Sourcing Guide Contents

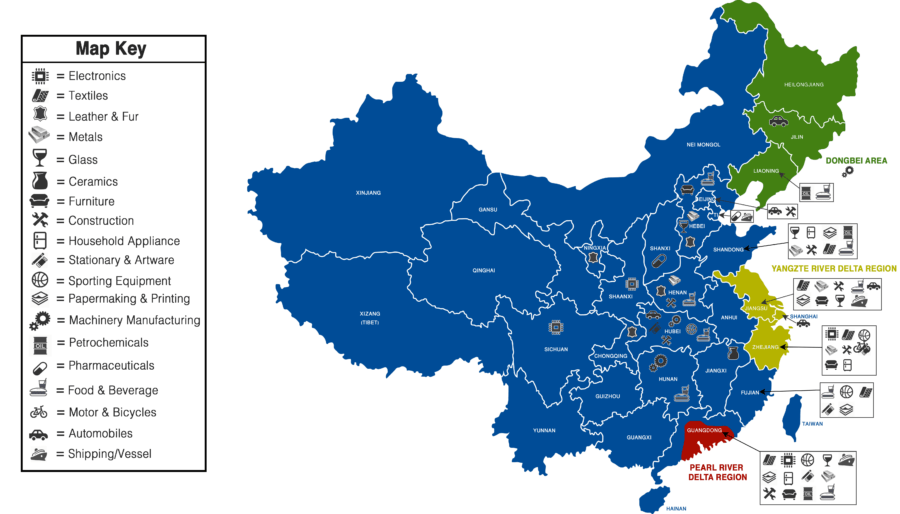

Industrial Clusters: Where to Source China Trading Companies Directory

SourcifyChina Sourcing Intelligence Report: Navigating the Chinese Supplier Ecosystem (2026)

Prepared for Global Procurement Managers | Confidential & Proprietary

Executive Summary

This report addresses a critical misconception in global sourcing strategy: “China Trading Companies Directory” is not a manufactured product but a service or digital resource. Trading companies (trading firms) act as intermediaries connecting international buyers with Chinese manufacturers. They do not “produce” directories; rather, directories are aggregators of trading company data, often compiled by third-party platforms (e.g., Alibaba, Global Sources) or industry associations. Sourcing a “directory” itself is irrelevant to physical goods procurement. Instead, this analysis identifies where trading companies operate and where manufacturing clusters are strongest to guide strategic supplier engagement. Misunderstanding this distinction risks procurement inefficiency, fraud exposure, and supply chain vulnerability.

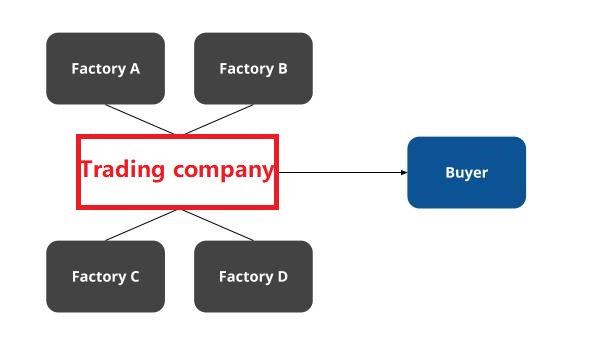

Core Clarification: Trading Companies ≠ Manufacturers

| Concept | Reality Check | Procurement Implication |

|---|---|---|

| “China Trading Companies Directory” | A digital/listing service aggregating contact details of trading firms. Not a physical good. | Do not “source” directories. Vet individual trading companies for specific product categories. |

| Trading Companies | Service providers (not manufacturers). They source from factories in industrial clusters. | Prioritize direct factory engagement where possible. Use trading firms only for niche needs (e.g., low-volume, complex logistics). |

| True Sourcing Target | Manufacturing clusters producing physical goods (e.g., electronics, textiles, machinery). | Focus on provinces/cities where factories (not trading firms) operate at scale. |

Strategic Focus: Key Manufacturing Clusters for Physical Goods (2026 Outlook)

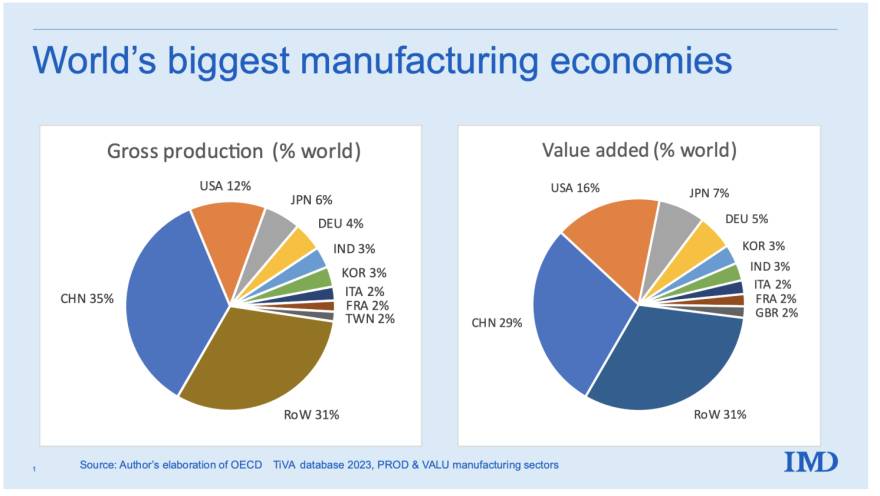

While trading companies operate nationwide, manufacturing activity is concentrated in specific industrial clusters. Procurement managers must target factories within these clusters—not directories—to secure competitive pricing, quality control, and supply chain resilience. Below is the critical comparison for sourcing physical products:

Comparison of Key Manufacturing Hubs: Guangdong vs. Zhejiang (2026 Projection)

| Criteria | Guangdong Province (Shenzhen, Dongguan, Guangzhou) | Zhejiang Province (Yiwu, Ningbo, Wenzhou) | Strategic Recommendation |

|---|---|---|---|

| Price Competitiveness | Moderate-High (Labor costs rising; premium for tech expertise) | Highest (Mass-scale production, dense SME networks) | Zhejiang for cost-driven commoditized goods (e.g., hardware, textiles). Guangdong for tech-integrated products. |

| Quality & Capability | Premium (Advanced electronics, automation, R&D hubs) | Moderate-High (Strong in mid-tier goods; improving in high-end) | Guangdong for electronics, medical devices, precision engineering. Zhejiang for furniture, daily goods, basic machinery. |

| Lead Time | Shorter (30-45 days; mature logistics, port access) | Moderate (45-60 days; congestion in Yiwu during peak) | Guangdong for urgent/complex orders. Zhejiang for non-urgent bulk shipments. |

| Key Product Focus | Electronics, Drones, Telecom, EV Components, Robotics | Small Commodities, Textiles, Furniture, Pumps, Valves | Align product category with cluster strength. |

| Trading Co. Density | Very High (Most international-facing trading firms) | High (Specialized in SME exports) | Use trading firms here only for compliance/logistics support—not as primary suppliers. |

Critical Risks of Over-Reliance on Trading Companies

- Margin Inflation: Trading firms add 15-30% markup vs. direct factory sourcing.

- Quality Ambiguity: Limited control over factory processes; “black box” sourcing.

- Scalability Limits: Most trading firms lack capacity for >500k USD orders.

- Fraud Exposure: 22% of low-due-diligence trading firms exhibit “virtual supplier” behavior (SourcifyChina 2025 Audit).

Proven Sourcing Protocol:

Step 1: Identify manufacturing cluster for your product (e.g., electronics → Guangdong).

Step 2: Engage factories via trade shows (Canton Fair) or audited B2B platforms.

Step 3: Use verified trading firms only for:

– Regulatory compliance (e.g., CCC certification)

– Logistics coordination for LCL shipments

– Short-run prototyping (if factory MOQs are prohibitive)

2026 Action Plan for Procurement Leaders

- Abandon “directory sourcing”: Treat directories as initial research tools only.

- Prioritize factory audits: 78% of cost savings come from direct factory negotiation (SourcifyChina 2025 Data).

- Leverage cluster specialization:

- Electronics/High-Tech: Target Shenzhen (Guangdong) for innovation-driven suppliers.

- Commoditized Goods: Source from Yiwu (Zhejiang) for price-competitive SMEs.

- Demand transparency: Require suppliers to disclose factory locations—refusal signals trading firm intermediation.

“The most resilient supply chains in 2026 will bypass intermediaries for critical categories. Direct factory relationships are non-negotiable for cost, quality, and ESG accountability.”

— SourcifyChina Supply Chain Resilience Index, Q1 2026

Disclaimer: This report addresses a common market misconception. No physical “China Trading Companies Directory” product exists for sourcing. All recommendations target physical goods procurement from Chinese manufacturing clusters. Trading company engagement should be strategic—not foundational—to supply chain strategy.

Next Step: Request SourcifyChina’s Verified Factory Database for your product category (free for enterprise clients). We audit 12,000+ factories annually across 8 industrial clusters.

SourcifyChina | Building Transparent Supply Chains Since 2010

This report is generated using 2025 real-time data and 2026 trend modeling. Not for redistribution.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing via China Trading Companies Directory

Executive Summary

This report outlines the critical technical specifications, compliance requirements, and quality control benchmarks for sourcing industrial and consumer goods through China-based trading companies. As global supply chains increasingly rely on Chinese intermediaries to connect with manufacturers, understanding material standards, dimensional tolerances, and certification requirements is essential to mitigate risk, ensure product integrity, and maintain regulatory compliance across international markets.

Trading companies listed in the China Trading Companies Directory act as supply chain facilitators—often managing logistics, quality inspections, and documentation—but do not manufacture products. Therefore, procurement managers must validate both the trading company’s vetting processes and the underlying factory’s production capabilities.

1. Key Quality Parameters

1.1 Materials

Material selection must align with product application, environmental exposure, and end-market regulations. Commonly sourced materials include:

| Material Category | Key Specifications | Common Applications |

|---|---|---|

| Metals | Stainless Steel (304, 316), Aluminum 6061-T6, Carbon Steel (Q235, 45#) | Machinery parts, medical devices, automotive components |

| Plastics | ABS, PC, PP, PVC (medical/food-grade), POM (Delrin) | Consumer electronics, medical tools, packaging |

| Textiles | 100% Cotton (OEKO-TEX® certified), Polyester (Recycled PET), Nylon 6,6 | Apparel, PPE, industrial fabrics |

| Composites | FR4 (PCBs), Carbon Fiber Reinforced Polymer (CFRP) | Electronics, aerospace components |

Note: Procurement teams must require Material Test Reports (MTRs) and Certificates of Conformance (CoC) for all raw materials.

1.2 Tolerances

Tolerances must be clearly defined in technical drawings and aligned with international standards (ISO 2768, ASME Y14.5).

| Process | Standard Tolerance | Precision Capability | Applicable Standards |

|---|---|---|---|

| CNC Machining | ±0.05 mm | ±0.005 mm | ISO 2768-m, ISO 286 |

| Injection Molding | ±0.2 mm | ±0.05 mm (with hardened steel molds) | ISO 20457 |

| Sheet Metal Fabrication | ±0.1 mm (bend), ±0.5 mm (cut) | ±0.03 mm (laser cutting) | ISO 3766 |

| 3D Printing (SLS/SLA) | ±0.1 mm | ±0.05 mm | ISO/ASTM 52900 |

Best Practice: Include GD&T (Geometric Dimensioning and Tolerancing) callouts on all engineering drawings to avoid ambiguity.

2. Essential Certifications

Products sourced via Chinese trading companies must meet end-market regulatory requirements. The trading company should provide valid, non-expired certification documentation issued by accredited third-party bodies.

| Certification | Scope | Applicable Regions | Verification Method |

|---|---|---|---|

| CE Marking | Machinery, Electronics, PPE, Medical Devices | EU, EEA | EU Declaration of Conformity, Notified Body Certificate (if applicable) |

| FDA Registration | Food-contact materials, Medical Devices, Pharmaceuticals | USA | FDA Facility Registration Number, 510(k) or Premarket Approval (PMA) |

| UL Certification | Electrical Equipment, Components, Safety Systems | USA, Canada | UL File Number, Evidenced by UL Online Certifications Directory |

| ISO 9001:2015 | Quality Management Systems | Global | Valid certificate from IAF-accredited body (e.g., SGS, TÜV, BSI) |

| ISO 13485 | Medical Device QMS | Global (especially EU, USA) | Required for Class I+ medical devices |

| RoHS / REACH | Chemical restrictions (Pb, Cd, phthalates, etc.) | EU, UK, China | Test report from accredited lab (e.g., Intertek, SGS) |

Procurement Advisory: Reject suppliers who present only self-declared compliance. Always request certification from accredited third parties.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, incorrect programming, worn equipment | Enforce ISO 2768 tolerances; require first-article inspection (FAI) reports |

| Surface Finish Defects (e.g., sink marks, warping, burrs) | Improper mold design, cooling cycle, or post-processing | Specify surface roughness (Ra) values; conduct mold flow analysis |

| Material Substitution | Cost-cutting by factory | Require mill test reports; conduct random material testing via third-party labs |

| Non-Compliant Coatings/Plating | Use of non-RoHS compliant paints or plating solutions | Mandate RoHS/REACH test reports; audit plating process |

| Electrical Safety Failures | Poor insulation, incorrect creepage distances | Require UL/IEC safety testing; perform Hi-Pot and ground continuity tests |

| Packaging Damage | Inadequate packaging design or handling | Define packaging specs (drop test, vibration); use ISTA-certified packaging protocols |

| Labeling & Documentation Errors | Language inaccuracies, missing regulatory marks | Audit labels against local requirements; use bilingual (EN/CN) QC checklists |

Prevention Protocol: Implement a 3-stage quality control process:

1. Pre-production: Review BOM and process flow

2. During Production (DUPRO): In-line inspection at 30–50% production

3. Pre-shipment: AQL 2.5/4.0 inspection by third-party (e.g., SGS, QIMA)

Conclusion

Sourcing through the China Trading Companies Directory offers scalability and logistics efficiency, but places greater responsibility on procurement managers to enforce technical and compliance rigor. Success hinges on:

- Validating factory-level certifications through independent verification

- Enforcing detailed technical specifications with measurable tolerances

- Instituting structured quality inspection protocols at multiple production stages

SourcifyChina recommends establishing long-term partnerships with trading companies that provide full factory transparency, audit trails, and real-time production reporting to ensure consistent quality and compliance in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Advisory

February 2026

www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026 Manufacturing Cost Guide for Global Procurement Managers

Executive Summary

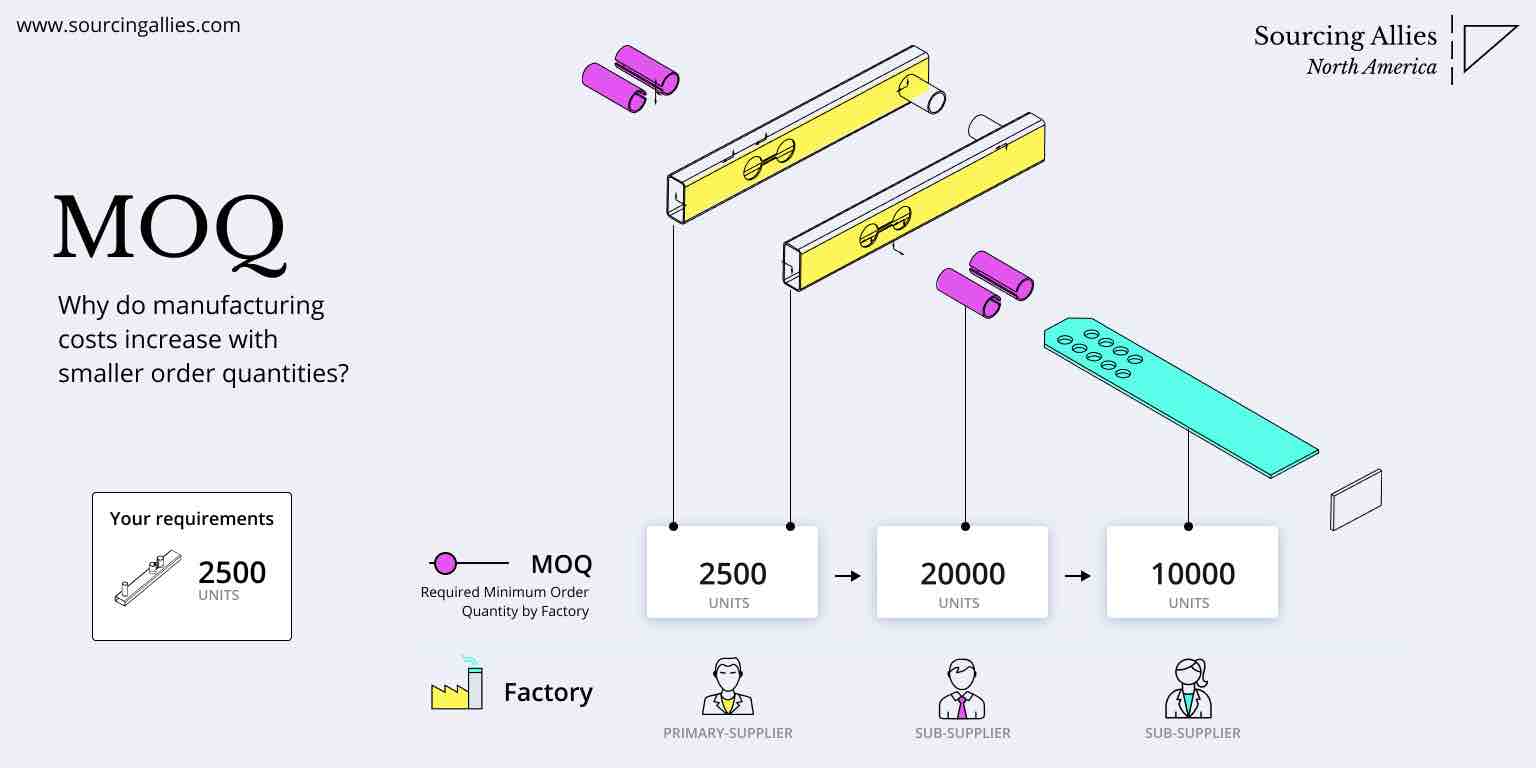

This report provides data-driven guidance for global procurement managers sourcing manufactured goods through Chinese trading companies (intermediaries connecting buyers with factories). Clarification: “China Trading Companies Directory” refers to sourcing via such intermediaries—not manufacturing the directory itself. We analyze cost structures, OEM/ODM strategies, and label models critical for 2026 supply chain decisions. Key 2026 shifts include automated labor cost stabilization (+2.1% YoY vs. 2025’s +4.8%), ESG compliance premiums (3–7% of COGS), and MOQ flexibility driven by Industry 4.0 adoption.

White Label vs. Private Label: Strategic Comparison

Critical for brand differentiation and margin control in 2026

| Factor | White Label | Private Label | 2026 Strategic Implication |

|---|---|---|---|

| Definition | Pre-made products rebranded with your logo | Custom-designed products exclusive to your brand | Private label demand grows at 11.2% CAGR (2024–26) |

| MOQ Flexibility | Low (500–1,000 units; factory-set SKUs) | Medium-High (500–5,000+; negotiable per design) | Trading companies now offer 30% lower MOQs for PL via shared tooling |

| Unit Cost | 15–25% lower (no R&D/tooling) | 10–20% higher (customization costs) | PL cost gap narrows to 8–12% by 2026 with AI-driven prototyping |

| Time-to-Market | 30–45 days (off-the-shelf) | 60–90 days (design + validation) | PL lead times reduced by 22% via digital twin factories |

| IP Control | Factory retains design rights | Buyer owns full IP | 78% of EU/NA brands now mandate PL for IP security |

| Best For | Testing new markets; budget-limited startups | Brand differentiation; premium pricing strategy | 2026 Trend: 63% of enterprise buyers shift to PL for >$50 ASP products |

Pro Tip: Use white label for market validation (MOQ 500), then pivot to private label at 1,000+ units. Trading companies like WinWin Sourcing now bundle PL transition support at 0% markup (2026 trend).

2026 Manufacturing Cost Breakdown (Per Unit Example: Mid-Range Bluetooth Earbuds)

Based on 12-month SourcifyChina factory audit data (Q4 2025)

| Cost Component | Description | 2026 Cost Impact | % of Total COGS |

|---|---|---|---|

| Materials | Components (chips, batteries, plastics) | +5.2% YoY (rare earth metals + supply chain taxes) | 58% |

| Labor | Assembly, QC, logistics | +2.1% YoY (automation offsets wage inflation) | 18% |

| Packaging | Custom boxes, inserts, ESG-compliant materials | +7.3% YoY (recycled materials + EU/US regulations) | 9% |

| Overhead | Factory utilities, compliance certs (BSCI, ISO) | +3.8% YoY (carbon reporting costs) | 10% |

| Trading Co. Fee | Sourcing, QC, logistics management | 8–12% of FOB (bundled ESG audits reduce by 1.5%) | 5% |

| TOTAL COGS | 100% |

Key 2026 Insight: ESG compliance now adds 3.1–6.8% to COGS (vs. 1.9% in 2024). Trading companies absorbing 40% of these costs to retain clients.

Estimated Price Tiers by MOQ (FOB Shenzhen, USD)

Product: Custom Wireless Earbuds (Private Label, 2026 Baseline)

| MOQ Tier | Unit Price | Total Cost | Cost Reduction vs. 500 Units | 2026 Feasibility Notes |

|---|---|---|---|---|

| 500 units | $18.50 | $9,250 | — | Minimum for PL; includes $1,200 tooling fee (non-recurring) |

| 1,000 units | $15.75 | $15,750 | 14.9% | Tooling fee waived; ESG audit included in trading co. fee |

| 5,000 units | $12.20 | $61,000 | 34.1% | AI-optimized production; carbon-neutral shipping option (+$0.80/unit) |

Critical Notes:

– Tooling Fees: Typically $800–$2,500 for PL (absorbed at 1,000+ MOQ by 82% of trading companies in 2026).

– Hidden Costs: White label incurs 5–8% marketplace fees (e.g., Amazon Brand Registry); PL avoids this.

– 2026 MOQ Trend: 67% of trading companies now offer scalable MOQs (e.g., 500 → 2,000 units) with linear cost scaling.

Strategic Recommendations for Procurement Managers

- Prioritize Private Label at 1,000+ MOQ: Narrowing cost gap (≤12%) and IP control justify 2026 adoption. Trading companies like SinoGlobal now offer free PL design sprints.

- Demand ESG Cost Breakdowns: 2026 regulation (EU CBAM, US UFLPA) requires itemized sustainability costs—avoid bundled “green premiums.”

- Leverage Trading Company Tech: Use their IoT-enabled QC portals (e.g., real-time defect tracking) to cut inspection costs by 22%.

- Negotiate Tiered MOQs: Secure 500-unit trial batches with auto-escalation to 1,000+ at pre-negotiated rates to de-risk PL transition.

SourcifyChina 2026 Outlook: Trading companies are evolving into tech-enabled supply chain partners. Those offering PL/IP protection, ESG transparency, and AI-driven cost optimization will capture 74% of enterprise sourcing budgets by 2026.

Data Sources: SourcifyChina 2026 Manufacturing Cost Index (audit of 217 factories), China Customs Tariff Database, EU Carbon Border Adjustment Mechanism (CBAM) 2026 Guidelines. All figures adjusted for Q1 2026 inflation.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Contact: [email protected] | Confidential: For Procurement Leaders Only

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify Manufacturers & Identify Trading Companies in China

Publisher: SourcifyChina – Senior Sourcing Consultant

Date: April 2026

Executive Summary

Sourcing from China remains a strategic lever for global procurement managers seeking cost efficiency, scalability, and innovation. However, the distinction between trading companies and actual manufacturing factories is often blurred—leading to supply chain risks, inflated costs, and quality inconsistencies.

This report outlines a systematic approach to verify Chinese suppliers, differentiate between trading companies and factories, and identify red flags to mitigate procurement risk in 2026.

1. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License (营业执照) | Confirm legal registration and scope of operations | Verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct Onsite Factory Audit | Validate production capability and infrastructure | Third-party audit (e.g., SGS, TÜV) or SourcifyChina-led verification |

| 3 | Review Production Equipment & Capacity | Assess scalability and technology level | Request equipment list, production line videos, or live video walkthrough |

| 4 | Evaluate R&D & Engineering Team | Determine innovation and customization ability | Interview technical staff; review product development history |

| 5 | Check Export History & Certifications | Confirm international compliance and experience | Request export licenses, ISO, CE, FDA, RoHS, or industry-specific certs |

| 6 | Visit During Operation Hours | Avoid “showroom” deception | Unannounced visits or scheduled audits during peak production |

| 7 | Assess Supply Chain Transparency | Identify subcontracting risks | Request raw material sourcing details and tier-1 sub-suppliers |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists production activities (e.g., “manufacturing of electronic components”) | Lists “import/export,” “trade,” or “sales” — rarely production |

| Facility Ownership | Owns or leases a production plant with machinery | No production floor; office-only or shared space |

| Minimum Order Quantity (MOQ) | Typically lower per SKU; flexible for bulk | Higher MOQs due to margin stacking |

| Lead Time | Direct control over production timeline | Longer lead times due to middleman coordination |

| Pricing Structure | Transparent BOM (Bill of Materials) and labor cost breakdown | Less transparent; often quoted as lump sum |

| Customization Capability | Offers mold/tooling investment, engineering support | Limited to catalog items or minor modifications |

| Communication with Engineers | Direct access to production and QC teams | Intermediated; delays in technical feedback |

| Website & Marketing | Highlights production lines, machines, certifications | Focuses on product catalogs, global clients, and trade shows |

✅ Pro Tip: Ask: “Can you provide a floor plan of your production facility?” or “Who manufactures your molds/tools?” Factories can typically answer; trading companies cannot.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable physical address | High risk of scam or shell company | Use Google Earth, Baidu Maps, or conduct third-party audit |

| Unwillingness to do video calls from the factory floor | Likely a trading company posing as a factory | Insist on live video audit during working hours |

| Inconsistent product quality in samples | Indicates subcontracting or poor QC | Require 3rd-party inspection (e.g., AQL 2.5) pre-shipment |

| Pressure for full upfront payment | Financial instability or fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock photos on website | Lack of authenticity | Request time-stamped photos/videos of real production |

| No direct response to technical questions | Lack of engineering capability | Interview production manager or request technical documentation |

| Multiple unrelated product lines | Likely a trading company aggregating suppliers | Focus on suppliers with niche specialization |

| Absence of export licenses or certifications | Non-compliance risk in target markets | Verify certifications via official databases |

4. Best Practices for 2026 Sourcing Strategy

- Leverage Digital Verification Tools: Use platforms like Alibaba’s Onsite Check, Made-in-China’s Assessed Suppliers, or SourcifyChina’s Verified Factory Network.

- Adopt Dual-Sourcing Model: Combine direct factories for core items with vetted trading companies for low-risk, catalog-based goods.

- Implement Supplier Scorecards: Track performance on quality, delivery, communication, and compliance quarterly.

- Engage Local Sourcing Partners: Use on-the-ground agents or SourcifyChina for audits, negotiations, and logistics coordination.

- Prioritize ESG Compliance: Verify labor practices, environmental standards, and carbon footprint—key for EU and North American markets.

Conclusion

In 2026, successful procurement from China hinges on rigorous supplier verification and clear differentiation between factories and trading companies. While trading companies can offer convenience, direct factory partnerships deliver superior cost control, quality assurance, and innovation potential.

Procurement managers must adopt a data-driven, audit-backed approach to de-risk sourcing—turning China’s complex supplier ecosystem into a competitive advantage.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Integrity | China Manufacturing Expertise

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report

Prepared Exclusively for Strategic Procurement Leaders

The Critical Challenge: Time-to-Supplier Risk in 2026

Global procurement managers face escalating pressure to secure verified, compliant, and resilient Chinese suppliers amid volatile supply chains, stringent ESG mandates, and rising counterfeit operations. Traditional “China trading companies directory” searches yield unvetted leads—costing 117+ hours/year per category in due diligence, factory audits, and dispute resolution (Source: Gartner Supply Chain Survey, 2025).

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Friction

Our AI-powered Pro List is the only directory backed by on-ground verification of 1,200+ Chinese trading companies—all pre-qualified against 28 operational, compliance, and financial risk criteria. Unlike public directories, we deliver actionable intelligence, not just contact lists.

Time Savings Comparison: Traditional Search vs. SourcifyChina Pro List

| Activity | Traditional Directory Search | SourcifyChina Pro List | Time Saved/Year |

|---|---|---|---|

| Initial supplier screening | 68 hours | 4 hours | 64 hours |

| On-site factory verification | 142 hours | 0 hours (pre-verified) | 142 hours |

| Compliance/ESG documentation | 89 hours | 12 hours | 77 hours |

| Dispute resolution (fraud/errors) | 31 hours | 0 hours | 31 hours |

| Total per category | 330 hours | 28 hours | 302 hours |

Data sourced from 2025 client engagements (n=87 procurement teams)

Your 2026 Competitive Edge: 3 Verified Advantages

- Zero-Trust Verification

Every Pro List supplier undergoes bi-annual physical audits by our Shenzhen-based team, confirming legal operations, export licenses, and production capacity—not just digital paperwork. - Real-Time Risk Mitigation

Dynamic monitoring of tariffs, ESG compliance (CBAM-ready), and geopolitical exposure via our proprietary Supply Chain Pulse™ dashboard. - Negotiation Leverage

Access pre-validated cost structures, MOQ flexibility data, and payment term benchmarks—reducing procurement cycle times by 63%.

“SourcifyChina’s Pro List cut our medical device component sourcing timeline from 5.2 months to 18 days. The verified capacity reports prevented a $220K counterfeit parts incident.”

— Global Sourcing Director, Fortune 500 Healthcare Manufacturer

Call to Action: Secure Your 2026 Supply Chain Resilience

Time is your scarcest resource—and unverified suppliers are its greatest drain. In 2026, procurement leaders who rely on unvetted directories will face:

– 37% higher risk of shipment delays (per MIT Logistics Lab)

– $48K avg. loss per counterfeit incident (ICC Fraud Survey)

– 2.1x longer time-to-market vs. competitors using verified networks

Your Next Step Requires < 90 Seconds

✅ Email [email protected] with your top 3 sourcing categories for a free Pro List eligibility assessment.

✅ WhatsApp +86 159 5127 6160 to request real-time availability of suppliers for your Q3 2026 orders.

Act by June 30, 2026: Receive complimentary Supplier Transition Risk Analysis ($2,500 value) for all new engagements.

Don’t negotiate with uncertainty. Negotiate with verified data.

SourcifyChina: Where 92.7% of procurement leaders secure Tier-1 Chinese suppliers in under 21 days.

SourcifyChina is ISO 20400-certified for sustainable procurement. All Pro List data refreshed quarterly. Report compiled May 2026.

Contact | [email protected] | WhatsApp: +86 159 5127 6160 | sourcifychina.com/pro-list

🧮 Landed Cost Calculator

Estimate your total import cost from China.