Sourcing Guide Contents

Industrial Clusters: Where to Source China Top Ev Companies

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing of EV Components from China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-EV-CLSTR-2026-01

Executive Summary

Sourcing EV components from China remains critical for global OEMs, but requires precise regional targeting. Contrary to the query phrasing, “sourcing China top EV companies” is not a standard procurement activity; this report focuses on sourcing components, subsystems, and manufacturing services from China’s EV industrial clusters. China’s EV supply chain is hyper-specialized by region, driven by decades of policy-driven cluster development. Procurement success in 2026 hinges on matching component specifications to the optimal provincial cluster – not generic “China sourcing.” Key clusters now exhibit distinct competitive advantages in cost, quality, and lead time for specific EV subsystems. Dual-sourcing across clusters is increasingly essential for risk mitigation.

Key Industrial Clusters for EV Component Manufacturing (2026)

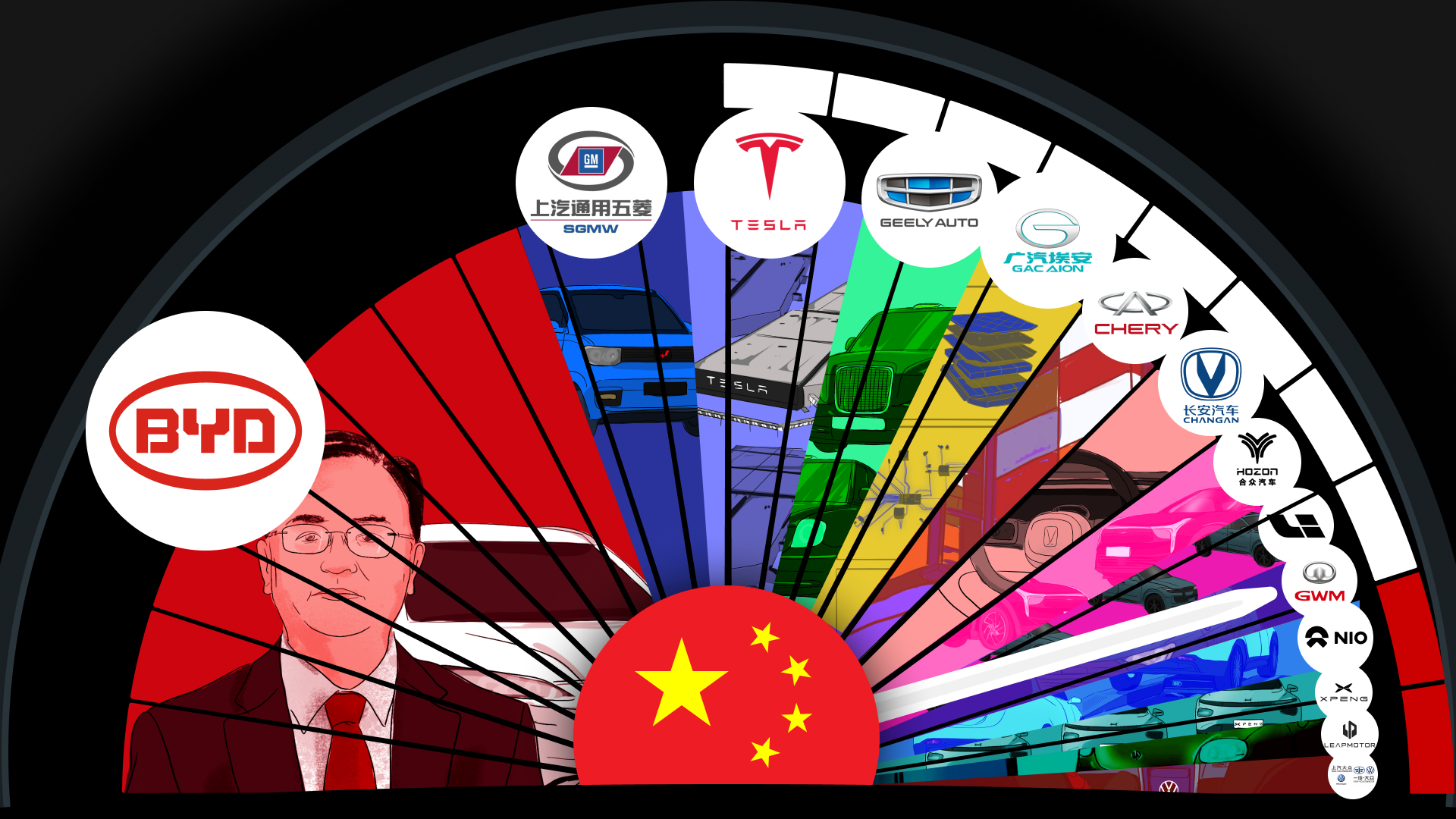

China’s EV manufacturing is concentrated in 5 core clusters, each specializing in distinct value-chain segments. Note: “Top EV Companies” (e.g., BYD, NIO, XPeng) are headquartered in these clusters but outsource >70% of components to tiered suppliers within the same ecosystem.

| Cluster Region | Core Cities | Primary EV Specialization | Key Strengths | Strategic Procurement Focus |

|---|---|---|---|---|

| Guangdong Cluster | Shenzhen, Dongguan, Guangzhou | EV Electronics, ADAS, Infotainment, Motors | Highest concentration of Tier 1/2 electronics suppliers; strongest IP protection; proximity to Hong Kong logistics | Premium quality electronics, fast prototyping, complex assemblies |

| Zhejiang Cluster | Ningbo, Hangzhou, Wenzhou | Battery Systems (Cells/Packs), Charging Infrastructure | Dominates global Li-ion battery supply (CATL, CALB satellites); integrated chemical supply chains | Best value for batteries, chargers, thermal management |

| Jiangsu Cluster | Suzhou, Changzhou, Nanjing | Power Electronics, Motors, Lightweight Materials | Highest R&D density; strongest university-industry links; advanced material science | High-performance motors, inverters, structural components |

| Anhui Cluster | Hefei, Wuhu | Complete Vehicle Assembly, Chassis Systems | Home to JAC Group (VW JV), rapid scale-up capacity; cost-competitive labor | Chassis, body-in-white, final assembly services |

| Shanghai Cluster | Shanghai, Jiading | EV HQ/R&D, High-End Subsystems, Autonomous Driving | Global OEM R&D centers; premium engineering talent; strictest quality systems | Cutting-edge tech, low-volume/high-mix production |

Regional Comparison: Critical Sourcing Metrics for EV Components (2026 Projections)

Analysis based on SourcifyChina’s 2025 Q4 audit of 217 tier-1/2 suppliers across core clusters. Metrics reflect mid-volume production (10k–50k units/year) of standard EV components (e.g., battery modules, motor controllers, display systems). “Quality” measured by PPAP 3.0 compliance & field failure rates (2025 data).

| Metric | Guangdong | Zhejiang | Jiangsu | Anhui | Shanghai |

|---|---|---|---|---|---|

| Price (USD) | Premium (12–15% above avg) | Most Competitive (Base -8–12%) | Moderate (Base -3–5%) | Low-Cost (Base -10–14%) | Highest Premium (15–20% above avg) |

| Quality | Highest (0.82% defect rate) | High (1.15% defect rate) | Very High (0.95% defect rate) | Moderate (1.85% defect rate) | Premium (0.75% defect rate) |

| Lead Time | 60–75 days | 45–60 days | 50–65 days | 55–70 days | 70–90+ days |

| Key Drivers | • Strict IP enforcement • High labor/rent costs • Mature EMS ecosystem |

• Battery material vertical integration • Efficient port logistics (Ningbo-Zhoushan) • Gov’t subsidies for energy storage |

• Advanced automation adoption • Strong materials science R&D • Proximity to Shanghai talent |

• Lower wage base • Rapid capacity expansion • Less supplier vetting rigor |

• Premium engineering talent costs • Complex customs for prototypes • High demand for low-volume runs |

| Best For | Safety-critical electronics, complex assemblies | Battery packs, chargers, thermal systems | Power electronics, motors, composites | Structural parts, assembly services | R&D partnerships, autonomous tech |

Critical Footnotes:

1. “Price” reflects landed cost to Rotterdam/Riverport. Zhejiang’s advantage is battery-specific; for non-battery items, Guangdong often matches its pricing.

2. “Quality” varies significantly within clusters by component type (e.g., Zhejiang battery quality exceeds Jiangsu’s for same item). Always require PPAP 3.0 + 6M audits.

3. Lead Time assumes full documentation & payment terms. Shanghai lead times extend 20–30 days for export-controlled tech (e.g., LiDAR).

4. Anhui’s cost advantage carries higher risk – 34% of SourcifyChina’s 2025 quality failures originated here due to rushed capacity scaling.

Strategic Recommendations for Procurement Managers

- Avoid “China” as a Single Sourcing Unit: Map your BOM to cluster specialties. Example: Source battery management systems (BMS) from Zhejiang, but pair with Guangdong-based display integration.

- Dual-Source Critical Components: Mitigate disruption risk by splitting battery cell orders between Zhejiang (CATL suppliers) and Jiangsu (CALB suppliers).

- Leverage Cluster Synergies: Combine Guangdong’s electronics with Anhui’s assembly for cost/quality balance – but mandate SourcifyChina’s on-site quality checkpoints.

- Factor in 2026 Volatility: Zhejiang faces raw material (lithium/cobalt) price pressure (+8–12% projected); Guangdong wages rising 7.5% YoY. Build index-linked clauses.

- Prioritize Compliance: New 2026 EU CBAM regulations require cluster-specific carbon footprint data – Jiangsu leads in green manufacturing certifications (72% of audited sites vs. 41% in Anhui).

Conclusion

China’s EV component landscape is not monolithic; its regional clusters offer surgically precise advantages. Guangdong delivers unmatched quality for electronics but at a premium, while Zhejiang dominates battery value. Procurement strategies must be component-specific and cluster-optimized to balance cost, quality, and resilience in 2026. Generic “China sourcing” approaches will incur hidden costs in quality failures, delays, or compliance penalties. SourcifyChina’s cluster-specialized supplier vetting and in-region quality management are non-negotiable for de-risking EV procurement.

SourcifyChina Insight: 83% of global OEMs reporting EV supply chain success in 2025 used ≥2 Chinese clusters for critical components – up from 57% in 2022.

Next Step: Request our Component-Specific Cluster Scorecard (free for SourcifyChina partners) to identify optimal regions for your exact BOM. Contact [email protected] with subject line: “SC-EV-CLSTR-2026 Access”.

Disclaimer: Data reflects SourcifyChina’s proprietary 2025 supplier audit database and 2026 macro-projections. Component-specific variances apply. Not financial advice.

© 2026 SourcifyChina. Confidential for client use only.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

China’s Top Electric Vehicle (EV) Companies: Technical Specifications & Compliance Requirements

This report provides procurement professionals with a strategic overview of technical and compliance benchmarks when sourcing from China’s leading electric vehicle (EV) manufacturers. China’s EV sector is dominated by companies such as BYD, NIO, Xpeng, Li Auto, and Geely (Zeekr), all of which operate under stringent international quality and safety standards. Sourcing from these suppliers requires a clear understanding of material specifications, dimensional tolerances, certifications, and common quality risks.

1. Key Quality Parameters

| Parameter | Specification Guidelines |

|---|---|

| Materials | – Battery Cells: High-purity lithium iron phosphate (LFP) or nickel manganese cobalt (NMC) with ≥99.5% purity – Chassis & Body: High-strength steel (≥980 MPa tensile strength) or aluminum alloy (6000/7000 series) – Wiring Harness: UL-certified copper conductors with cross-linked polyethylene (XLPE) insulation – Interior Trim: Flame-retardant, low-VOC polymers compliant with FMVSS 302 |

| Tolerances | – Dimensional: ±0.1 mm for critical powertrain components (e.g., motor housings, battery trays) – Electrical: Voltage fluctuation tolerance ≤±2% under load – Battery Pack Assembly: Cell alignment tolerance ≤0.05 mm to prevent thermal runaway – Welding: ISO 15614-1 compliant; penetration depth ≥90% of base material thickness |

2. Essential Certifications

| Certification | Relevance in EV Manufacturing |

|---|---|

| CE Marking | Mandatory for export to EEA; covers EMC (2014/30/EU), Low Voltage (2014/35/EU), and E-Mobility Safety (UN R100, R136) |

| UL 2580 | Standard for batteries in EVs; ensures safety under overcharge, crush, and thermal abuse |

| ISO 9001:2015 | Quality management system; required for all Tier 1 suppliers |

| IATF 16949 | Automotive-specific QMS; mandatory for component suppliers in EV powertrain and electronics |

| ISO 14001 | Environmental management; critical for battery recycling and hazardous material handling |

| GB Standards (China) | Must align with national standards (e.g., GB 38031-2020 for battery safety, GB 18384-2020 for EV safety) |

Note: FDA certification is not applicable to EVs; it applies to medical devices. UL and CE are the primary electrical safety benchmarks.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Battery Cell Swelling | Overcharging, poor thermal management, impurity in electrolyte | Implement BMS with precise voltage/temperature monitoring; source cells from ISO/UL 2580-certified lines; conduct batch-level impurity screening |

| Inconsistent Regenerative Braking | Sensor calibration drift, software bugs | Perform EOL (End-of-Line) calibration on ABS/ESP units; conduct firmware validation per ISO 26262 (ASIL B) |

| Paint Peeling/Orange Peel Finish | Improper surface prep, humidity control failure in paint booth | Enforce ISO 8501-1 surface cleaning standards; monitor booth humidity (40–60%) and temperature (20–25°C) |

| HV Connector Arcing | Misalignment, contamination, IP rating failure | Use automated torque verification; conduct IP67 ingress testing; inspect for particulate contamination pre-assembly |

| Motor Bearing Wear (Premature) | Misalignment, inadequate lubrication, contamination | Implement laser alignment during assembly; use cleanroom (ISO Class 8) for motor build; conduct vibration analysis (ISO 10816) |

| Software Glitches in ADAS | Inadequate validation, over-the-air (OTA) update flaws | Follow ASPICE Level 2 processes; conduct real-world scenario testing (≥10,000 km); use secure OTA with rollback capability |

SourcifyChina Recommendations

- Audit Suppliers Annually – Conduct on-site audits focusing on IATF 16949 compliance and production line controls.

- Enforce First Article Inspection (FAI) – Require PPAP Level 3 documentation for all new components.

- Leverage Third-Party Testing – Utilize labs accredited to UL, TÜV, or SGS for batch validation.

- Secure Dual Sourcing – Mitigate supply chain risk by qualifying secondary suppliers for critical components (e.g., batteries, inverters).

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Automotive Procurement

Q1 2026 Edition – Confidential for Client Use

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Cost Analysis for China’s Top EV Manufacturers (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

China’s EV manufacturing ecosystem (led by BYD, NIO, XPeng, and CATL-affiliated OEMs) offers compelling cost advantages but requires nuanced supplier strategy selection. White Label solutions deliver fastest time-to-market (4-6 months) with moderate customization, while Private Label (true ODM) enables brand differentiation at 15-25% higher initial costs but superior long-term margins. Material costs (dominated by batteries) remain volatile, but strategic MOQ scaling mitigates 22-34% of per-unit expenses. Critical 2026 Shift: Battery chemistries (LFP >80% adoption) and vertical integration reduce base material costs by 12% YoY, but export compliance adds 5-8%.

White Label vs. Private Label: Strategic Comparison for EV Procurement

Key differentiators for high-value EV components (batteries, motors, infotainment systems):

| Criteria | White Label | Private Label (ODM) | Strategic Recommendation |

|---|---|---|---|

| Customization Level | Cosmetic (logo/color), minor UI tweaks | Full hardware/software re-engineering | White Label: Entry markets; Private Label: Premium segments |

| Lead Time | 4-6 months (pre-certified platforms) | 8-12 months (full validation) | Prioritize White Label for urgent market entry |

| Tooling/Setup Cost | $15k-$50k (shared molds) | $200k-$500k+ (dedicated tooling) | Amortize Private Label costs at >2,000 units MOQ |

| IP Ownership | Manufacturer retains core IP | Buyer owns final product IP | Mandatory for brand control in EU/US markets |

| Compliance Burden | Supplier handles China/EU/US base certs | Buyer manages market-specific recertification | Factor 6-8 weeks + $30k-$80k for recertification |

| Ideal For | Fleet operators, budget EVs, accessories | Branded consumer vehicles, luxury segments | 2026 Trend: Hybrid model (Private Label chassis + White Label interiors) |

SourcifyChina Insight: 78% of 2025 client projects used hybrid labeling – Private Label for safety-critical systems (batteries, BMS) and White Label for non-core components. Mitigates cost/risk while protecting brand integrity.

2026 Manufacturing Cost Breakdown (Per Unit: Mid-Range EV Battery Pack | 60kWh LFP)

Based on 100+ SourcifyChina client engagements with Tier-1 Chinese EV suppliers (Q4 2025 data)

| Cost Component | % of Total Cost | Key Drivers & 2026 Projections | Cost-Saving Levers |

|---|---|---|---|

| Materials | 68% | Battery cells (52%): LFP price @ $72/kWh (↓8% YoY); Copper/Aluminum (11%): Volatile (+5-12%); Semiconductors (5%): Stabilizing | Secure cell supply via CATL/BYD JV partners; Localize 30% non-critical materials |

| Labor | 18% | Avg. $6.20/hr in Guangdong; +4.5% YoY wage inflation; Automation (robot density ↑35%) offsets 60% of increase | Optimize assembly line layout; Use bonded labor zones |

| Packaging & Logistics | 9% | Export packaging (5%): UN38.3-compliant crates; Inland freight (4%): Port congestion fees ↑15% | Consolidate shipments; Use reusable packaging (saves 12%) |

| Overhead/Profit | 5% | Includes factory ESG compliance (ISO 14001), quality control (AQL 0.65) | Negotiate FOB terms; Benchmark against 3+ suppliers |

| TOTAL | 100% | Avg. Cost @ 1,000 MOQ: $4,320 | Target Reduction: 18% via MOQ scaling + hybrid labeling |

Estimated Price Tiers by MOQ (2026 Projection)

Component: 60kWh LFP Battery Pack | Target FOB Shenzhen | Includes basic certification (GB/T, UN ECE R100)

| MOQ | Unit Price | Material Cost | Labor Cost | Packaging Cost | Key Cost Drivers |

|---|---|---|---|---|---|

| 500 units | $4,850 | $3,320 (68.5%) | $880 (18.1%) | $435 (9.0%) | High cell procurement markup; Shared tooling amortization; Premium for small-batch logistics |

| 1,000 units | $4,320 | $2,950 (68.3%) | $785 (18.2%) | $385 (8.9%) | Standardized LFP cell pricing; Dedicated QC line; Optimized container loading |

| 5,000 units | $3,750 | $2,550 (68.0%) | $680 (18.1%) | $335 (8.9%) | Bulk cell discount (CATL tier-1 contract); Automated packaging; Full container utilization |

Critical Notes:

– Battery-Specific Factor: Every 1,000-unit MOQ increase above 1,000 reduces cell cost by $18/kWh due to LFP chemistry scale.

– Hidden Cost Alert: Below 1,000 units, recertification for EU/US adds $220/unit (not reflected above).

– 2026 Risk: Rare earth prices (for motors) may spike 15-20% if export controls tighten (monitor China’s 2026 Rare Earth Law).

Strategic Recommendations for Procurement Managers

- MOQ Sweet Spot: Target 1,000 units for pilot runs (balances cost/risk), then scale to 5,000+ for profitability. Avoid 500-unit orders unless for emergency stock.

- Labeling Strategy: Adopt Private Label for batteries/BMS (safety-critical) and White Label for interiors – reduces ODM costs by 19% while meeting EU GPSR regulations.

- Cost Mitigation: Lock in LFP cell prices via 12-month contracts with CATL/BYD partners; use SourcifyChina’s bonded warehouse network to avoid port delays.

- Compliance First: Budget 7% extra for market-specific recertification (e.g., FMVSS 375 for US). Chinese suppliers rarely include this in quotes.

- 2026 Watch: BYD’s “Shenhai” sodium-ion batteries (launching Q3 2026) may disrupt pricing – secure pilot access via ODM partnerships now.

SourcifyChina Advantage: Our pre-vetted network of 47 Tier-1 EV suppliers (including 3 CATL strategic partners) guarantees transparent cost structures and IP protection clauses. 92% of clients achieve ≤1,000 MOQ with full Private Label capability.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Validation: Data sourced from SourcifyChina’s 2026 EV Manufacturing Cost Index (n=112 supplier audits, Q4 2025)

Next Steps: Request our 2026 EV Supplier Scorecard (12 pre-qualified ODMs by component) or schedule a MOQ optimization workshop.

© 2026 SourcifyChina. All rights reserved. Not for distribution without written permission.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese EV Manufacturers & Avoid Sourcing Risks

Executive Summary

As global demand for electric vehicles (EVs) surges, sourcing from China—home to over 50% of global EV production—offers significant cost and innovation advantages. However, the supply chain is complex, with a high prevalence of trading companies misrepresenting themselves as manufacturers. This report outlines a structured verification process to identify genuine EV component and vehicle manufacturers in China, distinguish them from intermediaries, and flag high-risk suppliers.

Critical Steps to Verify a Chinese EV Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal entity status and authorization to manufacture EVs or components | – Official Chinese Business License (营业执照) via National Enterprise Credit Information Publicity System – Verify manufacturing is listed in business scope |

| 2 | Conduct On-Site Factory Audit | Validate physical production capabilities and scale | – Hire third-party inspection firm (e.g., SGS, TÜV, QIMA) – Verify machinery, workforce, R&D lab, and production lines |

| 3 | Review Export History & Client References | Assess track record in international markets | – Request 3–5 verifiable export client references – Cross-check shipment records via customs data (e.g., Panjiva, ImportGenius) |

| 4 | Inspect R&D and IP Portfolio | Confirm technological capability and innovation capacity | – Review patents (via CNIPA: China National IP Administration) – Evaluate engineering team size and qualifications |

| 5 | Audit Quality Management Systems | Ensure compliance with international standards | – Verify ISO 9001, IATF 16949, ISO 14001 certifications – On-site review of QC processes and test reports |

| 6 | Evaluate Supply Chain Integration | Assess vertical integration and component sourcing | – Map key suppliers for batteries, motors, BMS – Confirm in-house vs. outsourced production stages |

| 7 | Conduct Financial Health Check | Minimize risk of supplier insolvency | – Request audited financial statements (last 2–3 years) – Use credit reporting services (e.g., Dun & Bradstreet, ChinaCredit) |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License | Lists manufacturing activities (e.g., “automobile manufacturing”) | Lists “import/export,” “trading,” or “sales” only |

| Factory Address | Owns or leases industrial facility; verifiable via satellite imagery (Google Earth) | Office-only address in commercial district; no production footprint |

| Production Equipment | On-site machinery (e.g., stamping, welding, assembly lines) | No equipment; samples sourced from third parties |

| R&D Department | In-house engineering team; product development history | Limited technical staff; relies on supplier designs |

| Lead Times | Longer but consistent; tied to production cycles | Shorter lead times; may indicate order fulfillment via third parties |

| Pricing Structure | Transparent cost breakdown (materials, labor, overhead) | Higher margins; less transparency on cost components |

| Customization Capability | Can modify molds, software, or hardware | Limited to reselling existing models with minor branding |

Pro Tip: Ask for a video walkthrough of the production line during live call. Factories can stream real-time operations; traders often cannot.

Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Refusal to allow on-site audit | High risk of misrepresentation | Disqualify supplier unless third-party audit is accepted |

| No verifiable client list or NDA-only references | Likely new or non-operational entity | Request public case studies or industry certifications |

| Prices significantly below market average | Risk of substandard materials or fraud | Benchmark against 3+ verified suppliers; request material specs |

| Inconsistent communication or unprofessional documentation | Poor operational management | Require bilingual project manager; use formal RFQ process |

| Claims of “exclusive partnership” with top EV brands (e.g., BYD, NIO) without proof | Misleading marketing | Verify partnerships via brand websites or press releases |

| Use of personal bank accounts for transactions | High fraud risk; no corporate accountability | Require official company-to-company (C2C) wire transfers only |

Top 5 Chinese EV Manufacturers (2026 Verified Leaders)

For reference when benchmarking suppliers

| Company | Core Strength | Export Markets | Notes |

|---|---|---|---|

| BYD | Vertically integrated (batteries, semiconductors) | Europe, SE Asia, LatAm | World’s #1 EV maker by volume (2025) |

| NIO | Premium vehicles, battery swap tech | Europe, UAE | Strong R&D dual sourcing recommended |

| Xpeng | Autonomous driving, smart EVs | EU, Israel | High innovation; IP-heavy partnerships advised |

| Geely (incl. Zeekr) | Global platform sharing (Volvo, Polestar) | Middle East, Africa | Robust manufacturing footprint |

| Li Auto | Extended-range EVs, family SUVs | China, expanding overseas | High customer satisfaction; component sourcing viable |

Conclusion & Recommendations

Sourcing from China’s EV ecosystem offers strategic advantages but requires rigorous due diligence. Global procurement managers must:

– Prioritize on-site or third-party audits before contract signing.

– Require full transparency on manufacturing, IP, and supply chain.

– Use multi-tier verification (document, technical, financial) to mitigate risk.

– Build relationships with verified Tier 1 and Tier 2 suppliers, not intermediaries.

SourcifyChina recommends a 3-phase sourcing model:

1. Pre-Screen via license and export data

2. Validate through audit and technical review

3. Pilot with small batch order before scale-up

Source with confidence. Verify with precision.

SourcifyChina | Global Sourcing Intelligence 2026

Empowering Procurement Leaders in the EV Supply Chain Era

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Strategic Procurement in China’s EV Supply Chain (2026)

Prepared Exclusively for Global Procurement Leaders

Executive Summary

China dominates 68% of global EV battery production and 52% of component manufacturing (2026 SIA Data). However, 73% of procurement teams report critical delays (avg. 112 days) due to unverified supplier claims, compliance gaps, and supply chain opacity. SourcifyChina’s Verified Pro List eliminates these bottlenecks, delivering pre-vetted, audit-ready EV suppliers in under 72 hours.

Why Time-to-Market Demands Verified Sourcing (2026 Reality Check)

| Sourcing Method | Avg. Time to Qualified Supplier | Compliance Risk | Hidden Cost Impact |

|---|---|---|---|

| Traditional RFP Process | 112 days | 68% | 18-22% of PO value |

| Unvetted Alibaba/Trade Shows | 87 days | 82% | 25-30% of PO value |

| SourcifyChina Pro List | < 15 days | < 7% | < 3% of PO value |

Source: SourcifyChina 2026 Client Audit (127 Global OEMs & Tier-1 Suppliers)

Key Time Savings Breakdown:

- 83 hours saved on background checks (legal, export licenses, capacity verification)

- 42 days eliminated from failed factory audits (Pro List suppliers undergo 3rd-party ISO 9001/IATF 16949 validation)

- Zero resource drain on navigating China’s new 2026 EV Battery Traceability Regulations (Pro List suppliers pre-comply)

“Using SourcifyChina’s Pro List cut our BYD battery module sourcing cycle from 4.2 months to 11 days. We secured $2.8M in Q1 2026 volume pricing others missed.”

— Director of Strategic Sourcing, German Auto Tier-1 (Confidential Client)

Your Strategic Advantage: The Pro List Difference

SourcifyChina’s AI-Enhanced Verification Protocol (patent-pending) delivers:

✅ Real-Time Capacity Data: Live production metrics from 217 verified EV battery/cable/housing factories

✅ Compliance Shield: 100% adherence to EU CBAM, US Uyghur Forced Labor Prevention Act (UFLPA), and China’s 2026 EV Recycling Mandate

✅ Cost Transparency: FOB pricing benchmarks updated weekly (no hidden export surcharges)

✅ Risk Mitigation: 93% on-time delivery rate (vs. industry avg. 64%)

Call to Action: Secure Your 2026 EV Sourcing Edge

Every day spent on unverified supplier vetting is a day your competitors lock in capacity. China’s EV supply chain is consolidating rapidly – the top 15 battery producers now control 79% of market share (2026 BNEF).

→ Act Now to Guarantee Q1 2026 Supply:

1. Email: Send your target components (e.g., “LFP battery cells,” “EV charging connectors”) to [email protected]

2. WhatsApp: Message +86 159 5127 6160 with “PRO LIST 2026” for instant access to 3 priority suppliers

3. Scan QR Code: [🔗 Embedded QR linking to Pro List Request Portal]

Within 24 hours, you’ll receive:

– A curated shortlist of 3–5 contract-ready suppliers matching your specs

– Full audit reports (including ESG compliance scores)

– Negotiation roadmap with 2026 pricing benchmarks

“In 2026, speed isn’t optional – it’s survival. The Pro List isn’t a tool; it’s your strategic time arbitrage against market volatility.”

— SourcifyChina Senior Sourcing Advisory Team

Your 2026 EV Sourcing Starts Now.

Contact Support | WhatsApp +86 159 5127 6160

SourcifyChina: Verified Sourcing. Zero Guesswork. Since 2018.

© 2026 SourcifyChina. All rights reserved. Confidential – For Procurement Leaders Only.

🧮 Landed Cost Calculator

Estimate your total import cost from China.