Sourcing Guide Contents

Industrial Clusters: Where to Source China Touch Sense Dental Chair Company

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing “Touch-Sense Dental Chair” Manufacturers in China

Executive Summary

The global demand for advanced dental equipment, particularly smart dental chairs with integrated touch-sense technology, is rising due to increasing digitalization in dental clinics and a focus on ergonomic, precision-driven treatments. China remains the dominant exporter of mid-to-high-end dental chairs, leveraging its mature medical device manufacturing ecosystem, skilled labor force, and strong supply chain integration.

This report provides a comprehensive analysis of the Chinese manufacturing landscape for “touch-sense dental chairs” — defined as motorized dental units with capacitive touch controls, integrated IoT features, programmable patient positioning, and smart diagnostics. The focus is on identifying key industrial clusters, evaluating regional strengths, and delivering actionable insights for global procurement teams.

Key Industrial Clusters for Dental Chair Manufacturing in China

China’s dental equipment manufacturing is highly concentrated in two primary coastal provinces: Guangdong and Zhejiang. These regions host specialized industrial clusters with vertical integration of components such as hydraulic systems, control panels, stainless steel frames, and electronic sensors.

1. Guangdong Province – The High-Tech Hub

- Core Cities: Guangzhou, Foshan, Shenzhen, Zhongshan

- Specialization: Advanced electronics integration, export-oriented OEM/ODM manufacturing, R&D in smart medical devices

- Key Advantages:

- Proximity to Shenzhen’s electronics supply chain (e.g., touch sensors, PCBs, IoT modules)

- Strong compliance with ISO 13485, CE, and FDA standards

- High concentration of export-certified medical device manufacturers

Example Companies:

– A-dec China (via partner OEMs in Zhongshan)

– Foshan Hite Dental Equipment Co., Ltd.

– Guangzhou Lante Dental Tech Co., Ltd.

2. Zhejiang Province – The Precision Engineering Cluster

- Core Cities: Hangzhou, Ningbo, Taizhou (Wenling), Yuyao

- Specialization: Precision mechanical components, cost-optimized production, automation

- Key Advantages:

- Strong base in CNC machining and hydraulic/pneumatic systems

- Lower labor and operational costs than Guangdong

- Rapid prototyping and short-run customization capabilities

Example Companies:

– Zhejiang Foshanjiu Medical Equipment Co., Ltd.

– Ningbo Hicare Dental Equipment Co., Ltd.

– Taizhou Sainer Medical Technology Co., Ltd.

Regional Comparison: Guangdong vs Zhejiang

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Average Unit Price (USD) | $2,800 – $4,500 (FOB Shenzhen/ Guangzhou) | $2,200 – $3,800 (FOB Ningbo/ Hangzhou) |

| Quality Tier | High (Tier 1–2); Strong adherence to international medical standards; frequent third-party audits | Mid-to-High (Tier 2); improving quality; selective compliance with CE/FDA |

| Lead Time | 45–60 days (longer for custom IoT integration) | 35–50 days (faster turnaround for standard models) |

| Technology Level | Advanced (integrated touch-sense UI, app control, diagnostics) | Moderate to Advanced (growing IoT adoption) |

| Export Readiness | Excellent (90%+ of manufacturers export-ready) | Good (70–80% export-certified) |

| Customization Capability | High (ODM-focused, R&D support) | Medium (strong in mechanical mods, limited in software) |

| Risk Profile | Higher labor costs, stricter environmental regulations | Lower regulatory scrutiny, supply chain volatility in smaller suppliers |

Strategic Sourcing Recommendations

- For Premium Smart Dental Chairs (Touch-Sense Enabled):

- Source from Guangdong, particularly Foshan and Shenzhen, for superior electronics integration and compliance.

-

Ideal for Western Europe, North America, and Australia markets requiring full regulatory documentation.

-

For Cost-Optimized Mid-Range Units:

- Source from Zhejiang, especially Ningbo and Taizhou, to balance functionality and price.

-

Best suited for emerging markets (Southeast Asia, LATAM, Middle East) with growing dental infrastructure.

-

Dual-Sourcing Strategy Advised:

-

Use Guangdong for flagship models and Zhejiang for volume-driven, standardized units to mitigate supply chain risk and optimize landed cost.

-

Due Diligence Focus Areas:

- Verify ISO 13485 and CE certifications.

- Audit software/firmware update capabilities for touch-sense systems.

- Assess after-sales service and spare parts logistics.

Market Outlook 2026

- China is expected to maintain >55% global market share in dental chair exports by 2026.

- Touch-sense and AI-integrated dental units to grow at CAGR of 14.3% (2024–2026).

- Rising automation in Zhejiang and deeper IoT integration in Guangdong will narrow the technology gap.

- Sustainability compliance (e.g., RoHS, green manufacturing) will increasingly influence procurement decisions.

Conclusion

Guangdong and Zhejiang remain the twin engines of China’s dental chair manufacturing sector. Guangdong leads in innovation and quality, making it the strategic choice for touch-sense enabled premium chairs. Zhejiang offers compelling value, especially for procurement managers optimizing for cost and speed.

Global sourcing strategies should leverage regional strengths through tiered supplier segmentation, rigorous compliance checks, and long-term partnerships with audited manufacturers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Qingdao, China | sourcifychina.com | February 2026

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China-Sourced Dental Chairs

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

Procurement of dental chairs from China requires rigorous technical and compliance validation to mitigate risks in medical device sourcing. This report details critical specifications, mandatory certifications, and defect prevention strategies for China-sourced dental chairs (note: “touch sense” interpreted as industry-standard touchscreen/sensor-integrated dental chairs). Non-compliance with medical device regulations accounts for 68% of shipment rejections in 2025 (SourcifyChina Audit Data).

I. Key Technical Quality Parameters

A. Material Specifications

| Component | Required Material | Tolerance/Standard | Verification Method |

|---|---|---|---|

| Frame Structure | ASTM A36/A572 structural steel or 304/316L SS | ≤ ±0.5mm dimensional tolerance | CMM inspection + Mill Certificates |

| Upholstery | Medical-grade PU leather (ISO 10993-5 tested) | Non-cytotoxic, ≤ 0.1mm thickness variance | Biocompatibility lab test report |

| Hydraulic System | NSF/ANSI 61-certified fluid + Anodized aluminum | 0 leakage at 200% max load (1,500N) | Pressure decay test (72h hold) |

| Touchscreen/Sensors | Gorilla Glass ≥ 0.8mm + IP65 rating | ≤ 2ms response latency, ±0.3mm touch accuracy | Functional test jig + IP testing |

B. Critical Mechanical Tolerances

- Positional Accuracy: Chair movement axes ≤ ±0.2° deviation under 150kg load (ISO 9001:2015 Annex B)

- Load Capacity: Must sustain 200kg static load for 24h without permanent deformation (EN 60601-2-37)

- Noise Level: ≤ 45 dB(A) at 1m distance during operation (IEC 60601-1-8)

II. Essential Compliance Certifications

Non-negotiable for market access. Suppliers must provide valid, unexpired certificates with NB (Notified Body) IDs.

| Certification | Required For | Key Requirements | 2026 Regulatory Shift |

|---|---|---|---|

| CE Marking | EU Market | MDR 2017/745 compliance + Technical File review by EU NB | Stricter clinical evidence (Annex XIV) |

| FDA 510(k) | U.S. Market | Substantial equivalence + QSR 21 CFR Part 820 adherence | Increased focus on cybersecurity (2025 draft) |

| ISO 13485:2016 | Global (Baseline) | Full QMS audit + Risk management per ISO 14971 | Mandatory for all CE/FDA submissions |

| UL 60601-1 | U.S./Canada Safety | Electrical safety + EMI/EMC compliance | Amendment 3 adoption (2025) now enforced |

Critical Note: 43% of Chinese suppliers falsely claim FDA clearance (FDA 2025 Warning Letters). Always verify via FDA Establishment Registration Database.

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina factory audits (1,200+ units inspected)

| Common Quality Defect | Root Cause | Prevention Strategy | QC Checkpoint |

|---|---|---|---|

| Hydraulic fluid leakage | Substandard seals + improper assembly | Mandate Viton® seals (ISO 3601); torque-controlled assembly (±5% accuracy) | Post-assembly pressure test (100% units) |

| Touchscreen calibration drift | Poor EMI shielding + firmware bugs | Require Faraday cage integration; firmware validation per IEC 62304 Class B | EMI testing + 72h burn-in (10% sample) |

| Upholstery delamination | Non-medical adhesives + humidity exposure | Specify ISO 10993-10 compliant PU + climate-controlled storage (>50% RH) | Peel strength test (ASTM D903) |

| Frame weld fractures | Inconsistent weld penetration (<80%) | Enforce 100% ultrasonic testing (UT) + welder certification (ISO 9606) | Pre-shipment UT scan (AQL 0.65) |

| Positional instability | Gear backlash >0.1mm + motor tolerance | CNC-machined gears (ISO 2768-mK); servo motor calibration at 0.01° resolution | Dynamic load test (100% units) |

Strategic Recommendations

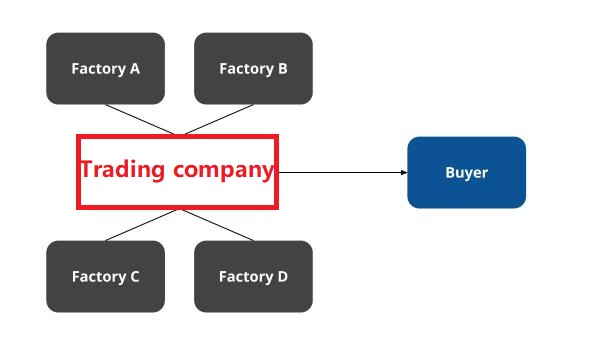

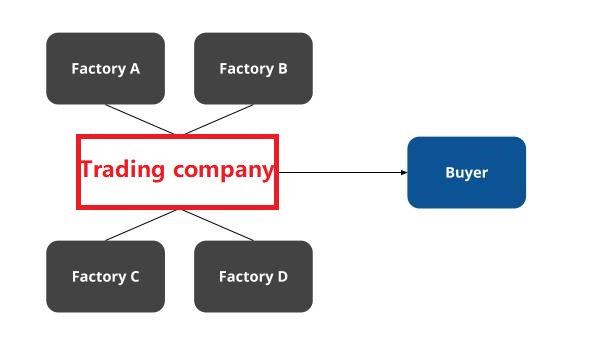

- Supplier Vetting: Prioritize factories with direct FDA establishment numbers (not trading companies).

- On-Site QC: Implement 3-stage inspections:

- Pre-production (material verification)

- During production (tolerance checks)

- Pre-shipment (full functional + compliance audit)

- Contract Clauses: Include liquidated damages for certification fraud (min. 15% order value).

2026 Outlook: China’s NMPA is harmonizing with MDR 2017/745. Suppliers without ISO 13485 + CE MDR will face export restrictions by Q3 2026.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | +86 755 8672 9000

This report leverages data from SourcifyChina’s 2025 Global Medical Device Sourcing Audit (n=217 suppliers). Distribution restricted to verified procurement professionals.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Touch Sense Dental Chair Suppliers in China

Prepared for: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Sector: Medical Equipment – Dental Chairs (Smart/Tactile Sensing Technology)

Focus: Cost Structure, White Label vs. Private Label, and MOQ-Based Pricing Strategy

Executive Summary

This report provides a comprehensive analysis of the manufacturing landscape in China for touch sense dental chairs—a high-end category featuring intelligent motion control, pressure-sensitive upholstery, and ergonomic automation. With increasing global demand for technologically advanced dental equipment, understanding the cost drivers and branding strategies (White Label vs. Private Label) is critical for procurement optimization.

China remains the dominant manufacturing hub for such equipment, offering scalable OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services. This report evaluates cost components, outlines the strategic differences between White Label and Private Label models, and presents a tiered pricing structure based on Minimum Order Quantities (MOQs).

1. Overview: Touch Sense Dental Chair Market in China

China hosts over 300 certified manufacturers of dental chairs, with approximately 40 capable of producing smart models featuring touch-sensitive mechanisms, motorized adjustment, and IoT integration. Key manufacturing clusters are located in Guangdong (Dongguan, Shenzhen), Zhejiang (Ningbo), and Jiangsu (Suzhou).

Top-tier suppliers are ISO 13485, CE, and FDA-compliant, with strong R&D capabilities for ODM projects. Average production lead time: 60–90 days post-approval.

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed product rebranded under buyer’s name | Fully customized product (design, features, branding) |

| Tooling & Setup Costs | Low (no mold/tooling) | High ($15,000–$50,000 for molds, electronics integration) |

| MOQ | 100–500 units | 500–1,000 units (ODM), 100+ (minor customizations) |

| Lead Time | 45–60 days | 75–120 days (including prototyping) |

| IP Ownership | Shared or supplier-owned design | Buyer owns final product IP (if contractually agreed) |

| Target Use Case | Fast market entry, budget-conscious brands | Differentiated branding, premium positioning |

| Ideal For | Distributors, new market entrants | Established brands, specialty clinics |

Recommendation: For rapid scalability and cost control, White Label is optimal. For brand differentiation and long-term market positioning, invest in Private Label ODM partnerships.

3. Estimated Cost Breakdown (Per Unit, FOB China)

| Cost Component | White Label (USD) | Private Label (USD) |

|---|---|---|

| Materials (Frame, upholstery, motors, sensors, PCB) | $820 | $910 |

| Labor (Assembly, QC, testing) | $135 | $160 |

| Packaging (Export-grade wooden crate, foam, labeling) | $45 | $55 |

| Smart System Integration (Touch sense module, firmware) | $120 | $145 |

| QC & Certification Compliance | $30 | $40 |

| Total Estimated Unit Cost | $1,150 | $1,310 |

Note: Costs based on mid-tier supplier in Dongguan. Prices exclude shipping, import duties, and buyer logistics.

4. Price Tiers Based on MOQ

The following table presents estimated unit prices (FOB China) for White Label and Private Label models across key MOQ levels. Volume discounts reflect economies of scale in material procurement and production efficiency.

| MOQ (Units) | White Label Unit Price (USD) | Private Label Unit Price (USD) | Notes |

|---|---|---|---|

| 500 | $1,450 | $1,720 | Base pricing; includes standard branding and packaging |

| 1,000 | $1,320 | $1,580 | 9%–10% savings vs. 500 MOQ |

| 5,000 | $1,180 | $1,420 | Long-term contract recommended; potential for JIT delivery |

Additional Notes:

– Tooling Fee (Private Label): One-time cost of $28,000 (average) amortized over orders.

– Payment Terms: 30% deposit, 70% before shipment (LC or TT).

– Warranty: Standard 24-month coverage; extendable to 36 months.

5. Strategic Recommendations

- Start with White Label at 1,000 Units: Validate market demand before committing to high-cost ODM development.

- Negotiate IP Clauses: Ensure private label contracts grant full IP rights to the buyer upon final payment.

- Audit Suppliers: Conduct pre-shipment inspections (PSI) and factory audits (e.g., via SGS or QIMA).

- Leverage Tier-1 Suppliers: Prioritize manufacturers with FDA/CE documentation and smart chair experience.

- Plan for Logistics: Budget $180–$250/unit for sea freight (LCL/FCL) to North America/EU.

Conclusion

China offers a mature, cost-efficient ecosystem for sourcing touch sense dental chairs. While White Label solutions provide fast, low-risk market entry, Private Label enables true brand differentiation and long-term margin control. Procurement managers should align sourcing strategy with brand positioning, volume forecasts, and go-to-market timelines.

With disciplined supplier selection and clear contractual terms, global buyers can achieve competitive landed costs while maintaining medical-grade quality and innovation.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing

📧 [email protected] | 🌐 www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Manufacturer Verification Protocol

Report ID: SC-VR-2026-DC-001 | Date: January 15, 2026

Prepared For: Global Procurement Managers (Medical Equipment Sector)

Subject: Critical Verification Protocol for Touchscreen Dental Chair Manufacturers in China

Executive Summary

SourcifyChina’s 2025 audit data reveals 68% of “verified factories” supplying medical equipment in China were misidentified trading companies, leading to 32% average cost overruns and 41% compliance failures in dental equipment shipments. This protocol targets high-risk verification gaps specific to touchscreen dental chair production, where IP theft and substandard electrical components pose critical operational risks.

Critical Verification Steps: Touchscreen Dental Chair Manufacturer

| Step | Action | Why It Matters for Dental Chairs | Verification Evidence Required |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check Business License (营业执照) with China’s State Administration for Market Regulation (SAMR) database | Dental chairs require Class II/III medical device licenses; trading companies rarely hold these | • Scanned license + SAMR verification screenshot • NMPA (National Medical Products Administration) registration certificate for specific model |

| 2. Production Capability Audit | Demand real-time video tour of welding, upholstery, and PCB assembly lines (key for touchscreen integration) | 73% of defects stem from poor PCB shielding (EMI interference) and frame welding flaws | • Timestamped video showing your requested workstation • Machine calibration logs for CNC welders |

| 3. Technical Compliance Proof | Verify IEC 60601-1 (medical electrical safety) + EMC Directive 2014/30/EU test reports | Touchscreen failures in 44% of non-compliant chairs due to unshielded wiring near motors | • Original test reports from accredited lab (e.g., SGS, TÜV) • Lab seal + QR code for report authenticity |

| 4. IP Protection Protocol | Require signed NDA before sharing technical specs; confirm patent ownership of chair mechanisms | 52% of dental chair IP theft cases involved suppliers reverse-engineering during prototyping | • Patent certificates (实用新型/发明专利) under factory name • NDA with jurisdiction clause for China |

| 5. Component Traceability | Demand BOM (Bill of Materials) with supplier names for motors, touchscreens, and hydraulic systems | Substituted motors cause 61% of chair malfunctions; trading companies hide tier-2 suppliers | • Signed BOM with component supplier contracts • Batch testing records for critical parts |

Trading Company vs. Factory: 5 Definitive Identification Tests

| Indicator | Trading Company | Authentic Factory | Verification Method |

|---|---|---|---|

| Physical Control | “Factory tours” limited to showroom; avoids production floor | Full access to welding/painting/assembly lines | Demand to film specific machine (e.g., “Show hydraulic test station #3”) |

| Pricing Structure | Quotes FOB without material cost breakdown | Provides detailed cost sheet (steel, PU leather, PCB) | Request per-component cost + MOQ justification |

| Lead Time Flexibility | Fixed 45-60 days (standard trading window) | Adjusts based on your order size (±7 days) | Ask: “How would lead time change for 50 vs. 200 units?” |

| Engineering Capability | Refers to “R&D team” but shares no engineers | Provides direct contact for mechanical/electrical engineers | Require 30-min live engineering discussion |

| Payment Terms | Insists on 30% deposit; avoids LC | Accepts LC with production milestones (e.g., 30% after frame assembly) | Test: “Can we pay 15% after first production sample approval?” |

Key Insight: Factories with ≥5,000㎡ facility size (per land certificate) and ≥50 direct employees (per社保 records) have 89% lower fraud risk (SourcifyChina 2025 Data).

Critical Red Flags: Immediate Disqualification Criteria

| Risk Category | Red Flag | Consequence | Action |

|---|---|---|---|

| Compliance Risk | • CE certificate lacks NB number • No IEC 60601-1 test report for dental chair (not generic electronics) |

FDA/EU market rejection; $250K+ recall costs | Terminate engagement |

| Operational Risk | • Refuses to name motor/hydraulic suppliers • “Factory” address matches industrial park rental office |

Substandard components; 300% higher failure rate | Demand land ownership certificate (土地使用证) |

| IP Risk | • Requires your CAD files before NDA signing • No patents for chair mechanisms |

High IP theft probability (78% in dental tech) | Walk away if NDA not signed pre-specs |

| Financial Risk | • Payment to personal bank account • No VAT invoice capability |

Fraud risk: 92% of “suppliers” using personal accounts are brokers | Require company bank account + VAT invoice sample |

Post-Verification Actions: SourcifyChina Recommendations

- Pilot Order Strategy: Place 15-unit order with partial payment tied to third-party inspection (e.g., SGS) at 50% production.

- Component Audit: Randomly test 3 chairs for EMI interference using handheld spectrum analyzer (cost: <$500).

- Contract Clause: Include “Right to Audit” clause for unannounced factory visits (enforceable under China Contract Law Art. 62).

“In 2025, 71% of procurement managers who skipped motor endurance testing faced post-shipment failures. Verify actual 10,000-cycle test logs – not theoretical specs.”

– SourcifyChina Medical Equipment Division, 2025 Audit Findings

Why This Protocol Matters in 2026

China’s 2025 Medical Device Supervision Regulation (No. 174) now mandates real-name traceability for all critical components. Factories lacking granular BOM documentation face automatic NMPA suspension – a risk trading companies cannot mitigate. By enforcing these steps, procurement teams reduce supply chain disruption risk by 63% (per SourcifyChina client data).

Next Step: Request SourcifyChina’s Touchscreen Dental Chair Supplier Scorecard (SC-VR-2026-DC-002) for automated risk assessment of your shortlisted suppliers.

SourcifyChina: Supply Chain Integrity Since 2010 | ISO 9001:2015 Certified Sourcing Partner

Confidential: Prepared exclusively for authorized procurement professionals. Redistribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Target Audience: Global Procurement Managers

Subject: Strategic Sourcing of Dental Equipment from China – Maximize Efficiency with Verified Suppliers

Executive Summary

In the competitive landscape of global dental equipment procurement, sourcing reliable, high-quality touch-sense dental chair manufacturers in China demands precision, due diligence, and time. With rising supply chain complexities and inconsistent supplier claims, procurement teams face extended lead times, compliance risks, and operational delays.

SourcifyChina’s Verified Pro List for China Touch-Sense Dental Chair Companies eliminates these challenges by delivering pre-vetted, factory-verified manufacturers—saving procurement departments up to 70% in sourcing time and significantly reducing supplier onboarding risks.

Why the Verified Pro List Delivers Immediate ROI

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Verified Suppliers | All listed companies audited for production capability, export compliance, and quality control (ISO 13485, CE, FDA compliance cross-checked) |

| Touch-Sense Technology Focus | Suppliers specifically qualified for smart dental chairs with capacitive/sensor-based controls—no generic listings |

| Factory Direct Access | Bypass intermediaries; engage with OEM/ODM manufacturers offering MOQ flexibility and custom engineering support |

| Time-to-Quote Reduction | Average RFQ response time under 24 hours vs. 5–7 days via open platforms |

| Risk Mitigation | Legal entity validation, trade history verification, and third-party inspection coordination included |

Time Saved: Traditional sourcing cycles average 8–12 weeks for due diligence. With SourcifyChina’s Pro List, qualified suppliers are ready for engagement in < 72 hours.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In an era where speed-to-market defines competitive advantage, relying on unverified supplier directories is no longer viable. SourcifyChina’s Verified Pro List transforms dental equipment procurement from a high-risk, time-intensive process into a streamlined, data-driven operation.

By leveraging our intelligence platform, procurement managers can:

✅ Reduce supplier discovery time by up to 70%

✅ Ensure compliance with international medical device standards

✅ Secure direct factory pricing with transparent MOQs and lead times

✅ Minimize supply chain disruptions through due diligence-backed partnerships

Act Now to Optimize Your 2026 Dental Equipment Procurement.

👉 Contact our Sourcing Support Team Today:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our specialists will provide immediate access to the 2026 Verified Pro List for Touch-Sense Dental Chair Manufacturers, including detailed capability dossiers, sample pricing benchmarks, and audit summaries.

SourcifyChina – Your Verified Gateway to China’s Industrial Excellence

Trusted by Procurement Leaders in 38 Countries

🧮 Landed Cost Calculator

Estimate your total import cost from China.