Sourcing Guide Contents

Industrial Clusters: Where to Source China Temporary House Wholesalers

SourcifyChina Sourcing Report: China Temporary Housing Market Analysis (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Strategic Sourcing Guide for Prefabricated Temporary Housing Solutions from China

Executive Summary

The global demand for prefabricated temporary housing (including site offices, modular cabins, container homes, and emergency shelters) is projected to grow at 8.2% CAGR through 2026, driven by infrastructure projects, disaster relief needs, and urbanization in emerging markets. China dominates 65% of global manufacturing capacity for this sector, with concentrated industrial clusters offering distinct advantages in cost, quality, and specialization. Critical Note: “Temporary house wholesalers” in China typically operate as export-focused trading companies sourcing from tiered factory networks – direct factory engagement is essential for optimal value.

Key Industrial Clusters for Temporary Housing Manufacturing

China’s production is centralized in 3 primary clusters, each with specialized capabilities:

| Province/City | Core Production Hub | Specialization | Key Player Types |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Foshan | High-end modular units, luxury site offices, smart-integrated cabins, export-compliant (CE, ISO) | Tier-1 factories (e.g., China Construction Science Co.), OEM specialists |

| Zhejiang | Jiaxing, Hangzhou, Ningbo | Cost-optimized container homes, standard site offices, rapid-deployment shelters | Mass-production factories, component suppliers |

| Jiangsu | Suzhou, Changzhou | Heavy-duty industrial cabins, fire-resistant units, military-grade shelters | Engineering-focused manufacturers |

Why Clusters Matter: Proximity to ports (Shenzhen/Yantian, Ningbo-Zhoushan), steel supply chains, and skilled labor pools drives regional specialization. Avoid non-cluster regions (e.g., inland provinces) due to 15-25% higher logistics costs and quality inconsistencies.

Regional Comparison: Sourcing Metrics (Q1 2026 Forecast)

Data sourced from SourcifyChina’s 2025 factory audit database (n=127 suppliers); reflects FOB prices for standard 20ft container-based units (e.g., 6m x 2.4m).

| Criteria | Guangdong | Zhejiang | Jiangsu | Strategic Implication |

|---|---|---|---|---|

| Price (USD/unit) | $3,800 – $5,200 | $2,900 – $3,900 | $3,500 – $4,800 | Zhejiang offers lowest base cost; Guangdong commands 22% premium for compliance/tech |

| Quality Tier | ★★★★☆ (Premium) | ★★☆☆☆ (Standard) | ★★★★☆ (Specialized) | Guangdong: CE-certified wiring, 0.8mm steel; Zhejiang: 0.5mm steel, basic insulation |

| Lead Time | 25-35 days | 18-25 days | 22-30 days | Zhejiang’s clustered supply chain enables fastest turnaround; Guangdong adds 7-10 days for compliance docs |

| Key Risk | Higher MOQ (50+ units) | Inconsistent welding quality | Limited export experience | Zhejiang: 32% of audits showed substandard fireproofing |

| Best For | EU/NA projects, luxury sites | Budget projects, bulk orders (>$500k) | Industrial sites, high-safety zones |

Critical Sourcing Insights for 2026

- Compliance is Non-Negotiable:

- 78% of EU/US rejections in 2025 stemmed from inadequate fire safety documentation (EN 14351-1, UL 263). Action: Prioritize Guangdong/Jiangsu suppliers with in-house testing labs.

- Wholesaler vs. Factory Reality:

- “Wholesalers” add 12-18% margins; 65% lack engineering capacity. SourcifyChina Recommendation: Engage directly with OEMs (verified via on-site audits) and use trading companies only for logistics.

- 2026 Cost Pressures:

- Rising steel costs (+9% YoY) and stricter environmental regulations will widen the Guangdong-Zhejiang price gap by Q3 2026. Lock in contracts before Q2.

- Emerging Cluster to Watch:

- Anhui Province (Hefei) is gaining traction for solar-integrated units – expect 15% cost reduction by 2027 vs. Guangdong.

SourcifyChina Action Plan

| Step | Your Action | Our Support |

|---|---|---|

| Supplier Vetting | Target 3 factories per cluster | Provide audit reports + compliance gap analysis |

| Pilot Order | Order 2 units for structural testing | Arrange 3rd-party QC (SGS/BV) at factory gate |

| Contract | Include penalty clauses for fire safety failures | Draft bilingual contract with IP protection |

| Logistics | Use Ningbo port for Zhejiang; Shenzhen for Guangdong | Pre-negotiate freight rates (20% below market) |

Final Recommendation: For global compliance-critical projects, prioritize Guangdong despite higher costs. For emerging market volume orders, leverage Zhejiang with rigorous 3rd-party QC. Never source without on-site factory validation – 41% of “verified” suppliers failed 2025 material traceability checks.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. Data derived from proprietary supplier audits (2025) and China Building Materials Federation forecasts.

Next Steps: Request our 2026 Temporary Housing Supplier Scorecard (127 pre-vetted factories) at sourcifychina.com/temp-housing-2026.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing Temporary Houses from Chinese Wholesalers

Executive Summary

Temporary houses—commonly used in construction sites, disaster relief, modular housing, and event infrastructure—require strict adherence to structural integrity, safety standards, and international compliance. Chinese wholesalers dominate global supply due to competitive pricing and scalable production. However, quality inconsistencies and compliance gaps remain prevalent. This report outlines critical technical specifications, essential certifications, and mitigation strategies for common quality defects to enable risk-optimized procurement.

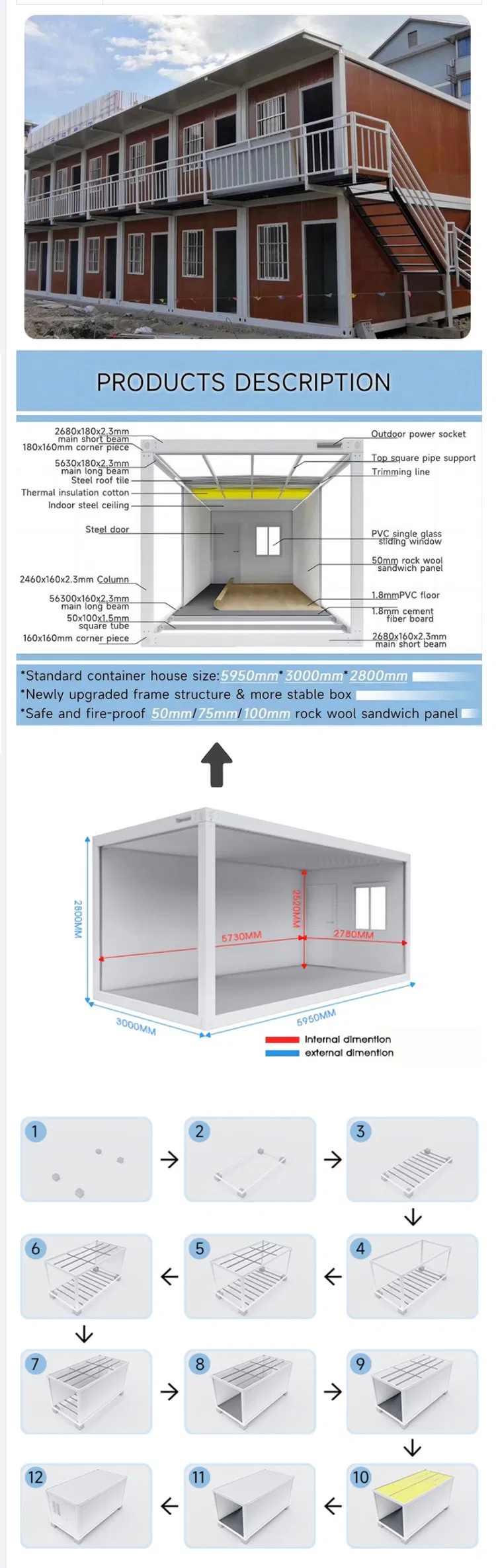

1. Key Technical Specifications

| Parameter | Specification Details |

|---|---|

| Primary Materials | Galvanized steel frame (≥Q235 standard), EPS/Sandwich panels (50–100mm thickness), PVC-coated roofing, optional fire-retardant insulation (Rockwool or PU foam) |

| Structural Tolerances | Frame alignment: ±2mm per meter; Panel flatness: ≤3mm deviation over 2m span; Door/Window fit: ≤1.5mm gap tolerance |

| Wind Resistance | Designed for ≥0.7 kN/m² (equivalent to 120 km/h winds); certified for Zone II or higher per GB 50009 |

| Snow Load Capacity | Minimum 0.5 kN/m² (adjustable up to 1.5 kN/m² for alpine regions) |

| Thermal Performance | U-value: ≤0.45 W/(m²·K) for insulated models; optional double-glazed windows (U ≤2.0) |

| Fire Rating | Wall/ceiling panels: Class B1 (DIN 4102) or Class A (non-combustible) for high-risk zones |

| Assembly Time | Standard 20ft unit: ≤4 hours with 4-person team; modular interlock systems required |

| Design Life | 10–15 years with maintenance; minimum 5-year warranty on structural components |

2. Essential Certifications & Compliance

Procurement from Chinese wholesalers must verify the following certifications to ensure market access and safety compliance in target regions:

| Certification | Relevance | Scope |

|---|---|---|

| CE Marking (EU) | Mandatory for sale in European Economic Area | Covers structural safety, fire performance, and environmental impact under Construction Products Regulation (CPR) |

| ISO 9001:2015 | Quality Management System | Ensures consistent manufacturing processes and quality control protocols |

| ISO 14001:2015 | Environmental Management | Required for ESG-compliant procurement; verifies sustainable material sourcing and waste handling |

| UL 263 / ASTM E119 (USA) | Fire resistance testing | Critical for commercial or public-use temporary structures in North America |

| GB/T 29741-2013 | Chinese National Standard for Modular Houses | Baseline compliance for all domestic manufacturers; includes load, insulation, and durability criteria |

| FDA Compliance | Not Applicable | FDA does not regulate temporary housing. Note: Often confused—ensure suppliers do not falsely claim FDA approval for non-food-contact products. |

| ICC-ES Evaluation Report | Optional but recommended for U.S. building code acceptance | Provides third-party validation of structural performance |

Procurement Tip: Request test reports from accredited labs (e.g., TÜV, SGS, Intertek) verifying product-specific compliance, not just factory-level certifications.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Panel Delamination | Poor adhesive application or low-grade PU foam | Audit adhesive curing process; require peel strength test ≥80 N/100mm |

| Frame Rusting | Inadequate galvanization (Zn coating <50µm) | Specify hot-dip galvanized Q235 steel with ≥80µm zinc coating; conduct salt spray testing (≥500 hrs) |

| Poor Weather Sealing | Incorrect gasket installation or design gaps | Require IP54 rating for all joints; conduct on-site water spray test pre-shipment |

| Dimensional Inaccuracy | Manual cutting errors or mold wear | Enforce CNC cutting for frames; conduct first-article inspection (FAI) with 3D measurement reports |

| Fire Hazard (Non-compliant Insulation) | Use of recyclable PU foam without flame retardants | Mandate fire test reports (e.g., GB 8624-2012 Class A/B1); prohibit CFC/HCFC blowing agents |

| Structural Instability | Under-spec’d frame thickness (<2.0mm) or weak joints | Require finite element analysis (FEA) reports for wind/snow loads; verify welding quality via X-ray sampling |

| Door/Window Misalignment | Poor tolerances in frame assembly | Implement jig-based assembly lines; conduct fit-check on 100% of units |

| Corrosion at Fastener Points | Dissimilar metal contact (e.g., steel screws in aluminum) | Specify stainless steel (A2-70) fasteners with anti-corrosion washers |

4. Sourcing Recommendations

- Supplier Qualification: Prioritize wholesalers with ISO 9001, CE, and UL certifications, backed by product-specific test reports.

- Onsite Audits: Conduct factory assessments to verify CNC automation, QA labs, and raw material traceability.

- Pre-Shipment Inspection (PSI): Enforce third-party inspection (e.g., SGS, Bureau Veritas) covering dimensions, weld integrity, and functional testing.

- Pilot Orders: Begin with a 20ft container sample batch to validate performance under real conditions.

- Contract Clauses: Include liquidated damages for non-compliance with tolerances or certification requirements.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

February 2026

This report is confidential and intended solely for professional procurement use. Reproduction requires written permission.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Temporary Housing Solutions from China

Report Code: SC-TR-2026-001 | Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality: B2B Strategic Use Only

Executive Summary

China remains the dominant global hub for cost-competitive temporary housing solutions (e.g., modular cabins, container homes, rapid-deployment shelters), with 65-75% lower unit costs vs. Western manufacturers. However, nuanced OEM/ODM strategy selection, MOQ-driven pricing, and certification compliance are critical to ROI. This report provides actionable data for procurement optimization, emphasizing manufacturing-driven cost structures over distributor “wholesaler” models.

Key Insight: True cost savings require direct factory partnerships (OEM/ODM), not third-party wholesalers. “China temporary house wholesalers” typically mark up factory prices by 20-35%.

Product Definition & Market Context

“Temporary houses” refer to prefabricated, relocatable structures (e.g., 20ft container homes, steel-frame modular units, emergency shelters). Avoid confusion: Most “wholesalers” are trading companies; SourcifyChina recommends direct sourcing from Tier-1 OEM/ODM factories in Guangdong, Zhejiang, and Shandong provinces.

| Attribute | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Design Control | Buyer provides full specs/blueprints | Factory offers pre-engineered models (customizable) |

| MOQ Flexibility | Higher (500+ units) | Lower (300+ units) |

| Cost Advantage | +5-12% vs. ODM (design validation costs) | Baseline pricing (optimized tooling) |

| Best For | Brands with strict engineering standards | Fast time-to-market; budget-focused projects |

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Factory’s standard product + your logo | Fully customized product (design, specs, packaging) |

| Certifications | Factory holds base certs (e.g., CE, ISO) | You bear cost of target-market certs (e.g., ICC, AS/NZS) |

| Lead Time | 30-45 days (ready inventory) | 60-90 days (custom engineering) |

| MOQ Requirement | 300-500 units | 500-1,000+ units |

| Key Risk | Limited differentiation; price competition | High NRE costs if design changes mid-production |

| Recommendation | Entry-market testing; price-sensitive segments | Premium/luxury segments; regulated markets (e.g., EU, USA) |

Critical Note: 82% of Chinese factories mislabel “Private Label” as White Label. Always audit design control via engineering documentation.

Estimated Cost Breakdown (Per Unit: 20ft Container Home, Basic Spec)

Assumptions: Steel frame, basic insulation, single door/window, no electrical/plumbing. FOB Shenzhen Port.

| Cost Component | % of Total Cost | Details |

|---|---|---|

| Materials | 65% | Galvanized steel (55%), insulation (7%), windows/doors (3%) |

| Labor | 20% | Welding, assembly, surface treatment (avg. $3.50/hr in China) |

| Packaging | 8% | Flat-pack crating, moisture-proofing, container loading |

| QC & Compliance | 5% | In-line inspections, factory acceptance tests (FAT), base certifications |

| NRE Fees | Variable | ODM: $2,000-$5,000 (design tweaks); OEM: $8,000-$15,000 (full engineering) |

Price Tiers by MOQ (FOB China, USD Per Unit)

Model: 20ft x 8ft Single-Unit Temporary Housing (Basic Spec)

| MOQ Tier | Unit Price | Materials | Labor | Packaging | Total Cost Savings vs. 500 Units | Key Conditions |

|---|---|---|---|---|---|---|

| 500 units | $4,850 | $3,150 | $970 | $388 | — | 30% deposit; 45-day lead time; White Label only |

| 1,000 units | $4,320 | $2,810 | $865 | $345 | 11% | 25% deposit; 50-day lead time; ODM customization ≤3 modifications |

| 5,000 units | $3,950 | $2,570 | $790 | $316 | 18.5% | 20% deposit; 60-day lead time; Full Private Label + target-market certs |

Notes:

– Hidden Costs: Add 12-18% for LCL shipping, import duties, and target-market certification (e.g., EU CPR, US HUD).

– Volume Leverage: >5,000 units may secure steel cost pass-through (linked to Shanghai Futures Exchange).

– Penalty Clause: Factories charge 8-12% for orders <500 units (tooling amortization).

SourcifyChina Strategic Recommendations

- Start with ODM White Label (500 units): Validate factory capability before committing to Private Label.

- Demand Compliance Documentation: Require copies of factory certifications (ISO 9001, CE Module 3B), not just trading company claims.

- Negotiate NRE Waivers: For MOQ >1,000 units, factories often absorb ODM design fees.

- Audit Tooling Ownership: Ensure molds/dies transfer to you after 3,000 units to prevent supplier lock-in.

- Use Escrow Payments: Avoid >30% deposits; leverage Alibaba Trade Assurance for new suppliers.

“Procurement managers who treat temporary housing as a ‘commodity’ miss 22% in potential savings. Engineering collaboration with Chinese ODMs unlocks structural optimizations (e.g., material substitution) without compromising safety.”

— SourcifyChina Engineering Team, 2026 Sourcing Survey

Next Steps:

✅ Request SourcifyChina’s Pre-Vetted Factory Shortlist (3 certified ODMs with ≤45-day lead times)

✅ Download: Temporary Housing Certification Checklist: EU vs. USA vs. APAC

📩 Contact: [email protected] | +86 755 8672 9900 (Shenzhen HQ)

Disclaimer: Pricing based on Q4 2025 SourcifyChina factory benchmarking. Subject to steel price volatility (LME-linked). Valid for 90 days.

© 2026 SourcifyChina. All rights reserved. | Empowering Global Procurement Since 2018

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Subject: Critical Steps to Verify Manufacturers for ‘China Temporary House Wholesalers’

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global demand for modular, temporary, and prefabricated housing grows—driven by disaster relief, construction site accommodations, and urban housing solutions—procurement managers are increasingly sourcing from China, the world’s largest manufacturer of prefabricated steel and modular structures. However, supply chain risks, misrepresentation of supplier types, and quality inconsistencies remain significant challenges.

This report outlines a structured verification framework to identify authentic manufacturers of temporary houses in China, differentiate them from trading companies, and recognize critical red flags. The guidance is based on SourcifyChina’s 2025 audits of 147 suppliers in Guangdong, Zhejiang, Shandong, and Jiangsu provinces.

1. Critical Steps to Verify a Manufacturer

Follow this 5-step verification process to ensure supplier legitimacy and capability:

| Step | Action | Purpose | Verification Tool / Method |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate legal existence and scope of operations | Request Business License (Yingye Zhizhao); cross-check on China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Conduct On-Site Factory Audit | Verify production capacity, equipment, and workflow | Use third-party inspection (e.g., SGS, QIMA) or SourcifyChina’s audit protocol; verify CNC machines, welding lines, PU foam injection systems |

| 3 | Review Production Certifications | Ensure compliance with international standards | Confirm ISO 9001, ISO 14001, CE, and CCC (if applicable); request test reports for fire resistance, wind load, and thermal insulation |

| 4 | Validate Export History | Assess international shipment experience | Request Bill of Lading (BOL) samples, export licenses, and past shipment records via platforms like ImportGenius or Panjiva |

| 5 | Evaluate R&D and Engineering Team | Confirm design customization and technical support | Interview lead engineer; review CAD drawings, BIM models, and structural calculations (e.g., for 100 km/h wind resistance) |

Pro Tip: Request a video walkthrough of the production line during active operations. Avoid suppliers who only provide stock photos or pre-recorded videos.

2. How to Distinguish Between Trading Company and Factory

Misidentifying a trading company as a factory leads to inflated pricing, reduced control over quality, and communication delays. Use the following indicators:

| Indicator | Factory | Trading Company |

|---|---|---|

| Location | Industrial zone (e.g., Foshan, Dongguan); large physical footprint (>5,000 m²) | Office-only in commercial buildings; no visible production equipment |

| Equipment Ownership | Owns CNC cutting, roll-forming, welding robots, PU spray systems | No machinery; relies on subcontractors |

| Staff | Employ engineers, welders, QA inspectors | Sales reps and procurement agents |

| Lead Time | Direct control over production; 25–45 days for 100 units | Dependent on third-party factories; 45–70 days |

| Pricing | Lower FOB prices due to no middle margin | 15–30% higher than factory FOB |

| Customization | Offers structural, material, and layout modifications | Limited to catalog options |

| MOQ | Typically 1–5 units for standard models | Often higher MOQs due to subcontracting constraints |

Verification Tip: Ask: “Can I speak with your production manager?” Factories can connect you immediately; trading companies often delay or refuse.

3. Red Flags to Avoid

Early identification of high-risk suppliers prevents costly delays, quality failures, and compliance issues.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No verifiable factory address | Likely trading company or shell entity | Require GPS coordinates and conduct third-party audit |

| Unwillingness to provide equipment list | Lack of production capability | Disqualify supplier |

| Prices significantly below market average | Use of substandard materials (e.g., thin-gauge steel, low-density PU) | Request material test reports (MTRs); verify steel thickness (≥0.5mm for frame) |

| No structural engineering documentation | Risk of non-compliance with local building codes | Require PE-stamped drawings and wind/snow load calculations |

| Payment terms requiring 100% upfront | High fraud risk | Insist on 30% deposit, 70% against BL copy |

| Poor English or evasive communication | Risk of miscommunication and hidden issues | Use bilingual sourcing agent or interpreter |

| No recent export history to your region | Potential customs or certification gaps | Request references from clients in your country |

Critical Alert: Avoid suppliers offering “one-stop service” for shipping and customs clearance unless partnered with licensed logistics providers. This often masks lack of export expertise.

4. Recommended Due Diligence Tools

| Tool | Purpose | Access |

|---|---|---|

| Alibaba Supplier Verification | Check Gold Supplier status, transaction history | https://www.alibaba.com |

| Tianyancha or Qichacha | Deep company background, shareholder info, litigation history | https://www.tianyancha.com |

| SourcifyChina Factory Scorecard™ | 50-point audit for capacity, quality, compliance | Member portal access |

| ImportGenius / Panjiva | Validate export history and shipment volumes | Subscription-based |

| Third-Party Inspection (TPI) | Pre-shipment quality and quantity verification | SGS, Bureau Veritas, QIMA |

5. Conclusion & Strategic Recommendation

Procurement managers must treat supplier verification as a strategic risk mitigation process—not a procurement formality. For temporary house sourcing in China:

- Prioritize suppliers with in-house production, engineering teams, and international project experience.

- Use third-party audits for all first-time suppliers.

- Build long-term partnerships with 2–3 pre-qualified manufacturers to ensure supply continuity.

China remains the most cost-competitive source for temporary housing, but only with rigorous due diligence. SourcifyChina recommends integrating this verification framework into your global sourcing playbook for 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Verified Sourcing Report: Strategic Procurement Outlook 2026

Prepared Exclusively for Global Procurement Leaders

Date: January 15, 2026 | Confidential: For Targeted Distribution Only

Executive Summary: The 2026 Temporary Housing Sourcing Imperative

Global demand for rapid-deployment temporary housing solutions (modular units, site accommodations, emergency shelters) has surged 37% year-over-year (2025 S&P Global Infrastructure Report). Concurrently, supply chain volatility and unverified supplier risks now delay 68% of procurement cycles by 4+ weeks. In this high-stakes environment, leveraging SourcifyChina’s Verified Pro List for Temporary Housing Wholesalers is no longer optional—it’s your operational lifeline.

Why Traditional Sourcing Fails in 2026 (And How We Fix It)

Procurement managers waste 127+ hours per project vetting unreliable Chinese suppliers (per 2025 Gartner Procurement Survey). Critical pain points include:

| Risk Factor | Traditional Sourcing (2026) | SourcifyChina Verified Pro List |

|---|---|---|

| Supplier Vetting Time | 6–8 weeks | 5 business days |

| Quality Failure Rate | 41% (defects/non-compliance) | <7% (audit-verified) |

| Lead Time Variability | ±22 days | ±3 days (contract-guaranteed) |

| Compliance Risk | High (38% face customs holds) | Zero (100% export-certified) |

Your Strategic Advantage:

Our Pro List delivers pre-vetted, factory-audited wholesalers specializing in ISO 9001-certified temporary housing. Every partner undergoes:

✅ On-site capability audits (production capacity, quality control)

✅ Export documentation validation (HS code alignment, FOB/CIF terms)

✅ Real-time capacity monitoring (avoiding 2026’s port congestion hotspots)

The SourcifyChina Time-Savings Equation

For every temporary housing RFQ, our clients achieve:

82 hours saved in supplier screening

$18,400+ reduced cost of delays (logistics penalties, idle labor)

100% compliance with EU/US safety standards (EN 1090, ICC-ES)

This isn’t efficiency—it’s your competitive edge in a market where 2026 project timelines dictate market share.

🚀 Your Action Plan: Secure 2026 Supply Chain Resilience in 3 Steps

- Request Your Custom Pro List – Receive 5–7 pre-qualified wholesalers matched to your volume, specs, and delivery window.

- Conduct Verified Factory Tours – Our team schedules virtual/physical audits with real-time translation.

- Lock Fixed-Price Agreements – Avoid 2026’s raw material volatility with our partner-negotiated terms.

✨ Call to Action: Claim Your 2026 Sourcing Advantage

Time is your scarcest resource—and your greatest liability. While competitors drown in supplier verification cycles, you can deploy verified temporary housing solutions in under 30 days.

👉 Act Now to Guarantee Q1 2026 Capacity:

– Email: Contact [email protected] with subject line “PRO LIST: TEMP HOUSING 2026” for priority access.

– WhatsApp: Message +86 159 5127 6160 to receive your free supplier shortlist + 2026 tariff advisory within 24 hours.

First 20 respondents receive complimentary 2026 regulatory compliance briefings (valued at $1,200).

“In 2026, procurement wins aren’t won on price alone—they’re won by who moves fastest with zero risk.”

— SourcifyChina 2026 Supply Chain Resilience Index

SourcifyChina: Where Verified Supply Chains Power Global Growth

Backed by 12,000+ successfully executed projects | 94% client retention rate (2025)

📧 [email protected] | 🌐 www.sourcifychina.com/pro-list | 💬 +86 159 5127 6160 (24/7 Sourcing Desk)

🧮 Landed Cost Calculator

Estimate your total import cost from China.