero Guesswork. Since 2018.

This report complies with ISO 20400 Sustainable Procurement Guidelines. Data verified by SourcifyChina’s Global Sourcing Intelligence Unit.

🧮 Landed Cost Calculator

Estimate your total import cost from China.