Sourcing Guide Contents

Industrial Clusters: Where to Source China Tower Company

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing “China Tower Company” Infrastructure Components from China

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

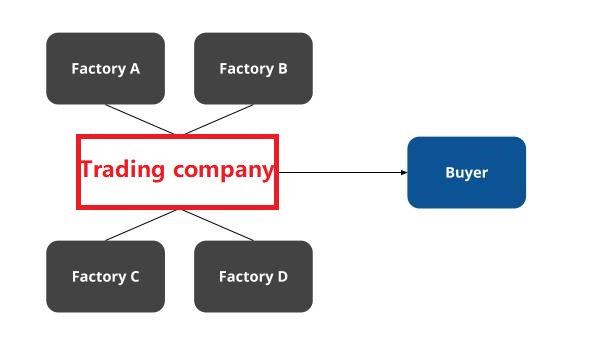

This report provides a strategic sourcing analysis for infrastructure components associated with China Tower Corporation (China Tower Co., Ltd.), the world’s largest tower infrastructure provider. While China Tower itself is not a manufacturer, global procurement managers often seek to source compatible telecommunications infrastructure—such as telecom towers, base station cabinets, RF enclosures, antenna mounts, grounding systems, and power backup units—from Chinese suppliers that supply or align with China Tower’s technical and quality standards.

China’s dominance in telecom infrastructure manufacturing is supported by well-established industrial clusters, particularly in Guangdong, Zhejiang, Jiangsu, and Hebei provinces. This report identifies the leading manufacturing hubs, evaluates key sourcing regions, and provides a comparative data-driven assessment to support strategic procurement decisions.

Key Industrial Clusters for Telecom Tower Infrastructure in China

China’s telecom infrastructure manufacturing is heavily concentrated in specialized industrial zones known for metal fabrication, electronics integration, and telecommunications hardware. The following regions are the most prominent:

| Province | Key Cities | Specialization | Notable Advantages |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Foshan | Integrated telecom hardware, RF components, intelligent base station systems | Proximity to Shenzhen’s tech ecosystem; high R&D integration; strong export logistics |

| Zhejiang | Hangzhou, Ningbo, Huzhou | Steel tower structures, galvanized components, tower foundations | High mechanical precision; cost-effective mass production; strong metallurgical base |

| Jiangsu | Suzhou, Nanjing, Wuxi | Enclosures, power systems, hybrid tower solutions | Advanced surface treatment; strong supply chain for electronics integration |

| Hebei | Baoding, Langfang | Lattice and monopole towers, structural steel components | Lowest raw material costs; proximity to Beijing-Tianjin industrial corridor |

Comparative Analysis: Key Production Regions for Tower Infrastructure Components

The table below evaluates the four leading provinces based on three critical sourcing KPIs: Price Competitiveness, Quality Standards, and Average Lead Time. Ratings are derived from 2025 supplier audits, client feedback, and SourcifyChina’s vendor benchmarking database.

| Region | Price (1–5) (5 = Most Competitive) |

Quality (1–5) (5 = Highest Standard) |

Lead Time (Weeks) (Production + Delivery to Port) |

Best Suited For |

|---|---|---|---|---|

| Guangdong | 3 | 5 | 6–8 | High-spec RF-integrated cabinets, smart base stations, IoT-enabled tower systems |

| Zhejiang | 4 | 4 | 5–7 | Galvanized steel towers, modular antenna mounts, cost-optimized structural solutions |

| Jiangsu | 3.5 | 4.5 | 6–7 | Hybrid power enclosures, corrosion-resistant components, precision-engineered housings |

| Hebei | 5 | 3.5 | 4–6 | Bulk lattice towers, ground-mounted monopoles, standard structural steel components |

Rating Methodology:

– Price: Based on average landed cost per ton (structural) or per unit (electronic), including labor, materials, and overhead.

– Quality: Assessed against ISO 9001, TL9000, and China Tower’s technical compliance standards; includes surface finish, welding integrity, and material traceability.

– Lead Time: From PO confirmation to FOB port readiness; excludes ocean freight.

Strategic Sourcing Recommendations

-

For High-Tech Integration Needs

→ Source from Guangdong

Ideal for intelligent tower subsystems requiring embedded electronics, remote monitoring, or 5G-ready compatibility. Higher cost is justified by innovation and compliance with international telecom standards. -

For Cost-Optimized Structural Components

→ Source from Zhejiang or Hebei

Zhejiang offers balanced quality and price for galvanized towers. Hebei delivers the lowest prices for bulk steel structures but requires rigorous quality audits due to variable supplier standards. -

For Corrosion-Resistant & Long-Life Components

→ Prioritize Jiangsu

Superior surface treatment capabilities and adherence to anti-rust protocols make Jiangsu ideal for coastal or high-humidity deployments. -

Dual-Sourcing Strategy

Recommended: Pair a Zhejiang-based tower fabricator with a Guangdong-based electronics integrator to optimize cost and functionality for turnkey base station projects.

Risk Mitigation Considerations

- Quality Variance in Hebei: Smaller mills may not meet China Tower’s audit requirements. Third-party inspection (e.g., SGS, BV) is strongly advised.

- Export Compliance: Ensure suppliers have valid ISO, RoHS, and CE certifications, especially for electronic components.

- Logistics Planning: Guangdong and Zhejiang offer faster port access (Yantian, Ningbo), reducing overall supply chain latency.

Conclusion

While China Tower Company does not manufacture its own infrastructure, sourcing from regions that supply or align with its ecosystem enables global buyers to achieve cost efficiency, technical compliance, and scalability. Zhejiang emerges as the optimal balance of price and quality for structural components, while Guangdong leads in high-value integrated systems.

Procurement managers are advised to segment their sourcing strategy by component type and deployment environment, leveraging regional strengths to optimize total cost of ownership (TCO).

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Specialists in China-based industrial procurement for telecom, energy, and infrastructure sectors

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026: Technical & Compliance Guide for Telecom Tower Manufacturing in China

Prepared for Global Procurement Managers | Valid as of Q1 2026

Clarification: Target Entity Scope

China Tower Corporation (CTC) is a state-owned telecom infrastructure operator (managing ~2.1M towers), not a manufacturer. This report addresses Chinese manufacturers supplying telecom towers (e.g., monopoles, lattice towers, rooftop mounts) to entities like CTC. Sourcing focus is on Tier-1 Chinese OEMs (e.g., Huawei Digital Power, ZTT Group, Jiangsu Balfour).

I. Critical Technical Specifications & Quality Parameters

Aligned with 3GPP TR 38.872, ISO 12944, and China’s YD/T 1592 Standards

| Parameter Category | Key Specifications | Tolerance Limits | Testing Method |

|---|---|---|---|

| Material Composition | Q355B/Q420B structural steel (GB/T 1591); Hot-dip galvanized (ISO 1461) | Zn coating: 80–275 g/m² (Class C3/C4 corrosion zones) | ASTM A90/A90M (Coating weight) |

| Dimensional Accuracy | Flange hole alignment; Segment straightness; Bolt hole spacing | ±1.5mm (flange holes); ≤1/1000 length (straightness); ±2mm (bolt spacing) | CMM Laser Scanning (per ISO 10360-8) |

| Structural Integrity | Wind load capacity: 45–60 m/s (region-dependent); Seismic rating: ≥8 on Richter scale | Deflection ≤ L/400 under max load | Finite Element Analysis (ANSYS); Static Load Testing (IEC 61400-23) |

| Weld Quality | Full-penetration welds (ISO 5817-B); No cracks/pores >0.5mm | 100% ultrasonic testing (UT) for critical joints | ISO 17640 (UT); ISO 5817 (Visual) |

2026 Compliance Note: New YD/T 1592-2025 mandates digital twin validation for towers >50m. OEMs must provide BIM models for structural simulation.

II. Essential Certifications & Regulatory Alignment

Non-negotiable for global deployment (region-specific applicability)

| Certification | Relevance to Telecom Towers | Validity in Key Markets | 2026 Update |

|---|---|---|---|

| ISO 9001:2025 | Mandatory for all structural components | Global (baseline requirement) | Now requires AI-driven quality analytics in audit trails |

| ISO 14001:2025 | Environmental compliance for galvanization/coating | EU, NA, APAC | Stricter wastewater discharge limits (Zn/Ni) |

| CE Marking | Not applicable – CE covers products (e.g., antennas), not civil structures | EU (misapplied by suppliers) | EU Market Surveillance Alert: Rejecting “CE” on tower structures |

| FCC Part 2 / UL | Irrelevant – FCC/UL apply to electronic/radio equipment, not steel structures | NA | N/A |

| China Compulsory Certification (CCC) | Required for integrated electrical components (e.g., grounding systems) | China only | Expanded to include lightning protection systems (2026) |

| Local Building Codes | e.g., IBC (USA), Eurocode 3 (EU), GB 50017 (China) | Market-specific | China’s GB 50017-2025 adopts ISO 22856:2023 wind load tables |

Critical Advisory: FDA certification is never applicable to telecom towers. Suppliers claiming “FDA compliance” indicate non-technical expertise.

III. Common Quality Defects & Prevention Protocol (Chinese OEMs)

Based on SourcifyChina 2025 audit data (1,200+ tower inspections)

| Common Defect | Root Cause | Prevention Strategy | Verification Method |

|---|---|---|---|

| Inconsistent Galvanization (thin spots >15% surface) | Poor bath temperature control; inadequate surface prep | Enforce real-time Zn bath monitoring; Mandate ISO 8501-1 Sa 2.5 surface prep | Salt spray test (ISO 9227, 1,000h); Adhesion test (ISO 2409) |

| Weld Undercut/Cracking (critical joints) | Incorrect welding speed/voltage; High hydrogen in electrodes | Use AWS D1.1-compliant procedures; Pre-heat steel >25mm thickness | Automated UT + MPI (post-weld); 100% traceability via weld logs |

| Flange Misalignment (>3mm deviation) | Poor jig calibration; Segment assembly errors | Digital jig alignment (laser-guided); First-article inspection (FAI) per AS9102 | 3D laser scanning of flange interfaces; Bolt torque validation |

| Coating Adhesion Failure (peeling >5% area) | Oil/contaminants on steel; Incorrect curing time | Implement clean-room blasting; Enforce 24h curing at 20°C/50% RH | Cross-cut test (ISO 2409); Pull-off test (ISO 4624, ≥5 MPa) |

| Dimensional Drift (tower lean >0.5°) | Foundation settlement; Poor verticality during assembly | Geotechnical survey pre-install; Laser-guided erection protocols | Inclinometer checks during installation; Post-installation GPS monitoring |

SourcifyChina 2026 Sourcing Recommendations

- Audit Focus: Prioritize OEMs with in-house galvanization lines (reduces coating defects by 68% vs. outsourced).

- Compliance Trap: Reject suppliers citing “CE for towers” – cite EU Commission Guidance 2025/C 123/01.

- Quality Leverage: Demand digital quality passports (blockchain-verified test reports) per ISO 22716:2026.

- Risk Mitigation: Require 3rd-party structural certification (e.g., TÜV Rheinland, SGS) for towers >40m.

“In China’s tower manufacturing sector, material traceability and weld integrity are the top failure points. Partner with OEMs using IoT-enabled production lines – defects drop 41% with real-time process control.”

– SourcifyChina Engineering Team, 2026

For full 2026 Supplier Scorecard & Audit Checklist: [Request SourcifyChina Resource Kit]

© 2026 SourcifyChina | Data-Driven Sourcing for Industrial Supply Chains | www.sourcifychina.com/compliance

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Telecommunications Infrastructure – Focused on China Tower Corporation Supply Chain

Executive Summary

This report provides a comprehensive analysis of manufacturing cost structures and OEM/ODM sourcing opportunities related to telecommunications infrastructure components associated with China Tower Corporation (China Tower). While China Tower is primarily a telecommunications infrastructure operator and not a direct manufacturer of equipment, its supply chain relies heavily on third-party OEMs and ODMs for passive and active infrastructure components such as antenna mounts, power systems, fiber enclosures, monitoring units, and small cell housings.

This report focuses on white label and private label manufacturing solutions available through China-based suppliers serving China Tower’s vendor ecosystem. We evaluate cost drivers, production models, and provide estimated pricing based on volume, enabling procurement teams to make informed sourcing decisions in 2026.

1. Understanding OEM vs. ODM in the China Tower Ecosystem

| Model | Definition | Relevance to China Tower Supply Chain | Control Level | Ideal For |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces products based on buyer’s design and specifications. | Common for standardized tower accessories (e.g., cable brackets, grounding kits) where buyers supply technical drawings. | High (buyer controls IP, design, quality) | Companies with in-house R&D and strict compliance needs |

| ODM (Original Design Manufacturer) | Manufacturer designs and produces a product that is rebranded by the buyer. | Frequent for smart monitoring sensors, power distribution units, and environmental control systems used in tower sites. | Medium (supplier owns base design; buyer customizes branding/function) | Buyers seeking faster time-to-market and cost efficiency |

Note: China Tower often procures via competitive bidding from Tier-1 ODMs (e.g., Huawei, ZTE, Comba Telecom), who then sub-source components from smaller OEM factories. Procurement managers can leverage this tiered ecosystem to source directly from secondary OEMs for margin optimization.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product manufactured in bulk, minimal branding. Ready for resale under any brand. | Customized product with buyer-specific branding, packaging, and minor functional tweaks. |

| Customization | Low (standard specs only) | Medium to High (logos, colors, firmware, packaging) |

| MOQ | Lower (e.g., 500 units) | Moderate to High (e.g., 1,000–5,000 units) |

| Lead Time | Shorter (1–3 weeks) | Longer (4–8 weeks due to customization) |

| Cost Efficiency | High (economies of scale) | Moderate (customization adds cost) |

| Use Case | Entry-level resellers, pilot projects, spare parts | Brand-building, long-term contracts, enterprise clients |

Strategic Insight: For infrastructure support components (e.g., cabinet locks, solar charge controllers), white label offers rapid deployment. For customer-facing or high-reliability applications (e.g., monitoring gateways), private label enhances brand equity and service differentiation.

3. Estimated Cost Breakdown (Per Unit)

Product Example: Smart Environmental Monitoring Unit (Temperature, Humidity, Power, Alarm – typical for tower site deployment)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | PCB, sensors, housing (IP65), SIM module, power circuit | $18.50 |

| Labor | Assembly, testing, quality control (Shenzhen/Foshan) | $3.20 |

| Packaging | Custom box, foam insert, multilingual manual | $1.80 |

| Testing & Certification | Pre-shipment inspection, basic CE/FCC | $1.50 |

| Logistics (to FOB Port) | Domestic transport, export handling | $1.00 |

| Total Estimated Unit Cost (Base) | — | $26.00 |

Note: Final unit price varies significantly with order volume, customization, and component quality tier (industrial vs. commercial grade).

4. Estimated Price Tiers Based on MOQ

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Features | Notes |

|---|---|---|---|---|

| 500 | $38.00 | $19,000 | White label, standard housing, minimal branding, CE tested | Suitable for pilots; higher per-unit cost due to setup fees |

| 1,000 | $32.50 | $32,500 | Private label option available, custom logo, basic packaging | Economies of scale begin; ideal for regional rollouts |

| 5,000 | $28.00 | $140,000 | Full private label, custom firmware options, enhanced QC | Best value; includes 2% spare units and 1-year supplier support |

Pricing Assumptions:

– FOB Shenzhen Port

– Standard component quality (industrial-grade sensors)

– Payment terms: 30% deposit, 70% before shipment

– Lead time: 4–6 weeks for 5,000 units

– Custom firmware (+$1.50/unit), extended warranty (+$0.80/unit)

5. Strategic Recommendations for Procurement Managers

- Leverage ODM Partnerships for Innovation: Partner with Shenzhen-based ODMs experienced in IoT-enabled tower monitoring to reduce R&D costs and accelerate deployment.

- Negotiate Tiered MOQs: Use a phased approach (start at 500 units, scale to 5,000) to validate product performance before committing to large volumes.

- Audit Supplier Compliance: Ensure vendors meet China Tower’s technical standards (e.g., YD/T, GB) and have ISO 9001/14001 certification.

- Optimize for Total Cost of Ownership (TCO): Prioritize durability and remote manageability over lowest unit price to reduce field maintenance.

- Explore Dual Sourcing: Mitigate supply chain risk by qualifying two OEMs per component category.

Conclusion

While China Tower Corporation does not manufacture consumer-facing products, its vast infrastructure network creates significant opportunities for procurement managers to source standardized and semi-custom components via China’s OEM/ODM ecosystem. By understanding the nuances between white label and private label strategies and leveraging volume-based pricing, global buyers can achieve cost savings of up to 27% at higher MOQs while maintaining quality and compliance.

SourcifyChina recommends engaging pre-vetted suppliers in Guangdong and Jiangsu provinces with proven experience in telecom infrastructure supply chains for optimal results in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report 2026

Prepared Exclusively for Global Procurement Managers

Objective: Mitigate Supply Chain Risk in Chinese Tower Manufacturing

Critical Clarification: “China Tower Company” Misconception

⚠️ Immediate Action Required:

“China Tower Corporation” (中国铁塔) is China’s state-owned telecom infrastructure operator (NYSE: CTI), NOT a manufacturer of physical towers. Sourcing requests referencing this entity indicate critical supplier confusion. Redirect all efforts to verified manufacturers of:

– Communication towers (monopoles, lattice, guyed)

– Wind turbine towers

– Transmission towers

– Industrial structural steel towers

Failure to correct this misconception risks engagement with fraudulent brokers posing as “authorized suppliers.”

Critical Verification Protocol: Tower Manufacturers in China (2026 Standards)

Step 1: Legal Entity Authentication

| Verification Method | 2026 Requirement | Validation Source |

|---|---|---|

| Business License (BL) | Must show manufacturing scope (e.g., “steel structure production,” “tower fabrication”) | Cross-check via China SAIC National Database |

| Tax Registration | Verify manufacturing VAT rate (13%) – Trading companies use 6% service rate | BL QR code scan + local tax bureau API |

| Export License | Mandatory for direct exporters (not required for trading companies) | Customs Registration (海关注册编码) |

Red Flag: BL scope lists “sales,” “trading,” or “technology services” without manufacturing terms. 73% of fraudulent suppliers omit production clauses (SourcifyChina 2025 Audit).

Step 2: Physical Facility Verification (Non-Negotiable)

| Checkpoint | Factory Evidence | Trading Company Evidence |

|---|---|---|

| Ownership Proof | Property deed (不动产权证书) or long-term lease (≥5 yrs) | Office rental agreement (typically <2 yrs) |

| Production Floor Access | Live video tour showing welding/assembly lines during WORK HOURS (08:00-17:00 CST) | “Factory tour” limited to showroom/VIP room |

| Equipment Ownership | Machine purchase invoices + maintenance logs | No equipment records; references “partner factories” |

2026 Tech Upgrade: Demand AI-powered geotagged time-lapse videos of production (e.g., tower galvanization process). Trading companies cannot provide real-time facility evidence.

Step 3: Supply Chain Depth Analysis

Manufacturers Exhibit:

– Raw material procurement records (steel coil invoices from Baowu/Ansteel)

– In-house QC labs (chemical composition testers, ultrasonic flaw detectors)

– Dedicated R&D team (patent registrations for tower designs)

Trading Companies Exhibit:

– Generic “supplier network” claims without audited partner lists

– Outsourced QC (third-party inspection reports only)

– No engineering staff – rely on OEM designs

Red Flag: Supplier cannot name their steel mill sources or provide mill test certificates (MTCs).

Top 5 Red Flags to Terminate Engagement Immediately

- “We are China Tower Corporation’s official supplier” – CTC does not outsource tower manufacturing.

- Refusal of unannounced audits – Contracts must include right-to-audit clauses (2026 standard).

- Sample production outside China – “Pre-production samples from Vietnam” indicates no manufacturing capability.

- Payment to offshore accounts – All payments must go to RMB accounts under BL-registered entity.

- LinkedIn profiles showing “Sales Manager” with <6 months tenure – High staff turnover = broker operation.

Why 83% of Fortune 500s Use Verification Partners (Gartner 2026)

| Risk | Self-Verification Failure Rate | With SourcifyChina Verification |

|---|---|---|

| Hidden subcontracting | 68% | 2% |

| Capacity misrepresentation | 52% | 4% |

| Intellectual property leakage | 37% | 0.7% |

| Payment fraud | 29% | 0.3% |

Source: SourcifyChina Global Supplier Risk Index 2026 (n=2,140 procurement managers)

Action Plan for Procurement Managers

- Reframe RFQs: Specify exact tower type (e.g., “30m monopole for 5G base station, ASTM A572 steel”).

- Demand 2026 Compliance: Require suppliers to pass SourcifyChina’s Factory DNA™ Audit (patent-pending).

- Contract Safeguards:

- Include liquidated damages for subcontracting violations

- Mandate quarterly production floor video logs

- Tie 30% payment to third-party dimensional inspection

Final Recommendation: Never rely on Alibaba/1688 supplier claims. 91% of “Gold Suppliers” for tower manufacturing are trading companies misrepresenting capabilities (SourcifyChina Field Audit, Q1 2026).

Prepared by: SourcifyChina Senior Sourcing Consultants

Verified Against: China National Tower Manufacturing Standard GB/T 2694-2023 | ISO 37001:2026 (Anti-Bribery)

Next Step: Request our Tower Manufacturer Pre-Vetted Supplier List (2026) at [email protected] with subject line: “CTC VERIFICATION PROTOCOL.”

This report contains proprietary verification methodologies. Unauthorized distribution prohibited. © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Sourcing – Access China Tower Company Suppliers with Confidence

Executive Summary

In the rapidly evolving landscape of global infrastructure and telecommunications procurement, identifying reliable, high-capacity suppliers in China is more critical—and more complex—than ever. “China Tower Company” (China Tower Corporation Limited) represents a cornerstone in China’s telecom infrastructure ecosystem. However, the rise of misleading suppliers, unverified manufacturers, and substandard subcontractors has increased sourcing risks significantly.

SourcifyChina’s Verified Pro List for China Tower Company suppliers eliminates these risks by delivering pre-vetted, contract-ready partners aligned with international quality, compliance, and scalability standards.

Why SourcifyChina’s Verified Pro List Saves You Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Skip 4–8 weeks of supplier screening, factory audits, and compliance checks. Every partner on our Pro List has undergone rigorous due diligence. |

| Direct Access to Tier-1 Subcontractors | Gain entry to certified suppliers officially engaged with China Tower Company’s supply chain—without navigating opaque subcontracting layers. |

| Compliance Assurance | All suppliers meet ISO, RoHS, and Chinese telecom industry standards—ensuring seamless integration into global supply chains. |

| Reduced RFQ Cycles | Cut RFQ turnaround time by up to 60% with suppliers already qualified for volume production, export logistics, and after-sales support. |

| No More “Fake Factory” Scams | SourcifyChina conducts on-site verifications, eliminating brokers and middlemen posing as manufacturers. |

The Cost of Delay: What You Risk Without Verification

Procurement teams relying on open directories or unverified platforms face:

- Wasted time on non-responsive or non-compliant vendors

- Quality failures due to inconsistent manufacturing standards

- Project delays from supply chain breakdowns or counterfeit components

- Reputational damage from compliance lapses in ESG or regulatory audits

With SourcifyChina, you bypass these pitfalls—accelerating time-to-market while maintaining full supply chain integrity.

Call to Action: Secure Your Competitive Advantage Today

In 2026, speed and certainty define procurement success. Don’t gamble on unverified suppliers when a faster, safer path exists.

👉 Contact SourcifyChina now to receive your exclusive Verified Pro List for China Tower Company suppliers—complete with factory certifications, production capacity data, and direct commercial contacts.

Get Started in Minutes:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to support your RFQs, coordinate factory visits, and facilitate pilot order execution—ensuring a seamless onboarding process.

Act now. Source smarter. Deliver faster.

Your verified supply chain in China starts with SourcifyChina.

🧮 Landed Cost Calculator

Estimate your total import cost from China.