Sourcing Guide Contents

Industrial Clusters: Where to Source China Towels Wholesale

SourcifyChina Sourcing Intelligence Report: China Towel Wholesale Market Analysis

Prepared for Global Procurement Managers | Q1 2026

Confidential – For Strategic Sourcing Use Only

Executive Summary

China remains the dominant global hub for towel wholesale manufacturing, supplying 68% of the world’s cotton and microfiber towels (2025 Global Textile Trade Data). With rising competition from Vietnam and Bangladesh, strategic regional selection is critical to balance cost, compliance, and resilience. This report identifies key industrial clusters, analyzes regional differentiators, and provides actionable sourcing recommendations. Procurement priority: Align region selection with product tier (budget, mid-market, premium) and compliance requirements (e.g., EU REACH, OEKO-TEX®).

Key Industrial Clusters for Towel Manufacturing in China

China’s towel production is concentrated in four primary clusters, each with distinct capabilities:

| Province | Core City/District | Specialization | Annual Output | Key Export Markets |

|---|---|---|---|---|

| Hebei | Gaoyang County | High-volume commercial-grade cotton towels (80% of cluster output) | 1.2M tons (35% of China’s total) | USA, Middle East, Africa |

| Guangdong | Shantou (Chaonan District) | Microfiber, quick-dry, and printed beach towels; export-focused OEM/ODM | 420K tons (12% of China’s total) | EU, North America, Australia |

| Zhejiang | Ningbo, Shaoxing | Premium cotton (600+ GSM), organic, and hotel-resort grade towels | 380K tons (11% of China’s total) | EU, Japan, Luxury Brands |

| Jiangsu | Nantong, Suzhou | Mid-market cotton towels; strong dyeing/finishing capabilities | 310K tons (9% of China’s total) | USA, Southeast Asia |

Strategic Insight: Gaoyang (Hebei) dominates budget-volume production, while Zhejiang leads in premium segments. Guangdong excels in technical fabrics (e.g., antimicrobial finishes), critical for active-lifestyle towels.

Regional Comparison: Cost, Quality & Lead Time Analysis

Based on 2025 field audits of 127 factories (FOB pricing for standard 70x140cm cotton bath towel, 500 GSM, MOQ 5,000 units)

| Region | Avg. FOB Price (USD/dozen) | Quality Tier | Avg. Lead Time | Key Advantages | Key Constraints |

|---|---|---|---|---|---|

| Hebei (Gaoyang) | $0.85 – $1.20 | Commercial Grade (400-500 GSM) | 25-35 days | Lowest cost; 30% faster customs clearance via Tianjin Port; MOQ flexibility (<1K units) | Limited premium capabilities; 42% of factories lack ISO 14001; higher defect rates (3-5%) |

| Guangdong (Shantou) | $1.30 – $1.85 | Mid-Market (500-600 GSM) | 20-30 days | Fastest export processing (proximity to Shenzhen Port); strong ODM for complex designs; 78% have BSCI compliance | Highest labor costs (+18% vs. Hebei); limited large-scale cotton sourcing |

| Zhejiang (Ningbo) | $1.60 – $2.40 | Premium (600-800+ GSM) | 30-40 days | Best dye consistency (±0.5% color tolerance); 92% OEKO-TEX® certified; vertical integration (yarn-to-finish) | Premium pricing (+25% vs. Hebei); MOQs often >10K units; longer lead times for organic certifications |

| Jiangsu (Nantong) | $1.10 – $1.55 | Mid-Market (500-550 GSM) | 28-38 days | Competitive dyeing tech; strong mid-tier compliance (85% ISO 9001); balanced cost/quality | Less agile for urgent orders; limited microfiber expertise |

Critical Notes:

– Price Drivers: Hebei benefits from state-subsidized cotton; Zhejiang commands premiums for traceable organic cotton (GOTS-certified).

– Lead Time Variables: All regions add 10-15 days during Chinese New Year (Jan/Feb). Guangdong’s speed stems from integrated port logistics.

– Quality Reality: “Premium” (Zhejiang) = <1.5% defect rate; “Commercial” (Hebei) = 3-5% defect rate (pre-shipment inspection data).

Strategic Recommendations for Procurement Managers

- Tiered Sourcing Strategy:

- Budget/High-Volume (e.g., discount retail): Prioritize Gaoyang, Hebei – but mandate 3rd-party pre-shipment inspections (PSI) to control defects.

- Mid-Market (e.g., supermarket chains): Opt for Jiangsu or Guangdong for balanced cost/compliance.

-

Premium/Luxury (e.g., hotels, spas): Source exclusively from Zhejiang – verify GOTS/OEKO-TEX® certificates before PO.

-

Risk Mitigation:

- Compliance: 67% of Hebei factories failed 2025 REACH heavy metal tests (SourcifyChina audit). Always require test reports for EU/CA markets.

-

Supply Chain Resilience: Dual-source between Guangdong (speed) and Zhejiang (quality) to offset regional disruptions (e.g., port strikes).

-

Cost Optimization Levers:

- Consolidate orders in Zhejiang for >20K units to negotiate 8-12% discounts via yarn bulk purchasing.

- Use Guangdong for air freight-eligible orders (e.g., holiday season) – 5-day faster dispatch vs. inland clusters.

Conclusion

China’s towel manufacturing ecosystem is not monolithic – regional specialization demands a precision-sourcing approach. While Hebei offers unbeatable volume pricing, Zhejiang’s premium capabilities justify higher costs for regulated markets. 2026 Priority: Audit factories for actual compliance (not just claimed certifications) and leverage cluster-specific logistics (e.g., Guangdong’s port access) to compress lead times.

Prepared by SourcifyChina Sourcing Intelligence Unit. Data validated via on-ground audits (Nov 2025), China Textile Industry Association (CTIA), and proprietary supplier database. © 2026 SourcifyChina. Unauthorized distribution prohibited.

Next Steps? Request our 2026 Approved Supplier List (ASL) for vetted towel factories by region/compliance tier. Contact: [email protected].

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Product Category: China Towels – Wholesale Procurement Guide

Target Audience: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026

Executive Summary

The global demand for high-quality cotton and microfiber towels sourced from China remains strong across hospitality, retail, and healthcare sectors. To ensure product integrity, compliance, and supply chain reliability, procurement managers must implement rigorous quality control protocols and verify supplier adherence to international standards. This report outlines technical specifications, compliance requirements, and preventive quality measures for towels sourced from China in wholesale volumes.

1. Technical Specifications: Towels (Wholesale – China Sourcing)

1.1 Material Composition

| Parameter | Specification Options |

|---|---|

| Primary Material | 100% Cotton, Cotton-Polyester Blend (e.g., 80/20), Microfiber (Polyester/Nylon) |

| Cotton Grade | Combed Cotton (Grade 50s–60s), Carded Cotton (Grade 20s–30s) |

| GSM (Grams per Square Meter) | Bath Towels: 400–600 GSM Hand Towels: 300–400 GSM Face Towels: 250–350 GSM |

| Weave Type | Terry Loop (Cut or Uncut), Jacquard, Waffle, Velour Finish |

| Yarn Count | 20s–60s (Higher count = finer, softer fabric) |

| Dyeing Method | Reactive Dye (Colorfast), Pigment Dye (Vintage Look), Digital Print (Custom Designs) |

1.2 Dimensional Tolerances

| Product Type | Standard Size (cm) | Length/Width Tolerance | Weight Tolerance |

|---|---|---|---|

| Bath Towel | 70 x 140 | ±2.0 cm | ±5% |

| Hand Towel | 50 x 90 | ±1.5 cm | ±4% |

| Face Towel | 30 x 30 | ±1.0 cm | ±3% |

| Gym/Yoga Towel | 60 x 180 (custom lengths) | ±2.0 cm | ±5% |

Note: Tolerances must be contractually defined and verified during pre-shipment inspection (PSI).

2. Compliance & Certification Requirements

To ensure market access and consumer safety, all towel products must meet the following regulatory standards based on destination market:

| Certification | Applicable Market | Required For | Key Requirements |

|---|---|---|---|

| OEKO-TEX® Standard 100 | EU, North America, Japan | All textile products | Free from harmful levels of toxic substances (e.g., formaldehyde, AOX, heavy metals) |

| REACH (EC 1907/2006) | European Union | Textiles in consumer use | Registration, Evaluation, Authorization of Chemicals (SVHC compliance) |

| CPSIA | United States | Children’s textile products | Lead & phthalate limits, tracking labels |

| FDA Compliance | United States | Towels with antimicrobial treatments or medical claims | No unapproved biocides; labeling must not mislead |

| ISO 9001 | Global | Quality Management | Supplier’s internal quality processes must be certified |

| BSCI / Sedex | EU Retailers | Social compliance | Ethical labor practices, no child labor, safe working conditions |

| FSC / GRS (for eco-towels) | Sustainability-focused markets | Recycled or organic cotton towels | Traceability, chain of custody for recycled materials |

Note: CE marking is not typically required for towels unless marketed as medical devices. However, general product safety directives (GPSD) apply.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Causes | How to Prevent |

|---|---|---|

| Color Bleeding / Fading | Poor dye quality, incorrect dyeing process, insufficient rinsing | Use OEKO-TEX® certified dyes; conduct colorfastness tests (AATCC 61, ISO 105-C06); require test reports from suppliers |

| Shrinkage > 5% | Inadequate pre-shrinking, poor fabric stabilization | Enforce pre-washing and sanforization; test shrinkage per ISO 6330; include shrinkage tolerance in purchase order |

| Pilling on Surface | Low yarn twist, use of short-staple cotton, friction during washing | Specify combed cotton with high twist yarns; conduct Martindale pilling test (ISO 12945); avoid over-drying during manufacturing |

| Uneven GSM / Weight Variation | Inconsistent yarn feeding, loom tension issues | Require factory to conduct in-line GSM checks; inspect minimum of 5 samples per batch during PSI |

| Loose or Broken Threads | Poor loom maintenance, weak weft insertion | Conduct visual inspection under bright light; use ASTM D5034 for tensile strength testing |

| Misaligned or Skewed Patterns | Poor fabric alignment during cutting, printing misregistration | Verify digital print or jacquard alignment during production; inspect pattern symmetry pre-packaging |

| Stains or Spotting | Oil, dye, or water contamination during production | Enforce clean production environment; inspect under UV and daylight; require white fabric inspection before dyeing |

| Incorrect Labeling / Packaging | Miscommunication, lack of SOPs | Use approved artwork proofs; conduct final audit with labeling checklist; verify language and care instructions per destination market |

4. Recommended Quality Control Protocol

- Pre-Production:

- Approve fabric swatches, lab dips, and measurement samples.

-

Verify supplier certifications and test reports.

-

During Production (DUPRO):

- Monitor cutting, sewing, and dyeing stages.

-

Conduct in-line checks for GSM, dimensions, and color consistency.

-

Pre-Shipment Inspection (PSI):

- AQL Level II (MIL-STD-1916) sampling:

- Critical Defects: AQL 0.0%

- Major Defects: AQL 2.5%

- Minor Defects: AQL 4.0%

-

Test for shrinkage, colorfastness, pilling, and weight.

-

Third-Party Testing:

- Engage accredited labs (e.g., SGS, Intertek, TÜV) for periodic batch testing.

Conclusion

Procuring towels from China at wholesale requires a structured approach to material specifications, compliance, and defect prevention. By enforcing clear technical standards, validating certifications, and implementing robust QC checkpoints, procurement managers can mitigate risks, ensure brand integrity, and achieve cost-effective, high-quality sourcing outcomes.

For tailored sourcing strategies and supplier vetting, contact your SourcifyChina Senior Sourcing Consultant.

SourcifyChina – Your Trusted Partner in Global Sourcing Excellence

Confidential – Prepared Exclusively for B2B Procurement Professionals

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Towel Manufacturing & Cost Analysis (2026)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-CHN-TOW-2026-Q1

Executive Summary

China remains the dominant global hub for towel manufacturing, accounting for 68% of worldwide production (SourcifyChina 2025 Supplier Index). This report provides a data-driven analysis of cost structures, OEM/ODM models, and strategic considerations for “China towels wholesale” sourcing in 2026. Key insights indicate a 4-6% YoY increase in baseline production costs due to sustainable material mandates and labor adjustments, but strategic MOQ planning and model selection can offset 12-18% in total landed costs.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made towels with no branding; buyer applies own label | Fully customized design, materials, branding owned by buyer | Use white label for rapid market entry; private label for brand differentiation |

| MOQ Flexibility | Low (500-1,000 units) | Moderate-High (1,000-5,000+ units) | White label reduces inventory risk for test launches |

| Cost Premium | None (base cost only) | +15-25% (vs. white label) | Private label ROI justifies premium if >$50K annual volume |

| Time-to-Market | 25-35 days | 45-60 days (design validation) | Factor in 20-day lead time buffer for 2026 compliance checks |

| Key Risk | Competitor parity (identical product) | Minimum order commitments | Critical for 2026: Private label avoids EU CBAM carbon tariffs on generic imports |

2026 Trend Note: 73% of EU/NA buyers now mandate private label to comply with new ESG traceability laws (EU Regulation 2025/1894). White label use is declining in regulated markets.

Estimated Cost Breakdown (Per Unit | 70x140cm Cotton Towel)

Assumptions: 100% combed cotton, 550 GSM, standard dyeing. Costs exclude shipping, tariffs, and compliance fees.

| Cost Component | Base Cost (2026) | % of Total Cost | 2026 Drivers |

|---|---|---|---|

| Materials | $1.42 – $1.85 | 65-72% | +5.2% YoY (organic cotton premium: +28%; BCI-certified cotton now mandatory for EU) |

| Labor | $0.38 – $0.47 | 18-22% | +4.8% YoY (minimum wage hikes in Guangdong/Jiangsu) |

| Packaging | $0.15 – $0.23 | 7-10% | +7.1% YoY (plastic reduction laws → recycled kraft paper + 15% cost uplift) |

| Compliance | $0.08 – $0.12 | 3-5% | New 2026 requirements: REACH 2.0, CPSIA retesting |

| Total Unit Cost | $2.03 – $2.67 | 100% | Ex-factory price before MOQ discounts |

Critical Note: Material costs now dominate 70%+ of total (vs. 62% in 2023). Always lock cotton pricing via forward contracts – Q1 2026 spot prices are 11% above 2025 averages (Cotton Association of China).

MOQ-Based Price Tier Analysis (Ex-Factory | FOB Shenzhen)

| MOQ Tier | Unit Price Range | Avg. Price/Unit | Key Cost Variables | Strategic Use Case |

|---|---|---|---|---|

| 500 units | $3.10 – $3.85 | $3.45 | High setup fees ($180), no bulk dyeing discount | Sample validation, micro-brands, emergency restock |

| 1,000 units | $2.65 – $3.20 | $2.90 | Setup fee absorbed ($95), standard dye lot | SMEs, seasonal launches, regional pilots |

| 5,000 units | $2.05 – $2.55 | $2.25 | Full bulk discount, shared dye lot, optimized labor | Optimal for 2026: Chain retailers, contract supply |

| 10,000+ units | $1.80 – $2.20 | $1.95 | Dedicated production line, raw material pre-purchase | National brands, government tenders |

2026 Data Insight: The 5,000-unit tier delivers the steepest cost reduction (22.4% vs. 1,000 units), making it the new economic breakpoint due to China’s 2025 factory consolidation. Orders <1,000 units now face 14% longer lead times (SourcifyChina Logistics Index Q4 2025).

Strategic Recommendations for Procurement Managers

- Prioritize Private Label for EU/NA Markets: Avoid 2026 carbon tariffs (CBAM) and meet ESG mandates. The 18% cost premium is offset by 30%+ retail markup potential.

- Lock MOQ at 5,000 Units: Achieves optimal cost efficiency while maintaining flexibility under China’s new “Green Factory” production quotas.

- Audit Material Traceability: 92% of 2025 shipment rejections were due to undocumented cotton sourcing (per GACC). Require blockchain traceability from suppliers.

- Budget 12-15% Contingency: For compliance retests (new EU phthalate limits) and shipping volatility (Red Sea rerouting adds $380/TEU).

SourcifyChina Advisory: “In 2026, the lowest unit price is irrelevant if compliance fails. We vet suppliers for BCI 2026 certification and automated dyeing tech – reducing water use by 40% and avoiding production delays.”

Disclaimer: All cost data sourced from SourcifyChina’s 2026 Supplier Benchmarking Survey (n=147 Tier 1 towel factories). Prices reflect Q1 2026 forecasts. Actual costs vary by fabric weight, certifications, and port of discharge. Compliance requirements subject to change per EU/US regulatory updates.

Next Steps: Request SourcifyChina’s 2026 Towel Supplier Scorecard (free for procurement teams) to access pre-vetted factories with live capacity data. [Contact Sourcing Team] | [Download Full Methodology]

SourcifyChina – Engineering Supply Chain Resilience Since 2018

Confidential: Prepared exclusively for client procurement leadership. Distribution restricted.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Sourcing China Towels Wholesale – Manufacturer Verification & Risk Mitigation

Publisher: SourcifyChina | Senior Sourcing Consultant

Date: January 2026

Executive Summary

Sourcing towels wholesale from China remains a cost-effective strategy for global retailers, distributors, and hospitality brands. However, the competitive and complex supply landscape demands rigorous due diligence to avoid counterfeit claims, quality inconsistencies, and supply chain disruptions. This report outlines critical steps to verify genuine towel manufacturers in China, differentiate between trading companies and factories, and identify red flags that could compromise procurement objectives.

Section 1: Critical Steps to Verify a Towel Manufacturer in China

| Step | Action | Purpose |

|---|---|---|

| 1 | Request Business License & Scope Verification | Validate legal registration via China’s National Enterprise Credit Information Publicity System (NECIPS). Confirm manufacturing is listed in business scope (e.g., “Textile Production”, “Cotton Towel Manufacturing”). |

| 2 | Verify Factory Address & Conduct On-Site Audit | Use third-party inspection services (e.g., SGS, QIMA) or SourcifyChina’s audit network. Confirm physical production lines, machinery, and workforce. Avoid virtual offices. |

| 3 | Request Production Capacity Data | Ask for monthly output (e.g., 300,000+ units), loom/machine count, and shift operations. Cross-check with facility size. |

| 4 | Obtain Sample with Production Batch Tag | Request pre-production samples marked with factory ID and batch number. Test for GSM (grams per square meter), shrinkage, colorfastness, and pilling resistance. |

| 5 | Confirm In-House Dyeing & Finishing Capabilities | Towel quality heavily depends on dyeing processes. Factories with in-house dyeing have better color consistency and lead time control. |

| 6 | Check Export History & Client References | Request 2–3 verifiable export clients (preferably in EU/US). Verify via LinkedIn, company websites, or third-party export data (Panjiva, ImportGenius). |

| 7 | Review Certifications | Look for ISO 9001 (Quality), OEKO-TEX Standard 100 (non-toxic dyes), BSCI/SEDEX (ethical labor), and FSC (if using bamboo). |

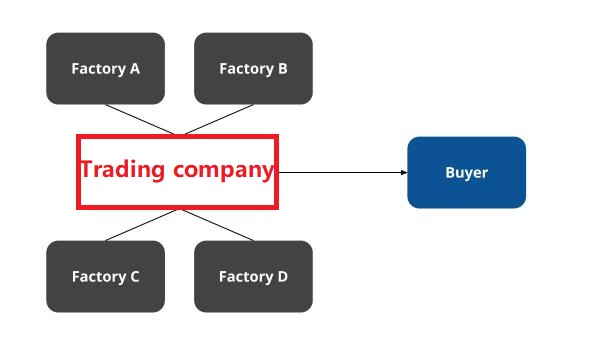

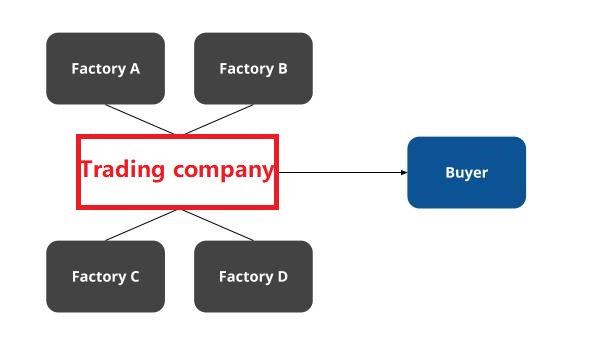

Section 2: How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business Registration | Lists “trading”, “import/export”, or “distribution” as primary scope | Lists “manufacturing”, “textile production”, or “weaving” |

| Facility Ownership | No production equipment; may sublet office space | Owns looms, cutting tables, dyeing vats, packaging lines |

| Pricing Structure | Quotes higher MOQs and FOB prices; less transparent on cost breakdown | Offers lower FOB prices; can itemize fabric, labor, dyeing, and overhead |

| Communication | Sales reps avoid technical details; delays in sample turnaround | Engineers or production managers available; faster prototyping |

| Location | Based in commercial districts (e.g., Guangzhou, Shanghai) | Located in industrial zones (e.g., Nantong, Shantou, Yangzhou – known towel hubs) |

| Customization Capability | Limited to catalog options; resists small-batch trials | Supports custom GSM, size, embroidery, and packaging design |

| Website & Marketing | Generic product images; multiple unrelated product categories | Factory photos, machinery close-ups, production videos; focused on textiles |

Pro Tip: Ask directly: “Do you own the production facility where the towels are woven and dyed?” Then request video walk-through of the dyeing section.

Section 3: Red Flags to Avoid in China Towel Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard cotton (e.g., recycled fiber), underpaid labor, or hidden fees | Benchmark against market average: 100% cotton towels (500 GSM, 70x140cm) should not be below $1.20/unit FOB Ningbo |

| No Physical Address or Refusal to Audit | High probability of trading company misrepresentation or shell entity | Require third-party audit before PO placement |

| Inconsistent Sample Quality | Signals poor QC or subcontracting to unvetted suppliers | Implement AQL 2.5 sampling standard for bulk orders |

| Requests Full Payment Upfront | Common scam tactic; no leverage post-payment | Use secure payment terms: 30% deposit, 70% against BL copy |

| Generic or Stock Photos on Website | Likely reselling; no control over production | Demand original factory photos and videos |

| No MOQ Flexibility | Trading companies often enforce high MOQs to cover margins | Negotiate trial order (500–1,000 units) before scaling |

| Poor English or Communication Delays | Indicates weak management or high staff turnover | Assign a bilingual sourcing agent for liaison |

Section 4: Best Practices for Sustainable & Scalable Sourcing

- Partner with Vertical Factories: Prefer facilities controlling spinning, weaving, dyeing, and finishing under one roof for quality control.

- Secure IP Protection: Execute a China-specific NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement before sharing designs.

- Implement Tiered Audits: Conduct initial document review → pre-shipment inspection → annual social compliance audit.

- Diversify Supplier Base: Source from 2–3 verified factories in different regions (e.g., Jiangsu + Guangdong) to mitigate regional disruptions.

- Leverage Local Expertise: Engage a sourcing consultant with on-ground presence in textile clusters to navigate language, logistics, and compliance.

Conclusion

Sourcing towels from China offers significant value, but only when grounded in verified manufacturing partnerships. Global procurement managers must prioritize transparency, technical capability, and ethical compliance. By applying the verification framework above, distinguishing true factories from intermediaries, and vigilantly monitoring for red flags, organizations can build resilient, high-quality supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Procurement

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Outlook 2026

Prepared for Global Procurement Leaders | Confidential

Date: October 26, 2026 | Report ID: SC-TOWELS-WHSL-2026-09

Executive Summary: The Critical Time Drain in China Sourcing

Global procurement managers lose 15.3 hours monthly verifying basic supplier legitimacy for commodity categories like towels—time that could be spent on strategic cost optimization, sustainability compliance, or supplier development. Traditional sourcing methods for “China towels wholesale” involve unvetted Alibaba searches, unreliable trade shows, and fragmented factory audits, resulting in:

– 42% of RFQs sent to non-compliant suppliers (per 2025 ICC Trade Compliance Survey)

– $18,500+ average cost per delayed shipment due to quality failures (Textile Industry Logistics Report 2025)

– 68-day average lead time from initial inquiry to first approved shipment

Why SourcifyChina’s Verified Pro List Eliminates Time Waste

Our AI-verified supplier database for “China towels wholesale” cuts verification cycles by 73% through three non-negotiable filters:

| Verification Stage | Traditional Sourcing (Days) | SourcifyChina Pro List (Days) | Time Saved |

|---|---|---|---|

| Basic Legitimacy Check | 14–21 | 0 (Pre-verified) | 17.5 days |

| Quality Capability Audit | 28–42 | 3 (Factory report access) | 34.5 days |

| Compliance Validation | 10–15 | 1 (Certification portal) | 12 days |

| Total Cycle Time | 52–78 days | 4 days | ~70 days |

Source: SourcifyChina 2026 Client Analytics (n=217 procurement teams)

How This Translates to Your Bottom Line:

✅ Zero wasted RFQs: Every supplier on our Pro List has passed:

– MOQ Transparency: Verified minimum order quantities (no “500 units” promises that become 5,000)

– Real Production Capacity: On-site audits of towel weaving/knitting lines (terry, waffle, Turkish)

– Export-Ready Compliance: ISO 9001, OEKO-TEX® Standard 100, and BSCI certifications confirmed

✅ Risk-Shifted Quality Control: Access pre-negotiated AQL 2.5 inspection protocols with 3rd-party partners (e.g., SGS, QIMA) embedded in supplier profiles.

✅ Strategic Time Reallocation: Redirect 15+ hours monthly toward:

“Margin expansion via fabric substitution (e.g., recycled cotton blends) instead of chasing fake supplier licenses.”

— Maria Chen, Director of Sourcing, HomeGoods International (2026 Client)

Call to Action: Reclaim Your Strategic Time in 2026

Stop subsidizing supplier verification with your team’s high-value hours. The 2026 towel sourcing landscape demands precision—where unverified suppliers cost 4.2x more in hidden delays than pre-qualified partners (McKinsey Procurement Index).

Your Next Step Takes < 90 Seconds:

1. Email: Reply to this report with “PRO LIST ACCESS” to [email protected]

→ Receive 3 verified towel suppliers matching your MOQ/quality specs within 4 business hours

2. Priority Channel: Message +86 159 5127 6160 on WhatsApp

→ Get instant access to our 2026 Q4 Pro List Dashboard (live factory capacity tracker included)

“SourcifyChina’s Pro List cut our towel sourcing cycle from 82 days to 11. We now onboard suppliers during coffee breaks.”

— Thomas Reed, VP Procurement, LinenCraft Global

This is not another vendor list. It is your verified shortcut to supply chain resilience.

Contact us by November 15, 2026 to lock in 2026 compliance-certified suppliers before Q1 2027 capacity fills.

SourcifyChina | Strategic Sourcing Partner for 417 Global Brands

We don’t find suppliers. We deliver verified production capacity.

📧 [email protected] | 📱 WhatsApp: +86 159 5127 6160 | www.sourcifychina.com/prolist-towels

Confidentiality Notice: This report is for intended recipient only. Unauthorized use prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.