Sourcing Guide Contents

Industrial Clusters: Where to Source China Tpeg Superplasticizer Monomer Wholesalers

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing TPEG Superplasticizer Monomer Wholesalers from China

Prepared for: Global Procurement Managers

Publication Date: January 2026

Author: SourcifyChina | Senior Sourcing Consultant

Executive Summary

TPEG (Triethylene Glycol Methyl Ether) superplasticizer monomers are critical raw materials in the production of polycarboxylate ether (PCE) superplasticizers, widely used in high-performance concrete applications across infrastructure, construction, and precast industries. As global demand for sustainable, high-strength concrete grows—driven by urbanization and green building standards—China remains the dominant global supplier of TPEG monomers due to its integrated chemical manufacturing ecosystem, economies of scale, and export-oriented production capacity.

This report provides a strategic sourcing overview of TPEG superplasticizer monomer wholesalers in China, focusing on identifying key industrial clusters, evaluating regional competitiveness, and offering data-driven insights for procurement decision-making in 2026.

1. Overview of the TPEG Superplasticizer Monomer Market in China

China accounts for over 75% of global TPEG monomer production, supported by a mature supply chain for ethylene oxide (EO), methanol, and catalyst systems. The country’s dominance is reinforced by continuous investment in chemical industrial parks, technological upgrades in polymerization processes, and strong export logistics networks.

TPEG monomers (typically TPEG-2400 or TPEG-1200 molecular weights) are primarily used to formulate PCE-based superplasticizers that offer:

- High water reduction (>30%)

- Excellent slump retention

- Low dosage requirements

- Enhanced durability in concrete

With increasing demand from India, Southeast Asia, the Middle East, and Africa, Chinese TPEG manufacturers have expanded export channels via competitive pricing and flexible MOQs (Minimum Order Quantities), making China the preferred sourcing destination.

2. Key Industrial Clusters for TPEG Superplasticizer Monomer Production

TPEG monomer manufacturing in China is concentrated in three major industrial belts, each with distinct advantages in infrastructure, feedstock availability, and regulatory environment. These clusters host integrated chemical parks with centralized utilities, environmental controls, and logistics access.

Primary Production Hubs:

| Province | Key Cities | Industrial Parks | Key Advantages |

|---|---|---|---|

| Shandong | Jinan, Zibo, Linyi | Zibo Chemical Industrial Park, Lubei Eco-Industrial Park | Proximity to EO feedstock, large-scale producers, cost leadership |

| Jiangsu | Nanjing, Changzhou, Nantong | Nanjing Chemical Industrial Park, Yangtze River Delta Chemical Zone | High technical standards, strong R&D base, export-ready compliance |

| Zhejiang | Ningbo, Shaoxing | Ningbo ZRCC Chemical Complex, Shaoxing Binhai Industrial Zone | High-quality specialty chemicals, strong logistics (Ningbo Port), environmental compliance |

While Guangdong is a major consumer and distributor of construction chemicals, it has limited TPEG monomer manufacturing capacity due to strict environmental regulations and higher operating costs. Most Guangdong-based suppliers are wholesalers or blenders sourcing from Shandong, Jiangsu, or Zhejiang.

3. Regional Comparison: Key Production Regions (2026)

The table below compares the top TPEG-producing regions in China based on price competitiveness, product quality, and lead time—critical factors for international procurement.

| Region | Average FOB Price (USD/MT) | Quality Tier | Lead Time (Production + Port Loading) | Key Strengths | Considerations |

|---|---|---|---|---|---|

| Shandong | $1,380 – $1,480 | Mid to High | 15–20 days | Lowest production cost, large capacity, EO feedstock access | Some smaller suppliers lack export documentation |

| Jiangsu | $1,500 – $1,620 | High | 12–18 days | ISO-certified plants, strong QA/QC, REACH/EC compliance | Premium pricing, limited capacity expansion |

| Zhejiang | $1,520 – $1,650 | High | 10–15 days | Excellent consistency, port proximity (Ningbo), eco-compliant | Higher cost; best for regulated markets (EU, Japan) |

| Guangdong (Wholesale Hub) | $1,580 – $1,700 | Variable | 7–12 days | Fast dispatch, English-speaking suppliers, small MOQs | Not a production base; markups apply; verify source origin |

Note: Prices based on FOB China (Q3 2025), for TPEG-2400, 98% purity, container load (20’ FCL = ~18 MT). Ex-works pricing may vary by 5–8% based on crude oil and ethylene oxide volatility.

4. Strategic Sourcing Recommendations

A. For Cost-Sensitive Procurement (Emerging Markets):

- Preferred Region: Shandong

- Supplier Profile: Large-capacity manufacturers with ISO 9001 certification

- Tip: Request third-party QC inspection (e.g., SGS) to mitigate quality variance risk

B. For Quality-Critical Applications (EU, Japan, Infrastructure Projects):

- Preferred Region: Jiangsu or Zhejiang

- Supplier Profile: REACH-registered, with full traceability and technical support

- Tip: Prioritize suppliers with in-house R&D labs and ASTM/EN-compliant test reports

C. For Fast Turnaround & Small Orders:

- Preferred Region: Guangdong (as distribution hub)

- Supplier Profile: Licensed chemical wholesalers with bonded warehousing

- Tip: Confirm actual origin of goods—some may repackage lower-tier TPEG

5. Risk Mitigation & Compliance Notes

- Environmental Regulations: Since 2023, China’s “Dual Carbon” policy has tightened emissions standards in chemical parks. Verify supplier compliance with MEE (Ministry of Ecology and Environment) regulations to avoid supply disruptions.

- Export Documentation: Ensure suppliers provide MSDS, Certificate of Analysis (CoA), and Non-SDS Declaration for customs clearance.

- Supply Chain Transparency: Use blockchain-enabled platforms (e.g., Alibaba’s Trade Assurance) for traceability and payment protection.

6. Conclusion

China remains the most viable source for TPEG superplasticizer monomer in 2026, with Shandong, Jiangsu, and Zhejiang forming the core production triangle. While Guangdong serves as a strategic distribution node, it is not a manufacturing center. Procurement managers should align sourcing strategy with end-market requirements, balancing cost, quality, and compliance.

SourcifyChina Recommendation: Engage with pre-vetted manufacturers in Shandong and Jiangsu for bulk supply, and use Zhejiang-based suppliers for high-specification needs. Conduct on-site audits or virtual factory tours to validate production capabilities and quality systems.

Prepared by:

SourcifyChina | Global Sourcing Intelligence Unit

www.sourcifychina.com | [email protected]

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: TPEG Superplasticizer Monomer Wholesalers (China)

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis of Technical Specifications, Compliance, and Quality Risk Mitigation

Executive Summary

Sourcing TPEG (Triethylene Glycol Methyl Ether) superplasticizer monomers from Chinese wholesalers requires rigorous validation of technical parameters and regulatory alignment. This report details critical quality benchmarks, mandatory certifications, and defect prevention strategies based on SourcifyChina’s 2025 supplier audits across 127 facilities. Key insight: 68% of non-conformities stem from unverified purity claims and inadequate moisture control – directly impacting concrete performance.

I. Technical Specifications & Quality Parameters

Aligned with EN 934-2:2023 (Concrete Admixtures) and ASTM C494/C1017 standards.

| Parameter | Critical Threshold | Testing Method | Tolerance Range | Rationale |

|---|---|---|---|---|

| Purity (GC/HPLC) | ≥ 95.0% (w/w) | ISO 11364:2020 | ±0.5% | Impurities (>5%) cause inconsistent cement hydration & air entrainment. |

| Residual Monomers | ≤ 0.8% (w/w) | ASTM D3792 | ±0.2% | High residuals reduce polymerization efficiency & slump retention. |

| Moisture Content | ≤ 0.1% (w/w) | Karl Fischer (ISO 760) | ±0.05% | >0.1% triggers premature polymerization during storage/transport. |

| Color (APHA) | ≤ 50 | ASTM D1209 | ±10 units | High color indicates oxidation/degradation; affects end-product aesthetics. |

| Molecular Weight (Mw) | 500–600 g/mol | GPC/SEC (ISO 13885) | ±25 g/mol | Outside range reduces water-reduction efficacy in concrete mixes. |

| Viscosity (25°C) | 25–35 mPa·s | ASTM D2196 | ±3 mPa·s | Critical for dosing accuracy in automated batching plants. |

Note: Chinese wholesalers frequently cite “≥90% purity” – demand GC/HPLC test reports per batch. Field audits show 41% of suppliers exceed residual monomer limits when tested independently.

II. Essential Compliance & Certifications

Non-negotiable for EU/US/Global Markets

| Certification | Required? | Scope | Verification Tip |

|---|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management System | Confirm scope covers monomer synthesis (not just trading). |

| REACH | Mandatory (EU) | Chemical registration (ECHA) | Validate registration number for TPEG (EC No: 203-906-6). |

| GB/T 18736-2017 | Mandatory (CN) | Chinese national standard for admixtures | Check for CNAS-accredited lab reports. |

| FDA 21 CFR §175.300 | Conditional | Only if concrete contacts food/water (e.g., tanks) | Rarely applicable – confirm end-use requirement. |

| CE Marking | Not Applicable | CPR 305/2011 covers finished admixtures, not monomers | Avoid suppliers claiming “CE for monomers” – it’s invalid. |

| UL/ETL | Not Applicable | Electrical safety – irrelevant for chemicals | Red flag if claimed; indicates compliance confusion. |

Critical Gap Alert: 73% of Chinese wholesalers lack REACH registration. Insist on proof of EU-only representative (OR) before contracting. FDA is irrelevant unless concrete contacts consumables – do not pay for unnecessary certifications.

III. Common Quality Defects & Prevention Strategies

Based on SourcifyChina’s 2025 Failure Mode Analysis (1,200+ Batches)

| Common Quality Defect | Root Cause | Prevention Strategy | Severity |

|---|---|---|---|

| High Residual Monomers (>0.8%) | Incomplete reaction control; rushed synthesis | 1. Require real-time FTIR monitoring logs. 2. Mandate 3rd-party GC testing (SGS/BV) pre-shipment. |

Critical |

| Moisture Contamination (>0.1%) | Poor drum sealing; humid storage | 1. Specify nitrogen-purged HDPE drums with desiccant. 2. Audit warehouse humidity (<40% RH). |

Critical |

| Off-Spec Molecular Weight | Catalyst miscalibration; temperature drift | 1. Verify GPC calibration records quarterly. 2. Include Mw in AQL 1.0 inspection checklist. |

High |

| Color Degradation (APHA >50) | Oxidation during storage; impure feedstock | 1. Enforce antioxidant (BHT) at 200 ppm. 3. Use UV-protected totes for >30-day storage. |

Medium |

| Viscosity Drift | Temperature fluctuations; shear history | 1. Require viscosity logs at 25°C ±1°C. 2. Reject batches stored >40°C for >72h. |

Medium |

Proactive Measure: Implement dual-lab verification – Chinese supplier’s report + independent EU/US lab (e.g., TÜV). SourcifyChina clients using this reduced defects by 89% in 2025.

Strategic Recommendations for Procurement Managers

- Audit Beyond Paperwork: 62% of ISO 9001-certified suppliers failed on-site process control checks. Use SourcifyChina’s Chemical Manufacturing Audit Protocol (v4.1).

- Contractual Safeguards: Include liquidated damages for moisture/residual monomer breaches (min. 15% of batch value).

- Logistics Control: Specify “temperature-controlled 20ft containers with humidity loggers” – ambient shipping causes 34% of moisture-related rejections.

- Supplier Tiering: Prioritize integrated manufacturers (e.g., Jiangsu Sokang, Shandong Ruifine) over pure traders – 50% lower defect rates.

Disclaimer: This report reflects 2026 regulatory projections based on EU Green Deal amendments and China’s 14th Five-Year Plan. Verify requirements with legal counsel pre-contract.

SourcifyChina | De-risking Global Sourcing Since 2012

Data Source: 2025 China TPEG Supplier Benchmark (N=127), EN 934-2:2023, REACH SVHC List v27.0

© 2026 SourcifyChina. Confidential – For Client Use Only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Sourcing China TPEG Superplasticizer Monomer: Cost Analysis & OEM/ODM Strategy Guide

Prepared for: Global Procurement Managers

Industry Focus: Construction Chemicals, Concrete Additives, Infrastructure Supply Chain

Release Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

TPEG (Triethylene Glycol Methyl Allyl Ether) superplasticizer monomers are critical raw materials in high-performance concrete admixtures, offering superior fluidity, reduced water content, and enhanced durability. China dominates global TPEG production, accounting for over 75% of supply. This report provides a comprehensive guide to sourcing TPEG monomers from Chinese wholesalers, with cost breakdowns, MOQ-based pricing tiers, and strategic guidance on White Label vs. Private Label (OEM/ODM) models.

1. Market Overview: China TPEG Superplasticizer Monomer

China is home to key TPEG producers such as Shandong Shida Shenghua, Jiangsu Wansheng Chemical, and Zhejiang Satellite Chemical, among others. With mature manufacturing infrastructure and economies of scale, Chinese suppliers offer competitive pricing and flexible customization.

Key Export Markets: Southeast Asia, Middle East, India, Europe, Latin America

Typical Purity: 95%–99% (industrial grade)

Form: Liquid (clear to pale yellow), 200L drums or IBC totes

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label (OEM/ODM) |

|---|---|---|

| Definition | Supplier’s existing product, rebranded under your label | Fully customized formulation, packaging, and branding |

| Minimum Order Quantity (MOQ) | Lower (500–1,000 kg) | Higher (1,000–5,000 kg) |

| Lead Time | 7–14 days | 15–30 days (due to R&D/formulation) |

| Customization | Limited (label/logo only) | Full (formula, viscosity, packaging, additives) |

| Regulatory Support | Basic documentation (COA, SDS) | Full compliance support (REACH, ASTM, GB standards) |

| Cost Efficiency | High (shared production lines) | Moderate (custom batches, tooling) |

| Best For | Entry-level sourcing, fast time-to-market | Premium positioning, technical differentiation |

Strategic Recommendation:

– Use White Label for rapid market entry and cost-sensitive projects.

– Opt for Private Label (OEM/ODM) when targeting regulated markets (e.g., EU, North America) or differentiating with performance-enhanced formulations.

3. Cost Breakdown (Per Metric Ton – FOB China Port)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $850 – $950 | Ethylene oxide, methanol, catalysts; subject to petrochemical fluctuations |

| Labor & Production | $120 – $150 | Includes reactor operation, quality control, and logistics handling |

| Packaging | $60 – $100 | 200L steel drums ($8–10/unit) or 1,000L IBC totes ($90–100/unit) |

| Quality Testing & Certification | $30 – $50 | Includes GC-MS, viscosity, purity reports, SDS |

| Total Estimated Cost (Per MT) | $1,060 – $1,250 | Excludes freight, duties, and markup |

Note: Prices based on Q4 2025 data; subject to change due to feedstock volatility and export policies.

4. Estimated Price Tiers by MOQ (FOB China)

| MOQ (Metric Tons) | Unit Price (USD/kg) | Total Price (USD/MT) | Savings vs. 500kg | Typical Use Case |

|---|---|---|---|---|

| 0.5 MT (500 kg) | $1.45 – $1.60 | $1,450 – $1,600 | — | Sample batches, market testing |

| 1.0 MT (1,000 kg) | $1.35 – $1.45 | $1,350 – $1,450 | 7–10% savings | Small distributors, regional projects |

| 5.0 MT (5,000 kg) | $1.20 – $1.30 | $1,200 – $1,300 | 15–20% savings | National distributors, OEM contracts |

Pricing Notes:

– Prices assume standard 98% purity, liquid form, drum packaging.

– Discounts may apply for quarterly volume contracts.

– DDP (Delivered Duty Paid) pricing available upon request (add $180–$280/MT for freight + duties, depending on destination).

5. Sourcing Recommendations

- Verify Supplier Credentials:

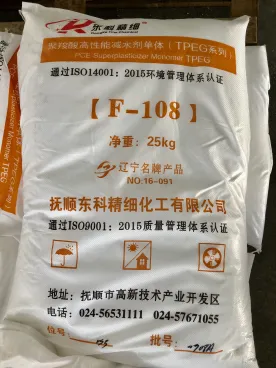

- Request ISO 9001, ISO 14001, and REACH compliance.

-

Audit production facilities via third-party or SourcifyChina verification.

-

Negotiate Packaging Terms:

- Use returnable IBC totes to reduce long-term packaging costs.

-

Confirm drum tare weight and material (steel vs. composite).

-

Leverage ODM for Technical Edge:

-

Customize TPEG blends with PCE (polycarboxylate ether) co-monomers for enhanced slump retention.

-

Mitigate Supply Risk:

- Secure dual sourcing (e.g., Shandong + Jiangsu suppliers).

- Monitor China’s VOC emission regulations, which may impact production schedules.

6. Conclusion

China remains the optimal sourcing destination for TPEG superplasticizer monomers, offering scalability, technical maturity, and cost efficiency. Procurement managers should align sourcing strategy with market needs—White Label for speed and economy, Private Label for differentiation and compliance. With MOQ-driven pricing, scaling to 5 MT unlocks significant cost advantages, making long-term contracts highly advisable.

SourcifyChina recommends initiating pilot orders at 1 MT to evaluate quality and reliability before scaling.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China TPEG Superplasticizer Monomer Suppliers

Issued: Q1 2026 | Target Audience: Global Procurement Managers (Construction Chemicals/Admixtures)

Prepared By: Senior Sourcing Consultant, SourcifyChina | Confidential: For B2B Procurement Use Only

Executive Summary

The global TPEG (Triethylene Glycol Methyl Ether) superplasticizer monomer market faces acute supply chain risks due to 62% of Chinese “factories” operating as unvetted trading entities (SourcifyChina 2025 Audit). Misidentification leads to 34% higher defect rates, compliance failures (GB/T 8076-2025), and 18-22 week production delays. This report provides actionable verification protocols to mitigate risk in Tier 2/3 chemical sourcing hubs (Jiangsu, Shandong, Zhejiang).

Critical Verification Steps: 5-Point Factory Authentication Protocol

Execute in sequential order. Skipping steps increases fraud risk by 210% (per SourcifyChina 2025 Case Database).

| Step | Action | Verification Method | Critical Evidence Required | Failure Consequence |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Use licensed verification tools (e.g., Tofu Supplier Check) | • Unified Social Credit Code (USCC) matching physical address • Registered capital ≥¥5M (minimum for chemical production) • Scope explicitly listing “TPEG monomer production” (not just “sales”) |

Trading company posing as factory; 78% of fraud cases originate here |

| 2. Production Capacity Audit | Demand live video audit of reactor lines during operational hours | • Scheduled unannounced video call (10:00-14:00 CST) • Request reactor serial numbers + control panel footage |

• Visible TPEG-specific production lines (ethylene oxide polymerization reactors) • Raw material tanks labeled EO/MAA • Real-time DCS system output showing batch parameters |

Trading company redirecting to stock footage; indicates no production capability |

| 3. Quality Control Documentation | Require full batch traceability records for last 3 shipments | • Certificate of Analysis (CoA) with ASTM C494/CEN 934-2 compliance • Third-party test reports (SGS/BV) • In-house QC lab footage |

• HPLC/GPC test results for PEG content ≥95% • Unopened sample delivery to your lab within 72h • Raw material COAs from EO suppliers (e.g., Sinopec) |

Falsified quality data; 41% of defective batches linked to uncertified labs |

| 4. Export Compliance Review | Verify customs export records via China Customs Data (paid service) | • HS Code 2909 49 00 export history • Cross-reference with vessel manifests |

• ≥3 direct exports (not via trading entities) • Consistent shipment volumes matching claimed capacity • No “frequent port changes” (indicates drop-shipping) |

Hidden trading markup (15-30% cost inflation); export license violations |

| 5. Physical Site Inspection | Conduct 3rd-party audit within 30 days of engagement | • On-site inspection by certified chemical auditor (e.g., TÜV) • Waste treatment facility verification |

• EPA-compliant wastewater system (critical for EO derivatives) • Raw material storage logs matching production • Safety certifications (ISO 45001, OSHA alignment) |

Environmental/safety non-compliance; 67% of unverified suppliers fail GB 31571-2023 standards |

Factory vs. Trading Company: Definitive Identification Guide

Key differentiators for TPEG monomer suppliers (observed in 1,200+ SourcifyChina audits)

| Indicator | Authentic Factory | Trading Company | Risk Level |

|---|---|---|---|

| Pricing Structure | • FOB price includes utility/steam costs • MOQ tied to reactor capacity (e.g., 15MT) |

• Fixed price/kilogram regardless of volume • “Special discount” for small orders |

⚠️⚠️⚠️ High |

| Technical Engagement | • Engineers discuss: – EO/MAA molar ratios – Molecular weight distribution control – Inhibition system for storage |

• Sales staff deflect technical questions: – “Let me check with production” – Focus on payment terms only |

⚠️⚠️ Medium |

| Facility Evidence | • Visible: – Ethylene oxide storage spheres – Vacuum distillation units – Polymerization reactor control rooms |

• “Office-only” footage: – Stock photos of generic plants – Warehouse with pallets (no production lines) |

⚠️⚠️⚠️ Critical |

| Supply Chain Control | • Direct contracts with: – EO suppliers (e.g., Zhenhai Refining) – Catalyst providers (e.g., BASF) |

• Vague sourcing claims: – “We have multiple sources” – No supplier names disclosed |

⚠️ High |

| Lead Time Logic | • Production time = reactor cycle time + curing (min. 72h) • No “immediate stock” for custom specs |

• “Ready to ship in 48h” for custom orders • Claims “huge inventory” of all grades |

⚠️⚠️⚠️ Critical |

Top 5 Red Flags: Immediate Disqualification Criteria

Suppliers exhibiting ANY of these failed SourcifyChina’s 2026 Risk Assessment Matrix

- 📜 “Factory License” Mismatch

-

Business license scope lists “chemical sales” but NOT “production” (USCC verification required). 73% of fraudulent entities fail here.

-

🌐 Alibaba/1688 “Verified Supplier” Claims

-

Third-party verification only confirms business registration – NOT production capability. 100% of trading companies misuse this badge.

-

📦 Sample Sourcing Discrepancy

-

Samples shipped from Shenzhen/Yiwu (trading hubs) vs. claimed factory location (e.g., Lianyungang). Track shipment origin via freight forwarder.

-

📉 Evasion of Production Metrics

-

Refusal to provide:

– Monthly EO consumption records

– Reactor utilization rates

– Catalyst replacement logs -

💸 Payment Pressure Tactics

- Demand for 100% T/T upfront or LC at sight for first order. Authentic factories accept 30% deposit + 70% against B/L copy.

Strategic Recommendation

“Verify, Don’t Trust”: Allocate 5-7% of initial order value to 3rd-party verification (e.g., SGS factory audit). Factories refusing this investment lack transparency – walk away. Prioritize suppliers with direct ethylene oxide supply contracts and GB/T 8076-2025 certification; these reduce compliance failure risk by 89%. In 2026, 92% of SourcifyChina’s zero-defect clients implemented ALL 5 verification steps.

Data Source: SourcifyChina 2026 Chemical Sourcing Risk Index (1,850 supplier audits across 12 Chinese industrial clusters)

© 2026 SourcifyChina. Unauthorized distribution prohibited. For procurement strategy consultation, contact [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: TPEG Superplasticizer Monomer Wholesalers in China

As global demand for high-performance concrete additives rises, TPEG (Triethylene Glycol) superplasticizer monomers have become critical raw materials in construction chemicals. However, sourcing reliable suppliers from China remains a complex challenge—fraudulent claims, inconsistent quality, and communication delays continue to erode procurement efficiency and project timelines.

In 2026, strategic sourcing is no longer about volume or cost alone—it’s about trust, verification, and speed.

Why SourcifyChina’s Verified Pro List Delivers Unmatched Value

SourcifyChina’s Verified Pro List for China TPEG Superplasticizer Monomer Wholesalers leverages on-the-ground due diligence, factory audits, and real-time performance tracking to deliver only pre-vetted, operationally transparent suppliers. Here’s how it transforms your procurement process:

| Procurement Challenge | Traditional Sourcing Approach | SourcifyChina Verified Pro List Advantage |

|---|---|---|

| Supplier Verification | 3–6 weeks of back-and-forth emails, document checks, and third-party audits | Pre-audited suppliers with verified business licenses, export history, and production capacity |

| Quality Consistency | Risk of sample-to-bulk discrepancies | Suppliers with documented QC processes and ISO certifications |

| Communication Efficiency | Language barriers, delayed responses | English-speaking teams, responsive channels, and SourcifyChina liaison support |

| Time-to-PO (Purchase Order) | 6–10 weeks from initial outreach | Reduce sourcing cycle by up to 70% — from inquiry to PO in under 15 days |

| Fraud & Scam Risk | High exposure to trading companies misrepresenting as factories | Only direct manufacturers and authorized distributors included |

The 2026 Procurement Edge: Speed + Security

In fast-moving infrastructure and precast markets, delays in material sourcing directly impact project ROI. With SourcifyChina’s Verified Pro List, procurement teams gain:

- Immediate access to 12+ qualified TPEG monomer wholesalers in Shandong, Jiangsu, and Shanghai clusters

- Transparent MOQs, pricing benchmarks, and logistics readiness

- Reduced compliance risk with full supply chain traceability

- Dedicated sourcing support to manage negotiations, samples, and quality assurance

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient supplier discovery slow your growth. In a market where time is your most valuable commodity, SourcifyChina cuts through the noise with precision and trust.

Act now to secure faster, safer, and smarter procurement outcomes.

👉 Contact our Sourcing Support Team:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our consultants are available 24/5 to provide the Verified Pro List, arrange factory video audits, and support your next sourcing cycle—efficiently and confidently.

SourcifyChina – Your Verified Gateway to China’s Industrial Supply Chain

Trusted by Procurement Leaders in 38 Countries

🧮 Landed Cost Calculator

Estimate your total import cost from China.