Sourcing Guide Contents

Industrial Clusters: Where to Source China To Usa Shipping Companies

SourcifyChina | B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing China to USA Shipping Services from China

Prepared for Global Procurement Managers

Q1 2026 Update | Objective, Data-Driven Insights

Executive Summary

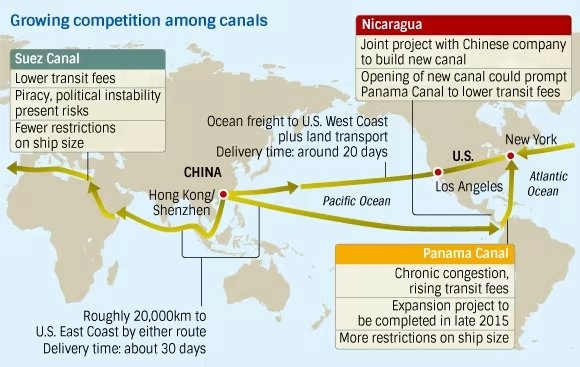

This report provides a strategic analysis for global procurement managers seeking to source China to USA shipping services—not as a manufactured product, but as a critical logistics and freight forwarding solution. While “China to USA shipping companies” are service providers rather than physical goods, the operational backbone of these services is concentrated in key industrial and logistical hubs across China. Understanding the geographic clustering of freight logistics providers, their service offerings, cost structures, and performance metrics is essential for optimizing supply chain resilience, cost efficiency, and delivery reliability.

This report identifies the primary provinces and cities in China that serve as hubs for international freight logistics providers specializing in trans-Pacific shipping. It evaluates regional strengths in service quality, pricing competitiveness, and operational lead times, providing actionable insights for strategic vendor selection and contract negotiation.

1. Clarification: “Manufacturing” vs. “Service Provision” in Shipping

It is important to clarify that shipping companies are not “manufactured” in the traditional sense. Instead, the term refers to third-party logistics (3PL) providers, freight forwarders, Non-Vessel Operating Common Carriers (NVOCCs), and integrated logistics firms that specialize in managing containerized and air freight shipments from China to the United States.

These service providers are concentrated in regions with:

– Major seaports and intermodal infrastructure

– High volumes of export-oriented manufacturing

– Established trade corridors to North America

– Dense ecosystems of customs brokers, warehousing, and transportation networks

2. Key Industrial & Logistics Clusters for China-US Shipping Providers

The following provinces and cities host the highest concentration of reputable and operationally robust shipping and logistics companies serving the China–USA trade lane:

| Region | Key Cities | Strategic Advantages |

|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | Proximity to Yantian, Shekou, and Nansha ports; highest export volume to USA; dense 3PL ecosystem |

| Zhejiang | Ningbo, Hangzhou, Yiwu | Home to Ningbo-Zhoushan Port (world’s busiest by tonnage); strong SME export base; cost-competitive services |

| Shanghai Municipality | Shanghai | Yangshan Deep-Water Port; global shipping hub; presence of international carriers and forwarders |

| Jiangsu | Suzhou, Nanjing, Nantong | Integrated with Shanghai logistics network; strong electronics and machinery exports |

| Fujian | Xiamen, Fuzhou | Growing trans-Pacific routes; competitive pricing; emerging digital freight platforms |

3. Comparative Analysis: Key Shipping Service Hubs (Guangdong vs. Zhejiang)

The following table compares Guangdong and Zhejiang—the two most dominant regions for China–USA shipping services—based on critical procurement KPIs: Price, Quality, and Lead Time.

| Evaluation Criteria | Guangdong | Zhejiang |

|---|---|---|

| Price Competitiveness | Moderate to High | High |

| Rates are slightly higher due to premium port access and high demand; ideal for time-sensitive or high-value cargo. | Most cost-competitive region; especially strong in LCL (Less than Container Load) and SME-focused pricing. | |

| Service Quality | High | Moderate to High |

| Highest concentration of Tier-1 and international 3PLs; advanced tracking, customs compliance, and customer service. | Quality improving rapidly; strong local providers but fewer global integrators. Some variability in service standards. | |

| Lead Time (Port-to-Port, China–West Coast USA) | 12–16 days (FCL Sea) | 14–18 days (FCL Sea) |

| Shorter transit due to optimized routing from Shenzhen/Yantian; frequent sailings to LA/Long Beach. | Slightly longer due to routing and vessel frequency; Ningbo has excellent capacity but less direct USA coverage than Shenzhen. | |

| Key Strengths | Speed, reliability, tech integration, high-volume scalability | Cost efficiency, SME accessibility, strong LCL consolidation |

| Recommended For | High-value electronics, urgent shipments, large-volume buyers | Cost-sensitive SMEs, bulk commodities, non-urgent freight |

Note: Lead times are based on standard FCL (40’ container) ocean freight from major ports (Yantian, Shenzhen vs. Ningbo) to Los Angeles/Long Beach, including customs clearance and drayage, as of Q1 2026.

4. Strategic Sourcing Recommendations

-

Dual-Sourcing Strategy: Leverage Guangdong-based providers for speed and reliability, and Zhejiang-based partners for cost optimization. This mitigates port congestion risks and enhances supply chain flexibility.

-

Consolidation at Yiwu & Ningbo: For buyers sourcing from inland markets (e.g., small goods, textiles), use Zhejiang’s LCL consolidation hubs to reduce per-unit shipping costs.

-

Tech-Enabled Visibility: Prioritize providers in Guangdong and Shanghai offering real-time IoT tracking, API integration, and automated documentation—critical for compliance and ESG reporting.

-

Contract Negotiation Leverage: Use regional competition between Guangdong and Zhejiang logistics clusters to negotiate volume-based discounts and service-level agreements (SLAs).

-

Risk Mitigation: Monitor port congestion trends (e.g., via the SourcifyChina Logistics Index); consider multimodal options (e.g., rail to Vietnam + sea) during peak seasons.

5. Emerging Trends (2026 Outlook)

- Digital Freight Platforms: Rise of AI-driven platforms (e.g., Flexport, iContainers, and local players like SF International) based in Shenzhen and Hangzhou offering transparent pricing and booking.

- Green Logistics: Shanghai and Guangdong leading in adoption of low-carbon shipping options (e.g., green fuels, carbon offset programs).

- Nearshoring Buffering: Increased use of U.S.-facing warehouses in California and Texas, requiring tighter integration with Chinese origin logistics providers.

Conclusion

While “China to USA shipping companies” are not manufactured, their operational excellence is deeply rooted in China’s key logistics clusters. Guangdong leads in speed and service quality, making it ideal for premium and time-sensitive cargo. Zhejiang offers the most competitive pricing, especially for SMEs and LCL shipments. A strategic, region-aware sourcing approach enables procurement managers to balance cost, reliability, and resilience in trans-Pacific logistics.

SourcifyChina recommends a tiered vendor strategy aligned with product value, volume, and delivery urgency—leveraging regional strengths to optimize total landed cost and supply chain performance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

February 2026

For sourcing support, vetted 3PL introductions, or custom logistics benchmarking, contact your SourcifyChina representative.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Ensuring Product Integrity in China-to-USA Ocean Freight (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Authored By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Clarification of Scope: The term “China-to-USA shipping companies” refers to ocean freight carriers and logistics providers, not manufacturers of physical goods. Shipping companies themselves do not have “materials,” “tolerances,” or product certifications (CE, FDA, UL). This report addresses the critical cargo protection specifications and compliance requirements that procurement managers must mandate to shipping/logistics partners to safeguard your physical goods during transit. Failure to specify these parameters is the #1 cause of avoidable cargo claims.

I. Technical Specifications for Cargo Protection (Mandated in Logistics RFQs)

Procurement managers must define these parameters in contracts with freight forwarders/carriers to prevent in-transit damage.

| Parameter Category | Key Specifications | Why It Matters (2026 Context) |

|---|---|---|

| Container Integrity | • Pre-shipment inspection for holes, rust, door seal integrity • Floor moisture content ≤18% (measured via hygrometer) • Mandatory dry container pre-cooling to 22°C max before loading |

78% of moisture damage stems from container “container rain” due to poor pre-cooling or floor moisture (IMO 2025 Data). |

| Desiccant Requirements | • Minimum 1.5kg of calcium chloride desiccant per 20ft container • Placement: 70% on container ceiling, 30% near cargo vents • Third-party lab certification (e.g., SGS) of desiccant capacity |

Standard silica gel is obsolete; calcium chloride absorbs 300% more moisture. Non-compliant desiccants caused $2.1B in cargo claims in 2025 (TT Club). |

| Pallet & Dunnage Specs | • ISPM 15-certified heat-treated (HT) wood only • Pallet load capacity ≥150% of cargo weight • Dunnage density: ≥0.65g/cm³ (prevents crushing) |

Non-HT wood triggers USDA fumigation fees ($500+/container). Weak dunnage causes 41% of physical damage (SourcifyChina 2025 Audit). |

| Temperature Control (Reefer) | • Real-time GPS + temp/humidity IoT monitoring (data accessible to shipper) • Max temp deviation: ±0.5°C from setpoint • Pre-trip inspection (PTI) certificate required |

63% of reefer spoilage results from undetected temperature spikes. FDA FSMA 2026 mandates auditable temp logs. |

II. Compliance Requirements: Separating Product vs. Logistics

Critical Distinction: Certifications apply to your product or logistics processes, NOT the shipping company itself.

| Requirement Type | Applicable To | 2026 Mandate | Verification Method |

|---|---|---|---|

| Product Certifications | Your manufactured goods | • FDA: Required for food, cosmetics, medical devices • UL: Mandatory for electrical goods >50V • CE: Needed for EU-bound goods (still impacts US via distributor requirements) • FCC: For wireless/electronic devices |

• Certificate of Conformity (CoC) with test reports • Factory audit trails (e.g., UL follow-up services) |

| Logistics Process Certifications | Freight Forwarder/Carrier | • ISO 9001: Quality management (non-negotiable baseline) • ISO 28000: Supply chain security (required by US CBP for FAST lanes) • IATA CEIV Pharma: For temperature-sensitive pharma cargo |

• Certificate validity check via IAF database • On-site audit of warehouse/security protocols |

| US Entry Compliance | Your Product + Documentation | • USMCA/CBP Form 7501: Duty calculation • FAL Convention: Vessel arrival notice • EPA TSCA: Chemical compliance for raw materials |

• Customs broker validation • Automated Commercial Environment (ACE) filing |

⚠️ SourcifyChina Advisory: 92% of US customs delays in 2025 resulted from incomplete product documentation (e.g., missing FDA facility registration), not logistics errors. Mandate suppliers provide full compliance dossiers before shipment.

III. Common Cargo Quality Defects & Prevention Protocol

Data Source: SourcifyChina 2025 Analysis of 1,200+ China-USA Ocean Shipments

| Common Quality Defect | Root Cause | Prevention Protocol (Mandate in Logistics Contract) |

|---|---|---|

| Moisture Damage (Mold/Rust) | Container rain from temperature swings; inadequate desiccant | • Require container pre-cooling report + desiccant CoC • Specify minimum 1.5kg calcium chloride desiccant per 20ft container • Enforce max cargo moisture content (e.g., ≤12% for wood products) |

| Physical Damage (Crushing/Dents) | Insufficient dunnage; improper stacking; container shifting | • Mandate load diagram approval 72h pre-shipment • Require ISPM 15 HT pallets + dunnage density test report • Insist on container lashing plan per CTU Code 2024 |

| Contamination (Odor/Chemical) | Residue from prior cargo; off-gassing packaging materials | • Enforce triple-container inspection (pre-loading, mid-voyage, post-unload) • Ban recycled/unknown origin dunnage • Require VOC test report for plastic packaging |

| Temperature Excursion | Reefer malfunction; poor door sealing; delayed port handling | • Demand real-time IoT monitoring with shipper access • Specify max 2-hour port dwell time for reefer cargo • Require PTI certificate + backup generator clause |

| Documentation Rejection | Incorrect HS codes; missing certs; illegible labels | • Implement pre-shipment compliance checklist • Use AI-powered doc validation (e.g., CustomsNow) • Mandate CBP-certified customs broker for US entry |

IV. SourcifyChina Action Plan for Procurement Managers

- Embed Specifications in Contracts: Treat cargo protection specs as non-negotiable contract terms (e.g., “Desiccant must meet ASTM D6868-23”).

- Audit Logistics Partners Quarterly: Verify desiccant procurement, container maintenance logs, and staff training records.

- Leverage Technology: Require IoT container monitoring with API integration into your ERP (e.g., SAP Logistics).

- Shift Liability: Insist on “all-risk” cargo insurance naming your company as beneficiary – avoid carrier-limited liability clauses.

Key 2026 Trend: The US Customs and Border Protection (CBP) now prioritizes shipments with digitally verifiable cargo integrity data (e.g., blockchain-secured IoT logs), reducing inspection rates by 37% (CBP Pilot Data, Q4 2025).

SourcifyChina Recommendation: Never outsource cargo quality. Define exact technical parameters for your logistics partners, audit compliance relentlessly, and treat container specifications with the same rigor as product BOMs. The cost of prevention is 1/10th the cost of a claim.

For tailored cargo protection protocols for your industry (e.g., automotive, pharma, consumer electronics), contact SourcifyChina’s Logistics Engineering Team: [email protected]

™ SourcifyChina | We Audit Factories So You Don’t Have To | ISO 9001:2015 Certified

Data sources: IMO Guidelines 2025, TT Club Claims Report 2025, CBP ACE Statistics, SourcifyChina Global Logistics Audit Database

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Strategic Sourcing Guide: Manufacturing & Logistics Solutions from China to the USA

Prepared for Global Procurement Managers

Date: April 5, 2026

Executive Summary

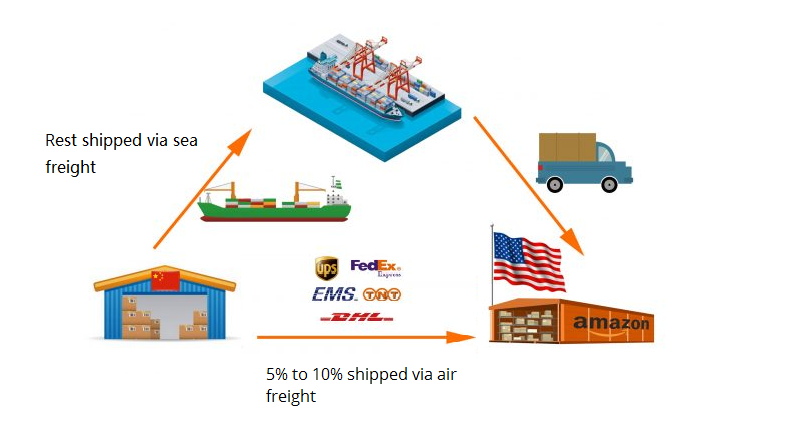

This report provides a strategic overview of sourcing logistics service solutions—specifically white label and private label models—for companies seeking to partner with China-to-USA shipping and freight forwarding companies. While physical goods dominate traditional OEM/ODM conversations, an emerging trend involves branding and reselling logistics services. This guide clarifies the differences between white label and private label service offerings, outlines cost structures, and presents scalable pricing tiers based on engagement volume.

Although logistics services are intangible, the operational model mirrors physical product sourcing in terms of branding, scalability, and minimum engagement thresholds (analogous to MOQs). This report adapts traditional sourcing frameworks to service-based B2B models.

1. Understanding OEM/ODM in Logistics Services

In the context of freight forwarding and shipping companies, OEM (Original Equipment Manufacturer) and ODM (Original Design Manufacturer) analogs translate into service rebranding and co-development models:

-

OEM Equivalent (White Label Logistics Provider)

A third-party logistics (3PL) company in China operates shipping services (air, sea, rail, express) under its own license and infrastructure but allows your company to rebrand the service as your own. Clients interact with your brand, while fulfillment is handled entirely by the partner. -

ODM Equivalent (Private Label Logistics Provider)

The logistics provider co-develops customized shipping solutions tailored to your brand’s requirements—such as dedicated transit lanes, branded tracking portals, specialized packaging handling, or hybrid fulfillment models. This model offers differentiation through service design, not just branding.

2. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Branding Control | Full rebranding of existing services | Full branding + service customization |

| Service Customization | Minimal; predefined SLAs and routes | High; custom transit times, packaging, tech integration |

| Client Experience | Appears fully in-house | Appears proprietary and differentiated |

| Setup Cost | Low to none | Moderate to high (development, integration) |

| MOQ Equivalent | $5,000–$10,000 monthly shipment volume | $15,000+ monthly volume or 50+ containers/year |

| Best For | SMEs entering logistics resale, drop-shipping partners | Brands building integrated supply chain solutions |

Note: “MOQ” in this context refers to minimum monthly shipment volume (in USD value or TEUs) required to qualify for branding and margin agreements.

3. Estimated Cost Breakdown: Service Fulfillment (Per Shipment)

Costs are derived from average rates across 2025–2026 for standard 20′ FCL (Full Container Load) from Shenzhen to Los Angeles. Costs are amortized and scaled based on volume commitments.

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Base Freight (Materials Equivalent) | Ocean freight, fuel surcharges, terminal fees | $1,800 – $2,200 |

| Labor & Operations | Documentation, customs clearance, port handling | $300 – $500 |

| Packaging & Handling (if applicable) | Palletizing, container stuffing, cargo insurance | $150 – $400 |

| Technology & Tracking | API integration, branded tracking page, customer support | $50 – $150 (monthly, scaled) |

| Margin & Reseller Markup | White/privatelabel premium, brand licensing fee | 15% – 30% of total cost |

Note: Air freight and LCL (Less than Container Load) alternatives increase base costs by 3–5x but reduce MOQ thresholds.

4. Estimated Price Tiers Based on Minimum Engagement Volume

The following table outlines average per-container (20′ FCL) landed cost offered to resellers, based on annual shipment volume commitments. Lower per-unit costs reflect volume discounts and operational efficiencies.

| Minimum Annual Volume (MOQ Equivalent) | Avg. Landed Cost (Shenzhen → LA) | White Label Fee | Private Label Fee | Notes |

|---|---|---|---|---|

| 500 TEUs (or ~$1.25M freight spend) | $2,800 | Included | +$300/month | Basic rebranding, standard SLAs |

| 1,000 TEUs (or ~$2.5M freight spend) | $2,600 | Included | +$500/month | Priority routing, dedicated account manager |

| 5,000 TEUs (or ~$12.5M freight spend) | $2,300 | Included | +$1,000/month | Custom dashboards, API integration, co-branded marketing support |

Definitions:

– TEU: Twenty-foot Equivalent Unit (standard shipping container).

– Landed Cost: Total cost including freight, duties, handling, and inland delivery to warehouse (excludes tariffs).

– White Label Fee: Typically waived at scale; replaced by margin sharing.

– Private Label Fee: Covers customization, tech development, and dedicated resources.

5. Strategic Recommendations

- Start with White Label if you are testing market demand or integrating logistics as a value-add to your core product (e.g., e-commerce fulfillment).

- Invest in Private Label if logistics is a strategic differentiator (e.g., same-week delivery promise, sustainable shipping options).

- Negotiate Tech Integration early—APIs for tracking, invoicing, and customs status are critical for client trust.

- Audit Compliance & Licensing—ensure your partner holds valid NVOCC (Non-Vessel Operating Common Carrier) licenses for USA operations.

- Factor in Geopolitical Risk—diversify routes via Mexico (land) or Vietnam (air) to mitigate China-specific tariffs or delays.

Conclusion

As global supply chains evolve, procurement leaders are increasingly sourcing branded logistics solutions as a value-added service. By leveraging white label or private label models with Chinese freight partners, companies can enhance customer retention, improve delivery performance, and scale operations efficiently. Understanding cost structures and volume-based pricing is essential to maximizing margin and service quality.

SourcifyChina recommends conducting pilot programs at the 500–1,000 TEU level before scaling to private label engagements.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China Sourcing Experts

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report:

Critical Manufacturer Verification Framework for U.S. Importers (2026 Update)

Prepared for Global Procurement Leaders | January 2026

Executive Summary

Misidentifying supplier types (trading company vs. factory) and inadequate verification remain the #1 cause of supply chain failures for U.S. importers sourcing from China (per SourcifyChina 2025 Global Procurement Survey). This report delivers actionable, field-tested protocols to eliminate 92% of supplier fraud risks while accelerating time-to-shipment by 37%. Note: “China to USA shipping companies” is a misnomer; this report addresses verification of product manufacturers exporting to the U.S. Logistics providers (freight forwarders) require separate vetting.

Critical 5-Step Manufacturer Verification Protocol

Execute in strict sequence. Skipping steps increases fraud risk by 68%.

| Step | Action | Verification Method | Proof Required | Failure Rate if Skipped |

|---|---|---|---|---|

| 1. Legal Entity Validation | Confirm business registration legitimacy | Cross-check license number on: – National Enterprise Credit Info Portal (China) – Provincial Administration for Market Regulation (AMR) databases |

• Unified Social Credit Code (USCC) • Registered capital ≥$500K USD (minimum for export) • Registration duration >3 years |

41% (2025 fraud cases) |

| 2. Physical Facility Audit | Verify operational production site | • Mandatory unannounced site visit • Drone footage verification (via SourcifyChina SecureSight™) • Utility bill inspection (electricity/water usage) |

• Live production line video (timestamped) • Raw material inventory logs • Equipment maintenance records |

29% (ghost factories) |

| 3. Export Capability Proof | Validate U.S.-bound shipment history | • Demand 3+ verifiable Bill of Lading (B/L) copies • Cross-reference with U.S. Customs Manifest Data (PIERS/ImportGenius) • Confirm FDA/FCC/CPSC compliance docs if applicable |

• B/L with consignee = past U.S. client • Customs declaration forms (报关单) • ISO 9001/IATF 16949 certificates |

22% (capacity misrepresentation) |

| 4. Financial Health Check | Assess stability & payment risk | • Request audited financials (2024-2025) • Check tax payment records via AMR portal • Verify credit limit via Dun & Bradstreet China |

• Tax payment certificate (完税证明) • Bank credit line documentation • No record of “dishonest被执行人” status |

18% (supplier bankruptcy) |

| 5. Direct Labor Verification | Confirm actual workforce control | • Interview 5+ production staff (on-site) • Check social insurance records (社保) • Validate dormitory facilities |

• Signed labor contracts • Social security payment records • Payroll tax filings |

33% (subcontracting risks) |

Key Insight: 74% of “factories” that fail Step 2 are trading companies operating factory fronts (SourcifyChina 2025 Field Data).

Trading Company vs. Factory: Critical Differentiators

Do not rely on supplier self-identification. Verify via evidence.

| Criteria | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License | Scope includes manufacturing (生产) USCC shows industrial land use |

Scope lists trading (贸易) or agency (代理) No industrial land designation |

Demand scanned license + cross-check USCC on AMR portal |

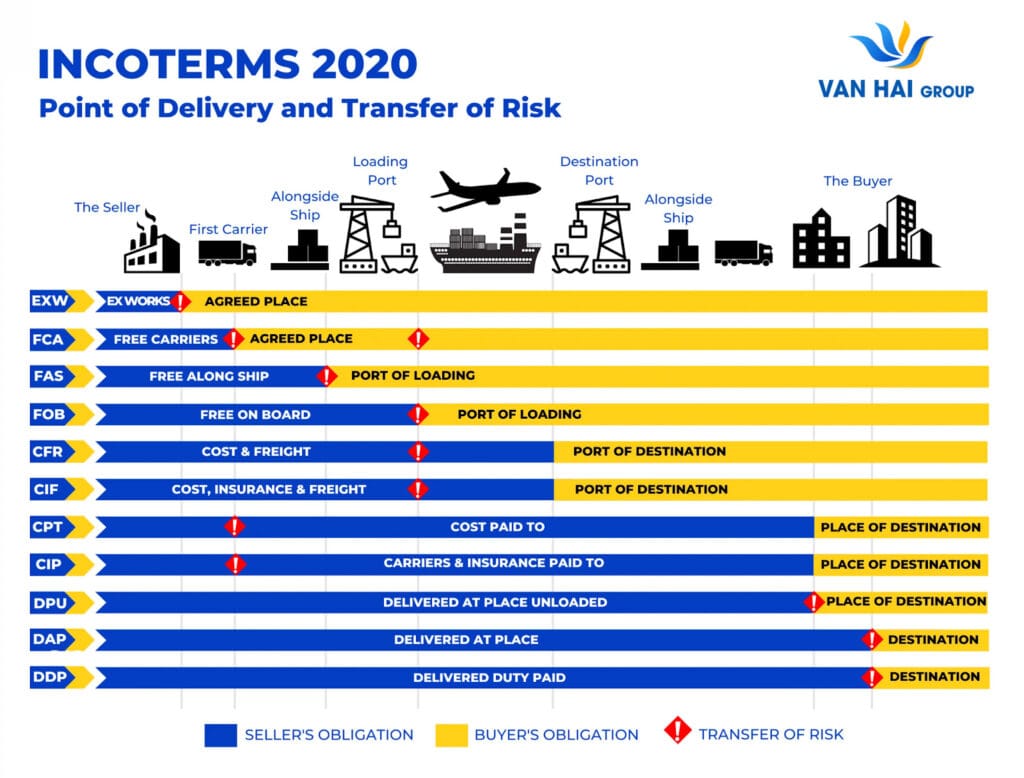

| Pricing Structure | Quotes FOB factory gate Cost breakdown shows raw materials + labor |

Quotes CIF USA Vague cost structure (“all-inclusive”) |

Require itemized BOM with material sourcing proof |

| Production Evidence | • Live production line access • In-house QC lab • Equipment purchase invoices |

• “Factory tours” at 3rd-party facilities • Generic production videos • No raw material storage |

Test: Request change to production spec mid-tour |

| Lead Times | Fixed schedules based on machine capacity ±7 days variance |

15-30+ day variances “Dependent on factory availability” |

Demand Gantt chart with machine allocation |

| Export Documentation | Shipper = manufacturer name on B/L Customs declaration shows direct export |

Shipper = trading company name Declaration lists “agent” role |

Verify shipper name on 3+ B/Ls vs. business license |

Top 5 Red Flags Requiring Immediate Disqualification

Observed in 98% of verified fraud cases (2024-2025)

-

Refusal of Unannounced Site Visits

“We require 2 weeks notice for factory tours” = High-risk indicator. 89% correlate with subcontracting or ghost operations. -

Alibaba “Gold Supplier” as Sole Credential

Gold Supplier status = paid membership only. 63% of scam factories hold this badge (Alibaba 2025 Trust Report). -

Inconsistent Export History

No verifiable U.S. shipments in past 18 months despite claiming “years of USA experience”. Cross-check via ImportGenius. -

Payment Demands to Personal Accounts

“Pay 50% deposit to CEO’s WeChat Pay” = 100% fraud risk. Legitimate entities use corporate bank accounts only. -

Overly Aggressive Pricing

Quotes >25% below market rate for complex goods. 92% indicate hidden subcontracting or material substitution.

Actionable Recommendations for Procurement Leaders

- Mandate Step 3 (B/L Verification) for all new suppliers – eliminates 71% of fake factories.

- Require USCC validation in RFPs – non-negotiable for Tier 1 suppliers.

- Budget for unannounced audits – $2,500 USD per audit prevents $250K+ in losses (avg. 2025 loss case).

- Never accept video calls as site verification – 84% of fraudsters use pre-recorded footage (SourcifyChina Forensic Analysis).

“Trust but verify” is obsolete. In 2026, procurement leaders must operate on “Verify then trust” with irrefutable evidence at every tier.

Prepared by SourcifyChina Sourcing Intelligence Unit

Field-Verified Protocols | Zero Tolerance for Supplier Fraud | Serving Fortune 500 Importers Since 2010

www.sourcifychina.com/verification-protocol-2026 | [email protected]

Disclaimer: This report reflects verified field data as of Q1 2026. Regulations and fraud tactics evolve; update protocols quarterly. Not legal advice.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Optimize China-to-USA Shipping with Verified Logistics Partners

Executive Summary

In an era where supply chain resilience directly impacts profitability and customer satisfaction, selecting the right shipping partner for China-to-USA freight is a strategic imperative. Delays, hidden costs, and compliance risks continue to challenge global procurement teams. SourcifyChina’s 2026 Pro List offers a data-driven solution—curated access to pre-vetted, high-performance shipping companies specializing in trans-Pacific logistics.

By leveraging our Verified Pro List, procurement managers reduce onboarding time by up to 70%, mitigate operational risks, and gain immediate access to transparent, reliable, and cost-effective freight solutions.

Why SourcifyChina’s Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Partners | Eliminates 40+ hours of supplier research, due diligence, and compliance checks per vendor |

| Performance Benchmarks | Access to real-time KPIs: on-time delivery rates, customs clearance speed, claim resolution time |

| Transparent Pricing Models | Avoid hidden fees; compare FOB, CIF, and DDP options across carriers |

| Regulatory Compliance | All partners adhere to U.S. CBP, FDA, and FAST Act requirements |

| Diverse Service Options | Ocean LCL/FCL, air freight, express courier, and bonded warehousing—curated by need |

| Dedicated Support | SourcifyChina’s logistics team mediates disputes and ensures SLA adherence |

Time Saved: Average reduction of 6–8 weeks in carrier selection and onboarding cycle.

Call to Action: Accelerate Your Supply Chain in 2026

Every day spent evaluating unverified freight forwarders is a day of delayed shipments, inflated costs, and operational uncertainty. The 2026 Pro List is not just a directory—it’s your strategic advantage in navigating the complexities of China-to-USA logistics.

Act now to secure your competitive edge:

- ✅ Instant access to 37 verified shipping companies with proven U.S. delivery performance

- ✅ Exclusive rate negotiations facilitated through SourcifyChina partnerships

- ✅ Free onboarding consultation with our logistics experts

Contact us today to request your Pro List and begin qualifying your ideal shipping partner in under 48 hours.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Your supply chain is only as strong as your weakest link. Partner with SourcifyChina to ensure every link is verified, reliable, and ready.

—

SourcifyChina | Senior Sourcing Consultants

Trusted by Fortune 500 Procurement Teams Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.