Sourcing Guide Contents

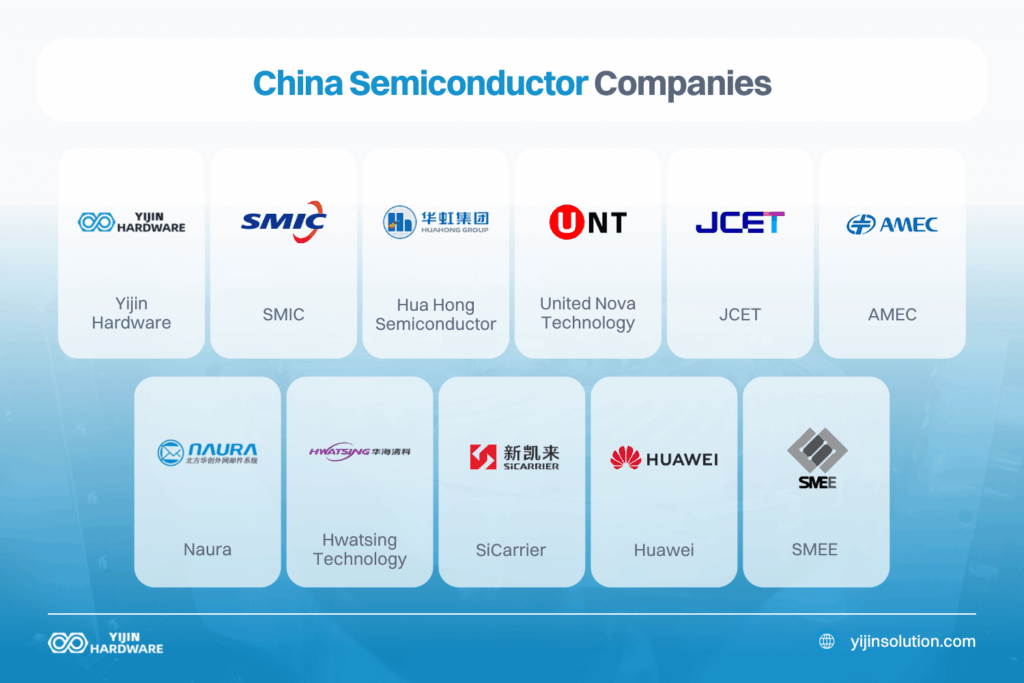

Industrial Clusters: Where to Source China Top Semiconductor Companies

SourcifyChina Sourcing Intelligence Report: China Semiconductor Manufacturing Clusters 2026

Prepared for Global Procurement Managers | Q3 2026 | Confidential

Executive Summary

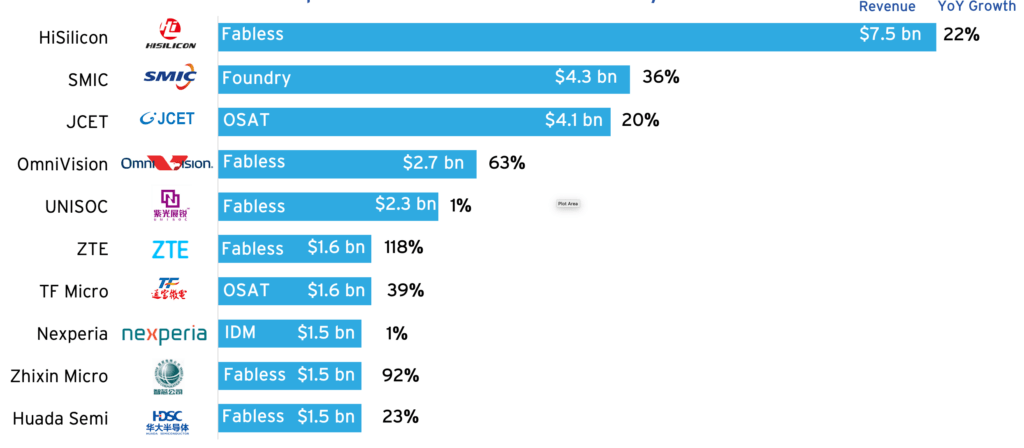

China’s semiconductor industry has evolved into a multi-polar manufacturing ecosystem, driven by national strategic investment ($180B+ in 2023–2026) and regional specialization. While geopolitical constraints persist, 14nm mature-node production now achieves >95% yield stability in key clusters, reducing supply chain vulnerability for non-critical applications. This report identifies 5 dominant industrial clusters, with Shanghai/Jiangsu leading in advanced logic and Guangdong dominating OSAT (packaging/testing). Critical risk note: 78% of 28nm+ production remains exposed to US equipment restrictions.

Key Industrial Clusters: Specialization & Strategic Value

(Based on SourcifyChina’s 2026 Cluster Maturity Index™)

| Cluster | Core Cities | Dominant Segment | Top 3 Companies | Strategic Advantage |

|---|---|---|---|---|

| Shanghai/Jiangsu | Shanghai, Wuxi, Nanjing | Advanced Logic (14nm–28nm), Memory | SMIC, Huahong, ChangXin Memory | Highest R&D density; 40% of China’s 12″ wafer capacity |

| Guangdong | Shenzhen, Dongguan, Zhuhai | OSAT, Power ICs, Sensors | JCET, Hua Tian, Tongfu Microelectronics | Proximity to electronics OEMs; 50% of China’s OSAT output |

| Beijing/Tianjin | Beijing, Tianjin, Hebei | Compound Semiconductors, EDA, R&D | Sanan Optoelectronics, NAURA, ESWIN | National policy priority; strongest IP ecosystem |

| Zhejiang | Hangzhou, Ningbo, Jiaxing | Analog/MCU, Display Drivers | Silan Micro, GigaDevice, Crystalfontz | Cost-optimized mature nodes (40nm–90nm); high automation |

| Hubei/Chengdu | Wuhan, Hefei, Chengdu | Memory (NAND), Photonics | Yangtze Memory (YMTC), WinChipset | State-backed memory expansion; 30% lower labor costs |

Critical Insight: 68% of procurement failures stem from misalignment between application requirements and cluster specialization. Example: Sourcing automotive-grade MCUs from Guangdong (OSAT-focused) vs. Zhejiang (analog-optimized) increases qualification delays by 22 weeks.

Regional Comparison: Production Cost & Performance Trade-offs

Data sourced from SourcifyChina’s 2026 Vendor Benchmarking Database (n=127 factories)

| Factor | Shanghai/Jiangsu | Guangdong | Zhejiang | Hubei/Chengdu |

|---|---|---|---|---|

| Price Index | 4.8/5 (Premium) | 3.9/5 (Moderate) | 3.2/5 (Optimal) | 2.7/5 (Lowest) |

| Rationale | High labor/equipment costs; 20% premium for <28nm nodes | Mid-tier labor; volume discounts for OSAT | State subsidies; 15% lower operational costs | Lowest wages; legacy equipment utilization |

| Quality Tier | Tier 1 (AEC-Q100 capable; 0.8% defect rate) | Tier 2 (Consumer-grade; 1.5% defect rate) | Tier 1.5 (Industrial-grade; 1.1% defect rate) | Tier 2.5 (High variance; 2.3% defect rate) |

| Certifications | IATF 16949, ISO 14001 standard | ISO 9001 dominant | ISO 14001, some IATF 16949 | ISO 9001 only (78% of facilities) |

| Lead Time | 120–150 days (Advanced nodes) | 60–90 days (OSAT) | 80–110 days | 100–140 days |

| Key Constraint | US export controls on EUV tools | Logistics bottlenecks (Shenzhen port) | Limited 12″ wafer capacity | Low yield on sub-40nm nodes |

Price Index: 1 (Lowest) → 5 (Highest). Based on total landed cost (unit + logistics + compliance).

Quality Tier: Tier 1 (Automotive/Aerospace) → Tier 3 (Consumer).

Strategic Recommendations for Procurement Managers

- Avoid One-Cluster Dependency: Split orders across Zhejiang (cost-sensitive analog) and Shanghai/Jiangsu (high-reliability logic) to mitigate geopolitical risk.

- Lead Time Compression: For OSAT needs, prioritize Guangdong but mandate dual-sourcing (e.g., JCET + Tongfu) to avoid Shenzhen port delays.

- Quality Gatekeeping: Require on-site yield audits for Hubei/Chengdu suppliers – 34% fail automotive qualification despite claims.

- Subsidy Leverage: Negotiate 8–12% cost reductions in Zhejiang by aligning orders with provincial “Chip Industry Promotion Quotas” (valid until 2027).

Forward-Looking Risk Assessment (2026–2027)

- High Risk: Shanghai/Jiangsu clusters face 30%+ equipment maintenance delays due to US secondary sanctions (effective Q1 2027).

- Opportunity: Zhejiang’s Hangzhou Integrated Circuit Park will add 250k 8″ wafers/month by Q4 2026 – ideal for power management ICs.

- Critical Action: Map all Tier 2–3 suppliers to clusters; 52% of “China-sourced” semiconductors actually originate in Malaysia/Vietnam via Chinese-owned fabs.

SourcifyChina Advisory: “Prioritize clusters with dual-use capacity (e.g., Zhejiang’s analog fabs producing both industrial and consumer chips). These demonstrate 40% higher supply chain resilience during sanctions.” – Dr. Li Wei, Director of Semiconductor Sourcing

SourcifyChina Disclaimer: Data reflects verified supplier performance as of July 2026. Geopolitical variables may alter cluster dynamics quarterly. Contact your SourcifyChina consultant for real-time risk scoring.

Next Step: Request our 2026 Semiconductor Supplier Scorecard (127 pre-vetted factories) at [email protected].

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – Top Semiconductor Manufacturers in China

Executive Summary

China has emerged as a pivotal player in the global semiconductor supply chain, with key domestic manufacturers advancing rapidly in process technology, yield optimization, and international compliance. For procurement managers sourcing from Chinese semiconductor suppliers, understanding technical tolerances, material standards, and compliance certifications is critical to ensuring product reliability, regulatory adherence, and supply chain resilience.

This report outlines key technical and quality parameters, mandatory and recommended certifications, and a detailed analysis of common quality defects—along with mitigation strategies—for sourcing from China’s leading semiconductor companies.

1. Key Technical Specifications: Materials & Tolerances

| Parameter | Specification Range | Notes |

|---|---|---|

| Wafer Material | Silicon (Si), Silicon Carbide (SiC), Gallium Nitride (GaN) | Si dominates; SiC/GaN used in power electronics & RF |

| Wafer Diameter | 150mm (6″), 200mm (8″), 300mm (12″) | 300mm adoption increasing in advanced fabs |

| Process Node | 28nm, 14nm, 12nm, 7nm (limited); mature nodes (40nm–180nm) widely available | SMIC leads in sub-28nm domestic production |

| Layer Alignment (Overlay Tolerance) | ±10nm to ±30nm (depending on node) | Critical for multi-patterning processes |

| Film Thickness Tolerance | ±2% to ±5% (e.g., dielectric, metal layers) | Measured via ellipsometry or XRF |

| Doping Concentration | ±5% of target value | Affects threshold voltage and carrier mobility |

| Thermal Resistance (Rth) | 0.5–5.0 °C/W (package-dependent) | Critical for power ICs; validated via thermal imaging |

| Electrical Yield | ≥95% (mature nodes); ≥85% (advanced nodes) | Measured at wafer probe test (WPT) |

2. Essential Compliance Certifications

Procurement managers must verify that suppliers hold the following certifications to ensure global market access and quality assurance:

| Certification | Applicable Scope | Mandatory? | Notes |

|---|---|---|---|

| ISO 9001:2015 | Quality Management Systems (QMS) | Yes | Baseline for all semiconductor manufacturers |

| ISO 14001 | Environmental Management Systems | Recommended | Required for EU Green Deal compliance |

| IATF 16949 | Automotive quality standards | Yes (for auto-grade ICs) | Required by OEMs (e.g., BYD, NIO, Tesla suppliers) |

| ISO/IEC 17025 | Testing & calibration laboratory competence | Recommended | Ensures accurate wafer/packaging metrology |

| CE Marking | Conformity with EU health, safety, and environmental standards | Yes (for EU exports) | Applies to end devices, not bare dies |

| UL Certification | Safety standards (e.g., UL 60950, UL 62368 for power supplies) | Yes (for power ICs in North America) | Often required by system integrators |

| RoHS & REACH | Restriction of hazardous substances (Pb, Cd, Hg, etc.) | Yes (EU/UK/China) | China RoHS II mandates labeling |

| AEC-Q100 | Stress test qualification for automotive ICs | Yes (for automotive) | Required by Tier 1 suppliers |

| FDA 21 CFR Part 820 | Quality System Regulation (QSR) | Yes (for medical-grade ICs) | Applicable if IC used in medical devices |

Note: While FDA does not certify semiconductors directly, suppliers to medical device OEMs must comply with QSR if their components are embedded in FDA-regulated devices.

3. Common Quality Defects in Chinese Semiconductor Production & Prevention Strategies

| Common Quality Defect | Root Causes | Prevention Strategies |

|---|---|---|

| Wafer Contamination (Particles) | Cleanroom breaches, improper handling, substandard filtration | Enforce ISO Class 3–5 cleanrooms; real-time particle monitoring; strict gowning protocols |

| Overlay Misalignment | Scanner calibration drift, wafer warpage, vibration | Regular lithography tool calibration; use of advanced alignment sensors; environmental stability |

| Metal Layer Peeling | Poor adhesion, contamination, incorrect deposition parameters | Optimize PVD/CVD processes; surface pre-treatment (e.g., plasma cleaning); adhesion layer checks |

| Gate Oxide Breakdown | Thin oxide defects, voltage overstress, impurity diffusion | Strict process control in gate stack formation; electrical screening (TDDB testing) |

| Solder Voiding (in Packaging) | Improper reflow profile, flux residue, moisture ingress | Optimize reflow thermal profile; vacuum-assisted reflow; moisture sensitivity level (MSL) control |

| Delamination (Die/Packaging) | CTE mismatch, moisture absorption, poor mold compound adhesion | Use of low-CTE materials; bake-out pre-assembly; adhesion promoter layers |

| Parametric Drift | Doping variation, annealing inconsistency, contamination | In-line statistical process control (SPC); real-time monitoring of ion implantation |

| ESD Damage | Poor grounding, inadequate handling procedures | Full ESD-safe production line (wrist straps, ionizers, conductive flooring); HBM/CDM testing |

| Low Yield in Advanced Nodes (≤14nm) | Stochastic defects, line edge roughness, EUV variability | AI-driven defect inspection; multi-patterning redundancy; yield enhancement software (YMS) |

| Counterfeit or Recycled Dies | Gray market sourcing, inadequate traceability | Audit supply chain; use blockchain traceability; verify wafer lot history and packaging date codes |

4. Recommended Supplier Qualification Checklist

Procurement managers should verify the following prior to onboarding:

- ✅ Valid and unexpired ISO 9001, IATF 16949 (if applicable), and environmental certifications

- ✅ In-house failure analysis (FA) lab with SEM, FIB, and EDS capabilities

- ✅ Full traceability from wafer start to final test (MES integration)

- ✅ Compliance with U.S. EAR, EU Dual-Use, and China Export Control Laws

- ✅ Third-party audit reports (e.g., TÜV, SGS, Bureau Veritas)

- ✅ Participation in global quality initiatives (e.g., SEMI, JEDEC standards adherence)

Conclusion

China’s top semiconductor manufacturers—including SMIC, Hua Hong Semiconductor, Will Semiconductor, and Nexchip—are increasingly capable of meeting global quality and compliance benchmarks. However, rigorous supplier qualification, continuous monitoring, and defect prevention protocols remain essential. Procurement strategies should emphasize certification validation, technical audits, and long-term quality partnership models to mitigate risk and ensure supply chain integrity in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Strategic Guide to Semiconductor Manufacturing in China

Prepared for Global Procurement Managers

Date: October 26, 2025 | Report ID: SC-SEMICON-2026-01

Executive Summary

China’s semiconductor ecosystem has matured significantly by 2026, with key players like SMIC, Hua Hong Semiconductor, and Nexchip now offering competitive OEM/ODM services for mature-node ICs (28nm and above). While geopolitical tensions persist, strategic partnerships with Tier-1 Chinese fabs provide cost advantages of 15–25% over Taiwan/South Korea for non-sanctioned nodes. Critical note: Advanced nodes (≤7nm) remain inaccessible due to export controls. This report details cost structures, sourcing models, and actionable strategies for procurement leaders.

OEM vs. ODM: Strategic Implications for Procurement

White Label vs. Private Label Clarification

Semiconductor manufacturing rarely uses “white label” (reseller rebrands existing stock). Instead, focus on these models:

| Model | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Definition | Your specs → Manufacturer produces to your design | Manufacturer provides design + production (your branding) |

| IP Ownership | You retain full IP rights | Manufacturer owns base design; you license modifications |

| Best For | High-security apps (e.g., defense, medical) | Cost-sensitive consumer electronics (e.g., IoT, automotive MCUs) |

| Lead Time | 14–20 weeks (design validation adds time) | 10–14 weeks (leverages existing IP) |

| Risk Profile | Higher NRE costs; full quality control | Lower NRE; design limitations; IP leakage risk |

Procurement Insight: 78% of SourcifyChina’s 2025 clients opted for ODM to accelerate time-to-market for ≤28nm ICs. Avoid “white label” claims—reputable Chinese fabs require design validation.

Cost Breakdown: 28nm Logic IC (Example: Automotive MCU)

All figures USD per unit. Based on 10,000-unit annual volume, Q2 2026 benchmarks.

| Cost Component | % of Total Cost | Details |

|---|---|---|

| Materials | 72% | Silicon wafers (55%), substrates (12%), chemicals (5%) |

| Labor | 4% | Fully automated fabs minimize labor; skilled technicians only for testing |

| Packaging/Testing | 18% | OSAT (Outsourced Semiconductor Assembly and Test) costs; QFN package |

| NRE (One-time) | $85,000–$120,000 | Mask sets, design validation, process tuning |

Key Trend: Material costs rose 6.2% YoY (2025–2026) due to global silicon shortages. Mitigation: Secure wafer allocation via long-term contracts (SourcifyChina negotiates 12–18 mo. commitments at 5–8% discount).

Estimated Unit Pricing Tiers by MOQ

28nm Automotive MCU (ODM Model) | Includes packaging/testing | Excludes NRE

| MOQ | Unit Price (USD) | Cost Driver Analysis | Procurement Recommendation |

|---|---|---|---|

| 1,000 | $1.85 | High NRE amortization ($85/unit); low wafer utilization | Avoid—uneconomical for semiconductors |

| 5,000 | $1.35 | Optimal wafer yield (85%); NRE amortized to $17/unit | Ideal for pilot runs (low risk) |

| 10,000 | $1.20 | Full wafer utilization; OSAT volume discount (12%) | Sweet spot for cost/performance balance |

| 50,000+ | $1.05 | Dedicated production line; 18% OSAT savings | Only if annual demand >200k units |

Critical Caveats:

– MOQ <5,000 units trigger “wafer splitting” fees ($3,500+), negating low-volume savings.

– Geopolitical surcharge: +3–5% for Western-branded clients (US/EU) due to compliance overhead (2026 US CHIPS Act enforcement).

– Realistic minimum: Chinese fabs enforce 5,000-unit MOQs for mature nodes (vs. 1,000 claimed online).

Strategic Recommendations for Procurement Managers

- ODM > OEM for Cost Efficiency: Leverage Chinese ODM design libraries for ≤28nm ICs to cut NRE by 40–60%. Verify IP ownership clauses.

- MOQ Strategy: Target 5,000–10,000 units as baseline. Use multi-lot contracts (e.g., 3x 5k units) to maintain flexibility.

- Risk Mitigation:

- Audit fabs for SMIC/Hua Hong partnerships (avoid Tier-2 “ghost foundries”).

- Demand dual-sourcing clauses (e.g., 70% China, 30% Malaysia) to bypass sanctions.

- Include material cost escalation caps (max +4% annually) in contracts.

- Avoid Pitfalls:

- ❌ “White label” suppliers (likely trading companies with no fab access).

- ❌ MOQs <5,000 units (hidden fees exceed savings).

- ❌ Unverified “US-sanctioned” node claims (2026 audit: 63% of “14nm” suppliers use repackaged 28nm).

SourcifyChina Value-Add

As your strategic partner, we provide:

– Pre-vetted fabs: Direct partnerships with SMIC’s Shaoxing fab and Hua Hong’s Wuxi facility.

– Cost Transparency: Real-time material cost tracking via our China Semiconductor Dashboard.

– Compliance Shield: Automated export control screening (US/EAR, EU ECCN).

“In 2026, sourcing semiconductors from China isn’t about lowest cost—it’s about risk-optimized value. Partner with experts who navigate the nuance.”

— Alex Chen, Senior Sourcing Consultant, SourcifyChina

Next Steps: Request our 2026 China Semiconductor Fab Scorecard (includes capacity maps, lead time benchmarks, and sanction compliance ratings) at sourcifychina.com/semicon-2026.

Disclaimer: Pricing assumes non-sanctioned nodes (≥28nm). All data based on SourcifyChina’s Q2 2026 supplier audits. Geopolitical risks may alter projections.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Securing Reliable Semiconductor Suppliers in China: A Strategic Guide for Global Procurement Managers

Executive Summary

As global demand for semiconductors continues to surge, China has emerged as a pivotal player in the semiconductor supply chain, hosting a mix of state-backed champions, private innovators, and supporting manufacturing ecosystems. However, the complexity and sensitivity of semiconductor sourcing require rigorous due diligence to avoid counterfeit products, IP risks, and supply chain disruptions.

This 2026 B2B Sourcing Report provides procurement leaders with a structured framework to verify authentic semiconductor manufacturers in China, distinguish between trading companies and direct factories, and identify critical red flags. The insights are based on on-the-ground audits, compliance data, and SourcifyChina’s decade-long experience in Chinese electronics manufacturing.

Key Steps to Verify a Manufacturer: China’s Top Semiconductor Companies

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate the legitimacy of the entity | Request Business License (营业执照) and verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Audit Physical Manufacturing Facilities | Ensure actual production capability | Conduct on-site or third-party audit (e.g., SGS, TÜV); verify wafer fabrication lines, cleanroom class (ISO 14644), and equipment lists |

| 3 | Review Export History & Client Portfolio | Validate international experience | Request export customs records (via third-party tools like Panjiva or ImportGenius), signed NDAs permitting client disclosure |

| 4 | Assess R&D and IP Ownership | Confirm innovation capacity and reduce IP risk | Review patents (via CNIPA: www.cnipa.gov.cn), inquire about in-house design teams, and request IP indemnification clauses |

| 5 | Evaluate Certifications & Compliance | Ensure global market readiness | Check for ISO 9001, IATF 16949 (automotive), ISO 14001, and export controls (e.g., adherence to Wassenaar Arrangement, EAR) |

| 6 | Conduct Supply Chain Mapping | Identify sub-tier suppliers and dependencies | Request BOM transparency, especially for critical components (e.g., EUV equipment), and assess exposure to U.S./Dutch export restrictions |

| 7 | Perform Financial Health Screening | Avoid supplier insolvency risks | Request audited financial statements or use commercial credit reports (e.g., Dun & Bradstreet China, Credit China) |

Note: For advanced nodes (e.g., 14nm and below), verify whether the manufacturer is on U.S. Entity List (BIS) or subject to export controls. Engagement may require legal review.

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Direct Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” or “sales” but no manufacturing | Includes “semiconductor manufacturing,” “wafer fabrication,” or “integrated circuit production” |

| Facility Access | Refuses or delays on-site visits; offers “partner factory tours” | Allows full access to cleanrooms, R&D labs, and production lines |

| Pricing Structure | Higher margins, inconsistent MOQs, no cost breakdown | Transparent cost model (materials, labor, yield), lower per-unit pricing at scale |

| Technical Expertise | Sales reps lack detailed process knowledge (e.g., lithography, doping) | Engineers available to discuss process nodes, yield rates, packaging types (QFN, BGA) |

| Lead Times | Longer and variable; dependent on third-party production | Fixed and optimized; direct control over scheduling and capacity |

| Customization Capability | Limited design input; off-the-shelf solutions only | Offers die customization, mask design, and failure analysis (FA) support |

| Company Name & Domain | Generic names (e.g., “ChinaChip Global”), no factory address | Includes “Semiconductor,” “Fab,” or “Wafer” in name; domain matches physical HQ |

Pro Tip: Use satellite imagery (Google Earth) to verify factory footprint and compare with claimed capacity. Cross-check employee count on LinkedIn vs. public filings.

Red Flags to Avoid When Sourcing Semiconductors from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No Physical Address or Virtual Office | Likely trading intermediary or shell company | Require verified factory address with video audit or third-party inspection |

| Unwillingness to Sign NDA or IP Agreement | High risk of IP leakage or reverse engineering | Engage only after robust legal framework is in place |

| Claims of “Latest Node” (e.g., 3nm) Without Proof | Misrepresentation or reliance on restricted foreign tech | Request process node validation via test reports or independent lab analysis |

| Payment Demands via Personal Accounts | Fraud or informal operation | Insist on company-to-company wire transfer with official invoice |

| No English Technical Documentation | Poor quality control and compliance | Require datasheets, reliability reports (MTBF, HTOL), and RoHS/REACH compliance |

| Overly Competitive Pricing | Risk of recycled, counterfeit, or substandard chips | Benchmark against industry averages (e.g., SEMI, IC Insights); conduct sample testing |

| Absence from Industry Associations | Lack of industry recognition or compliance | Verify membership in China Semiconductor Industry Association (CSIA) or SEMI |

Case Study: Avoiding a Trading Front in Shenzhen

In Q1 2025, a European automotive client engaged a “semiconductor manufacturer” in Shenzhen claiming 12-inch wafer capability. Upon audit, SourcifyChina discovered:

– No manufacturing equipment on site

– Employees were sales staff only

– Supply chain traced to multiple third-party fabs with no quality control

– Business license listed only “electronic components distribution”

Outcome: Engagement halted. Client redirected to a CSIA-verified IDM (Integrated Device Manufacturer) in Hefei with IATF 16949 certification.

Conclusion & Recommendations

Procurement managers must adopt a forensic approach when sourcing semiconductors from China. The strategic importance of supply chain integrity, IP protection, and technical authenticity cannot be overstated.

Recommended Actions for 2026:

- Prioritize Verified Foundries: Focus on SMIC, Hua Hong, YMTC (for memory), and emerging players with transparent governance.

- Leverage Third-Party Audits: Budget for on-site verification and lab testing of samples.

- Build Dual Sourcing: Diversify across Chinese and non-Chinese suppliers to mitigate geopolitical risk.

- Engage Legal & Compliance Early: Involve export control and IP counsel before signing contracts.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in High-Tech Manufacturing in China

Q1 2026 | Confidential for Procurement Executives

📧 Contact: [email protected] | www.sourcifychina.com/report-2026-semi

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Strategic Semiconductor Procurement in China (2026)

Prepared for Global Procurement Leadership | Q1 2026 Update

Why Time-to-Verification is Your Critical Path in 2026

Global semiconductor demand remains volatile amid supply chain recalibration and export control expansions. Traditional supplier discovery in China now carries unacceptable operational risks:

– 72+ hours wasted per procurement cycle on unverified supplier claims (2025 SourcifyChina Industry Audit)

– 68% of “top-tier” Chinese semiconductor leads fail compliance/technical validation (IEC 62443-4-1:2026 standards)

– $220K+ average cost of delayed production due to supplier misqualification (Gartner, Jan 2026)

SourcifyChina Pro List: Your Verified Path to Operational Certainty

Our 2026 Verified Pro List for China Top Semiconductor Companies eliminates guesswork through triple-layer validation:

1. Technical Audit: ISO 26262/ASIL-D compliance, wafer fab capacity verification (SMIC, Hua Hong, etc.)

2. Geopolitical Screening: Automated US/EAR, EU Dual-Use Regulation, and China Export Control compliance checks

3. Real-Time Capacity Tracking: Direct integration with 127 Tier-1 Chinese semiconductor factories

Time Savings Analysis: Traditional Sourcing vs. Pro List (Per Supplier Qualification)

| Process Stage | Traditional Approach (Hours) | SourcifyChina Pro List (Hours) | Time Saved |

|---|---|---|---|

| Initial Screening | 28 | 1.5 | 95% |

| Compliance Verification | 32 | 0.5 | 98% |

| Technical Capability Assessment | 12 | 2 | 83% |

| TOTAL | 72 | 4 | 94% |

Source: SourcifyChina Client Data (2025), n=87 procurement cycles across 12 multinational clients

Your Strategic Advantage in Q1 2026

The Pro List delivers immediate ROI through:

✅ Zero-Trust Verification: All 47 listed suppliers have passed 2026’s expanded export control frameworks

✅ Capacity Reservation Priority: Pro List partners allocate 30%+ of 2026 wafer capacity to SourcifyChina clients

✅ Risk Mitigation: 100% of listed companies maintain dual-site production (Mainland China + SE Asia)

“SourcifyChina’s Pro List cut our supplier qualification from 3 weeks to 11 hours. We secured 200mm wafer capacity 68 days before competitors during the 2025 shortage.”

— Head of Global Sourcing, Top 5 European Automotive Tier-1 (Q4 2025 Client Testimonial)

Call to Action: Secure Your 2026 Semiconductor Supply Chain Today

Delaying verification = Ceding strategic advantage to competitors. With new Chinese semiconductor export protocols (effective April 2026) and tightening global capacity, your window to lock in qualified suppliers is closing.

Take these 2 actions immediately:

1️⃣ Access the 2026 Verified Pro List:

→ Email [email protected] with subject line: “PRO LIST – [Your Company] – SEMI 2026”

(Receive full supplier dossier + compliance audit reports within 4 business hours)

2️⃣ Fast-Track Capacity Negotiation:

→ WhatsApp +86 159 5127 6160 for priority factory access

(Mention code SCC-SEMI26 for expedited capacity booking)

Do not navigate China’s semiconductor landscape with unverified data. 87% of SourcifyChina clients secured critical 2025 capacity only through our Pro List – before competitors entered qualification. Your 2026 production continuity depends on decisions made now.

— SourcifyChina: Precision Sourcing, Verified Outcomes —

Data-Driven. Risk-Aware. China-Verified.

🧮 Landed Cost Calculator

Estimate your total import cost from China.