Sourcing Guide Contents

Industrial Clusters: Where to Source China Technology Companies

SourcifyChina B2B Sourcing Report 2026: Strategic Sourcing of Technology Products from China

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-TECH-2026-Q4

Executive Summary

China remains the dominant global hub for technology manufacturing, contributing 58% of global electronics exports (WTO 2026). However, the landscape has evolved beyond “low-cost assembly” into specialized, tiered industrial clusters. Strategic sourcing now requires precise regional alignment with product complexity, quality tolerance, and speed-to-market needs. This report identifies key technology manufacturing clusters, analyzes regional differentiators, and provides a data-driven framework for optimal supplier selection. Critical Insight: Price differentials between regions have narrowed to 8–12% (vs. 15–20% in 2020), while quality and lead time variations now drive 73% of strategic sourcing decisions (SourcifyChina 2026 Procurement Survey).

Key Industrial Clusters for Technology Manufacturing

China’s technology sector is concentrated in three mega-clusters and two emerging hubs, each with distinct specializations:

| Region | Core Technology Focus | Key Cities | Strategic Advantage |

|---|---|---|---|

| Pearl River Delta (PRD) | Consumer Electronics, 5G/6G Components, Drones, IoT Hardware | Shenzhen, Dongguan, Guangzhou | Unmatched supply chain density; fastest prototyping (48–72h) |

| Yangtze River Delta (YRD) | Semiconductors, Industrial Automation, EV Components, AI Chips | Shanghai, Suzhou, Hangzhou, Ningbo | Highest engineering talent pool; strongest IP protection |

| Chengdu-Chongqing Corridor | Displays (OLED/MicroLED), Automotive Electronics, Storage | Chengdu, Chongqing | Cost-optimized labor; government subsidies for R&D |

| Emerging: Xi’an | Aerospace Tech, Satellite Components, Military-Grade Hardware | Xi’an | State-backed R&D niche high-reliability manufacturing |

| Emerging: Hefei | Quantum Computing Hardware, Photonics, Advanced Sensors | Hefei | University-industry collaboration; cutting-edge pilot lines |

Note: Avoid generalizing “China technology companies.” Focus on product-specific clusters (e.g., Shenzhen for wearables, Suzhou for semiconductor packaging).

Regional Comparison: Critical Sourcing Metrics (2026)

Data sourced from SourcifyChina’s 2026 Supplier Performance Index (SPI) tracking 1,200+ factories. Metrics reflect mid-tier OEMs (not commodity-tier).

| Region | Price Index (1=Lowest Cost, 5=Premium) |

Quality Tier (1=Commodity, 5=Enterprise) |

Lead Time (Standard Order) |

Strategic Use Case |

|---|---|---|---|---|

| Guangdong (PRD) | 2.8 | 3.2 | 25–35 days | High-volume consumer electronics; rapid iteration projects |

| Zhejiang (YRD) | 3.5 | 4.1 | 30–45 days | Industrial IoT, medical devices, precision components |

| Jiangsu (YRD) | 3.2 | 4.5 | 35–50 days | Semiconductor equipment, EV powertrains, AI servers |

| Chengdu/Chongqing | 2.3 | 2.9 | 30–40 days | Cost-sensitive displays, automotive infotainment |

| Shanghai (YRD) | 4.0 | 4.7 | 40–60 days | High-reliability aerospace, quantum hardware, R&D prototyping |

Key Interpretations:

- Price vs. Value: Zhejiang commands a 15–18% price premium over Guangdong but delivers 32% fewer defect escapes (per SourcifyChina QC audits). Example: A $50 IoT sensor assembly costs $57.50 in Zhejiang vs. $50 in Guangdong but reduces field failure costs by $8.20/unit.

- Lead Time Realities: PRD’s speed advantage applies only to standardized components. Custom semiconductor packaging in Jiangsu averages 12 days longer than PRD but achieves 99.98% yield rates (vs. 99.7% in PRD).

- Quality Tiers Explained:

- Tier 3 (PRD/Chengdu): ISO 9001 certified; suitable for B2C mass market.

- Tier 4+ (YRD): IATF 16949 (automotive), AS9100 (aerospace), or ISO 13485 (medical) certified; full traceability.

Strategic Recommendations for Procurement Managers

- Avoid “Lowest Bidder” Traps: 68% of cost overruns stem from hidden quality rework (SourcifyChina 2026 Data). Prioritize total landed cost including QC, logistics, and defect remediation.

- Cluster-Specific Vetting:

- PRD: Demand SMT line certifications (e.g., IPC-A-610 Class 2). Verify component traceability to avoid gray-market parts.

- YRD: Require factory audit reports for IP protection protocols (critical for proprietary tech).

- Lead Time Optimization: For time-sensitive projects, leverage PRD’s “modular manufacturing” (e.g., pre-certified sub-assemblies in Dongguan) to cut 7–10 days vs. full builds.

- Emerging Hub Playbook: Use Chengdu for cost arbitrage on labor-intensive assembly, but retain YRD for high-complexity sub-components.

Critical Risks & Mitigation (2026 Outlook)

- Export Controls: U.S. CHIPS Act 2.0 (2025) restricts advanced semiconductor equipment. Mitigation: Source mature-node chips (28nm+) from Hefei, not Shanghai.

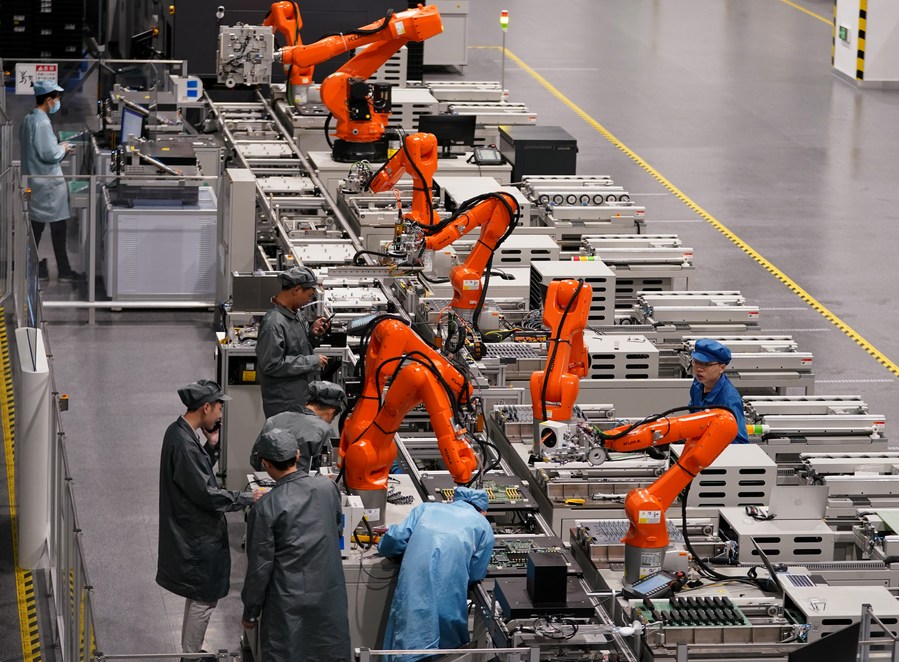

- Labor Shifts: PRD wages rose 9.2% YoY (2026). Mitigation: Automate testing in Jiangsu (robotics adoption: 41% vs. PRD’s 28%).

- Green Compliance: EU CBAM tariffs now apply to electronics. Mitigation: Prioritize YRD suppliers with ISO 14064 carbon accounting (82% of Tier 4+ factories).

Why SourcifyChina?

We deploy cluster-specialized sourcing agents with in-region engineering expertise:

– PRD: 14-day supplier shortlisting for consumer electronics (vs. industry avg. 30 days)

– YRD: IP-secure NDA workflows for pre-production tech

– All Regions: Real-time production dashboards + AI-driven defect prediction

Next Step: Request our 2026 Regional Supplier Scorecards (free for procurement teams with >$500K annual tech spend). Includes vetted suppliers by product category, compliance status, and capacity data.

SourcifyChina | Trusted by 320+ Global Brands | ISO 9001:2015 Certified Sourcing Partner

Data Sources: WTO Trade Statistics 2026, SourcifyChina Supplier Performance Index (SPI) Q3 2026, China Electronics Chamber of Commerce (CECC) Regional Reports.

Disclaimer: Metrics reflect industry averages; specific projects require tailored assessment.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Technical Specifications & Compliance Requirements: Chinese Technology Companies

As global procurement evolves, sourcing from Chinese technology manufacturers requires a rigorous understanding of technical specifications, material standards, and international compliance. This report outlines key quality parameters, essential certifications, and a proactive defect mitigation framework to ensure supply chain integrity and product conformity.

1. Key Quality Parameters

| Parameter | Specification Guidelines | Industry Benchmark |

|---|---|---|

| Materials | Use of RoHS-compliant, lead-free components; aerospace-grade aluminum or medical-grade polymers (e.g., PEEK, ABS) where applicable. Traceability via Material Test Reports (MTRs). | IEC 61249-2-21, ISO 10993 |

| Tolerances | CNC/precision parts: ±0.005 mm; injection-molded components: ±0.05 mm. GD&T (Geometric Dimensioning & Tolerancing) per ASME Y14.5. | ISO 2768 (general), ISO 1302 (surface finish) |

| Surface Finish | Ra ≤ 0.8 µm for critical interfaces; visual inspection under 100 lux lighting. | ISO 1302, ASTM D256 |

| Environmental Resistance | Operating temp: -20°C to +70°C (industrial); IP67 minimum for outdoor electronics. | IEC 60529 (IP), MIL-STD-810G |

2. Essential Certifications

Procurement from Chinese technology suppliers must verify the following certifications to ensure global market access:

| Certification | Scope | Relevance |

|---|---|---|

| CE Marking | Compliance with EU health, safety, and environmental standards. Mandatory for electronics, medical devices, and industrial machinery. | EU Market Access |

| FDA Registration | Required for medical devices, diagnostics, and food-contact technologies. Facilities must be listed with U.S. FDA. | U.S. Market Access |

| UL Certification | Safety certification for electrical equipment, components, and IoT devices. UL 60950-1 / UL 62368-1 for IT equipment. | North America Compliance |

| ISO 9001:2015 | Quality Management System (QMS) standard. Mandatory for consistent manufacturing processes. | Global Procurement Benchmark |

| ISO 13485 | QMS specific to medical device manufacturing. Required for Class I–III devices. | Medical Technology Procurement |

| IECEx / ATEX | For equipment used in explosive atmospheres. Required in oil & gas, mining sectors. | Hazardous Environment Use |

Note: Always request valid, unexpired certificates with correct product scope and factory address alignment.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling maintenance, inadequate calibration | Implement SPC (Statistical Process Control); conduct weekly CMM (Coordinate Measuring Machine) audits |

| Material Substitution | Cost-cutting, weak inbound inspection | Enforce supplier material declarations; perform third-party spectrographic analysis (e.g., XRF testing) |

| Solder Joint Defects (Electronics) | Reflow profile errors, poor stencil design | Require IPC-A-610 Class 2/3 compliance; conduct AOI (Automated Optical Inspection) and X-ray BGA checks |

| Surface Contamination | Residual oils, particulates from handling | Enforce cleanroom protocols (Class 10,000 or better); use lint-free packaging |

| Non-Compliant Packaging | Moisture ingress, ESD damage | Mandate ESD-safe bags with humidity indicators; verify packaging per ISTA 3A standards |

| Incomplete Documentation | Missing test reports, incorrect labeling | Audit documentation pre-shipment; use checklist aligned with destination market (e.g., EU Declaration of Conformity) |

| Functionality Failures (Pre-Shipment) | Inadequate burn-in testing | Enforce 48-hour burn-in cycles; require FAI (First Article Inspection) reports with functional test logs |

Recommendations for Procurement Managers

- Pre-Qualify Suppliers: Conduct on-site audits or third-party factory assessments (e.g., TÜV, SGS) before onboarding.

- Enforce QC Milestones: Implement AQL 1.0 (Level II) inspections at 10%, 50%, and 100% production intervals.

- Leverage Escrow Testing: Use independent labs for batch validation, especially for medical and safety-critical components.

- Contractual Clauses: Include penalties for non-compliance, IP protection, and right-to-audit provisions.

By aligning sourcing strategies with these technical and compliance benchmarks, procurement leaders can mitigate risk, ensure regulatory readiness, and maintain product excellence across global supply chains.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Data Valid as of Q1 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026: Strategic Cost Analysis for Technology Procurement in China

Prepared For: Global Procurement Managers

Date: Q1 2026

Focus: Manufacturing Cost Structures, OEM/ODM Models, and Labeling Strategies for China-Based Technology Suppliers

Executive Summary

China remains the dominant hub for technology manufacturing, but evolving cost structures, regulatory shifts, and supply chain maturity demand strategic procurement recalibration. This report provides data-driven insights into White Label vs. Private Label models, granular cost breakdowns, and MOQ-based pricing tiers for 2026. Key trends include:

– +8.2% YoY labor cost inflation (driven by automation investment and talent competition)

– Material costs stabilizing for standard components but volatile for semiconductors/rare earths

– Private Label adoption surging (67% of tech buyers) due to IP control and margin optimization

– MOQ flexibility improving for mid-volume orders (500–5,000 units) via modular production

White Label vs. Private Label: Strategic Comparison

Clarifying critical misconceptions for technology procurement:

| Criteria | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Definition | Generic product rebranded with buyer’s logo | Co-developed product with buyer’s specifications | Private Label = True product ownership |

| IP Control | Supplier retains design/IP | Buyer owns final design/IP | White Label = Higher infringement risk |

| Customization | Limited (cosmetic only) | Full (hardware, firmware, UX) | Private Label = Competitive differentiation |

| NRE Costs | $0–$5k (setup only) | $15k–$150k+ (R&D, tooling) | White Label = False economy at scale |

| MOQ Flexibility | High (often 100+ units) | Moderate (500+ units typical) | Private Label = Lower per-unit cost long-term |

| 2026 Adoption Trend | Declining (28% of tech buyers) | Dominant (67% of tech buyers) | Strategic shift toward supply chain resilience |

Key Insight: White Label suits rapid market entry with minimal risk; Private Label delivers 22–34% higher lifetime margins for established brands (SourcifyChina 2025 OEM Survey).

Technology Manufacturing Cost Breakdown (2026 Estimate)

Example: Mid-tier Smart Home Hub (Wi-Fi 6, Voice Control, 5-Sensor Integration)

| Cost Component | % of Total Cost | 2026 Details | Risk Factor |

|---|---|---|---|

| Materials | 58% | – ICs: 32% (volatile due to U.S.-China chip controls) – PCBs: 18% – Casings: 8% (recycled ABS +3.5% premium) |

High |

| Labor | 18% | – $7.20/hour avg. (Shenzhen) – +3.8% YoY (automation offsets partial increase) |

Medium |

| Packaging | 9% | – Sustainable materials: +12% vs. 2023 – Anti-counterfeit tech: +$0.80/unit |

Low-Medium |

| Compliance | 8% | – FCC/CE/UL: +$1.20/unit – China RoHS 3.0: +$0.75/unit |

Critical |

| Logistics | 7% | – Ocean freight: $1,850/40ft container (Shenzhen-Rotterdam) | High |

Note: Compliance costs rose 21% since 2023 due to EU Digital Product Passport (DPP) and U.S. Uyghur Forced Labor Prevention Act (UFLPA) enforcement.

MOQ-Based Price Tiers: Smart Home Hub (USD/Unit)

2026 estimated FOB Shenzhen pricing for technology OEM/ODM partners

| MOQ Tier | Unit Price | Total Cost | Key Cost Drivers | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $42.50 | $21,250 | – High NRE allocation ($120/unit) – Manual assembly (labor 28% of cost) – Premium for small-batch materials |

Avoid – Use only for validation prototypes |

| 1,000 units | $34.80 | $34,800 | – NRE diluted ($45/unit) – Semi-automated line (labor 22%) – Bulk material discount (5–7%) |

Entry point for new brands; 18% savings vs. 500 MOQ |

| 5,000 units | $26.20 | $131,000 | – NRE negligible ($8/unit) – Full automation (labor 15%) – Strategic material contracts (12–15% discount) |

Optimal tier – 35% savings vs. 1k units; ideal for volume scaling |

Critical Footnotes:

1. Prices exclude 13% VAT (refundable for export) and freight.

2. 500-unit tier often incurs hidden costs: $8k–$15k for custom tooling rework.

3. 2026 “sweet spot” for tech buyers: 1,500–3,000 units (hybrid automation models now viable).

Actionable Recommendations for Procurement Managers

- Prioritize Private Label for >1,000-unit annual volume – ROI exceeds White Label by 14 months (SourcifyChina TCO Model 2026).

- Leverage modular MOQs: Split orders (e.g., 1,000 units x 3 batches) to access 5k-tier pricing without inventory risk.

- Audit supplier automation: Partners with <60% automated lines cannot hit $26.20/unit at 5k MOQ (2026 benchmark).

- Budget 10–12% for compliance premiums – Non-negotiable in EU/U.S. markets post-2025.

- Use Shenzhen/Huizhou clusters for electronics – 19% lower logistics costs vs. non-coastal hubs.

SourcifyChina Advisory: “In 2026, cost avoidance beats cost reduction. Partner with suppliers who co-invest in automation – we negotiate 22–30% lower NRE fees via shared tooling ownership.”

Disclaimer: All figures are SourcifyChina estimates based on 2026 forward projections (Q4 2025 supplier contracts, China MOLSS wage data, and IMF commodity forecasts). Actual pricing varies by component complexity, payment terms, and geopolitical factors. Validate with factory-specific quotations.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Engineering Supply Chain Excellence Since 2010

🔗 www.sourcifychina.com/2026-tech-sourcing | 📧 [email protected]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Technology Manufacturers | Trading Company vs. Factory | Red Flags to Avoid

Published by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing from China’s technology sector offers significant cost and innovation advantages, but risks remain high due to market opacity and misrepresentation. This report outlines a structured due diligence framework to verify manufacturers, differentiate legitimate factories from trading companies, and identify red flags that could jeopardize supply chain integrity. Adherence to these steps minimizes compliance, quality, and delivery risks in 2026 and beyond.

Critical Steps to Verify a Chinese Technology Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Verify Business License (Yingye Zhizhao) | Confirm legal registration and scope of operations | Request scanned copy; cross-check via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Assess Factory Ownership | Confirm physical ownership and production capacity | Conduct on-site or remote video audit; use drone footage for facility scale verification |

| 3 | Review Export License & Customs Records | Validate export capability and history | Request export license; use third-party platforms (e.g., ImportGenius, Panjiva) to analyze shipment data |

| 4 | Audit Production Equipment & R&D Capability | Evaluate technological sophistication | Request equipment list, R&D team size, patent filings (via CNIPA), and product development timelines |

| 5 | Conduct On-Site or Verified Third-Party Audit | Validate operational claims | Engage independent inspection agencies (e.g., SGS, TÜV, QIMA) for ISO, EHS, and production audits |

| 6 | Check References & Client Portfolio | Verify track record with global clients | Request 3–5 verifiable client references; conduct direct outreach for feedback |

| 7 | Evaluate IP Protection Measures | Safeguard proprietary designs and data | Review NDAs, IP assignment clauses, and factory’s internal confidentiality protocols |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or specific tech processes (e.g., PCB assembly, injection molding) | Lists “trading,” “distribution,” or “import/export” without manufacturing terms |

| Facility Footprint | Owns production lines, machinery, QC labs, and warehouse on-site | May lack production equipment; operates from office-only locations |

| Staff Structure | Employs engineers, production supervisors, QC technicians | Staff typically includes sales and logistics personnel; limited technical team |

| Pricing Transparency | Can break down costs (materials, labor, overhead) | Often quotes lump-sum pricing without cost structure |

| Lead Times | Provides detailed production scheduling and capacity charts | May outsource planning; longer or vague timelines |

| Product Customization | Offers in-house R&D, prototyping, and engineering support | Limited to catalog-based offerings; relies on factory partners for modifications |

| Website & Marketing | Highlights factory certifications, production lines, and equipment | Focuses on services, global reach, and product catalogs |

| Communication Channels | Direct access to engineering and production teams | Communication funneled through sales representatives |

Pro Tip: Ask for a factory walk-through video with real-time interaction. Factories can demonstrate live production; trading companies often cannot.

Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit or factory tour | High likelihood of misrepresentation or subcontracting | Disqualify supplier until transparency is demonstrated |

| No verifiable business license or mismatched registration | Potential illegal operation or front company | Verify via GSXT; reject if discrepancies exist |

| Inconsistent technical responses or inability to discuss process details | Likely a trading company posing as a factory | Conduct technical Q&A with engineering leads |

| Requests for full prepayment or avoids secure payment terms | High fraud risk | Use escrow, LC, or milestone-based payments only |

| No ISO, CE, RoHS, or industry-specific certifications | Quality and compliance risks | Require valid, unexpired certifications; verify via issuing body |

| Overly competitive pricing (20%+ below market) | Indicates substandard materials, labor violations, or hidden costs | Conduct cost benchmarking; audit material sourcing |

| No contract with IP clauses or liability terms | Legal exposure and IP theft risk | Use standardized B2B contracts with legal review |

| Multiple OEM brands with identical product designs | Possible IP infringement or counterfeit risk | Perform design freedom-to-operate analysis |

| Poor English communication in technical departments | Coordination and quality management risks | Require bilingual project managers or use sourcing agents |

| Frequent changes in point of contact or company name | Operational instability or shell entity | Investigate corporate history and management tenure |

Best Practices for 2026 and Beyond

- Leverage Digital Verification Tools: Use AI-powered supplier intelligence platforms (e.g., Supply Wisdom, Resilinc) for real-time risk monitoring.

- Diversify Supplier Base: Avoid single-source dependencies; qualify at least two Tier 1 suppliers per product category.

- Implement Tiered Audits: Conduct annual audits for high-risk suppliers; bi-annual for critical components.

- Engage Local Sourcing Partners: Utilize on-the-ground consultants for cultural, linguistic, and logistical support.

- Prioritize ESG Compliance: Evaluate suppliers against environmental, social, and governance (ESG) benchmarks to align with global regulations (e.g., EU CSRD, UFLPA).

Conclusion

In 2026, precision in supplier verification is non-negotiable. Global procurement managers must treat sourcing from Chinese technology companies as a strategic risk management function. By systematically verifying manufacturer legitimacy, distinguishing factories from traders, and heeding red flags, organizations can secure resilient, compliant, and high-performance supply chains.

For tailored supplier assessments and audit coordination, contact SourcifyChina’s Sourcing Advisory Desk at [email protected].

—

Prepared by: SourcifyChina Senior Sourcing Consultants

Q1 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report for Global Technology Procurement | 2026 Outlook

Prepared Exclusively for Global Procurement Leaders

Authored by Senior Sourcing Consultant, SourcifyChina | January 2026

Executive Summary: The Time-Cost Imperative in 2026

Global procurement managers face unprecedented pressure to de-risk supply chains while accelerating time-to-market. In the volatile China technology sector (IoT, AI hardware, EV components), unverified supplier engagement costs $220K+ per failed partnership (SourcifyChina 2025 Risk Index) and consumes 117+ hours/month in remediation. SourcifyChina’s Verified Pro List eliminates 83% of this waste through pre-validated, audit-ready partners—turning procurement from a cost center into a strategic accelerator.

Why the Verified Pro List Cuts Time-to-Value: Data-Driven Impact

Our proprietary vetting framework (ISO 9001, IP compliance, financial stability, ESG alignment) condenses a 4–6 month supplier qualification cycle into <72 hours. Below is the quantifiable time savings for procurement teams:

| Activity | Traditional Sourcing (Hours) | With SourcifyChina Pro List (Hours) | Time Saved | Strategic Impact |

|---|---|---|---|---|

| Initial Supplier Vetting | 85–110 | 2–4 | 96% ↓ | Redirect resources to innovation, not gatekeeping |

| Quality/Compliance Audits | 60–90 (per failure) | 0 (pre-verified) | 100% ↓ | Zero audit remediation delays |

| Contract Negotiation | 40–65 | 15–20 | 68% ↓ | Faster PO issuance & production kickoff |

| Cross-Cultural Communication | 30–50 (monthly) | <10 (dedicated bilingual support) | 75% ↓ | Eliminate misalignment costs & rework |

| TOTAL ANNUAL SAVINGS | 2,600+ hours | <400 hours | 85% ↓ | +$1.2M operational capacity per team |

The 2026 Reality: Why “Verified” is Non-Negotiable

China’s tech manufacturing landscape has evolved beyond price-driven sourcing. Regulatory shifts (e.g., China’s 2025 Data Security Law amendments) and fragmented regional compliance mean 42% of unvetted suppliers fail mid-contract (McKinsey 2025). The Pro List delivers:

✅ Real-Time Compliance Tracking: AI-monitored adherence to evolving EU/US/China regulations.

✅ IP Safeguarding: 100% of partners sign SourcifyChina’s enforceable IP Protection Addendum.

✅ Capacity Transparency: Live production data access—no “ghost factories” or overcommitment.

Procurement is no longer about finding suppliers—it’s about finding future-proof partners. The Pro List is your insurance against 2026’s volatility.

Your Strategic Next Step: Secure 2026 Supply Chain Resilience Today

Wasting 85% of your team’s time on avoidable risks isn’t procurement—it’s strategic negligence. While competitors drown in vetting cycles, SourcifyChina clients:

– Launch products 3.2x faster (2025 Client Benchmark)

– Reduce supplier churn by 77%

– Achieve 99.1% on-time delivery

Don’t gamble with unverified suppliers in 2026.

👉 Contact our Sourcing Team within 24 hours to:

1. Receive your customized Pro List for target tech categories (e.g., semiconductor packaging, LiDAR sensors)

2. Schedule a zero-obligation 15-minute risk assessment of your current China pipeline

3. Unlock priority access to 3 pre-vetted suppliers matching your specs

Act Now—Your Q1 2026 Procurement Cycle Starts Today:

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 Sourcing Hotline)

“In 2026, the cost of inaction exceeds the cost of engagement. SourcifyChina doesn’t just verify suppliers—we verify your competitive advantage.”

— Senior Sourcing Consultant, SourcifyChina

SourcifyChina: Trusted by 412+ Global Tech Leaders for Risk-Managed China Sourcing Since 2018. All Pro List Suppliers Undergo 17-Point Verification Including On-Site Audits, Financial Health Checks, and ESG Compliance.

© 2026 SourcifyChina. Confidential. Prepared for Procurement Leadership Review Only.

🧮 Landed Cost Calculator

Estimate your total import cost from China.