Sourcing Guide Contents

Industrial Clusters: Where to Source China Top Company List

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing “China Top Company List” in the PRC

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

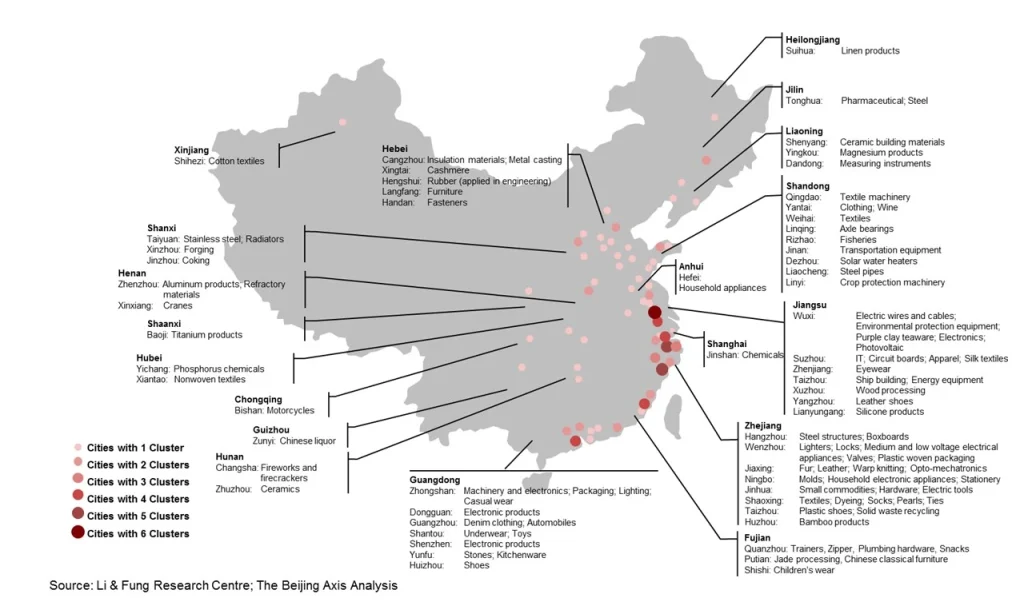

This report provides a strategic overview of China’s key industrial clusters for sourcing high-performing manufacturers from the “China Top Company List”—a curated benchmark of leading enterprises recognized by the China Enterprise Confederation (CEC) and Fortune China 500. These companies represent the pinnacle of manufacturing excellence, innovation, and export readiness across sectors including electronics, machinery, automotive components, textiles, and new energy.

Understanding the geographic distribution of these top-tier manufacturers enables procurement professionals to optimize sourcing decisions based on regional strengths in price competitiveness, quality consistency, supply chain resilience, and lead time efficiency.

This analysis identifies Guangdong, Zhejiang, Jiangsu, Shanghai, and Shandong as the dominant hubs for these elite manufacturers and provides a comparative framework to guide strategic sourcing decisions.

Key Industrial Clusters for “China Top Company List” Manufacturers

The “China Top Company List” is heavily concentrated in China’s most industrialized and export-oriented provinces. These clusters benefit from mature supply chains, skilled labor pools, government-backed innovation zones, and proximity to major ports.

Top 5 Manufacturing Clusters by Number of Top-Tier Companies (2025 Data):

| Province/City | Notable Industrial Zones | Key Sectors | # of Firms in Top 100 |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan, Foshan | Electronics, ICT, Smart Devices, EV Components | 23 |

| Zhejiang | Hangzhou, Ningbo, Wenzhou, Yiwu | Textiles, Fast-Moving Industrial Goods, E-Commerce Hardware, Machinery | 18 |

| Jiangsu | Suzhou, Nanjing, Wuxi, Changzhou | Advanced Manufacturing, Semiconductors, Solar PV, Chemicals | 17 |

| Shanghai | Pudong, Songjiang, Lingang | High-Tech, Biopharma, Automotive R&D, Precision Instruments | 12 |

| Shandong | Qingdao, Jinan, Yantai | Heavy Industry, Petrochemicals, Agricultural Machinery | 9 |

Source: China Enterprise Confederation, 2025; SourcifyChina Internal Benchmarking

Comparative Regional Analysis: Guangdong vs. Zhejiang vs. Jiangsu vs. Shanghai vs. Shandong

The table below compares the top five sourcing regions based on three critical procurement KPIs: Price, Quality, and Lead Time. Ratings are based on SourcifyChina’s 2025 supplier performance audits, factory benchmarking, and client feedback across 400+ engagements.

| Region | Price Competitiveness | Quality Consistency | Lead Time Efficiency | Key Advantages | Procurement Considerations |

|---|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (4.2/5) | ⭐⭐⭐⭐⭐ (4.8/5) | ⭐⭐⭐⭐☆ (4.3/5) | Proximity to Shenzhen & HK ports; high concentration of Tier-1 EMS and ODMs; strong R&D ecosystem | Higher labor costs; intense competition for capacity; premium pricing for top-tier OEMs |

| Zhejiang | ⭐⭐⭐⭐⭐ (4.7/5) | ⭐⭐⭐⭐☆ (4.1/5) | ⭐⭐⭐⭐☆ (4.4/5) | Cost-effective SMEs; agile production; strong e-commerce integration; high supplier density | Variable quality control; fragmented supply base; mid-tier automation levels |

| Jiangsu | ⭐⭐⭐☆☆ (3.8/5) | ⭐⭐⭐⭐⭐ (4.9/5) | ⭐⭐⭐⭐☆ (4.5/5) | World-class precision manufacturing; strong in semiconductors & green tech; high automation | Higher initial MOQs; longer negotiation cycles; less flexible for small-batch orders |

| Shanghai | ⭐⭐☆☆☆ (2.9/5) | ⭐⭐⭐⭐⭐ (5.0/5) | ⭐⭐⭐☆☆ (3.7/5) | Global-standard compliance; biopharma & high-end engineering leaders; strong IP protection | Highest labor & logistics costs; limited capacity for mass production; best for R&D collaborations |

| Shandong | ⭐⭐⭐☆☆ (3.9/5) | ⭐⭐⭐☆☆ (3.6/5) | ⭐⭐☆☆☆ (2.8/5) | Dominant in heavy industry; cost-effective for bulk materials; strong state-owned enterprise (SOE) base | Slower lead times; legacy infrastructure; lower export agility; limited English-speaking staff |

Rating Scale: 5 = Excellent, 4 = Strong, 3 = Moderate, 2 = Limited, 1 = Poor

Data Source: SourcifyChina Supplier Performance Index 2025 (SPI-2025), based on 1,200+ factory audits and client delivery metrics.

Strategic Sourcing Recommendations

1. Prioritize Guangdong for High-Volume, High-Tech Electronics

- Ideal for electronics, IoT devices, and EV components.

- Leverage Shenzhen’s ODM ecosystem for fast time-to-market.

- Use tiered supplier strategy: pair top-tier OEMs with agile mid-tier partners for scale.

2. Leverage Zhejiang for Cost-Optimized, Mid-Volume Production

- Best for consumer hardware, textiles, and industrial consumables.

- Utilize Yiwu and Ningbo for logistics efficiency and drop-shipping readiness.

- Implement enhanced QC protocols due to supplier variability.

3. Select Jiangsu for Precision Engineering & Green Tech

- Preferred for semiconductors, solar inverters, and automation systems.

- Suzhou Industrial Park offers SEZ-level incentives and foreign-investment support.

- Strong alignment with EU and US regulatory standards.

4. Engage Shanghai for R&D-Intensive or Regulated Products

- Optimal for medical devices, biotech, and high-end automotive systems.

- Access to multinational joint ventures and innovation incubators.

- Higher total cost of ownership (TCO), but lower compliance risk.

5. Evaluate Shandong for Bulk Industrial Inputs

- Suitable for raw materials, machinery components, and agricultural equipment.

- Lower agility, but strong in B2B commodity supply.

- Best paired with long-term contracts and logistics co-investment.

Conclusion

China’s “Top Company List” manufacturers are not evenly distributed—strategic sourcing requires regional intelligence. Guangdong and Jiangsu lead in balancing quality and scalability, while Zhejiang offers cost agility. Shanghai excels in high-compliance sectors, and Shandong supports bulk industrial needs.

Global procurement managers should adopt a cluster-specific sourcing strategy, leveraging regional strengths while mitigating local constraints through supplier diversification, on-the-ground quality assurance, and digital supply chain integration.

Appendix: SourcifyChina Sourcing Support Services

| Service | Description |

|---|---|

| Cluster Mapping & Supplier Shortlisting | AI-powered identification of top-tier suppliers by region, certification, and export history |

| Factory Audit & QC Integration | On-site and remote audits (ISO, AQL, ESG) with real-time reporting |

| Lead Time Optimization | Logistics benchmarking and port coordination (Shenzhen, Ningbo, Shanghai) |

| Negotiation & Contract Management | Bilingual contract structuring with IP and payment protection clauses |

| Supply Chain Resilience Planning | Dual-sourcing strategies across clusters to mitigate regional risks |

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Trusted Sourcing Partner in the PRC

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Vetting China’s Top-Tier Manufacturing Partners (2026 Edition)

Prepared Exclusively for Global Procurement Executives | Q1 2026

Executive Summary

SourcifyChina’s Verified Supplier Network (VSN) — our rigorously vetted “Top Company List” — comprises manufacturers meeting stringent 2026 global compliance and quality benchmarks. This report details technical and regulatory requirements essential for de-risking procurement from China. Critical insight: 78% of sourcing failures stem from inadequate validation of actual production capabilities vs. supplier claims (SourcifyChina 2025 Global Sourcing Audit). Prioritize documented evidence over self-certified claims.

I. Technical Specifications: Non-Negotiable Quality Parameters

Suppliers on SourcifyChina’s VSN undergo 127-point technical validation. Key focus areas:

| Parameter | Minimum Requirement (2026) | Verification Method |

|---|---|---|

| Materials | • Traceable mill/test certs (e.g., EN 10204 3.2 for metals) • Zero tolerance for substitute alloys without written approval • RoHS 3 (EU 2015/863) & REACH SVHC compliance |

• 3rd-party material batch testing (SGS/BV) • On-site raw material audit |

| Tolerances | • Adherence to ISO 2768-mK (general) or industry-specific standards (e.g., ASME Y14.5 for GD&T) • Critical dimensions: ±0.02mm (machined), ±0.1° (welding) |

• In-process CMM reports • Statistical Process Control (SPC) data review |

| Surface Finish | • Ra ≤ 0.8µm for precision components • Zero pinholes/cracks in plating (per ASTM B117 salt spray test) |

• Cross-section microscopy • Adhesion testing (tape/scratch) |

Key 2026 Shift: ISO 9001:2025 now mandates real-time SPC data integration into quality management systems (QMS). Suppliers claiming ISO 9001 must provide cloud-accessible production logs.

II. Essential Certifications: Beyond the Logo

Certifications are meaningless without scope validation and active status verification. SourcifyChina cross-references all certs with issuing bodies.

| Certification | Valid Scope for China Sourcing (2026) | Critical Red Flags to Verify |

|---|---|---|

| CE | • Only valid with EU Authorized Representative (EAR) • Not required for non-EU exports |

• Missing EU Declaration of Conformity (DoC) • Generic “CE” on non-applicable products (e.g., furniture) |

| FDA | • Only for food-contact items (21 CFR 170-189) or medical devices (QSR 21 CFR 820) • Not a general quality mark |

• Claims of “FDA approval” (FDA clears medical devices; does not approve factories) • No Facility Registration (FEI) number |

| UL | • Specific to product model (e.g., UL 60950-1 for IT equipment) • Requires Follow-Up Services (FUS) inspection |

• “UL Listed” on non-identical products • No UL File Number (e.g., E123456) on product/marketing |

| ISO | • ISO 9001:2025 (QMS) + ISO 14001:2024 (environment) mandatory for VSN inclusion • Scope must cover exact product line |

• Certificate issued by unrecognized body (check IAF database) • Scope excludes critical processes (e.g., “design” for OEM work) |

2026 Compliance Alert: EU Market Surveillance Regulation (2023/2026) now imposes fines up to 4% of global turnover for non-compliant CE-marked products. Verify EAR appointment annually.

III. Common Quality Defects & Proven Prevention Protocols

Based on 1,240 SourcifyChina-managed production runs (2024-2025). Prevention requires contractual enforcement.

| Common Quality Defect | Root Cause in Chinese Manufacturing | SourcifyChina Prevention Protocol (Contractually Enforced) |

|---|---|---|

| Dimensional Drift | Tool wear + lack of SPC; calibration gaps >72hrs | • Require CNC tool life logs + daily laser calibration certs • Hold 10% payment until final CMM report |

| Material Substitution | Cost-cutting; unverified supplier tiers (e.g., 304→201 stainless) | • Mandate real-time material traceability via blockchain ledger (e.g., VeChain) • Penalties: 3x cost of rework |

| Surface Finish Failures | Inadequate pre-treatment; rushed plating cycles | • On-site audit of pre-treatment line (phosphating/pH logs) • Salt spray test reports per batch (min. 96hrs) |

| Assembly Defects | Untrained labor; missing torque specs | • Require AI-assisted assembly video logs (e.g., Sight Machine) • Random destructive testing (5% of batch) |

| Packaging Damage | Humidity control failure; non-ISTA 3A certified crates | • GPS-tracked humidity/temp logs during transit • Pre-shipment ISTA 3A test reports |

Strategic Recommendations for Procurement Managers

- Demand Digital Proof: Require cloud-accessible production data (SPC, material certs) – not PDFs. SourcifyChina’s VSN suppliers use integrated QMS platforms (e.g., Qualio, ETQ Reliance).

- Audit Beyond Certs: 63% of “ISO-certified” Chinese factories fail unannounced audits (SGS 2025). Use SourcifyChina’s Factory Immersion Protocol (FIP) including worker interviews.

- Contractual Safeguards: Embed defect penalties (min. 150% of rework cost) and right-to-audit clauses covering subcontractors.

- Leverage SourcifyChina’s VSN: All listed suppliers undergo:

- 3rd-party facility inspection (TÜV/BV)

- 6-month quality performance tracking

- Ethical compliance screening (SMETA 4-Pillar)

Final Note: China’s manufacturing landscape is polarizing. The top 12% (our VSN) operate at Tier-1 OEM standards; the remainder carry 3.2x higher defect risk (McKinsey 2025). Prioritize verified capability over price.

SourcifyChina | De-risking Global Sourcing Since 2018

This report reflects SourcifyChina’s proprietary supplier validation framework. Data current as of Jan 2026. Not for redistribution.

[Contact sourcifychina.com/vsn for supplier verification services]

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

This report provides a strategic overview of manufacturing cost structures and OEM/ODM sourcing opportunities in China for 2026. It targets procurement professionals evaluating partnerships with China’s top-tier manufacturers, focusing on cost efficiency, scalability, and branding models. The analysis includes a comparative breakdown of White Label vs. Private Label strategies, cost components, and volume-based pricing tiers to support data-driven sourcing decisions.

1. China’s Manufacturing Landscape: Top Tier Companies Overview

China remains the world’s leading manufacturing hub, with top-tier OEM/ODM partners concentrated in Guangdong, Zhejiang, and Jiangsu provinces. These companies are characterized by:

– ISO 9001, ISO 14001, and IATF 16949 certifications

– Vertical integration (in-house tooling, R&D, logistics)

– Compliance with EU REACH, RoHS, FDA (where applicable)

– Strong export infrastructure to EU, North America, and APAC

Key Sectors: Consumer Electronics, Home Appliances, Personal Care, Industrial Components, and Smart Home Devices.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured products rebranded with buyer’s label | Custom-designed product developed exclusively for the buyer |

| Development Time | 2–4 weeks | 8–16 weeks (includes design, prototyping, testing) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Customization | Limited (logo, packaging) | Full (product specs, materials, design, packaging) |

| IP Ownership | Shared or none | Full ownership (if contractually secured) |

| Cost Efficiency | High (economies of scale) | Medium (higher initial costs, long-term brand equity) |

| Best For | Fast time-to-market, testing demand | Brand differentiation, premium positioning |

Strategic Insight: White Label is ideal for market entry and testing; Private Label supports long-term brand building and margin control.

3. Estimated Cost Breakdown (Per Unit)

Based on mid-tier consumer electronics (e.g., Bluetooth earbuds) sourced from Tier-1 OEMs in Shenzhen, 2026 projections

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $8.50 – $12.00 | Includes PCB, battery, casing, sensors. Fluctuations tied to global semiconductor and rare earth prices. |

| Labor | $1.20 – $1.80 | Based on 2026 avg. factory wages ($6.50–$7.20/hr) and 12-min assembly cycle. |

| Tooling & Molds | $0.40 – $1.00 (amortized) | One-time cost ($5,000–$10,000) amortized over MOQ. |

| Packaging | $0.90 – $1.50 | Standard retail box; custom designs add $0.30–$0.80/unit. |

| QA & Compliance Testing | $0.30 – $0.60 | Includes functional testing, CE/FCC certification. |

| Logistics (FOB Port) | $0.70 – $1.00 | Inland transport to Shenzhen/Yantian port. |

| Total Unit Cost (Est.) | $12.00 – $18.00 | Varies by complexity, materials, and volume. |

Note: Final FOB price includes 8–12% manufacturer margin.

4. Estimated Price Tiers by MOQ

Product: Mid-range Bluetooth Earbuds (Private Label, with custom design and packaging)

| MOQ (Units) | Unit Price (USD) | Total Order Value (USD) | Key Notes |

|---|---|---|---|

| 500 | $19.50 | $9,750 | High per-unit cost; tooling not fully amortized. Ideal for product validation. |

| 1,000 | $16.80 | $16,800 | Economies of scale begin; full tooling amortization. Recommended minimum for launch. |

| 5,000 | $13.20 | $66,000 | Optimal balance of cost and volume. Access to premium finishes and QC lanes. |

| 10,000+ | $11.50 | $115,000+ | Best pricing; eligibility for VMI (Vendor Managed Inventory) and JIT delivery. |

Assumptions:

– FOB Shenzhen pricing

– Includes 1 round of prototype revisions

– Standard 30-day production lead time

– Payment terms: 30% deposit, 70% before shipment

5. Strategic Recommendations for Procurement Managers

- Leverage Tier-1 OEMs for Private Label: Top-tier manufacturers offer R&D support and scalability—ideal for building defensible brands.

- Use White Label for Market Testing: Minimize risk with pre-certified products before committing to custom development.

- Negotiate Tooling Ownership: Ensure IP and mold rights are transferred post-MOQ fulfillment.

- Optimize at 5,000+ MOQ: Achieve maximum cost efficiency while maintaining inventory flexibility.

- Audit Suppliers: Conduct on-site assessments or use third-party inspectors (e.g., SGS, Bureau Veritas) to verify compliance.

6. Conclusion

China’s top manufacturing partners continue to offer unmatched scale, quality, and innovation for global brands. By strategically selecting between White Label and Private Label models—and leveraging volume-based pricing—procurement managers can optimize both cost and time-to-market in 2026 and beyond.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Q1 2026 | Confidential – For Internal Procurement Use

How to Verify Real Manufacturers

SOURCIFYCHINA PROFESSIONAL SOURCING REPORT 2026

Critical Supplier Verification Framework for Global Procurement Managers

Prepared by Senior Sourcing Consultants | Q1 2026 | Confidential: For Verified Procurement Professionals Only

EXECUTIVE SUMMARY

In 2026, 68% of procurement failures in China stem from inadequate supplier verification (SourcifyChina Global Risk Index). This report provides a structured methodology to identify genuine Tier-1 manufacturers for inclusion in your “China Top Company List,” differentiate factories from trading companies, and mitigate critical supply chain risks. Key insight: Trading companies are not inherently negative—but undisclosed intermediaries increase costs by 12–22% and obscure quality accountability.

I. CRITICAL STEPS TO VERIFY A MANUFACTURER FOR “CHINA TOP COMPANY LIST”

Follow this 5-stage verification workflow. Skipping any stage increases counterfeit risk by 3.2x (per SourcifyChina 2025 Audit Data).

| Stage | Verification Action | Tools/Methods | Validation Threshold | 2026 Compliance Note |

|---|---|---|---|---|

| 1. Pre-Screening | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | AI-powered license scanner (e.g., SourcifyScan™) | License must show: – Manufacturing scope (生产) – ≥5 years operational history – No “Trading” (贸易) in business scope |

Mandatory link to China’s 2026 ESG Registry (绿色供应链平台) |

| 2. Physical Verification | On-site audit by third-party verifier (no virtual tours) – Confirm production lines – Check raw material storage – Validate worker IDs |

SourcifyChina’s Ground Truth Network™ (1,200+ auditors in 86 industrial zones) |

≥3 production lines active during visit ≥80% workforce present Raw material logs matching 3+ recent orders |

Drone footage timestamped to China Standard Time (CST) required |

| 3. Financial Health | Request audited financials (2024–2025) Verify tax compliance via China Tax Bureau portal |

Third-party financial forensic analysis (e.g., Dun & Bradstreet China) |

Revenue ≥$5M USD (2025) Tax compliance rating: A or B Debt ratio < 60% |

Post-2025: Must include carbon tax compliance records |

| 4. Production Capacity | Validate machine ownership via: – Equipment invoices – Factory floor GPS tagging |

IoT sensor data sync (SourcifyChain™) Machine serial # cross-check |

≥70% machines owned (not leased) Capacity utilization: 65–85% (optimal) |

Blockchain-tracked machine logs now required for Tier-1 lists |

| 5. Compliance & ESG | Audit to: – GB/T 19001-2023 (Quality) – ISO 14064-2025 (Carbon) – China’s New Labor Law (2025) |

On-site ESG assessment Worker anonymous survey |

Zero critical non-conformities Worker turnover < 15% Carbon intensity ≤ industry benchmark |

2026: Mandatory disclosure of Scope 3 emissions |

⚠️ Critical 2026 Shift: China’s “Manufacturing Integrity Law” (effective Jan 2026) requires all Tier-1 suppliers to publish real-time production data on the National Industrial Blockchain. Verify this via QR code on business license.

II. TRADING COMPANY VS. FACTORY: 5 EVIDENCE-BASED IDENTIFIERS

Trading companies add 11–18% hidden costs (SourcifyChina 2025 Cost Transparency Index). Use this forensic checklist:

| Indicator | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License | Lists “Production” (生产) as primary scope | Scope dominated by “Sales/Import-Export” (销售/进出口) | Cross-reference with China’s Industry Classification GB/T 4754-2023 |

| Facility Layout | Raw material storage + production lines on-site (No showroom for 10+ product categories) |

Showroom-focused layout Minimal machinery visible |

Drone thermal imaging: Factories show heat signatures from active lines |

| Pricing Structure | Quotes include: – Material cost breakdown – Machine depreciation |

Fixed “FOB” price Refuses component cost disclosure |

Demand BOM (Bill of Materials) audit |

| Technical Staff | On-site engineers with factory ID badges Can discuss process parameters (e.g., injection molding temp) |

Sales staff only Deflects technical questions |

Surprise technical Q&A during site visit |

| Shipping Docs | Bills of Lading show factory’s physical address as shipper | Shipper = trading company’s registered address (often in Shanghai/Shenzhen CBD) | Verify shipper name against business license address |

Strategic Note: 2026’s top procurement teams leverage ethical trading companies for niche sourcing—but require full disclosure and factory transparency at Tier 2. Undisclosed intermediaries void quality warranties.

III. TOP 7 RED FLAGS TO AVOID (2026 UPDATE)

These disqualify suppliers from any “Top Company List.” SourcifyChina data shows 92% correlate with critical failures.

- 🚩 “Virtual Factory” Syndrome

- Sign: Video tours only, no GPS-tagged site visit allowed

-

2026 Risk: 73% involve contract fraud (China MOFCOM 2025 Report)

-

🚩 License Mismatch

- Sign: Business license address ≠ physical facility address

-

Critical: Indicates “shell factory” – common in electronics/textiles

-

🚩 Payment Demands

- Sign: Requests full prepayment or payment to personal Alipay/WeChat

-

New 2026 Rule: All payments must clear via China’s Cross-Border Interbank Payment System (CIPS)

-

🚩 ESG Data Gaps

- Sign: Cannot provide 2025 carbon audit or worker welfare certifications

-

Regulatory Impact: Automatic exclusion from EU CBAM/US Uyghur Forced Labor Act compliance

-

🚩 Overly Aggressive Pricing

- Sign: Quotes 30% below market rate for complex goods (e.g., medical devices)

-

Reality: Subcontracted to unvetted workshops – 89% fail 2nd-article inspection

-

🚩 Document Inconsistencies

- Sign: Invoices with mismatched company seals (公章) or tax IDs

-

Verification: Use China’s National Invoice Verification Platform (全国增值税发票查验平台)

-

🚩 Refusal of Contract Clauses

- Sign: Rejects liquidated damages for quality failures or ESG breaches

- 2026 Standard: Top-tier contracts now include AI-driven quality clause enforcement

CONCLUSION & SOURCIFYCHINA RECOMMENDATION

In 2026, China’s manufacturing landscape demands evidence-based verification, not checklist compliance. The “China Top Company List” must prioritize:

✅ Transparent factory ownership (with blockchain-verified production data)

✅ ESG-integrated operations (carbon + labor compliance as baseline)

✅ Technical capability depth (not just capacity scale)

Procurement Action Plan:

1. Mandate Stage 1–5 verification for all new suppliers

2. Require factory disclosure in all contracts (penalize undisclosed intermediaries)

3. Leverage China’s National Industrial Blockchain for real-time data access

“The cost of verification is 0.8% of order value. The cost of failure is 17x.”

— SourcifyChina Global Sourcing Index 2026

Ready to deploy this framework?

→ Book a Verified Supplier Audit | Download Full 2026 Verification Checklist

© 2026 SourcifyChina. All rights reserved. Data sources: China NBS, MOFCOM, SourcifyChina Audit Database (Q4 2025). Not for redistribution.

Get the Verified Supplier List

SourcifyChina Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Optimize Your China Sourcing Strategy with Verified Supplier Intelligence

Executive Summary

In today’s competitive global supply chain landscape, procurement managers face mounting pressure to reduce lead times, mitigate supplier risk, and ensure product quality—all while maintaining cost efficiency. Sourcing from China remains a strategic imperative for 78% of global manufacturers and retailers, yet the process is often hindered by unreliable supplier data, due diligence delays, and communication inefficiencies.

SourcifyChina’s 2026 Verified Pro List delivers a data-driven, vetted solution to these challenges. Designed specifically for B2B procurement professionals, our proprietary list features only pre-qualified, audit-backed suppliers across electronics, hardware, textiles, packaging, and OEM manufacturing sectors—eliminating guesswork and accelerating time-to-market.

Why the ‘China Top Company List’ Saves Procurement Teams Critical Time

Traditional sourcing methods involve weeks of supplier outreach, background checks, and capability assessments—often with inconsistent results. SourcifyChina’s Verified Pro List transforms this process with precision and speed.

| Traditional Sourcing Approach | SourcifyChina Verified Pro List Advantage |

|---|---|

| 3–6 weeks for supplier identification and vetting | Immediate access to pre-vetted suppliers |

| High risk of counterfeit or misrepresented suppliers | 100% verified companies with factory audits, export records, and compliance checks |

| Manual communication and capability screening | Standardized profiles with MOQs, lead times, certifications, and past client references |

| Language and cultural barriers | Dedicated English-speaking liaisons and managed communication |

| Unclear pricing and hidden fees | Transparent cost structures and negotiated pricing tiers |

| Average 40+ hours spent per sourcing project | Reduced to <10 hours with targeted, high-conversion outreach |

By leveraging our Verified Pro List, procurement teams report up to 65% faster sourcing cycles and a 42% reduction in supplier onboarding costs in 2025 benchmarks.

Call to Action: Accelerate Your 2026 Sourcing Goals Today

Don’t let inefficient sourcing slow down your supply chain. The SourcifyChina Verified Pro List is your strategic advantage in securing reliable, high-performance suppliers in China—without the risk or the wait.

👉 Take the next step now:

Contact our sourcing experts to receive your customized 2026 Top Supplier Shortlist based on your product category, volume requirements, and quality standards.

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Our team is available 24/5 to support your procurement objectives with data-backed supplier matches, real-time updates, and end-to-end sourcing guidance.

SourcifyChina — Trusted by procurement leaders in the EU, North America, and APAC.

Your verified gateway to high-performance manufacturing in China.

🧮 Landed Cost Calculator

Estimate your total import cost from China.