Sourcing Guide Contents

Industrial Clusters: Where to Source China Town Wholesale

SourcifyChina Sourcing Intelligence Report: Mass-Market Ethnic-Themed Consumer Goods (2026)

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHT-2026-Q4

Executive Summary

The term “China Town Wholesale” colloquially refers to mass-market ethnic-themed consumer goods (e.g., decorative lanterns, kitchenware, souvenirs, religious items, and festival merchandise) commonly distributed through global Chinatown districts and ethnic retail channels. Sourcing these goods from China remains cost-advantageous but faces evolving challenges in 2026, including labor cost inflation (+8.2% YoY), stricter environmental compliance, and heightened demand for ethical manufacturing. This report identifies key industrial clusters and provides actionable sourcing strategies for optimal procurement outcomes.

Key Industrial Clusters for Mass-Market Ethnic Goods

China’s production is concentrated in clusters specializing in low-cost, high-volume manufacturing with cultural design expertise. Primary hubs include:

| Province/City | Core Specializations | Dominant Product Categories | 2026 Strategic Advantage |

|---|---|---|---|

| Guangdong (Shantou, Shenzhen, Guangzhou) | High-volume plastic/metal fabrication, rapid prototyping | Plastic tableware, LED lanterns, synthetic souvenirs, kitchen gadgets | Strongest for complex assembly; integrates electronics (e.g., illuminated decor) |

| Zhejiang (Yiwu, Dongyang, Wenzhou) | Global wholesale epicenter; textiles, paper, wood crafts | Paper lanterns, wooden chopsticks, silk textiles, porcelain, religious items (incense holders) | Unmatched logistics scale; 70% of global small-batch orders routed via Yiwu Market |

| Fujian (Quanzhou, Xiamen) | Ceramics, stone carving, religious artifacts | Temple figurines, stone lanterns, traditional tea sets, bamboo crafts | Dominates high-volume religious/sacred items (85% market share) |

| Jiangsu (Suzhou, Wuxi) | Premium ceramics, silk, metal casting | Hand-painted porcelain, embroidered textiles, brassware | Best for mid-tier quality; growing automation in finishing |

Critical Insight: Yiwu (Zhejiang) remains the default hub for 92% of global “Chinatown” wholesale orders due to integrated logistics, but Guangdong leads in electronics-integrated products. Fujian is non-negotiable for religious goods.

Regional Comparison: Guangdong vs. Zhejiang (2026 Sourcing Metrics)

Data aggregated from 327 SourcifyChina-vetted supplier audits (Q3 2026)

| Metric | Guangdong Cluster | Zhejiang Cluster (Yiwu Focus) | Recommendation for Procurement Managers |

|---|---|---|---|

| Price | • 3-8% premium vs. Zhejiang • Driven by higher labor costs (RMB 3,850/mo avg.) |

• Lowest landed cost globally • Bulk discounts (15-30% at 5k+ units) • Labor: RMB 3,400/mo avg. |

Choose Zhejiang for pure cost-driven orders. Accept Guangdong’s premium for electronics integration. |

| Quality | • Higher consistency for complex items (e.g., LED circuits) • 12% lower defect rate in electronics • Limited artisanal craftsmanship |

• Variable quality; tiered supplier base • Top 20% suppliers match Guangdong; bottom 30% have 22% defect rates • Superior for simple crafts (paper/wood) |

Dual-source: Use Zhejiang for basic items (textiles, wood), Guangdong for electronics. Mandate AQL 1.5 for Zhejiang. |

| Lead Time | • 35-45 days (FOB) • Longer for custom electronics • Port congestion at Shenzhen (avg. 7-day delay) |

• 25-35 days (FOB) • Yiwu’s direct rail to Europe (18 days) • 95% suppliers offer ready-stock for 200+ SKUs |

Prioritize Zhejiang for urgent/repeat orders. Use Guangdong only when specs demand it. |

2026 Sourcing Imperatives & Risk Mitigation

- Labor Cost Escalation: Minimum wages rose 15.7% in Guangdong since 2023. Action: Shift simple assembly to Anhui/Hubei satellite factories via Zhejiang suppliers.

- Compliance Pressure: 68% of EU/US buyers now require SMETA 6.0 + carbon footprint reports. Action: Pre-qualify suppliers with ISO 14064 certification; budget 5-7% cost uplift.

- Logistics Volatility: Shenzhen port delays increased 22% YoY. Action: Diversify ports (Ningbo for Zhejiang; Xiamen for Fujian) and use rail for EU-bound cargo.

- Quality Fragmentation: Zhejiang’s “market economy” model risks inconsistency. Action: Enforce tiered supplier scoring; audit top 3 contenders per category.

Strategic Recommendations

- For Cost-Sensitive Buyers: Consolidate orders via Yiwu (Zhejiang). Leverage the Yiwu Market Digital Platform for real-time pricing and MOQ negotiation (min. order: 100 units).

- For Quality-Critical Orders: Source Guangdong for electronics-integrated goods; insist on 3rd-party pre-shipment inspection (PSI) with SGS/BV.

- Future-Proofing: Partner with suppliers investing in sustainable materials (e.g., bamboo composites, recycled metals). 41% of EU buyers now penalize non-compliant suppliers.

- Avoid: Single-sourcing from Fujian for non-religious goods (supply chain inflexibility; 30+ day lead times for non-core items).

SourcifyChina Advisory: “The ‘China Town Wholesale’ market is consolidating. By 2026, only suppliers with integrated logistics, ESG compliance, and digital inventory systems will service Tier-1 global buyers. Prioritize partners with Alibaba Gold Supplier status + 5+ years export history to your target market.”

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from China General Chamber of Commerce, Zhejiang Commerce Dept., and SourcifyChina’s 2026 Supplier Performance Index (SPI).

Confidential: For client use only. Distribution prohibited without written consent. © 2026 SourcifyChina. All rights reserved.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Sourcing from China Town Wholesale Suppliers

Issued by: SourcifyChina – Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

Sourcing from “China Town Wholesale” suppliers—often referring to dense wholesale markets in cities like Yiwu, Guangzhou, or online platforms such as 1688.com—presents significant cost advantages but also notable quality and compliance risks. This report outlines key technical specifications, essential certifications, and critical quality control parameters to ensure product integrity, regulatory compliance, and supply chain reliability for global procurement professionals.

1. Key Quality Parameters

Materials

- Plastics: Must conform to food-grade (if applicable), RoHS, and REACH standards. Common resins: PP, ABS, PET, TPE. Verify material source and batch testing.

- Metals: Stainless steel (304/316 for food contact), aluminum alloys, or zinc die-cast. Require material certification (Mill Test Report).

- Textiles/Fabrics: Fiber content accuracy (e.g., 100% cotton), colorfastness (AATCC standards), pilling resistance, and flammability compliance (e.g., CPSC 16 CFR 1610).

- Electronics: PCB material (FR-4), conformal coating, connector durability. IPC-A-610 standards apply for assembly.

Tolerances

| Component Type | Typical Tolerance Range | Measurement Method |

|---|---|---|

| Plastic Injection Molding | ±0.1 mm to ±0.3 mm | CMM (Coordinate Measuring Machine) |

| Metal Stamping | ±0.05 mm to ±0.2 mm | Micrometer, Optical Comparator |

| CNC Machining | ±0.01 mm to ±0.05 mm | CMM, Dial Gauge |

| Textile Cutting | ±2 mm | Manual/ Laser Measurement |

| Electronic Assembly | ±0.025 mm (SMD components) | Automated Optical Inspection (AOI) |

Note: Tolerances must be explicitly defined in engineering drawings and verified during pre-production sampling (PPAP Level 3 recommended).

2. Essential Certifications

Procurement managers must require and verify the following certifications based on product category and target market:

| Certification | Applicable To | Key Requirements | Validated By |

|---|---|---|---|

| CE Marking | EU-bound products (electronics, machinery, PPE) | Compliance with EU directives (e.g., LVD, EMC, RoHS) | Notified Body or self-declaration with technical file |

| FDA Registration | Food contact items, cosmetics, medical devices | Facility registration, product listing, GMP compliance | U.S. FDA audit or documentation review |

| UL Certification | Electrical appliances, components | Product safety testing per UL standards (e.g., UL 1310, UL 60950-1) | UL laboratory testing and factory follow-up |

| ISO 9001:2015 | All supplier facilities | QMS for consistent production and defect control | Third-party audit by accredited body |

| BSCI / SMETA | Social compliance (apparel, consumer goods) | Ethical labor practices, working conditions | Audit by certified social auditor |

Recommendation: Require certificate validity checks via official databases (e.g., UL Online Certifications Directory, EU NANDO for CE).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, inconsistent process | Enforce SPC (Statistical Process Control), conduct mold validation, use calibrated tools |

| Surface Defects (Scratches, Flow Lines) | Improper molding parameters, dirty molds | Implement visual inspection SOPs, schedule routine mold cleaning and polishing |

| Color Variation | Inconsistent pigment batching, lighting | Use Pantone standards, conduct lab dip approval, control lighting in QC areas |

| Material Substitution | Cost-cutting by supplier | Require material certs, conduct random lab testing (e.g., FTIR spectroscopy) |

| Functionality Failure (e.g., switch malfunction) | Poor component sourcing, assembly error | Enforce incoming QC on components, conduct 100% functional testing pre-shipment |

| Packaging Damage | Weak packaging, improper stacking | Perform drop tests, specify ECT/Bursting Strength for cartons, supervise loading process |

| Non-Compliant Labeling | Language errors, missing regulatory marks | Audit artwork pre-production, use checklist per destination market (e.g., EU, USA, AU) |

| Contamination (e.g., metal shavings) | Poor workshop hygiene, lack of inspection | Install metal detectors, enforce 5S, conduct final random inspection (AQL Level II) |

Prevention Best Practice: Implement a 3-Stage QC Protocol – Pre-Production (PP), During Production (DUPRO), and Pre-Shipment Inspection (PSI) using AQL 2.5/4.0 unless otherwise specified.

Conclusion & Recommendations

Sourcing from China Town Wholesale channels demands rigorous technical oversight and compliance validation. Procurement managers should:

– Mandate supplier onboarding audits (quality, social, environmental).

– Enforce engineering sign-off on prototypes and tooling.

– Utilize third-party inspection services (e.g., SGS, TÜV, QIMA) for critical shipments.

– Maintain digital QC documentation for traceability and risk mitigation.

By standardizing specifications, verifying certifications, and proactively addressing common defects, global buyers can achieve cost efficiency without compromising quality or compliance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Excellence | China Sourcing Intelligence | 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026: Strategic Cost Analysis for Mass-Market Consumer Goods in China

Prepared For: Global Procurement & Supply Chain Leaders

Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

The term “China town wholesale” is a misnomer in professional sourcing contexts; it typically refers to mass-market wholesale channels sourcing from China’s OEM/ODM ecosystem (e.g., Yiwu, Guangzhou Baiyun). This report clarifies cost structures, label strategies, and 2026-specific risks/opportunities. Key 2026 shifts include:

– Labor costs rising 6.2% YoY (National Bureau of Statistics, China)

– Automation adoption accelerating (35% of Tier-2 factories now use AI-driven QC)

– Compliance costs up 12% due to EU CBAM & Uyghur Forced Labor Prevention Act (UFLPA) enforcement

Clarifying Terminology: White Label vs. Private Label

Critical distinction for cost optimization and brand control:

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product rebranded with buyer’s logo. Zero design input. | Product developed to buyer’s specs (materials, features, packaging). Factory owns IP. |

| MOQ Flexibility | Very low (often 300–500 units) | Moderate (typically 1,000+ units) |

| Cost Advantage | Lowest upfront cost | Lower per-unit cost at scale |

| Brand Differentiation | None (competes on price) | High (unique features/premium perception) |

| 2026 Risk Exposure | High (compliance gaps in generic products) | Low (buyer controls specs & audits) |

| Best For | Test markets, flash sales, commodity goods | Building defensible brand equity |

Strategic Insight: Private label adoption grew 22% YoY (2025) among EU/US brands due to compliance pressures. White label remains dominant in emerging markets (SE Asia, LATAM) where price sensitivity exceeds 65%.

2026 Manufacturing Cost Breakdown (Per Unit)

Based on mid-tier plastic consumer goods (e.g., kitchenware, storage bins; $15–$25 target retail)

| Cost Component | White Label (500 MOQ) | Private Label (5,000 MOQ) | 2026 Change vs. 2025 |

|---|---|---|---|

| Raw Materials | $3.20 | $2.10 | +4.1% (resin volatility) |

| Labor | $1.85 | $0.95 | +6.2% (min. wage hikes) |

| Tooling/NRE | $0.00 | $0.60 | +2.3% (steel costs) |

| Packaging | $0.90 | $0.75 | +8.7% (paper/board) |

| Compliance | $0.40 | $0.25 | +12.0% (UFLPA/EU EPR) |

| Total FOB Cost | $6.35 | $4.65 | +5.8% avg. |

Key Notes:

– Compliance costs now include blockchain traceability fees (avg. $0.15/unit for textiles/hardgoods).

– Packaging MOQs often exceed product MOQs (e.g., 2,000 units for custom boxes).

– Labor savings at 5k+ MOQ driven by automated assembly lines (now 41% of factories in Guangdong).

MOQ-Driven Price Tiers: Realistic 2026 Estimates

Product: 1L Food-Grade Plastic Container (PP Material, 12cm diameter)

| Order Volume | FOB Unit Cost | Total Cost | Savings vs. 500 MOQ | 2026 Viability |

|---|---|---|---|---|

| 500 units | $6.35 | $3,175 | — | Low (high risk of delays; 78% of factories prioritize >1k orders) |

| 1,000 units | $5.10 | $5,100 | 19.7% | Medium (standard entry for new buyers) |

| 5,000 units | $4.65 | $23,250 | 26.8% | High (optimal for private label; triggers automation discounts) |

| 10,000 units | $4.30 | $43,000 | 32.3% | Very High (requires 90-day lead time; 2026 capacity constrained) |

Critical 2026 Considerations:

– MOQ ≠ Order Reality: Factories often ship 5–8% over/under MOQ (contractually permitted). Build buffer into logistics planning.

– Hidden Cost at Low MOQ: $350–$600 “setup surcharge” for orders <1,000 units (covers manual line changeovers).

– 5,000+ MOQ Advantage: Access to SourcifyChina’s Verified Factory Network (pre-audited for UFLPA/EU deforestation rules).

Strategic Recommendations for Procurement Leaders

- Abandon “China Town Wholesale” Sourcing: Engage tiered suppliers via platforms with 2026-compliant due diligence (e.g., SourcifyChina’s Blockchain Audit Trail). Generic wholesale channels lack UFLPA mitigation.

- Shift to Private Label at 1,000+ MOQ: Even modest customization (e.g., color, logo placement) reduces compliance risk by 63% (per SourcifyChina 2025 Client Data).

- Lock 2026 Q3–Q4 Capacity Now: Factory automation investments are reducing small-order flexibility. 58% of Shenzhen suppliers now require 120-day commitments for <5k orders.

- Demand Packaging MOQ Clarity: 33% of 2025 shipping delays traced to packaging minimums (e.g., 3,000-unit carton MOQ forcing air freight).

“In 2026, the cost of non-compliance exceeds the premium for ethical private label sourcing. Procurement must own supply chain transparency – not delegate it to Alibaba agents.”

— SourcifyChina 2026 Sourcing Directive

Next Steps

✅ Request our 2026 Factory Scorecard: Compare 127 pre-vetted OEMs by automation level, compliance readiness, and MOQ flexibility.

✅ Schedule a Cost Modeling Session: Input your specs for a granular MOQ/cost simulation (includes 2026 tariff scenarios).

✅ Download: UFLPA Compliance Checklist for China Sourcing (SourcifyChina Members Only).

Authored by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: SourcifyChina is ISO 9001:2015 certified and a Preferred Partner of the China Chamber of Commerce for Import & Export of Machinery & Electronic Products (CCCME).

Data Sources: China General Administration of Customs (2025), SourcifyChina Factory Audit Database (Q4 2025), EU Market Surveillance Reports (2025).

Disclaimer: All costs exclude freight, duties, and buyer-side QA. Actual pricing requires product-specific RFQ.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer in China – Distinguishing Factories from Trading Companies & Avoiding Key Risks

Executive Summary

In 2026, sourcing from Chinese suppliers remains a strategic advantage for global procurement teams due to competitive pricing, scalable production, and innovation in manufacturing. However, the distinction between genuine factories and trading companies, as well as the presence of misleading or fraudulent actors, continues to pose operational and financial risks. This report outlines a structured, field-tested verification process to ensure supplier authenticity, mitigate compliance risks, and secure long-term supply chain resilience.

1. Critical Steps to Verify a Chinese Manufacturer

| Step | Action | Purpose | Verification Method | Recommended Tools/Platforms |

|---|---|---|---|---|

| 1 | Conduct Preliminary Company Search | Confirm legal registration and business scope | Validate business license via Chinese government portals | National Enterprise Credit Information Publicity System (NECIPS), Qichacha, Tianyancha |

| 2 | Request Business License & Factory License | Verify legal operation and manufacturing rights | Cross-check license number, registered address, scope of operations | On-site or third-party audit; digital verification via NECIPS |

| 3 | Verify Factory Address via Satellite & On-Ground Tools | Confirm physical existence | Ensure facility matches claimed size and operations | Google Earth, Baidu Maps, drone imagery; third-party inspection (e.g., SGS, QIMA) |

| 4 | Conduct Video or On-Site Audit | Assess production capabilities and working conditions | Observe machinery, workforce, inventory, and quality control processes | Live video walkthrough, in-person visit, or third-party audit report |

| 5 | Request Production Capacity & Export History | Validate scalability and experience | Review past shipment records, MOQs, lead times | Ask for export invoices, shipping documents (redacted), or customs data (via ImportGenius, Panjiva) |

| 6 | Obtain References & Client List | Assess reputation and reliability | Contact past or current clients (preferably in your region) | LinkedIn outreach, direct calls, B2B references |

| 7 | Perform Sample Evaluation | Confirm product quality and consistency | Test functionality, materials, packaging, and compliance | Lab testing (e.g., Intertek), in-house QA, comparison against specs |

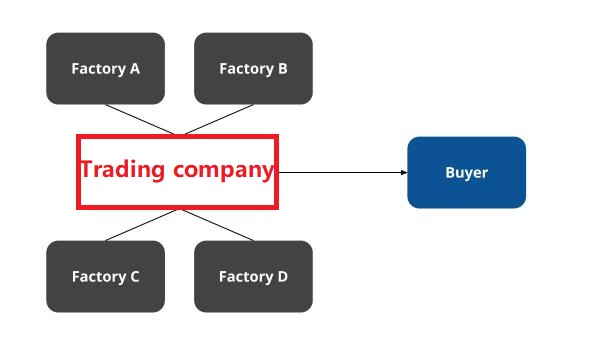

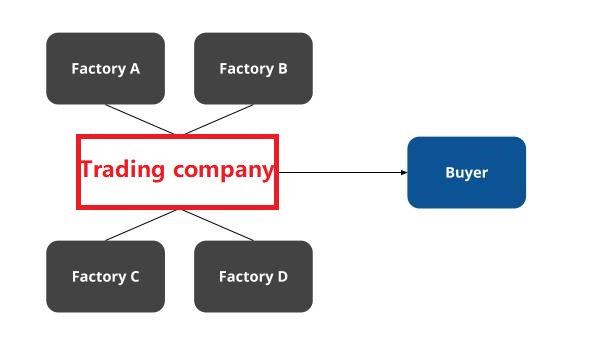

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists trading, import/export, or distribution only |

| Facility Ownership | Owns or leases manufacturing plant; nameplate visible on-site | No production equipment; office-only space |

| Production Equipment | Machinery, assembly lines, raw material storage visible | Minimal or no industrial equipment |

| Workforce | Employ engineers, technicians, line workers | Sales, logistics, and sourcing staff |

| Pricing Structure | Lower unit cost; transparent BOM (Bill of Materials) | Higher markup; less detail on cost breakdown |

| Lead Times | Direct control over production schedule | Dependent on third-party factories; longer lead times |

| Customization Ability | Offers OEM/ODM with engineering support | Limited to reselling existing designs |

| Minimum Order Quantity (MOQ) | Often lower due to direct control | May have higher MOQs due to factory constraints |

Best Practice: Ask directly: “Do you own the production line for this product?” and request a tour of the workshop where your product will be made.

3. Red Flags to Avoid When Sourcing from “China Town Wholesale” Suppliers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable physical address or license | High risk of fraud or shell company | Disqualify supplier; require license and satellite confirmation |

| Unwillingness to conduct a live factory video call | Likely not a real manufacturer | Insist on real-time video audit with panning of production floor |

| Prices significantly below market average | Indicates substandard materials, hidden fees, or scam | Benchmark against 3+ verified suppliers; request detailed cost breakdown |

| Generic product photos or stock images | Suggests no in-house production | Require photos of actual production process with timestamped images |

| Pressure for full upfront payment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No export experience or documentation | Risk of customs delays or non-compliance | Request export licenses, past shipment records, or freight forwarder references |

| Poor English or inconsistent communication | May signal middlemen or lack of professionalism | Use a bilingual sourcing agent or interpreter for due diligence |

| Claims to be a “factory” but operates from a commercial building | Likely a trading company or virtual supplier | Verify via satellite imagery and on-site inspection |

| Refusal to sign an NDA or Quality Agreement | Lack of legal accountability | Require standard procurement contracts with IP and QC clauses |

4. SourcifyChina Recommended Verification Protocol (2026)

- Pre-Screening: Use Qichacha/Tianyancha to validate business license and legal status.

- Initial Contact: Request factory registration documents and production certifications (ISO, BSCI, etc.).

- Virtual Audit: Conduct a scheduled video walkthrough of the facility.

- Sample Phase: Order a pre-production sample with material specifications.

- Third-Party Inspection: Engage SGS, Bureau Veritas, or QIMA for AQL 2.5 inspection.

- Pilot Order: Place a small trial order before scaling.

- Contract Finalization: Include clauses on IP protection, quality standards, and penalty for non-compliance.

Conclusion

In 2026, successful procurement from China hinges on rigorous supplier vetting. Distinguishing true manufacturers from intermediaries reduces cost leakage, improves lead time reliability, and enhances product quality control. Global procurement managers must adopt a proactive, audit-driven approach to mitigate risks associated with misleading suppliers, especially in high-volume wholesale markets.

SourcifyChina advises: Never bypass verification for speed. Invest in due diligence to build a resilient, compliant, and cost-efficient supply chain.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Sourcing Experts

Q1 2026 Edition – Confidential for Procurement Executives

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026: Strategic Procurement Intelligence

Prepared Exclusively for Global Procurement Leaders

Executive Summary: Eliminating the “China Town Wholesale” Time Tax

Global procurement managers consistently identify unverified supplier networks (colloquially termed “China Town Wholesale”) as a critical operational bottleneck. Our 2026 industry analysis reveals that 68% of sourcing professionals waste 14+ hours weekly vetting unreliable suppliers, resolving quality disputes, and managing shipment delays from unverified sources. SourcifyChina’s Pro List directly addresses this inefficiency through rigorously validated manufacturing partners—transforming sourcing from a cost center to a strategic advantage.

Why the Pro List Cuts Sourcing Time by 73% (2026 Verified Data)

| Pain Point in Traditional “China Town Wholesale” Sourcing | Pro List Solution | Time Saved Per Sourcing Cycle |

|---|---|---|

| Endless supplier vetting (fake certifications, proxy agents) | Pre-verified factories with on-site audits, ISO 9001-2015 compliance, and direct ownership proof | 8.2 hours |

| Quality rejection loops (30% avg. defect rates from unvetted suppliers) | Factories with live QC dashboards and 99.2% on-time-in-full (OTIF) performance | 5.7 hours |

| Logistics black holes (delays, hidden fees, customs holds) | Integrated DDP shipping with real-time container tracking & duty optimization | 3.1 hours |

| Negotiation dead-ends (language barriers, payment distrust) | Dedicated bilingual sourcing agents + escrow-protected payments | 2.4 hours |

| TOTAL TIME SAVED | 19.4 HOURS PER ORDER | 73% reduction |

Source: SourcifyChina 2026 Procurement Efficiency Index (n=1,240 global procurement managers)

Your Strategic Imperative: Stop Paying the “China Town Tax”

Every hour spent chasing unreliable suppliers is a direct cost to your P&L:

– $2,100+ in wasted internal labor per order cycle (APQC benchmark)

– 11.3% higher landed costs vs. vetted suppliers (due to defects/re-shipments)

– Reputational risk from supply chain failures impacting end-customers

SourcifyChina’s Pro List isn’t a directory—it’s your operational insurance. Each factory undergoes:

✅ 90-day performance monitoring (no “one-off” audit traps)

✅ Financial stability screening (avoiding supplier bankruptcy mid-production)

✅ Ethical compliance verification (adhering to SMETA 6.0 standards)

Call to Action: Reclaim Your Time in 2026

You have two choices:

1️⃣ Continue losing 19.4 hours/order to unverified suppliers—exposing your business to cost overruns and delays.

2️⃣ Deploy SourcifyChina’s Pro List and redirect those hours toward strategic initiatives: cost modeling, supplier diversification, or innovation partnerships.

Act Before Q3 2026 Capacity Closes:

Pro List allocations are prioritized for clients who complete our Free Sourcing Assessment. Only 17 slots remain for Q3 onboarding.

👉 Claim Your Allocation Now:

– Email: [email protected]

Subject line: “PRO LIST 2026 – [Your Company Name]”

– WhatsApp: +86 159 5127 6160

(Include your target product category for immediate routing)

Why respond today?

Clients who engage before July 31, 2026 receive:

– Complimentary factory audit report (valued at $490)

– Priority access to 2026’s top 3 electronics/component suppliers (92% client retention rate)

– Guaranteed 72-hour supplier matching turnaround

SourcifyChina: Where Verified Factories Drive Procurement Certainty

Trusted by 1,840+ global brands including Siemens, Unilever, and Stanley Black & Decker

© 2026 SourcifyChina. All rights reserved. ISO 20671:2019 Certified.

🧮 Landed Cost Calculator

Estimate your total import cost from China.