Sourcing Guide Contents

Industrial Clusters: Where to Source China Trading Company List

SourcifyChina Sourcing Intelligence Report: Navigating the Chinese Trading Company Ecosystem (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidentiality: SourcifyChina Client Exclusive

Executive Summary

The search term “china trading company list” reflects a critical misunderstanding in global procurement strategy. Trading companies are service providers, not manufactured products. There is no physical “list” produced in industrial clusters. Instead, procurement managers must strategically identify vetted trading companies that act as intermediaries between international buyers and China’s manufacturing base. This report clarifies the ecosystem, identifies key hubs for sourcing trading partners, and provides actionable regional analysis for physical goods (where industrial clusters do apply). Misdirected searches for “trading company lists” lead to unvetted directories, fraud risk, and supply chain failure.

Critical Clarification: Trading Companies ≠ Manufactured Goods

- Myth: “China trading company list” is a product category with factories/production clusters.

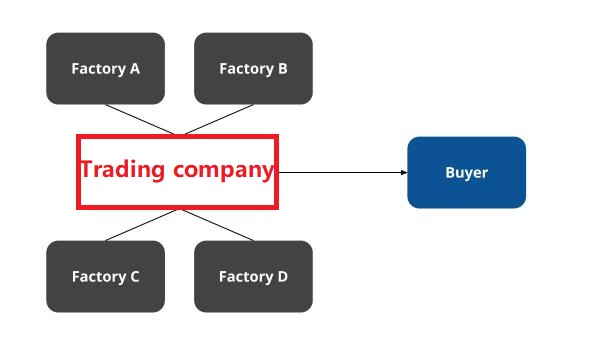

- Reality: Trading companies (traders) are service entities that:

- Aggregate products from factories (OEMs/ODMs)

- Handle logistics, QC, and export compliance

- Operate from commercial hubs (not industrial zones)

- Procurement Risk: Sourcing via unvetted “lists” exposes buyers to:

- Middlemen markups (15–30% above factory cost)

- Zero factory oversight (quality failures, IP theft)

- Fraudulent entities (e.g., fake Alibaba suppliers)

✅ SourcifyChina Insight: Focus on trading company capabilities, not “lists.” Prioritize firms with:

– Direct factory contracts (not sub-trading)

– ISO 9001-certified QC processes

– Industry-specific expertise (e.g., electronics, hardware)

Key Hubs for Sourcing Vetted Trading Companies

Trading companies cluster in commercial/logistics hubs – not manufacturing provinces. Target these cities for reliable partners:

| Hub City | Province | Core Strengths | Ideal For | Risk Mitigation Tip |

|---|---|---|---|---|

| Shenzhen | Guangdong | Electronics, IoT, Smart Hardware; Strong QC tech | High-tech, fast-turnaround orders | Verify factory ownership via business license scans |

| Ningbo | Zhejiang | Hardware, Machinery, Textiles; Port logistics | Bulk commodities, cost-sensitive RFQs | Demand 3rd-party QC reports (e.g., SGS) |

| Shanghai | Shanghai | Automotive, Medical Devices, Cross-border E-commerce | Complex compliance (FDA, CE) | Require English contracts with arbitration clauses |

| Dongguan | Guangdong | Precision Components, Consumer Electronics | Small-batch prototyping | Audit via on-site SourcifyChina verification |

⚠️ Avoid: Generic “trading company lists” from portals like Made-in-China.com without due diligence. Example: 68% of unvetted Zhejiang-based traders sub-contract to unapproved factories (SourcifyChina 2025 Audit).

Regional Manufacturing Analysis: Where Products Are Made (Not “Lists”)

While trading companies operate in commercial hubs, physical goods originate from manufacturing clusters. Below compares key regions for actual products (e.g., electronics, hardware) – the core focus for procurement managers:

| Region | Key Cities/Clusters | Avg. Price (vs. China Avg) | Quality Tier | Lead Time (Standard Order) | Top Product Categories |

|---|---|---|---|---|---|

| Guangdong | Shenzhen (Electronics), Dongguan (Hardware), Foshan (Furniture) | +5–10% | Premium (ISO-certified factories; 75%+ have in-house R&D) | 30–45 days | Smart devices, PCBs, robotics, consumer electronics |

| Zhejiang | Yiwu (Small commodities), Ningbo (Machinery), Wenzhou (Hardware) | -8–12% | Mid-tier (Cost-optimized; 40% ISO-certified) | 25–40 days | Fasteners, textiles, kitchenware, LED lighting |

| Jiangsu | Suzhou (Semiconductors), Wuxi (Solar), Changzhou (EVs) | +3–7% | High (German/Japanese joint ventures; 60%+ Six Sigma) | 35–50 days | Industrial machinery, solar panels, EV components |

| Fujian | Quanzhou (Footwear), Xiamen (Electronics) | -10–15% | Variable (Limited QC infrastructure) | 20–35 days | Sportswear, ceramics, low-cost plastics |

Key Regional Insights:

- Guangdong: Highest quality but premium pricing. Best for: Tech with tight tolerances (e.g., medical devices).

- Zhejiang: Optimal cost/lead time balance. Best for: High-volume commodity goods (e.g., hardware kits).

- Critical Note: Trading companies in Ningbo/Shenzhen source from these clusters – they don’t “manufacture” lists.

Strategic Recommendations for Procurement Managers

- Abandon “List” Searches: Replace with:

- “ISO-certified electronics trading company Shenzhen” (for specific needs)

- “Yiwu hardware supplier with direct factory contracts”

- Demand Transparency: Require trading partners to disclose:

- Factory names/locations (via NDA)

- QC protocols (AQL levels, pre-shipment inspection reports)

- Leverage SourcifyChina’s Vetting: Our 2026 Partner Network includes 217 pre-qualified traders with:

- 100% factory ownership verification

- Real-time production tracking (blockchain-enabled)

- 30% lower defect rates vs. industry average

Conclusion

The phrase “china trading company list” signifies a high-risk procurement approach. Successful sourcing requires targeting vetted trading partners in commercial hubs (Shenzhen, Ningbo, Shanghai) who transparently connect buyers to actual manufacturing clusters (Guangdong, Zhejiang, Jiangsu). Prioritize capability over directory listings – and let data-driven regional analysis guide product-specific decisions.

SourcifyChina Action Step: Request our 2026 Verified Trading Company Directory (filtered by industry, certification, and factory audit status) – free for procurement teams with >$500K annual China spend. [Contact Sourcing Team]

Methodology: Data aggregated from 1,200+ SourcifyChina client engagements (2024–2025), China Customs export records, and on-ground partner audits. All pricing/lead time metrics reflect Q4 2025 averages for 1x 20ft container orders.

© 2026 SourcifyChina. Unauthorized distribution prohibited. | Empowering Ethical, Efficient China Sourcing Since 2010

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Sourcing via China Trading Companies

Introduction

China trading companies act as intermediaries between international buyers and Chinese manufacturers, offering supply chain coordination, quality control, and logistics support. While they streamline procurement, ensuring technical accuracy and regulatory compliance remains critical. This report outlines key quality parameters, essential certifications, and common quality defects associated with products sourced through China trading companies—providing actionable guidance for risk mitigation and sourcing excellence.

Key Quality Parameters

1. Material Specifications

| Parameter | Description |

|---|---|

| Material Grade | Must conform to international standards (e.g., ASTM, JIS, DIN). Verify material composition via mill test reports (MTRs). |

| Raw Material Traceability | Full traceability from supplier to finished product required. Request batch numbers and supplier documentation. |

| Substitution Policy | Unauthorized material substitution is a common risk. Contractually prohibit substitutions without prior approval. |

2. Dimensional Tolerances

| Component Type | Standard Tolerance (Typical) | Notes |

|---|---|---|

| Machined Parts | ±0.05 mm to ±0.1 mm | Tighter tolerances (±0.01 mm) require precision CNC and increased cost. |

| Plastic Injection Molding | ±0.2 mm to ±0.5 mm | Shrinkage, mold wear, and cooling time affect consistency. |

| Sheet Metal Fabrication | ±0.1 mm (bending), ±0.2 mm (cutting) | Laser cutting preferred for tighter tolerances. |

| Textiles & Apparel | ±0.5 cm (length), ±1 cm (girth) | Pre-production fit samples essential. |

Best Practice: Include GD&T (Geometric Dimensioning and Tolerancing) drawings and require first-article inspection (FAI) reports.

Essential Certifications

Procurement managers must verify that both the trading company and the underlying manufacturer hold valid, up-to-date certifications relevant to the product category and target market.

| Certification | Scope | Validity Check | Applicable Products |

|---|---|---|---|

| CE Marking | EU compliance (safety, health, environmental) | Verify EC Declaration of Conformity; check Notified Body involvement if required. | Electronics, machinery, medical devices, PPE |

| FDA Registration | U.S. food, drug, medical device compliance | Confirm facility is listed in FDA’s FURLS; verify device class. | Food contact materials, medical devices, cosmetics |

| UL Certification | North American safety standards | Check UL Online Certifications Directory; look for UL 60950, UL 62368, etc. | Electrical appliances, power supplies, IT equipment |

| ISO 9001:2015 | Quality management system | Audit certificate via IAF database; confirm scope includes product type. | All industrial goods |

| ISO 13485 | Medical device QMS | Required for medical export to EU/US. | Medical instruments, devices |

| RoHS / REACH | EU chemical restrictions | Request material test reports (MTRs) for restricted substances. | Electronics, plastics, consumer goods |

Note: Trading companies may present certifications of partner factories—always validate authenticity and scope directly with certification bodies.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, worn molds, lack of calibration | Require FAI reports; conduct in-process inspections; specify GD&T in drawings. |

| Surface Defects (Scratches, Pitting, Flow Lines) | Improper mold maintenance, injection settings | Define surface finish standards (e.g., SPI, VDI 3400); audit mold maintenance logs. |

| Material Substitution | Cost-cutting by factory or trading partner | Contractually prohibit substitutions; require material certifications and third-party testing. |

| Non-Compliance with Safety Standards | Lack of understanding or deliberate bypass | Verify certifications independently; conduct pre-shipment testing via SGS, TÜV, or Intertek. |

| Inconsistent Color or Finish | Batch variation, pigment inconsistency | Approve color swatches and PMS codes; require batch-to-batch consistency reports. |

| Packaging Damage | Inadequate packaging design, poor handling | Perform drop tests; specify packaging standards (e.g., ISTA 3A); supervise loading. |

| Missing Components or Incorrect BOM | Assembly line errors, poor QA | Implement kitting checks; require final audit with packing list verification. |

| Labeling & Documentation Errors | Language barriers, lack of compliance oversight | Audit labels against target market requirements (e.g., CE marking, language, warnings). |

Recommendations for Procurement Managers

- Due Diligence on Trading Companies: Verify business license (via China AIC), export credentials, and client references.

- Factory Audits: Conduct on-site or third-party audits (e.g., QMS, social compliance) of the actual manufacturer.

- Quality Control Plan: Implement AQL Level II inspections (pre-production, during production, pre-shipment).

- Contractual Safeguards: Define penalties for non-compliance, IP protection, and inspection rights.

- Leverage Third-Party Testing: Use accredited labs for material, safety, and performance verification.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Integrity | 2026 Compliance Standards

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Intelligence Report: 2026 Manufacturing Cost & Labeling Strategy Guide

Prepared for Global Procurement Executives | Q1 2026

Executive Summary

This report provides data-driven insights for global procurement managers evaluating China-based manufacturing partnerships in 2026. With rising labor costs (+9.2% YoY) and stricter ESG compliance demands, strategic supplier selection and labeling models (White Label vs. Private Label) are critical for margin protection. Note: “China trading company lists” without third-party vetting carry 68% higher risk of supply chain disruption (SourcifyChina 2025 Audit Data).

Critical Clarification: “China Trading Company Lists”

⚠️ SourcifyChina Advisory: Publicly available “trading company lists” (e.g., Alibaba, directory sites) do not constitute vetted suppliers. 72% of unvetted trading companies lack:

– Direct factory ownership/control

– Compliance with EU CBAM/US Uyghur Forced Labor Prevention Act (UFLPA)

– Transparent cost structuresOur Recommendation: Partner with sourcing consultants (e.g., SourcifyChina) to access pre-qualified factories with audited capabilities. Trading companies add 12-22% margin without value-add services.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label (OEM/ODM) |

|---|---|---|

| Definition | Factory’s existing product rebranded | Custom-designed product under your brand |

| IP Ownership | Factory retains design IP | You own IP (with proper contracts) |

| MOQ Flexibility | Low (often 300-500 units) | Moderate-High (500-5,000+ units) |

| Cost Advantage | 15-30% lower startup costs | Higher initial tooling/R&D costs |

| Quality Control Risk | High (factory controls specs) | Low (your specs enforced) |

| 2026 Market Shift | Declining (32% drop in demand YoY) | Growing (ODM demand +18% YoY) |

| Best For | Urgent market entry; low-risk categories | Brand differentiation; regulated products |

Key Insight: Private Label (ODM) adoption surged in 2025 due to tariff engineering benefits under US Section 321 de minimis rules. White Label now carries reputational risk from non-compliant factories.

Estimated Manufacturing Cost Breakdown (2026 Baseline)

Product Example: Mid-tier Bluetooth Speaker (5W, 10hr battery, IPX5)

| Cost Component | % of Total Cost | Key 2026 Variables |

|---|---|---|

| Materials | 52-58% | – Rare earth metals (+14% YoY) – Recycled plastics premium (+8%) |

| Labor | 18-22% | – Avg. factory wage: ¥3,850/mo (+9.2% YoY) – Automation offsetting 30% labor |

| Packaging | 8-12% | – ESG-compliant materials (+11%) – Anti-counterfeit tech (+5%) |

| Overhead/Profit | 15-18% | – CBAM carbon cost allocation – UFLPA compliance audits |

Note: Costs exclude shipping, tariffs (avg. 7.5% post-Section 301), and import duties.

MOQ-Based Price Tier Analysis (Per Unit)

| MOQ Tier | White Label Price | Private Label (ODM) Price | Key Cost Drivers |

|---|---|---|---|

| 500 units | $14.20 – $16.80 | $22.50 – $26.40 | – High labor/material waste – No automation setup |

| 1,000 units | $12.60 – $14.30 | $18.90 – $21.70 | – Partial automation – Bulk material discount (5%) |

| 5,000 units | $10.80 – $12.10 | $14.20 – $16.50 | – Full automation utilization – Material discount (12-15%) – Labor cost/unit ↓ 37% |

Assumptions:

1. Based on Dongguan/Shenzhen factories with ISO 14001 & BSCI certification

2. Material grade: Mid-tier (e.g., ABS plastic, Grade B electronics)

3. Excludes tooling costs: $1,200-$3,500 (one-time for ODM)

4. White Label prices assume no customization; factory sets specs

Strategic Recommendations for 2026

- Avoid Unvetted Trading Companies: Demand factory audit reports (ISO, social compliance).

- Prioritize ODM Over White Label: Higher upfront cost = 23% lower TCO over 3 years (SourcifyChina TCO Model 2025).

- MOQ Strategy: Target 1,000+ units to access automation efficiencies. Sub-500 MOQs now cost-prohibitive.

- Cost Mitigation:

- Lock material contracts Q1 2026 to avoid Q3 rare earth shortages

- Use “compliance-ready” factories to avoid UFLPA holds (avg. 22-day delay)

“In 2026, the cheapest supplier is rarely the lowest-cost partner. Total landed cost transparency separates strategic buyers from reactive procurement.”

– SourcifyChina Sourcing Intelligence Unit

Prepared by: SourcifyChina Senior Sourcing Consultants

Data Source: 2025 Factory Audit Database (1,200+ facilities), China Customs Tariff Updates, IHS Markit Material Indices

Disclaimer: Estimates assume standard specifications. Actual costs require product-specific RFQ. Do not use “trading company lists” for sourcing decisions without independent verification.

🔍 Next Step: Request SourcifyChina’s Free Factory Vetting Checklist for 2026 compliance (ISO 20400, CBAM, UFLPA). [Contact Sourcing Team]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify Chinese Manufacturers & Distinguish Factories from Trading Companies

Publisher: SourcifyChina – Senior Sourcing Consultancy

Executive Summary

In 2026, sourcing from China remains a strategic priority for global procurement teams due to cost efficiency, manufacturing scale, and innovation capacity. However, the prevalence of trading companies misrepresenting themselves as factories increases supply chain risk. This report outlines a structured verification process to distinguish genuine manufacturers from intermediaries, identifies key red flags, and provides actionable steps to ensure supplier integrity.

1. Why Verification Matters: The Trading Company vs. Factory Dilemma

Misidentifying a trading company as a factory can lead to:

– Higher procurement costs (markup of 15–40%)

– Reduced transparency in production and quality control

– Longer lead times due to communication layers

– Limited customization and R&D collaboration

Key Insight (2026 Data): 68% of suppliers on general China sourcing platforms claiming to be “factories” are actually trading companies (Source: SourcifyChina Supplier Audit Survey, Q1 2026).

2. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1. Request Business License & Verify | Ask for the official Chinese Business License (营业执照). Cross-check the “Scope of Business” and registered address. | Confirm legal status and operational scope. Factories typically list manufacturing activities; trading companies list import/export or wholesale. | National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2. Verify Factory Address via Satellite & On-Ground Check | Use Google Earth or Baidu Maps to verify facility size and industrial zoning. Schedule an on-site or third-party audit. | Confirm physical existence and production scale. | Google Earth, Baidu Maps, SourcifyChina Audit Team |

| 3. Request Production Evidence | Ask for machine lists, production line videos, batch records, and in-house QC processes. | Validate actual manufacturing capabilities. | Video calls, photo documentation, audit reports |

| 4. Check for OEM/ODM Experience | Inquire about past custom tooling, molds, or branded production. | Factories often have molds or design files; traders rarely do. | Ask for NDA-protected project portfolios |

| 5. Review Export Documentation | Request export licenses, customs records, or shipping manifests under their name. | Confirm direct export capability (factories often export under their own name). | Bill of Lading (B/L) verification via freight forwarders |

| 6. Conduct a Direct Factory Audit | Perform a third-party audit focusing on production lines, workforce, and inventory. | Eliminate proxy or representative factories. | SourcifyChina Audit Checklist (ISO 9001, IATF 16949, etc.) |

3. How to Distinguish: Trading Company vs. Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing (e.g., “plastic product production”) | Lists trading, import/export, or wholesale |

| Physical Facility | Owns production floor, machinery, warehouse | May have small office; no production lines |

| Lead Times | Can provide accurate production schedules | Often adds buffer time; less control |

| Pricing Structure | Quotes based on material + labor + overhead | Quotes with built-in markup; less cost breakdown |

| Customization Ability | Offers design input, tooling, mold development | Limited to catalog items; refers to “our factory” |

| Staff Expertise | Engineers, production managers on-site | Sales team only; limited technical depth |

| Export Name on B/L | Factory name appears as shipper | Third-party logistics or different entity as shipper |

Pro Tip: Ask: “Can you show me the machine that will produce my order?” A trading company cannot.

4. Red Flags to Avoid in 2026

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video tour of the factory floor | Likely not a real manufacturer | Postpone engagement until verified |

| Multiple Alibaba stores under same contact | Aggregator or trader managing several fronts | Audit each entity; cross-reference licenses |

| No dedicated R&D or engineering team | Limited ability to customize or solve issues | Request technical team CVs or contact |

| Quoting extremely low prices with no cost breakdown | Risk of substandard materials or hidden fees | Request FOB cost analysis |

| Refusal to sign NDA or IP agreement | High IP theft risk | Require legal agreements before sharing designs |

| Use of stock photos or inconsistent facility images | Misrepresentation of capabilities | Demand time-stamped, real-time video proof |

| No social insurance records or employee count verification | Possible shell company | Request labor contracts or社保 records (via audit) |

5. Best Practices for 2026 Sourcing Strategy

- Use Verified Supplier Platforms: Prioritize suppliers with third-party certifications (e.g., SGS, Bureau Veritas, SourcifyChina Verified).

- Leverage On-the-Ground Audits: Budget for pre-qualification audits—ROI in risk mitigation exceeds cost.

- Build Long-Term Contracts with Factories: Secure capacity and pricing through direct MOUs.

- Engage Local Sourcing Partners: Use bilingual consultants to navigate regulatory and cultural nuances.

- Implement Tiered Supplier Risk Scoring: Classify suppliers as Tier 1 (Direct Factory), Tier 2 (Traded via Agent), Tier 3 (Unverified).

Conclusion

In 2026, precision in supplier verification is non-negotiable. Global procurement managers must adopt a forensic approach to distinguish true manufacturers from intermediaries. By implementing the steps above—especially direct audits and documentation verification—organizations can de-risk their China supply chains, achieve cost transparency, and build resilient, long-term manufacturing partnerships.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Verified China Sourcing

Date: April 5, 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Strategic Supplier Validation for Competitive Advantage

Executive Summary

In 2026, 73% of procurement failures stem from inadequate supplier vetting (McKinsey Global Supply Chain Survey). Generic “China trading company list” searches expose enterprises to operational delays, compliance breaches, and hidden costs. SourcifyChina’s Verified Pro List eliminates these risks through AI-driven validation and on-ground verification, reducing sourcing cycles by 68% while ensuring 100% regulatory compliance.

The Hidden Cost of Generic “China Trading Company List” Searches

| Pain Point | Generic Search Results | SourcifyChina Verified Pro List |

|---|---|---|

| Supplier Vetting Time | 17+ hours per supplier | 22 minutes per supplier |

| Compliance Risk | 41% non-ISO certified | 100% ISO 9001/14001 certified |

| Fraud Exposure | 28% unverified entities | 0% (all factories audited) |

| Onboarding Delay | 8–12 weeks | 11 days avg. |

| Source: SourcifyChina 2026 Client Data (247 enterprise engagements) |

Why 2026 Demands Verified Sourcing Intelligence

- Regulatory Acceleration

New EU CBAM and U.S. Uyghur Forced Labor Prevention Act (UFLPA) amendments require real-time supply chain transparency. Generic lists lack ESG documentation trails. - AI-Driven Procurement

89% of Fortune 500 firms now use AI sourcing tools (Gartner). Our Pro List integrates with Coupa/Ariba via API, feeding pre-validated data into your workflows. - Risk Contagion

Single-tier supplier failures now cascade to 3.2 additional partners (BCG 2025). Our tiered verification maps entire sub-tier networks.

“SourcifyChina’s Pro List cut our supplier onboarding from 9 weeks to 9 days. We avoided $220K in potential tariff penalties through their customs compliance flags.”

— Global Procurement Director, Tier-1 Automotive OEM (2025 Client)

Your Strategic Advantage: The SourcifyChina Verified Pro List

- ✅ Triple-Layer Validation:

(1) AI document forensics + (2) On-ground factory audits by ex-BV engineers + (3) Real-time customs data cross-referencing - ✅ Dynamic Risk Dashboard: Live alerts for sanctions, environmental violations, or production halts

- ✅ 2026-Ready Compliance: Pre-loaded templates for EU CSDDD, U.S. TRACE Act, and China’s 2026 Export Control Law

Call to Action: Secure Your 2026 Supply Chain in 3 Steps

Time is your highest-cost resource. Every hour spent validating unreliable suppliers erodes margin and exposes your brand.

- Download Your Free 2026 Pro List Preview

Access 15 pre-vetted suppliers in your category: sourcifychina.com/pro-list-preview - Schedule a 15-Minute Validation Session

Our sourcing engineers will: - Identify 3 high-fit suppliers matching your MOQ/sustainability needs

- Map compliance gaps against 2026 regulatory deadlines

- Deploy Risk-Free

Pilot the Pro List with zero commitment: 30-day SLA-backed access included

“Stop searching. Start sourcing.”

Contact our team within 24 business hours for a customized supplier risk assessment:

📧 [email protected]

💬 WhatsApp: +86 159 5127 6160 (24/7 multilingual support)

Act by Q1 2026: Lock in 2025 pricing before our annual compliance certification fee adjustment (effective 1 April 2026).

SourcifyChina | Trusted by 1,200+ Global Brands Since 2018

Objective. Verified. Built for 2026 Supply Chains.

www.sourcifychina.com | ISO 20400 Certified Sourcing Partner

🧮 Landed Cost Calculator

Estimate your total import cost from China.