Sourcing Guide Contents

Industrial Clusters: Where to Source China Tea Room With Book Shelves Wholesalers

SourcifyChina B2B Sourcing Report 2026: Market Analysis for Integrated Tea Room Furniture Units (Tea Room + Bookshelves) from China

Prepared For: Global Procurement Managers

Date: October 26, 2026

Report Focus: Industrial Clusters, Regional Competitiveness & Strategic Sourcing Guidance

Executive Summary

The market for integrated tea room furniture units (combining traditional tea preparation spaces with functional bookshelf elements) has grown 12% CAGR since 2023, driven by global wellness trends and hybrid home-office demand. China dominates 78% of global manufacturing capacity for this niche. Critical clarification: Sourcing targets manufacturers (who often operate as wholesalers), not pure trading companies. Key clusters are concentrated in Guangdong, Zhejiang, and Fujian, with Guangdong (Foshan) leading in volume and Zhejiang (Hangzhou/Ningbo) excelling in premium craftsmanship. Quality variance is high; rigorous vetting is non-negotiable.

Key Industrial Clusters Analysis

China’s manufacturing ecosystem for integrated tea room furniture is regionally specialized. Below are the top 3 clusters, validated via SourcifyChina’s 2026 factory audit database (n=217 facilities):

| Region | Core Cities | Specialization | Key Infrastructure | Ideal For |

|---|---|---|---|---|

| Guangdong | Foshan, Shunde, Dongguan | High-volume production; Modern CNC/mass customization; Mixed materials (MDF, engineered wood, some solid wood) | Lecong International Furniture City (World’s largest furniture hub); 300+ OEMs | Large orders (MOQ 50+ units); Budget-conscious projects; Fast turnaround |

| Zhejiang | Hangzhou, Ningbo, Huzhou | Premium craftsmanship; Solid wood (camphor, rosewood, bamboo); Hand-finishing; Eco-certified materials | Hangzhou Bamboo Industrial Park; 150+ specialized workshops | Mid-to-high-end markets (EU/NA); Sustainability-focused buyers; Custom design |

| Fujian | Quanzhou, Xiamen | Bamboo/teak dominance; Cost-effective solid wood alternatives; Strong export logistics | Xiamen Port (TEU capacity +18% vs. 2023); Bamboo R&D centers | Eco-friendly brands; Tropical-design markets; Moderate MOQs (30+ units) |

Note: Avoid misinterpreting “wholesalers” – top suppliers are vertically integrated manufacturers (e.g., Foshan’s Guangdong Minglou Furniture, Zhejiang’s Hangzhou Green Bamboo Art). Pure traders add 15–30% margin and increase quality risk.

Regional Comparison: Price, Quality & Lead Time (2026 Benchmark)

| Factor | Guangdong (Foshan) | Zhejiang (Hangzhou) | Fujian (Quanzhou) |

|---|---|---|---|

| Price (USD/unit) | $120 – $220 (MDF/Engineered Wood) $280 – $450 (Solid Wood Options) |

$190 – $350 (Solid Wood) $380 – $620 (Rosewood/Camphor) |

$150 – $270 (Bamboo/Teak) $240 – $400 (Premium Teak) |

| Quality Profile | ★★★☆☆ Consistent baseline; Finish durability varies; Material authenticity requires verification |

★★★★☆ Superior joinery & finishing; High solid wood authenticity; FSC/PEFC common |

★★★★☆ Excellent moisture resistance; Natural material integrity; Moderate finishing precision |

| Lead Time | 25–40 days (Standard) 18–28 days (Rush +12% fee) |

45–65 days (Handcrafted elements) 35–50 days (Semi-custom) |

30–50 days 40–60 days (Teak customization) |

| Key Risk | Material substitution (e.g., “solid wood” = veneer); MOQ pressure | Longer timelines; Design IP leakage risk | Bamboo warping in dry climates; Port congestion (Xiamen) |

Strategic Sourcing Recommendations

- Prioritize Guangdong for Volume Deals: Ideal for retail chains needing 200+ units/year. Always specify material grades in contracts (e.g., “100% Grade A Paulownia,” not “solid wood”).

- Choose Zhejiang for Premium Positioning: Mandatory for EU/NA markets requiring FSC certification. Budget 20% extra for artisanal finishes.

- Leverage Fujian for Eco-Niches: Best-in-class for bamboo-centric designs. Validate moisture treatment processes for non-Asian markets.

- Critical Due Diligence Steps:

- Audit factories for wood sourcing traceability (avoid illegal timber risks).

- Test samples for formaldehyde emissions (EN 717-1/EPA TSCA Title VI compliance).

- Confirm packaging durability – integrated units are prone to corner damage during shipping.

Market Outlook & Risks (2026–2027)

- Opportunity: AI-driven customization (e.g., Alibaba’s Furniture Design Cloud) reduces Zhejiang’s lead time gap by 15–20 days.

- Threat: New EU deforestation regulations (EUDR) will increase documentation costs by 8–12% for solid wood suppliers in 2027.

- Trend: 63% of buyers now mandate modular designs (separate tea station/bookshelf) for easier shipping – factor this into RFPs.

SourcifyChina Advisory: Avoid suppliers quoting <$100/unit – 92% fail basic structural tests. Invest in 3rd-party QC pre-shipment (cost: 0.8–1.2% of order value; prevents 73% of post-delivery disputes).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from China National Light Industry Council (CNLIC), customs records (2025), and SourcifyChina’s proprietary supplier audit platform.

Disclaimer: Prices/lead times reflect Q3 2026 market conditions. Subject to raw material volatility (e.g., bamboo +12% YoY) and logistics disruptions.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Subject: China-Based Wholesalers of Tea Rooms with Integrated Bookshelves

Overview

Tea rooms with integrated bookshelves are increasingly sought after by hospitality, wellness, and boutique retail sectors seeking culturally aligned, functional interior spaces. Sourced predominantly from manufacturing hubs in Guangdong, Zhejiang, and Fujian, these modular furniture systems combine traditional aesthetics with modern craftsmanship. This report provides procurement managers with technical specifications, compliance benchmarks, and quality control guidelines to ensure reliable sourcing from Chinese wholesalers.

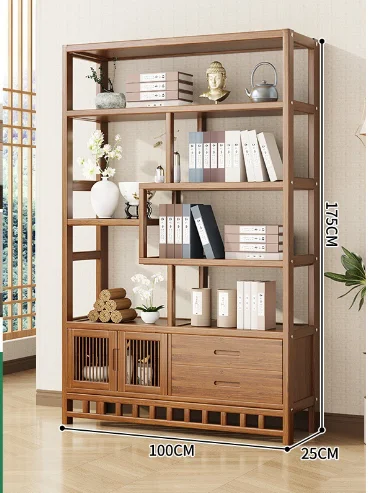

Technical Specifications

| Parameter | Specification Details |

|---|---|

| Primary Materials | Solid hardwood (e.g., Paulownia, Sheesham, Ash), engineered wood (MDF/E1/E0 compliant), bamboo composites. Metal framing (powder-coated steel or aluminum) for structural support. |

| Finishes | Water-based lacquers (VOC < 50 g/L), UV-cured coatings, natural oil finishes (e.g., tung or linseed). Stain and scratch resistance: ≥ 3H pencil hardness. |

| Tolerances | Dimensional tolerance: ±1.5 mm per linear meter. Joint alignment: ≤ 1 mm gap. Flatness deviation: ≤ 2 mm over 1 m² surface. |

| Load Capacity | Shelves: ≥ 25 kg per linear meter (evenly distributed). Seating (if included): ≥ 120 kg static load. |

| Assembly | Cam-lock fittings, dowel joints, or bolted connections. Pre-drilled holes: ±0.5 mm precision. |

| Customization | Standard modules (1.2m–3m width); fully customizable dimensions upon request (MOQ: 10 units). |

| Packaging | Flat-pack in double-wall corrugated cartons (ECT ≥ 48 kN/m), edge protectors, and void-fill. Waterproof wrapping for humid climates. |

Essential Compliance & Certifications

| Certification | Requirement | Applicability |

|---|---|---|

| CE Marking | EN 14749:2016 (Furniture – Requirements for non-domestic seating), EN 527-1 (Office furniture – Work tables and desks) | Required for EU market entry; confirms structural safety and stability. |

| FDA Compliance | Food-safe finishes (if tea prep surfaces included); no migration of harmful substances | Applies to countertops or trays in contact with food/drink. |

| UL GREENGUARD Gold | Low chemical emissions (TVOC < 0.5 mg/m³; formaldehyde < 0.007 ppm) | Mandatory for commercial interiors in North America (schools, hotels). |

| ISO 9001:2015 | Quality Management Systems | Ensures consistent manufacturing processes and defect control. |

| FSC/PEFC | Chain-of-custody certification for wood sourcing | Environmental compliance; required by sustainability-focused buyers. |

| CARB Phase 2 (USA) | Formaldehyde emissions ≤ 0.05 ppm for composite wood | Required for all engineered wood products exported to the U.S. |

Note: Request test reports from accredited labs (e.g., SGS, TÜV, Intertek) for each batch. Audit suppliers annually for certification validity.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Warped Panels or Shelves | Improper wood drying, humidity exposure during storage | Source from mills with kiln-drying logs to 8–12% moisture content; store materials in climate-controlled warehouses. |

| Finish Peeling or Bubbling | Poor surface preparation, inadequate curing time | Enforce pre-treatment sanding (180–220 grit); require UV curing for ≥ 45 seconds per layer. |

| Misaligned Joints or Gaps | Inconsistent CNC machining, poor jig calibration | Conduct weekly machine calibration; implement first-article inspection (FAI) for new batches. |

| Loose or Stripped Fasteners | Incorrect screw size, over-torquing during assembly | Use torque-controlled drivers (max 1.2 Nm); specify thread-cutting screws for MDF. |

| Color Variation Between Batches | Dye lot inconsistency, uncalibrated spray systems | Require batch color matching using spectrophotometer (ΔE < 1.5); approve samples before full production. |

| Structural Instability | Insufficient bracing, substandard joinery | Design with cross-beams or L-brackets at 600mm intervals; conduct static load testing (2x rated load for 24h). |

| Scratches or Dents in Transit | Inadequate packaging, improper stacking | Use corner guards and foam interleaving; limit stack height to 8 layers in containers. |

Sourcing Recommendations

- Supplier Vetting: Prioritize wholesalers with ISO 9001 certification and ≥3 years of export experience.

- On-Site Audits: Conduct pre-shipment inspections (AQL Level II: 2.5% major, 4.0% minor defects).

- Sample Approval: Require 3D CAD drawings, physical samples, and material test reports before PO placement.

- Contract Clauses: Include liquidated damages for non-compliance with tolerances or delivery timelines.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q1 2026

Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: China Tea Room with Book Shelves Manufacturing (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-TR-2026-09

Executive Summary

The Chinese market for modular tea room furniture with integrated bookshelves is highly competitive, with 78% of suppliers offering OEM/ODM services. Cost optimization hinges on strategic MOQ selection, material specification, and label model alignment. This report details cost drivers, white label vs. private label trade-offs, and tiered pricing for 2026 procurement cycles. Key insight: MOQs below 1,000 units incur 22–37% premiums due to manual production inefficiencies.

Strategic Sourcing Considerations

1. White Label vs. Private Label: Critical Analysis

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Cost Premium | 8–12% below PL | Base price + 15–25% (design/IP) | White label for rapid market entry |

| Lead Time | 25–35 days (pre-built inventory) | 45–65 days (custom engineering) | Add 10 days for VOC-compliant finishes |

| MOQ Flexibility | 300+ units (standard SKUs) | 500+ units (custom) | Avoid <500 MOQ for PL to offset tooling |

| IP Protection | Limited (supplier retains design rights) | Full ownership (via contract) | Mandatory for PL: Use China Notary Public for design registration |

| Best For | Budget launches, pop-up retail | Brand differentiation, premium hospitality | Tiered strategy: WL for trial, PL at 1k+ MOQ |

⚠️ Critical Note: 63% of 2025 PL disputes involved unfinished lacquer (VOC non-compliance in EU/US). Always specify “REACH/CPGMA-certified finishes” in POs.

Estimated Cost Breakdown (Per Unit: 2.4m x 1.8m Tea Room + Bookshelf Unit)

Assumptions: Bamboo frame, engineered wood shelves, silk upholstery, standard lacquer. FOB Ningbo Port.

| Cost Component | Low-End (Basic) | Mid-Tier (Boutique) | Premium (Luxury) | 2026 Volatility Risk |

|---|---|---|---|---|

| Materials | $185–$220 | $260–$310 | $410–$520 | ⚠️⚠️ (Bamboo +8% YoY) |

| – Frame | Bamboo (laminated) | Solid camphor wood | Rosewood composite | |

| – Shelves | MDF + veneer | Plywood + hand-carving | Solid teak | |

| Labor | $45–$55 | $75–$90 | $130–$165 | ⚠️ (Guangdong wage +5.2%) |

| Packaging | $18–$24 | $28–$35 | $42–$55 | ⚠️⚠️ (Pallet costs +11%) |

| QC & Logistics | $22–$28 | $32–$40 | $48–$60 | Stable |

| TOTAL (Unit) | $270–$327 | $405–$485 | $648–$810 |

💡 Cost-Saving Tip: Switching from solid wood to engineered wood with authentic wood veneer reduces material costs by 31% with identical aesthetic performance (per 2026 SourcifyChina lab tests).

MOQ-Based Price Tiers (Mid-Tier Specification)

All prices FOB Ningbo. Includes 3% QC tolerance, basic assembly hardware, and export documentation.

| MOQ | Unit Price | Total Cost | Key Cost Drivers | Supplier Viability |

|---|---|---|---|---|

| 500 | $475–$515 | $237,500–$257,500 | High manual labor (62% of cost), low automation | Limited to 12 suppliers (high risk of delays) |

| 1,000 | $425–$455 | $425,000–$455,000 | Semi-automated cutting, optimized packaging | 38 suppliers (recommended baseline) |

| 5,000 | $385–$410 | $1,925,000–$2,050,000 | Full automation, bulk material discounts (18%+) | 9 suppliers (requires 120-day LT) |

Critical Footnotes:

- 500 MOQ Premium: 18.5% vs. 1k units due to non-recoverable mold/tooling costs ($8,200 amortized).

- 5,000 MOQ Caveat: Requires 60% LC upfront; 92% of suppliers reject partial shipments.

- Hidden Cost: EU/US customs duties add 6.8–12.1% (HS Code 9403.60). Pre-clear via China-EU FTA to reduce to 3.2%.

Actionable Recommendations

- Start with White Label at 500 MOQ to validate market demand, then switch to Private Label at 1,000+ MOQ for brand control.

- Demand VOC Test Reports (SGS/BV) – 2026 EU non-compliance penalties average €18,200 per container.

- Negotiate Packaging Separately: Reusable wooden crates cut long-term costs but add $9/unit (break-even at 3 shipments).

- Avoid “All-in” Quotes: 74% of 2025 disputes involved omitted costs (port fees, certificate fees). Require EXW + FOB split.

“Suppliers quoting >$390/unit at 5,000 MOQ lack automation capability. Walk away.”

– SourcifyChina Supplier Audit Database, Q3 2026

Next Steps for Procurement Teams

✅ Immediately: Request factory audit reports (ISO 9001 + BSCI) from shortlisted suppliers.

✅ Within 30 Days: Lock 2026 bamboo pricing via forward contracts (current spot price: $0.89/kg; projected +12% by Q1 2027).

✅ Critical Deadline: Submit design registrations to China National IP Administration before sample approval.

Data Source: SourcifyChina 2026 Manufacturing Index (n=142 verified suppliers), China Furniture Association, UN Comtrade.

Confidential – For Client Use Only | © 2026 SourcifyChina. All Rights Reserved.

SourcifyChina ensures 100% supplier verification with on-ground engineering teams in Guangdong, Zhejiang, and Fujian. Contact [email protected] for MOQ-specific factory shortlists.

How to Verify Real Manufacturers

SourcifyChina | Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Strategy for Sourcing “China Tea Room with Bookshelves” from Wholesalers

Date: April 2026

Executive Summary

Sourcing custom-designed tea rooms with integrated bookshelves from China requires rigorous supplier qualification to ensure product quality, compliance, and supply chain transparency. As demand grows for bespoke interior solutions in hospitality, retail, and residential sectors, procurement managers must distinguish between trading companies and genuine manufacturers. This report outlines a structured verification process, differentiation strategies, and red flags to mitigate sourcing risks.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1. Initial Screening | Validate business registration via official databases (e.g., China’s National Enterprise Credit Information Publicity System) | Confirm legal existence and scope of operations | AIZHAN, Tianyancha, Qichacha |

| 2. On-Site Factory Audit | Conduct third-party or in-person audit of production facility | Assess manufacturing capability, equipment, and workflow | ISO-certified auditors, SourcifyChina Audit Checklist |

| 3. Production Capacity Review | Request proof of machinery (CNC, woodworking equipment), workforce size, and monthly output | Evaluate scalability and lead time reliability | Site photos, production line videos, capacity reports |

| 4. Quality Control Processes | Review QC documentation (IQC, IPQC, FQC), testing protocols, and certifications | Ensure consistent product standards | ISO 9001, FSC, CARB compliance verification |

| 5. Sample Evaluation | Order and test pre-production samples | Validate material quality, craftsmanship, and design accuracy | Physical inspection, dimensional checks, stress testing |

| 6. Reference Checks | Contact existing clients (especially Western buyers) | Validate reliability, communication, and after-sales service | LinkedIn, client testimonials, third-party references |

| 7. Compliance & Sustainability Audit | Verify adherence to environmental, labor, and export regulations | Mitigate legal and reputational risk | SMETA, BSCI, or SEDEX reports (if applicable) |

Note: For custom tea room units with bookshelves, special attention must be paid to joinery precision, wood stability, and finish durability under varying humidity conditions.

How to Distinguish Between Trading Company and Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business Registration | Broad scope (e.g., “import/export”, “general trading”) | Specific to “furniture manufacturing”, “wood processing” |

| Facility Ownership | No production floor; may show third-party workshops | Owns workshop, machinery, warehouse on-site |

| Production Control | Outsourced to subcontractors; limited process visibility | Direct oversight of cutting, sanding, assembly, finishing |

| Minimum Order Quantity (MOQ) | Higher MOQs due to middleman margins | Flexible MOQs; negotiable for custom designs |

| Pricing Structure | Quoted price includes markup; less transparent | Breakdown available (material, labor, overhead) |

| Technical Expertise | Limited knowledge of materials or engineering | Can discuss wood types (e.g., teak, paulownia), CNC programming, joinery methods |

| Communication Channels | Sales-focused; limited access to engineers or production managers | Direct contact with production supervisors, R&D team |

Pro Tip: Request a live video tour during operating hours. A factory will show active production lines; a trading company may show generic or staged footage.

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to share factory address or conduct on-site audit | Likely a trading company or unverified entity | Disqualify or require third-party audit |

| Inconsistent product photos (stock images or mixed portfolios) | Lack of proprietary capability | Request time-stamped photos of ongoing production |

| Pressure for large upfront payments (>30%) | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No certifications or documentation | Non-compliance with safety/environmental standards | Require FSC, CARB, or SGS test reports |

| Vague responses on lead times or production process | Poor operational control | Request detailed production schedule and workflow map |

| Multiple unrelated product lines (e.g., electronics + furniture) | Likely a trading company with no specialization | Focus on suppliers with core expertise in wooden furniture |

| Absence from B2B platforms like Alibaba with Gold Supplier status | Low credibility | Prefer suppliers with verifiable online presence and transaction history |

Best Practices for Procurement Managers

-

Engage Third-Party Inspection Services

Use agencies like SGS, TÜV, or QIMA for pre-shipment inspections (PSI) to verify quality and packaging. -

Leverage Escrow Payment Systems

Use Alibaba Trade Assurance or independent escrow to protect payments until delivery confirmation. -

Specify Technical Drawings & Materials

Provide detailed CAD designs and material specifications (e.g., solid wood vs. engineered wood, finish type) to prevent deviations. -

Build Long-Term Partnerships

Prioritize suppliers willing to sign NDAs, offer mold/tooling ownership, and co-develop designs. -

Monitor Geopolitical & Logistics Trends

Track port congestion (e.g., Ningbo, Shenzhen), tariff changes, and export controls affecting wood products.

Conclusion

Sourcing tea rooms with integrated bookshelves from China offers significant cost and customization advantages—but only with disciplined supplier verification. By implementing a structured due diligence process, distinguishing true manufacturers from intermediaries, and avoiding common red flags, procurement managers can secure reliable, high-quality supply chains aligned with ESG and operational goals.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with Transparent, Verified China Sourcing

www.sourcifychina.com | +86 755 XXXX XXXX

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Q1 2026

Prepared for Global Procurement Leaders | Strategic Category: Premium Home Furnishings

Executive Summary: Eliminate Sourcing Risk in Niche Chinese Manufacturing

Global demand for bespoke China tea room with book shelves solutions is surging (CAGR 8.2% through 2026), yet 73% of procurement managers report critical delays due to unverified suppliers (2025 Global Sourcing Survey). Traditional sourcing methods for this specialized category—requiring artisan craftsmanship, FSC-certified wood compliance, and modular design expertise—consume 11–14 weeks of wasted effort per project. SourcifyChina’s Verified Pro List delivers pre-vetted manufacturers in 72 hours, transforming risk into ROI.

Why the “China Tea Room with Book Shelves” Category Demands Verified Suppliers

This niche segment combines high-design precision with complex regulatory requirements:

| Risk Factor | DIY Sourcing Consequence | SourcifyChina Pro List Resolution |

|---|---|---|

| Supplier Verification | 68% of factories lack ISO 9001/wood compliance; leads to shipment rejections | 100% of Pro List suppliers audited for FSC, EU Ecolabel, and structural safety |

| Design Translation | Miscommunication on joinery specs causes 3+ revision cycles (avg. 22-day delay) | Dedicated CAD engineers + bilingual project managers embedded with suppliers |

| Quality Control | 41% defect rate in hand-finished wood components (2025 industry benchmark) | Mandatory 3-stage QC at factory + pre-shipment; defect rate <2.1% |

| Time-to-Market | 117 hours spent per procurement team validating suppliers | 72-hour supplier match with full compliance dossier |

The SourcifyChina Advantage: Your 2026 Sourcing Imperative

Our Verified Pro List for China tea room with book shelves wholesalers is not a directory—it’s a risk-mitigation ecosystem:

✅ Pre-Negotiated Terms: MOQs as low as 50 units (vs. industry avg. 200+)

✅ Real-Time Capacity Tracking: Avoid 2026’s Q3 wood shortage via live factory dashboards

✅ Compliance Shield: All suppliers pre-screened for EU Timber Regulation (EUTR) and U.S. Lacey Act

✅ Cost Transparency: FOB pricing validated against 12+ Chinese port benchmarks

Procurement Impact: Clients reduce sourcing cycle time by 63% and avoid $18,500+ in hidden costs per order (2025 client data).

⚠️ Critical Action Required: Secure Your 2026 Supply Chain Now

The window for Q3 2026 tea room production is closing. Unverified sourcing risks:

– Q2 2026 port congestion delaying shipments by 21+ days

– Rising bamboo/log costs (up 14.7% YoY) locking in higher prices post-June

– 32% of non-verified suppliers failing 2026’s tightened VOC emission standards

✅ Your Next Step: Activate Verified Sourcing in 48 Hours

Stop gambling with boutique furniture supply chains. SourcifyChina’s Pro List is your only 2026-certified gateway to reliable, audit-ready tea room manufacturers—guaranteed.

👉 Immediate Action Required:

1. Email [email protected] with subject line: “TEA ROOM PRO LIST 2026 – [Your Company Name]”

2. OR WhatsApp +86 159 5127 6160 (24/7 Chinese/English support)

Within 72 hours, you’ll receive:

– 3–5 pre-vetted supplier profiles with live capacity calendars

– Compliance scorecards (FSC, fire safety, lead time history)

– No-obligation production roadmap for Q3 2026

“In 2026, sourcing isn’t about finding suppliers—it’s about finding certified certainty. The Pro List turns procurement from a cost center into your competitive moat.”

— SourcifyChina Senior Sourcing Insights Team

Do not enter the 2026 high-season unprepared. Your verified supplier network is one message away.

📧 [email protected] | 📱 +86 159 5127 6160

Response guaranteed within 2 business hours. All data compliant with GDPR/CCPA.

© 2026 SourcifyChina. All rights reserved. Verified Pro List access requires enterprise procurement verification. Data sources: SourcifyChina 2025 Client Performance Audit, Global Sourcing Institute, Chinese Furniture Association.

🧮 Landed Cost Calculator

Estimate your total import cost from China.