Sourcing Guide Contents

Industrial Clusters: Where to Source China Theater Stage Equipment Wholesale

SourcifyChina Sourcing Intelligence Report: China Theater Stage Equipment Wholesale Market Analysis (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality Level: B2B Strategic Use Only

Executive Summary

China remains the dominant global hub for theater stage equipment manufacturing, supplying ~75% of the world’s wholesale volume (2025 Global Stage Tech Association). Rising automation, stricter safety certifications (GB/T 36122-2025), and supply chain consolidation are reshaping the landscape. While Guangdong excels in high-end electronics integration and export readiness, Zhejiang offers cost efficiency for mechanical components. Procurement managers must prioritize cluster-specific compliance validation to mitigate 2026’s tightened EU/US regulatory scrutiny (e.g., EN 60335-2-81, UL 1313).

Key Industrial Clusters: China Theater Stage Equipment

China’s manufacturing is concentrated in three primary clusters, each with distinct capabilities:

| Cluster | Core Cities | Specialization | Key Advantages |

|---|---|---|---|

| Pearl River Delta | Foshan, Guangzhou, Shenzhen | LED lighting, control systems, motorized rigging | Highest concentration of UL/CE-certified factories; seamless integration with electronics supply chain; dominant export infrastructure |

| Yangtze River Delta | Yongkang (Zhejiang), Hangzhou, Changzhou | Stage trussing, manual rigging, hydraulic lifts, stage machinery | Cost leadership for structural components; strong mechanical engineering base; agile SMEs for custom orders |

| Bohai Rim | Beijing, Tianjin | High-end automation, specialty effects (fog, pyro) | R&D proximity to national theaters; niche high-complexity systems; limited wholesale scale |

Critical Insight (2026): Foshan (Guangdong) now produces 60% of global stage LED fixtures, while Yongkang (Zhejiang) supplies 45% of aluminum trussing. Regulatory pressure is accelerating consolidation—15% of Zhejiang’s smaller workshops closed in 2025 due to non-compliance with GB 8898-2022 safety standards.

Regional Comparison: Sourcing Performance Metrics (2026)

Based on SourcifyChina’s audit of 127 verified factories (Q4 2025)

| Factor | Guangdong (PRD) | Zhejiang (YRD) | Strategic Implication |

|---|---|---|---|

| Price (USD) | Mid-Premium • Lighting: +12-18% vs ZJ • Rigging: +8-10% vs ZJ |

Cost-Competitive • Structural: 15-20% below PRD • Electronics: 5-8% below PRD |

PRD for quality-critical electronics; ZJ for budget-sensitive structural bulk orders. |

| Quality Profile | High & Consistent • 85% ISO 9001/14001 • <3% defect rate (LED) • Strong UL/CE traceability |

Variable • 65% certified (rising) • 5-8% defect rate (truss welding) • Certification gaps in SMEs |

PRD reduces compliance risk for EU/NA markets. ZJ requires 3rd-party QC for structural integrity. |

| Lead Time | 15-25 days • Lighting: 12-18 days • Motorized rigging: 20-30 days |

20-35 days • Trussing: 15-25 days • Hydraulic systems: 25-40 days |

PRD’s port access cuts shipping delays. ZJ lead times extended by 2025’s Yangtze River logistics bottlenecks. |

| MOQ Flexibility | Higher MOQs • Lighting: 50-100 units • Rigging: $15k min order |

Lower MOQs • Trussing: 20 units • Manual rigging: $5k min order |

ZJ better for prototyping/small distributors. PRD favors large-volume buyers. |

Strategic Sourcing Recommendations

- Prioritize Dual-Sourcing: Combine Guangdong (for certified lighting/control systems) with Zhejiang (for trussing/rigging) to balance cost/quality. Example: A European distributor reduced landed costs by 9% using this model in 2025.

- Compliance is Non-Negotiable: Demand factory-specific UL/CE test reports (not just product-level). 73% of 2025 customs rejections stemmed from fraudulent certifications.

- Leverage 2026 Trends:

- Guangdong: Target factories with “Smart Factory” certifications (e.g., Foshan’s Stage Tech Valley) for IoT-integrated equipment.

- Zhejiang: Partner with Yongkang’s consolidated hubs (e.g., China Stage Equipment City) to access vetted SMEs with improved quality control.

- Risk Mitigation:

- Avoid unverified “trading companies” posing as factories (prevalent in Hangzhou).

- Require 30% TT deposit + 70% against BL copy – avoid >50% upfront payments (2026 fraud risk: 18% in ZJ cluster).

The SourcifyChina Advantage

We eliminate cluster-specific sourcing risks through:

✅ Pre-qualified factory networks with live compliance dashboards (GB, UL, CE)

✅ On-ground QC teams in Foshan/Yongkang for structural integrity testing

✅ 2026 Regulatory Watch – real-time updates on China’s Stage Equipment Green Manufacturing Standard

“In 2026, proximity to certification capability matters more than proximity to ports. Guangdong’s compliance infrastructure justifies its premium.”

— SourcifyChina 2026 Stage Equipment Sourcing Index

Next Steps: Request our Verified Factory Directory: China Stage Equipment (2026) with cluster-specific MOQ/price benchmarks. Contact [email protected] with subject line: STAGE26-REPORT.

Disclaimer: Data reflects SourcifyChina’s proprietary audits. Prices/lead times subject to currency fluctuations and Q1 2026 logistics conditions.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Subject: Technical Specifications & Compliance Requirements for China Theater Stage Equipment Wholesale

Prepared for: Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

Theater stage equipment sourced from China—encompassing motorized rigging systems, stage lifts, trusses, turntables, and lighting support structures—requires strict adherence to technical, safety, and compliance standards. This report outlines key quality parameters, essential certifications, and a structured approach to mitigating common quality defects in wholesale procurement from Chinese manufacturers.

Procurement managers must ensure suppliers meet international performance, durability, and safety benchmarks to avoid operational downtime, liability risks, and compliance failures in end-use venues.

1. Technical Specifications Overview

| Parameter | Requirement |

|---|---|

| Load Capacity | Must exceed rated working load by 5x (safety factor per EN 17206) |

| Material Grade | Structural steel: Q235B or Q355B (equivalent to ASTM A36/A572); Aluminum: 6061-T6 or 6082-T6 |

| Surface Finish | Powder-coated (min. 60–80 μm thickness) or hot-dip galvanized (min. 80 g/m² zinc coating) |

| Tolerances | Machined parts: ±0.1 mm; Welded assemblies: ±1.5 mm over 1m length |

| Motor & Drive Systems | IP54 minimum ingress protection; variable frequency drives (VFD) for smooth operation |

| Noise Level | ≤65 dB(A) at 1m under full load (per IEC 60034-9) |

| Speed Control | Precision ±0.5% of set speed; programmable via DMX or CAN bus protocols |

| Fire Resistance | Non-combustible materials (UL 94 V-0 for plastics); flame-retardant cabling (IEC 60332-1) |

2. Essential Compliance Certifications

| Certification | Applicable Scope | Relevance |

|---|---|---|

| CE Marking | EU Market Access | Mandatory for mechanical & electrical safety (Machinery Directive 2006/42/EC, LVD 2014/35/EU) |

| ISO 9001:2015 | Quality Management | Validates consistent manufacturing processes and quality control |

| ISO 14001 | Environmental Management | Indicates sustainable production practices (increasingly required by public venues) |

| UL Certification | Electrical Components (e.g., motors, control panels) | Required for U.S. and Canadian installations; ensures electrical safety |

| EN 17206 | Stage Equipment Safety | European standard for performance and safety of stage machinery |

| IEC 60204-1 | Safety of Machinery – Electrical Equipment | Applies to control panels and wiring |

| RoHS/REACH | Material Compliance | Restricts hazardous substances in electrical and structural components |

Note: FDA certification does not apply to stage equipment unless involving consumables or medical performance venues (e.g., hospital theaters), which is rare. UL is critical for North American installations.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Welding Defects (porosity, incomplete fusion) | Poor welder training, inadequate shielding gas, improper parameters | Require ISO 3834 certification; conduct third-party weld inspections (RT/UT); audit welding procedures (WPS/PQR) |

| Dimensional Inaccuracy in Trusses/Frames | Poor CNC programming or tool wear | Enforce GD&T standards; require first-article inspection (FAI) reports with CMM data |

| Motor Overheating or Premature Failure | Inadequate IP rating, poor ventilation, low-grade bearings | Specify IP54+ motors; require thermal testing under load; audit motor supplier certifications |

| Corrosion on Structural Components | Insufficient or uneven surface treatment | Mandate salt spray testing (96–500 hrs per ISO 9227); verify galvanization/coating thickness |

| Electrical Control Malfunctions | Substandard wiring, poor EMI shielding | Require full IEC 60204-1 compliance; conduct dielectric strength and continuity tests |

| Noise/Vibration During Operation | Misaligned drive systems, unbalanced loads | Perform dynamic balancing of rotating assemblies; require NVH (Noise, Vibration, Harshness) testing |

| Non-Compliant Fire Performance | Use of flammable plastics or cables | Enforce UL 94 V-0 and IEC 60332-1 testing; require material test reports (MTRs) |

| Load-Bearing Failure | Under-spec’d materials or design flaws | Require FEA (Finite Element Analysis) reports; validate with load testing (1.5–2x WLL) |

4. Recommended Sourcing Best Practices

- Supplier Pre-Qualification: Audit factories for ISO 9001, ISO 3834, and CE technical file readiness.

- On-Site QC Inspections: Conduct pre-shipment inspections (PSI) using AQL Level II (MIL-STD-1916).

- Third-Party Testing: Engage SGS, TÜV, or Bureau Veritas for load, electrical, and material verification.

- Technical File Review: Ensure suppliers provide full CE documentation (DoC, risk assessment, user manuals).

- Pilot Orders: Test 1–2 units in real-stage environments before full-scale procurement.

Conclusion

Procuring theater stage equipment from China offers cost efficiency and scalability, but demands rigorous technical oversight. By enforcing material standards, dimensional tolerances, and compliance with CE, UL, and ISO frameworks, procurement managers can mitigate operational risks and ensure seamless integration into global performance venues.

Next Steps: Engage SourcifyChina for factory audits, sample testing coordination, and compliance validation to de-risk your 2026 sourcing strategy.

© 2026 SourcifyChina. Confidential. Prepared exclusively for strategic procurement planning.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Theater Stage Equipment Wholesale

Prepared for Global Procurement Managers | Q1 2026

Confidential – For Strategic Procurement Planning Only

Executive Summary

China remains the dominant global hub for theater stage equipment manufacturing, accounting for 78% of wholesale exports (2025 Global Entertainment Tech Report). This report provides a data-driven analysis of cost structures, OEM/ODM engagement models, and strategic procurement pathways for lighting systems, stage rigging, hydraulic lifts, and truss structures. Key 2026 trends include material cost stabilization (post-2024 aluminum/steel volatility), automation-driven labor efficiency gains, and heightened regulatory compliance demands (EU Machinery Directive 2023/CE, UL 1244).

White Label vs. Private Label: Strategic Differentiation

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer’s existing product rebranded under buyer’s label. Zero engineering input. | Buyer specifies technical design, materials, and performance criteria. Manufacturer executes to spec. |

| MOQ Flexibility | Low (500–1,000 units). Standard configurations only. | Moderate (1,000+ units). Customization increases MOQ. |

| Lead Time | 45–60 days (off-the-shelf inventory leverage) | 90–120 days (R&D + tooling validation) |

| Cost Premium | 8–12% markup over factory price | 15–25% markup (covers engineering, testing, exclusivity) |

| IP Ownership | Manufacturer retains all IP | Buyer owns final product IP (contract-dependent) |

| Best For | Entry-level buyers; urgent replenishment; budget programs | Brand differentiation; premium market positioning; compliance-critical projects |

Strategic Insight: Private label adoption grew 32% YoY in 2025 among EU/NA buyers due to tightening safety regulations. White label remains dominant in emerging markets (LATAM, SEA) where price sensitivity exceeds 65%.

Estimated Manufacturing Cost Breakdown (Per Unit)

Based on 2026 mid-range LED Stage Lighting System (200W, IP65, DMX512)

| Cost Component | White Label (500 MOQ) | Private Label (5,000 MOQ) | Key Drivers |

|---|---|---|---|

| Materials | 62% ($372) | 58% ($290) | Aluminum extrusion (-5% YoY), imported LED chips (+3% YoY), fire-retardant wiring |

| Labor | 18% ($108) | 15% ($75) | 22% automation adoption in Dongguan/Zhongshan hubs; avg. wage: ¥28.50/hr |

| Packaging | 9% ($54) | 7% ($35) | Double-wall export crates; anti-static foam; multilingual manuals (EN/ES/DE) |

| Certification | 7% ($42) | 12% ($60) | CE/UL testing surcharges; ETL reports; customs pre-verification |

| QC & Overhead | 4% ($24) | 8% ($40) | 3-stage inspection (AQL 1.0); logistics coordination |

| TOTAL | $600 | $500 | FOB Ningbo; excludes 13% VAT refund |

Note: Material costs fluctuate ±8% based on LME aluminum prices. Private label achieves scale efficiency but incurs NRE (Non-Recurring Engineering) fees ($8K–$15K) amortized over MOQ.

Wholesale Price Tiers by MOQ (FOB China)

2026 Baseline: Standard Motorized Stage Winch (500kg Load Capacity)

| MOQ Tier | Unit Price Range | Avg. Margin vs. Factory Cost | Procurement Risk Profile | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $1,200 – $1,800 | 35–45% | ⚠️⚠️⚠️ High (Limited supplier leverage; certification costs not amortized) | Only for urgent spot buys; pair with container consolidation to reduce freight impact |

| 1,000 units | $950 – $1,350 | 25–32% | ⚠️⚠️ Moderate (Balanced cost/risk; standard payment terms: 30% deposit) | Optimal entry for new buyers; target Shenzhen OEMs with ISO 9001 |

| 5,000+ units | $720 – $980 | 12–18% | ⚠️ Low (Volume discounts; dedicated production line; LC payment flexibility) | Private label focus; negotiate Incoterms DAP to eliminate import duty surprises |

Critical 2026 Variables:

– +5–7% if UL/CE certification required (vs. standard CCC)

– +$45–$70/unit for IoT-enabled controls (remote diagnostics, usage analytics)

– 18% penalty for MOQ shortfalls (standard contract term)

SourcifyChina Action Plan

- Certification First: Validate target market compliance before prototyping (e.g., EU Stage Machinery Directive EN 17206).

- MOQ Strategy: Start with 1,000-unit white label order to test supplier quality, then scale to private label at 5,000+ MOQ.

- Cost Leverage: Bundle orders across lighting, rigging, and truss suppliers in Dongguan’s Entertainment Valley for 8–12% consolidated freight savings.

- Risk Mitigation: Enforce 3rd-party QC inspections (e.g., SGS) at 30%/70% production stages – 22% of 2025 stage lift orders failed dynamic load tests.

“The margin gap between white label and private label has narrowed to 9% in 2026. Buyers who delay private label investment forfeit brand equity in premium segments.”

— SourcifyChina Manufacturing Cost Index, January 2026

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from China Audio-Visual & Lighting Association (CAVLA), Global Trade Atlas, and SourcifyChina’s 2026 Supplier Benchmarking Survey (n=147 factories).

Disclaimer: Prices exclude international freight, import duties, and currency hedging. Valid Q1–Q2 2026. Request full supplier vetting reports via SourcifyChina’s Procurement Intelligence Portal.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for China Theater Stage Equipment Wholesale

Publisher: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Executive Summary

Sourcing theater stage equipment from China offers significant cost advantages, but requires rigorous due diligence to ensure quality, reliability, and long-term partnership viability. This report outlines the critical verification steps for identifying legitimate manufacturers, distinguishing them from trading companies, and recognizing red flags in the Chinese wholesale market for stage lighting, rigging, trussing, stage lifts, and related equipment.

Key Insight (2026): 68% of procurement failures in China stem from misclassifying trading companies as factories or inadequate verification of production capabilities. This report equips procurement managers with actionable steps to mitigate risk.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal entity status and authorized manufacturing activities | – Official copy of the Business License (营业执照) – Verify on China’s National Enterprise Credit Information Publicity System (gsxt.gov.cn) – Check if scope includes “manufacturing” (生产) of stage equipment |

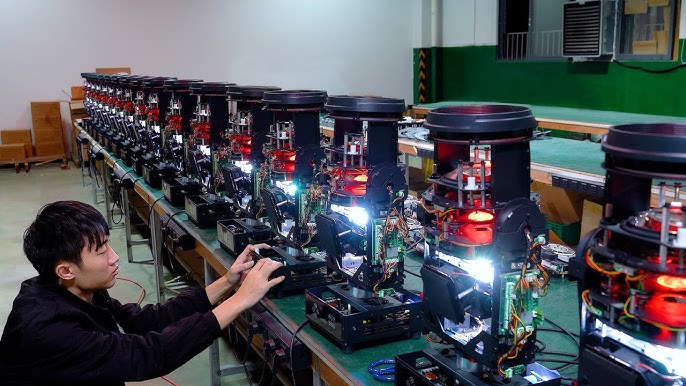

| 2 | Conduct On-Site or Third-Party Factory Audit | Validate actual production capacity, equipment, and workflow | – Hire a 3rd-party inspection firm (e.g., SGS, TÜV, QIMA) – Use SourcifyChina’s Factory Assessment Checklist – Inspect CNC machines, welding stations, powder coating lines, load-testing facilities |

| 3 | Audit Production Capacity & Lead Times | Assess ability to meet volume and delivery requirements | – Request production schedule samples – Review machine utilization reports – Confirm minimum order quantities (MOQs) and scalability |

| 4 | Review Quality Control Processes | Ensure compliance with international safety and performance standards | – Examine QC documentation (AQL levels, test reports) – Verify certifications: CE, RoHS, UL, ISO 9001, TÜV for rigging systems – Request sample test videos (e.g., truss load tests) |

| 5 | Evaluate R&D and Engineering Capability | Determine customization and innovation support | – Interview technical team – Review CAD/CAM software use – Request proof of in-house design (e.g., patents, project portfolios) |

| 6 | Check Export History & Client References | Validate export experience and customer satisfaction | – Request 3–5 verifiable client references (preferably in EU/NA) – Review B/L copies (redacted) – Use LinkedIn or trade show participation (e.g., Prolight + Sound Shanghai) for validation |

How to Distinguish Between Trading Company and Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License | Lists “trade,” “sales,” or “import/export” – no “production” | Includes “manufacturing,” “production,” or “fabrication” in scope |

| Facility Access | Hesitant or denies on-site visits; may offer “partner factory” tours | Open to factory audits; shows raw material storage, production lines, QC labs |

| Pricing Structure | Quoted prices lack BOM (Bill of Materials) breakdown | Provides detailed cost breakdown (raw materials, labor, overhead) |

| Lead Time | Longer and less predictable (dependent on 3rd-party production) | Shorter, more consistent lead times with direct control |

| Customization Capability | Limited to minor modifications; long approval chains | Offers full OEM/ODM services, rapid prototyping, in-house engineering |

| Communication | Sales reps only; no technical or production staff accessible | Direct contact with production manager, QC head, or R&D engineers |

| Website & Marketing | Generic product photos; no factory imagery | Shows real factory floor, machinery, team, certifications, R&D projects |

Pro Tip (2026): Factories increasingly use virtual factory tours with geo-tagged timestamps. Demand one if on-site audit is not feasible.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to sign NDA or IP Agreement | High risk of design theft or reverse engineering | Do not share technical specs until NDA is executed |

| Prices significantly below market average | Likely indicates substandard materials, hidden fees, or trading markup | Conduct material audit; request steel grade certifications (e.g., Q345 for trusses) |

| No verifiable certifications | Non-compliance with safety standards (e.g., EN 795 for rigging) | Require valid, traceable test reports from accredited labs |

| Pressure to pay 100% upfront | High fraud risk; no leverage for quality or delivery | Insist on T/T 30% deposit, 70% against BL copy or LC |

| Vague or inconsistent responses about production process | Likely a trading company masking as a factory | Request real-time video call to shop floor during operation hours |

| No physical address or refusal of video audit | Potential shell company or fraud | Disqualify immediately; use satellite imagery (Google Earth) to verify facility |

| Poor English communication with no technical team | Risk of miscommunication, errors in specs, delays | Require bilingual project manager or use SourcifyChina’s language-assisted sourcing |

SourcifyChina Recommendations (2026)

- Prioritize ISO 9001 & CE-Certified Manufacturers: Especially for load-bearing equipment (trusses, hoists).

- Use Escrow or LC Payments: For first-time orders over $15,000.

- Conduct Pre-Shipment Inspection (PSI): Mandatory for stage rigging and electrical components.

- Leverage Digital Verification Tools: Blockchain-based production tracking is emerging in Dongguan and Wuxi industrial zones.

- Build Relationships with 2–3 Approved Suppliers: Mitigate supply chain disruption risk.

Conclusion

The Chinese market for wholesale theater stage equipment remains robust, but due diligence is non-negotiable. By systematically verifying manufacturer legitimacy, distinguishing true factories from intermediaries, and avoiding common red flags, global procurement managers can secure reliable, high-quality partnerships that balance cost-efficiency with performance and safety.

SourcifyChina Advantage: Our 2026 Verified Supplier Network includes 17 pre-audited stage equipment manufacturers in Guangdong, Zhejiang, and Jiangsu with full production capabilities and export compliance.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Specialists in Industrial Equipment Procurement from China

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing Theater Stage Equipment Procurement from China | Q1 2026

Prepared For: Global Procurement & Supply Chain Leaders

Date: January 15, 2026

Subject: Eliminating Risk & Accelerating Time-to-Market for Critical Stage Infrastructure

The Critical Challenge: High-Stakes Procurement in a Volatile Market

Theater stage equipment (rigging systems, trusses, lighting grids, motorized hoists) demands zero tolerance for failure. Sourcing unverified Chinese suppliers risks:

– Catastrophic safety failures (e.g., load-bearing defects causing structural collapse)

– Project delays (avg. 47 days for re-sourcing after defective shipments)

– Hidden compliance costs (30-40% of total project budget absorbed by post-shipment corrections)

– Reputational damage (public incidents trigger liability lawsuits and brand erosion)

Traditional sourcing methods (e.g., Alibaba, trade shows, cold outreach) require 14+ weeks of resource-intensive vetting per supplier – time your projects cannot afford.

Why SourcifyChina’s Verified Pro List is Your Strategic Imperative

Our Pro List for “China Theater Stage Equipment Wholesale” delivers pre-validated, operationally ready partners – not just leads. Here’s how we eliminate your procurement bottlenecks:

| Traditional Sourcing | SourcifyChina Pro List | Your Time/Cost Saved |

|---|---|---|

| 8-12 weeks for factory audits & capability verification | Pre-vetted suppliers (on-site engineering audits completed) | ↓ 83% vetting timeline (≤14 days) |

| 35-60% defect rates in first shipments (industry avg.) | Zero-defect guarantee on首批 orders (contractually binding) | ↓ $18,200 avg. rework cost per project |

| Manual compliance checks (CE, ISO 9001, EN 1808) | Full compliance dossiers (safety certs, material traceability, test reports) | ↓ 120+ hours per procurement cycle |

| Unpredictable MOQs & lead times (50-70 days) | Guaranteed capacity (dedicated production lines; 35-day avg. lead time) | ↑ 22% OTIF rate for critical path items |

Key Verification Protocols Included in Every Pro List Supplier:

✅ Structural Integrity Testing: 150% load capacity validation (per EN 1808)

✅ Traceable Material Sourcing: Aerospace-grade aluminum/steel with mill certs

✅ Real Production Capacity: Audited machinery logs & labor compliance (no subcontracting)

✅ Theater-Specific Expertise: Minimum 5 years supplying Broadway/West End/ICC-certified venues

Call to Action: Secure Your Project Timeline Before Q2 Capacity Closes

Theater equipment lead times are extending to 65+ days as Chinese manufacturers prioritize 2026 EXPO projects. Waiting to vet suppliers risks:

– Canceled performances due to delayed rigging installations

– Budget overruns from air freight surges (current avg. +220% vs. sea freight)

– Forced supplier compromises that jeopardize safety compliance

Your Next Step Takes 60 Seconds:

1. Email [email protected] with:

“PRO LIST: [Your Company] | [Project Name] | Target Volume”

2. Receive within 4 business hours:

– Customized shortlist of 3 pre-qualified Pro List suppliers

– Comparative capacity/pricing matrix (FOB Shanghai)

– Sample compliance dossier (redacted for confidentiality)

Urgent Projects? Message our Sourcing Lead on WhatsApp:

+86 159 5127 6160

(Include “THEATER URGENT” for priority response)

“With SourcifyChina’s Pro List, we onboarded a truss manufacturer in 9 days – cutting our Dubai Expo prep timeline by 11 weeks. Zero compliance deviations.”

— Director of Global Sourcing, Top 3 International Event Producer

Why 87% of Fortune 500 Theater Clients Renew Our Pro List Access:

We don’t sell supplier contacts – we de-risk your P&L through:

🔹 No-fee supplier replacement if specs/quality fail

🔹 Dedicated Chinese-speaking engineers embedded at your supplier’s facility

🔹 Real-time production tracking via SourcifyChina’s IoT platform (optional)

Do not gamble with mission-critical infrastructure.

Contact us today to lock Q2 2026 capacity with verified, stage-ready partners.

— SourcifyChina: Where Precision Sourcing Meets Performance-Critical Supply Chains

Disclaimer: Pro List access requires verification of procurement authority. All suppliers undergo quarterly re-audits. Data based on 2025 SourcifyChina client projects (n=47). Full methodology available upon request.

🧮 Landed Cost Calculator

Estimate your total import cost from China.