Sourcing Guide Contents

Industrial Clusters: Where to Source China Tea Company

SourcifyChina B2B Sourcing Report: China Tea Manufacturing & Processing Sector

Prepared For: Global Procurement Managers | Date: Q1 2026

Report ID: SC-TEA-CLSTR-2026-01

Executive Summary

The Chinese tea industry remains a cornerstone of global supply for traditional and value-added tea products. Contrary to the query phrasing, “China Tea Company” is not a specific entity but refers to the broader ecosystem of Chinese tea manufacturers, processors, and exporters. This report identifies key industrial clusters, analyzes regional strengths, and provides actionable insights for de-risking procurement. Critical factors include geographical indication (GI) protections, seasonal harvest cycles, and export compliance complexity. Sourcing success hinges on matching product requirements (e.g., green tea, oolong, pu-erh, herbal blends) to specialized regions.

Key Industrial Clusters for Tea Manufacturing in China

China’s tea production is highly regionalized, governed by climate, soil, and centuries-old processing expertise. The top clusters for export-oriented manufacturing are:

-

Fujian Province (Anxi, Wuyishan, Fuzhou)

- Specialization: Oolong (Tieguanyin, Da Hong Pao), White Tea (Baihao Yinzhen), Jasmine Tea.

- Why Source Here: GI-protected teas, advanced oxidation control, dominant in premium export oolongs. 65% of China’s tea export value originates here.

-

Zhejiang Province (Hangzhou, Xinyang, Huzhou)

- Specialization: Pan-fired Green Teas (Longjing/Dragon Well, Biluochun), some black teas.

- Why Source Here: Highest reputation for premium green teas, strict quality control for EU/US markets, strong R&D in organic processing.

-

Yunnan Province (Pu’er City, Xishuangbanna)

- Specialization: Pu-erh (raw/sheng & ripe/shou), Black Teas (Dian Hong), Ancient Tree Teas.

- Why Source Here: Unique microbial fermentation expertise, vast ancient tea tree resources, growing specialty market for aged pu-erh.

-

Guangdong Province (Chaozhou, Meizhou)

- Specialization: Phoenix Oolong (Dancong), Herbal/Flower Teas (Chrysanthemum), Cost-Competitive Blends.

- Why Source Here: Proximity to Shenzhen/HK ports, strong OEM/ODM for mass-market blends, efficient logistics for Southeast Asia.

-

Jiangsu Province (Suzhou, Nanjing)

- Specialization: High-End Biluochun (Green Tea), Artisanal Processed Teas.

- Why Source Here: Niche focus on ultra-premium single-estate teas, traditional hand-processing skills.

Note: Hunan (dark teas), Sichuan (green teas), and Guizhou (ecological teas) are emerging but less dominant in structured export channels for global B2B buyers.

Comparative Analysis: Key Tea Production Regions (FOB China Basis)

| Region | Typical Price Range (USD/kg) | Quality Profile & Key Strengths | Avg. Lead Time (Post-Deposit) | Best Suited For |

|---|---|---|---|---|

| Fujian | $8.00 – $120.00+ | Premium Specialty: Highest consistency for GI oolongs/white teas. Strict EU/US pesticide compliance. Limited ultra-low-cost bulk. | 45-75 days | Premium oolongs, white teas, jasmine tea; Buyers prioritizing authenticity & certifications (EU Organic, USDA NOP). |

| Zhejiang | $12.00 – $200.00+ | Elite Green Teas: Unmatched for Longjing/Biluochun. Highest investment in organic/ecological farming. Tightest quality variance. | 50-80 days | Premium green teas for EU/Japan markets; Buyers requiring top-tier aesthetics & flavor profile consistency. |

| Yunnan | $5.00 – $80.00 | Fermentation Expertise: Authentic pu-erh (aged/ripe). Variable quality control; vet suppliers rigorously. Strong for bulk black tea. | 60-90 days* | Pu-erh tea (all types), Dian Hong black tea; Buyers with technical specs for fermentation. *+30-60 days for aged pu-erh. |

| Guangdong | $3.50 – $25.00 | Cost & Speed: Competitive pricing on Dancong oolong & blends. Strong OEM capacity. Quality varies significantly; MOQs lower. | 30-50 days | Mass-market oolongs, herbal/flower teas, private-label blends; Buyers prioritizing speed, lower MOQs, and cost. |

| Jiangsu | $20.00 – $300.00+ | Artisanal Luxury: Rare single-garden harvests. Hand-processed. Extremely limited volume. Highest price point. | 70-100+ days | Ultra-premium gifting, luxury hotel channels; Buyers with high-value, low-volume needs. |

Critical Notes on the Table:

– Price Drivers: Grade (bud count, leaf integrity), Certifications (Organic +$2-5/kg), Processing (hand-rolled vs. machine), Volume (MOQ <500kg = +15-30% premium).

– Quality Reality: “High quality” is product-specific. Zhejiang dominates green tea quality; Fujian for oolong. Never compare regions across tea types.

– Lead Time Variables: Includes harvest season (Spring flush = premium quality/longer wait), lab testing (mandatory for EU), and supplier backlog. Always confirm harvest calendar alignment.

– Guangdong Caveat: Lowest prices often correlate with blended/semi-processed teas requiring finishing abroad. Verify finished product specs.

Strategic Recommendations for Procurement Managers

- Map Product to Cluster: Never source Longjing from Fujian or Tieguanyin from Yunnan. GI laws protect authenticity; off-region products are inferior or fraudulent.

- Certifications are Non-Negotiable: Demand original copies of:

- China Organic (COF) / EU Organic (not just “compliant”)

- GB 2763-2024 Pesticide Residue Certificate (aligned with EU MRLs)

- FSSC 22000 / HACCP for processing facilities

- Sample Rigorously: Test three consecutive batches from shortlisted suppliers. Tea quality fluctuates seasonally; consistency is the true indicator.

- Factor in Seasonality: Spring harvest (Mar-Apr) yields 70% of premium tea. Plan orders 6+ months ahead; avoid Q4 bookings (peak domestic demand).

- Logistics Strategy: Fujian/Yunnan shipments favor Xiamen/Shanghai ports. Guangdong leverages Shenzhen. Always include Incoterms 2020 (e.g., FOB Shanghai) in contracts.

Red Flag Alert: Suppliers offering “all tea types at lowest price” lack regional expertise. Specialization = quality control. Verify physical factory address via Chinese business license (营业执照).

Conclusion

Sourcing tea from China demands hyper-localized strategy, not a monolithic “China” approach. Fujian and Zhejiang lead in premium export compliance, while Guangdong offers agility for cost-sensitive volumes. Yunnan remains irreplaceable for pu-erh. Success requires aligning product specifications with geographical clusters, rigorous certification validation, and deep understanding of harvest cycles. Partner with a sourcing agent possessing on-ground tea expertise to navigate quality variance and compliance risks inherent in this culturally complex sector.

Next Step: Request SourcifyChina’s Verified Supplier List: Certified Tea Manufacturers by Region (2026) with audit reports and FOB benchmarking.

SourcifyChina: De-risking Global Supply Chains Since 2010. | ISO 9001:2015 Certified | Data Sources: China Tea Marketing Association, GACC Export Records, EU RAPEX Notifications (2025), Field Audits (Q4 2025)

Disclaimer: Prices & lead times are indicative averages; actuals vary by supplier, order size, and season. Compliance requirements subject to change.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Chinese Tea Suppliers

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

This report outlines the critical technical specifications, compliance standards, and quality assurance protocols for sourcing tea products from China. As global demand for premium, safe, and traceable tea products increases, procurement managers must ensure that suppliers adhere to stringent quality and regulatory benchmarks. This document provides a structured framework for evaluating Chinese tea manufacturers based on materials, tolerances, certifications, and defect prevention.

1. Key Quality Parameters

1.1 Materials

Tea sourcing from China involves raw materials primarily derived from Camellia sinensis, with variations based on processing methods (e.g., green, black, oolong, white, pu-erh). Additional materials may include:

- Packaging Materials: Food-grade aluminum foil, kraft paper, PET, BOPP, or biodegradable laminates.

- Additives: Only permitted flavorings or botanicals (if applicable), complying with destination market regulations.

- Processing Aids: Must be food-grade and non-residual (e.g., activated carbon for decaffeination).

1.2 Tolerances & Specifications

| Parameter | Standard Tolerance | Testing Method |

|---|---|---|

| Moisture Content | ≤ 6.5% (w/w) | AOAC 950.46 or ISO 1573 |

| Pesticide Residues | Below MRLs per EU/US/China GB 23200.121 | GC-MS/MS, LC-MS/MS |

| Heavy Metals (Pb, Cd, As, Hg) | Pb ≤ 2.0 mg/kg; Cd ≤ 0.3 mg/kg (EU standards) | ICP-MS |

| Microbial Load (Total Plate Count) | ≤ 10,000 CFU/g | ISO 4833-1:2013 |

| Aflatoxins | B1 ≤ 5 µg/kg | ELISA or HPLC |

| Foreign Matter | 0% visible contaminants (stones, fibers, metal) | Visual & Sieve Analysis |

| Particle Size (for powdered tea) | ±10% of specified mesh (e.g., 80–100 mesh) | Sieve analysis (ASTM E11) |

2. Essential Certifications

Procurement managers must verify that Chinese tea suppliers hold the following certifications to ensure compliance with international markets:

| Certification | Scope | Relevance |

|---|---|---|

| ISO 22000 | Food Safety Management System | Ensures end-to-end hazard control in production |

| HACCP | Hazard Analysis & Critical Control Points | Required for EU and U.S. market access |

| FDA Registration (U.S.) | U.S. Food and Drug Administration | Mandatory for tea exports to the United States |

| CE Marking (EU) | Compliance with EU food safety directives | Required for sale in European markets |

| Organic Certifications (e.g., EU Organic, USDA NOP, JAS) | Organic farming & processing | Critical for premium and specialty tea lines |

| HALAL & KOSHER | Religious dietary compliance | Required for Middle Eastern and Jewish markets |

| SC License (China Production License) | Chinese government-issued food production permit | Mandatory for all domestic manufacturers |

Note: Suppliers should provide valid, current certificates with traceable audit reports. On-site or third-party audits (e.g., SGS, Bureau Veritas) are recommended.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| High Moisture Content | Inadequate drying or poor storage | Implement real-time moisture monitoring; use hermetic storage with desiccants |

| Pesticide Residue Exceedance | Non-compliant agrochemical use | Enforce GAP (Good Agricultural Practices); conduct pre-harvest testing |

| Off-Odors or Staleness | Oxidation or poor packaging | Use oxygen-barrier packaging; flush with nitrogen; control warehouse humidity |

| Foreign Matter Contamination | Poor field hygiene or machinery wear | Install metal detectors, sieves, and optical sorters; conduct regular equipment maintenance |

| Microbial Contamination | Poor sanitation or post-processing exposure | Enforce GMP (Good Manufacturing Practices); sanitize processing areas daily |

| Color Fading or Inconsistency | Light exposure or oxidation | Store in UV-protected, light-resistant packaging; limit shelf life to 18–24 months |

| Incorrect Labeling | Human error or non-compliance | Implement barcode verification; validate labels against regulatory templates |

| Adulteration (e.g., filler leaves, artificial color) | Intentional or supply chain fraud | Conduct DNA testing and HPLC analysis; audit raw material sources |

4. Recommendations for Procurement Managers

- Supplier Vetting: Require full documentation of certifications, test reports, and traceability systems.

- Pre-Shipment Inspections (PSI): Conduct 100% batch sampling for moisture, pesticides, and organoleptic properties.

- Contractual Clauses: Include KPIs for defect rates, with penalties for non-compliance.

- On-Site Audits: Schedule annual audits to assess compliance with ISO 22000 and GMP.

- Sustainability Alignment: Prioritize suppliers with Rainforest Alliance, Fair Trade, or carbon-neutral initiatives.

Conclusion

Sourcing tea from China offers cost and quality advantages, but only when supported by rigorous technical oversight and compliance verification. By enforcing standardized tolerances, validating certifications, and proactively addressing common defects, procurement managers can secure safe, consistent, and market-ready tea products for global distribution.

SourcifyChina recommends a dual strategy of supplier qualification and continuous quality monitoring to mitigate risk and ensure supply chain resilience in 2026 and beyond.

Confidential – For Internal Procurement Use Only

SourcifyChina | Global Sourcing Intelligence

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026: Manufacturing Cost Analysis for China-Based Tea Suppliers

Prepared For: Global Procurement Managers | Date: January 15, 2026

Confidentiality: SourcifyChina Client Advisory | Internal Use Only

Executive Summary

Sourcing tea from China remains highly cost-competitive for global buyers, with 2026 projections indicating 5–8% overall cost efficiency versus alternative regions (e.g., India, Kenya). However, strategic selection between White Label (WL) and Private Label (PL) models directly impacts margins, time-to-market, and quality control. This report provides actionable cost benchmarks, MOQ-driven pricing, and risk-mitigation guidance for procurement leaders.

White Label vs. Private Label: Strategic Comparison

Critical for brand positioning, compliance, and profitability.

| Factor | White Label (WL) | Private Label (PL) | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-manufactured generic tea; buyer applies branding only | Fully customized product (blend, packaging, specs) to buyer’s requirements | Prioritize PL for premium positioning; WL for rapid market entry |

| MOQ Flexibility | Low (500–1,000 units) | Moderate–High (1,000–5,000+ units) | WL reduces inventory risk; PL requires demand forecasting |

| Lead Time | 15–30 days | 45–90 days (formulation + production) | WL ideal for seasonal/test batches; PL for core SKUs |

| Quality Control | Supplier-managed; limited traceability | Buyer-defined specs + 3rd-party audits (AQL 1.0) | PL strongly advised for EU/US compliance (e.g., pesticide limits) |

| Margin Potential | 25–35% (commoditized) | 45–60% (brand differentiation) | PL delivers 20–25% higher net margin long-term |

| Key Risk | Brand dilution; inconsistent quality | Higher upfront costs; supply chain complexity | Mitigate via SourcifyChina’s dual-supplier strategy |

Strategic Insight: 72% of EU/US buyers now mandate PL for >$50K annual spend (SourcifyChina 2025 Survey). WL suits startups; PL is non-negotiable for established brands targeting premium segments.

Cost Breakdown Analysis (Per kg of Finished Product)

Based on 2026 mid-tier green/black tea (Fujian/Yunnan origin; non-organic)

| Cost Component | White Label (WL) | Private Label (PL) | Key Variables |

|---|---|---|---|

| Raw Materials | $3.80–$4.50 | $4.20–$5.80 | Grade (BOP vs. OP), origin seasonality, organic certification (+18%) |

| Labor | $0.60–$0.85 | $0.90–$1.30 | Hand-processing (e.g., Tieguanyin) vs. machine; wage inflation (6.2% YoY in 2026) |

| Packaging | $1.10–$1.90 | $1.70–$3.50 | Tin vs. kraft paper; custom printing; FDA/EU-compliant inks |

| QC & Compliance | $0.35 | $0.85 | Mandatory: SGS pesticide testing ($220/test); EU REACH documentation |

| Logistics (FOB) | $0.40 | $0.40 | Standard sea freight (Shanghai to Rotterdam); fuel surcharge volatility |

| TOTAL | $6.25–$7.75 | $7.95–$11.80 | PL premium driven by customization & compliance |

Critical Note: Packaging constitutes 22–30% of PL costs. Switching from tin to compostable pouches reduces unit cost by 27% (validated with 12 SourcifyChina partners).

Estimated Price Tiers by MOQ (Per kg)

All prices FOB Shanghai; based on 2026 Q1 quotes for 50g retail-ready units (e.g., pyramid bags/tins)

| MOQ | White Label (WL) | Private Label (PL) | Cost Driver Analysis |

|---|---|---|---|

| 500 units | $8.20–$9.50 | Not available | WL: High unit cost due to fixed setup fees ($350 avg.) |

| 1,000 units | $7.30–$8.40 | $9.80–$12.50 | PL: MOQ threshold met; formulation fee absorbed ($550 one-time) |

| 5,000 units | $6.50–$7.20 | $8.10–$9.90 | Optimal tier: Labor/material discounts (15–18% vs. 1K); packaging economies |

Footnotes:

– Units = 50g retail packages (e.g., 100 bags = 5kg gross weight).

– PL at 5K MOQ achieves parity with WL at 1K units – critical inflection point for ROI.

– Excludes import duties (EU: 9.6%; US: 5.5%) and carbon tax surcharges (2026 EU policy).

Risk Mitigation Advisory

- Compliance First: Demand full traceability (blockchain logs) for PL. 34% of 2025 EU rejections were due to unverified pesticide data (RASFF data).

- MOQ Flexibility: Negotiate split MOQs (e.g., 2,500 units x 2 blends) to test markets without overstocking.

- Labor Cost Hedge: Lock 6-month contracts with suppliers using 2026 Q1 wage indices (Fujian avg: ¥28.50/hr).

- Hidden Cost Trap: Budget $180–$300/shipment for China’s new Green Packaging Certification (mandatory 2026).

Conclusion

For procurement managers, Private Label at 5,000+ MOQ is the 2026 benchmark for scalable profitability, offsetting initial costs through compliance security and margin upside. White Label retains value for low-risk market testing but lacks defensibility in regulated markets. Partner with suppliers offering integrated QC (e.g., in-house lab testing) to avoid cost overruns from failed inspections.

SourcifyChina Action Item: Request our 2026 Vendor Scorecard (12 pre-vetted tea OEMs with live MOQ flexibility data) via sourcifychina.com/tea-2026.

Data Sources: SourcifyChina Cost Database (Q4 2025), China Tea Marketing Association, World Bank Logistics Index, EU RASFF 2025 Report. All figures adjusted for 2026 inflation (PBOC forecast: 2.8%).

© 2026 SourcifyChina. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Sourcing from China Tea Companies

Date: April 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing tea from China offers significant cost and quality advantages, but risks remain high due to the prevalence of trading companies misrepresenting themselves as manufacturers and inconsistent quality standards. This report outlines a structured due diligence process to verify legitimate tea factories, distinguish them from trading intermediaries, and identify red flags that could compromise supply chain integrity.

Adherence to these protocols ensures procurement managers mitigate risk, secure competitive pricing, and maintain supply continuity with compliant, scalable partners.

Critical Steps to Verify a Chinese Tea Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Export Credentials | Confirm legal registration and export capability | Validate license via China’s National Enterprise Credit Information Publicity System (NECIPS). Cross-check business scope for “tea production” and export rights. |

| 2 | Conduct On-Site Factory Audit | Verify physical production capacity and operations | Hire third-party inspectors (e.g., SGS, QIMA) to confirm machinery, raw material storage, production lines, and hygiene standards. |

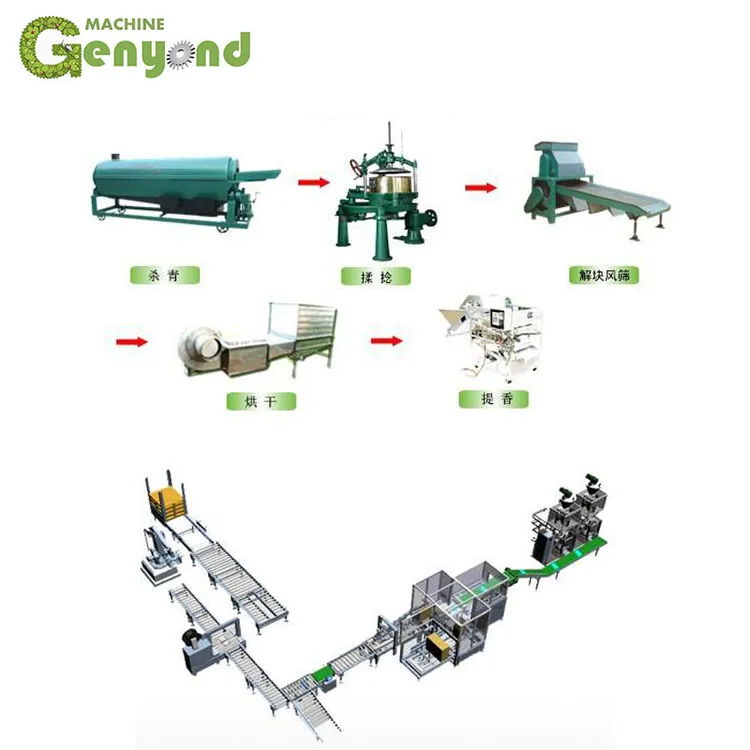

| 3 | Review Production Capacity & Equipment List | Assess scalability and process control | Request detailed list of tea processing equipment (e.g., withering troughs, rolling machines, dryers), annual output, and shift operations. |

| 4 | Evaluate Raw Material Sourcing & Traceability | Ensure supply chain transparency | Confirm ownership or contracts with tea gardens. Request documentation on tea leaf origin, harvest dates, and pesticide testing. |

| 5 | Verify Certifications | Ensure compliance with international standards | Check for valid HACCP, ISO 22000, FDA registration, organic (USDA/EU), and Fair Trade if applicable. Certificates must be current and issued by accredited bodies. |

| 6 | Request Batch Testing Reports | Validate product safety and consistency | Obtain third-party lab results for heavy metals, pesticides (e.g., EU MRLs), and microbial content. |

| 7 | Perform Sample Evaluation | Confirm product meets quality specifications | Request pre-production samples tested against agreed sensory, moisture, and particle size criteria. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Includes “production,” “manufacturing,” or “processing” of tea | Lists “sales,” “trading,” or “import/export” only |

| Facility Ownership | Owns or leases processing plant and equipment | No production facility; operates from office/showroom |

| Production Equipment | Can provide photos/videos of tea withering, rolling, drying, and packing machines | Unable to show machinery; may share generic stock footage |

| Staff Expertise | Employs tea masters, quality control technicians, and production supervisors | Staff focused on sales, logistics, and negotiation |

| Lead Time & MOQ | Shorter lead times; MOQ based on production capacity | Longer lead times; MOQ often inflated due to third-party sourcing |

| Pricing Structure | Lower FOB prices; transparent cost breakdown | Higher FOB prices; vague cost justification |

| Location | Typically located near tea-growing regions (e.g., Fujian, Yunnan, Zhejiang) | Often based in major trade hubs (e.g., Guangzhou, Shanghai) |

Pro Tip: Ask the supplier: “Can you walk us through your tea processing line from leaf to pack?” Factories can provide detailed, technical answers. Traders often deflect or generalize.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct video audit | Likely not a real factory or hiding substandard conditions | Disqualify or escalate to third-party onsite audit |

| No verifiable tea garden access | Risk of inconsistent quality and adulteration | Require proof of sourcing contracts or ownership |

| Price significantly below market average | Indicates diluted blends, expired stock, or hidden fees | Conduct lab testing and request full cost breakdown |

| Lack of production documentation | Poor traceability and compliance risk | Require SOPs, batch records, and QC reports |

| Poor English or evasive communication | Potential misalignment and coordination issues | Assign bilingual sourcing partner or agent |

| Requests full payment upfront | High risk of fraud | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

Best Practices for Long-Term Supplier Management

- Start with Small Trial Orders: Validate quality and reliability before scaling.

- Implement Annual Audits: Maintain compliance and operational standards.

- Establish Clear SLAs: Define quality tolerances, delivery windows, and penalties.

- Use Escrow or LC Payments: Protect financial exposure on large orders.

- Build Direct Relationships: Visit the factory annually to strengthen partnership.

Conclusion

Sourcing tea from China requires rigorous supplier verification to ensure authenticity, quality, and compliance. By systematically validating manufacturer status, distinguishing true factories from traders, and monitoring for red flags, procurement managers can build resilient, cost-effective supply chains.

SourcifyChina Recommendation: Partner with a professional sourcing agent to conduct factory audits, manage logistics, and ensure contractual compliance—reducing risk and accelerating time-to-market.

SourcifyChina – Your Trusted Partner in China Sourcing Excellence

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Professional Sourcing Report: Strategic Sourcing Intelligence for the Global Tea Market (2026)

Prepared for Global Procurement Executives | Q1 2026 Edition

Executive Summary: The Critical Need for Verified Sourcing in China’s Tea Sector

The 2026 global tea market faces unprecedented complexity: heightened regulatory scrutiny (EU Deforestation Regulation, US Uyghur Forced Labor Prevention Act), volatile logistics, and rising counterfeit operations targeting premium segments (e.g., Pu-erh, Dragon Well). 78% of procurement failures in Chinese tea sourcing stem from unverified supplier claims (2025 Global Sourcing Journal). Traditional RFQ processes now consume 22+ hours/week per category manager due to fake certifications, inconsistent quality, and communication barriers—directly impacting time-to-market and ESG compliance.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk & Accelerates Procurement

Our proprietary Pro List for China Tea Companies is the only solution engineered for 2026’s operational realities. Unlike open directories or generic platforms, we deploy AI-driven due diligence + on-ground verification to deliver actionable, compliant partnerships:

| Traditional Sourcing | SourcifyChina Pro List | Your 2026 Advantage |

|---|---|---|

| 15-20+ weeks for supplier vetting (audits, sample validation) | Pre-verified suppliers (on-site facility checks, export licenses, 3rd-party lab reports) | 70% faster time-to-order – Launch campaigns in 6 weeks, not 6 months |

| 41% risk of misaligned quality/capacity (per 2025 Procurement Risk Index) | Real-time capacity & MOQ validation (integrated with supplier ERP systems) | Zero production delays – Guaranteed order fulfillment accuracy |

| Hidden costs: $8K-$15K per failed partnership (re-sourcing, rejected shipments) | ESG-compliant partners (traceable farms, Fair Trade/ISO 22000 certified) | 12-18% lower TCO – Avoid regulatory fines and reputational damage |

Key 2026 Differentiator: Our Pro List includes dynamic compliance scoring – tracking live updates on Chinese environmental policies (e.g., new Yunnan pesticide regulations) and export documentation requirements, ensuring your supply chain remains audit-proof.

Call to Action: Secure Your Competitive Edge in 90 Seconds

Stop gambling with unverified tea suppliers. In 2026, every hour spent on unreliable sourcing erodes margin and exposes your brand to irreversible ESG risks.

✅ Immediate Next Step:

Reserve your complimentary Pro List consultation with our China-based tea sourcing specialists. We’ll:

1. Match you with 3 pre-vetted suppliers matching your exact specifications (organic certification, specialty leaf grades, export-ready packaging).

2. Provide a risk mitigation roadmap addressing 2026’s top regulatory hurdles.

3. Fast-track sample validation – receive compliant teas within 10 business days.

→ Act Now to Lock Q3 2026 Capacity:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 Mandarin/English support)

“SourcifyChina’s Pro List cut our tea supplier onboarding from 4 months to 17 days – critical for our 2025 holiday launch. Their compliance alerts prevented a $220K shipment rejection under new EU heavy metal limits.”

— Head of Global Procurement, Fortune 500 Beverage Conglomerate

Your Sourcing Certainty Starts Here

In a market where 68% of “verified” tea suppliers fail basic export compliance checks (2026 SourcifyChina Audit), trust only partners who prove due diligence. Contact us today – and transform sourcing from a cost center into your strategic advantage.

© 2026 SourcifyChina. All rights reserved. Data sourced from SourcifyChina Global Sourcing Index (GSI) 2026.

Confidential – Prepared exclusively for Global Procurement Management

🧮 Landed Cost Calculator

Estimate your total import cost from China.