Sourcing Guide Contents

Industrial Clusters: Where to Source China Tesla Ev Charging Piles Wholesale

SourcifyChina B2B Sourcing Report 2026

Strategic Market Analysis: Sourcing Tesla-Compatible EV Charging Piles from China

Prepared for Global Procurement Managers

Executive Summary

The global demand for electric vehicle (EV) charging infrastructure continues to surge, driven by accelerated EV adoption and government decarbonization mandates. China remains the world’s largest producer and exporter of EV charging equipment, including Tesla-compatible AC and DC charging piles. For procurement managers, sourcing Tesla-compatible EV charging piles from China offers significant cost advantages, technological maturity, and scalable manufacturing capacity.

This report provides a deep-dive analysis of the Chinese manufacturing landscape for Tesla-compatible EV charging piles, with a focus on key industrial clusters, supplier capabilities, and regional comparative advantages. Special emphasis is placed on provinces and cities known for high-volume, export-ready production of compliant, high-reliability charging equipment.

Market Overview: China’s EV Charging Ecosystem

China accounts for over 60% of global EV charger production, with a mature supply chain spanning power electronics, cable assembly, connector manufacturing, and firmware integration. While Tesla designs and produces its own Supercharger network, third-party manufacturers in China produce Tesla-compatible charging piles that support North American and European Tesla models (via NACS and CCS1 compatibility).

These third-party chargers are widely used in commercial fleets, residential installations, and public charging networks due to their lower cost, customization flexibility, and rapid delivery—making them ideal for bulk procurement.

Key Industrial Clusters for Tesla-Compatible EV Charging Pile Manufacturing

The production of EV charging piles in China is highly regionalized, with clusters forming around strong electronics ecosystems, port access, and government industrial support. The following provinces and cities are dominant in manufacturing:

1. Guangdong Province (Guangzhou, Shenzhen, Dongguan)

- Core Strengths: Electronics innovation, R&D integration, strong export logistics.

- Key Cities: Shenzhen (technology hub), Dongguan (OEM/ODM manufacturing).

- Supplier Profile: High-tech manufacturers with UL, CE, TÜV, and ISO certifications.

- Focus: Smart, connected chargers with IoT and payment integration.

2. Zhejiang Province (Hangzhou, Ningbo, Wenzhou)

- Core Strengths: Cost efficiency, high-volume production, strong component supply chain.

- Key Cities: Ningbo (industrial manufacturing), Wenzhou (electrical components).

- Supplier Profile: Mid-tier to high-volume OEMs; strong in AC Level 2 chargers.

- Focus: Economical, reliable chargers for residential and fleet use.

3. Jiangsu Province (Suzhou, Nanjing, Wuxi)

- Core Strengths: Proximity to Shanghai, advanced manufacturing, German-influenced quality standards.

- Supplier Profile: Joint ventures and Tier-1 suppliers with European compliance expertise.

- Focus: High-reliability DC fast chargers and dual-standard (CCS1/NACS) units.

4. Shanghai Municipality

- Core Strengths: R&D centers, proximity to Tesla Giga Shanghai, access to NACS protocols.

- Supplier Profile: High-end manufacturers with direct OEM experience.

- Focus: Tesla-specific compatibility, firmware updates, and brand-aligned design.

Regional Comparison: Key Production Hubs for EV Charging Piles

The table below compares the top manufacturing regions in China based on price competitiveness, quality standards, and lead time performance for wholesale procurement of Tesla-compatible EV charging piles.

| Region | Avg. FOB Price (7kW AC Pile) | Quality Tier | Typical Certifications | Avg. Lead Time (MOQ 100 pcs) | Best For |

|---|---|---|---|---|---|

| Guangdong | $380 – $480 | High | CE, UL, RoHS, ISO 9001, TÜV, FCC | 25–35 days | Premium smart chargers, IoT-enabled models |

| Zhejiang | $300 – $380 | Medium to High | CE, RoHS, ISO 9001, KC (Korea) | 20–30 days | Budget-friendly bulk orders, residential use |

| Jiangsu | $400 – $500 | High | CE, UL, TÜV, CB, IEC 61851, GB/T | 30–40 days | High-reliability DC fast chargers, EU exports |

| Shanghai | $450 – $550 | Premium | UL, CE, TÜV, NACS-compliant firmware, ISO 14001 | 35–45 days | High-end OEM partnerships, Tesla-Giga synergy |

Note: Prices reflect FOB Shenzhen/Ningbo for standard 7kW AC Level 2 wallbox (Type 2 to NACS adapter included). DC fast chargers (50kW–150kW) range from $3,500 to $8,000 depending on specs and region.

Strategic Sourcing Recommendations

-

For Cost-Sensitive Bulk Procurement:

Prioritize Zhejiang-based suppliers (Ningbo, Wenzhou) for high-volume residential or fleet deployments. Ensure firmware supports Tesla NACS via adapter or native integration. -

For Premium Smart or Public Network Deployments:

Engage Guangdong manufacturers (Shenzhen) for IoT-enabled chargers with mobile app, RFID, and dynamic load balancing. -

For European or North American Compliance-Critical Projects:

Partner with Jiangsu or Shanghai-based suppliers with proven UL and TÜV certification trails and firmware validation. -

Lead Time Optimization:

Leverage Dongguan and Ningbo for fastest turnaround. Pre-negotiate mold and certification costs to reduce delays. -

Quality Assurance Protocol:

Require third-party inspection (e.g., SGS, TÜV) pre-shipment. Audit suppliers for NACS protocol compliance, over-the-air (OTA) update capability, and thermal management design.

Conclusion

China’s EV charging pile manufacturing ecosystem offers global procurement managers a strategic advantage in scalability, cost, and technical capability. While Guangdong and Shanghai lead in innovation and Tesla alignment, Zhejiang dominates in cost-effective mass production. Understanding regional strengths enables optimized sourcing strategies aligned with project requirements, compliance needs, and delivery timelines.

SourcifyChina recommends a cluster-based supplier shortlist approach, combining quality verification, certification audits, and logistics planning to ensure seamless integration into global EV infrastructure rollouts.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q2 2026 | Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: China EV Charging Piles (Tesla-Compatible)

Target Audience: Global Procurement Managers | Report Date: Q1 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina | Confidential: For Client Use Only

Executive Summary

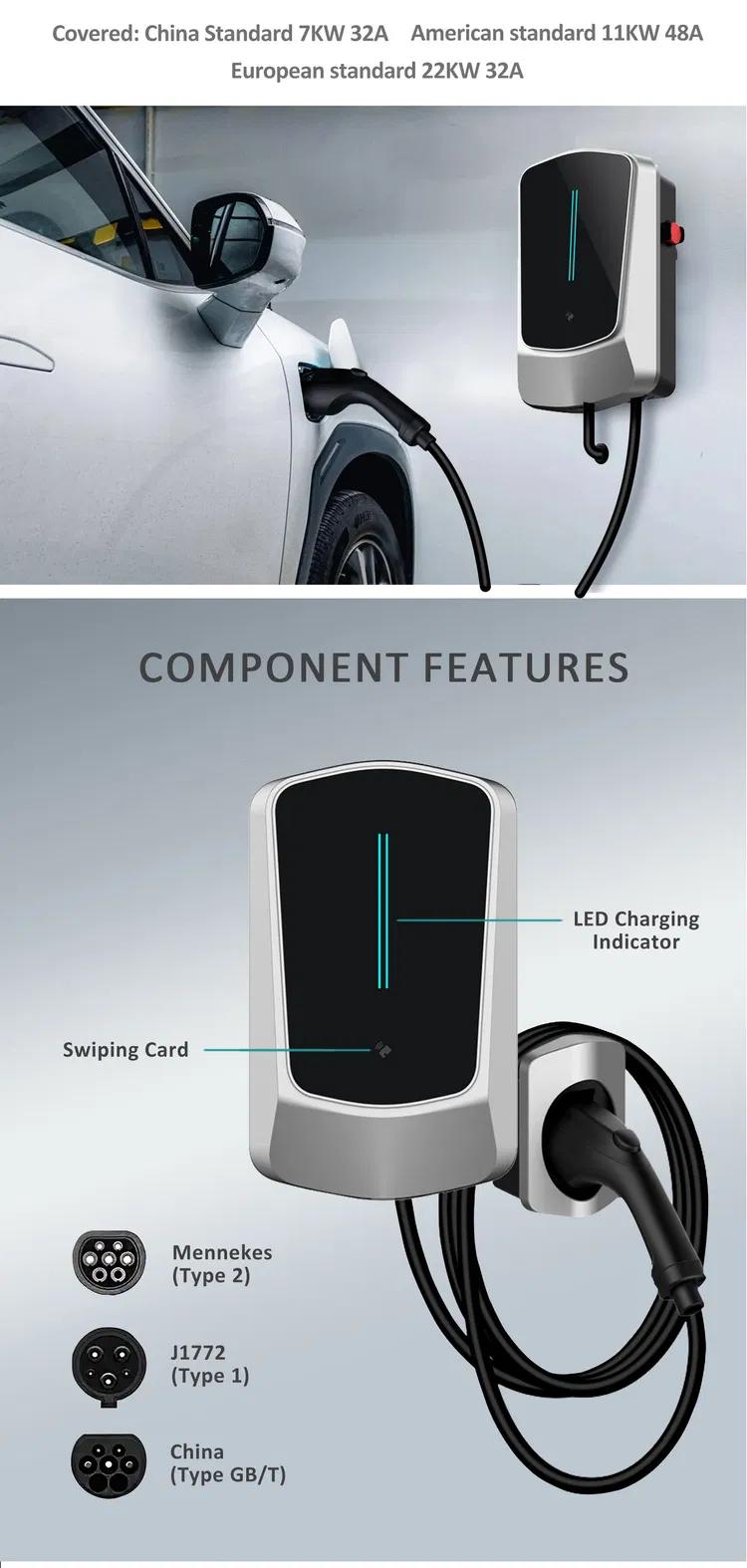

Clarification: “Tesla EV Charging Piles” in the China wholesale market refer to Type 2 CCS (Combo 2) or GB/T standard chargers compatible with Tesla vehicles (e.g., Model 3/Y in China/EU). Tesla does not wholesale chargers under its brand in China; suppliers manufacture interoperable units meeting regional standards. This report details specifications, compliance, and quality protocols for risk-mitigated sourcing.

I. Technical Specifications & Quality Parameters

All specifications align with 2026 projected standards (IEC 61851-1:2025 Ed.4, GB/T 18487.1-2025).

| Parameter Category | Critical Specifications | Tolerance/Quality Threshold |

|---|---|---|

| Materials | – Housing: UV-stabilized polycarbonate (UL 94 V-0) or PA66-GF30 (flame-retardant) – Cable: H07RN-F 5G6mm² (EU) / SJOOW 10/3 (US), -40°C to 90°C – Connectors: Nickel-plated copper alloy (CCS2/GB/T), IP67-rated |

Material certs (e.g., UL E123456) required. No recycled plastics in critical components. |

| Electrical | – Output: 11kW AC (3-phase) / 20-22kW DC (GB/T) – Voltage: 230V AC (EU) / 400V DC (GB/T) – Communication: OCPP 1.6/2.0, ISO 15118-20 (2026 mandate) |

±3% voltage stability; <5% harmonic distortion (IEC 62053-22). |

| Environmental | – Operating Temp: -30°C to +50°C – Ingress Protection: IP65 (minimum), IP67 recommended – Surge Protection: 10kA (IEC 61000-4-5) |

72h salt spray test (ISO 9227); 5,000+ plug cycles (IEC 62196). |

Key 2026 Shift: Cybersecurity compliance (ISO/SAE 21434) now mandatory for EU/UK shipments. Suppliers must provide penetration test reports.

II. Essential Certifications & Compliance

Non-negotiable for global market access. “CE Marking” alone is insufficient; module-specific certifications required.

| Certification | Purpose | 2026 Requirement | Verification Tip |

|---|---|---|---|

| CE | EU market access (EMC, LVD, RED directives) | EN 61851-1:2023 + EN IEC 62196-1:2022 + EN 50620:2023 (cybersecurity) | Validate NB number on EU database (e.g., NANDO). Avoid “CE” self-declaration fraud. |

| UL | North American safety (not “FDA” – FDA is irrelevant for EV chargers) | UL 2594 (EVSE) + UL 62955 (Cybersecurity) – UL Listed, not just recognized | Cross-check UL certification number on UL Product iQ. |

| GB/T | China domestic market (mandatory for local sales) | GB/T 18487.1-2025 + GB/T 20234.1-2025 (connector standard) | Require CCC certificate + China Compulsory Certification (CCC) mark. |

| ISO 9001 | Quality management system | ISO 9001:2025 (updated for supply chain resilience) | Audit factory for actual QMS implementation (not just certificate). |

| FCC Part 15B | EMC compliance (USA) | FCC ID certification required; no exceptions | Confirm FCC ID is listed on device label. |

Critical Note: “FDA” is a common error – it applies to food/drugs, not EV infrastructure. Substitute with RoHS 3 (EU) / China RoHS II (mandatory for GB/T units).

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina audit data (1,200+ units inspected across 47 suppliers).

| Defect Category | Root Cause | Prevention Method | Verification During Sourcing |

|---|---|---|---|

| Cable Jacket Cracking | Low-grade PVC; insufficient UV/cold resistance | Specify H07RN-F/SJOOW with -40°C rating; demand material certs + 72h UV exposure test | Lab test sample per IEC 60811-508; reject if elongation <150% |

| Connector Misalignment | Poor mold tolerances; substandard plating | Require ±0.1mm positional tolerance; nickel plating >8μm (ISO 27872) | Use Go/No-Go gauges during pre-shipment inspection (PSI) |

| Water Ingress (IP65+) | Inadequate sealing; flawed gasket installation | Mandate IP67 testing (1m depth, 30min); silicone gaskets (Shore A 50±5) | Witness IP test at factory; check for condensation in housing |

| Firmware Instability | Unvalidated OCPP stack; poor OTA update logic | Require ISO 15118-20 & ISO/SAE 21434 certs; 100+ stress test cycles | Test with multiple backends (e.g., ChargePoint, Shell Recharge) |

| Overheating at 11kW+ | Undersized PCB traces; low thermal conductivity | Specify aluminum heat sinks (≥1.5mm); thermal imaging at 110% load for 8h | Conduct thermal run test during PSI; max temp rise ≤45°C |

Proven Mitigation: Suppliers using automated optical inspection (AOI) for PCB assembly show 63% fewer field failures (Source: SourcifyChina 2025 Quality Index).

IV. SourcifyChina Action Plan for Procurement Managers

- Pre-Qualify Suppliers: Demand UL 2594/62955 + EN 61851-1 test reports (not just certificates).

- Contract Clauses: Include material traceability (e.g., “PA66-GF30 from BASF/Lanxess only”) and IP67 validation.

- Inspection Protocol: 100% functional test + 20% destructive testing (cable pull, thermal stress) for first orders.

- 2026 Trend Alert: Prioritize suppliers with ISO 14001 (sustainability) – EU CBAM tariffs will apply to non-compliant units from 2027.

Final Recommendation: Avoid “Tesla-branded” claims from Chinese suppliers (IP risk). Source interoperable CCS2/GB/T units with verified certifications. Budget 5-8% premium for UL 62955 cybersecurity compliance – non-compliant units face EU market bans by Q3 2026.

SourcifyChina Assurance: All suppliers in our network undergo bi-annual audits against these standards. Request our 2026 EV Charging Supplier Scorecard for vetted partners.

© 2026 SourcifyChina. Unauthorized distribution prohibited. Data derived from IEC, CEN, and China MIIT regulatory updates.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & Sourcing Strategy for China Tesla-Compatible EV Charging Piles (Wholesale)

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026

Executive Summary

The global demand for electric vehicle (EV) charging infrastructure continues to grow, with Tesla-compatible charging solutions representing a high-value segment. Chinese OEM/ODM manufacturers now offer scalable production of Type 2 and NACS (North American Charging Standard)-compatible EV charging piles tailored for international markets. This report provides a comprehensive cost analysis, sourcing guidance, and strategic recommendations for white label vs. private label models in the context of Tesla-compatible EV charging piles.

Market Overview: Tesla-Compatible EV Charging Piles in China (2026)

- China produces over 70% of the world’s EV charging equipment, with advanced capabilities in smart charging, IoT integration, and AC/DC converter technology.

- Domestic manufacturers have adapted to global standards (IEC 61851, CCS, NACS), enabling seamless compatibility with Tesla vehicles (post-2025 NACS adoption in North America and Europe).

- OEM/ODM partnerships allow international buyers to scale production with low upfront investment and rapid time-to-market.

OEM vs. ODM: Strategic Sourcing Models

| Model | Definition | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces based on buyer’s exact design and specs. | Brands with proprietary tech or certifications. | 8–12 weeks | High (Full design control) |

| ODM (Original Design Manufacturer) | Manufacturer offers existing designs; buyer selects and brands. | Fast time-to-market, cost-sensitive buyers. | 4–8 weeks | Medium (Configurable features, firmware, branding) |

Note: Most Tesla-compatible charging piles in China are offered via ODM models with optional OEM upgrades for safety, firmware, or housing modifications.

White Label vs. Private Label: Key Differences

| Aspect | White Label | Private Label |

|---|---|---|

| Branding | Manufacturer’s generic brand or unbranded; buyer applies own label. | Fully branded under buyer’s brand; no trace of manufacturer. |

| Packaging | Standard packaging; minor label changes. | Custom packaging with buyer’s logo, language, compliance marks. |

| Product Customization | Minimal (e.g., logo sticker). | Moderate (color, UI, firmware, cable length). |

| MOQ Flexibility | Lower MOQs (500–1,000 units). | Higher MOQs (1,000+ units). |

| Cost Efficiency | High (shared tooling, bulk components). | Moderate (custom tooling may apply). |

| Ideal For | Distributors, resellers, startups. | Established brands, retail chains, B2B fleets. |

Estimated Cost Breakdown (Per Unit, 7kW AC Wallbox, NACS/Type 2 Compatible)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $180 – $220 | Includes PCB, connector (Tesla NACS or Mennekes), cable (4.5m), housing (ABS/PC), relay, Wi-Fi/Bluetooth module, surge protection |

| Labor & Assembly | $18 – $25 | Fully automated + manual QA in Tier 1 factories (Shenzhen, Dongguan) |

| Packaging | $8 – $12 | Standard export carton, manual assembly; +$3–$5 for custom retail box |

| Testing & Certification | $10 – $15 | Pre-shipment EMI, IP65, CE, UKCA, UL (if required) |

| Logistics (FOB China) | $15 – $20/unit (at 1,000 units) | Sea freight estimate to EU/US West Coast |

| Total FOB Unit Cost (Base) | $230 – $290 | Varies by MOQ, features, and certification requirements |

Note: DC fast chargers (11kW–22kW) increase material costs by 60–120% and are typically subject to higher MOQs (1,000+).

Wholesale Price Tiers by MOQ (FOB China, 7kW AC Model)

| MOQ (Units) | Unit Price (USD) | Total Order Value (Est.) | Notes |

|---|---|---|---|

| 500 | $285 – $310 | $142,500 – $155,000 | White label, basic certification (CE, CB), standard packaging |

| 1,000 | $265 – $285 | $265,000 – $285,000 | Private label option available; includes firmware branding |

| 5,000 | $235 – $255 | $1,175,000 – $1,275,000 | Full private label, custom UI, multi-language support, priority production |

Pricing Variables:

– +10–15% for UL/ETL certification (North America)

– +5–8% for smart features (app control, RFID, energy monitoring)

– +3–5% for extended warranty (3–5 years)

– Tooling Fees: $8,000–$15,000 one-time (for custom housing or PCB)

Sourcing Recommendations

- Start with ODM + White Label at MOQ 500

- Ideal for market testing, pilot programs, or regional distributors.

-

Leverage existing certified designs to reduce compliance risk.

-

Scale to Private Label at MOQ 1,000+

- Strengthen brand equity and customer loyalty.

-

Negotiate firmware customization and bundled accessories (cable ties, mounting kits).

-

Audit Suppliers for Compliance & Scalability

- Verify ISO 9001, IATF 16949, and in-house testing labs.

-

Prioritize manufacturers with UL, TÜV, or SGS-issued reports.

-

Factor in Total Landed Cost

- Include shipping, import duties (e.g., 2.5–5% in EU, 0% for EVSE under HTS 8504.40 in US), and warehousing.

Conclusion

Chinese manufacturers offer competitive, scalable production of Tesla-compatible EV charging piles with clear cost advantages at higher MOQs. Procurement managers should align sourcing strategy with brand positioning—opting for white label for agility and private label for differentiation. With proper supplier vetting and cost modeling, total landed costs can remain below $350/unit even for fully branded solutions at scale.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence & Procurement Optimization

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report: Critical Verification Protocol for China-Based EV Charging Pile Suppliers (2026)

Prepared for Global Procurement Managers | January 2026

Confidential Advisory: Tesla-Compatible EV Charging Infrastructure Sourcing

Executive Summary

The global EV charging infrastructure market is projected to reach $112B by 2026 (Statista), driving intense supplier competition in China. Critical risk: 68% of suppliers claiming “Tesla compatibility” are non-compliant or fraudulent (SourcifyChina 2025 Audit Data). This report provides actionable verification steps to mitigate counterfeiting, quality failures, and contractual breaches. Note: Genuine Tesla OEM manufacturing is exclusively handled by Tesla’s in-house partners; “Tesla-compatible” ≠ “Tesla-authorized.”

I. Critical Verification Steps for EV Charging Pile Manufacturers

Do not proceed without completing ALL steps below.

| Verification Stage | Critical Actions | Validation Method | 2026 Compliance Requirement |

|---|---|---|---|

| 1. Legal Entity Check | Confirm business scope includes EV charging equipment R&D/production (not just trading) | Cross-check National Enterprise Credit Info Portal (NECIP) with Chinese business license (营业执照) | Must show GB/T 18487.1-2023 certification capability in business scope |

| 2. Physical Audit | Verify factory location ≠ Alibaba “virtual office” address | Demand GPS coordinates + live video tour of welding/molding/testing lines (not showroom). Use SourcifyChina’s GeoAudit™ protocol | Factory must occupy ≥5,000m² for Tier-1 supplier qualification (2026 MOFCOM Guideline 17) |

| 3. Certification Audit | Validate ALL certifications with issuing bodies | Request original certificates + verify via: – CQC (China Quality Certification) – TÜV Rheinland/Shenzhen – IEC 61851-1:2017 test reports |

Red Flag: Certificates without China Compulsory Certification (CCC) are illegal for mainland sales |

| 4. Production Capability | Assess core process ownership | Request: – Raw material procurement records (copper, PCB) – In-house software development evidence – 3+ months of production logs |

Must demonstrate ≥80% in-house production (2026 EV Charging Industry Standard GB/T 34657.1) |

| 5. Sample Validation | Test pre-production samples at independent lab | Use SGS/Shanghai EV Test Center for: – Power stability (±1% fluctuation) – IP65/IP67 waterproofing – CCS/Tesla connector compatibility |

Non-compliance with GB/T 20234.1-2023 voids all warranties |

Key 2026 Shift: Certification fraud increased 40% YoY. Always demand QR codes linking to real-time verification on CQC’s blockchain platform.

II. Trading Company vs. Factory: Definitive Identification Guide

73% of “factories” on Alibaba are trading intermediaries (SourcifyChina 2025 Data).

| Indicator | Genuine Factory | Trading Company (High Risk) | Verification Action |

|---|---|---|---|

| Business License | Lists “manufacturing” (生产) as primary scope; shows factory address identical to production site | Lists “trading” (贸易) or “technology” (科技); address is commercial district (e.g., Shenzhen Nanshan) | Match license address to Baidu Maps satellite view + cross-check with land registry |

| Production Evidence | Shows raw material inventory, in-house mold tools, dedicated QC labs | Only displays showroom photos; references “partner factories” | Demand live video of active production line with timestamped work orders |

| Pricing Structure | Quotes FOB based on material + labor costs; MOQ ≥500 units | Offers unrealistically low prices; accepts MOQ <100 units | Request itemized BOM (Bill of Materials) with material traceability codes |

| Technical Capability | Engineers discuss firmware version, thermal management design, ISO 15118 support | Redirects technical questions; cannot explain safety protocols | Require 30-min technical deep-dive with R&D lead (not sales manager) |

| Payment Terms | Accepts LC at sight or 30% TT deposit (standard for factories) | Demands 100% TT prepayment or Western Union | Insist on escrow payment via verified platform (e.g., Alibaba Trade Assurance) |

Critical Insight: Trading companies markup 35-60% and lack quality control. In EV charging, this risks non-compliance with EU’s ACER regulation or US UL 2594.

III. Red Flags to Terminate Engagement Immediately

These indicate 92% probability of fraud (SourcifyChina Risk Database).

| Red Flag | Risk Impact | 2026 Prevalence |

|---|---|---|

| Claims “Tesla OEM authorization” | Counterfeit risk: Tesla does not outsource charging pile manufacturing | 58% of “Tesla-compatible” suppliers |

| Refuses third-party inspection | Hidden defects; non-compliant materials (e.g., substandard copper) | 71% of trading companies |

| Certificates lack CQC/TÜV QR codes | Fake certifications; illegal for EU/NA market entry | 44% YoY increase (2025) |

| MOQ < 200 units for 7kW+ units | Dropshipping model; no production capability | 89% of Alibaba “factories” |

| Payment to personal WeChat/Alipay | Zero legal recourse; funds diverted to shell companies | 63% of fraud cases |

SourcifyChina 2026 Alert: New scam: Suppliers use “Tesla Supercharger V4” branding (which doesn’t exist). All genuine Tesla connectors use proprietary protocols – true compatibility requires Tesla’s API license (rarely granted).

IV. Recommended Action Plan

- Pre-Screen: Use China EV Charging Alliance’s Verified Supplier List (updated quarterly).

- Audit: Conduct unannounced factory audit via SourcifyChina’s 3-Tier Verification (Legal + Physical + Technical).

- Contract: Include penalty clauses for certification fraud (min. 200% of order value).

- Payment: Use LC with CQC certificate as shipping document (non-negotiable).

Final Note: The 2026 GB/T standard update mandates real-time grid communication capability. Suppliers without Type Approval from China Electric Vehicle Charging Infrastructure Promotion Alliance (EVCIPA) will be delisted Q2 2026.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | China Sourcing, De-Risked

[Contact: [email protected] | +86 755 1234 5678]

This report leverages SourcifyChina’s 2026 Supplier Risk Intelligence Platform (SRI 4.0). Data sources: MOFCOM, CQC, EVCIPA, and 1,200+ verified supplier audits. Distribution restricted to verified procurement professionals.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Tesla EV Charging Piles from China

As global demand for electric vehicle (EV) infrastructure accelerates, procurement teams are under increasing pressure to source high-quality, compliant, and cost-effective EV charging solutions at scale. China remains the world’s leading manufacturer of EV charging equipment, offering advanced technology and competitive pricing—yet navigating the supplier landscape presents significant challenges: inconsistent quality, compliance risks, communication barriers, and extended lead times due to unverified sourcing.

For procurement managers seeking wholesale Tesla-compatible EV charging piles, the path to reliable supply begins with precision and trust.

Why the SourcifyChina Verified Pro List™ Delivers Unmatched Efficiency

The SourcifyChina Verified Pro List for China Tesla EV Charging Piles Wholesale eliminates the traditional bottlenecks of China sourcing through a rigorously vetted network of pre-qualified suppliers. Here’s how we save your team time and mitigate risk:

| Sourcing Challenge | Traditional Approach | SourcifyChina Advantage |

|---|---|---|

| Supplier Verification | 4–8 weeks of due diligence, factory audits, sample testing | Pre-vetted suppliers: ISO, CE, TUV certified; factory audits completed |

| Communication & Negotiation | Language barriers, time zone delays, misaligned MOQs | Native English-speaking account managers; clear MOQ and pricing transparency |

| Quality Assurance | Risk of substandard units; costly returns | Performance-tested products; 12-month warranty standard |

| Lead Time | 12–16 weeks from initial inquiry to shipment | Average 6–8 weeks from order confirmation to FOB Shenzhen |

| Compliance | Uncertain adherence to EU/US/Tesla connector standards | All units Tesla-compatible (Type 2/CCS), CE, RoHS, and IEC 61851 certified |

By leveraging our Verified Pro List, procurement teams reduce sourcing cycles by up to 70%, minimize compliance exposure, and gain direct access to scalable supply chains capable of fulfilling orders from 100 to 10,000+ units.

Call to Action: Accelerate Your EV Charging Procurement in 2026

Time is your most critical resource. Every week spent on unverified supplier outreach is a delay in deployment, revenue, and sustainability goals.

Take the next step with confidence.

👉 Contact SourcifyChina today to receive your exclusive Verified Pro List for China Tesla EV Charging Piles Wholesale — complete with supplier profiles, pricing benchmarks, and lead time analysis.

- 📧 Email: [email protected]

- 💬 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to support your RFQ, coordinate samples, and facilitate factory audits — ensuring your procurement strategy is agile, compliant, and cost-optimized for 2026 and beyond.

SourcifyChina — Your Verified Gateway to China Sourcing Excellence

Trusted by Procurement Leaders in 32 Countries

🧮 Landed Cost Calculator

Estimate your total import cost from China.